Picture this: You’re sitting across from a seasoned investor at a coffee shop, and they casually mention, “I never invest in a company without checking their EBIT first.” You nod politely, but inside you’re wondering, what exactly is EBIT, and why does it matter so much?

If you’ve ever felt confused by financial jargon or overwhelmed by income statements, you’re not alone. EBIT (Earnings Before Interest and Taxes) is one of those metrics that sounds intimidating but is actually pretty straightforward once you break it down. Think of it as the financial world’s way of answering a simple question: “How profitable is this business at doing what it actually does?”

Whether you’re evaluating stock market opportunities, comparing companies, or just trying to understand how businesses make money, EBIT is your new best friend. It cuts through the noise of tax strategies and debt structures to show you the raw earning power of a company’s operations.

In this guide, we’ll demystify EBIT completely, from the basic definition to real-world examples, formulas you can actually use, and why this metric matters for your investment decisions in 2025 and beyond.

TL;DR Summary

Quick takeaways about EBIT:

- EBIT (Earnings Before Interest and Taxes) measures a company’s operating profitability before accounting for interest expenses and tax obligations

- The formula is simple: EBIT = Revenue – Operating Expenses (or Net Income + Interest + Taxes)

- EBIT helps investors compare companies across different tax jurisdictions and capital structures on an apples-to-apples basis

- A higher EBIT typically indicates stronger operational efficiency and better core business performance

- Investors use EBIT to evaluate operational profitability, calculate important ratios like EBIT margin, and make informed investment decisions

What Is EBIT? The Simple Definition

In simple terms, EBIT means the profit a company generates from its operations before subtracting interest payments on debt and income taxes.

EBIT stands for Earnings Before Interest and Taxes. It’s a financial metric that shows how much money a company makes from its core business activities, selling products, providing services, or whatever it does to generate revenue, without the influence of its financing decisions (debt vs equity) or tax environment.

Think of EBIT as the “operational heartbeat” of a business.

Here’s why that matters: Two companies might have identical operating performance, but one has massive debt (leading to high interest payments) while the other is debt-free. Their net income would look drastically different, but their EBIT would be the same, revealing that their actual business operations are equally profitable.

Why EBIT Exists

Financial analysts created EBIT to solve a specific problem: How do we compare companies fairly when they have different capital structures and operate in different tax environments?

A company in Ireland faces different tax rates than one in the United States. A startup funded entirely by venture capital has no debt, while an established manufacturer might have billions in loans. EBIT levels the playing field by focusing purely on operational performance.

According to the CFA Institute, EBIT is one of the fundamental metrics used in equity valuation and credit analysis because it provides a clearer picture of operational efficiency than net income alone.

The EBIT Formula: How to Calculate It

There are two main ways to calculate EBIT, and both will give you the same result:

Method 1: Top-Down Approach (From Revenue)

EBIT = Revenue - Cost of Goods Sold (COGS) - Operating ExpensesOr more simply:

EBIT = Revenue - Operating ExpensesWhere:

- Revenue = Total sales or income generated

- Operating Expenses = COGS + Selling, General & Administrative expenses (SG&A) + Depreciation & Amortization

Method 2: Bottom-Up Approach (From Net Income)

EBIT = Net Income + Interest Expense + Tax ExpenseWhere:

- Net Income = The company’s profit after all expenses

- Interest Expense = Cost of servicing debt

- Tax Expense = Income taxes paid

Both methods work perfectly; use whichever is easier based on the financial data you have available. Most investors prefer Method 1 when analyzing income statements because it’s more intuitive, but Method 2 is handy when you’re working backward from net income.

Quick Example Calculation

Let’s say TechCorp reports the following for 2025:

- Revenue: $10,000,000

- Cost of Goods Sold: $4,000,000

- Operating Expenses: $3,000,000

- Interest Expense: $500,000

- Taxes: $750,000

Using Method 1:

EBIT = $10,000,000 – $4,000,000 – $3,000,000 = $3,000,000

Using Method 2:

First, calculate Net Income:

Net Income = $10,000,000 – $4,000,000 – $3,000,000 – $500,000 – $750,000 = $1,750,000

Then add back interest and taxes:

EBIT = $1,750,000 + $500,000 + $750,000 = $3,000,000

Both methods confirm TechCorp’s EBIT is $3 million.

