Revolving credit is a type of flexible borrowing that lets you spend, repay, and borrow again up to a set limit; think credit cards or lines of credit. Unlike loans with fixed payments, you only pay interest on the balance you carry, giving you control over your cash flow. Understanding how revolving credit works can help you manage debt smarter, protect your credit score, and avoid high-interest traps.

Balances and limits determine your utilization within the credit scoring system.

Key Takeaway

- Revolving credit is a type of credit that allows you to borrow up to a set limit, repay, and borrow again without reapplying—credit cards and HELOCs are the most common examples.

- Flexible but risky: You only pay interest on what you borrow, but high interest rates (often 15-25% APR) can lead to expensive debt cycles if not managed properly.

- Credit utilization matters: Keeping your balance below 30% of your credit limit is crucial for maintaining a healthy credit score.

- Best for short-term needs: Revolving credit works great for emergency expenses and building credit, but it’s not ideal for large, long-term purchases.

- Smart management is key: Pay more than the minimum, track your spending, and avoid maxing out your credit to harness the benefits while minimizing risks.

What Is Revolving Credit?

In simple terms, revolving credit means a credit arrangement that allows you to borrow money up to a predetermined limit, repay it, and borrow again without needing to reapply for a new loan.

Unlike installment loans (like mortgages or car loans), where you receive a lump sum and make fixed monthly payments until it’s paid off, revolving credit gives you ongoing access to funds. You can use as much or as little as you need, whenever you need it, as long as you stay within your credit limit.

The key characteristics of revolving credit include:

Reusable credit line – Once you pay down your balance, that credit becomes available again

Flexible borrowing – Borrow only what you need, when you need it

Variable payments – Your minimum payment changes based on your outstanding balance

Interest on balances – You only pay interest on the amount you’ve actually borrowed

No fixed repayment term – Unlike a 5-year car loan, there’s no set end date

How Does Revolving Credit Work?

Understanding the mechanics of revolving credit helps you use it wisely. Here’s a step-by-step breakdown:

The Revolving Credit Cycle

- You’re approved for a credit limit – The lender (bank or credit card company) approves you for a maximum borrowing amount, say $5,000.

- You make purchases or withdrawals – You spend $1,000 on your credit card.

- Your available credit decreases – You now have $4,000 available credit remaining.

- You receive a statement – At the end of your billing cycle, you get a statement showing your balance, minimum payment, and due date.

- You make a payment – You pay $500 toward your balance.

- Your available credit increases – Your available credit goes back up to $4,500.

- The cycle repeats – You can continue borrowing and repaying indefinitely.

Interest Calculation

Here’s how interest works on revolving credit:

Most revolving credit accounts use a daily periodic rate to calculate interest. The formula is:

Daily Periodic Rate = Annual Percentage Rate (APR) ÷ 365

If your credit card has an 18% APR:

- Daily rate = 18% ÷ 365 = 0.0493%

- If you carry a $2,000 balance for 30 days, you’d pay approximately $29.59 in interest

This is why carrying a balance month-to-month can become expensive quickly—especially if you’re only making minimum payments.

Common Examples of Revolving Credit

Revolving credit comes in several forms, each serving different financial needs:

1. Credit Cards

The most common type of revolving credit. Credit cards allow you to make purchases up to your credit limit and pay them off over time.

Types include:

- Rewards cards (cash back, travel points)

- Balance transfer cards

- Secured credit cards (for building credit)

- Store credit cards

Average credit limit in 2025: $30,365 (according to Experian)

Average APR: 20-24% for standard cards

2. Home Equity Lines of Credit (HELOCs)

A HELOC allows homeowners to borrow against the equity in their home. You typically have a “draw period” (usually 10 years) where you can borrow and repay, followed by a “repayment period.”

Typical features:

- Credit limits: $10,000 to $500,000+

- APR: 7-10% (usually variable, tied to prime rate)

- Tax-deductible interest (if used for home improvements)

3. Personal Lines of Credit

Similar to credit cards, but typically offered by banks with lower interest rates. You can draw funds as needed through checks or transfers.

Typical features:

- Credit limits: $1,000 to $100,000

- APR: 8-18%

- Often unsecured (no collateral required)

4. Business Lines of Credit

Designed for business owners to manage cash flow, purchase inventory, or cover unexpected expenses.

