Learn How Money Really Works

Beginner-friendly lessons on credit, investing, and personal finance explained step-by-step.

Clear, structured financial education for beginners that builds real stability.

Understanding Money From the Ground Up

Personal finance is not about quick tips or chasing trends. It is about understanding how money actually works, how credit systems operate, how banks calculate interest, how investments grow, and how financial decisions compound over time.

The Rich Guy Math is built around structured financial education. Instead of focusing on product promotions or market predictions, this site explains the mechanics behind credit, budgeting, investing, and long-term planning. When you understand the system, decisions become clearer.

Money problems rarely happen because people lack effort. They happen because the rules were never explained properly. Many invest before stabilizing their cash flow. Others open credit accounts without understanding how reporting works. Some save inconsistently because they do not have a defined framework.

This website organizes financial knowledge in the order it should be learned:

First, control cash flow through budgeting and saving.

Next, understand credit and how lenders evaluate risk.

Then, learn how investing works and how assets grow over time.

Finally, connect everything through structured financial planning.

Each category builds on the previous one. The goal is not complexity. The goal is clarity.

You will find beginner-friendly explanations of credit scores, utilization ratios, interest calculations, index funds, retirement accounts, and passive income strategies. Every guide is written to explain both how something works and why it matters in real life.

Financial education should reduce confusion, not increase it. That is why content here avoids unnecessary jargon and focuses on practical understanding supported by real financial principles.

If you are rebuilding credit, learning to invest for the first time, or trying to make smarter long-term decisions, this site is designed to guide you step by step.

Understanding money is not about luck.

It is about structure.

And structure creates confidence.

Start Here: A Step-by-Step Path

If you’re new to personal finance, follow this order. Each guide builds on the previous one, so you understand the foundation before moving forward.

What Is a Credit Score?

Why first:

Credit affects housing, loans, interest rates, and approvals. Understanding how scores are calculated gives context for every borrowing decision.

How Credit Cards Work

Why second:

Learn how interest is calculated, how statements are closed, and how balances are reported. This prevents costly beginner mistakes.