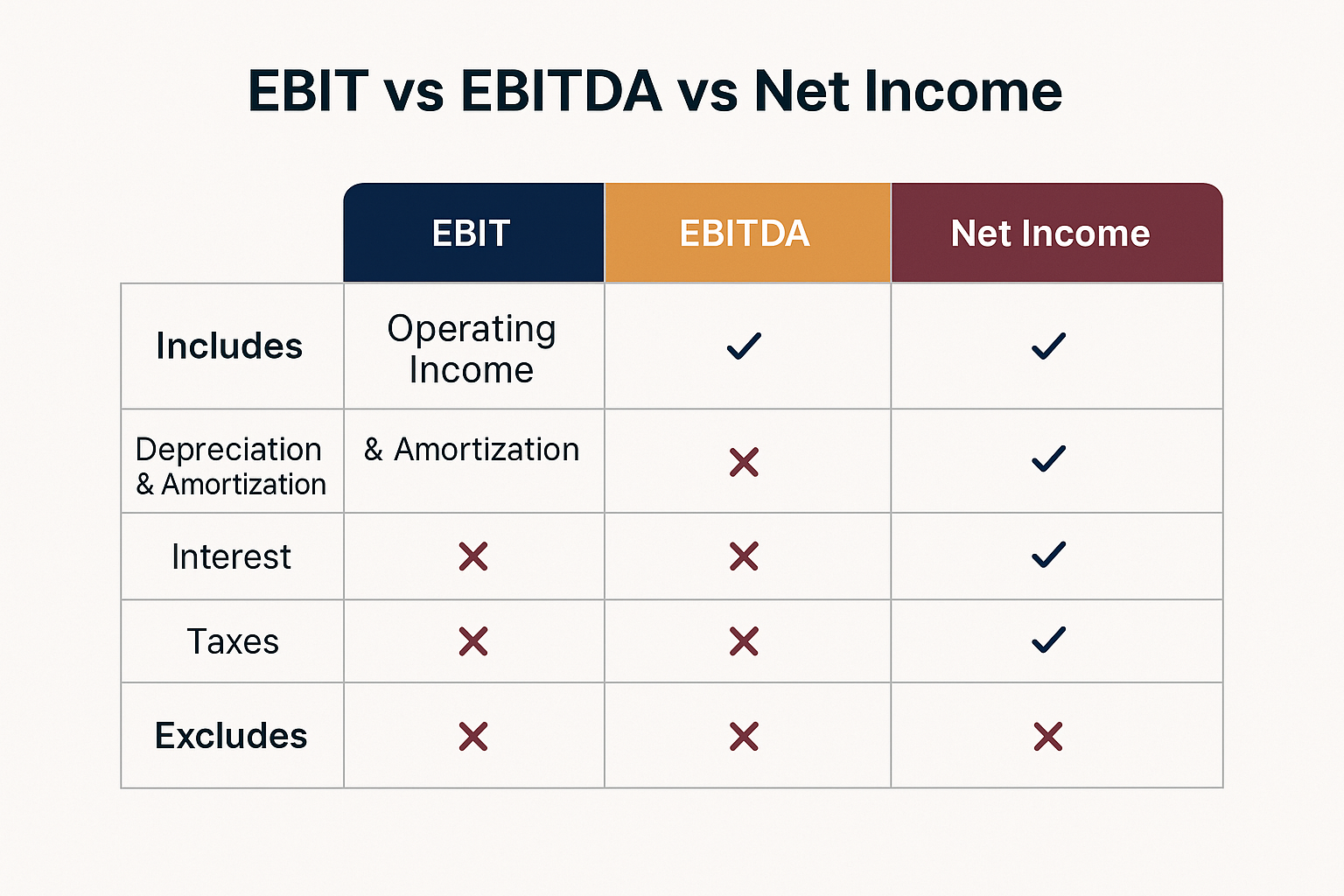

EBIT vs EBITDA vs Net Income: What’s the Difference?

