Picture this: You’re at a party, and someone asks what you do. “I run a business that made $10 million last year,” you say proudly. Impressive, right? But here’s the twist: what if that business spent $12 million to make that revenue? Suddenly, the story changes. This is the classic revenue vs profit dilemma that confuses entrepreneurs, investors, and business owners every single day.

Whether you’re analyzing companies for investment opportunities in the stock market or building your own business empire, understanding the difference between revenue and profit isn’t just accounting jargon; it’s the foundation of financial success. These two numbers tell completely different stories about a company’s health, and knowing which one to prioritize can mean the difference between sustainable growth and spectacular failure.

Key Takeaways

- Revenue is the total money coming in from sales, while profit is what remains after all expenses are paid

- Revenue growth can mask serious profitability problems; high sales don’t guarantee business success

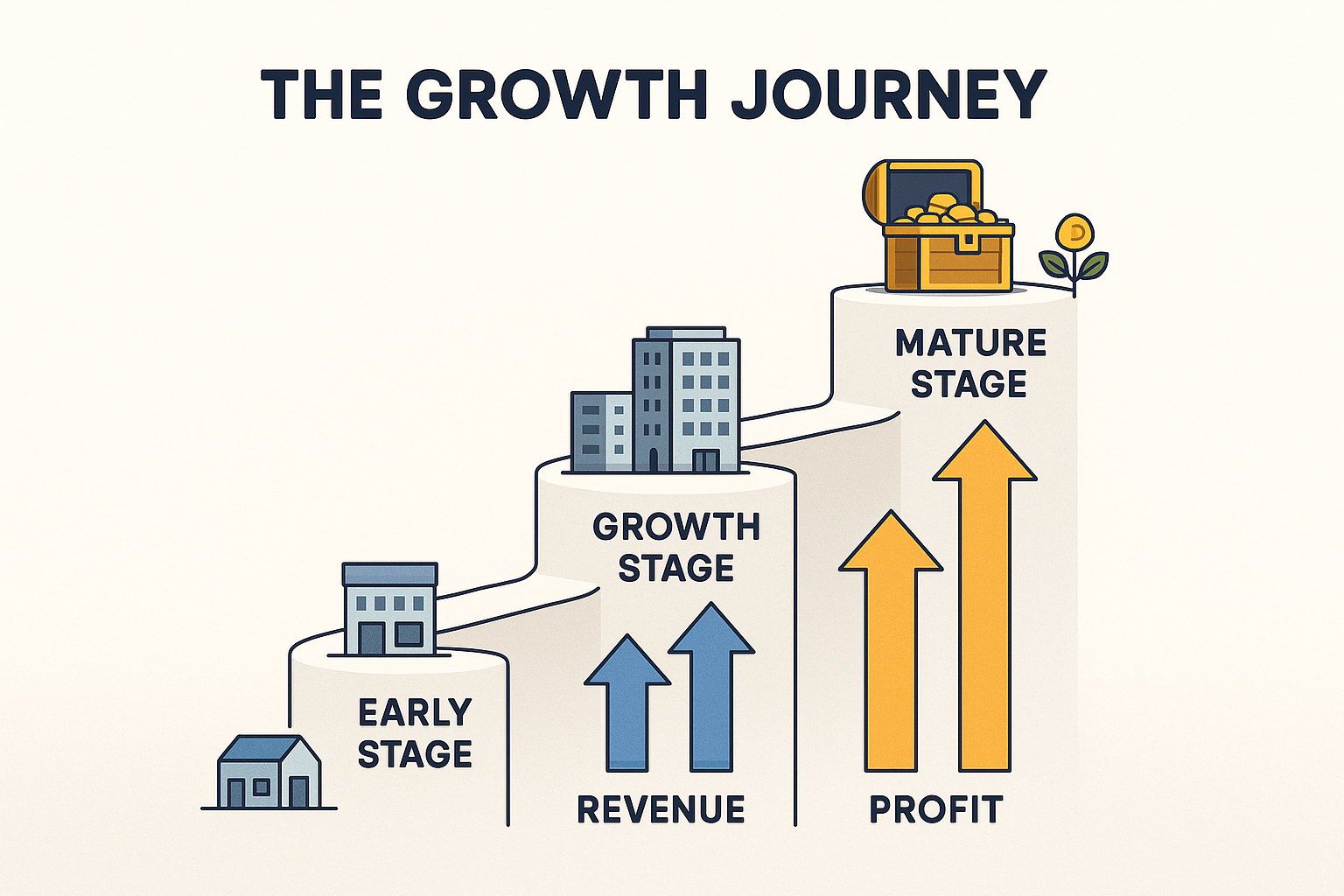

- Early-stage companies often prioritize revenue to gain market share, while mature businesses focus on profit margins

- The best approach balances both metrics: sustainable revenue growth with healthy profit margins

- Understanding both numbers helps investors make smarter financial decisions and avoid costly mistakes

What Is Revenue? The Top Line Explained

Revenue, often called the “top line,” is the total amount of money a business brings in from selling products or services before any expenses are deducted. It’s the starting point of every income statement and the most visible measure of business activity.

Think of revenue like water flowing into a bathtub. The faster the faucet runs, the more water comes in. But if the drain is wide open (high expenses), that water level might not rise much, or could even drop. Investopedia – Revenue

Types of Revenue

Operating Revenue

This is money earned from a company’s core business activities. For Apple, it’s iPhone sales. For Netflix, it’s subscription fees. This is the revenue that matters most because it shows whether the actual business model works.

Non-Operating Revenue

This includes income from secondary sources like investment returns, asset sales, or licensing deals. While nice to have, investors typically focus on operating revenue for a true picture of business performance.

