Capital Gains Tax is the tax you pay on profits earned from selling investments or assets for more than you paid. Whether you’re selling stocks, cryptocurrency, or real estate, understanding how this tax works can save you thousands of dollars and help you build wealth more efficiently.

This guide breaks down the math behind capital gains tax, shows you how different holding periods affect your tax bill, and reveals evidence-based strategies to legally reduce what you owe. By the end, you’ll understand exactly how to calculate your gains, when to sell assets, and how to structure your portfolio for maximum tax efficiency.

For comprehensive tax planning strategies, explore our Taxes guide, and to understand how taxes fit into your broader wealth-building approach, visit our Investing framework.

Key Takeaways

- Capital gains tax applies to profits from selling assets — stocks, real estate, crypto, and collectibles all trigger tax obligations when sold at a gain.

- Holding period determines your tax rate — assets held over 12 months qualify for preferential long-term rates, while short-term gains are taxed as ordinary income.

- Tax rates vary by income level — your filing status and taxable income determine whether you pay 0%, 15%, 20%, or higher rates on gains.

- Strategic planning reduces tax burden — tax-loss harvesting, using retirement accounts, and timing sales can legally minimize what you owe.

- Cost basis calculation is critical — accurate tracking of purchase price, fees, and improvements ensures you don’t overpay taxes on your gains.

What Is Capital Gains Tax?

Capital Gains Tax is a levy imposed by the IRS on the profit realized when you sell a capital asset for more than its purchase price.

The tax applies only to realized gains — meaning you must actually sell the asset to trigger the tax event. If your investment increases in value but you continue holding it, those unrealized gains remain untaxed.

Here’s how it works in practice:

If you buy 100 shares of stock at $50 per share ($5,000 total) and later sell them at $75 per share ($7,500 total), you’ve realized a capital gain of $2,500. That $2,500 becomes taxable income subject to capital gains tax rates.

The same principle applies across asset classes:

- Stock sale: You purchase shares of a company, they appreciate, and you sell for a profit

- Property sale: You buy a rental property, it increases in value, and you sell it years later

- Cryptocurrency trade: You acquire Bitcoin at $30,000, it rises to $50,000, and you convert it to cash

Simple calculation example:

Purchase price: $10,000

Sale price: $15,000

Transaction fees: $200

Capital gain: $4,800

This $4,800 represents your taxable gain — the amount the IRS will use to calculate your tax liability.

The tax you actually pay depends on how long you held the asset and your income level, which we’ll explore in detail throughout this guide.

How Capital Gains Tax Works

Capital gains tax operates on a straightforward principle: you pay tax on the difference between what you paid for an asset and what you received when you sold it.

However, the calculation involves several components that affect your final tax bill. Understanding these mechanics helps you plan sales strategically and avoid overpaying.

What Counts As A Capital Asset?

The IRS defines capital assets broadly to include most property you own for personal or investment purposes.

Common capital assets include:

- Stocks and bonds — Individual company shares, corporate bonds, and government securities

- Exchange-traded funds (ETFs) — Diversified investment vehicles that trade like stocks

- Mutual funds — Pooled investment funds managed by professionals

- Cryptocurrency — Bitcoin, Ethereum, and other digital currencies are treated as property

- Real estate — Primary residences, rental properties, vacation homes, and land

- Business interests — Ownership stakes in partnerships, S-corporations, or LLCs

- Collectibles — Art, antiques, rare coins, stamps, and precious metals

What doesn’t count:

Inventory held for sale in your business, property used in your trade, accounts receivable, and certain creative works you created are excluded from capital asset treatment.

The distinction matters because different assets may face different tax rates. For example, collectibles face a maximum 28% rate, while most stocks qualify for preferential long-term rates.

How Gains Are Calculated

The formula for calculating capital gains is deceptively simple, but accurate record-keeping is essential.

The basic formula:

Sale Price – Cost Basis – Transaction Fees = Capital Gain

Cost basis represents your total investment in the asset, including:

- Original purchase price

- Brokerage commissions and fees are paid when buying

- Reinvested dividends (for stocks and funds)

- Improvements and renovations (for real estate)

Transaction fees reduce your gain and include:

- Brokerage commissions on the sale

- Transfer taxes and recording fees

- Legal and professional fees directly related to the sale

Real estate example:

Original purchase price: $300,000

Closing costs at purchase: $5,000

Kitchen renovation: $25,000

Bathroom upgrade: $15,000

Adjusted cost basis: $345,000

Sale price: $450,000

Selling costs (agent, fees): $27,000

Net proceeds: $423,000

Capital gain: $423,000 – $345,000 = $78,000

This $78,000 represents your taxable gain, subject to capital gains tax rates based on your holding period and income.

Accurate cost basis tracking prevents overpaying taxes. Many investors forget to include reinvested dividends or property improvements, artificially inflating their taxable gains.

