Your home might be your biggest financial asset—but did you know it could also be your secret weapon for funding renovations, consolidating debt, or covering emergency expenses? If you’ve built up equity in your home, you have two powerful borrowing options at your fingertips: a Home Equity Line of Credit (HELOC) and a Home Equity Loan. But here’s the catch: choosing the wrong one could cost you thousands of dollars and years of financial stress.

TL;DR

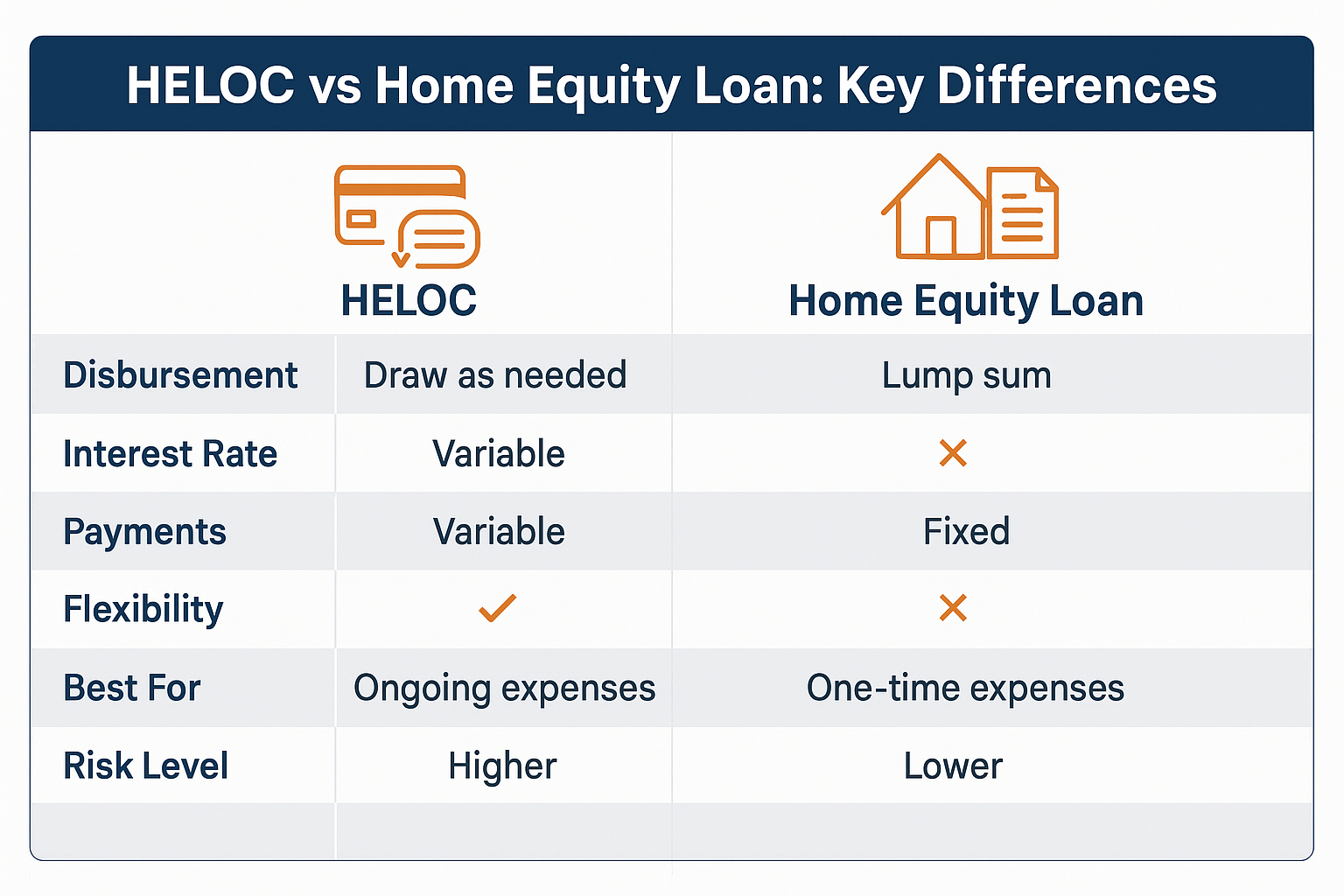

HELOC vs Home Equity Loan comes down to flexibility versus predictability: HELOCs offer revolving credit with variable rates, while home equity loans provide lump-sum funding with fixed rates.

HELOCs work like credit cards backed by your home—you borrow what you need, when you need it, during a draw period (typically 10 years), then repay over 10-20 years.

Home equity loans are second mortgages that give you all the money upfront with fixed monthly payments over 5-30 years, making budgeting easier.