Real-World Example: Amazon’s Revenue Strategy

In the early 2000s, Amazon famously prioritized revenue growth over profitability. Jeff Bezos poured every dollar back into expansion, customer acquisition, and infrastructure. Wall Street analysts criticized the company for years of minimal profits, but Amazon was playing the long game, building market dominance through massive revenue growth. Today, that strategy has paid off spectacularly, though the company now balances both revenue expansion and profit optimization.

What Is Profit? The Bottom Line That Matters

Profit, known as the “bottom line,” is what remains after subtracting all expenses, costs, and taxes from revenue. It’s the actual money a business gets to keep; the reward for taking risks and running operations efficiently.

If revenue is water flowing into the bathtub, profit is the water that stays in the tub after accounting for the drain (expenses). A company can have massive revenue but terrible profit if its expenses are out of control. Investopedia – Profit

The Three Types of Profit

Gross Profit

This is revenue minus the cost of goods sold (COGS), the direct costs of producing products or delivering services. It shows how efficiently a company produces its offerings. See our full guide on Gross Profit

Formula: Gross Profit = Revenue – Cost of Goods Sold

Operating Profit

Also called EBIT (Earnings Before Interest and Taxes), this subtracts operating expenses like salaries, rent, and marketing from gross profit. It reveals how well the core business operates. See our full guide on Operating Profit

Formula: Operating Profit = Gross Profit – Operating Expenses

Net Profit

The final number is after all expenses, interest, taxes, and other costs are removed. This is the true “take-home” amount and what ultimately matters to shareholders. See our full guide on Net Profit

Formula: Net Profit = Operating Profit – Interest – Taxes – Other Expenses

The Profit Margin Perspective

Profit margins tell you how much of each revenue dollar becomes actual profit. A company with $1 million in revenue and $100,000 in net profit has a 10% net profit margin. This percentage often matters more than raw profit numbers because it shows efficiency and scalability.