Keep detailed records of all purchases, improvements, and fees. Your brokerage statements typically track cost basis for securities, but you’re responsible for maintaining real estate and collectible records.

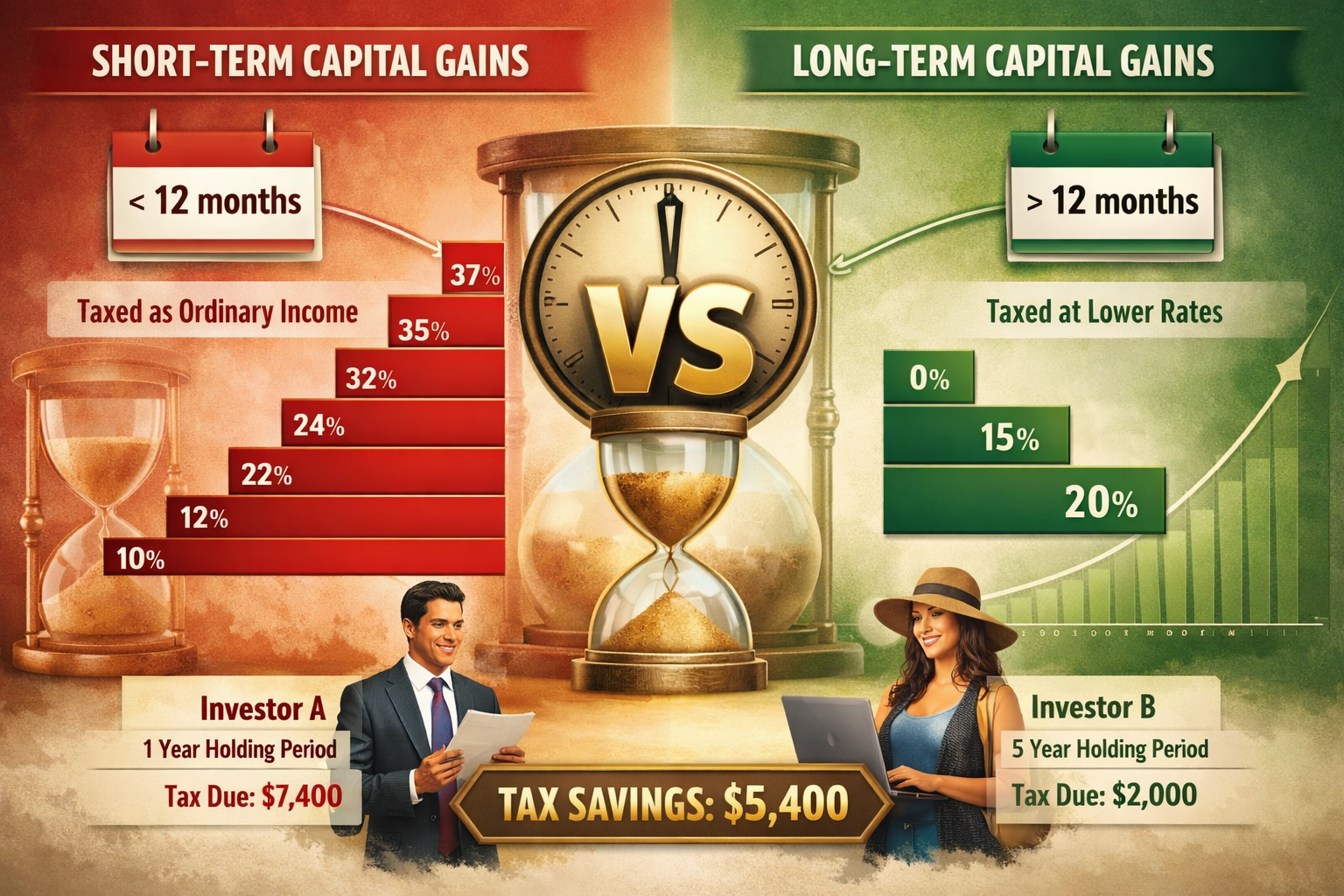

Short-Term vs Long-Term Capital Gains

The IRS divides capital gains into two categories based solely on how long you held the asset before selling. This distinction creates dramatically different tax consequences.

The holding period begins the day after you acquire the asset and ends on the day you sell it. One day can make a significant difference in your tax bill.

Short-Term Capital Gains

Short-term capital gains apply to assets held for 12 months or less before selling.

These gains receive no preferential tax treatment. Instead, the IRS taxes them as ordinary income at your regular income tax bracket rates.

Why this matters:

If you’re in the 24% federal tax bracket, your short-term capital gains are also taxed at 24%. Add state income taxes, and your effective rate could exceed 30% in high-tax states.

Example scenario:

You buy stock on January 15, 2026, for $10,000. On December 1, 2026, it’s worth $15,000, and you sell for a $5,000 profit.

Because you held the stock for less than 12 months, that $5,000 is taxed as ordinary income. At a 24% federal rate, you owe $1,200 in federal taxes alone.