Typical features:

- Credit limits: $10,000 to $1,000,000+

- APR: 7-25% depending on creditworthiness

- May require business collateral

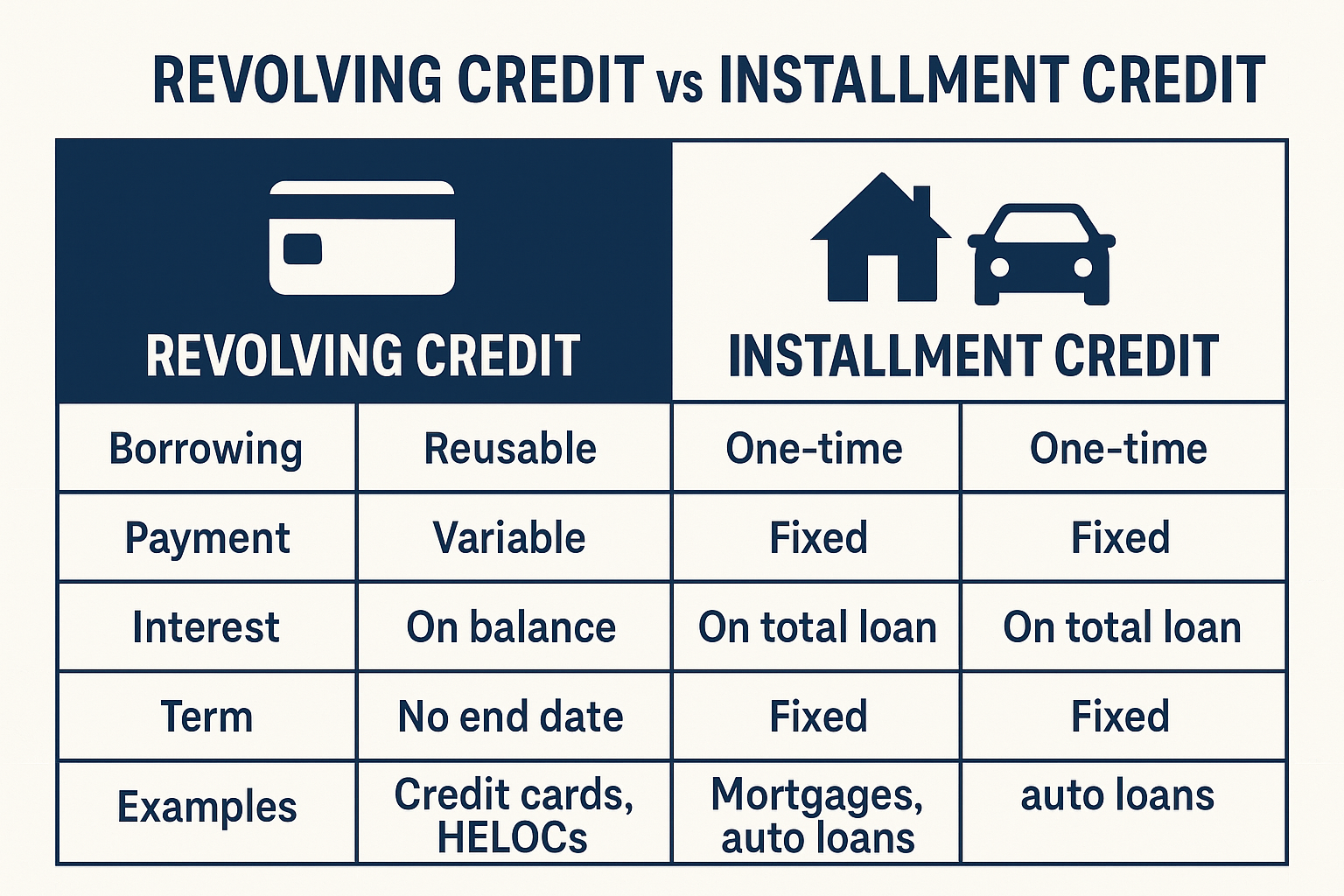

Revolving Credit vs Installment Credit: Key Differences

Understanding the difference between these two credit types (Revolving Credit vs Installment Credit) helps you choose the right financing for your needs:

| Feature | Revolving Credit | Installment Credit |

|---|---|---|

| Borrowing | Only on the amount borrowed | One-time lump sum |

| Payment | Variable based on balance | Fixed monthly payment |

| Interest | On the entire loan amount | On entire loan amount |

| Term | No fixed end date | Fixed term (e.g., 30 years) |

| Examples | Credit cards, HELOCs | Mortgages, car loans, student loans |

| Credit limit | Replenishes as you pay | Doesn’t replenish |

| Best for | Ongoing, variable expenses | Large, one-time purchases |

Quick tip: For building a diversified credit profile, having both types of credit can actually improve your credit score, as it demonstrates you can manage different types of debt responsibly. See our full guide on Revolving Credit vs Installment Credit

Benefits of Revolving Credit

When used wisely, revolving credit offers significant advantages:

1. Financial Flexibility

Revolving credit provides a financial safety net for unexpected expenses. Need to replace a broken water heater? Your credit card or HELOC can cover it immediately.

