← Back to Budgeting and Saving

Picture this: you just got paid, and within days, your bank account looks like a desert. Sound familiar? You’re not alone—millions of people struggle with budgeting simply because they’ve never learned a straightforward system. Enter the 50/30/20 rule, a refreshingly simple budgeting framework that takes the guesswork out of managing your money. Whether you’re earning your first paycheck or finally ready to take control of your finances, this balanced budget strategy can transform how you spend, save, and build wealth in 2025.

TL;DR

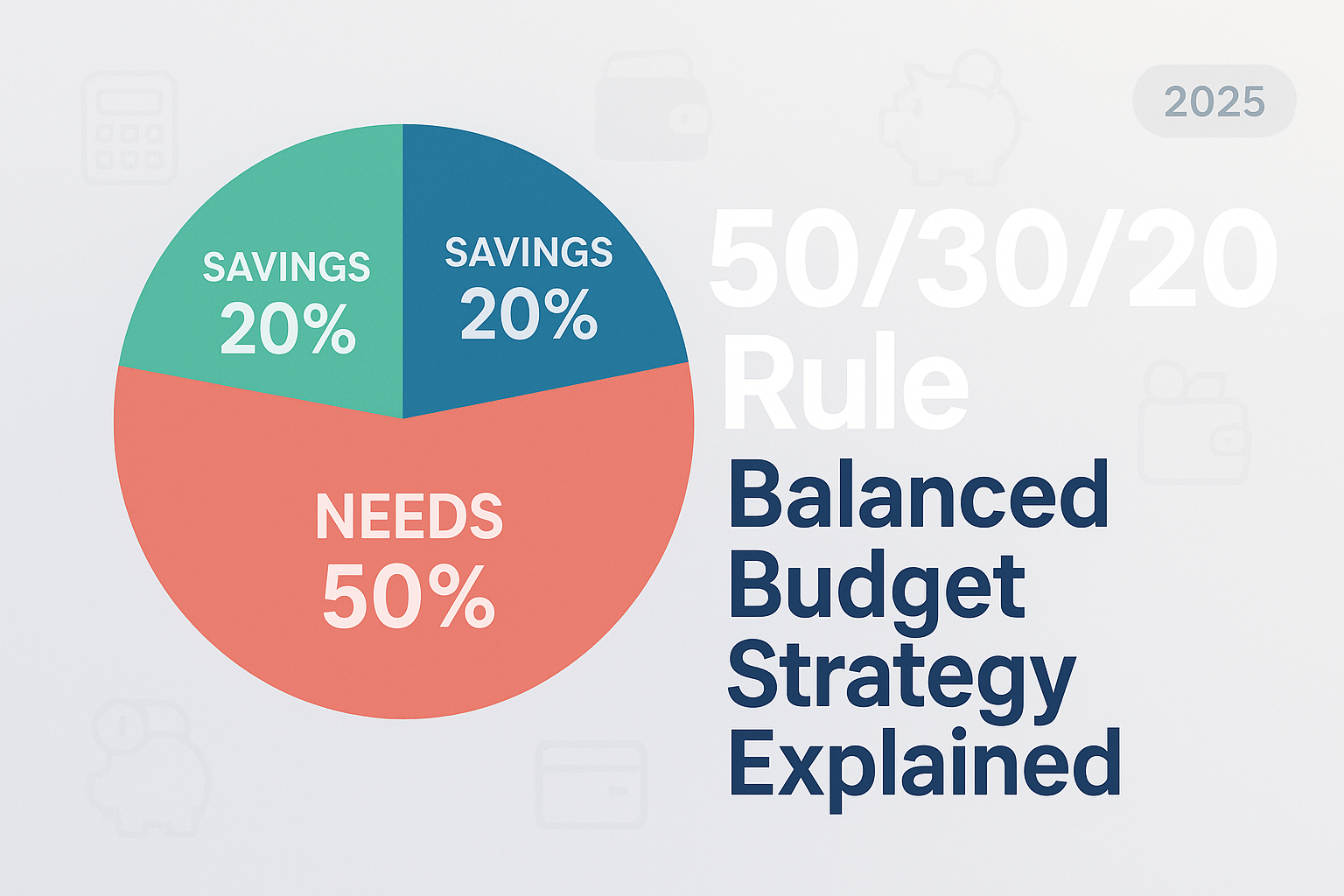

- The 50/30/20 rule divides your after-tax income into three categories: 50% for needs, 30% for wants, and 20% for savings and debt repayment.

