Picture this: You’re running a lemonade stand on a hot summer day. You sell 50 cups at $2 each, making $100 in revenue. Sounds great, right? But after buying lemons, sugar, and cups for $60, you’re left wondering, did you actually make good money? This is where profit margin comes in, and it’s one of the most important numbers in business and investing.

Whether you’re a small business owner, an aspiring entrepreneur, or someone learning to invest in the stock market, understanding how to calculate profit margin is essential. It tells you not just if you’re making money, but how efficiently you’re doing it. Companies with strong profit margins often make better investments, and businesses with healthy margins have more room to grow and weather tough times.

In this guide, we’ll break down everything you need to know about profit margins, what they are, why they matter, and most importantly, how to calculate them using simple formulas and real-world examples. By the end, you’ll be able to analyze any business like a pro!

Key Takeaways

- Profit margin measures how much of each dollar in sales becomes actual profit after all expenses are paid

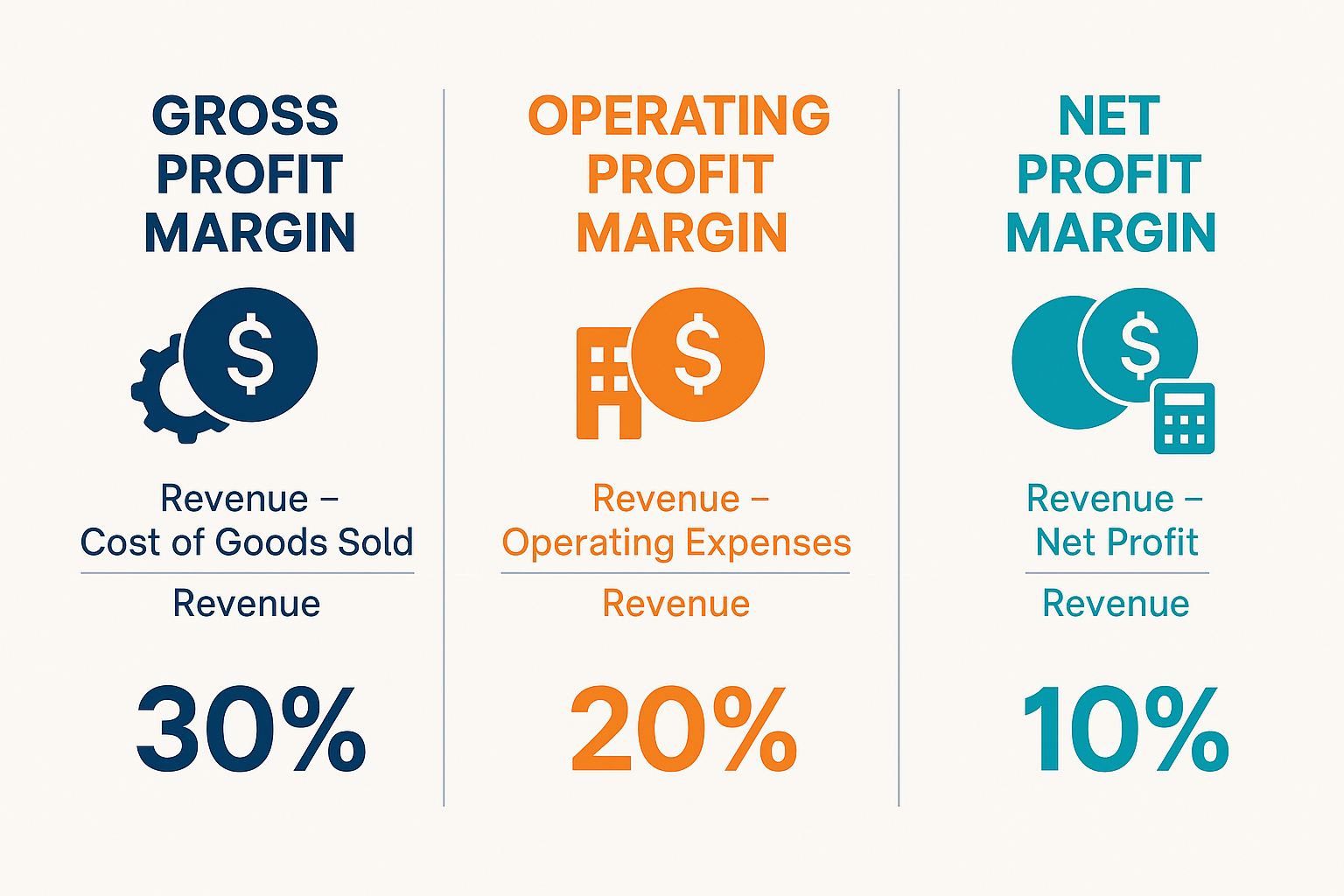

- There are three main types: gross profit margin, operating profit margin, and net profit margin. Each tells a different story about business health