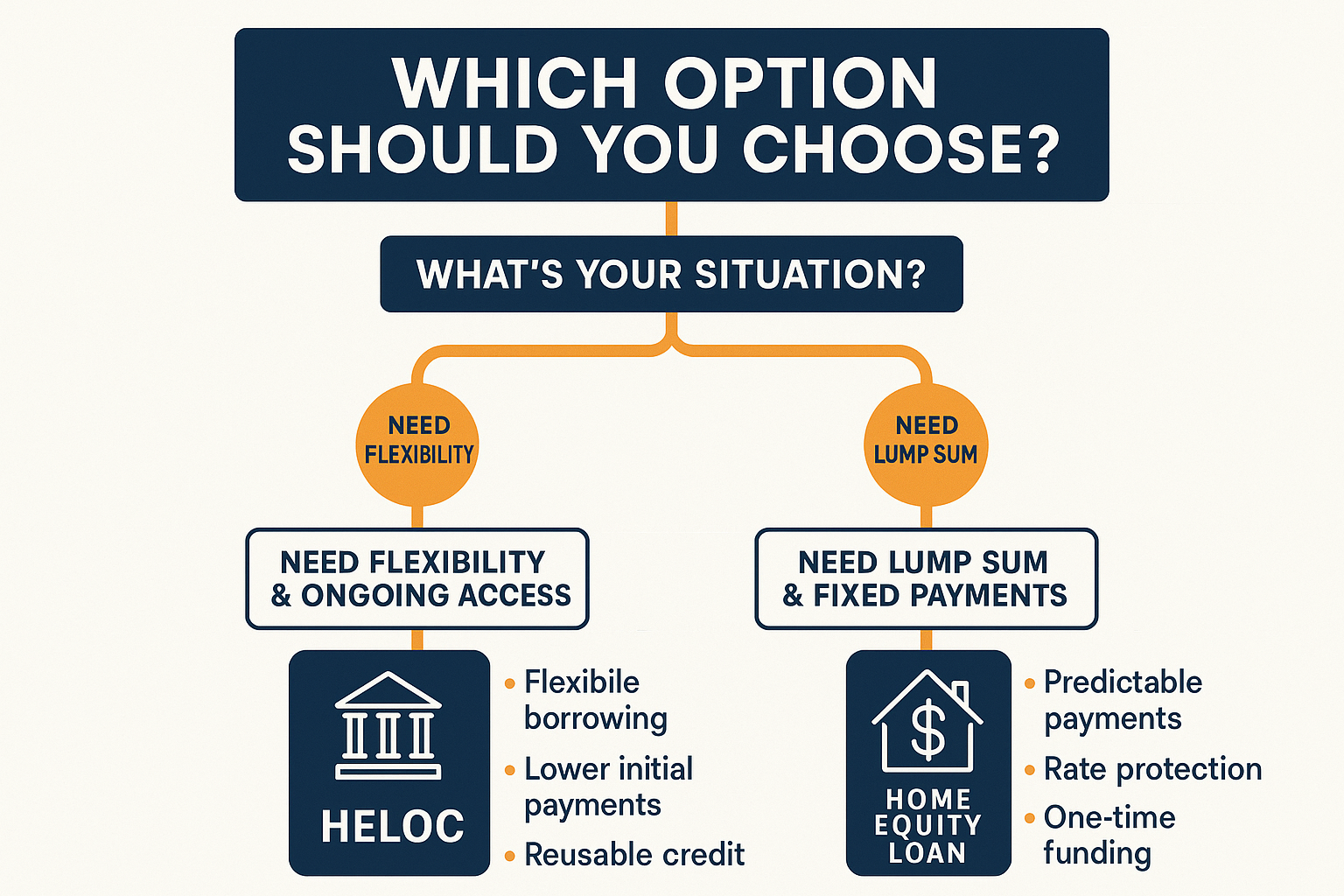

Choose a HELOC if you need flexible access to funds over time (like ongoing renovations) and can handle variable interest rates.

Choose a home equity loan if you need a specific amount for a one-time expense (like debt consolidation) and want payment certainty with fixed rates.

What Is Home Equity and Why Does It Matter?

Before diving into the HELOC vs home equity loan debate, let’s establish the foundation: home equity.

