Imagine waking up on your first day of retirement. No alarm clock. No commute. Just freedom. But then a question hits you: “How much can I actually spend without running out of money?” This is the question that keeps retirees awake at night. And it’s exactly why the 4% Rule has become the most famous retirement withdrawal strategy in financial planning history.

The 4% Rule is a retirement withdrawal strategy that suggests you can safely withdraw 4% of your retirement portfolio in the first year, then adjust that dollar amount for inflation each subsequent year, with a high probability of not outliving your money over a 30-year retirement. In simple terms, if you have $1 million saved, you’d withdraw $40,000 in year one, then adjust that amount for inflation annually.

Created by financial planner William Bengen in 1994 and later validated by the famous Trinity Study, this rule has guided millions of retirees toward financial security. But is it still relevant in 2025? Does it work for everyone? And what are the risks you need to know?

This comprehensive guide will walk you through everything you need to understand about the 4% Rule, from how it works to when it might fail you. Financial Planning

TL;DR Summary

- The 4% Rule suggests withdrawing 4% of your retirement savings in year one, then adjusting for inflation annually to make your money last 30+ years

- Based on historical data from 1926-1995, the rule has a 95% success rate using a portfolio of 50-75% stocks and 25-50% bonds

- It’s a starting point, not a gospel—your actual safe withdrawal rate depends on market conditions, retirement length, portfolio allocation, and spending flexibility

- In 2025’s environment of higher valuations and lower bond yields, some experts suggest a more conservative 3-3.5% withdrawal rate

- The rule works best with flexibility—being willing to reduce spending during market downturns significantly improves success rates

What Is the 4% Rule? The Foundation of Retirement Withdrawal Planning

The 4% Rule is a retirement withdrawal guideline that helps answer one of the most critical questions in financial planning: “How much can I safely spend in retirement without running out of money?”

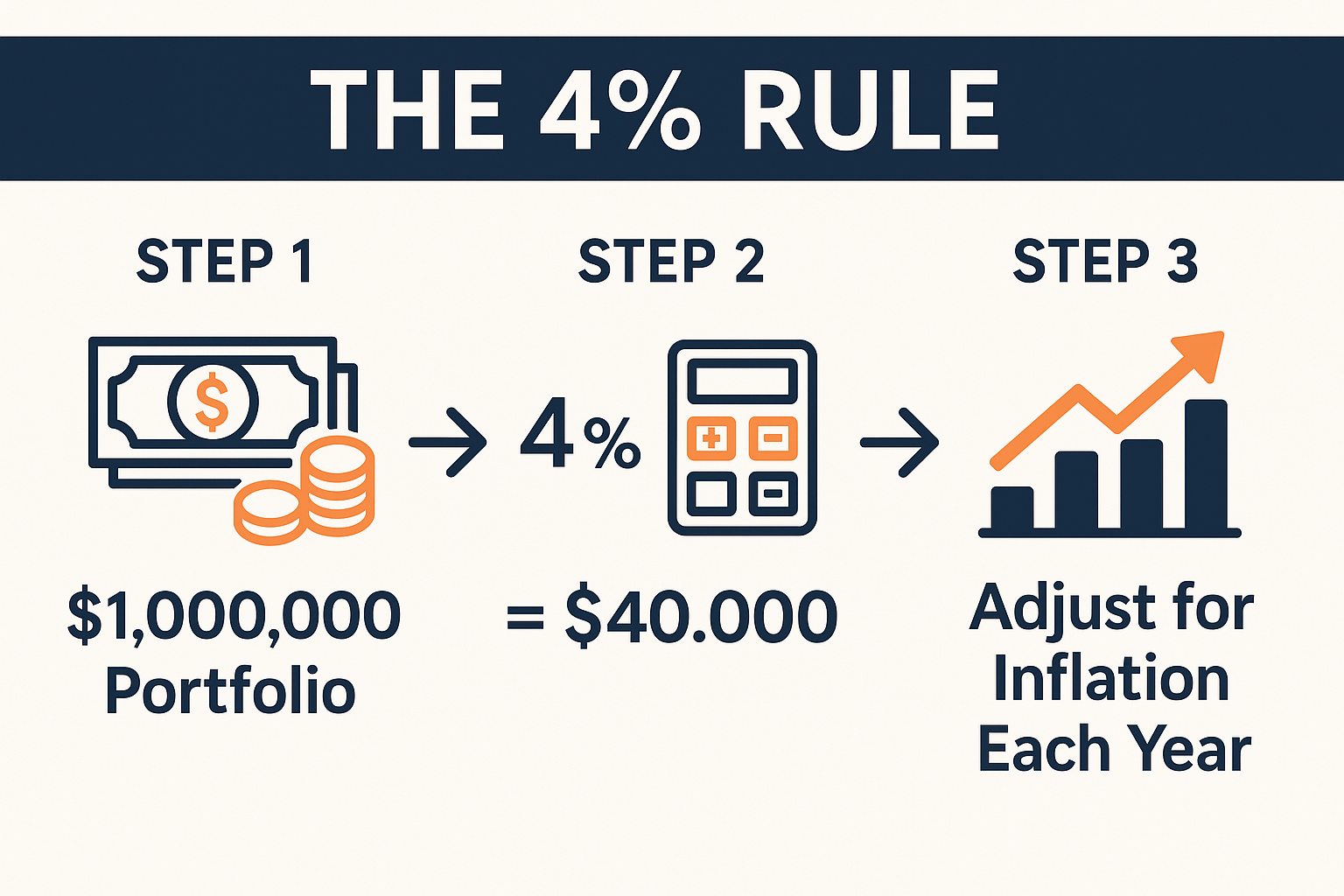

Here’s how it works in practice:

Year 1: Withdraw 4% of your total retirement portfolio balance

Year 2 and beyond: Withdraw the same dollar amount as Year 1, adjusted for inflation

A Simple Example

Let’s say you retire with $1,000,000 in your retirement accounts:

- Year 1 (2025): You withdraw $40,000 (4% of $1,000,000)

- Year 2 (2026): Inflation is 3%, so you withdraw $41,200 ($40,000 × 1.03)

- Year 3 (2027): Inflation is 2.5%, so you withdraw $42,230 ($41,200 × 1.025)

Notice that you’re not recalculating 4% of your current balance each year. You’re taking that initial dollar amount and simply adjusting it for inflation, regardless of how your portfolio performs.

This approach provides predictable income that maintains your purchasing power throughout retirement—at least in theory.

The Historical Foundation

The 4% Rule emerged from research by William Bengen, a financial planner who analyzed historical market returns from 1926 to 1992. He discovered that a retiree could have withdrawn 4% initially, adjusted for inflation, and never run out of money over any 30 years, even if they retired right before major market crashes like 1929 or the 1970s stagflation.

Later, three professors from Trinity University expanded this research in what’s now called the Trinity Study (1998), examining portfolio success rates across different withdrawal rates and asset allocations from 1926 to 1995.

Their findings? A 50/50 stock-bond portfolio with a 4% withdrawal rate had a 95% success rate over 30 years. That remaining 5%? Those were scenarios where retirees experienced the worst possible market timing. Morningstar

How to Calculate Your 4% Rule Withdrawal Amount

Calculating your initial withdrawal using the 4% Rule is remarkably straightforward. Here’s the step-by-step process:

Step 1: Total Your Retirement Assets

Add up all your retirement accounts:

- 401(k) and 403(b) accounts

- Traditional and Roth IRAs

- Taxable investment accounts earmarked for retirement

- Other retirement savings

Example: $850,000 (401k) + $200,000 (IRA) + $150,000 (taxable account) = $1,200,000

Step 2: Multiply by 0.04

Take your total and multiply by 4% (or 0.04):

$1,200,000 × 0.04 = $48,000

This is your first-year withdrawal amount.

Step 3: Adjust for Inflation in Subsequent Years

In year two and beyond, you don’t recalculate based on your portfolio balance. Instead, you adjust your previous year’s withdrawal for inflation.