The cost of impatience:

Frequent trading and short holding periods erode investment returns through higher taxes. A trader making multiple short-term trades throughout the year could lose 25-37% of profits to federal taxes, plus state taxes.

This tax structure incentivizes buy-and-hold investing over active trading — a principle aligned with evidence-based wealth building.

Long-Term Capital Gains

Long-term capital gains apply to assets held for more than 12 months before selling.

These gains qualify for preferential tax rates significantly lower than ordinary income rates. This tax advantage rewards patient, long-term investing.

Tax efficiency advantage:

While short-term gains might be taxed at 32% or higher, long-term gains are typically taxed at 0%, 15%, or 20%, depending on your income level.

Same example, different outcome:

You buy the same stock on January 15, 2026, for $10,000. You wait until January 16, 2027 — just one day past the 12-month mark — and sell for $15,000.

Now your $5,000 gain qualifies for long-term treatment. At the 15% long-term rate (for most middle-income investors), you owe just $750 in federal taxes.

Tax savings: $1,200 – $750 = $450

That’s a 37.5% reduction in taxes simply by waiting one additional day.

The compounding effect:

Over a lifetime of investing, the difference between short-term and long-term rates compounds dramatically. An investor who consistently holds assets for long-term treatment can accumulate significantly more wealth than an active trader with identical gross returns.

This mathematical reality supports long-term investing strategies and dollar-cost averaging approaches that emphasize patience over market timing.

Strategic implication:

If you’re approaching the 12-month mark on a profitable investment, waiting a few extra days or weeks to cross into long-term territory often makes financial sense — unless fundamental analysis suggests immediate selling is necessary.

Capital Gains Tax Rates (US)

Capital gains tax rates in the United States operate on a tiered system based on your taxable income and filing status.

Unlike a flat tax, these rates increase as your income rises, creating a progressive structure that taxes higher earners at higher rates.

Long-term capital gains rates (2026):

The IRS establishes three primary rate tiers for long-term gains:

- 0% rate: Applies to taxpayers in the lowest income brackets

- 15% rate: Covers most middle and upper-middle income earners

- 20% rate: Reserved for high-income taxpayers above specific thresholds

Income thresholds vary by filing status:

- Single filers face different thresholds than married couples filing jointly

- Head of household filers have separate brackets

- Married filing separately uses different limits

Short-term capital gains rates:

These match your ordinary income tax brackets, which for 2026 range from 10% to 37% depending on total taxable income.

Additional considerations:

High-income investors may face an additional 3.8% Net Investment Income Tax (NIIT) on capital gains when their modified adjusted gross income exceeds certain thresholds ($200,000 for single filers, $250,000 for married filing jointly).

State taxes add another layer:

Most states impose their own capital gains taxes, typically treating gains as ordinary income. Rates vary from 0% (states with no income tax, like Florida, Texas, and Nevada) to over 13% in California.

Total effective rate example:

A California resident in the 20% federal long-term bracket plus 3.8% NIIT plus 13.3% state tax faces a combined rate of approximately 37.1% — even on long-term gains.

Important disclaimer:

Tax rates and income thresholds change annually based on inflation adjustments and legislative changes. Always consult current IRS publications or a qualified tax professional for exact rates applicable to your situation.

The math behind these rates reveals a clear incentive structure: hold assets longer than 12 months, and manage your income to stay in lower brackets when possible.

For comprehensive tax planning that accounts for these variables, review strategies in our Taxes basics.

Capital Gains Tax On Different Assets

While the fundamental calculation remains consistent, capital gains tax treatment varies significantly across asset classes. Each category has unique rules, holding period requirements, and special considerations.

Stocks And ETFs

Stocks and exchange-traded funds represent the most straightforward capital gains scenario.

How it works:

When you sell shares for more than your cost basis, the gain is taxable in the year of sale. The holding period determines whether it’s short-term or long-term.

Cost basis methods:

For investors who purchase shares at different times and prices, the IRS allows several methods to calculate cost basis:

- FIFO (First In, First Out): Assumes you sell the oldest shares first

- Specific identification: Lets you choose which shares to sell for tax optimization

- Average cost: Uses the average price of all shares (typically for mutual funds)

Dividend reinvestment impact:

If you automatically reinvest dividends to purchase additional shares, each reinvestment creates a new cost basis entry. These reinvested amounts increase your total cost basis, reducing your taxable gain when you eventually sell.

Example:

You buy 100 shares at $50 ($5,000). Over three years, you reinvest $1,200 in dividends, purchasing 20 additional shares. Your adjusted cost basis is now $6,200, not just $5,000.

When you sell all 120 shares for $9,000, your taxable gain is $2,800 ($9,000 – $6,200), not $4,000.

Wash sale rule:

If you sell stock at a loss and repurchase the same or substantially identical security within 30 days before or after the sale, the IRS disallows the loss deduction. This prevents investors from claiming tax losses while maintaining their position.