- This budgeting strategy provides flexibility and simplicity, making it ideal for beginners who find traditional budgeting overwhelming.

- The rule helps you automatically prioritize savings while still enjoying life, creating a sustainable path to financial security.

- Adjustments may be necessary based on your cost of living, income level, and financial goals—the percentages serve as guidelines, not rigid requirements.s

- Implementing the 50/30/20 rule can help you build an emergency fund, pay off debt, and start building passive income streams for long-term wealth.

What Is the 50/30/20 Rule?

In simple terms, the 50/30/20 rule is a budgeting framework that divides your after-tax income into three categories: 50% for needs, 30% for wants, and 20% for savings and debt repayment.

This straightforward approach was popularized by Senator Elizabeth Warren in her book “All Your Worth: The Ultimate Lifetime Money Plan.” The beauty of this system lies in its simplicity—instead of tracking every single expense across dozens of categories, you only need to manage three buckets. Investopedia

The formula for the 50/30/20 rule is:

- 50% = Needs (essential expenses you can’t avoid)

- 30% = Wants (discretionary spending that enhances your lifestyle)

- 20% = Savings & Debt Repayment (building your financial future)

A higher percentage allocated to savings usually indicates stronger financial health and faster wealth accumulation. However, the standard 20% provides a balanced approach that most people can sustain long-term without feeling deprived.

Breaking Down the Three Categories

50% for Needs: Your Essential Expenses

Needs are expenses you absolutely must pay to maintain your basic standard of living. These are non-negotiable costs that keep a roof over your head and food on your table.

Your “needs” category typically includes:

- Housing costs (rent or mortgage payments, property taxes, HOA fees)

- Utilities (electricity, water, gas, internet, phone)

- Groceries and basic food

- Transportation (car payment, insurance, gas, public transit)

- Insurance (health, auto, renters/homeowners)

- Minimum debt payments (student loans, credit cards, personal loans)

- Childcare or dependent care

- Essential clothing and household items

Common mistake: Many people incorrectly categorize wants as needs. That premium cable package? That’s a want. The $200 monthly gym membership? Also, I want. Basic internet for work? That’s a need.

If your needs exceed 50% of your after-tax income, you have three options:

- Reduce housing costs (consider a roommate, downsize, or relocate)

- Cut transportation expenses (sell an expensive car, use public transit)

- Increase your income through side hustles or passive income opportunities

30% for Wants: Enjoying Your Life

Wants are discretionary expenses that improve your quality of life but aren’t essential for survival. This category makes budgeting sustainable—you’re not living like a monk, you’re living with intention.

Your “wants” bucket includes:

- Dining out and takeout

- Entertainment (streaming services, concerts, movies, events)

- Hobbies and recreation

- Gym memberships and fitness classes

- Travel and vacations

- Shopping (non-essential clothing, gadgets, home décor)

- Subscription services (beyond necessities)

- Personal care (salon visits, spa treatments, premium grooming)

- Gifts and charitable donations

Pro tip: This 30% permits you to enjoy your money guilt-free. The key is staying within the boundary. When you know exactly how much you can spend on wants, you avoid the anxiety of wondering if you’re overspending.

The wants category is also your flexibility buffer. If you’re aggressively paying off debt or saving for a major goal, you can temporarily reduce this percentage to 20% or 25% and redirect those funds to your financial priorities.

20% for Savings and Debt Repayment: Building Your Future

Investors use the 20% savings allocation to build emergency funds, eliminate debt, and create long-term wealth. This is where financial transformation happens.

Your savings and debt repayment category includes:

- Emergency fund (target: 3-6 months of expenses)

- Retirement contributions (401k, IRA, Roth IRA)

- Extra debt payments (beyond minimums to eliminate balances faster)

- Investment accounts (brokerage accounts, index funds, dividend stocks)

- Savings goals (down payment for a house, education fund, major purchases)

- Health Savings Account (HSA) contributions

The priority order matters:

- Build a starter emergency fund ($1,000-$2,000)

- Get any employer 401 (k) match (free money!)

- Pay off high-interest debt (credit cards above 15% APR)

- Build a full emergency fund (3-6 months of expenses)

- Maximize retirement contributions

- Invest in taxable accounts and explore the stock market

According to the Federal Reserve’s 2024 Report on the Economic Well-Being of U.S. Households, nearly 37% of Americans would struggle to cover a $400 emergency expense. The 20% savings allocation helps you avoid becoming part of this statistic.