- Higher margins generally mean better efficiency and more financial cushion for unexpected challenges

- The formula is straightforward: (Profit ÷ Revenue) × 100 = Profit Margin %

- Comparing margins across industries is crucial because a “good” margin varies dramatically by business type

What Is Profit Margin? (And Why It Matters?)

Profit margin is a financial metric that shows what percentage of your revenue turns into profit. Think of it as your “efficiency score” for making money. According to Investopedia, profit margin represents the percentage of revenue a company retains as profit after all costs are deducted.

Here’s why it matters:

- For business owners: It reveals whether your pricing strategy works and if you’re controlling costs effectively

- For investors: It helps identify well-managed companies that generate strong returns

- For financial planning, it shows the true health of a business beyond just revenue numbers

Revenue alone can be misleading. A company might generate millions in sales but lose money on every transaction. Profit margin cuts through the noise and shows the real picture.

“Revenue is vanity, profit is sanity, but cash is king.” This old business adage highlights why profit margins matter more than impressive sales numbers.

The Three Types of Profit Margins Explained

Not all profit margins are created equal. There are three main types, each measuring profitability at different stages of the business process. Let’s break them down!

1. Gross Profit Margin

Gross profit margin measures how much money remains after subtracting the cost of goods sold (COGS), the direct costs of producing your product or service.

What it includes:

- Raw materials

- Direct labor costs

- Manufacturing expenses

What it excludes:

- Operating expenses (rent, marketing, salaries)

- Interest and taxes

Why it matters: Gross profit margin shows how efficiently you produce your product. A declining gross margin might signal rising production costs or pricing pressure.

2. Operating Profit Margin

Operating profit margin goes one step further by including operating expenses like rent, utilities, salaries, and marketing costs. Corporate Finance Institute (CFI) – Operating Margin

What it shows: How profitable your core business operations are, before considering interest payments and taxes.

Why it matters: This metric reveals whether your business model is fundamentally sound. Even if you’re selling products profitably (good gross margin), high operating costs can eat away at profits.

3. Net Profit Margin

Net profit margin is the “bottom line”; it includes everything: COGS, operating expenses, interest, taxes, and any other costs. AccountingTools – Net Profit Margin

What it shows: The actual percentage of revenue that becomes profit and can be reinvested or distributed to shareholders.

Why it matters: This is the ultimate measure of profitability. When investors evaluate dividend-paying stocks, they look closely at net profit margins to ensure the company can sustain payouts.