2. Build Credit History

Regular, responsible use of revolving credit is one of the best ways to build and maintain a strong credit score. Payment history accounts for 35% of your FICO score.

3. Rewards and Perks

Many credit cards offer:

- Cash back (1-5% on purchases)

- Travel rewards and airline miles

- Sign-up bonuses

- Purchase protection and extended warranties

- Fraud protection

4. Only Pay for What You Use

Unlike a personal loan, where you pay interest on the full amount from day one, with revolving credit, you only pay interest on your actual balance.

5. Emergency Access to Funds

Having available revolving credit provides peace of mind. According to a 2024 Federal Reserve report, 37% of Americans couldn’t cover a $400 emergency expense with cash—revolving credit can bridge that gap.

6. Improved Cash Flow Management

For businesses, especially, revolving credit helps manage the gap between paying suppliers and receiving customer payments.

Risks and Disadvantages of Revolving Credit

Despite the benefits, revolving credit comes with serious risks that have trapped millions in debt:

1. High Interest Rates

Credit card APRs often range from 18-29%, making them one of the most expensive forms of borrowing. Carrying a $5,000 balance at 20% APR costs you about $1,000 per year in interest alone.

2. Minimum Payment Trap

Credit card companies set minimum payments low (typically 2-3% of your balance). If you only pay the minimum on a $3,000 balance at 18% APR, it would take you:

- Over 10 years to pay off

- Cost you $2,200+ in interest

3. Easy to Overspend

The convenience of revolving credit can lead to impulse purchases and lifestyle inflation. Studies show people spend 12-18% more when using credit cards versus cash.

4. Credit Score Impact

Credit utilization ratio (the percentage of your available credit you’re using) accounts for 30% of your credit score. Using more than 30% of your limit can hurt your score significantly.

Example:

- Credit limit: $10,000

- Balance: $7,000

- Utilization: 70% (Too high—likely to lower your score)

5. Variable Interest Rates

Many revolving credit products have variable rates tied to the prime rate. When the Federal Reserve raises rates, your borrowing costs increase automatically.

6. Fees Can Add Up

Common fees include:

- Annual fees: $0-$550+

- Late payment fees: $25-$40

- Over-limit fees: $25-$35

- Balance transfer fees: 3-5%

- Cash advance fees: 3-5% plus a higher APR

7. Debt Spiral Risk

Because credit replenishes as you pay, some people fall into a cycle of constantly borrowing, never fully paying off balances, and accumulating interest charges—similar to the emotional cycles that cause people to lose money in the stock market.

How Revolving Credit Affects Your Credit Score

Your credit score is a critical financial metric, and revolving credit plays a major role in determining it. Here’s exactly how:

Credit Score Components

According to FICO, your credit score breaks down as:

- Payment History (35%) – Do you pay on time?

- Credit Utilization (30%) – How much of your available credit are you using?

- Length of Credit History (15%) – How long have your accounts been open?

- Credit Mix (10%) – Do you have different types of credit?

- New Credit (10%) – Have you recently applied for new credit?