How to Calculate Your 50/30/20 Budget

Let’s walk through a practical example to show exactly how this works.

Step 1: Calculate Your After-Tax Income

Start with your monthly take-home pay—the amount that actually hits your bank account after taxes, health insurance, and other payroll deductions. NerdWallet

Example:

- Gross annual salary: $60,000

- After taxes and deductions: $48,000/year

- Monthly after-tax income: $4,000

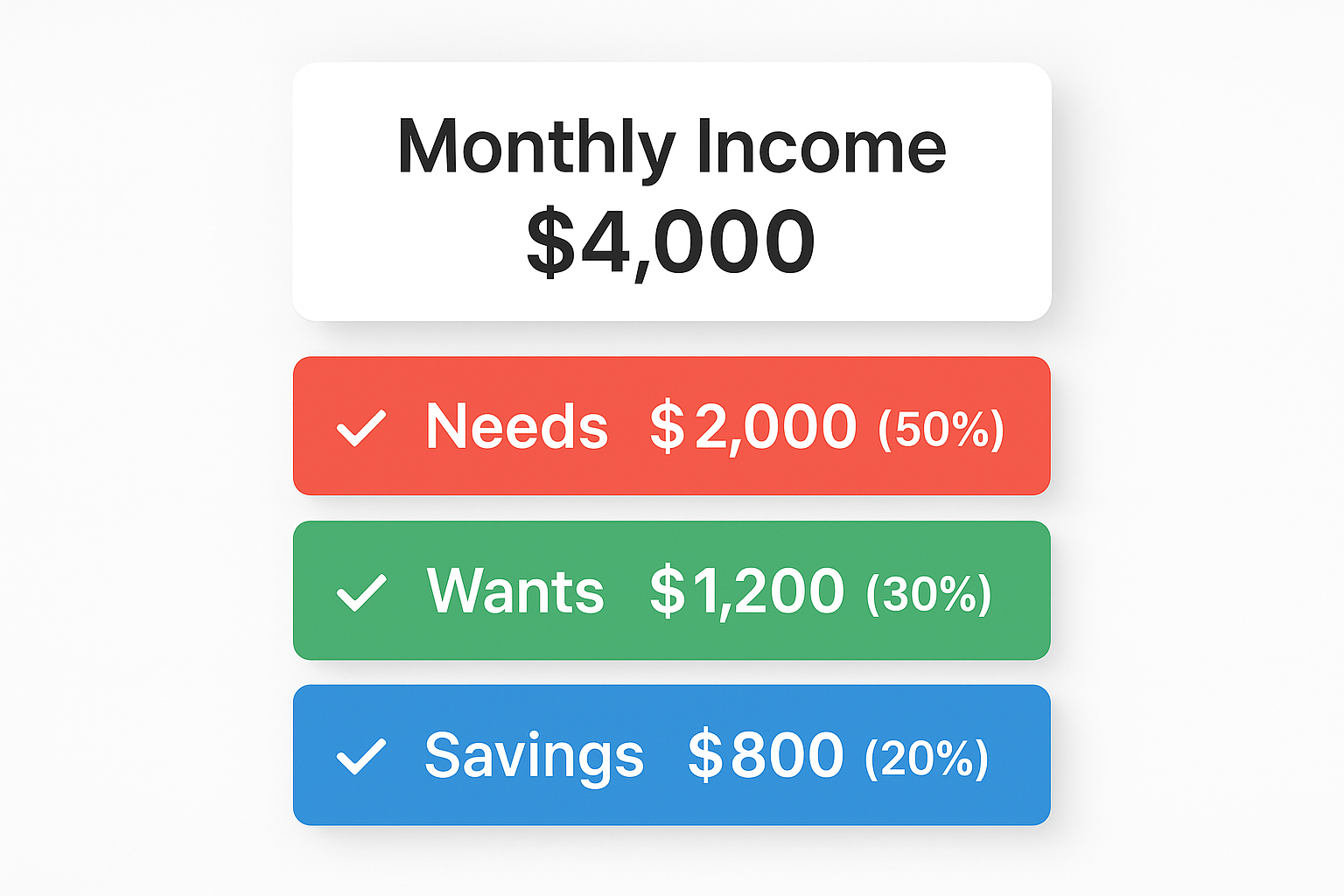

Step 2: Calculate Each Category

Once you know your monthly after-tax income, multiply it by the percentages:

| Category | Percentage | Monthly Amount (on $4,000) |

|---|---|---|

| Needs | 50% | $2,000 |

| Wants | 30% | $1,200 |

| Savings/Debt | 20% | $800 |

| Total | 100% | $4,000 |

See our full guide on Need vs Want

Step 3: Track Your Current Spending

Before implementing the 50/30/20 rule, spend one month tracking where your money actually goes. Use a budgeting app, spreadsheet, or even pen and paper to categorize every expense.