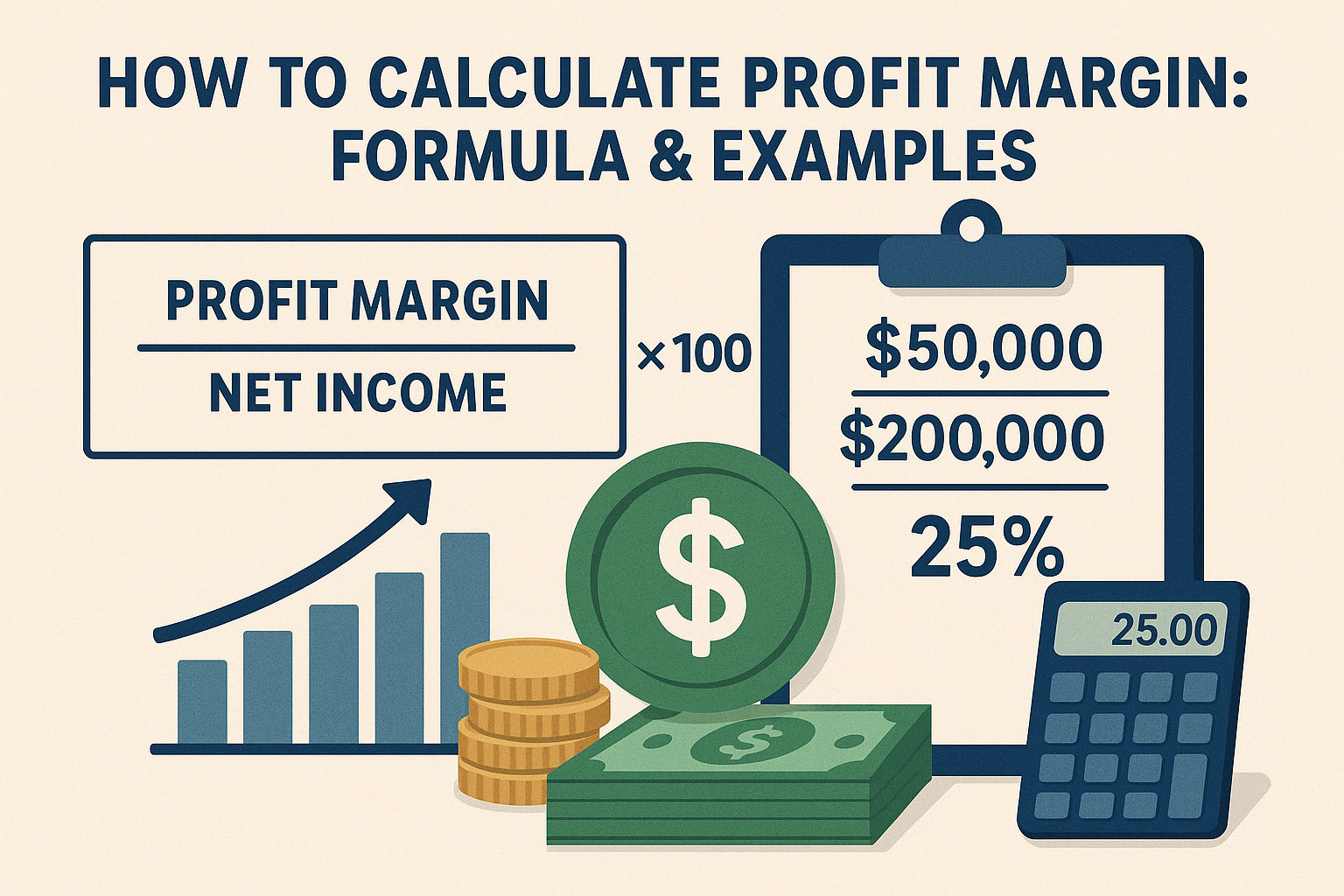

How to Calculate Profit Margin: The Basic Formula

Ready to crunch some numbers? The good news is that calculating profit margin is surprisingly straightforward once you understand the formula.

The Universal Profit Margin Formula

Profit Margin (%) = (Profit ÷ Revenue) × 100That’s it! The key is knowing which “profit” number to use depending on which margin type you’re calculating.

Step-by-Step Calculation Process

Step 1: Determine your revenue (total sales)

Step 2: Calculate your profit (revenue minus relevant expenses)

Step 3: Divide profit by revenue

Step 4: Multiply by 100 to get a percentage

| Margin Type | Formula | What You’re Measuring |

|---|---|---|

| Gross Profit Margin | (Revenue – COGS) ÷ Revenue × 100 | Production efficiency |

| Operating Profit Margin | Operating Income ÷ Revenue × 100 | Operational efficiency |

| Net Profit Margin | Net Income ÷ Revenue × 100 | Overall profitability |

Let’s look at specific formulas for each type:

Real-World Examples: Calculating Profit Margins

Nothing beats learning through examples! Let’s calculate profit margins for a fictional small business and see how the numbers tell different stories.

Example 1: Sarah’s Bakery (All Three Margins)

Sarah runs a small bakery. Here are her annual numbers:

- Total Revenue: $200,000

- Cost of Goods Sold (ingredients, packaging): $80,000

- Operating Expenses (rent, utilities, salaries): $70,000

- Interest and Taxes: $15,000

Calculating Gross Profit Margin:

- Gross Profit = Revenue – COGS = $200,000 – $80,000 = $120,000

- Gross Profit Margin = ($120,000 ÷ $200,000) × 100 = 60%

Calculating Operating Profit Margin:

- Operating Profit = Gross Profit – Operating Expenses = $120,000 – $70,000 = $50,000

- Operating Profit Margin = ($50,000 ÷ $200,000) × 100 = 25%

Calculating Net Profit Margin:

- Net Profit = Operating Profit – Interest & Taxes = $50,000 – $15,000 = $35,000

- Net Profit Margin = ($35,000 ÷ $200,000) × 100 = 17.5%

What this tells us: Sarah’s bakery has a healthy gross margin of 60%, meaning she’s pricing her products well above ingredient costs. Her operating margin of 25% shows solid operational efficiency. The final net margin of 17.5% is excellent for a small bakery; for every dollar in sales, Sarah keeps 17.5 cents as profit!