One of the most common questions beginners ask is: “How is EBIT different from EBITDA or net income?” Great question! Let’s break it down:

| Metric | What It Includes | What It Excludes | Best Used For |

|---|---|---|---|

| Net Income | All revenues minus ALL expenses (including interest, taxes, depreciation) | Nothing; it’s the bottom line | Overall profitability after everything |

| EBIT | Operating profit before interest and taxes | Interest, taxes | Comparing operational efficiency across companies with different debt/tax situations |

| EBITDA | Operating profit before interest, taxes, depreciation, and amortization | Interest, taxes, depreciation, amortization | Evaluating cash-generating ability; popular in M&A and leveraged buyouts |

The key difference: EBITDA adds back depreciation and amortization to EBIT, making it even more focused on cash flow. Some argue EBITDA is “cleaner” for capital-intensive industries, while others prefer EBIT because depreciation is a real expense that shouldn’t be ignored.

“EBIT tells you how profitable the business operations are, while EBITDA shows you how much cash those operations might generate.” Financial analysts at Morningstar

For most investing decisions, understanding both metrics gives you a fuller picture.

Why EBIT Matters: The Real-World Importance

So why should you care about EBIT? Here are five compelling reasons this metric deserves your attention:

1. Apples-to-Apples Comparisons

EBIT allows you to compare companies in the same industry regardless of their capital structure or tax situation.

Imagine you’re comparing two retail chains, one operates primarily in low-tax states and has minimal debt, while the other expanded aggressively using loans and operates in high-tax jurisdictions. Their net incomes might tell completely different stories, but EBIT reveals which one actually runs a more profitable operation.

2. Focuses on What Management Controls

Management teams can’t control tax laws or interest rates (set by lenders), but they can control operational efficiency, pricing strategies, cost management, and revenue generation. EBIT measures exactly that: how well management executes the core business.

3. Critical for Valuation Models

Professional investors and analysts use EBIT in several important valuation metrics:

- EBIT Margin = (EBIT ÷ Revenue) × 100

- EV/EBIT Multiple = Enterprise Value ÷ EBIT

- Interest Coverage Ratio = EBIT ÷ Interest Expense

These ratios help determine if a stock is overvalued or undervalued, and whether a company can comfortably service its debt.

4. Reveals Operating Trends

By tracking EBIT over multiple quarters or years, you can spot trends in operational performance that might be hidden in net income. Is EBIT growing while net income shrinks? That could signal rising interest expenses or tax burdens, important information for investors.

5. Essential for Credit Analysis

Lenders and credit rating agencies (like Moody’s and S&P) heavily rely on EBIT to assess a company’s ability to repay debt. A company with strong, consistent EBIT is a safer lending risk than one with volatile or declining operating profits.

How to Interpret EBIT: What the Numbers Tell You

Understanding EBIT is one thing; knowing what it means is another. Here’s how to interpret different EBIT scenarios:

Positive and Growing EBIT

What it means: The company’s core operations are profitable and improving. This is what you want to see!

Example: A software company increases EBIT from $5 million to $7 million year-over-year, indicating strong operational growth, better pricing power, or improved cost efficiency.

Positive but Declining EBIT

What it means: The business is still a profitable operation, but efficiency is slipping. This warrants investigation.

Possible causes:

- Rising input costs (materials, labor)

- Increased competition is forcing price cuts

- Operational inefficiencies

- Market saturation

Negative EBIT

What it means: The company loses money on its core operations before even considering debt or taxes.

Example: A startup in growth mode might show negative EBIT as it invests heavily in expansion, marketing, and product development. This isn’t necessarily bad if it’s part of a strategic plan, but mature companies with negative EBIT are red flags.

EBIT Margin Analysis

The EBIT margin (EBIT ÷ Revenue × 100) is often more useful than the absolute EBIT number because it shows profitability as a percentage of sales.

Industry benchmarks (approximate):

- Software/Tech: 20-30%+

- Retail: 5-10%

- Manufacturing: 8-15%

- Banking/Financial Services: 25-40%

A company with an EBIT margin significantly below its industry average might be struggling with cost control or pricing power.

Real-World EBIT Example: Apple Inc.