You might discover you’re currently spending:

- 65% on needs

- 30% on wants

- 5% on savings

This awareness is powerful—it shows you exactly what needs to change.

Step 4: Adjust Your Spending

Now comes the challenging part: aligning your actual spending with the 50/30/20 targets. This might require:

- Negotiating bills (call service providers for better rates)

- Eliminating unused subscriptions (that gym you haven’t visited in months)

- Meal planning to reduce food costs

- Setting up automatic transfers to savings accounts

- Creating sinking funds for irregular expenses

Real-World Example: The 50/30/20 Rule in Action

Let’s follow Maria, a 28-year-old marketing coordinator earning $55,000 annually ($3,666 monthly after-tax income).

Maria’s 50/30/20 Budget:

Needs (50% = $1,833):

- Rent: $1,100

- Utilities: $120

- Groceries: $300

- Car insurance: $100

- Gas: $80

- Phone: $50

- Minimum student loan payment: $83

- Total: $1,833

Wants (30% = $1,100):

- Dining out: $300

- Streaming services: $40

- Gym membership: $60

- Shopping/personal: $250

- Entertainment: $150

- Coffee shops: $100

- Hobbies: $200

- Total: $1,100

Savings & Debt (20% = $733):

- Emergency fund: $200

- 401k contribution: $300

- Extra student loan payment: $233

- Total: $733

Maria’s results after 12 months:

- Built an emergency fund of $2,400

- Contributed $3,600 to retirement (plus employer match)

- Paid an extra $2,796 toward student loans

- Still enjoyed regular dinners out, travel, and hobbies

This is the power of the 50/30/20 rule—sustainable progress without deprivation.