The disallowed loss gets added to the cost basis of the repurchased shares, deferring the tax benefit.

For diversified portfolio strategies that minimize single-stock risk, explore our guide to the best ETFs to buy.

Cryptocurrency

The IRS treats cryptocurrency as property, not currency, for tax purposes. This classification creates capital gains obligations on virtually every transaction.

Taxable crypto events:

- Selling crypto for US dollars or other fiat currency

- Trading one cryptocurrency for another (Bitcoin for Ethereum)

- Using crypto to purchase goods or services

- Receiving crypto as payment for services (taxed as ordinary income, then subject to capital gains when sold)

Not taxable:

- Buying crypto with fiat currency

- Transferring crypto between your own wallets

- Gifting crypto (though gift tax rules may apply for large amounts)

Tracking challenge:

Every crypto transaction requires calculating gain or loss based on the fair market value at the time of the transaction. For active traders making dozens of trades, this creates significant record-keeping complexity.

Example:

You buy 1 Bitcoin for $30,000. Three months later, you use 0.5 Bitcoin (then worth $25,000) to purchase a car.

This triggers a taxable event. Your cost basis for the 0.5 Bitcoin is $15,000. The fair market value at sale is $25,000. Your capital gain is $10,000, taxed as short-term because you held it less than 12 months.

Hard fork and airdrop rules:

When a blockchain splits (hard fork), or you receive free tokens (airdrop), the IRS considers this ordinary income at the fair market value when you receive control of the new coins.

Documentation is critical:

The IRS has increased cryptocurrency enforcement. Exchanges may not provide complete tax reporting, so maintaining your own detailed transaction logs is essential.

Real Estate

Real estate capital gains involve more complex calculations but also offer significant tax advantages unavailable to other asset classes.

Primary residence exclusion:

The most powerful real estate tax benefit: if you’ve lived in your home as your primary residence for at least 2 of the past 5 years before selling, you can exclude:

- $250,000 of gain (single filers)

- $500,000 of gain (married filing jointly)

This exclusion can be used repeatedly throughout your lifetime, though generally not more than once every two years.

Example:

A married couple buys a home for $300,000, lives in it for five years, and sells it for $750,000. Their $450,000 gain is completely tax-free because it falls below the $500,000 exclusion.

Investment property:

Rental properties and investment real estate don’t qualify for the primary residence exclusion. All gains are taxable, though the holding period still determines short-term versus long-term treatment.

Depreciation recapture:

If you claimed depreciation deductions on rental property, the IRS “recaptures” that depreciation when you sell, taxing it at a maximum 25% rate — even if the rest of your gain qualifies for lower long-term rates.

Cost basis adjustments:

For real estate, your cost basis includes:

- Original purchase price

- Closing costs and title fees

- Capital improvements (new roof, additions, major renovations)

- Legal fees related to the purchase

Regular maintenance and repairs don’t increase basis — only improvements that add value or extend the property’s life.

1031 exchange:

Real estate investors can defer capital gains taxes indefinitely by using a 1031 like-kind exchange. This allows you to sell one investment property and reinvest the proceeds into another similar property without recognizing the gain.

The tax liability transfers to the new property, deferring taxes until you eventually sell without exchanging.

Installment sales:

Selling real estate over time through an installment agreement spreads the capital gain across multiple years, potentially keeping you in lower tax brackets.

Collectibles And Special Assets

Collectibles face higher maximum tax rates than most other capital assets, reducing their tax efficiency as investments.

IRS definition of collectibles:

- Art, antiques, and decorative items

- Rare coins and stamps

- Precious metals (gold, silver, platinum bullion)

- Gems and jewelry

- Alcoholic beverages (wine collections)

- Certain rare books and historical documents

Maximum 28% rate:

While stocks and real estate qualify for 0%, 15%, or 20% long-term rates, collectibles held long-term face a maximum federal rate of 28%.

If your ordinary income tax bracket is lower than 28%, you pay that lower rate. But high-income investors pay 28% regardless, higher than the 20% maximum for other long-term gains.

Valuation challenges:

Unlike publicly traded stocks with clear market prices, collectibles require professional appraisals to establish fair market value for tax purposes.

This creates additional costs and potential disputes with the IRS if valuations are challenged.

Example:

You purchase a rare painting for $50,000 and sell it five years later for $200,000. Your $150,000 gain is subject to the 28% collectibles rate, resulting in $42,000 in federal taxes — compared to $30,000 at the 20% rate for stocks.

Precious metals in IRAs:

Certain gold, silver, platinum, and palladium coins and bullion can be held in self-directed IRAs, allowing you to defer or eliminate capital gains taxes depending on the account type.

How To Reduce Or Avoid Capital Gains Tax (Legally)

Strategic tax planning transforms capital gains from a wealth drain into a manageable component of your investment strategy. These evidence-based approaches legally minimize your tax burden.