Let’s look at a real company to see EBIT in action. According to SEC.gov filings, Apple Inc. reported the following for fiscal year 2024 (simplified):

- Total Revenue: $383 billion

- Cost of Revenue: $214 billion

- Operating Expenses: $55 billion

- Operating Income (EBIT): $114 billion

- Interest and Other Income: $1 billion

- Tax Expense: $25 billion

- Net Income: $97 billion

Calculating EBIT:

EBIT = Revenue – Cost of Revenue – Operating Expenses

EBIT = $383B – $214B – $55B = $114 billion

EBIT Margin:

($114B ÷ $383B) × 100 = 29.8%

This tells us that for every dollar of revenue Apple generates, nearly 30 cents is operating profit, an exceptional margin that reflects Apple’s pricing power, brand strength, and operational efficiency.

Interest Coverage Ratio:

Apple’s interest expense was approximately $3.9 billion.

Coverage Ratio = $114B ÷ $3.9B = 29.2x

This means Apple’s EBIT could cover its interest expenses nearly 30 times over, indicating extremely low financial risk and excellent debt management.

This is the kind of analysis you can perform on any publicly traded company using EBIT. For those interested in dividend investing, strong EBIT is often a prerequisite for sustainable dividend payments.

EBIT in Action: Comparing Two Companies

Let’s compare two fictional restaurant chains to see EBIT’s power:

Company A: “FastBite”

- Revenue: $50 million

- Operating Expenses: $40 million

- EBIT: $10 million

- Interest Expense: $1 million (low debt)

- Taxes: $3 million

- Net Income: $6 million

Company B: “QuickEats”

- Revenue: $50 million

- Operating Expenses: $40 million

- EBIT: $10 million

- Interest Expense: $4 million (high debt from expansion)

- Taxes: $2 million

- Net Income: $4 million

At first glance, FastBite looks more profitable with $6M net income versus QuickEats’ $4M. But look at their EBIT, both companies have identical operating profitability at $10 million!

The difference in net income comes entirely from QuickEats’ higher debt load. If you only looked at net income, you might think FastBite runs a better business. But EBIT reveals they’re equally efficient operationally; QuickEats just chose a different financing strategy.

This is exactly why investors who understand why the stock market goes up rely on EBIT for operational comparisons.

Advantages of Using EBIT

Let’s summarize why EBIT is such a valuable metric:

Key Advantages

- Eliminates Capital Structure Bias: Companies with different debt levels can be compared fairly

- Removes Tax Distortions: Businesses in different tax jurisdictions or with different tax strategies are comparable

- Focuses on Core Operations: Shows how well the actual business performs, not just financial engineering

- Easier Cross-Border Comparisons: International companies face different tax regimes—EBIT normalizes this

- Useful for Trend Analysis: Tracking EBIT over time reveals operational improvements or deterioration

- Foundation for Other Metrics: EBIT feeds into important ratios like EBIT margin, EV/EBIT, and interest coverage

Limitations and Common Mistakes with EBIT

No metric is perfect, and EBIT has its limitations. Here’s what to watch out for:

Key Limitations

1. Ignores Capital Expenditures

EBIT doesn’t account for capital expenditures (CapEx) needed to maintain or grow the business. A company might show strong EBIT but require massive ongoing investments in equipment, facilities, or technology.

Example: A manufacturing company with $20M EBIT looks great until you realize it needs $15M annually in CapEx just to maintain operations.

2. Doesn’t Reflect Cash Flow

EBIT is an accounting measure, not a cash flow measure. A company can have positive EBIT but negative cash flow if customers pay slowly or inventory builds up.

3. Excludes Debt Obligations

While this is intentional for comparison purposes, it means EBIT doesn’t tell you if a company can actually afford its debt. Always check the interest coverage ratio (EBIT ÷ Interest Expense) alongside EBIT.

4. Can Be Manipulated

Companies can boost EBIT temporarily through aggressive revenue recognition, delaying expenses, or one-time gains. Always read the footnotes in financial statements!

5. Industry Differences

EBIT margins vary wildly by industry. A 5% EBIT margin might be excellent for a grocery chain but terrible for a software company. Always compare companies within the same sector.

Common Mistakes to Avoid

- Mistake #1: Using EBIT alone without considering cash flow, CapEx, or debt levels

- Mistake #2: Comparing EBIT across different industries without context

- Mistake #3: Ignoring EBIT trends—one year’s number doesn’t tell the whole story

- Mistake #4: Forgetting that negative EBIT might be acceptable for growth-stage companies

- Mistake #5: Not verifying EBIT calculations—sometimes companies report “adjusted EBIT” that excludes important expenses

According to Investopedia, savvy investors always use EBIT as part of a comprehensive analysis, not as the sole decision-making metric.