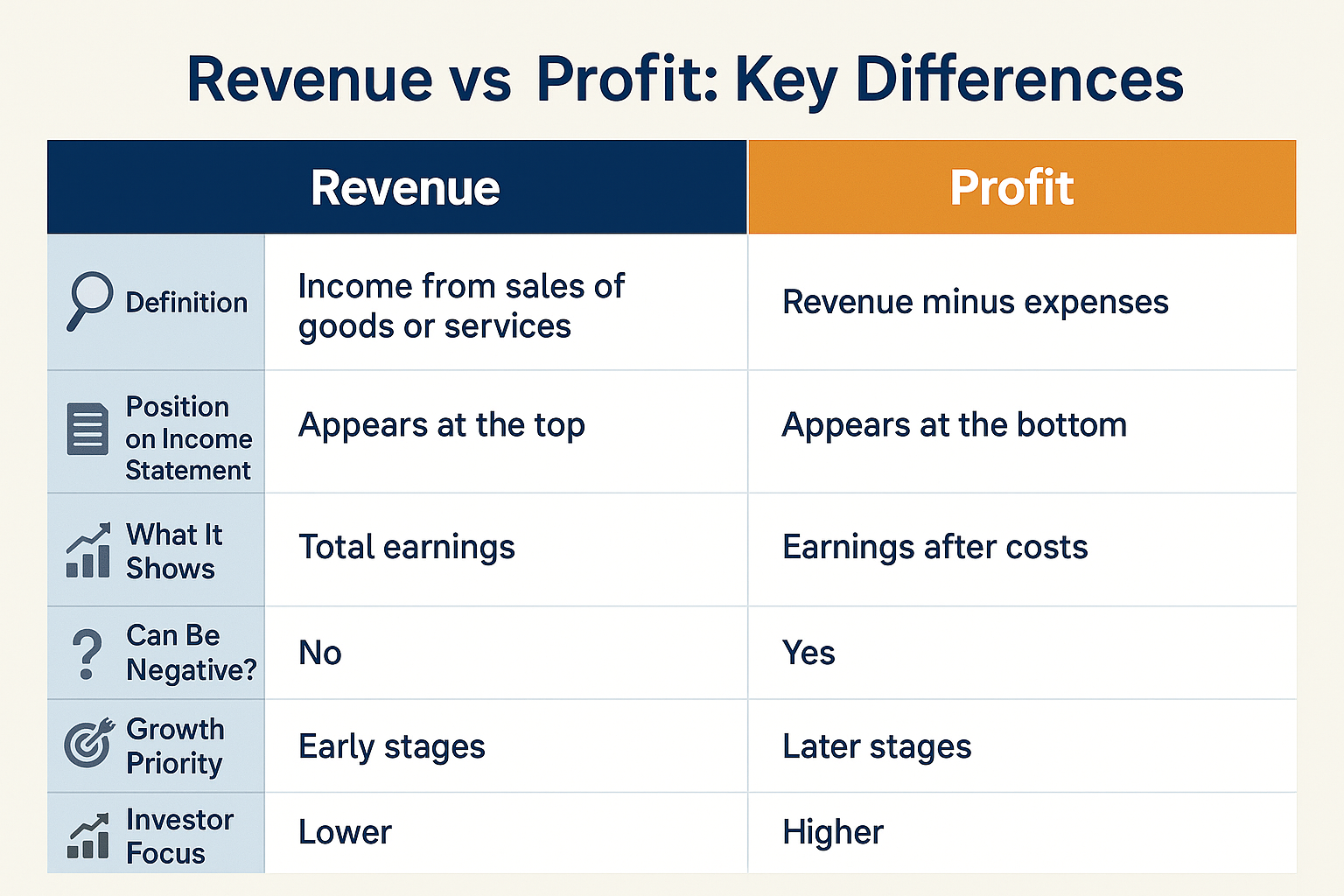

Revenue vs Profit: The Critical Differences

| Aspect | Revenue | Profit |

|---|---|---|

| Definition | Total income from sales | Money left after expenses |

| Position | Bottom line of the income statement | Can it be negative? |

| What it shows | Business activity & market demand | Business efficiency & sustainability |

| Can be negative? | No (minimum is zero) | Yes (when expenses exceed revenue) |

| Growth priority | Early-stage companies | Mature companies |

| Investor focus | Growth investors | Value investors |

Understanding these differences is crucial for anyone looking to make smart investment decisions or evaluate business performance accurately. Corporate Finance Institute (CFI) – Revenue vs Profit

Why Revenue Matters: The Case for the Top Line

Revenue isn’t just a vanity metric; it serves critical strategic purposes and tells important stories about business health.