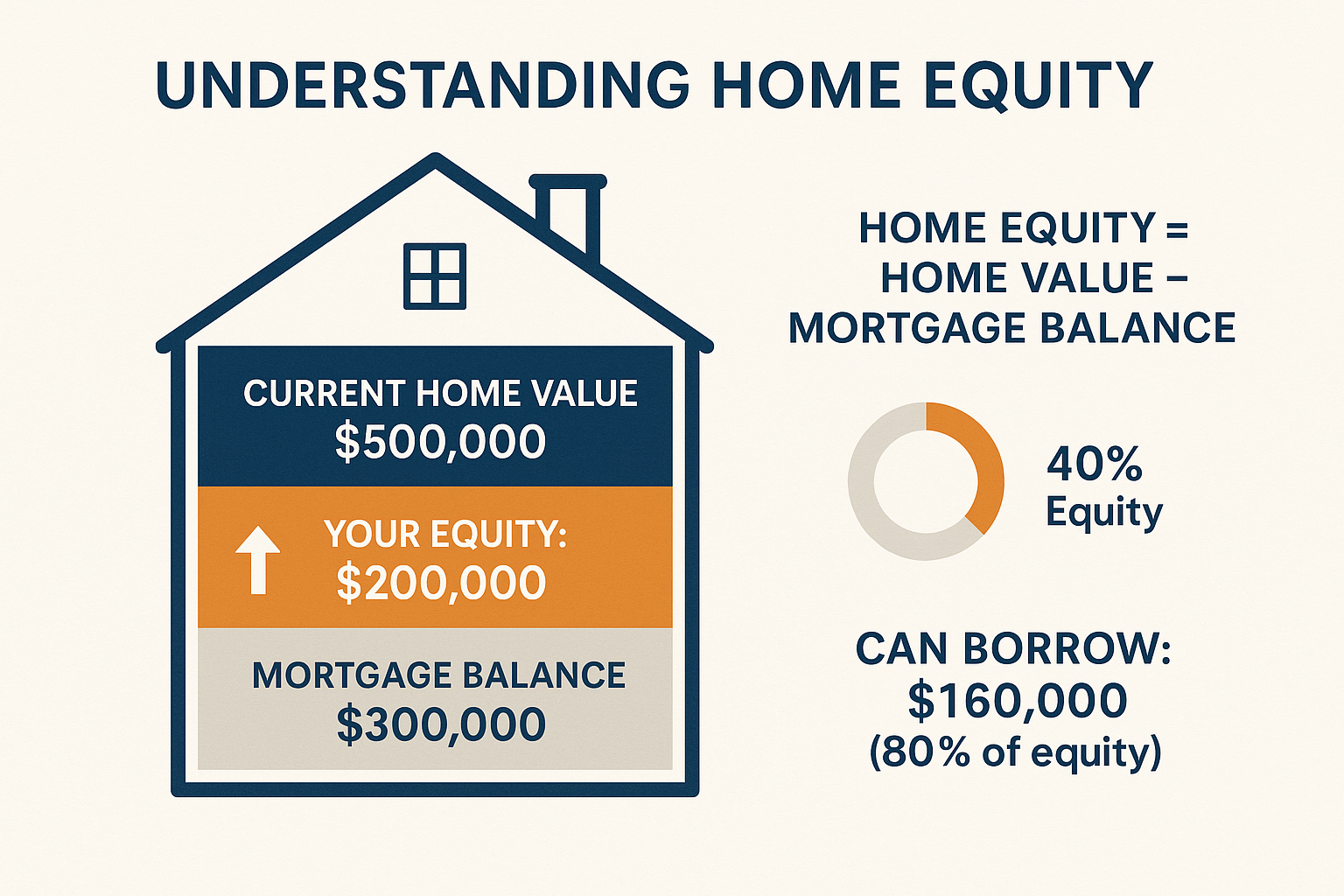

In simple terms, home equity is the portion of your home that you truly own. It’s calculated by subtracting what you owe on your mortgage from your home’s current market value.

The formula for home equity is:

Home Equity = Current Home Value - Outstanding Mortgage BalanceFor example, if your home is worth $400,000 and you owe $250,000 on your mortgage, you have $150,000 in equity. That’s real money you can potentially borrow against—and it’s often available at much lower interest rates than credit cards or personal loans.

Most lenders allow you to borrow up to 80-85% of your home equity, though some may go as high as 90% for well-qualified borrowers. This means if you have $150,000 in equity, you might be able to access $120,000 to $127,500.

Understanding your home equity is crucial because it determines how much you can borrow and whether tapping into it makes financial sense for your situation. Building equity happens in two ways: paying down your mortgage principal and your home appreciating over time.

What Is a HELOC (Home Equity Line of Credit)?

A HELOC is a revolving line of credit secured by your home, functioning much like a credit card but with your house as collateral. Instead of receiving a lump sum, you get access to a credit line you can draw from as needed during a specific period.