EBIT vs Operating Income: Are They the Same?

Here’s a question that confuses many beginners: Is EBIT the same as operating income?

Short answer: Usually yes, but not always.

Operating Income = Revenue – Operating Expenses (COGS + SG&A + Depreciation & Amortization)

EBIT = Earnings Before Interest and Taxes

In most cases, these are identical. However, EBIT can include non-operating income or expenses that aren’t part of operating income.

When They Differ

Example: A company sells an old building for a gain of $2 million. This is non-operating income.

- Operating Income: $10 million (excludes the building sale)

- EBIT: $12 million (includes the $2M gain)

For most companies, especially those without significant non-operating items, EBIT and operating income are the same number. But when analyzing financial statements, check for non-operating items that might create differences.

How to Use EBIT in Investment Decisions

Now that you understand EBIT, here’s how to actually use it when evaluating investments:

Step 1: Calculate EBIT Margin

EBIT Margin = (EBIT ÷ Revenue) × 100Compare this margin to:

- The company’s historical margins (is it improving or declining?)

- Competitors’ margins (is this company more or less efficient?)

- Industry averages (is the whole sector struggling or thriving?)

Step 2: Check Interest Coverage

Interest Coverage Ratio = EBIT ÷ Interest ExpenseRule of thumb:

- Below 1.5x: High financial risk—the company barely covers interest

- 1.5x – 2.5x: Moderate risk—manageable but watch closely

- Above 2.5x: Low risk—comfortable debt servicing

- Above 5x: Very safe—minimal default risk

This is especially important when considering high dividend stocks, as companies with weak interest coverage may cut dividends to preserve cash.

Step 3: Analyze EBIT Trends

Pull 3-5 years of EBIT data and look for patterns:

- Consistent growth: Indicates strong, sustainable operations

- Volatile swings: Suggests cyclical business or operational instability

- Declining trend: Red flag requiring investigation

Step 4: Use EV/EBIT for Valuation

EV/EBIT Ratio = Enterprise Value ÷ EBITEnterprise Value (EV) = Market Cap + Total Debt – Cash

This ratio shows how many years of EBIT you’re paying for the entire business. Lower ratios suggest better value (all else equal). Enterprise Value (EV)

Industry benchmarks:

- Tech: 15-25x

- Consumer Goods: 10-18x

- Utilities: 8-12x

- Mature Industrials: 8-15x

Step 5: Consider EBIT in Context

Never use EBIT in isolation. Combine it with:

- Free Cash Flow: Is EBIT converting to actual cash?

- Return on Equity (ROE): How efficiently does the company use shareholder capital?

- Debt-to-Equity Ratio: Is the balance sheet healthy?

- Revenue Growth: Is the top line expanding?

This holistic approach helps you avoid common mistakes that cause people to lose money in the stock market.

EBIT in Different Industries: What to Expect

EBIT performance varies significantly across sectors. Here’s what to expect:

Manufacturing & Industrials

Typical EBIT Margin: 8-15%

These capital-intensive businesses have moderate margins but require significant CapEx. Look for consistent EBIT and strong interest coverage.

Technology & Software

Typical EBIT Margin: 20-35%+

High margins reflect low marginal costs and scalability. Growth-stage tech companies might show negative EBIT as they invest in expansion, evaluate whether the growth justifies losses.

Retail & Consumer Goods

Typical EBIT Margin: 5-10%

Low margins mean small changes in costs or pricing can swing EBIT significantly. Focus on EBIT trends and same-store sales growth.

Financial Services

Typical EBIT Margin: 25-40%

Banks and insurance companies often show high EBIT margins, but their business models differ significantly from other industries. Interest income is actually revenue for banks, making EBIT analysis somewhat different.

Healthcare & Pharmaceuticals

Typical EBIT Margin: 15-25%

Pharmaceutical companies with patented drugs show high margins, while healthcare providers operate on thinner margins. R&D expenses can significantly impact EBIT.

Utilities

Typical EBIT Margin: 15-25%

Regulated utilities typically show stable, predictable EBIT due to their monopolistic or oligopolistic market positions. Great for conservative investors seeking passive income.

