In 2025, President Donald Trump’s second term brought with it a new wave of tariffs (Trump Tariffs on Canada), this time hitting Canada harder than ever. With duties reaching up to 35% on certain Canadian exports, and even 10% on energy products, the ripple effects have been swift and severe.

From grocery store prices to stock market shifts, Canadians are already feeling the pinch. But what exactly do these tariffs cover? Why were they imposed? And most importantly, what can you do about it?

This post breaks down the full economic impact of the Trump tariffs on Canada in 2025 and offers insights for both everyday consumers and investors trying to navigate the uncertainty.

What Are Trump Tariffs on Canada?

A Brief Timeline of Tariff Escalation

- March 4, 2025 – The Trump administration invoked national emergency powers to impose 25% tariffs on most Canadian imports, citing immigration enforcement and illicit drug concerns along the northern border.

- August 1, 2025 – Tariffs increased to 35% for many non-USMCA (United States-Mexico-Canada Agreement) compliant goods.

- Energy products, including oil and natural gas, saw 10% duties, though many shipments received exemptions.

According to Reuters, small Canadian firms in agriculture, chemicals, and furniture are the most exposed.

What Does This Mean for Canadian Consumers?

Everyday Costs Are Rising

Even though most essential trade remains protected under USMCA, tariffs have created upstream cost pressures. As import/export supply chains adjust, prices for many goods are increasing.

Here are some categories already affected:

| Category | Example Price Hike |

|---|---|

| Furniture | +12–18% |

| Packaged Food Items | +7–10% |

| Auto Parts & Repairs | +15–20% |

| Home Renovation Materials | +10–25% |

“Buy Canadian” Movement Gaining Momentum

A grassroots boycott of U.S. products has taken hold, with 85% of surveyed Canadians saying they’re prioritizing domestic goods.

According to the Vancouver Sun, hashtags like #BuyCanadian and #KeepItNorth have trended as consumers turn their wallets into a protest.

Impact on Canadian Businesses and Trade

Small Businesses Bear the Brunt

Small and medium-sized enterprises (SMEs) are being disproportionately affected, especially those:

- Relying on U.S. machinery or components now under duty

- Selling value-added goods like furniture or processed foods

- Operating in border towns that depend on U.S. tourism

USMCA Isn’t a Total Shield

While 85–95% of Canadian exports remain tariff-free thanks to USMCA, that still leaves billions of dollars in trade vulnerable, especially for:

- Non-compliant shipments

- Re-exported goods

- Specialized sectors like chemicals and forestry

According to TD Economics, forestry, aluminum, and agricultural processing are among the highest-risk sectors.

Economic Impact: What the Numbers Say

GDP Drag: Canada Takes a Hit

Economists now project that the tariffs could shrink Canada’s GDP by 1.25% by 2027, with a long-term loss of over 2.1% versus pre-tariff forecasts.

| Economic Indicator | Impact |

|---|---|

| GDP (2025–2027) | –1.25% |

| Manufacturing output | –3.5% |

| Cross-border tourism | –40% decline |

| Business investment | –5.2% year-over-year (Q2 2025) |

Canadian Dollar Volatility

As trade uncertainty grows, the CAD has experienced a 4–6% slide against the USD. This weakens purchasing power abroad and raises the cost of imports, further fueling inflation.

Political Reactions & Policy Moves

Government Relief Efforts

In response to the tariffs, the Canadian federal government has rolled out:

- C$1.2 billion in aid for the softwood lumber industry

- Loan guarantees for SMEs in affected sectors

- Expanded export development programs targeting Asia and Europe

Source: Canada.ca – Department of Finance

Diplomatic Friction

Prime Minister Mark Carney has called the tariffs “unwarranted” and “economically damaging.” Trade ministers have paused formal negotiations until after the 2026 USMCA review.

Despite tensions, both governments have kept energy cooperation and cross-border security intact, for now.

Investor Outlook: What to Watch

Sectors to Monitor Closely

| Sector | Risk Level | Why It Matters |

|---|---|---|

| Forestry | 🔴 High | Softwood tariffs, U.S. protectionism |

| Consumer Retail | 🟠 Medium | Boycotts & cost volatility |

| Energy | 🟢 Low | Mostly exempt under USMCA |

| Agriculture | 🔴 High | Duties on food processing & machinery |

Investment Tips During Trump Tariff Turbulence

- Look Local: Focus on companies with strong domestic revenue and low U.S. dependency.

- Go Global: Consider funds with exposure to EU and Asia-Pacific.

- Commodity Hedge: Gold, oil, and real assets may offer protection amid currency dips.

- Diversify Your Portfolio: Tariffs often trigger sector-specific volatility. Balance your holdings accordingly.