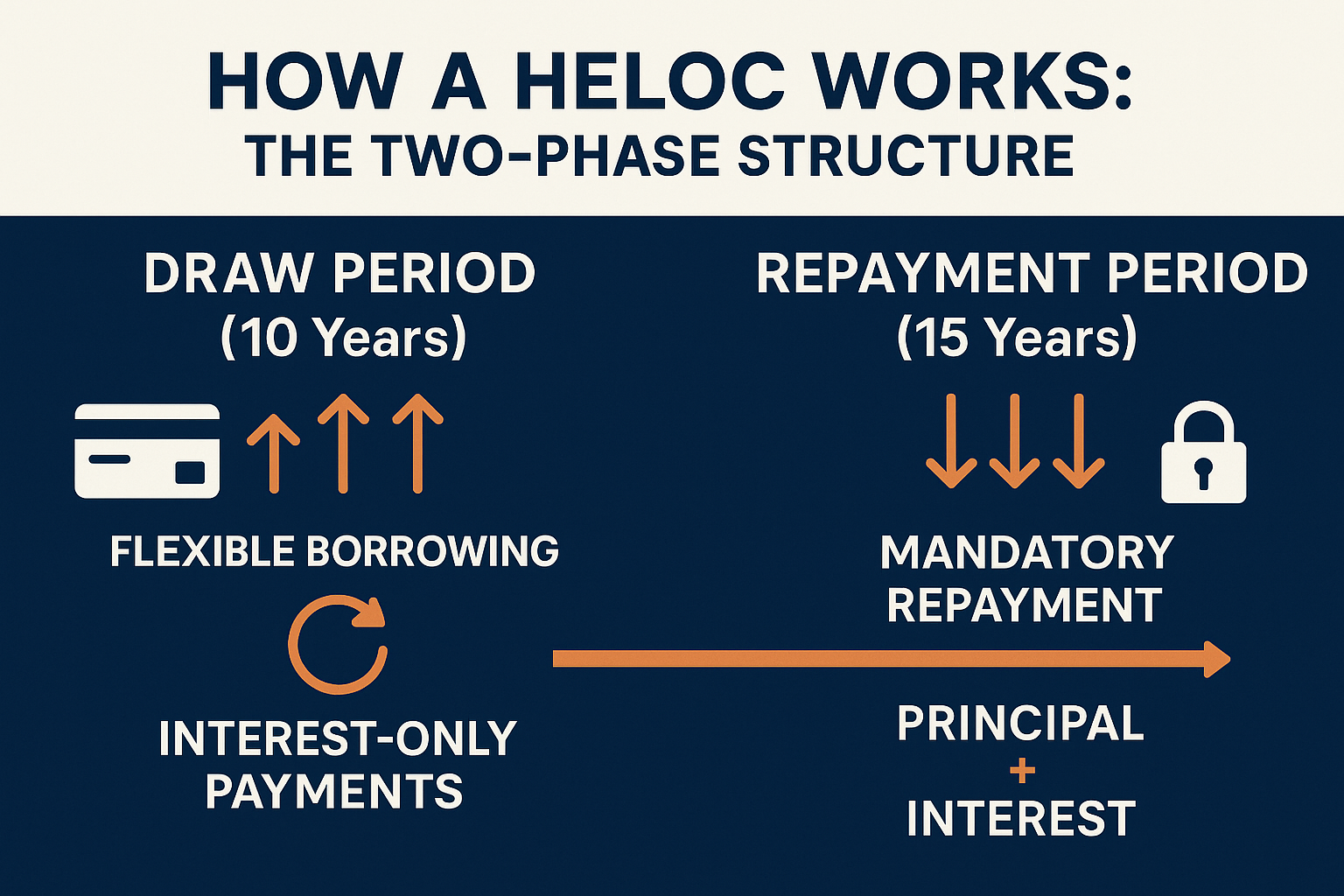

How HELOCs Work: The Two-Phase Structure

Phase 1: Draw Period (Typically 5-10 Years)

During this phase, you can borrow money up to your credit limit, repay it, and borrow again—just like a credit card. You’re usually only required to make interest-only payments during this time, though you can pay toward the principal if you choose.

Phase 2: Repayment Period (Typically 10-20 Years)

Once the draw period ends, you can no longer borrow money. Your HELOC converts to a traditional loan, and you must repay both principal and interest through fixed monthly payments. This can cause payment shock if you’re not prepared, as your monthly payment could jump significantly.

Key HELOC Features

Variable interest rates that fluctuate with market conditions (usually tied to the prime rate)

Flexible borrowing – only take what you need, when you need it

Interest-only payment option during the draw period

Reusable credit line during the draw period

Lower initial payments compared to home equity loans

HELOC Interest Rate Example

If the prime rate is 8.5% and your HELOC has a margin of 0.5%, your rate would be 9.0%. If the prime rate drops to 7.5%, your rate would fall to 8.0%. This variability can work for or against you depending on economic conditions.

What Is a Home Equity Loan?

A home equity loan is a second mortgage that provides a lump sum of money upfront with fixed monthly payments over a set term. Because of this structure, it’s sometimes called a “second mortgage.”

How Home Equity Loans Work

When you take out a home equity loan, you receive the entire loan amount at closing—whether that’s $30,000 or $150,000. You immediately begin repaying the loan through fixed monthly payments that include both principal and interest, typically over 5 to 30 years.

A home equity loan usually offers fixed interest rates, meaning your monthly payment stays the same throughout the loan term. This predictability makes budgeting straightforward and protects you from rising interest rates.

Key Home Equity Loan Features

Fixed interest rates for predictable monthly payments

Lump-sum disbursement at closing

Fixed repayment schedule (5-30 years typical)

Consistent monthly payments throughout the loan term

No draw period – you get all the money upfront

Home Equity Loan Payment Example

If you borrow $100,000 at a fixed 7.5% interest rate for 15 years, your monthly payment would be approximately $927. That payment remains constant for the entire 15-year term, making it easy to plan your budget.

HELOC vs Home Equity Loan: Side-by-Side Comparison

Understanding the differences between these two options is crucial for making the right choice. Here’s a comprehensive comparison:

| Feature | HELOC | Home Equity Loan |

|---|---|---|

| Disbursement | Revolving credit line | Lump sum at closing |

| Interest Rate | Variable (adjustable) | Fixed |

| Payment Structure | Interest-only option during draw period, then principal + interest | Principal + interest from day one |

| Payment Predictability | Payments fluctuate with rate changes | Same payment every month |

| Access to Funds | Potentially higher initially, but protected from increases | One-time only |

| Best For | Ongoing or uncertain expenses | One-time, known expenses |

| Flexibility | High – borrow as needed | Ongoing during the draw period |

| Interest Cost | Potentially lower if rates drop | Potentially higher initially but protected from increases |

| Typical Terms | 10-year draw + 10-20 year repayment | 5-30 years |

| Risk Level | Higher (variable rates can increase) | Lower (fixed payments) |

Bankrate – Home Equity Loan vs. HELOC

Advantages and Disadvantages of HELOCs

Advantages of HELOCs

1. Pay Interest Only on What You Use

Unlike a home equity loan, where you pay interest on the entire amount from day one, a HELOC charges interest only on your outstanding balance. If you have a $50,000 credit line but only use $10,000, you’re only paying interest on $10,000.

2. Flexibility for Ongoing Projects

HELOCs are perfect for projects with uncertain costs or extended timelines. Renovating your home room by room? A HELOC lets you draw funds as each phase begins, rather than having unused money sitting in your account.

3. Lower Initial Monthly Payments

Interest-only payments during the draw period mean lower monthly obligations initially, which can help with cash flow management.