Market Share and Competitive Position

High revenue often indicates strong market presence and customer demand. Companies like Walmart and Amazon use revenue growth to dominate their industries, creating economies of scale that competitors can’t match. When you control a significant market share, you gain pricing power and operational advantages.

Growth Potential and Scalability

Investors, especially in tech and startups, often focus on revenue growth as a signal of future profitability. A company growing revenue at 50% annually demonstrates product-market fit and scalability, even if it’s not profitable yet. The logic? Profits can be optimized later once market dominance is secured.

Access to Capital and Valuation

Companies with strong revenue growth typically command higher valuations and easier access to funding. Venture capitalists and growth investors will often fund revenue-generating businesses with negative profits, betting on future profitability once the company matures.

The Revenue Growth Story: Salesforce

Salesforce spent years prioritizing revenue growth over profitability, investing heavily in sales, marketing, and product development. This strategy helped them dominate the CRM market. Only after securing market leadership did they shift focus toward profit optimization, a transition that has rewarded shareholders handsomely.

Why Profit Matters: The Case for the Bottom Line

While revenue growth excites investors, profit sustainability keeps businesses alive and thriving long-term.

Business Sustainability and Survival

No business can survive indefinitely without profit. Eventually, investors lose patience, credit dries up, and the company faces bankruptcy. Profit ensures a business can weather economic downturns, invest in innovation, and reward stakeholders.

Cash Flow and Operational Health

Profitable companies generate cash that can be reinvested, distributed to shareholders as dividends, or saved for emergencies. This financial flexibility is invaluable during economic uncertainty.

True Value Creation

Warren Buffett famously said, “Price is what you pay, value is what you get.” Profit represents genuine value creation, the excess value produced beyond all costs. For long-term investors focused on passive income strategies, profitable companies with strong margins are far more attractive than revenue-rich but profit-poor alternatives.

Risk Management and Resilience

Profitable businesses have cushions to absorb mistakes, market shifts, and competitive threats. They’re not dependent on continuous fundraising or favorable market conditions to survive.

The Profit-First Success: Apple

Apple demonstrates how profit focus creates shareholder value. Rather than chasing maximum revenue through cheap products, Apple maintains premium pricing and exceptional profit margins (often 20%+ net margins). This strategy has made Apple one of the world’s most valuable companies and a favorite among dividend investors.

When to Prioritize Revenue Over Profit

The revenue-first strategy isn’t wrong; it’s situational. Certain business stages and market conditions favor revenue prioritization.

Early-Stage Growth Companies

Startups and young companies often sacrifice short-term profitability to capture market share quickly. The logic is sound: establish dominance while the market is forming, then optimize for profit once you’ve won.

Example: Uber and Lyft both operated at massive losses for years, using investor capital to subsidize rides and gain market share. The bet was that once they dominated, they could raise prices and achieve profitability.

Winner-Takes-All Markets

In markets with strong network effects (social media, marketplaces, platforms), being the biggest player creates insurmountable advantages. Facebook, Twitter, and LinkedIn all prioritized user growth (a revenue proxy) over profitability in their early years.

Strategic Market Entry

When entering new markets or launching new products, companies may accept low or negative profits to establish a presence and customer relationships. Amazon Web Services (AWS) initially operated at thin margins to win enterprise customers from established competitors.

When Investors Support the Strategy

If you have patient capital from investors who understand and support a revenue-first approach, this strategy can work. However, this patience isn’t infinite; eventually, the path to profitability must become clear.