Read also: How to Reinvest Dividends for Maximum Compound Growth

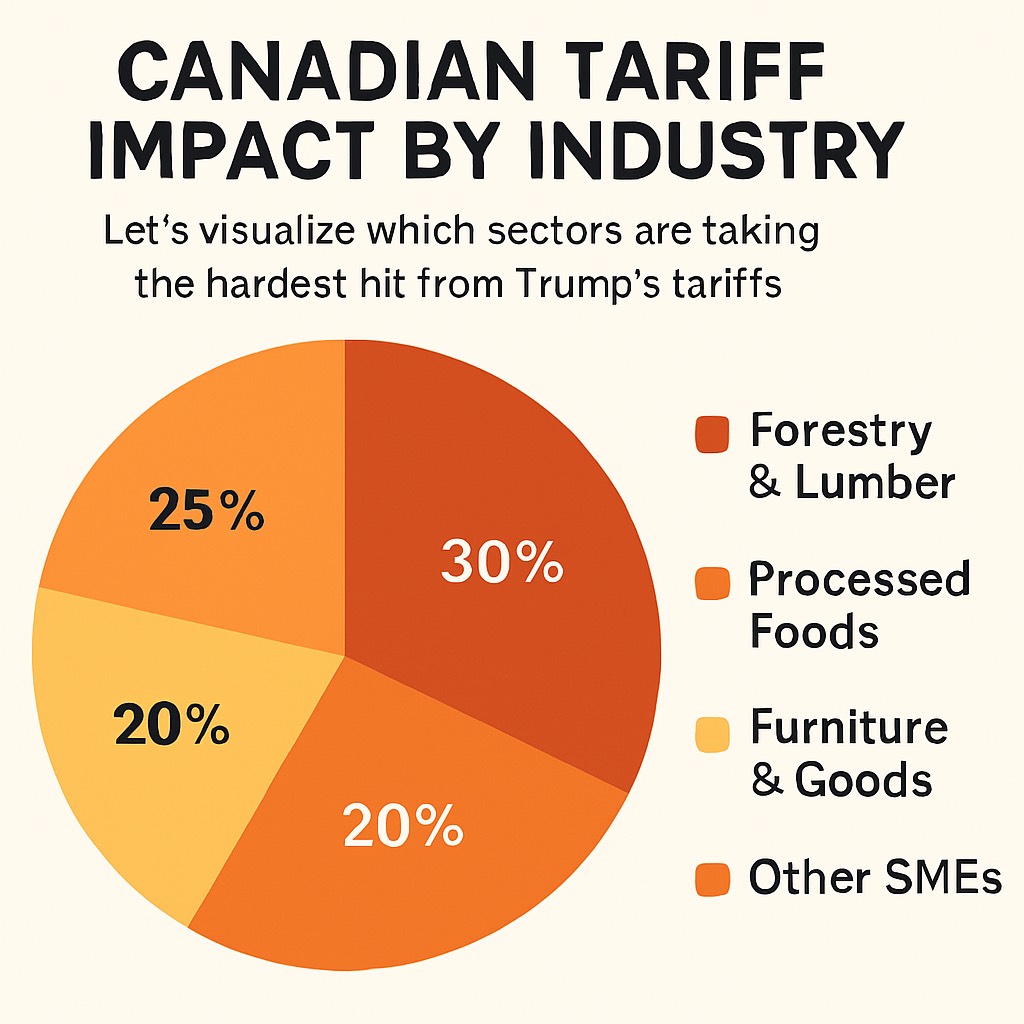

Chart: Impact of Trump Tariffs on Canada by Industry

Let’s visualize which sectors are taking the hardest hit from Trump’s tariffs:

| Sector | Estimated Tariff Impact |

|---|---|

| Forestry & Lumber | 30% |

| Processed Foods | 20% |

| Furniture & Goods | 25% |

| Other SMEs | 25% |

What You Can Do as a Consumer

Support local: Buy Canadian-made goods to keep money within the country and reduce tariff pressure.

Watch prices: Tariff-related inflation hits unevenly—compare brands and store options.

Delay non-urgent purchases: Some durable goods might drop in price if policy shifts.

Be active politically: Demand transparency and better trade negotiation from elected officials.

What You Can Do as an Investor

Diversify globally to hedge against North American trade instability

Focus on domestic stocks and sectors like banking, healthcare, and telecom

Limit exposure to U.S.-sensitive industries like forestry, auto parts, and non-exempt exporters

Stay liquid: Keep a cash cushion ready for market dips or opportuniti

Conclusion: Trade Wars Have Real Consequences

The Trump tariffs of 2025 are more than just political theater, they’re directly impacting Canadian wallets, businesses, and investments. While the USMCA provides a partial safety net, it doesn’t insulate the economy entirely.

In an interconnected world, even a 10% tariff can ripple through supply chains and portfolios. Staying informed, investing wisely, and supporting local businesses are all crucial to weathering the storm.