4. Reusable Credit Source

During the draw period, you can repay and reborrow as needed—creating a financial safety net for emergencies or opportunities.

5. Potential Tax Deductions

If you use HELOC funds for home improvements, the interest may be tax-deductible (consult a tax professional for your specific situation).

Disadvantages of HELOCs

1. Variable Interest Rate Risk

Your rate—and therefore your payment—can increase significantly if market rates rise. What starts as an affordable 7% rate could climb to 10% or higher during economic uncertainty.

2. Payment Shock After Draw Period

When the draw period ends, your payment can jump dramatically as you begin repaying principal plus interest. This catches many borrowers off guard.

3. Temptation to Overborrow

Having easy access to credit can lead to overspending on non-essential items, putting your home at risk if you can’t repay.

4. Potential for Negative Amortization

If you only make minimum payments and rates rise, you could end up owing more than you initially borrowed.

5. Fees and Costs

Many HELOCs come with annual fees, transaction fees, or early closure penalties that can add up over time.

Advantages and Disadvantages of Home Equity Loans

Advantages of Home Equity Loans

1. Predictable Fixed Payments

You’ll know exactly what you owe each month for the entire loan term. This makes budgeting simple and protects you from rising interest rates.

2. Protection from Rate Increases

Even if market rates skyrocket, your rate stays locked in. This can save you thousands of dollars during periods of rising rates.

3. Immediate Access to Full Amount

Get all your money at once, which is ideal for large, one-time expenses like debt consolidation or a major home renovation.

4. Potentially Lower Interest Rates

Home equity loans often offer lower rates than HELOCs, especially for borrowers with excellent credit.

5. Simpler to Understand

The straightforward structure—borrow once, repay over time—is easier for many people to comprehend and manage.

Disadvantages of Home Equity Loans

1. Pay Interest on the entire Amount Immediately

Even if you don’t need all the money right away, you start paying interest on the full loan balance from day one.

2. No Flexibility After Closing

Once you take the loan, you can’t access additional funds without applying for a new loan or refinancing.

3. Potentially Higher Initial Costs

Fixed-rate loans may start with higher interest rates than the initial variable rate on a HELOC.

4. Missed Opportunity if Rates Fall

If market interest rates drop significantly, you’re stuck with your higher fixed rate unless you refinance (which involves additional costs).

5. Closing Costs and Fees

Like any mortgage, home equity loans come with closing costs that can range from 2-5% of the loan amount.

When to Choose a HELOC

A HELOC is typically the better choice in these scenarios:

Ongoing Home Renovations

If you’re planning a multi-phase renovation where costs are uncertain or spread over months or years, a HELOC provides the flexibility to draw funds as needed. You might start with the kitchen, then move to bathrooms, and finally tackle the basement—borrowing incrementally rather than all at once.

Education Expenses

College costs span multiple years and semesters. A HELOC allows you to withdraw funds for each tuition payment rather than borrowing the entire four-year cost upfront.

Emergency Fund Backup

Some homeowners keep a HELOC as a financial safety net. You pay nothing if you don’t use it, but it’s there if you face unexpected medical bills, job loss, or major home repairs.

Business Funding

Entrepreneurs and small business owners often use HELOCs for working capital, inventory purchases, or other business expenses that vary over time.

When You Expect Rates to Fall

If you believe interest rates will decline in the near future, a HELOC’s variable rate could work in your favor, allowing you to benefit from lower rates without refinancing.

You Have Strong Financial Discipline

HELOCs require self-control. If you’re confident you won’t overspend and can handle variable payments, the flexibility can be valuable.

When to Choose a Home Equity Loan

A home equity loan makes more sense in these situations:

Debt Consolidation

If you’re consolidating high-interest credit card debt or personal loans, you need to know the exact amount you’re borrowing and want predictable payments. A home equity loan provides both, often at a much lower interest rate than credit cards.

According to the Federal Reserve, the average credit card interest rate in 2025 hovers around 20-24%, while home equity loans typically range from 6-10%—a potential savings of thousands of dollars in interest.

Single Large Home Improvement

Planning a complete kitchen remodel with a fixed budget of $75,000? A home equity loan gives you all the money upfront with no surprises, making it easier to pay contractors and suppliers.

One-Time Major Purchase

Whether it’s a wedding, adoption expenses, or a major medical procedure with a known cost, a lump sum with fixed payments simplifies financial planning.

When You Expect Rates to Rise

If economic indicators suggest interest rates will increase, locking in a fixed rate now protects you from future rate hikes. This was particularly valuable for borrowers who secured home equity loans in 2020-2021 before the Federal Reserve began raising rates aggressively.

You Want Payment Certainty

If you prefer knowing exactly what you’ll pay each month and don’t want to worry about rate fluctuations, a home equity loan’s fixed payment structure provides peace of mind.

You Need the Lowest Possible Rate

In some market conditions, home equity loans offer lower rates than HELOCs, especially for borrowers with excellent credit scores above 740.

Real-World Example: HELOC vs Home Equity Loan in Action

Let’s compare how these two options work for the same borrower in a realistic scenario.

Scenario: Sarah owns a home worth $500,000 with a mortgage balance of $300,000, giving her $200,000 in equity. She wants to borrow $80,000 for a home renovation.