Advantages of the 50/30/20 Rule

1. Simplicity and Ease of Use

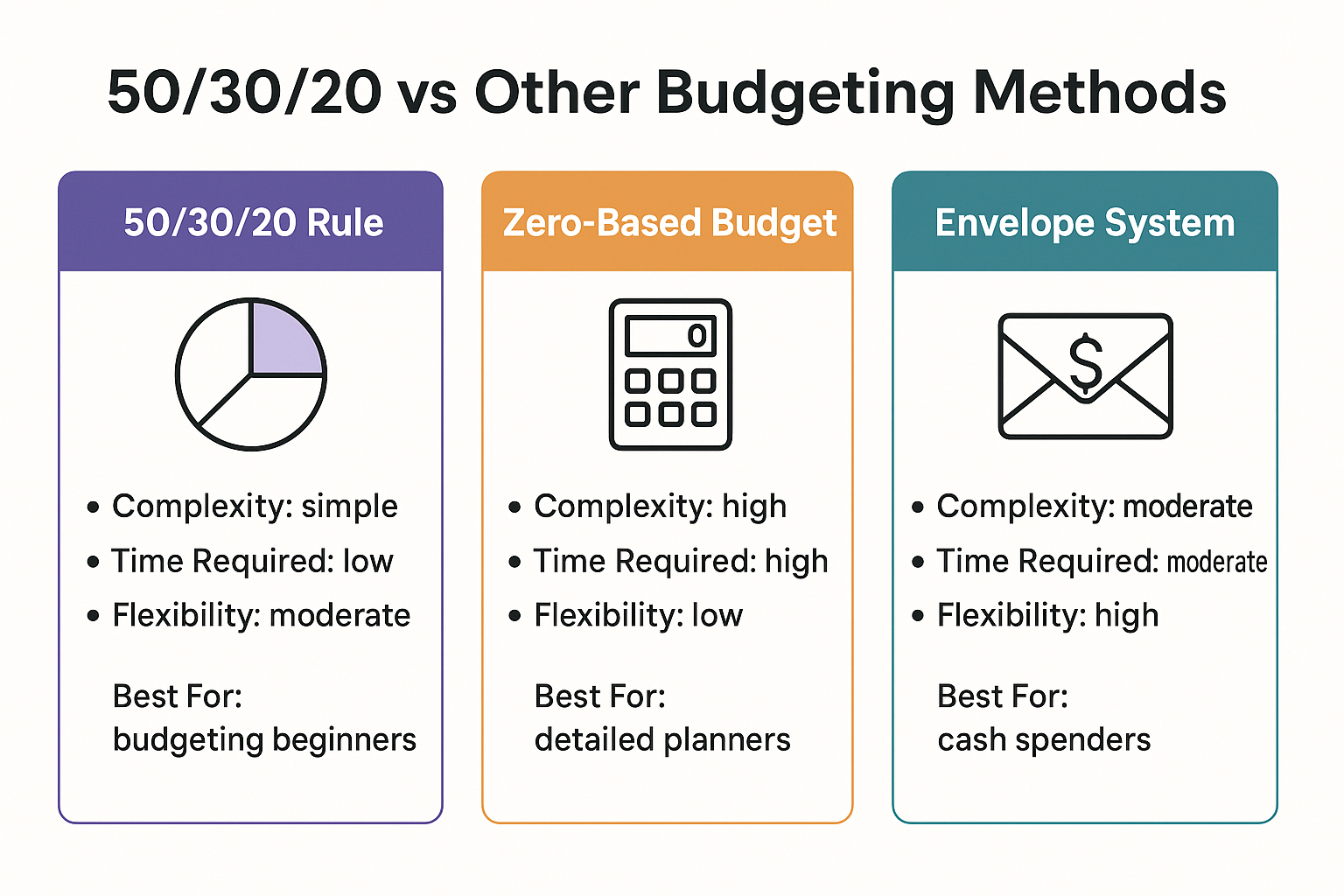

Unlike zero-based budgeting or envelope systems that require tracking dozens of categories, the 50/30/20 rule only requires managing three buckets. This simplicity increases the likelihood you’ll actually stick with it.

2. Built-In Flexibility

Life happens. The 30% wants category gives you breathing room to adapt to changing circumstances without derailing your entire financial plan.

3. Automatic Savings Priority

By allocating 20% to savings before you start spending on wants, you’re paying yourself first—a principle that smart investors use to build wealth consistently.

4. Balanced Approach

The rule prevents both extremes: overspending that leaves nothing for savings, and extreme frugality that leads to burnout and binge spending.

5. Scalable Across Income Levels

Whether you earn $30,000 or $300,000 annually, the percentages provide a framework that scales with your income.

Limitations and Challenges

1. High Cost-of-Living Areas

If you live in expensive cities like San Francisco, New York, or Seattle, keeping housing costs at 50% of your total needs (which should be 50% of your income) can be nearly impossible. You might need to adjust to 60/20/20 or 55/25/20 temporarily.

2. Low-Income Situations

When income barely covers basic needs, allocating 20% to savings may not be realistic. In this case, focus on the principles while adjusting percentages: even saving 5-10% is progress.

3. High-Debt Scenarios

If you’re carrying significant high-interest debt, you might want to flip to a 50/20/30 budget, using 30% for aggressive debt repayment and reducing wants to 20% temporarily.

4. Irregular Income

Freelancers, commission-based workers, and seasonal employees face variable income. The solution: base your budget on your lowest typical monthly income, and treat extra earnings as bonuses to allocate strategically.

5. One-Size-Does n’t-Fit-All

Your financial situation is unique. The 50/30/20 rule provides a starting framework, but you should adjust based on your specific goals, obligations, and circumstances.

50/30/20 Rule vs Other Budgeting Methods

50/30/20 vs. Zero-Based Budgeting

Zero-based budgeting assigns every dollar a specific job until your income minus expenses equals zero.

| Feature | 50/30/20 Rule | Zero-Based Budget |

|---|---|---|

| Complexity | Low (3 categories) | High (many categories) |

| Time Required | Minimal | Significant |

| Flexibility | High | Low |

| Detail Level | General | Granular |

| Best For | Beginners, busy people | Detail-oriented planners |

50/30/20 vs Envelope System

The envelope system allocates cash to physical or digital envelopes for different spending categories.

| Feature | 50/30/20 Rule | Envelope System |

|---|---|---|

| Tracking Method | Percentage-based | Cash/category-based |

| Spending Limits | Category-wide | Specific subcategories |

| Overspending Prevention | Moderate | Very high |

| Convenience | High | Low (especially physical cash) |

| Best For | Digital banking users | Overspenders needing hard limits |

50/30/20 vs Pay Yourself First

Pay Yourself First prioritizes savings by automatically transferring a set amount to savings before spending on anything else.

