What Is Cash Central?

Cash Central is an online lending platform offering short-term payday loans and installment loans in select U.S. states. Founded in 2005 and headquartered in Utah, the company positions itself as a state-licensed, secure, and fast alternative to traditional credit.

Borrowers turn to Cash Central when they need quick access to money, often for emergencies like unexpected bills, car repairs, or rent shortfalls. Applications are completed online, and decisions can be made within minutes.

But convenience comes at a cost: annual percentage rates (APRs) are often triple-digit, and consumer reviews raise concerns about transparency.

This guide explains exactly how Cash Central works, what it costs, and whether it’s the right fit or if you should consider alternatives.

How Cash Central Works

Cash Central offers two main loan products:

1. Payday Loans

- Definition: Short-term loans due in a lump sum, typically on your next payday (14–45 days).

- Borrow Amounts: Usually $100–$1,500, depending on state rules.

- Repayment: Single lump sum (loan amount + fees + finance charges).

- Cost: Triple-digit APRs are common.

Example (Washington State):

- Loan Amount: $700

- Term: 45 days

- Finance Charge: $95

- APR: ~110.08% (CreditNinja)

2. Installment Loans

- Definition: Loans repaid in multiple monthly installments, spreading costs over time.

- Borrow Amounts: Typically $1,000–$5,000, depending on eligibility.

- Repayment: Monthly payments until the loan is paid off.

- Cost: APR varies by state but can still be high (often 99%–200%+).

Note: Cash Central does not clearly list installment loan APRs on its public site, which some reviewers consider a lack of transparency.

Cash Central Loan Comparison

| Feature | Payday Loan | Installment Loan |

|---|---|---|

| Loan Amounts | $100–$1,500 (state-dependent) | $1,000–$5,000 (state-dependent) |

| Repayment | Lump sum on next payday | Monthly installments |

| Typical Term | 14–45 days | Several months to 2 years |

| APR Example | 110.08% (WA $700, 45 days) | Varies widely; often 99%–200%+ |

| Transparency | APRs shown in some examples | Terms less clear online |

| Best For | Emergency short-term needs | Larger expenses repaid over time |

State Availability

Cash Central is not available nationwide. Licensing is determined state by state.

Some states where Cash Central operates:

- California

- Texas

- Washington

- Indiana

- Florida

- Utah

Borrowers outside of these licensed states can not use Cash Central. To check eligibility, users must enter their ZIP code during the application process.

Pros & Cons of Cash Central

Advantages

- Fast approval process (minutes online).

- Licensed in multiple states (more legitimate than offshore payday lenders).

- Convenient 24/7 application with secure online portal.

- Repeat borrowers may qualify for slightly better terms.

Disadvantages

- Very high APRs, often over 100%.

- Installment loan transparency issues (rates not clearly disclosed).

- Not available in all states.

- Mixed customer reviews (WalletHub: 2.4/5 stars).

- F rating with BBB due to unresolved complaints (BBB.org).

Customer Reviews & Reputation

WalletHub

- Average Rating: 2.4/5 stars

- Complaints: Poor communication, billing issues, and misleading terms

Better Business Bureau (BBB)

- Not accredited

- F Rating

- Complaints: Aggressive collections, lack of repayment flexibility, customer service issues

Takeaway

While Cash Central is legal and licensed, its reputation is mixed. Many borrowers caution against relying on it for repeat loans.

Payday Loan APR Formula:

APR = (Finance Charge / Loan Amount) × (365 / Loan Term in days) × 100Example:

Loan Amount = $700

Finance Charge = $95

Loan Term = 45 days

APR = (95 / 700) × (365 / 45) × 100

APR ≈ 110.08%When to Use Cash Central (and When Not To)

Best Situations to Consider:

- True emergency expenses (medical, urgent repairs).

- No access to traditional credit (poor credit history, no credit card).

- Small, short-term borrowing (if repayment is 100% certain).

When to Avoid:

- Long-term borrowing needs → interest compounds quickly.

- Repeat payday loans → lead to debt cycles.

- If alternatives are available (credit unions, personal loans, buy-now-pay-later, emergency assistance).