If inflation was 3% in year one:

Year 2 withdrawal = $48,000 × 1.03 = $49,440

The Quick Reference Table

| Portfolio Value | 4% First-Year Withdrawal | Monthly Income |

|---|---|---|

| $500,000 | $20,000 | $1,667 |

| $750,000 | $30,000 | $2,500 |

| $1,000,000 | $40,000 | $3,333 |

| $1,500,000 | $60,000 | $5,000 |

| $2,000,000 | $80,000 | $6,667 |

Understanding these numbers helps you work backward: if you need $50,000 per year in retirement income, you’d need approximately $1,250,000 in retirement savings ($50,000 ÷ 0.04).

The Research Behind the 4% Rule: Why It Became the Gold Standard

Understanding why the 4% Rule works requires diving into the research that created it. This isn’t just someone’s guess; it’s based on nearly 70 years of actual market data.

William Bengen’s Groundbreaking 1994 Study

Financial planner William Bengen asked a simple question: “What’s the maximum withdrawal rate that would have survived every historical 30-year retirement period?”

He tested withdrawal rates from 3% to 7% against actual historical returns from 1926 to 1992, examining what would have happened if someone retired in 1926, 1927, 1928, and so on.

His findings were eye-opening:

At 4% withdrawal rate, the Portfolio survived 100% of the 30-year periods

At 5% withdrawal rate, the Portfolio failed in several scenarios

At 3% withdrawal rate, Retirees ended up with massive unused wealth

The worst-case scenario occurred for someone who retired in 1966, right before a brutal period of high inflation and poor stock returns. Even then, a 4% withdrawal rate (with a 50-75% stock allocation) would have lasted the full 30 years.

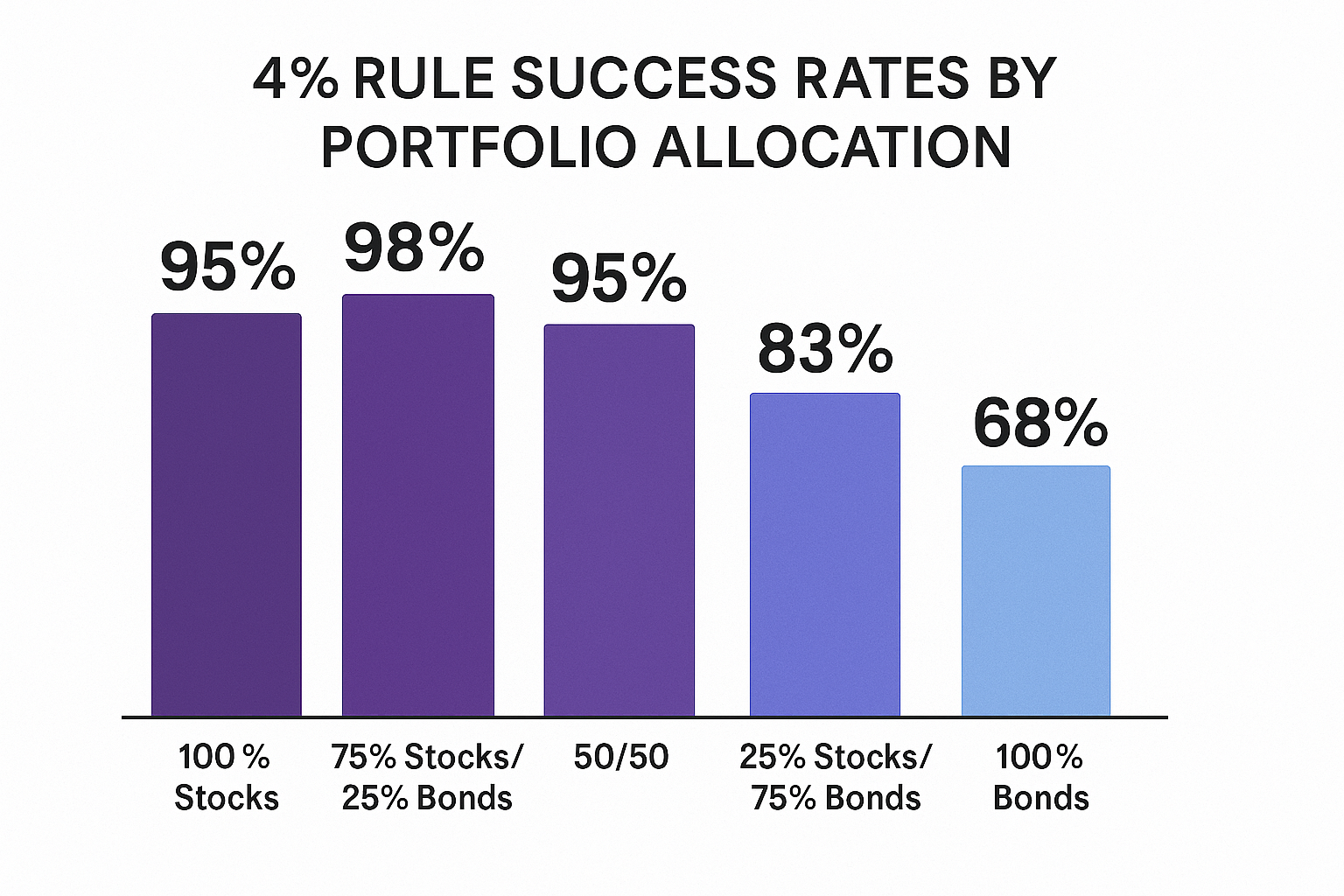

The Trinity Study: Validation and Expansion

In 1998, three finance professors from Trinity University, Philip Cooley, Carl Hubbard, and Daniel Walz, expanded on Bengen’s work. Their study, formally titled “Retirement Savings: Choosing a Withdrawal Rate That Is Sustainable,” examined:

- Different portfolio allocations (from 100% bonds to 100% stocks)

- Various withdrawal rates (3% to 12%)

- Different time horizons (15 to 30 years)

- Historical periods from 1926 to 1995

Key Trinity Study Findings

For a 30-year retirement with a 4% withdrawal rate:

| Portfolio Allocation | Success Rate |

|---|---|

| 100% Stocks | 95% |

| 75% Stocks / 25% Bonds | 98% |

| 50% Stocks / 50% Bonds | 95% |

| 25% Stocks / 75% Bonds | 83% |

| 100% Bonds | 68% |

The sweet spot appeared to be 50-75% stocks, which balanced growth potential with downside protection. Motley Fool Wealth

“The 4% Rule isn’t a guarantee—it’s a probability-based guideline derived from the worst historical scenarios. In most cases, retirees following this rule ended up with significantly more money than they started with.” — Trinity Study authors

What the Research Tells Us

The historical data reveals several important insights:

The sequence of returns matters most in the first decade of retirement

Stock allocation improves success rates for longer retirements

Inflation adjustments are critical to maintain purchasing power

The rule was designed for a worst-case scenario, not an average one

Understanding the cycle of market emotions helps explain why many retirees panic during downturns and make poor withdrawal decisions that undermine the 4% Rule’s effectiveness.

Advantages of the 4% Rule: Why It’s Still Popular in 2025

Despite being developed decades ago, the 4% Rule remains the most widely referenced retirement withdrawal strategy. Here’s why it continues to resonate with retirees and financial planners:

1. Simplicity and Ease of Understanding

The 4% Rule’s greatest strength is its simplicity. You don’t need a PhD in finance or complex software to implement it. Calculate 4% of your portfolio, adjust for inflation annually, and you’re done.

This simplicity makes it:

- Easy to explain to clients

- Simple to implement without professional help

- Straightforward to monitor year after year

For someone just learning about smart moves in retirement planning, the 4% Rule provides an accessible starting point.

2. Based on Real Historical Data

Unlike purely theoretical models, the 4% Rule is grounded in actual market performance across nearly a century. It accounts for:

- The Great Depression (1929-1939)

- World War II

- The 1970s stagflation

- The 1987 market crash

- Multiple recessions and recoveries

This historical validation gives retirees confidence that the strategy has weathered the worst financial storms in modern history.