When to Prioritize Profit Over Revenue

Mature businesses and certain market conditions demand a profit focus over pure revenue growth.

Mature or Saturated Markets

In established industries with limited growth potential, squeezing more profit from existing revenue becomes the primary value driver. Companies like Coca-Cola and Procter & Gamble focus on margin improvement and operational efficiency rather than explosive revenue growth.

Economic Uncertainty and Recessions

During economic downturns, profitability becomes paramount. Companies with strong profits and cash reserves survive while revenue-focused competitors collapse. Understanding market cycles and emotions helps investors recognize when to favor profitable businesses.

Capital-Intensive Industries

Businesses requiring significant ongoing capital investment (manufacturing, infrastructure, energy) must generate strong profits to fund operations and growth without constant external financing.

When Building Sustainable Businesses

If your goal is building a business that lasts decades rather than achieving a quick exit, profit focus ensures long-term viability. This approach aligns with value investing principles and creates genuine economic value.

The Profit Pivot: Netflix

Netflix provides an interesting case study. After years of aggressive spending on content and subscriber acquisition, the company shifted toward profit optimization in 2022-2023. As subscriber growth slowed in mature markets, management focused on improving margins, cracking down on password sharing, and raising prices—prioritizing profitability over pure subscriber growth.

The Balanced Approach: Why Both Matter

The truth? The revenue vs profit debate presents a false choice. The most successful businesses master both metrics, understanding when to emphasize each.

The Growth-Profit Matrix

High Revenue Growth + High Profit = Exceptional Business

These rare companies achieve efficient growth, expanding rapidly while maintaining healthy margins. Think Google in its prime or Visa today.

High Revenue Growth + Low/Negative Profit = Growth Investment

These companies bet on future profitability. Success requires a clear path to profit and sufficient capital to reach that goal.

Low Revenue Growth + High Profit = Cash Cow

Mature businesses that generate excellent returns on existing operations. Perfect for dividend investors seeking stable income.

Low Revenue Growth + Low Profit = Troubled Business

These companies face serious challenges and often make poor investments unless turnaround plans are credible.

Sustainable Growth Requires Both

The most valuable companies eventually achieve profitable revenue growth. They build revenue streams that generate attractive margins, creating compounding value for shareholders. This balance is what separates temporary market darlings from enduring business franchises.

What Investors Should Watch

When evaluating companies, sophisticated investors examine:

- Revenue growth rate (is the business expanding?)

- Profit margins (is growth efficient?)

- Path to profitability (for unprofitable companies)

- Cash flow generation (can profits convert to cash?)

- Return on invested capital (Does growth create value?)

Understanding these metrics helps avoid common stock market mistakes and identify genuinely attractive opportunities.

Common Mistakes When Analyzing Revenue vs Profit

Even experienced investors and business owners make critical errors when evaluating these metrics.

1: Ignoring Profit Quality

Not all profits are created equal. Companies can artificially inflate profits through accounting tricks, one-time asset sales, or unsustainable cost-cutting. Always examine the sources of profit and whether they’re recurring and sustainable.

2: Accepting Permanent Losses

Some companies claim they’ll “eventually” become profitable while burning cash for years with no clear path forward. WeWork’s spectacular failure demonstrated the dangers of this narrative. Patience with losses requires concrete milestones and improving unit economics.

3: Overlooking Revenue Quality

Revenue from one-time contracts differs vastly from recurring subscription revenue. High-churn revenue (customers constantly leaving and needing replacement) is far less valuable than sticky, predictable revenue streams.

4: Comparing Across Different Industries

A 5% profit margin might be excellent in grocery retail but terrible in software. Always compare companies within their industry context and understand sector-specific benchmarks.

5: Focusing Solely on Growth Rate

A company growing revenue 100% annually sounds impressive, until you realize it’s growing from $100,000 to $200,000 while spending $1 million to achieve that growth. Absolute numbers and efficiency matter as much as percentages.