The 50/30/20 rule actually incorporates the pay-yourself-first principle within its structure—the 20% savings allocation ensures you’re building wealth before spending on wants.

How to Adjust the 50/30/20 Rule for Your Situation

Scenario 1: Aggressive Debt Payoff

Adjustment: 50/20/30 (reduce wants to 20%, increase savings/debt to 30%)

This temporary modification helps you eliminate high-interest debt faster. Once debt-free, return to the standard allocation and redirect that 10% to investments or building dividend income.

Scenario 2: High Cost of Living

Adjustment: 60/20/20 or 55/25/20

If housing and transportation legitimately consume more than 50% of your income, adjust accordingly. However, also explore ways to reduce these costs over time through relocation, roommates, or downsizing.

Scenario 3: Aggressive Wealth Building

Adjustment: 50/20/30 or 50/15/35

High earners or those pursuing financial independence might reduce wants to 15-20% and increase savings to 30-35%. This accelerates retirement savings and investment growth.

Scenario 4: Very Low Income

Adjustment: 70/20/10 or 80/15/5

When income barely covers necessities, start with whatever savings percentage you can manage—even 5% builds the habit. Focus on increasing income through smart money moves and side hustles.

Scenario 5: Irregular Income

Strategy: Use the lowest monthly income from the past year as your baseline. When you earn more, allocate the extra using the 50/30/20 framework or direct it entirely to savings and debt.

Common Mistakes to Avoid

1. Misclassifying Wants as Needs

The newest iPhone isn’t a need—a working phone is. Premium cable isn’t a need—basic internet for work might be. Be honest about the difference.

2. Ignoring Irregular Expenses

Annual insurance premiums, holiday gifts, and car maintenance aren’t monthly expenses, but they’re still needs. Create sinking funds within your needs category to avoid budget-busting surprises.

3. Not Adjusting for Life Changes

Got a raise? Adjust your budget. Had a baby? Recalculate. Changed jobs? Update your allocations. Your budget should evolve with your life.

4. Forgetting the Employer Match

If your employer offers a 401 (k) match, contribute enough to get the full match before paying extra on debt. This is free money with an immediate 100% return—you can’t beat that anywhere, including the stock market.

5. Being Too Rigid

The 50/30/20 rule is a guideline, not gospel. Some months you’ll need to adjust. That’s okay—what matters is the overall trend over time.

6. Not Automating

Manual budgeting requires willpower. Automation requires setup. Automate your savings transfers, bill payments, and investment contributions to remove temptation and ensure consistency.

Tools and Apps to Implement the 50/30/20 Rule

Budgeting Apps

- YNAB (You Need A Budget): Can be customized for 50/30/20 categories

- Mint: Free app that auto-categorizes transactions

- EveryDollar: Simple interface, good for beginners

- PocketGuard: Shows how much you have left to spend in each category

- Goodbudget: Digital envelope system that works with 50/30/20

Spreadsheet Templates

Many people prefer the control of a spreadsheet. Create three main categories with subcategories underneath, and update weekly or monthly.

Banking Tools

Some banks offer automatic savings features:

- Ally Bank’s buckets: Divide savings into different goals

- Capital One’s automatic savings plans

- Chime’s automatic savings (rounds up purchases)

Automation Strategy

- Set up direct deposit to split your paycheck automatically

- Schedule automatic transfers on payday (to savings, investments, extra debt payments)

- Use autopay for bills (within your needs category)

- Set spending alerts when you approach category limits

Building Wealth with the 20% Savings Allocation

The 20% savings category is your wealth-building engine. Here’s how to maximize its impact:

Emergency Fund First

Before investing, build liquid savings for emergencies:

- Starter fund: $1,000-$2,000

- Full fund: 3-6 months of expenses

- Keep it accessible in a high-yield savings account

Retirement Accounts

Take advantage of tax-advantaged accounts:

- 401 (k)/403b: Contribute enough for the full employer match

- Roth IRA: $7,000 annual limit in 2025 ($8,000 if 50+)

- Traditional IRA: Tax deduction now, taxes later

- HSA: Triple tax advantage if you have a high-deductible health plan

Taxable Investment Accounts

Once retirement accounts are maxed, invest in:

- Low-cost index funds (S&P 500, total market)

- Dividend-paying stocks for passive income

- Real estate investment trusts (REITs)

According to Morningstar data, investors who consistently save 20% of their income and invest in diversified portfolios can retire comfortably in 30-35 years, even starting from zero.