Example 2: Tech Startup vs Grocery Store

Understanding that “good” margins vary by industry is crucial. Let’s compare two very different businesses:

Tech Software Company:

- Revenue: $5,000,000

- Total Costs: $2,500,000

- Net Profit: $2,500,000

- Net Profit Margin: 50%

Local Grocery Store:

- Revenue: $5,000,000

- Total Costs: $4,750,000

- Net Profit: $250,000

- Net Profit Margin: 5%

Both businesses generate the same revenue, but the tech company has a 50% margin while the grocery store has only 5%. Does this mean the grocery store is failing? Not at all! Grocery stores operate on thin margins because of intense competition and low-priced goods. A 5% margin is actually healthy for that industry.

This illustrates an important principle: always compare margins within the same industry to get meaningful insights.

Interactive Profit Margin Calculator

💰 Profit Margin Calculator

What’s a “Good” Profit Margin? Industry Benchmarks

One of the most common questions is: “What profit margin should I aim for?” The answer depends entirely on your industry. Here’s a breakdown of typical net profit margins across different sectors:

Industry Profit Margin Benchmarks

| Industry | Typical Net Profit Margin | Notes |

|---|---|---|

| Software/Tech | 15-30% | High margins due to low marginal costs |

| Retail (General) | 2-5% | Thin margins, high competition |

| Restaurants | 3-9% | Varies widely by type and location |

| Healthcare | 5-10% | Heavily regulated, varies by segment |

| Construction | 3-7% | Project-based, weather-dependent |

| Consulting | 10-20% | Service-based, low overhead |

| Automotive | 2-5% | High volume, low margin |

| Banking | 15-30% | Financial services have higher margins |

Key insight: A 5% margin might be excellent for a grocery store, but concerning for a software company. Always compare apples to apples when evaluating business performance.

How to Improve Your Profit Margins: 7 Proven Strategies

Knowing your profit margin is just the first step. The real power comes from improving it over time. Here are seven actionable strategies:

1. Increase Your Prices Strategically

Many business owners undercharge for their products or services. A small price increase can dramatically boost margins without significantly impacting sales volume.

Example: If you have a 20% margin and raise prices by 5%, your margin could jump to 25% or higher, assuming costs stay the same.

2. Reduce Cost of Goods Sold

Look for ways to lower production costs:

- Negotiate better rates with suppliers

- Buy materials in bulk

- Find alternative suppliers

- Improve production efficiency

- Reduce waste

3. Cut Operating Expenses

Review your operating costs regularly:

- Renegotiate rent or move to a cheaper location

- Reduce utility costs through energy efficiency

- Automate repetitive tasks

- Outsource non-core functions

- Eliminate unnecessary subscriptions

4. Focus on High-Margin Products

Not all products or services are equally profitable. Identify your highest-margin offerings and promote them more aggressively.

Action step: Calculate the profit margin for each product line. Consider phasing out low-margin items that don’t drive significant volume.

5. Improve Inventory Management

Excess inventory ties up cash and increases storage costs. Better inventory management can reduce carrying costs and minimize waste from expired or obsolete products.

6. Increase Average Transaction Value

Encourage customers to spend more per purchase through:

- Upselling complementary products

- Creating product bundles

- Offering volume discounts

- Implementing minimum order values for free shipping

7. Enhance Customer Retention

Acquiring new customers costs 5-25 times more than retaining existing ones. Focus on customer satisfaction, loyalty programs, and excellent service to reduce marketing costs and improve margins over time.

Profit Margin vs Markup: Understanding the Difference

Many people confuse profit margin with markup, but they’re different concepts. Understanding both is crucial for proper pricing.

What’s the Difference?

Profit Margin measures profit as a percentage of the selling price:

- Formula: (Profit ÷ Revenue) × 100

Markup measures profit as a percentage of the cost:

- Formula: (Profit ÷ Cost) × 100

Example to Illustrate

You buy a product for $60 and sell it for $100.