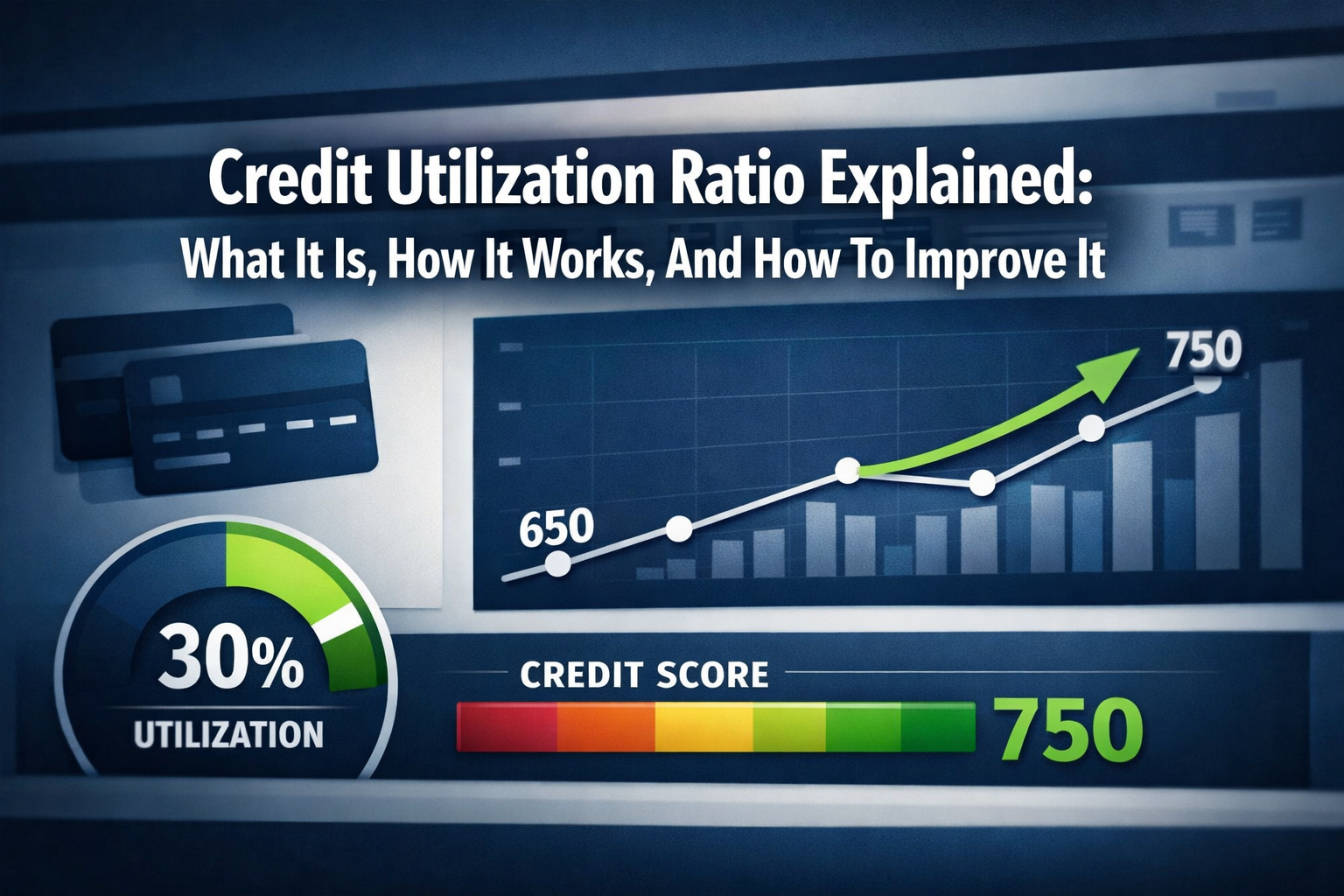

Credit Utilization Ratio Explained

Why third:

Understand how credit limits and balances affect your score and why small changes can cause score swings.

How to Create a Beginner Budget

Why fourth:

Before investing, you need a stable cash flow. Budgeting reduces debt reliance and builds financial control.

What Is an ETF?

Why fifth:

Once your foundation is stable, learn how diversified investing works and why index-based strategies matter.

Beginner Investing Guide

Why sixth:

Now that you understand credit and budgeting, this guide explains long-term investing principles and compounding.

Written & maintained by Max Fonji

Financial education website focused on:

• Credit systems

• Beginner investing

• Personal finance fundamentals

Content is updated regularly and written for educational purposes.

Why Trust The Rich Guy Math

• Educational content based on how financial systems actually work

• No product recommendations or paid rankings

• Designed for beginners learning real financial literacy

• Focused on long-term decision making, not quick tips

New to Finance? Start Here

If you’re beginning your financial journey, start with the fundamentals first. These guides walk you through money in the correct order so you understand each decision before you make it.

Choose Where to Begin

Every topic on this website connects to the others. Personal finance is not about a single decision, such as picking a credit card or choosing a stock. It is a series of skills learned in order.

Most financial problems happen when people jump ahead. They invest before establishing stability, open credit before learning to manage spending, or take loans without understanding the interest.

The guides below are organized in the same order as financial stability develops in real life. Start with the first section and move forward at your own pace. Each hub is a complete beginner’s guide that explains both how things work and why they matter.

Credit

Learn how credit scores work, how to build credit, and how to avoid long-term debt mistakes.

Investing

Understand what stocks actually represent and how beginners invest safely over time.

Financial Planning

Learn how to prepare for major life decisions, such as housing, insurance, taxes, and loans, before committing your money.

Budgeting & Saving

Control cash flow first, so every other financial decision becomes easier.

Financial Tools

Use calculators and practical tools to estimate interest, savings growth, and debt payoff so decisions are based on numbers, not guesses.

Passive Income

Understand realistic ways income streams are built over time and what passive income actually requires in practice.