Hold Investments Longer Than 1 Year

The simplest and most powerful tax reduction strategy: patience.

By holding assets for at least 12 months plus one day, you automatically qualify for preferential long-term capital gains rates instead of higher ordinary income rates.

The math:

A $10,000 gain taxed as short-term income at 32% costs $3,200 in federal taxes.

The same $10,000 gain taxed as long-term at 15% costs $1,500 in federal taxes.

Tax savings: $1,700 (53% reduction)

Compounding impact:

Over a 30-year investing career, consistently qualifying for long-term rates instead of short-term rates can increase your after-tax wealth by 40% or more, assuming identical pre-tax returns.

Implementation:

- Mark your calendar with the 12-month anniversary of each purchase

- Use portfolio tracking software that alerts you when positions approach long-term status

- Avoid emotional selling decisions driven by short-term market volatility

- Plan major sales to occur after crossing the long-term threshold

This strategy aligns perfectly with compound growth principles that reward time in the market over market timing.

Tax-Loss Harvesting

Tax-loss harvesting involves strategically selling investments at a loss to offset capital gains from profitable sales.

How it works:

Capital losses offset capital gains dollar-for-dollar. If your losses exceed your gains, you can deduct up to $3,000 of excess losses against ordinary income each year, carrying forward any remaining losses to future years.

Example:

You realize $15,000 in capital gains from selling Stock A.

You also sell Stock B at a $10,000 loss.

Your net taxable gain: $15,000 – $10,000 = $5,000.

Instead of paying taxes on $15,000, you only pay on $5,000 — saving $1,500 to $3,700 depending on your tax bracket.

Strategic timing:

Most investors harvest losses in December before year-end, reviewing portfolios for underperforming positions that can offset gains realized earlier in the year.

Wash sale rule caution:

Remember, you cannot claim the loss if you repurchase the same or substantially identical security within 30 days before or after the sale.

Workaround:

Sell an individual stock at a loss and immediately purchase a similar ETF in the same sector. Or sell one S&P 500 ETF and buy a different S&P 500 ETF from another provider. These aren’t considered “substantially identical” by the IRS.

Long-term portfolio benefit:

Tax-loss harvesting doesn’t just reduce current taxes — it allows you to reset your cost basis lower, potentially creating future tax benefits while maintaining market exposure.

For detailed implementation strategies, see our comprehensive tax-loss harvesting guide.

Use Tax-Advantaged Accounts

Retirement and tax-advantaged accounts eliminate or defer capital gains taxes entirely, making them powerful wealth-building tools.

Roth IRA:

Contributions are made with after-tax dollars, but all growth and withdrawals in retirement are completely tax-free. You never pay capital gains tax on trades within the account, and qualified withdrawals are tax-free.

Example:

You contribute $6,500 to a Roth IRA, invest in stocks, and over 30 years, it grows to $100,000. You pay zero capital gains taxes on that $93,500 growth, and zero taxes when you withdraw it in retirement.

Traditional IRA and 401(k):

Contributions may be tax-deductible, reducing current taxable income. Investments grow tax-deferred — no capital gains taxes on trades within the account. You pay ordinary income taxes on withdrawals in retirement.

While you don’t avoid taxes entirely, you defer them for decades, allowing more capital to compound. Plus, many retirees are in lower tax brackets than during their working years.

Health Savings Account (HSA):

Often overlooked for investment purposes, HSAs offer triple tax advantages:

- Tax-deductible contributions

- Tax-free growth (no capital gains taxes)

- Tax-free withdrawals for qualified medical expenses

After age 65, you can withdraw HSA funds for any purpose (paying ordinary income tax, like a traditional IRA), making it a powerful supplemental retirement account.

529 Education Savings Plans:

Contributions grow tax-free, and withdrawals for qualified education expenses are tax-free at the federal level (and usually state level too).

Strategic implementation:

- Max out Roth IRA contributions annually ($6,500 in 2026, $7,500 if age 50+)

- Contribute enough to a 401(k) to capture the full employer match

- Use taxable brokerage accounts only after maximizing tax-advantaged space

- Hold tax-inefficient investments (bonds, REITs) in tax-deferred accounts

- Keep tax-efficient investments (index funds, long-term stocks) in taxable accounts

For retirement account strategies and contribution limits, visit our Retirement Guide.

Offset With Capital Losses

Beyond tax-loss harvesting, understanding how to strategically use capital losses provides ongoing tax benefits.

Loss carryforward:

If your capital losses exceed your capital gains in a given year, you can deduct up to $3,000 against ordinary income. Any remaining losses carry forward indefinitely to future tax years.

Example:

2026: You realize $5,000 in gains and $20,000 in losses.

Net loss: $15,000.

You use $5,000 to offset the gains, reducing them to zero.

You deduct $3,000 against ordinary income.

Remaining loss: $7,000 carries forward to 2027.