3. Provides Inflation Protection

By adjusting withdrawals for inflation each year, the 4% Rule maintains your purchasing power throughout retirement. A $40,000 withdrawal in year one will buy the same amount of goods and services as your adjusted withdrawal 20 years later.

This is crucial because inflation is one of the biggest threats to retirement security, especially for those living 30+ years in retirement.

4. Offers Predictable Income

Knowing approximately how much you can spend each year allows for better budgeting and financial planning. You can:

- Create realistic retirement budgets

- Plan major purchases years in advance

- Understand whether you can afford your desired lifestyle

This predictability reduces the anxiety many retirees feel about their financial future.

5. Flexible Across Different Portfolio Sizes

The 4% Rule scales proportionally, whether you have $500,000 or $5,000,000 saved. The percentage-based approach works at any wealth level, making it universally applicable.

6. Conservative by Design

The 4% Rule was based on the worst historical scenarios. In most retirement periods, retirees following this rule ended up with substantially more wealth than they started with—often 2-3 times their initial portfolio value.

This built-in conservatism provides a margin of safety that many retirees appreciate.

7. Encourages Disciplined Spending

Having a predetermined withdrawal strategy helps prevent emotional spending decisions during market volatility. When the stock market drops 20%, the 4% Rule provides a framework to stick to your plan rather than panic.

Limitations and Criticisms of the 4% Rule: What You Need to Know

While the 4% Rule has guided millions of retirees successfully, it’s not perfect. Understanding its limitations is crucial for making informed decisions about your retirement strategy.

1. Assumes a 30-Year Retirement Period

The original research was based on 30-year retirements, but what if you retire at 55 and live to 95? That’s a 40-year retirement. Or what if you only need your money to last 20 years?

The problem: Longer retirements require lower withdrawal rates, while shorter retirements can support higher rates.

2025 reality: With improving healthcare and longevity, many people face 35-40-year retirements, which may require a more conservative 3.5% withdrawal rate.

2. Based on Historical Data That May Not Repeat

The 4% Rule relies on market returns from 1926-1995, a period that included:

- Relatively high bond yields

- Strong economic growth

- Lower market valuations

The problem: Current market conditions in 2025 are different:

- Bond yields remain lower than historical averages

- Stock valuations are higher (higher P/E ratios)

- Economic growth forecasts are more modest

Many financial experts, including Wade Pfau and Michael Kitces, have suggested that a 3-3.5% withdrawal rate may be more appropriate given today’s market valuations.

3. Doesn’t Account for Variable Spending Patterns

Real retirees don’t spend the same amount every year. Research shows retirement spending typically follows a pattern:

- Early retirement (60-70): Higher spending on travel and activities

- Middle retirement (70-80): Moderate, stable spending

- Late retirement (80+): Lower spending except for healthcare

The 4% Rule’s inflation-adjusted approach doesn’t reflect this natural spending curve.

4. Ignores Sequence of Returns Risk 🎲

Sequence of returns risk is the danger of experiencing poor market returns early in retirement. If you retire and immediately face a bear market, your portfolio may never recover, even if long-term returns are good.

Example scenario:

- Retiree A: Retires in 2020, experiences strong returns for 5 years, then a bear market

- Retiree B: Retires in 2020, immediately faces a 40% market drop, then strong returns

Even with identical average returns over 30 years, Retiree B is far more likely to run out of money because they were forced to sell assets at depressed prices early in retirement.

Understanding why people lose money in the stock market can help you avoid the behavioral mistakes that compound sequence risk.

5. Assumes a Fixed Asset Allocation

The 4% Rule typically assumes you maintain a consistent stock/bond allocation throughout retirement. However, many financial advisors recommend becoming more conservative as you age.

This shift to bonds may reduce your portfolio’s growth potential and require a lower withdrawal rate.

6. Doesn’t Consider Taxes

The 4% Rule doesn’t account for the tax implications of withdrawals. Your actual spendable income depends on:

- Whether funds come from traditional (pre-tax) or Roth (post-tax) accounts

- Your tax bracket in retirement

- Required Minimum Distributions (RMDs) starting at age 73

- State and local taxes

A $40,000 withdrawal from a traditional IRA might only provide $32,000 in after-tax income, requiring you to withdraw more than 4% to meet your spending needs.

7. Rigid in the Face of Market Volatility

The standard 4% Rule doesn’t adjust for market conditions. You withdraw the same inflation-adjusted amount whether the market is up 30% or down 30%.

This rigidity can accelerate portfolio depletion during extended bear markets.

8. May Leave Significant Unused Wealth

Because the 4% Rule was designed for worst-case scenarios, most retirees following it end up with substantial unused wealth. While this provides a safety margin, it also means many retirees could have spent more and enjoyed their retirement years more fully.

“The 4% Rule is better understood as a starting point for conversation, not a final answer. Your personal withdrawal rate should reflect your unique circumstances, risk tolerance, and flexibility.” — Michael Kitces, financial planner and researcher

When the 4% Rule Works Best: Ideal Scenarios

The 4% Rule isn’t universally applicable to every retirement situation. It works best under specific conditions. Understanding when it’s most effective helps you determine if it’s right for your situation.

1: You Have a 30-Year Retirement Horizon

If you’re retiring at 65 and planning for a 30-year retirement (to age 95), you’re right in the sweet spot of the original research. The historical data strongly support the 4% Rule for this timeframe.

2: You Have a Balanced Portfolio (50-75% Stocks)

The 4% Rule works best with a portfolio that includes significant stock exposure. The growth potential of equities helps offset withdrawals and inflation over time.

Optimal allocation for the 4% Rule:

- 50-60% stocks for moderate risk tolerance

- 60-75% stocks for higher risk tolerance and longer time horizons

- 25-50% bonds for stability and income

Those interested in building a stock portfolio should explore dividend investing as part of their retirement strategy.

3: You Have Spending Flexibility

The 4% Rule works significantly better when you can adjust spending during market downturns. If you can reduce discretionary expenses by 10-20% during bear markets, your success rate jumps considerably, potentially to 99%+.

Flexible expenses include:

- Travel and entertainment

- Gifts and charitable giving

- Home improvements

- Luxury purchases

Fixed expenses typically include:

- Housing (mortgage/rent, property taxes, insurance)

- Healthcare and insurance premiums

- Food and utilities

- Essential transportation

4: You Have Additional Income Sources

The 4% Rule works better when it supplements other guaranteed income rather than serving as your sole income source.

Additional income sources:

- Social Security benefits

- Pension payments

- Rental property income

- Part-time work or consulting

- Annuity payments

If Social Security covers your basic living expenses, you can use the 4% Rule for discretionary spending, significantly reducing the risk of running out of money.

5: You Retire During Normal or Favorable Market Valuations

The 4% Rule is safer when you retire during periods of:

- Average or below-average stock market valuations (P/E ratios around 15-20)

- Reasonable bond yields (3%+ on 10-year Treasuries)

- Moderate inflation environments (2-3% annually)

Retiring during extreme market conditions—either very high valuations or very low bond yields—may require a more conservative approach.

6: You’re Willing to Monitor and Adjust

The 4% Rule works best when treated as a dynamic guideline rather than a set-it-and-forget-it strategy. Annual reviews allow you to:

- Assess portfolio performance

- Adjust for major life changes

- Modify withdrawals based on market conditions

- Rebalance your asset allocation

Alternatives and Modifications to the 4% Rule

While the 4% Rule provides an excellent starting point, several alternative strategies and modifications can better address its limitations. Here are the most popular approaches financial planners use in 2025:

1. The Dynamic Withdrawal Strategy

Instead of withdrawing a fixed inflation-adjusted amount, the dynamic approach recalculates your withdrawal each year based on your current portfolio balance.