How to Use Revenue and Profit Data for Better Decisions

Whether you’re an investor, entrepreneur, or business professional, applying these concepts practically creates better outcomes.

For Investors

Evaluate Business Stage: Match your investment style to the company’s maturity. Growth investors might accept current losses for future potential, while value investors demand current profitability.

Examine Trends Over Time: Single-year snapshots mislead. Look at 3-5 year trends in both revenue and profit to understand trajectory and consistency.

Calculate Key Ratios:

- Gross margin percentage

- Operating margin percentage

- Net margin percentage

- Revenue per employee

- Profit per employee

Understand the Business Model: Does the model naturally support high margins (software, luxury goods) or require thin margins and high volume (retail, commodities)?

For Business Owners

Know Your Stage: Early-stage businesses might rationally prioritize revenue and market share. Mature businesses should optimize profitability.

Monitor Unit Economics: Understand profit per customer, customer acquisition cost, and lifetime value. These metrics reveal whether revenue growth creates or destroys value.

Balance Investment and Returns: Invest in growth initiatives that generate acceptable returns within reasonable timeframes. Not all revenue is worth pursuing if acquisition costs are too high.

Build Margin Awareness: Regularly review which products, services, and customers generate the best margins. Double down on high-margin opportunities and fix or eliminate low-margin drains.

For Career Professionals

Understanding revenue vs profit dynamics helps you contribute more strategically to your organization:

- Sales professionals can balance volume targets with margin considerations

- Marketing teams can optimize for profitable customer acquisition, not just lead volume

- Operations managers can identify efficiency improvements that boost profitability

- Executives can make better strategic decisions about growth investments

The Future of Revenue and Profit Metrics

As business models evolve, so do the ways we measure success.

Subscription Economy Changes

Recurring revenue models (SaaS, subscriptions, memberships) have introduced new metrics like Monthly Recurring Revenue (MRR), Annual Recurring Revenue (ARR), and Customer Lifetime Value (CLV). These metrics help predict future profit from current revenue investments.

Sustainability and ESG Considerations

Modern businesses increasingly balance financial metrics with environmental and social impact. “Profit at any cost” is giving way to sustainable profitability that considers broader stakeholder interests.

Technology and Real-Time Analytics

Cloud accounting and analytics tools now provide real-time visibility into revenue and profit drivers, enabling faster, more informed decision-making than ever before.

Interactive Calculator: Revenue vs Profit Analysis

💰 Revenue vs Profit Calculator

Real-World Case Studies: Revenue vs Profit in Action

Let’s examine how real companies navigated the revenue vs profit balance, with varying results.

Case Study 1: Tesla’s Journey to Profitability

Tesla spent over 15 years burning cash while prioritizing revenue growth and market share in electric vehicles. Critics claimed the company would never be profitable. However, Tesla’s strategy was deliberate: build manufacturing scale, establish brand dominance, and develop technological advantages before optimizing for profit.

By 2020, Tesla achieved sustained profitability while maintaining strong revenue growth. The company’s market valuation soared, rewarding patient investors who understood the long-term strategy. Today, Tesla balances both metrics, growing revenue in new markets while improving profit margins through manufacturing efficiency.

Lesson: Revenue-first strategies can work when there’s a credible path to profitability and sufficient capital to reach that goal.

Case Study 2: WeWork’s Cautionary Tale

WeWork represents the opposite outcome. The company grew revenue aggressively by signing long-term real estate leases and offering short-term flexible workspace. Revenue climbed to billions, and the company commanded a $47 billion valuation at its peak.

However, the business model had fatal flaws: high fixed costs, negative unit economics, and no clear path to profitability. When investors scrutinized the numbers before the planned IPO, they discovered the emperor had no clothes. The company’s valuation collapsed, the CEO was ousted, and WeWork barely avoided bankruptcy.

Lesson: Revenue growth without viable profit economics eventually fails. Unit economics and path to profitability matter immensely.