Profit Margin Calculation:

- Profit = $100 – $60 = $40

- Margin = ($40 ÷ $100) × 100 = 40%

Markup Calculation:

- Profit = $100 – $60 = $40

- Markup = ($40 ÷ $60) × 100 = 66.7%

Key takeaway: The markup percentage is always higher than the margin percentage for the same transaction. Many business owners set prices using markup, but should also track margins to understand true profitability.

Using Profit Margins in Investment Decisions

If you’re interested in building wealth through investing, profit margins are essential metrics for evaluating potential stock investments. Here’s how investors use them:

Why Investors Love High-Margin Companies

Companies with strong profit margins often make better investments because they:

- Have competitive advantages (pricing power, efficient operations, or unique products)

- Can we weather economic downturns better with a financial cushion

- Generate more cash for dividends, buybacks, or reinvestment

- Show management excellence in controlling costs and maximizing efficiency

Comparing Companies Within an Industry

When evaluating stocks, compare profit margins against competitors. A company with consistently higher margins than peers likely has something special—maybe a stronger brand, better technology, or superior management.

Example: If you’re considering investing in two retail companies, and Company A has a 7% net margin while Company B has only 3%, Company A might be the better investment (assuming other factors are equal).

Warning Signs: Declining Margins

Falling profit margins can signal trouble:

- Increasing competition

- Rising costs that can’t be passed to customers

- Operational inefficiencies

- Market saturation

Understanding market cycles helps investors recognize when declining margins are temporary industry-wide issues versus company-specific problems.

Dividend Sustainability

For those interested in passive income through dividends, profit margins indicate whether dividend payments are sustainable. Companies with thin margins may struggle to maintain payouts during tough times.

Common Mistakes When Calculating Profit Margins

Even experienced business owners sometimes make errors when calculating or interpreting profit margins. Here are the most common pitfalls to avoid:

1: Confusing Revenue with Profit

The error: Celebrating high revenue numbers without checking profitability.

The reality: Revenue is meaningless if expenses are equally high. A $10 million company with $9.5 million in expenses is less profitable than a $1 million company with $600,000 in expenses.

2: Ignoring Hidden Costs

The error: Forgetting to include all expenses in calculations.

Common overlooked costs:

- Owner’s salary (especially in small businesses)

- Depreciation

- Credit card processing fees

- Insurance

- Professional services (accounting, legal)

3: Not Tracking Margins Over Time

The error: Calculating the margin once and never revisiting it.

The fix: Track margins monthly or quarterly. Trends matter more than single snapshots. A gradually declining margin signals problems before they become critical.

4: Comparing Across Different Industries

The error: Thinking your 5% margin is bad because tech companies have 25% margins.

The reality: Each industry has different economics. Compare your business only to similar companies in the same sector.

5: Focusing Only on Net Margin

The error: Ignoring gross and operating margins.

Why it matters: Different margin types reveal different issues:

- Low gross margin = pricing or production problems

- Low operating margin = operational inefficiency

- Low net margin = too much debt or tax burden

Advanced Profit Margin Analysis: Going Deeper

Once you master basic margin calculations, these advanced concepts can provide even more insights:

Contribution Margin

Contribution margin measures how much each unit sold contributes to covering fixed costs and generating profit.

Formula: (Revenue – Variable Costs) ÷ Revenue × 100

Use case: Helps determine break-even points and pricing strategies for individual products.

EBITDA Margin

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) margin removes non-operating expenses to show core business profitability.

Formula: EBITDA ÷ Revenue × 100

Use case: Useful for comparing companies with different capital structures, tax situations, or depreciation schedules.

Segment Profit Margins

For businesses with multiple product lines or locations, calculate margins for each segment separately.

Why it matters: You might discover that one product line has 30% margins while another loses money. This insight allows strategic decisions about where to focus resources.

Margin Trends and Seasonality

Plot your margins over time to identify:

- Seasonal patterns

- Long-term trends

- Impact of specific decisions or market changes

Many businesses experience seasonal fluctuations. A restaurant might have 15% margins in summer but only 8% in winter. Understanding these patterns helps with planning and cash flow management.

Real-Life Success Story: Turning Around a Struggling Business

Let me share a story about Maria, who bought a small clothing boutique in 2023. The previous owner claimed the business was profitable, but Maria’s first step was to calculate the actual profit margins.