The Power of Consistency

A 25-year-old earning $50,000 who saves 20% annually ($10,000) and invests it with a 7% average return will have approximately $2.1 million by age 65. This is the mathematical reality of consistent saving and compound growth.

Understanding why the stock market goes up over time can help you stay committed during market volatility. Remember, investing involves ups and downs—knowing the cycle of market emotions helps you avoid panic selling during downturns.

The Psychology of the 50/30/20 Rule

Why It Works Behaviorally

The 50/30/20 rule succeeds where other budgets fail because it aligns with human psychology:

1. Satisficing vs. Maximizing: Instead of finding the “perfect” budget with 20 categories, you’re satisficing with three—good enough to be effective without being overwhelming.

2. Permission to Spend: The 30% wants category eliminates guilt. You’re not “cheating” on your budget when you go to a nice restaurant—you’re spending within your plan.

3. Clear Boundaries: Humans struggle with abstract goals but thrive with concrete limits. “Spend no more than $1,200 on wants” is clearer than “spend wisely.”

4. Immediate Rewards: Unlike extreme frugality that delays all gratification, the 50/30/20 rule lets you enjoy life now while building for the future.

Avoiding Budget Fatigue

Budget fatigue happens when the system is too complex or restrictive. The 50/30/20 rule prevents this by:

- Requiring minimal tracking time

- Allowing flexibility within categories

- Providing a balance between present enjoyment and future security

Many people lose money in the stock market due to emotional decisions. Similarly, people abandon budgets due to emotional exhaustion. The 50/30/20 rule’s simplicity helps you stay the course.

Teaching the 50/30/20 Rule to Your Family

Financial literacy starts at home. Teaching your children about budgeting creates lifelong money skills.

For Young Children (Ages 5-10)

Use three jars labeled:

- Spend (30% – for toys and treats)

- Save (50% – for bigger items they want)

- Give/Grow (20% – for charity or long-term savings)

When they receive allowance or gift money, help them divide it according to the percentages.

For Teenagers (Ages 11-18)

Introduce the actual 50/30/20 framework:

- Needs: Phone bill, gas money, school supplies

- Wants: Entertainment, clothes, eating out

- Savings: College fund, first car, emergency fund

Consider opening a teen checking account and a Roth IRA if they have earned income. Teaching them to invest early can help make your kid a millionaire through the power of compound growth.

For Couples

Financial disagreements are a leading cause of relationship stress. The 50/30/20 rule can help couples:

- Agree on shared needs (housing, utilities, groceries)

- Maintain individual wants budgets (reduces conflict over personal spending)

- Align on savings goals (retirement, house down payment, vacation fund)

Hold monthly “money dates” to review your budget together without judgment—focus on teamwork, not blame.

Advanced Strategies: Beyond the Basics

Geographic Arbitrage

If your needs consistently exceed 50%, consider:

- Relocating to a lower cost-of-living area

- Negotiating remote work to live somewhere more affordable

- House hacking (renting out rooms to offset housing costs)

Income Optimization

Rather than only cutting expenses, focus on increasing the pie:

- Negotiate a raise at your current job

- Develop high-income skills (coding, design, marketing)

- Start a side business in your wants category time

- Build passive income streams through dividend investing

A 20% raise is often easier to achieve than cutting expenses by 20%—and it doesn’t require sacrifice.

The 50/30/20 Rule for Business Owners

Self-employed individuals can adapt the framework:

- 50% for business operating expenses

- 30% for owner’s compensation

- 20% for taxes and business savings/reinvestment

This ensures you’re not draining all profits from the business while still paying yourself fairly.

Seasonal Adjustments

Your budget doesn’t have to be identical every month:

- December: Might increase wants for holiday spending, reduce savings temporarily

- Tax refund months: Direct entirely to savings or debt

- Bonus months: Split between wants (small celebration) and savings (majority)

The key is that your annual average aligns with 50/30/20, not necessarily every single month.

Tracking Progress and Staying Motivated

Set Milestones

Break big goals into smaller wins:

- First $1,000 in emergency fund

- One month of expenses saved

- First credit card paid off

- $10,000 in retirement accounts

- Three months of expenses saved

- Net worth reaches $50,000

Celebrate each milestone—this reinforces positive behavior.

Monthly Budget Reviews

Spend 30 minutes each month reviewing:

- Did you stay within each category?

- Where did you overspend, and why?

- What adjustments do you need next month?