Latest Articles

Explore the most recent guides on credit, investing, budgeting, and financial planning.

Credit Report vs Credit Score: What’s the Difference and Which One Matters More?

Picture this: You walk into a bank, confident about your 720 credit score, ready to secure that dream home loan. The loan officer pulls up […]

How Long Does It Take to Build Credit? Real Timeline Explained

Most beginners expect credit scores to change quickly. They open their first credit card, check their score app daily, and wonder why nothing moves. The […]

How to Dispute Credit Report Errors (Step-by-Step Guide)

Credit report errors are more common than most people realize, affecting one in five consumers according to Federal Trade Commission studies. These mistakes can devastate […]

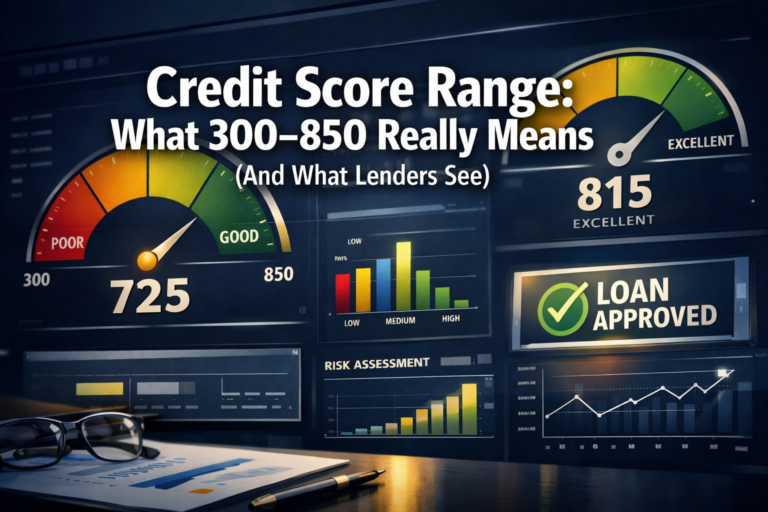

Credit Score Range: What 300–850 Really Means And What Lenders See

Picture this: You just checked your credit score and saw “687” staring back at you. But what does that number actually mean? Is it good? […]

Loan Payoff Calculator: See How Fast You Can Pay Off Your Loan

A loan payoff calculator takes three inputs your remaining balance, interest rate, and monthly payment, and tells you exactly when your loan will reach zero. […]

Authorized User: How It Works and How It Can Help You Build Credit

Picture this: You’re 22 years old, fresh out of college, and ready to rent your first apartment. The landlord runs a credit check and delivers […]

Why Did My Credit Score Drop? (10 Real Reasons + How to Fix Each One)

You checked your credit score, and your stomach dropped. The number fell maybe 20 points, maybe 80, maybe more, and you have no idea why. […]

FICO Score Factors: What Actually Determines Your Credit Score

Picture this: You check your credit score and discover it dropped 30 points seemingly overnight. You haven’t missed any payments, your income is stable, yet […]

When to Pay Your Credit Card: The Exact Timing That Improves Your Score

Most people believe paying their credit card bills early will hurt their credit score. Others think making multiple payments looks suspicious. Some even carry a […]

Who This Site Is For

This website is designed for beginners learning how money works, people rebuilding their credit, and readers who want to understand investing before risking real money. The goal is to replace financial confusion with clear explanations so decisions are made with knowledge instead of pressure.

Continue Learning

Let these values be your compass as you explore smarter ways to invest, save, and live a financially free life. Welcome to the journey, we’re glad you’re here.

Join our community and transform your financial outlook today!

Featured Guides

How Credit Cards Work

A beginner-friendly explanation of what happens when you swipe a credit card and how banks calculate balances.

Credit Utilization Ratio Explained

Learn how the amount of your credit card balance compared to your credit limit affects your credit score and why even small balances can temporarily lower it.

What Is a Credit Score

A beginner-friendly breakdown of what a credit score measures, how lenders use it, and the five factors that determine whether your score rises or falls.