Case Study 3: Microsoft’s Profit Excellence

Microsoft demonstrates how mature companies can maintain both revenue growth and exceptional profitability. Through cloud services (Azure), productivity software (Office 365), and strategic acquisitions, Microsoft grows revenue at double-digit rates while maintaining net profit margins above 30%.

This combination of growth and profitability makes Microsoft a favorite among both growth and value investors, including those seeking reliable dividend income.

Lesson: The most valuable companies eventually master both revenue growth and profit optimization.

Revenue is the total income a company earns from selling its products or services before deducting any costs.

Profit is the money left after all expenses (like salaries, rent, materials, and taxes) are subtracted from revenue.

Yes. A company might generate a lot of sales (high revenue) but still have high costs, resulting in low or even negative profit.

Both are important:

Revenue shows growth and market demand.

Profit shows efficiency and sustainability. Investors often prioritize profit because it indicates financial health.

High revenue can attract investors if growth potential is strong.

High profit (or strong profit margins) often increases a company’s valuation because it reflects efficient operations.

Gross profit: Revenue minus the cost of goods sold (COGS).

Operating profit: Gross profit minus operating expenses (like marketing, salaries, and rent).

Net profit: Total profit after all expenses, interest, and taxes are deducted.

Conclusion: Finding Your Revenue-Profit Balance

The revenue vs profit question doesn’t have a universal answer—it depends on your business stage, industry, competitive position, and strategic goals. But here’s what we know for certain:

Revenue matters because it demonstrates market demand, enables scale, and signals growth potential. Without revenue, there’s no business.

Profit matters because it ensures sustainability, creates genuine value, and provides the resources for long-term success. Without profit, revenue is just an expensive activity.

The smartest approach balances both:

✅ Early-stage businesses can rationally prioritize revenue and market share, but must have clear milestones toward profitability and sufficient capital to reach them.

✅ Growth-stage businesses should demonstrate improving unit economics and a credible path to sustainable profits while scaling revenue.

✅ Mature businesses must optimize profitability while finding new revenue growth opportunities to avoid stagnation.

✅ All businesses should understand their profit drivers, monitor margins carefully, and ensure revenue growth creates rather than destroys value.

For investors evaluating opportunities, examine both metrics in context. Understand the business model, competitive dynamics, and strategic priorities. Ask whether revenue growth is efficient and sustainable, and whether profits are genuine and recurring.

Whether you’re building wealth through the stock market, starting a business, or advancing your career, mastering the relationship between revenue and profit gives you a critical advantage. These aren’t just accounting concepts; they’re the fundamental measures of business success and the foundation of smart financial decision-making.

Take Action Today

Ready to apply these insights? Here’s what to do next:

- Review your investments using both revenue and profit lenses. Are you properly balancing growth and profitability?

- Calculate the margins of companies you own or are considering. Do they demonstrate efficient business models?

- Explore why the stock market goes up to understand how profitable companies drive long-term market returns

- Learn about dividend investing to benefit from companies that successfully convert profits into shareholder returns

- Continue your financial education with more beginner-friendly guides on investing and wealth building

Remember: successful investing isn’t about choosing revenue OR profit; it’s about understanding both and knowing which matters most in each specific situation.

Disclaimer

This article is for educational and informational purposes only and should not be construed as financial advice. The examples and case studies provided are for illustrative purposes. Investment decisions should be made based on your individual financial situation, risk tolerance, and goals. Always conduct your own research or consult with a qualified financial advisor before making investment decisions. Past performance does not guarantee future results.

About the Author

Max Fonji is a financial educator and content strategist at TheRichGuyMath.com, dedicated to making investing and personal finance accessible to everyone. With a passion for breaking down complex financial concepts into practical, actionable insights, Max helps readers build wealth through informed decision-making. When not writing about finance, Max enjoys analyzing market trends, studying successful businesses, and finding new ways to explain the math behind getting rich.