- Are you making progress toward your goals?

Visualize Your Progress

Create a simple chart showing:

- Emergency fund growth

- Debt paydown progress

- Net worth over time

- Retirement account balance

Visual progress is incredibly motivating—seeing that upward trend makes the sacrifice feel worthwhile.

Find an Accountability Partner

Share your goals with:

- A financially-minded friend

- Your partner or spouse

- An online community

- A financial coach

Regular check-ins create healthy pressure to stay on track.

Conclusion: Your Path to Financial Balance

The 50/30/20 rule isn’t just a budgeting method—it’s a philosophy of balanced living. By allocating 50% to needs, 30% to wants, and 20% to savings and debt repayment, you create a sustainable financial system that builds wealth without sacrificing your quality of life.

The beauty of this framework lies in its flexibility and simplicity. You don’t need to track every coffee purchase or feel guilty about occasional splurges. Instead, you’re operating within clear boundaries that ensure you’re making progress toward financial security while still enjoying the present.

Your next steps:

- Calculate your after-tax monthly income this week

- Track your spending for 30 days to understand your current allocation

- Set up three separate accounts (or budget categories) for needs, wants, and savings

- Automate your savings by scheduling transfers on payday

- Review and adjust monthly until the system feels natural

- Increase your income through raises, side hustles, or passive income strategies

Remember, perfect is the enemy of good. You don’t need to implement the 50/30/20 rule flawlessly from day one. Start where you are, adjust as needed, and focus on consistent progress rather than perfection.

The difference between financial stress and financial peace isn’t usually about how much you earn; it’s about how intentionally you manage what you have. The 50/30/20 rule gives you that intention without the overwhelm.

What will you do with your financial freedom? That’s the real question. This budget is simply the tool that gets you there.

Interactive 50/30/20 Budget Calculator

💰 50/30/20 Budget Calculator

Calculate your ideal budget allocation in seconds

- Housing (rent/mortgage)

- Utilities & phone

- Groceries & basic food

- Transportation & insurance

- Minimum debt payments

- Dining out & entertainment

- Hobbies & recreation

- Subscriptions & memberships

- Shopping & personal care

- Travel & vacations

- Emergency fund

- Retirement contributions

- Extra debt payments

- Investment accounts

- Major savings goals

FAQ

A good 50/30/20 budget for beginners starts with tracking current spending for one month to establish a baseline, then gradually adjusting spending habits to align with the 50% needs, 30% wants, and 20% savings framework over 3-6 months rather than making drastic changes overnight.

To calculate the 50/30/20 rule with irregular income, use your lowest typical monthly income from the past 12 months as your baseline budget, then allocate any additional income above that baseline using the same percentages or directing extra funds entirely toward savings and debt payoff.

Yes, 401k contributions count toward your 20% savings allocation, whether they're made pre-tax or post-tax (Roth), since they represent money you're saving for your financial future rather than spending on current needs or wants.

If your needs exceed 50% of your after-tax income, you have three options: reduce housing and transportation costs (the two largest need categories), increase your income through raises or side work, or temporarily adjust to a 60/20/20 or 55/25/20 split while working toward the standard allocation.

The 50/30/20 rule is effective for debt payoff because it allocates 20% to savings and debt repayment, but if you have high-interest debt above 15% APR, consider temporarily adjusting to 50/20/30 to accelerate debt elimination before returning to the standard allocation.

Yes, the 50/30/20 rule works well for saving for a house—your 20% savings allocation can be directed toward your down payment fund, and you can temporarily reduce wants to 20-25% to accelerate your savings timeline if needed.

Needs are essential expenses required to maintain your basic standard of living (housing, food, transportation, insurance, minimum debt payments), while wants are discretionary expenses that enhance your lifestyle but aren't necessary for survival (dining out, entertainment, hobbies, premium services).

Disclaimer: This article is for educational purposes only and does not constitute financial advice. The 50/30/20 rule is a general guideline that may not be appropriate for everyone's unique financial situation. Before making significant financial decisions, consult with a qualified financial advisor who can provide personalized recommendations based on your specific circumstances, goals, and risk tolerance. Past performance does not guarantee future results, and all investments carry risk.

About the Author

Written by Max Fonji — With over a decade of experience in personal finance education and investment strategy, Max is your go-to source for clear, data-backed investing education. Through TheRichGuyMath.com, Max has helped thousands of readers take control of their finances, eliminate debt, and build sustainable wealth through proven strategies and actionable insights.