Interactive EBIT Calculator

FAQ

A “good” EBIT depends entirely on the industry and company size. In general, positive and growing EBIT is ideal. For comparison, look at EBIT margin—software companies might target 25%+, while retailers might consider 8-10% strong. The key is comparing to industry peers and historical performance.

The formula for EBIT is: EBIT = Revenue – Operating Expenses, or alternatively, EBIT = Net Income + Interest + Taxes. Both methods produce the same result. Simply subtract all operating costs from revenue, or add back interest and taxes to net income.

Not exactly. EBIT is operating profit before interest and taxes, while “profit” usually refers to net income (the bottom line after all expenses). EBIT shows operational profitability, whereas net profit includes the impact of financing decisions and tax obligations.

EBIT excludes interest and taxes, while EBITDA excludes interest, taxes, depreciation, and amortization. EBITDA is often considered a closer proxy for cash flow since depreciation and amortization are non-cash expenses. EBIT is more conservative because it accounts for the real cost of asset depreciation.

Yes, EBIT can be negative when a company’s operating expenses exceed its revenue. This means the business loses money on core operations. Negative EBIT is common for startups and growth companies investing heavily in expansion, but it’s a red flag for mature, established businesses.

Investors use EBIT to measure operational efficiency without the distortion of different capital structures (debt levels) and tax situations. Two companies might have identical operations but very different net incomes due to debt or tax strategies—EBIT reveals the true operational performance.

EBIT is critical for calculating the EV/EBIT multiple (Enterprise Value divided by EBIT), which shows how many years of operating earnings you’re paying for a business. It’s also used in the interest coverage ratio (EBIT ÷ Interest Expense) to assess financial health and debt servicing ability.

Key Risks and Common Mistakes

Even experienced investors sometimes misuse EBIT. Here are critical risks to avoid:

Risk #1: Ignoring Cash Flow

A company can report strong EBIT while burning cash. Always cross-reference EBIT with the cash flow statement to ensure profits convert to actual cash.

Story: In the early 2000s, many dot-com companies showed positive EBIT on paper but had terrible cash flow because customers paid slowly or not at all. Those who focused only on EBIT lost money when these companies collapsed.

Risk #2: Overlooking One-Time Items

Companies sometimes include one-time gains (like asset sales) in EBIT, inflating the number. Read the footnotes and look for “adjusted” or “normalized” EBIT that excludes unusual items.

Risk #3: Forgetting Capital Requirements

High EBIT means nothing if the company needs constant capital investment to maintain it. Always check capital expenditures relative to EBIT.

Example: A mining company might show $100M EBIT but require $90M annually in CapEx for equipment and site maintenance—leaving only $10M in actual economic profit.

Risk #4: Not Considering Debt Levels

EBIT doesn’t tell you if a company can afford its debt. A business with $50M EBIT and $5M in interest payments is in great shape; one with $50M EBIT and $45M in interest is on thin ice.

Risk #5: Comparing Across Industries

Never compare EBIT margins across different industries. A 5% EBIT margin is excellent for a grocery chain but disastrous for a software company. Context matters!

Understanding these risks helps you navigate market emotions and make rational decisions even when others panic.

EBIT and Your Investment Strategy

So how does EBIT fit into your broader investment approach? Here’s a practical framework:

For Value Investors

Look for companies with:

- Consistent or growing EBIT over 5+ years

- EBIT margins above industry average

- Strong interest coverage (5x or higher)

- Low EV/EBIT multiples compared to peers

These characteristics often indicate undervalued companies with strong operational fundamentals.

For Growth Investors

Focus on:

- EBIT growth rate exceeding revenue growth (improving margins)

- Path to positive EBIT for currently unprofitable companies

- Scalability indicators (EBIT growing faster than headcount or assets)

Growth companies might show negative EBIT initially, but you want to see a clear trajectory toward profitability.

For Dividend Investors

Prioritize:

- Stable, positive EBIT that covers both interest and dividends

- EBIT coverage ratio (EBIT ÷ Total Dividends) above 2x

- Consistent EBIT even during economic downturns

Strong EBIT is the foundation of sustainable dividend payments. Companies that understand this principle make great passive income sources.

For Long-Term Wealth Building

Teaching your children about metrics like EBIT is part of building generational wealth. Understanding operational profitability early helps them make smarter financial decisions throughout life, a key principle in how to make your kid a millionaire.