Option 1: HELOC

- Credit line: $80,000

- Initial interest rate: 8.5% (variable)

- Draw period: 10 years (interest-only payments allowed)

- Repayment period: 15 years

- Initial monthly payment (interest-only): $567

- Payment after draw period (principal + interest): Approximately $787 (assuming rates remain stable)

Pros for Sarah: Lower initial payments, flexibility to draw funds as renovation phases are completed, and only pay interest on amounts actually used.

Cons for Sarah: Uncertainty about future rates, payment will increase significantly after 10 years, temptation to use credit line for non-renovation expenses.

Option 2: Home Equity Loan

- Loan amount: $80,000

- Fixed interest rate: 7.75%

- Term: 15 years

- Monthly payment: $752 (same every month for 15 years)

Pros for Sarah: Predictable payment, protection from rising rates, simpler structure, slightly lower rate than HELOC.

Cons for Sarah: Higher initial payment than HELOC interest-only option, pays interest on the full $80,000 immediately, even if renovation takes months, and no flexibility to access additional funds.

The Outcome

Sarah chose the home equity loan because she had a detailed renovation budget, valued payment predictability, and wanted protection from the rising interest rate environment of 2025. Her contractor required 50% upfront, making the lump sum disbursement ideal.

However, if Sarah’s renovation budget was uncertain and she planned to complete it over 2-3 years, the HELOC would have been the better choice despite slightly higher initial rates.

How to Qualify for a HELOC or Home Equity Loan

Lenders evaluate several factors when approving home equity borrowing. Understanding these requirements helps you prepare and potentially secure better terms.

Credit Score Requirements

Minimum scores typically needed:

- HELOC: 620-680 (varies by lender)

- Home Equity Loan: 620-700 (varies by lender)

Better rates with higher scores:

- 740+: Best rates and terms

- 680-739: Good rates

- 620-679: Higher rates, stricter requirements

- Below 620: Difficult to qualify; may need specialized lenders

Investors use credit scores to measure your borrowing risk and payment history. A higher score demonstrates financial responsibility and typically translates to lower interest rates.

Debt-to-Income Ratio (DTI)

Lenders prefer DTI ratios below 43%, though some may approve up to 50% for well-qualified borrowers.

The formula for DTI is:

DTI = (Total Monthly Debt Payments ÷ Gross Monthly Income) × 100For example, if your monthly debts total $3,000 and your gross monthly income is $8,000, your DTI is 37.5%—well within acceptable ranges.

Loan-to-Value Ratio (LTV)

Most lenders limit combined LTV to 80-85%, meaning your first mortgage plus the home equity borrowing can’t exceed 80-85% of your home’s value.

The formula for LTV is:

Combined LTV = (First Mortgage Balance + Home Equity Borrowing) ÷ Current Home Value × 100Using our earlier example: Sarah’s home is worth $500,000, her mortgage is $300,000, and she wants to borrow $80,000.

Combined LTV = ($300,000 + $80,000) ÷ $500,000 × 100 = 76%At 76%, Sarah is well within typical lending guidelines.

Income Verification

Lenders require proof of stable income through:

- Recent pay stubs (last 2-3 months)

- W-2 forms or tax returns (last 2 years)

- Bank statements

- Proof of additional income (rental properties, dividends, etc.)

Self-employed borrowers typically need two years of tax returns and may face additional scrutiny.

Home Appraisal

Most lenders require a professional appraisal to determine your home’s current market value. This typically costs $300-$600 and ensures the lender isn’t lending more than your home can support.

Common Mistakes to Avoid When Choosing Between HELOC vs Home Equity Loan

1: Borrowing More Than You Need

Just because you can borrow $150,000 doesn’t mean you should. Borrowing more than necessary increases interest costs and puts more of your home equity at risk.

Smart move: Calculate the exact amount you need, add a 10-15% buffer for unexpected costs, and borrow only that amount.

2: Using Home Equity for Depreciating Assets

Borrowing against your home to buy a boat, car, or vacation is financially dangerous. These purchases lose value immediately while you’re paying interest on them for years.

Smart move: Use home equity only for investments that increase in value (home improvements) or save you money (debt consolidation at lower rates).

3: Ignoring Total Interest Costs

Focusing only on monthly payments without considering total interest paid over the loan’s life can cost you thousands.

Smart move: Use online calculators to compare total interest costs for different loan terms and types before deciding.

4: Choosing Based Solely on Initial Rate

A HELOC might start at 7.5% while a home equity loan is 8.0%, making the HELOC seem cheaper. But if the HELOC rate rises to 10% after two years, you’ll end up paying more.

Smart move: Consider rate stability and your risk tolerance, not just the starting rate.

5: Not Shopping Around

The first lender you contact might not offer the best terms. Rates and fees can vary significantly between lenders.

Smart move: Get quotes from at least 3-5 lenders, including your current mortgage lender, local credit unions, and online lenders. Compare not just rates but also fees, terms, and flexibility.

6: Forgetting About Closing Costs

Both HELOCs and home equity loans come with closing costs—appraisal fees, origination fees, title search, recording fees, and more. These can total 2-5% of the loan amount.

Smart move: Factor closing costs into your decision. Some lenders offer no-closing-cost options with slightly higher interest rates—calculate which option costs less over your expected borrowing period.

7: Not Having a Repayment Plan

Borrowing without a clear plan for repayment puts your home at risk. Remember, your house is collateral—defaulting could mean foreclosure.

Smart move: Create a detailed repayment budget before borrowing. Ensure you can comfortably afford payments even if your income decreases or expenses increase.