Initial numbers:

- Annual revenue: $300,000

- COGS: $180,000 (60% of revenue)

- Operating expenses: $105,000

- Net profit: $15,000

- Net profit margin: 5%

While technically profitable, a 5% margin left no room for growth or unexpected expenses. Maria analyzed each component:

Gross margin analysis: Her 40% gross margin was low for retail clothing (typically 50-60%). She discovered the previous owner had poor inventory management, leading to excessive markdowns.

Operating expense analysis: Rent was reasonable, but marketing was ineffective—high spending with poor returns.

Maria’s improvements:

- Better inventory management: Ordered smaller quantities more frequently, reducing markdowns from 30% to 15%

- Renegotiated supplier terms: Achieved 10% better pricing through bulk commitments

- Shifted marketing budget: From print ads to social media, reducing costs by 40% while increasing reach

- Added high-margin accessories: Introduced jewelry and bags with 65% margins

Results after 18 months:

- Revenue increased to $360,000 (20% growth)

- COGS: $194,400 (54% of revenue—improved!)

- Operating expenses: $90,000 (reduced!)

- Net profit: $75,600

- Net profit margin: 21%

By focusing on profit margins rather than just revenue, Maria transformed a barely profitable business into a thriving one. The same principles apply whether you’re running a small business or evaluating investment opportunities.

Profit Margins and Business Valuation

When it comes time to sell a business or raise investment capital, profit margins significantly impact valuation. Here’s how:

Higher Margins = Higher Multiples

Businesses are often valued as a multiple of earnings. Companies with strong margins typically command higher multiples because:

- They’re perceived as less risky

- They demonstrate competitive advantages

- They have more room to absorb challenges

- They generate more cash for growth

Example: Two businesses each generate $100,000 in annual profit. Business A has 10% margins (requiring $1M in revenue), while Business B has 20% margins (requiring only $500K in revenue). Business B will likely receive a higher valuation multiple because it’s more efficient.

Margin Stability Matters

Consistent margins over time signal:

- Reliable business model

- Strong management

- Sustainable competitive position

Volatile margins raise red flags for potential buyers or investors, suggesting operational challenges or market instability.

Tools and Resources for Tracking Profit Margins

Managing profit margins requires good tools and systems. Here are recommendations for businesses of all sizes: 🛠️

For Small Businesses and Freelancers

- QuickBooks Online: Comprehensive accounting with built-in profit margin reports

- FreshBooks: User-friendly for service businesses

- Wave: Free accounting software with margin tracking

- Excel/Google Sheets: Create custom margin calculators and dashboards

For Investors Analyzing Stocks

- Yahoo Finance: Free financial statements and margin data

- Morningstar: In-depth analysis and industry comparisons

- SEC Edgar Database: Official company filings

- Your brokerage platform: Most offer financial metrics and screening tools

Key Reports to Generate

- Monthly profit & loss statement showing all three margin types

- Product/service profitability report, breaking down margins by offering

- Trend analysis comparing current margins to previous periods

- Budget vs. actual to identify variances

Frequently Asked Questions About Profit Margins

Profit margin measures profitability as a percentage of revenue, while ROI (Return on Investment) measures returns relative to the amount invested. Margin focuses on operational efficiency; ROI focuses on investment returns.

Yes, and many startups do initially. A negative margin means expenses exceed revenue—the company is losing money. This is sustainable only temporarily while building the business, assuming there’s sufficient capital.

Minimum: Quarterly

Recommended: Monthly

Ideal: Real-time tracking through accounting software

Regular monitoring helps identify problems early and measure the impact of changes.

Don’t panic, but do investigate. Possible explanations:

You’re still building scale

You’re in a different market segment

Your cost structure differs

There’s room for improvement

Use it as motivation to optimize operations and pricing.

This depends on your business stage and goals:

Early stage: Focus on margins to ensure viability

Growth stage: May sacrifice some margin for market share

Mature stage: Balance both—sustainable margins with steady growth

Remember: why the stock market tends to go up over time is partly because successful companies balance growth with profitability.