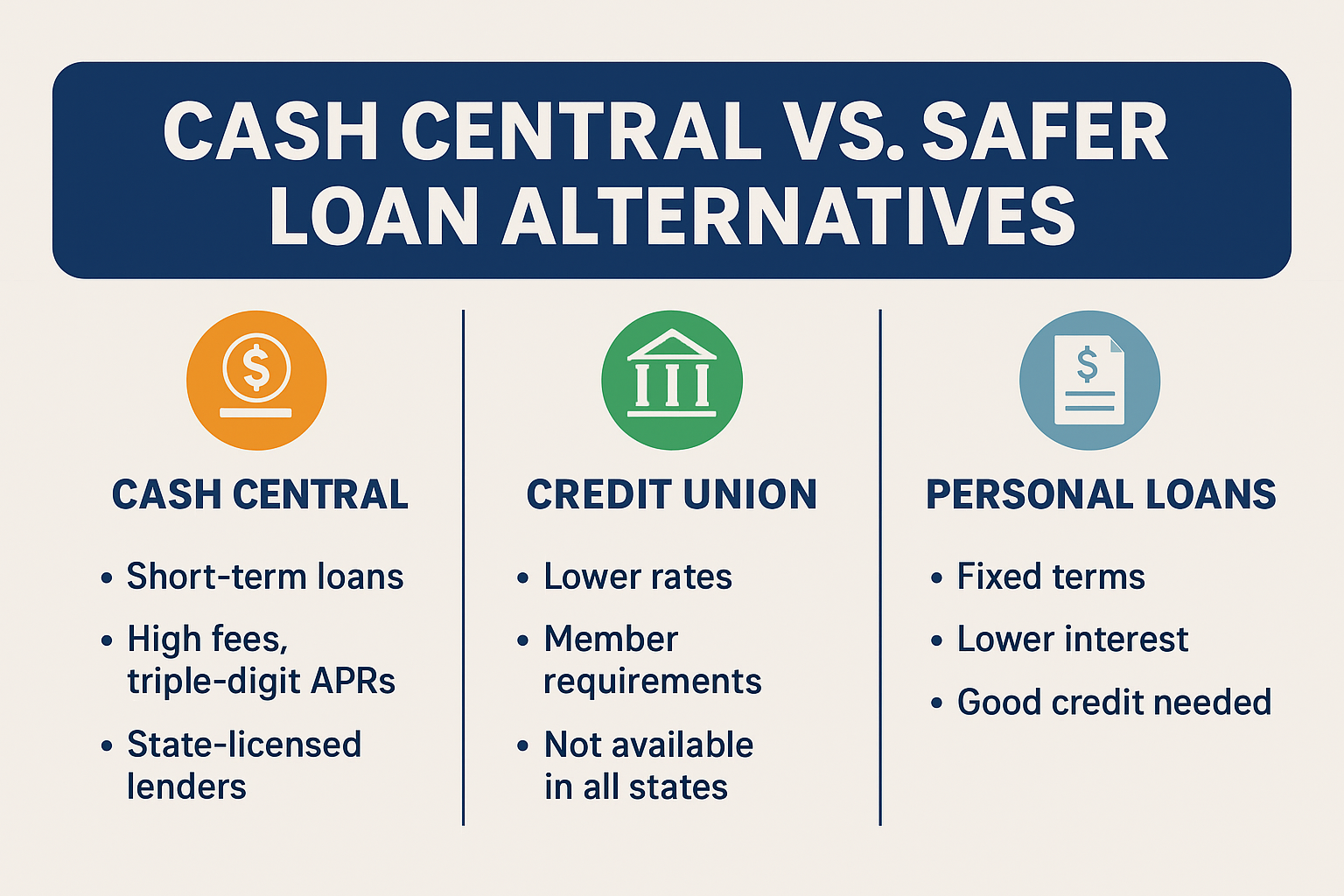

Alternatives to Cash Central

If you’re considering Cash Central, compare these safer or lower-cost options first:

- Credit Union Payday Alternative Loans (PALs) – typically 28% APR cap.

- Personal loans from online banks – lower rates if you qualify.

- Credit cards may carry lower APRs than payday loans.

- Buy-Now-Pay-Later (BNPL) services – 0% short-term financing.

- Emergency local assistance programs – utilities, rent relief.

FAQS

Yes, it is state-licensed and regulated, but reviews are mixed, and APRs are very high.

Payday loans range $100–$1,500, while installment loans may reach $5,000, depending on state and eligibility.

If approved, funds are often deposited as soon as the next business day.

Payday and short-term installment loans are high-risk for lenders, so they charge interest rates in the triple digits.

No, only in states where it is licensed (e.g., CA, TX, WA, IN, FL, UT).

Sources Link

- Consumer Financial Protection Bureau: Payday Loans

- Better Business Bureau: Cash Central

- CreditNinja – Loans like Cash Central

Bottom Line

Cash Central offers fast, licensed access to payday and installment loans; however, the high costs and mixed reviews make it a risky option. If you use it, treat it as a last resort, borrow as little as possible, and only if you can repay in full.

Before borrowing, compare safer alternatives. Use calculators to understand true APRs, and always review terms closely. For more financial guides, visit The Rich Guy Math for smarter money decisions.

Author: Max Fonji

Founder of TheRichGuyMath.com, Max is a financial strategist and personal finance writer with 8+ years of experience studying wealth-building strategies. His mission is to help everyday investors achieve financial independence through data-driven strategies, behavioral finance insights, and real-world case studies.

Disclaimer: This article is for educational purposes only and does not constitute financial, legal, or professional advice. Always consult with a qualified financial advisor or lender before making credit decisions.