2027: You realize $10,000 in gains.

You apply the $7,000 carryforward loss, reducing taxable gains to $3,000.

Netting gains and losses:

The IRS requires you to net short-term gains/losses separately from long-term gains/losses first, then combine the results.

Process:

- Net all short-term gains and losses

- Net all long-term gains and losses

- If both are positive, report both

- If one is negative, offset it against the other

- Apply the $3,000 ordinary income deduction if the net result is negative

- Carry forward any remaining loss

Strategic advantage:

Investors who actively manage their portfolios can use accumulated loss carryforwards to offset large gains in future years — such as when selling a business, exercising stock options, or liquidating a concentrated position.

Record keeping:

Track your capital loss carryforwards carefully. The IRS requires you to maintain these records, and tax software doesn’t always transfer this information perfectly between years.

Capital Gains Tax Examples

Real-world examples demonstrate how capital gains tax calculations work across different scenarios and asset types.

Example 1: Stock Sale

Scenario:

Sarah purchases 200 shares of a technology company on March 1, 2025, at $100 per share. She pays a $10 brokerage commission.

Initial investment:

200 shares × $100 = $20,000

Brokerage commission: $10

Total cost basis: $20,010

On April 15, 2026, the stock reached $140 per share. Sarah sells all 200 shares, paying another $10 commission.

Sale proceeds:

200 shares × $140 = $28,000

Brokerage commission: $10

Net proceeds: $27,990

Capital gain calculation:

$27,990 – $20,010 = $7,980 gain

Holding period:

March 1, 2025, to April 15, 2026 = 13.5 months

Classification: Long-term capital gain

Tax calculation:

Sarah’s taxable income places her in the 15% long-term capital gains bracket.

$7,980 × 15% = $1,197 federal tax

After-tax profit:

$7,980 – $1,197 = $6,783

Key insight:

If Sarah had sold just one month earlier (12.5 months), the gain would have been short-term, taxed at her 24% ordinary income rate, costing $1,915 in taxes — $718 more.

Example 2: Crypto Trade

Scenario:

Marcus buys 2 Bitcoin on June 1, 2026, at $35,000 each, paying $100 in exchange fees.

Initial investment:

2 BTC × $35,000 = $70,000

Exchange fees: $100

Total cost basis: $70,100

On August 15, 2026 (2.5 months later), Bitcoin rises to $42,000. Marcus sells 1 Bitcoin, paying $75 in fees.

Sale proceeds:

1 BTC × $42,000 = $42,000

Exchange fees: $75

Net proceeds: $41,925

Cost basis for 1 BTC:

$70,100 ÷ 2 = $35,050

Capital gain calculation:

$41,925 – $35,050 = $6,875 gain

Holding period:

June 1 to August 15 = 2.5 months

Classification: Short-term capital gain

Tax calculation:

Marcus is in the 32% ordinary income tax bracket.

$6,875 × 32% = $2,200 federal tax

After-tax profit:

$6,875 – $2,200 = $4,675

Additional consideration:

Marcus still holds 1 Bitcoin with a cost basis of $35,050. If he later sells it after holding for more than 12 months total, that sale would qualify for long-term treatment.

Key insight:

Had Marcus waited until June 2, 2027 (just over 12 months), his tax on the same gain would have been approximately $1,031 at the 15% long-term rate — saving $1,169.

Example 3: Home Sale

Scenario:

David and Maria, a married couple, purchased a home in 2020 for $400,000. They pay $8,000 in closing costs.

Original cost basis:

Purchase price: $400,000

Closing costs: $8,000

Initial basis: $408,000

Over five years, they have made improvements:

- Kitchen renovation: $35,000

- New roof: $15,000

- HVAC system: $10,000

Adjusted cost basis:

$408,000 + $35,000 + $15,000 + $10,000 = $468,000

In 2026, they sell the home for $750,000, paying $45,000 in real estate commissions and closing costs.

Net proceeds:

$750,000 – $45,000 = $705,000

Capital gain calculation:

$705,000 – $468,000 = $237,000 gain

Primary residence exclusion:

David and Maria lived in the home as their primary residence for more than 2 of the past 5 years. As a married couple filing jointly, they qualify for a $500,000 exclusion.

Since their $237,000 gain is below the $500,000 threshold, they pay $0 in capital gains tax.

Key insight:

Without the primary residence exclusion, they would have owed approximately $35,550 in federal taxes (at 15% long-term rate), plus state taxes. This exclusion represents one of the most powerful tax benefits in the US tax code.

What if they had rented it out?

If they had converted the home to a rental property and lived elsewhere, they would lose the primary residence exclusion eligibility unless they moved back in for at least 2 years before selling.

Common Capital Gains Tax Mistakes

Even experienced investors make costly errors when managing capital gains taxes. Avoiding these mistakes preserves more wealth.