Tax Implications: What You Need to Know

The Tax Cuts and Jobs Act of 2017 changed how home equity borrowing interest is treated for tax purposes.

When Is Interest Tax-Deductible?

Interest on HELOCs and home equity loans is tax-deductible only if the funds are used to “buy, build, or substantially improve” the home securing the loan, according to IRS guidelines.

Tax-deductible uses:

- Home renovations and improvements

- Home additions

- Major repairs that increase home value

NOT tax-deductible uses:

- Debt consolidation

- Car purchases

- Education expenses

- Vacations

- Business expenses

- Investment purchases

Deduction Limits

The total mortgage debt (including your first mortgage and home equity borrowing) must be $750,000 or less ($375,000 if married filing separately) for interest to be deductible. This limit applies to mortgages taken out after December 15, 2017.

For mortgages originated before this date, the limit is $1 million ($500,000 if married filing separately).

Important Tax Considerations

Keep detailed records of how you use home equity funds. If audited, you’ll need to prove the money went toward eligible home improvements.

Consult a tax professional to understand how home equity borrowing affects your specific tax situation. Tax laws are complex and vary based on individual circumstances.

You must itemize deductions to claim home equity interest. With the increased standard deduction ($14,600 for individuals and $29,200 for married couples filing jointly in 2025), many taxpayers no longer itemize, making this deduction irrelevant for them.

Alternatives to HELOCs and Home Equity Loans

Before committing to either option, consider these alternatives that might better suit your needs:

Cash-Out Refinance

Replace your existing mortgage with a larger one and pocket the difference. This works best when current mortgage rates are lower than your existing rate.

Pros: Single payment, potentially lower rate than HELOC or home equity loan, can extend repayment over 30 years

Cons: Resets your mortgage term, high closing costs (2-6% of the loan amount), replaces your existing mortgage rate

Personal Loan

Unsecured borrowing based on creditworthiness without using your home as collateral.

Pros: No risk to your home, faster approval, no appraisal needed

Cons: Higher interest rates (8-20%+), smaller loan amounts, shorter repayment terms (2-7 years typical)

0% APR Credit Cards

For smaller amounts ($5,000-$20,000) needed short-term, promotional credit cards offer interest-free borrowing for 12-21 months.

Pros: No interest if repaid during promotional period, no collateral required, quick access

Cons: Requires excellent credit, high rates after promotional period (20-30%), smaller borrowing limits, temptation to overspend

401(k) Loan

Borrow from your retirement savings, typically up to $50,000 or 50% of your vested balance.

Pros: No credit check, low interest rates, you pay interest to yourself

Cons: Reduces retirement savings, must repay quickly if you leave your job, opportunity cost of missing market gains, potential taxes and penalties if not repaid

Reverse Mortgage (Age 62+)

For retirees with significant home equity, reverse mortgages allow you to convert equity into cash without monthly payments.

Pros: No monthly payments, remain in your home, access large amounts of equity

Cons: Complex and expensive, reduces inheritance, accruing interest, must maintain property, and pay taxes/insurance

Making smart financial moves requires understanding all available options and choosing the one that aligns with your goals and risk tolerance.

How to Apply for a HELOC or Home Equity Loan

Once you’ve decided which option suits your needs, follow these steps for a smooth application process:

Step 1: Check Your Credit Score

Review your credit report from all three bureaus (Equifax, Experian, TransUnion) for errors and get a sense of where you stand. Dispute any inaccuracies before applying.

Step 2: Calculate Your Home Equity

Get a realistic estimate of your home’s current value through online tools like Zillow, Redfin, or Realtor.com, though understand these are estimates. Subtract your mortgage balance to determine available equity.

Step 3: Determine How Much You Need

Create a detailed budget for your project or expense. Add 10-15% for contingencies, but resist the temptation to borrow significantly more than needed.

Step 4: Shop Multiple Lenders

Contact at least 3-5 lenders:

- Your current mortgage lender

- Local credit unions often offer competitive rates)

- National banks

- Online lenders

Compare:

- Interest rates (APR for complete cost comparison)

- Fees (origination, annual, early closure)

- Terms (draw period, repayment period, total term)

- Flexibility (prepayment penalties, rate locks)

Step 5: Gather Required Documentation

Prepare these documents in advance:

- Government-issued ID

- Recent pay stubs (last 2-3 months)

- W-2s or tax returns (last 2 years)

- Bank statements (last 2-3 months)

- Current mortgage statement

- Homeowners insurance information

- Property tax information

- List of other debts and monthly payments

Step 6: Submit Application

Complete the lender’s application, which typically takes 30-60 minutes. Be thorough and accurate—inconsistencies can delay approval.

Step 7: Home Appraisal

The lender will order an appraisal (you typically pay $300-$600). The appraiser will inspect your home and compare it to recent sales of similar properties in your area.

Step 8: Underwriting and Approval

The lender reviews your application, credit, income, and appraisal. This process typically takes 2-6 weeks. Be responsive to requests for additional documentation.

Step 9: Closing

Review and sign loan documents. Pay closing costs (unless rolled into the loan). For HELOCs, you’ll receive checks or a card to access your credit line. For home equity loans, you’ll receive the lump sum, typically via direct deposit or check.

Step 10: Access Your Funds

HELOC: Draw funds as needed during your draw period using checks, a card, or online transfers.

Home Equity Loan: Receive the full amount at closing, typically within days.