Real Data: EBIT Across Market Sectors (2025)

Here’s a snapshot of average EBIT margins across major sectors in 2025, based on data from Morningstar and S&P Capital IQ:

| Sector | Average EBIT Margin | Typical Range |

|---|---|---|

| Technology | 24% | 15-35% |

| Healthcare | 18% | 10-28% |

| Financial Services | 32% | 20-45% |

| Consumer Discretionary | 9% | 4-15% |

| Consumer Staples | 11% | 7-16% |

| Industrials | 10% | 6-14% |

| Energy | 12% | -5-25% (highly volatile) |

| Utilities | 19% | 15-23% |

| Real Estate | 22% | 15-30% |

| Materials | 13% | 8-18% |

Key insight: Sector matters enormously. A 15% EBIT margin would be mediocre for technology but outstanding for consumer discretionary retail.

Conclusion: Making EBIT Work for You

We’ve covered a lot of ground, so let’s bring it all together.

EBIT—Earnings Before Interest and Taxes—is one of the most powerful tools in your investing toolkit. It cuts through the complexity of financial statements to reveal the operational heartbeat of a business. While net income can be distorted by debt levels and tax strategies, EBIT shows you the raw earning power of a company’s core operations.

Here’s what you now know:

EBIT measures operational profitability before financing and tax considerations

The formula is straightforward: Revenue – Operating Expenses, or Net Income + Interest + Taxes

EBIT enables fair comparisons across companies with different capital structures and tax situations

EBIT margin, interest coverage, and EV/EBIT are critical ratios for investment analysis

Context matters—always compare EBIT within industries and consider trends over time

EBIT has limitations—it doesn’t show cash flow, CapEx needs, or debt sustainability alone

Your Next Steps

Ready to put this knowledge into action? Here’s what to do:

- Pull financial statements for 3-5 companies you’re interested in (available free on SEC.gov for U.S. companies)

- Calculate their EBIT using both methods to verify your understanding

- Compare EBIT margins to industry averages and competitors

- Check interest coverage ratios to assess financial risk

- Track EBIT trends over 3-5 years to identify improving or deteriorating operations

- Use the interactive calculator above to experiment with different scenarios

Remember, EBIT is just one piece of the puzzle. Combine it with cash flow analysis, balance sheet health, competitive positioning, and management quality for a complete picture.

The most successful investors, those who consistently build wealth through smart investing strategies, don’t rely on single metrics. They develop a comprehensive analytical framework, and EBIT is a cornerstone of that framework.

Whether you’re building a dividend portfolio, hunting for undervalued stocks, or simply trying to understand which businesses create real value, EBIT will serve you well. Master this metric, and you’ll make better investment decisions for decades to come.

Now get out there and start analyzing!

References and Further Reading

To deepen your understanding of EBIT and financial analysis, explore these authoritative resources:

- SEC.gov – Official company filings and financial statements

- Investopedia – Comprehensive financial education

- Morningstar – Investment research and data

- CFA Institute – Professional standards for investment analysis

- Federal Reserve Economic Data (FRED) – Economic and financial data

Disclaimer

This article is for educational purposes only and does not constitute financial advice. EBIT is a useful analytical tool, but investment decisions should be based on comprehensive research, personal financial circumstances, and professional guidance when appropriate.

Past performance does not guarantee future results. All investments carry risk, including the potential loss of principal. Before making any investment decisions, consult with a qualified financial advisor who understands your specific situation and goals.

The examples and calculations provided are for illustrative purposes and may not reflect actual company performance. Always verify financial data from official sources like SEC filings before making investment decisions.

About the Author

Written by Max Fonji — With over a decade of experience in financial analysis, investing education, and helping everyday people build wealth through smart money decisions, Max is your go-to source for clear, data-backed investing education. Max founded TheRichGuyMath.com to demystify finance and empower readers to take control of their financial futures.

Max believes that understanding metrics like EBIT shouldn’t require an MBA or finance degree; it just requires clear explanations, practical examples, and a commitment to continuous learning. When not analyzing financial statements or researching market trends, Max enjoys teaching financial literacy to the next generation and proving that anyone can master the math of getting rich.

Connect with Max and explore more investing insights at TheRichGuyMath.com.