How it works:

- Each year, withdraw 4% of your current portfolio value

- Your income fluctuates with market performance

- You automatically reduce spending during downturns and increase it during booms

Example:

- Year 1: Portfolio = $1,000,000 → Withdraw $40,000

- Year 2: Portfolio = $900,000 (after market drop) → Withdraw $36,000

- Year 3: Portfolio = $1,050,000 (after recovery) → Withdraw $42,000

Pros:

Virtually eliminates the risk of running out of money

Automatically adjusts to market conditions

Simple to calculate annually

Cons:

Income unpredictability makes budgeting difficult

May require significant lifestyle adjustments

Psychological difficulty of cutting spending after marketthe drops

2. The Guardrails Strategy

Developed by financial planners Jonathan Guyton and William Klinger, this approach sets upper and lower boundaries for your withdrawal rate.

How it works:

- Start with a 4-5% withdrawal rate

- Set guardrails (e.g., 3% lower bound, 6% upper bound)

- If your withdrawal rate exceeds 6% of your portfolio, cut spending by 10%

- If your withdrawal rate drops below 3%, increase spending by 10%

Example:

- Initial portfolio: $1,000,000, withdrawal: $40,000 (4%)

- Market drops to $800,000 → withdrawal rate = 5% (still within guardrails, no change)

- Market drops to $650,000 → withdrawal rate = 6.15% (exceeds upper guardrail)

- Action: Reduce withdrawal by 10% to $36,000

Pros:

Provides flexibility while maintaining some predictability

Reduces portfolio depletion risk

Allows for spending increases during good markets

Cons:

More complex to implement

Still requires spending cuts during downturns

Requires discipline to follow the rules

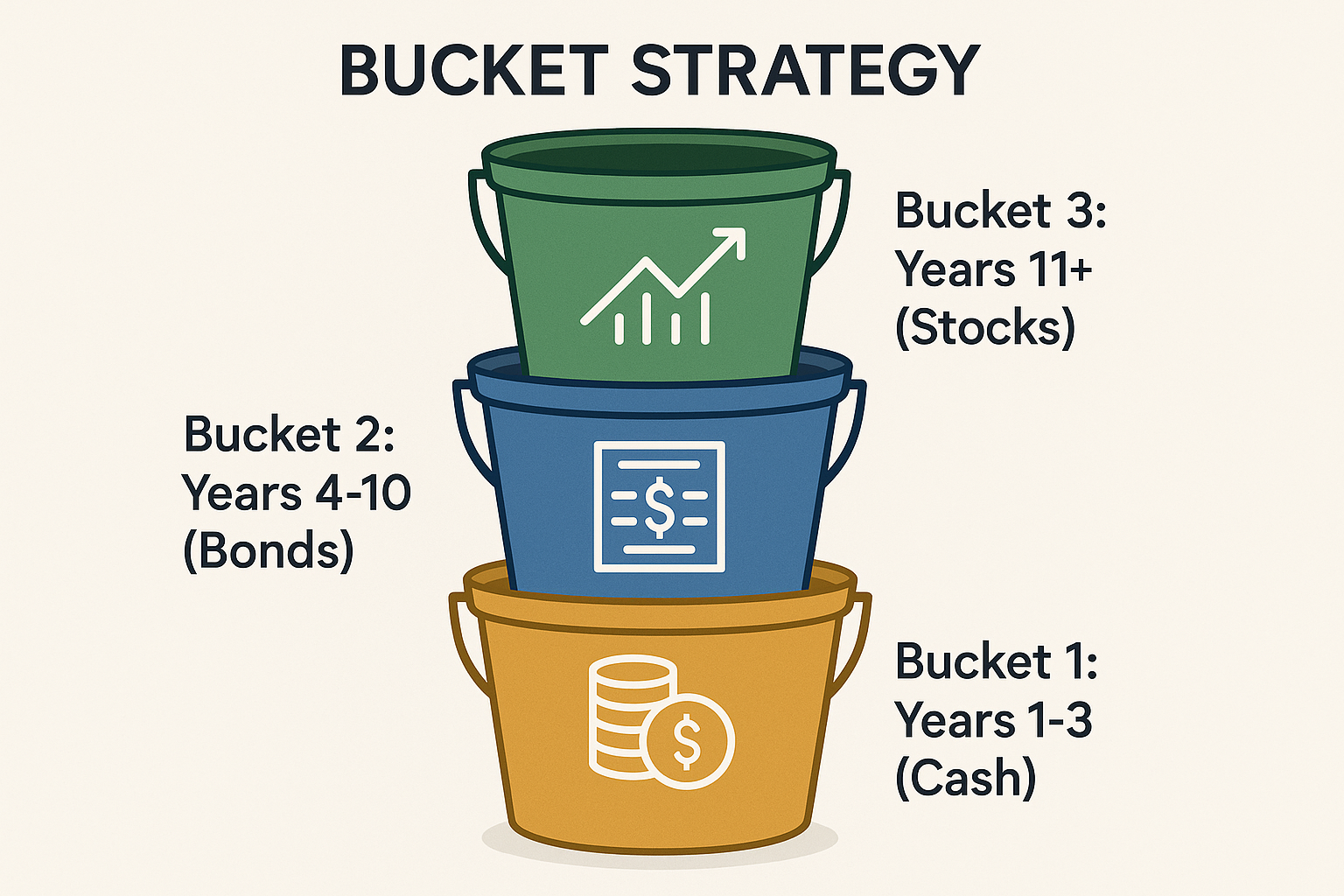

3. The Bucket Strategy

This approach divides your portfolio into three “buckets” based on when you’ll need the money:

Bucket 1 (Years 1-3): Cash and cash equivalents

Bucket 2 (Years 4-10): Bonds and conservative investments

Bucket 3 (Years 11+): Stocks and growth investments

How it works:

Pros:

Provides psychological comfort with a cash buffer

Reduces the sequence of returns risk

Clear, visual strategy that’s easy to understand

Cons:

May be overly conservative

Requires active management and rebalancing

It can be complex to implement efficiently

4. The Essential vs. Discretionary Approach

This strategy separates retirement expenses into two categories and funds them differently:

Essential expenses (housing, food, healthcare, utilities):

- Cover with guaranteed income (Social Security, pensions, annuities)

- Use conservative withdrawal rates (2-3%)

Discretionary expenses (travel, entertainment, gifts):

- Fund with higher withdrawal rates (4-5%)

- Accept more volatility and flexibility

Pros:

Ensures basic needs are always met

Provides peace of mind

Allows for aggressive investing of discretionary funds

Cons:

May require purchasing annuities

Complex to set up initially

Less flexibility in how income is used

5. The Constant Percentage Withdrawal

Similar to the dynamic strategy but with modifications for inflation and market volatility.

How it works:

- Withdraw a fixed percentage (3-4%) of your portfolio value

- Use a 3-year rolling average to smooth volatility

- Adjust for inflation only in years with positive returns

Pros:

Balances flexibility with predictability

Smooths out year-to-year volatility

Nearly eliminates portfolio depletion risk

Cons:

Still involves income variability

More complex calculations

May result in lower lifetime spending

6. The Floor-and-Upside Strategy

This approach guarantees a minimum income floor while allowing for upside potential.

How it works:

- Purchase an immediate annuity to cover essential expenses (the “floor”)

- Invest remaining assets more aggressively

- Withdraw from investments for discretionary spending using a higher rate (5-6%)

Pros:

Guarantees an essential income for life

Allows for aggressive investing of remaining assets

Provides both security and upside potential

Cons:

Requires purchasing annuities (which have costs)

Reduces estate value

Annuity income isn’t inflation-adjusted (unless purchased with that feature)

Which Strategy Is Right for You?

The best approach depends on your:

- Risk tolerance: How comfortable are you with income variability?

- Spending flexibility: Can you reduce expenses during downturns?

- Income sources: Do you have Social Security or pension income?

- Estate goals: Do you want to leave money to heirs?

- Complexity preference: Do you want simple or sophisticated strategies?

Many retirees combine elements from multiple strategies to create a personalized approach. For example, using the bucket strategy for structure while applying guardrails for withdrawal decisions.