Selling Too Early

The mistake:

Selling profitable investments at 11 months to “lock in gains,” triggering short-term capital gains rates instead of waiting one more month for long-term treatment.

The cost:

The difference between a 32% short-term rate and a 15% long-term rate on a $20,000 gain equals $3,400 in unnecessary taxes.

The fix:

Track holding periods carefully. Unless fundamental analysis suggests immediate selling is critical, waiting to cross the 12-month threshold almost always makes financial sense.

Ignoring The Holding Period

The mistake:

Not understanding that the holding period begins the day after purchase and ends on the sale date, leading to miscalculations about long-term status.

Example:

Buying stock on January 15, 2025, and selling on January 15, 2026, is exactly 12 months, which counts as short-term. You must hold until January 16, 2026, or later for long-term treatment.

The fix:

Use portfolio tracking tools that calculate exact holding periods and alert you when positions approach long-term status.

Forgetting Transaction Fees

The mistake:

Calculating capital gains using only purchase and sale prices, forgetting to include brokerage commissions, exchange fees, and other transaction costs in the cost basis.

The cost:

Overstating your gain and overpaying taxes. On a $100,000 sale with $500 in total fees, forgetting the fees costs you an extra $75-$185 in taxes, depending on your rate.

The fix:

Maintain detailed records of all transaction costs. Most brokerages include these in your cost basis calculations, but verify accuracy, especially for cryptocurrency and real estate transactions.

Not Planning Taxes Ahead

The mistake:

Realizing large capital gains without considering the tax impact, then facing an unexpected tax bill in April without funds set aside.

The consequence:

Being forced to sell additional investments (potentially at unfavorable prices) to pay the tax bill, or facing IRS penalties and interest.

The fix:

Calculate estimated taxes quarterly. Set aside 15-20% of realized gains in a high-yield savings account earmarked for taxes. Consider making estimated tax payments if your gains are substantial.

For high-yield savings options to park tax reserves, explore our guide to the best high-yield savings accounts.

Overtrading

The mistake:

Making frequent trades based on short-term market movements, generating excessive short-term capital gains, and incurring transaction costs.

The math:

An active trader with $100,000 in annual gains taxed at 32% short-term rates pays $32,000 in taxes.

A buy-and-hold investor with the same $100,000 in long-term gains taxed at 15% pays $15,000.

Difference: $17,000 annually

Over 20 years, this difference compounds to hundreds of thousands in lost wealth.

The fix:

Adopt evidence-based long-term investing strategies that minimize trading frequency. Focus on time in the market, not timing the market.

Missing The Wash Sale Rule

The mistake:

Selling stock at a loss for tax purposes, then repurchasing the same stock within 30 days, triggering the wash sale rule and losing the tax deduction.

The consequence:

The loss deduction is disallowed, and the disallowed loss gets added to the cost basis of the repurchased shares — deferring rather than eliminating the benefit, but losing the immediate tax value.

The fix:

Wait 31 days before repurchasing, or purchase a similar but not substantially identical security to maintain market exposure while preserving the tax loss.

Not Tracking Reinvested Dividends

The mistake:

Forgetting that automatically reinvested dividends increase your cost basis, leading to overstated gains when you sell.

Example:

You buy $10,000 of a dividend fund. Over 10 years, you reinvest $3,000 in dividends. Your actual cost basis is $13,000, not $10,000.

When you sell for $20,000, your gain is $7,000, not $10,000 — saving you $450-$1,050 in taxes depending on your rate.

The fix:

Use brokerage statements that track adjusted cost basis, including reinvestments. Verify accuracy before filing taxes.

💰 Capital Gains Tax Calculator

Conclusion

Capital Gains Tax represents one of the highest costs in long-term wealth building, but strategic planning transforms it from a wealth drain into a manageable component of your investment strategy.

The math is clear: holding investments longer than 12 months, using tax-advantaged accounts, harvesting losses strategically, and timing sales carefully can save tens of thousands of dollars over a lifetime of investing. These aren’t complex strategies — they’re evidence-based approaches grounded in understanding how the tax code actually works.

Start by tracking your holding periods, maximizing contributions to retirement accounts, and reviewing your portfolio for tax-loss harvesting opportunities before year-end. Small actions compound into significant tax savings over time.

For comprehensive tax strategies and ongoing updates, explore our Taxes Hub. To build a tax-efficient investment portfolio, visit our Investing Guide for evidence-based guidance.

Disclaimer

This article provides educational information about capital gains tax for general knowledge purposes only. It does not constitute tax, legal, or financial advice.

Tax laws change frequently, and individual circumstances vary significantly. Capital gains tax rates, income thresholds, and regulations discussed in this article reflect 2026 information and may not apply to your specific situation or future tax years.

Before making any investment or tax decisions, consult with a qualified tax professional, certified public accountant (CPA), or financial advisor who can evaluate your personal circumstances and provide guidance tailored to your situation.