The Bottom Line: Making Your Decision

Choosing between a HELOC vs home equity loan isn’t about finding the objectively “better” option—it’s about identifying which tool best matches your specific financial situation, goals, and risk tolerance.

Choose a HELOC if you:

- Need flexible access to funds over time

- Have ongoing or uncertain expenses

- Can handle variable interest rates

- Have strong financial discipline

- Believe interest rates may decrease

- Want lower initial payments

Choose a home equity loan if you:

- Need a specific amount for a one-time expense

- Want predictable, fixed monthly payments

- Prefer protection from rising interest rates

- Value simplicity and straightforward terms

- Are consolidating debt

- Want to lock in today’s rates before they increase

Remember, both options put your home at risk. Defaulting on either can result in foreclosure, so borrow responsibly and only for purposes that improve your financial position or add genuine value to your life.

Just as understanding what moves the stock market helps investors make informed decisions, understanding the mechanics of home equity borrowing empowers you to leverage your home’s value wisely. Both require careful analysis, a realistic assessment of your situation, and a clear plan for success.

Consider consulting with a financial advisor who can review your complete financial picture and help you determine whether tapping your home equity makes sense—and if so, which option aligns best with your goals. The right choice today can save you thousands of dollars and years of financial stress tomorrow.

Making wise decisions about home equity is similar to developing smart ways to make passive income—both require strategic thinking, careful planning, and a long-term perspective on building wealth.

Take Action: Your Next Steps

Ready to move forward? Here’s your action plan:

- Calculate your available equity using your current home value and mortgage balance

- Check your credit score and review your credit report for errors

- Determine exactly how much you need with a detailed budget

- Decide which option fits your needs based on the guidance in this article

- Request quotes from at least 3-5 lenders to compare rates and terms

- Review all terms carefully before signing, paying special attention to fees and penalties

- Create a repayment plan that fits comfortably within your budget

- Consult a tax professional if you plan to deduct the interest

- Use the funds wisely for value-adding purposes only

- Make payments on time, every time, to protect your home and credit

Your home equity is a powerful financial tool—use it wisely, and it can help you achieve important goals while building long-term wealth. Use it carelessly, and it can put your most valuable asset at risk.

FAQ

A HELOC is a revolving line of credit with variable interest rates that you can draw from as needed during a draw period, while a home equity loan provides a lump sum upfront with fixed interest rates and fixed monthly payments. Think of a HELOC like a credit card and a home equity loan like a traditional loan.

Yes, you can have both simultaneously, as long as your combined loan-to-value ratio stays within lender limits (typically 80-85%). However, managing multiple loans against your home increases financial complexity and risk, so carefully consider whether you truly need both.

As of 2025, competitive HELOC rates range from 8.0% to 10.5%, while home equity loan rates typically fall between 7.5% and 9.5%. Your actual rate depends on your credit score, loan-to-value ratio, debt-to-income ratio, and market conditions. Borrowers with excellent credit (740+) and strong equity positions receive the best rates.

Most lenders allow you to borrow up to 80-85% of your home’s value minus your existing mortgage balance. For example, with a $400,000 home value and $250,000 mortgage balance, you have $150,000 in equity and could potentially borrow $120,000-$127,500 (80-85% of equity).

A home equity loan is typically better for debt consolidation because you receive a lump sum to pay off all debts at once, and the fixed rate and payment make budgeting easier. HELOCs can work if you’re consolidating debt gradually, but the variable rate introduces uncertainty. Either option usually offers much lower rates than credit cards, potentially saving thousands in interest.

Most modern HELOCs and home equity loans don’t have prepayment penalties, but some do—especially those advertising very low rates. Always read the fine print and ask specifically about prepayment penalties before signing. Early repayment can save substantial interest costs.

Both must be repaid in full when you sell your home, just like your primary mortgage. The loan payoff comes from your sale proceeds at closing. If you’re considering selling within a few years, factor in how much equity you’ll need for your next home purchase.

Initially, yes—applying triggers a hard inquiry (typically 5-10 point temporary drop) and increases your debt load. However, if you make on-time payments and use the funds responsibly, your score can improve over time as you build positive payment history and potentially improve your credit utilization ratio (especially if consolidating credit card debt).

💰 HELOC vs Home Equity Loan Calculator

Compare costs and find the best option for your situation

Disclaimer

This article is for educational purposes only and does not constitute financial, tax, or legal advice. Home equity borrowing involves significant financial risk, including the potential loss of your home through foreclosure if you cannot repay the debt. Interest rates, terms, lending requirements, and tax laws vary by lender, location, and individual circumstances, and are subject to change.

Always consult with qualified financial, tax, and legal professionals before making borrowing decisions. The information provided reflects general market conditions as of 2025 and may not represent current rates or terms. Lender requirements, interest rates, and regulations can change frequently.

Past performance and historical rates do not guarantee future results. Your actual rates, terms, and borrowing capacity will depend on your individual financial situation, credit profile, home value, and lender policies.

Author Bio

Written by Max Fonji — With over a decade of experience in personal finance and investing education, Max is your go-to source for clear, data-backed investing and financial education. As the founder of TheRichGuyMath.com, Max has helped thousands of readers make smarter financial decisions through accessible, actionable content that cuts through the complexity. When not researching financial strategies, Max enjoys analyzing market trends and helping everyday people build lasting wealth. For more insights on building wealth through smart financial decisions, explore our comprehensive guides on dividend investing and high-dividend stocks.