Those looking to supplement retirement income should consider smart ways to make passive income that can reduce reliance on portfolio withdrawals.

The 4% Rule in 2025: Does It Still Work?

The financial landscape has changed dramatically since William Bengen introduced the 4% Rule in 1994. With different market conditions, longer lifespans, and evolving economic realities, the critical question is: Does the 4% Rule still work in 2025?

Current Market Conditions vs. Historical Averages

Let’s compare the environment that produced the 4% Rule with today’s reality:

| Factor | Historical Average (1926-1995) | 2025 Environment |

|---|---|---|

| 10-Year Treasury Yield | ~5.0% | ~4.2% |

| Stock Market P/E Ratio | ~15-16 | ~22-24 |

| Expected Stock Returns | ~10% | ~7-8% |

| Expected Bond Returns | ~5-6% | ~4-5% |

| Inflation | ~3.0% | ~2.5-3.0% |

| Retirement Duration | 30 years | 30-35 years |

The bottom line: Expected returns are lower while valuations are higher, suggesting the 4% Rule may be too aggressive for 2025 retirees.

What the Latest Research Says

Several prominent researchers have updated the 4% Rule for current conditions:

Wade Pfau (2025): Suggests a 3.3-3.5% withdrawal rate for new retirees given current market valuations and bond yields. His research indicates this provides a similar 95% success rate as the original 4% Rule did historically.

Michael Kitces (2025): Argues the 4% Rule is still viable but recommends a “ratcheting” approach, starting at 4%, but if the market performs well in the first 5 years, you can increase withdrawals. If it performs poorly, reduce it to 3.5%.

Morningstar (2024 Study): Recommends a 3.7% withdrawal rate for a balanced 50/50 portfolio with a 90% success rate over 30 years.

Vanguard (2025): Suggests 3.4-3.8% depending on portfolio allocation, with lower rates for bond-heavy portfolios.

Factors That Make the 4% Rule More Conservative in 2025

Several trends actually improve the 4% Rule’s effectiveness today:

Better portfolio construction: Low-cost index funds and ETFs weren’t widely available in the 1990s. Today’s retirees can build diversified portfolios with expense ratios under 0.10%, compared to 1-2% in the past.

Tax-advantaged accounts: Roth IRAs and Roth 401(k)s provide tax-free income, effectively increasing your spendable withdrawal rate.

Flexibility and awareness: Today’s retirees are more financially literate and willing to adjust spending during downturns, significantly improving success rates.

Dividend strategies: High dividend stocks and dividend growth strategies can provide more reliable income streams that reduce the need to sell assets during downturns.

The Real Question: What Withdrawal Rate Should You Use?

Given all the research and current conditions, here’s a practical framework for 2025:

Conservative approach (3-3.5%):

- Retiring in your 50s or early 60s (40+ year horizon)

- Low risk tolerance

- Limited spending flexibility

- No other income sources

- Desire to leave a substantial estate

Moderate approach (3.5-4%):

- Retiring at 65 (30-year horizon)

- Moderate risk tolerance

- Some spending flexibility

- Social Security income

- Balanced 60/40 portfolio

Aggressive approach (4-4.5%):

- Retiring at 70+ (shorter horizon)

- High risk tolerance

- Significant spending flexibility

- Multiple income sources

- Higher stock allocation (70%+)

- Willing to reduce spending during downturns

A Real-World Story: The 2008 Test

Consider two retirees who both retired in January 2008 with $1,000,000, right before the financial crisis:

Retiree A (Rigid 4% Rule):

- Withdrew $40,000 in 2008

- Portfolio dropped to $650,000 by March 2009

- Continued withdrawing $40,800 in 2009 (adjusted for inflation)

- By 2025, portfolio value: ~$1,450,000

- Result: Survived and thrived, despite worst-case timing

Retiree B (Flexible approach):

- Withdrew $40,000 in 2008

- Reduced withdrawal to $30,000 in 2009 (25% cut)

- Gradually increased back to $40,000 by 2012

- By 2025, portfolio value: ~$1,850,000

- Result: Better outcome with temporary spending reduction

This real-world example demonstrates that the 4% Rule worked even in the worst retirement timing in modern history, and worked even better with flexibility.

Understanding why the stock market goes up over time helps build confidence to stick with your plan during inevitable downturns.

How to Implement the 4% Rule: A Step-by-Step Action Plan

Ready to put the 4% Rule into practice? Here’s a comprehensive, actionable guide to implementing this strategy for your retirement.

Step 1: Calculate Your Total Retirement Portfolio

Include:

- 401(k) and 403(b) accounts

- Traditional and Roth IRAs

- SEP-IRAs and SIMPLE IRAs

- Taxable investment accounts

- Health Savings Accounts (HSAs)

Don’t include:

- Primary residence (unless you plan to sell it)

- Emergency funds (keep 6-12 months separate)

- Money earmarked for specific purposes (kids’ college, etc.)

Example calculation:

- 401(k): $650,000

- IRA: $200,000

- Taxable account: $150,000

- Total retirement portfolio: $1,000,000

Step 2: Determine Your Target Withdrawal Rate

Based on your situation, choose your starting withdrawal rate:

- 3.0-3.5%: Very conservative, long retirement horizon

- 3.5-4.0%: Moderate, standard 30-year retirement

- 4.0-4.5%: Aggressive, shorter horizon or high flexibility

For our example, let’s use 4% for a 65-year-old with a 30-year horizon.

First-year withdrawal = $1,000,000 × 0.04 = $40,000

Step 3: Optimize Your Asset Allocation

Your portfolio mix significantly impacts success rates. Here are recommended allocations:

For ages 60-70:

- 60-70% stocks (U.S. and international)

- 30-40% bonds (government and corporate)

- 0-5% cash

For ages 70-80:

- 50-60% stocks

- 40-50% bonds

- 0-5% cash

For ages 80+:

- 40-50% stocks

- 50-60% bonds

- 0-5% cash

Within stocks, consider:

- 70% U.S. stocks (total market index)

- 30% international stocks

- Include dividend-paying stocks for income stability

Step 4: Create a Tax-Efficient Withdrawal Strategy

The order in which you withdraw from different accounts matters significantly for taxes:

Standard withdrawal sequence:

- Required Minimum Distributions (RMDs) from traditional accounts (age 73+)

- Taxable accounts (often taxed at lower capital gains rates)

- Tax-deferred accounts (traditional 401k/IRA)

- Tax-free accounts (Roth IRA) – save for last

Why this order?

- Satisfies legal requirements (RMDs)

- Minimizes lifetime tax burden

- Allows Roth accounts to grow tax-free the longest

- Provides tax-free income in later years when RMDs may push you into higher brackets

Example annual withdrawal ($40,000 needed):

- $15,000 from taxable account (mix of dividends and capital gains)

- $25,000 from a traditional IRA

- $0 from Roth IRA (saving for later years or emergencies)

Step 5: Set Up Systematic Withdrawals

Monthly approach (recommended):

- Divide the annual withdrawal by 12

- Set up automatic monthly transfers to a checking account

- Example: $40,000 ÷ 12 = $3,333/month

Quarterly approach:

- Withdraw every 3 months

- Allows more flexibility in time market conditions

- Example: $40,000 ÷ 4 = $10,000/quarter

Annual approach:

- Withdraw once per year

- Maximum flexibility, but requires more cash management

- Example: $40,000 once in January

Step 6: Track Inflation and Adjust Annually

Each year, adjust your withdrawal for inflation using the Consumer Price Index (CPI).