The Rich Guy Math and its authors assume no liability for actions taken based on information contained in this article. Always verify current tax regulations with official IRS publications or a licensed tax professional.

Author Bio

Max Fonji is the founder of The Rich Guy Math, a data-driven financial education platform that explains the math behind money with precision and authority. With a background in financial analysis and a commitment to evidence-based investing, Max breaks down complex financial concepts into clear, actionable insights.

Max’s approach combines analytical rigor with educational clarity, helping readers understand not just what to do with their money but why specific strategies work through numbers, logic, and evidence. His work focuses on compound growth, valuation principles, risk management, and tax-efficient wealth building.

Through The Rich Guy Math, Max has helped thousands of investors build financial literacy and make informed decisions grounded in data rather than emotion or marketing hype.

Connect with Max and explore more financial education resources at The Rich Guy Math.

References

[1] Internal Revenue Service. “Topic No. 409 Capital Gains and Losses.” IRS.gov. https://www.irs.gov/taxtopics/tc409

[2] Internal Revenue Service. “Publication 550: Investment Income and Expenses.” IRS.gov. https://www.irs.gov/publications/p550

[3] Internal Revenue Service. “Publication 523: Selling Your Home.” IRS.gov. https://www.irs.gov/publications/p523

[4] Internal Revenue Service. “Topic No. 703 Basis of Assets.” IRS.gov. https://www.irs.gov/taxtopics/tc703

[5] U.S. Securities and Exchange Commission. “Investor Bulletin: Tax Loss Harvesting.” SEC.gov. https://www.sec.gov/investor/alerts/ib_taxloss.pdf

[6] Congressional Research Service. “Capital Gains Taxation: An Overview,” CRS Reports. https://crsreports.congress.gov

[7] Tax Policy Center. “How are capital gains taxed?” Urban Institute & Brookings Institution. https://www.taxpolicycenter.org/briefing-book/how-are-capital-gains-taxed

Capital Gains Tax FAQ

Do I pay capital gains tax if I reinvest the proceeds?

Yes. The IRS taxes capital gains in the year you sell the asset, regardless of what you do with the proceeds.

Reinvesting the money into another investment does not defer or eliminate the tax liability. The sale itself triggers the taxable event.

Exception: Real estate investors may use a 1031 like-kind exchange to defer taxes when selling one investment property and purchasing another. This exception does not apply to stocks, cryptocurrency, or other assets.

Do I pay capital gains tax if I don’t withdraw cash from my brokerage account?

Yes. Capital gains tax is owed when you sell an asset for a profit, even if the proceeds remain inside your brokerage account.

The taxable event is the sale itself—not the withdrawal of cash. Moving money from your brokerage to your bank account is not taxable because the tax was already triggered at the time of sale.

Important: Unrealized gains are not taxed. If your investment increases in value but you do not sell it, no capital gains tax is owed.

How does capital gains tax affect retirement accounts?

Tax-advantaged retirement accounts do not generate capital gains taxes on trades made inside the account.

- Roth IRA: Qualified withdrawals are completely tax-free, including all capital gains

- Traditional IRA / 401(k): Withdrawals are taxed as ordinary income

- Taxable brokerage accounts: Capital gains are taxed in the year the asset is sold

This makes retirement accounts highly tax-efficient for active investing and long-term growth.

Can I avoid capital gains tax legally?

You cannot completely avoid capital gains tax on taxable investments, but you can legally minimize it through planning:

- Hold investments longer than 12 months to qualify for long-term rates

- Use tax-advantaged retirement accounts

- Apply the $250,000 / $500,000 primary residence exclusion

- Harvest tax losses to offset gains

- Donate appreciated assets to charity

- Hold assets until death to receive a step-up in basis

Note: Failing to report gains is illegal tax evasion. Using legal strategies to reduce taxes is tax avoidance and is encouraged by the tax code.

What happens if I don’t report capital gains?

Failing to report capital gains is illegal and can result in:

- Accuracy-related penalties (typically 20% of unpaid tax)

- Compounding interest on unpaid balances

- In severe cases, criminal prosecution

- Increased audit risk

Brokerages and exchanges report transactions to the IRS using Form 1099-B, making unreported gains easy to detect.

If you discover an error, filing an amended return voluntarily usually results in lower penalties.

Are capital gains added to my income and can they push me into a higher tax bracket?

Short-term capital gains are taxed as ordinary income and can push you into a higher tax bracket.

Long-term capital gains use separate tax brackets (0%, 15%, 20%) but are still included when determining which capital gains rate applies.

Strategic planning can help manage when gains are realized to minimize overall tax impact.

How do I report capital gains on my tax return?

Capital gains are reported on Schedule D of Form 1040.

- Receive Form 1099-B from your brokerage

- Report transactions on Form 8949

- Transfer totals to Schedule D

- Include the final amount on Form 1040

Most tax software automates this process, but investors with complex situations may benefit from professional tax assistance.