Profit Margins in Different Business Models

Different business models have inherently different margin structures. Understanding your model helps set realistic expectations:

Product-Based Businesses

Typical margins: 20-50% gross, 5-20% net

Characteristics:

- Inventory costs

- Shipping and fulfillment

- Physical storage needs

Margin improvement strategies: Bulk purchasing, efficient fulfillment, product mix optimization

Service-Based Businesses

Typical margins: 40-70% gross, 15-30% net

Characteristics:

- Labor-intensive

- Lower overhead

- Scalability challenges

Margin improvement strategies: Productize services, improve efficiency, raise rates, leverage technology

Subscription/SaaS Businesses

Typical margins: 70-90% gross, 10-30% net (after growth investments)

Characteristics:

- High initial customer acquisition costs

- Low marginal costs

- Recurring revenue

Margin improvement strategies: Reduce churn, increase lifetime value, optimize pricing tiers

Marketplace/Platform Businesses

Typical margins: 60-80% gross, 10-40% net

Characteristics:

- Network effects

- Minimal inventory

- High scalability

Margin improvement strategies: Increase take rate, add premium features, reduce fraud/disputes

The Psychology of Profit Margins: Mindset Matters

Beyond the numbers, there’s a psychological component to profit margins that affects business success:

The “Race to the Bottom” Trap

Many business owners compete primarily on price, continuously lowering margins to win customers. This strategy rarely works long-term because:

- You can’t sustain losses indefinitely

- You attract price-sensitive customers with no loyalty

- You devalue your offering

- Competitors can always go lower

Better approach: Compete on value, quality, service, or specialization—factors that justify higher margins.

The Confidence to Charge More

Entrepreneurs often undercharge because they lack confidence in their value. Remember:

- Customers associate higher prices with higher quality

- Profitable margins allow better service (which creates more value)

- You need a financial cushion to invest in improvement

- Your time and expertise have real value

The Long-Term Perspective

Understanding why people lose money in the stock market often comes down to short-term thinking. The same applies to business margins. Don’t sacrifice long-term profitability for short-term revenue gains.

Example: Accepting a large contract at low margins might boost revenue temporarily, but it consumes resources that could serve higher-margin customers and sets dangerous precedents.

5 Quick Wins to Improve Your Profit Margin

- Raise Prices Strategically: Review pricing annually, small changes compound profits.

- Cut Hidden Costs: Track recurring expenses like software, shipping, or processing fees.

- Upsell or Cross-Sell: Offer premium upgrades or bundles to boost revenue per customer.

- Streamline Operations: Automate workflows or negotiate supplier discounts.

- Focus on High-Margin Products: Promote your best profit drivers instead of low-margin volume.

Conclusion: Your Profit Margin Action Plan

Understanding how to calculate profit margin is more than just math; it’s a fundamental business skill that reveals the true health of any enterprise. Whether you’re running a business, evaluating investments, or simply want to make smarter financial decisions, profit margins give you the clarity to act with confidence.

Here’s your action plan:

- Calculate your current margins using the formulas provided (or use the interactive calculator above)

- Compare against industry benchmarks to understand where you stand

- Identify improvement opportunities in pricing, costs, or operations

- Set specific margin goals for the next quarter and year

- Track margins monthly to monitor progress and catch problems early

- Make data-driven decisions based on margin analysis rather than gut feeling

Remember, profit margins aren’t just numbers on a spreadsheet; they’re the scoreboard for your business efficiency and the foundation for sustainable growth. Companies with healthy margins weather economic storms better, attract investors more easily, and create more opportunities for everyone involved.

Start calculating your profit margins today. The insights you gain will transform how you think about business, investing, and wealth creation.

Ready to take the next step? Apply these concepts to evaluate potential investments or build passive income streams that can grow your wealth over time.

Disclaimer

The information provided in this article is for educational purposes only and should not be considered financial, investment, or business advice. Profit margin calculations and business decisions should be made in consultation with qualified professionals, including accountants, financial advisors, and business consultants. While we strive for accuracy, financial situations vary greatly, and what works for one business may not work for another. Always conduct thorough research and due diligence before making business or investment decisions. Past performance and industry benchmarks do not guarantee future results.

About the Author

Max Fonji is a financial educator and the founder of TheRichGuyMath.com, where he breaks down complex financial concepts into simple, actionable advice. With over a decade of experience in business analysis and investment strategy, Max is passionate about helping people build wealth through smart financial decisions. His approach combines practical math with real-world wisdom, making finance accessible to everyone from complete beginners to experienced investors. When he’s not writing about money, Max enjoys analyzing market trends, mentoring entrepreneurs, and finding creative ways to optimize business operations.