Example progression:

- Year 1 (2025): Withdraw $40,000

- Year 2 (2026): Inflation = 2.8% → Withdraw $41,120

- Year 3 (2027): Inflation = 3.1% → Withdraw $42,395

- Year 4 (2028): Inflation = 2.5% → Withdraw $43,455

Where to find inflation data:

- Bureau of Labor Statistics (BLS.gov)

- Your financial advisor

- Many retirement calculators auto-calculate this

Step 7: Rebalance Your Portfolio Regularly

At least annually, rebalance back to your target allocation:

Example:

- Target: 60% stocks / 40% bonds

- After market gains: 68% stocks / 32% bonds

- Action: Sell stocks, buy bonds to return to 60/40

Rebalancing benefits:

- Maintains your desired risk level

- Forces you to “sell high, buy low”

- Provides discipline during market extremes

When to rebalance:

- Annually on a set date (e.g., your birthday)

- When allocation drifts 5+ percentage points from the target

- When making withdrawals (withdraw from overweight assets)

Step 8: Monitor and Adjust Your Plan

Review your retirement plan annually and ask:

Is my portfolio performing as expected?

Has my spending changed significantly?

Have there been major life changes (health, family, goals)?

Are market conditions suggesting I should adjust my withdrawal rate?

Am I on track, or do I need to make changes?

Red flags that suggest reducing withdrawals:

- Portfolio value dropped 20%+ from peak

- Three consecutive years of negative returns

- Withdrawal rate exceeds 5% of the current portfolio value

- Unexpected major expenses depleted reserves

Green flags that suggest you could increase withdrawals:

- Portfolio value increased 50%+ from the initial retirement value

- Withdrawal rate dropped below 3% of the current portfolio

- Strong market performance for 5+ consecutive years

- Lower-than-expected spending in early retirement

Common Mistakes to Avoid with the 4% Rule

Even with a solid understanding of the 4% Rule, retirees often make critical errors that undermine their financial security. Here are the most common mistakes and how to avoid them:

1: Treating It as a Guarantee

The error: Assuming that withdrawing 4% guarantees your money will last 30 years.

The reality: The 4% Rule has a 95% historical success rate—which means a 5% failure rate. It’s a probability-based guideline, not a promise.

The solution: Build in flexibility, maintain an emergency fund, and be prepared to adjust if needed. Consider starting more conservatively at 3.5% if you have low risk tolerance.

2: Ignoring Sequence of Returns Risk

The error: Not understanding that when returns occur matters as much as average returns.

The reality: Experiencing negative returns in the first 5-10 years of retirement can devastate your portfolio, even if long-term returns are strong.

The solution:

- Keep 2-3 years of expenses in cash/bonds

- Consider reducing withdrawals by 10-20% during severe bear markets

- Use the bucket strategy to avoid selling stocks at losses

3: Withdrawing from the Wrong Accounts

The error: Not optimizing which accounts you withdraw from, leading to unnecessary tax bills.

The reality: Withdrawing from traditional IRAs before taxable accounts can push you into higher tax brackets and increase Medicare premiums.

The solution: Follow a tax-efficient withdrawal sequence (taxable → tax-deferred → tax-free) and consider Roth conversions in low-income years.

4: Not Adjusting for Your Actual Situation

The error: Blindly following the 4% Rule without considering your unique circumstances.

The reality: Your ideal withdrawal rate depends on your retirement length, risk tolerance, spending flexibility, other income sources, and current market valuations.

The solution: Customize your withdrawal rate based on:

- Retirement age and expected lifespan

- Portfolio size and allocation

- Other income sources (Social Security, pensions)

- Spending flexibility and lifestyle goals

- Current market conditions

5: Forgetting About Inflation

The error: Withdrawing the same dollar amount each year without inflation adjustments.

The reality: $40,000 today will have significantly less purchasing power in 20 years. At 3% inflation, you’ll need $72,000 in 20 years to buy what $40,000 buys today.

The solution: Adjust your withdrawal amount annually for inflation using the CPI or a personal inflation rate based on your actual spending.

6: Being Too Conservative

The error: Using a withdrawal rate so low (2-2.5%) that you sacrifice quality of life unnecessarily.

The reality: The 4% Rule was based on worst-case scenarios. Most retirees following it end up with 2-3 times their starting portfolio value.

The solution: Balance security with enjoyment. If you’re healthy in your 60s and early 70s, consider spending more on experiences. You can always adjust later.

7: Panicking During Market Downturns

The error: Abandoning your withdrawal strategy and making emotional decisions during bear markets.

The reality: Market volatility is normal. The 4% Rule accounts for major downturns in its historical analysis.

The solution:

- Maintain a cash buffer for market downturns

- Understand the cycle of market emotions to recognize when you’re reacting emotionally

- Focus on your long-term plan, not short-term volatility

- Consider temporary spending reductions rather than strategy abandonment

8: Not Considering Healthcare Costs

The error: Underestimating healthcare expenses in retirement.

The reality: The average couple retiring at 65 will spend $315,000+ on healthcare throughout retirement (Fidelity, 2024), and this doesn’t include long-term care.

The solution:

- Factor healthcare costs into your withdrawal rate calculation

- Consider supplemental insurance policies

- Maximize HSA contributions before retirement (triple tax advantage)

- Budget for Medicare premiums, supplemental insurance, and out-of-pocket costs

9: Failing to Account for RMDs

The error: Not planning for Required Minimum Distributions from traditional retirement accounts starting at age 73.

The reality: RMDs can force you to withdraw more than your 4% strategy suggests, potentially pushing you into higher tax brackets.

The solution:

- Calculate expected RMDs in advance

- Consider Roth conversions in your 60s and early 70s

- Factor RMDs into your tax planning strategy

- Adjust your withdrawal strategy once RMDs begin

10: Not Having a Backup Plan

The error: Having no contingency plan if the 4% Rule doesn’t work for you.

The reality: Market conditions, personal circumstances, and unexpected expenses can derail even the best plans.

The solution: Develop a “Plan B” that includes:

- Spending categories you can reduce if needed

- Part-time work or consulting opportunities

- Delayed Social Security claiming for higher benefits

- Downsizing or relocating options

- Reverse mortgage as a last resort

FAQ: The 4% Rule

What is a good withdrawal rate for retirement?

A good withdrawal rate depends on your specific situation, but research suggests 3.5-4% for a 30-year retirement starting at age 65. More conservative retirees or those retiring earlier should consider 3-3.5%, while those with shorter time horizons, high spending flexibility, or additional income sources might safely use 4-4.5%. Current market conditions in 2025 suggest leaning toward the lower end of these ranges.

How do you calculate the 4% Rule?

To calculate your 4% Rule withdrawal: multiply your total retirement portfolio value by 0.04 (4%). For example, with a $1,000,000 portfolio, your first-year withdrawal would be $40,000. In subsequent years, adjust this dollar amount for inflation rather than recalculating 4% of your current balance. If inflation is 3%, your year-two withdrawal would be $41,200 ($40,000 × 1.03).

Does the 4% Rule include Social Security?

No, the 4% Rule typically applies only to your investment portfolio withdrawals and doesn’t include Social Security benefits. Social Security is a separate, guaranteed income stream that reduces your reliance on portfolio withdrawals. If Social Security covers $30,000 of your annual expenses, you only need to withdraw the remaining amount from your portfolio, which could allow for a lower withdrawal rate and increased portfolio longevity.

Is the 4% Rule too conservative or too aggressive in 2025?

For 2025, the 4% Rule is considered slightly aggressive by many financial experts due to lower expected returns and higher market valuations compared to historical averages. Research from Morningstar, Vanguard, and Wade Pfau suggests 3.3-3.7% may be more appropriate for new retirees today. However, the 4% Rule remains viable if you have spending flexibility, a balanced portfolio, and willingness to adjust during market downturns.

What happens if I run out of money using the 4% Rule?

The 4% Rule has a 95% historical success rate, meaning a 5% chance of portfolio depletion over 30 years. If you’re at risk of running out of money, you have several options: reduce discretionary spending by 10-25%, return to part-time work, delay or reduce gifts and charitable giving, downsize your home, consider a reverse mortgage, or rely more heavily on Social Security. Most failures occur due to inflexibility during severe bear markets early in retirement.

Should I adjust my withdrawal rate as I age?

Yes, many financial planners recommend adjusting your withdrawal strategy as you age. You might start with 4% in your 60s, reduce to 3.5% in your 70s if markets underperform, or increase to 5% in your 80s if your portfolio has grown substantially. Additionally, research shows retirement spending naturally decreases in later years (except for healthcare), so your withdrawal needs may decline even without strategic adjustments.

How does the 4% Rule work with a Roth IRA?

The 4% Rule works the same way with Roth IRAs, but with a significant advantage: Roth withdrawals are tax-free. This means a 4% withdrawal from a Roth IRA provides more spendable income than the same withdrawal from a traditional IRA. For example, a $40,000 Roth withdrawal gives you $40,000 to spend, while a $40,000 traditional IRA withdrawal might only provide $32,000 after taxes, effectively requiring a higher withdrawal rate to meet your spending needs.

Can I use the 4% Rule if I retire early at 50 or 55?

The 4% Rule becomes riskier for early retirees because it was designed for 30-year retirements, not 40-50 year retirements. If you retire at 50, consider a more conservative 2.5-3.5% withdrawal rate to account for the longer time horizon. You’ll also need to bridge the gap until Social Security eligibility at 62-67 and Medicare at 65, requiring additional planning for healthcare costs. Early retirees should also maintain higher stock allocations (70%+) to ensure sufficient growth.

What’s the difference between the 4% Rule and the 4% Safe Withdrawal Rate?

These terms are often used interchangeably, but there’s a subtle difference. The “4% Rule” specifically refers to withdrawing 4% in year one and adjusting for inflation thereafter. The “Safe Withdrawal Rate” is a broader concept referring to whatever percentage rate is considered sustainable based on current research, which might be 3.5%, 4%, or another number depending on market conditions and individual circumstances.

How do I adjust the 4% Rule for inflation?

To adjust for inflation, multiply your previous year’s withdrawal by (1 + inflation rate). For example, if you withdrew $40,000 last year and inflation was 2.5%, this year’s withdrawal would be $40,000 × 1.025 = $41,000. You can find the official inflation rate from the Bureau of Labor Statistics’ Consumer Price Index (CPI). Some retirees use a “personal inflation rate” based on their actual spending categories, which may differ from the national CPI

Real-World Example: The 4% Rule in Action

Let’s follow a realistic retirement scenario to see how the 4% Rule works in practice, including the challenges and decisions that arise.

Meet Sarah and Tom: A Retirement Case Study

Background:

- Sarah (65) and Tom (67) retire in January 2025

- Combined retirement savings: $1,200,000

- Social Security (combined): $45,000/year (starting immediately)

- No pension

- Own their home (no mortgage)

- Annual expenses: $85,000

Year 1 (2025): The Setup

Portfolio allocation:

- 60% stocks ($720,000)

- 40% bonds ($480,000)

Income planning:

- Social Security: $45,000

- Portfolio withdrawal (4% of $1,200,000): $48,000

- Total income: $93,000

After expenses ($85,000): $8,000 cushion for unexpected costs

Tax planning:

- $30,000 from taxable account (mostly qualified dividends, 15% tax rate)

- $18,000 from traditional IRA (22% tax bracket)

- Tax bill: ~$7,500

- Net spendable income: $85,500

Year 2 (2026): The First Market Test

Market conditions: Stocks return -12%, bonds return +2%

Portfolio value:

- Stocks: $720,000 → $633,600 (-12%)

- Bonds: $480,000 → $489,600 (+2%)

- Minus withdrawal ($48,000)

- New total: $1,075,200

Withdrawal decision:

- Inflation: 2.8%

- Inflation-adjusted withdrawal: $48,000 × 1.028 = $49,344

- Current withdrawal rate: $49,344 ÷ $1,075,200 = 4.59%

Sarah and Tom’s decision: They proceed with the $49,344 withdrawal but decide to reduce discretionary spending (travel budget) by $5,000 as a precaution. They also rebalance their portfolio back to 60/40, selling bonds and buying stocks while they’re “on sale.”

Year 3 (2027): Recovery Begins

Market conditions: Stocks return +18%, bonds return +3%

Portfolio value:

- After rebalancing in 2026: 60% stocks ($645,120), 40% bonds ($430,080)

- Stocks: $645,120 → $761,242 (+18%)

- Bonds: $430,080 → $442,982 (+3%)

- Minus withdrawal ($49,344)

- New total: $1,154,880

Withdrawal decision:

- Inflation: 3.2%

- Inflation-adjusted withdrawal: $49,344 × 1.032 = $50,923

- Current withdrawal rate: $50,923 ÷ $1,154,880 = 4.41%

Sarah and Tom’s decision: They’re pleased with the recovery but maintain spending discipline. They restore their full travel budget but don’t increase lifestyle spending. They continue annual rebalancing.

Year 5 (2029): Major Healthcare Expense

Unexpected event: Tom needs knee replacement surgery

Healthcare costs:

- Medicare covers most costs

- Out-of-pocket: $8,500

- Solution: Withdraw an additional $8,500 from the taxable account (doesn’t affect the annual 4% withdrawal)

Portfolio status: $1,180,000 (after strong market years)

Lesson learned: This is why maintaining some flexibility and not spending every dollar is crucial. Their conservative spending in earlier years created a buffer for this unexpected expense.

Year 10 (2034): Mid-Retirement Assessment

Portfolio value: $1,425,000 (strong market performance)

Withdrawal: $61,500 (inflation-adjusted from original $48,000)

Current withdrawal rate: $61,500 ÷ $1,425,000 = 4.32%

Assessment:

Portfolio has grown despite withdrawals

Withdrawal rate remains sustainable

On track for 30+ year retirement

Could potentially increase discretionary spending

Decision: Sarah and Tom decide to take a special anniversary trip to Europe ($12,000) without guilt, knowing their plan is working well. They don’t permanently increase their annual withdrawal but feel comfortable with occasional splurges.

Year 15 (2039): Entering the “Go-Slow” Years

Ages: Sarah (80), Tom (82)

Portfolio value: $1,550,000

Observation: Their spending has naturally decreased. They travel less, entertain less frequently, and have fewer expensive hobbies.

Actual spending: $70,000 (down from $85,000)

Decision: They reduce their withdrawal rate to 3.5% of the original portfolio ($42,000 inflation-adjusted), relying more on Social Security and allowing their portfolio to continue growing for potential long-term care needs and legacy goals.

Key Takeaways from Sarah and Tom’s Journey

- Flexibility was crucial: Reducing discretionary spending during the Year 2 downturn helped preserve their portfolio

- Rebalancing discipline paid off: Buying stocks during the downturn positioned them for recovery

- Emergency funds matter: Having an extra cushion allowed them to handle unexpected healthcare costs

- Natural spending decreases helped: Their reduced spending in later years improved portfolio longevity

- The 4% Rule worked: Despite market volatility, their disciplined approach kept them financially secure

This realistic example demonstrates that the 4% Rule isn’t a rigid formula; it’s a framework that works best when combined with flexibility, discipline, and periodic reassessment.

Those interested in building wealth for future generations can learn about how to make your kid a millionaire using similar long-term investment principles.

Beyond the 4% Rule: Building a Comprehensive Retirement Income Strategy

While the 4% Rule provides an excellent foundation, a truly robust retirement plan incorporates multiple income streams and strategies. Here’s how to build a comprehensive approach:

1. Maximize Social Security Benefits

Social Security can provide 30-50% of your retirement income, making optimization crucial.

Key strategies:

- Delay claiming until age 70 for maximum benefits (8% increase per year after full retirement age)

- Coordinate spousal benefits for married couples

- Consider the “file and suspend” strategy if applicable

- Understand how working affects benefits before full retirement age

Example impact:

- Claiming at 62: $2,000/month

- Claiming at 67 (full retirement age): $2,800/month

- Claiming at 70: $3,472/month

- Lifetime difference: Hundreds of thousands of dollars

2. Create Multiple Income Streams

Diversifying income sources reduces portfolio withdrawal pressure.

Income stream options:

- Dividend-paying stocks: Explore dividend investing strategies

- Rental real estate: Property income can cover significant expenses

- Part-time work or consulting: Reduces withdrawal needs in early retirement

- Annuities: Guaranteed lifetime income (use cautiously)

- Royalties or passive business income: Explore smart passive income strategies

- Pension payments: If available

Benefits:

- Reduces the sequence of returns risk

- Provides inflation protection (especially real estate and dividends)

- Offers psychological security

- Decreases portfolio depletion risk

3. Implement Tax-Efficient Withdrawal Strategies

Minimizing taxes can effectively increase your withdrawal rate without touching more principal.

Advanced strategies:

Roth Conversion Ladder:

- Convert traditional IRA funds to Roth IRA during low-income years (early retirement)

- Pay taxes at lower rates now

- Access tax-free income later

- Reduces future RMDs

Tax Bracket Management:

- Keep income just below the next tax bracket threshold

- Time large expenses or income events strategically

- Consider qualified charitable distributions (QCDs) after age 70½

Capital Gains Harvesting:

- Realize long-term capital gains at 0% tax rate (income under ~$94,000 for couples in 2025)

- Reset cost basis for future tax efficiency

- Strategically balance ordinary income with capital gains

4. Plan for Healthcare Costs

Healthcare is often the biggest unknown expense in retirement.

Strategies:

Before Medicare (under 65):

- COBRA continuation (expensive but comprehensive)

- ACA marketplace plans (subsidies available based on income)

- Healthcare sharing ministries

- Spouse’s employer coverage

- Part-time work with benefits

After Medicare (65+):

- Medicare Parts A, B, D + supplemental (Medigap) or Medicare Advantage

- Budget $6,000-12,000/year per person for premiums and out-of-pocket costs

- Consider long-term care insurance in your 50s-60s

- Maximize HSA contributions before retirement (triple tax advantage)

HSA Strategy:

- Contribute maximum annually while working ($8,300 for couples 55+ in 2025)

- Invest HSA funds for growth (don’t spend on current healthcare)

- Use HSA in retirement for tax-free healthcare withdrawals

- After 65, can withdraw for non-healthcare expenses (taxed as ordinary income, no penalty)

5. Build in Flexibility and Contingency Plans

The most successful retirement plans include multiple “levers” to pull if needed.

Spending flexibility levers:

- Tier 1 cuts (easy): Reduce entertainment, dining out, gifts

- Tier 2 cuts (moderate): Postpone travel, reduce hobby spending

- Tier 3 cuts (significant): Downsize home, relocate to a lower-cost area

Income flexibility levers:

- Return to part-time work

- Monetize hobbies (consulting, teaching, crafts)

- Rent out space in your home

- Delay Social Security claiming for higher benefits

Asset flexibility levers:

- Downsize primary residence

- Sell vacation property

- Reverse mortgage (last resort)

- Life insurance policy loans or sales

6. Consider Longevity and Legacy Goals

Your withdrawal strategy should reflect your priorities.

Questions to consider:

- How important is leaving an inheritance?

- Do you have long-term care concerns?

- Are you willing to spend down principal or preserve it?

- Do you have charitable giving goals?

Strategy adjustments:

If legacy is important:

- Use more conservative withdrawal rates (3-3.5%)

- Consider life insurance to replace estate value

- Establish trusts for efficient wealth transfer

- Utilize charitable giving strategies (donor-advised funds, QCDs)

If spending down is acceptable:

- Can use higher withdrawal rates (4.5-5%)

- Focus on maximizing life enjoyment

- Consider immediate annuities for guaranteed income

- Spend more in early retirement when health allows

7. Stay Educated and Informed

Retirement planning isn’t “set it and forget it.”

Ongoing education:

- Review your plan annually

- Stay informed about tax law changes

- Understand market conditions and adjust if needed

- Work with a fee-only fiduciary financial advisor for complex situations

- Read reputable sources like TheRichGuyMath blog for ongoing education

When to seek professional help:

- Complex tax situations

- Large estates requiring planning

- Uncertainty about investment management

- Major life transitions

- Need for accountability and discipline

Conclusion: Making the 4% Rule Work for Your Retirement

The 4% Rule has stood the test of time as a retirement withdrawal guideline, but it’s not a one-size-fits-all solution. It’s a starting point—a research-backed framework that provides direction while requiring personalization for your unique situation.

The Essential Truths About the 4% Rule:

It’s historically validated with a 95% success rate over 30-year retirements

It’s simple to understand and implement for most retirees

It provides inflation-protected income that maintains purchasing power

It works best with flexibility and willingness to adjust during extreme markets

It requires customization based on your age, risk tolerance, and circumstances

Key Factors for Success:

- Start with the right withdrawal rate for your situation (3-4.5% depending on retirement length, market conditions, and flexibility)

- Maintain a balanced portfolio with 50-70% stocks for growth and 30-50% bonds for stability

- Build in spending flexibility to reduce withdrawals during severe bear markets

- Optimize tax efficiency by withdrawing from accounts in the right order

- Supplement with other income from Social Security, pensions, or part-time work

- Monitor and adjust annually based on portfolio performance and life changes

- Keep emotions in check during market volatility by understanding long-term trends

Your Action Plan for the Next 30 Days:

Week 1: Calculate your total retirement portfolio and determine your target withdrawal rate based on your age and risk tolerance.

Week 2: Review your asset allocation and rebalance if necessary to a 50-70% stock, 30-50% bond mix appropriate for your situation.

Week 3: Create a tax-efficient withdrawal strategy, determining which accounts to tap first (taxable → traditional → Roth).

Week 4: Set up systematic withdrawals, build a 2-3 year cash buffer, and establish your annual review process.

Remember:

The 4% Rule isn’t about perfection; it’s about having a disciplined, research-based approach to retirement spending that balances security with quality of life. Most retirees who follow this framework successfully either end up with substantially more wealth than they started with or maintain their lifestyle comfortably throughout retirement.

The biggest risks aren’t market crashes or inflation; they’re panic-driven decisions, inflexibility during downturns, and failing to plan for the unexpected.

By understanding the 4% Rule’s strengths and limitations, customizing it for your situation, and maintaining the discipline to stick with your plan through market cycles, you can navigate retirement with confidence.

Your retirement should be about freedom, enjoyment, and peace of mind—not constant worry about money. The 4% Rule, properly implemented and periodically adjusted, can help you achieve exactly that.

Ready to take control of your retirement planning? Start by calculating your numbers today, and remember: the best retirement plan is one you’ll actually follow.

Interactive 4% Rule Retirement Calculator

🧮 4% Rule Retirement Calculator

Calculate your safe retirement withdrawal amount and see how long your money will last

Disclaimer

This article is for educational purposes only and does not constitute financial advice. The 4% Rule is a guideline based on historical data and may not guarantee future results. Individual retirement situations vary significantly based on personal circumstances, market conditions, health status, longevity, tax situations, and spending needs.

Before making any retirement withdrawal decisions, consult with a qualified financial advisor, tax professional, and estate planning attorney who can assess your specific situation. Past performance does not guarantee future results, and all investments carry risk, including the potential loss of principal.

The information provided in this article is current as of 2025 and may become outdated as tax laws, market conditions, and retirement planning best practices evolve.

About the Author

Written by Max Fonji — With over a decade of experience in financial education and investment strategy, Max is your go-to source for clear, data-backed investing education. As the founder of TheRichGuyMath.com, Max has helped thousands of readers understand complex financial concepts through practical, actionable guidance.

Max specializes in breaking down sophisticated investment strategies into digestible information that empowers everyday investors to make informed decisions about their financial futures. His work focuses on evidence-based approaches to wealth building, retirement planning, and long-term financial security.

Connect with Max and continue your financial education journey at TheRichGuyMath.com.

SEO Metadata

Meta Title: 4% Rule for Retirement Withdrawals – Safe Spending Guide 2025

Meta Description: Learn the 4% Rule for retirement withdrawals. Calculate safe spending, understand risks, and discover if this strategy works in 2025. Complete guide with calculator.

URL Slug: 4-rule-retirement-withdrawals-safe-spending-guide