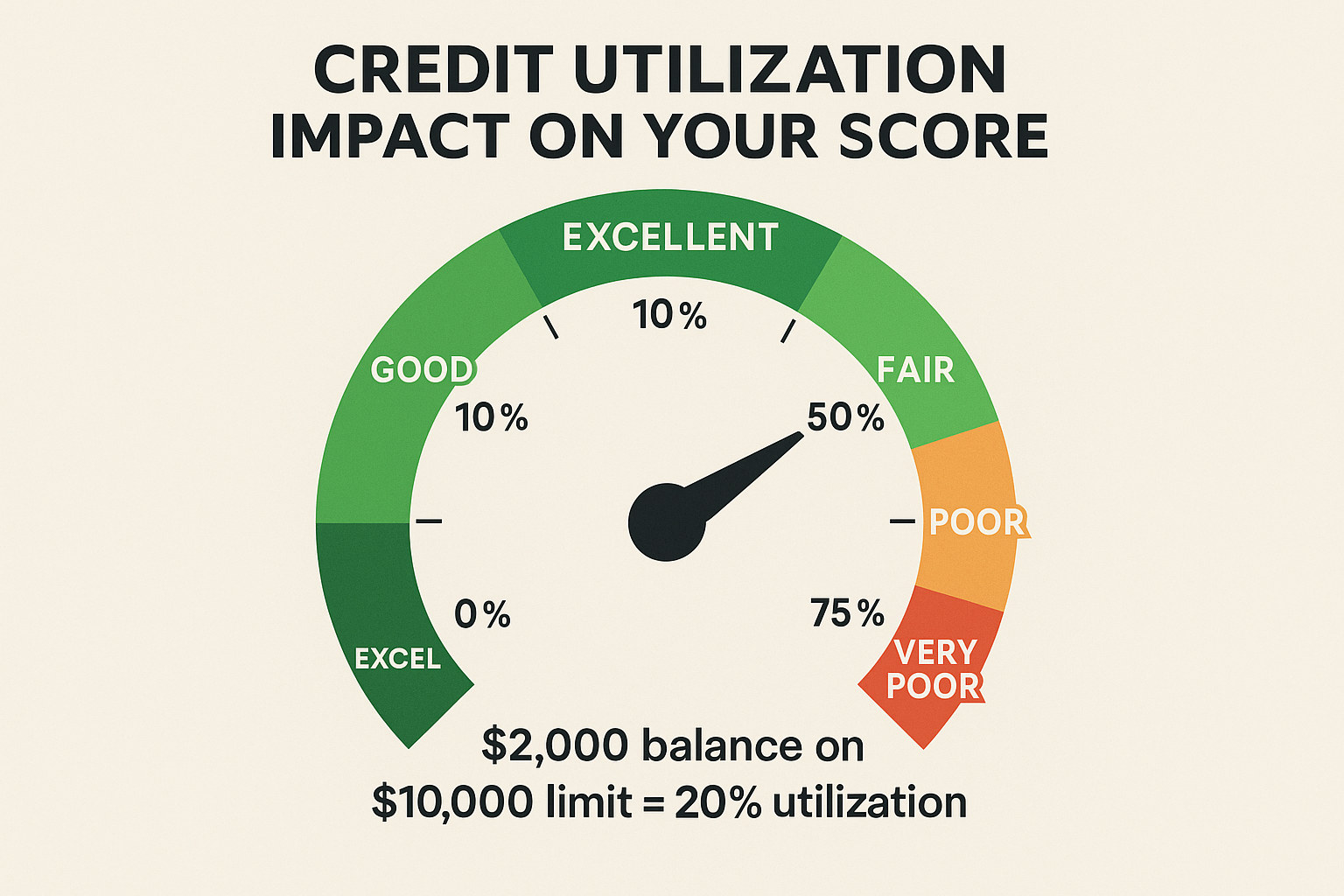

Credit Utilization: The 30% Rule

Credit utilization is the most important factor you can control in the short term.

Formula: (Total Credit Card Balances ÷ Total Credit Limits) × 100

Example:

- Card 1: $2,000 balance / $10,000 limit

- Card 2: $500 balance / $5,000 limit

- Total: $2,500 / $15,000 = 16.7% utilization (Excellent)

Credit utilization guidelines:

- Under 10%: Excellent

- 10-30%: Good

- 30-50%: Fair (score impact begins)

- 50-75%: Poor (significant score damage)

- Over 75%: Very Poor (major score damage)

Strategies to Optimize Your Credit Score

Pay balances before the statement date – Your statement balance is what gets reported to credit bureaus

Request credit limit increases – This lowers your utilization ratio (but don’t increase spending)

Keep old accounts open – Length of credit history matters

Set up autopay – Never miss a payment

Use multiple cards strategically – Spread purchases across cards to keep individual utilization low

Smart Strategies for Using Revolving Credit

The difference between revolving credit working for you versus against you comes down to strategy:

1. The Pay-in-Full Strategy

Best practice: Pay your full statement balance every month.

Benefits:

- Zero interest charges

- Build excellent credit history

- Earn rewards without cost

- Avoid debt accumulation

This is the gold standard for credit card use. If you can’t afford to pay in full, reconsider whether you should make the purchase.

2. The Emergency-Only Strategy

Keep revolving credit available, but only use it for genuine emergencies:

- Medical expenses

- Essential home repairs

- Car breakdowns

- Job loss

This approach requires discipline but provides a crucial safety net, much like maintaining an emergency fund alongside your passive income investments.

3. The Rewards Optimization Strategy

Use credit cards strategically to maximize rewards:

- Groceries: 3-6% cash back card

- Gas: 3-5% cash back card

- Travel: 2-5x points card

- Everything else: 2% cash back card

Critical rule: Only works if you pay in full monthly. Rewards never outweigh interest charges.

4. The Balance Transfer Strategy

If you’re carrying high-interest debt:

- Apply for a 0% APR balance transfer card (typically 12-21 months)

- Transfer existing balances

- Pay aggressively during the promotional period

- Avoid new purchases on the card

Watch out for: Balance transfer fees (typically 3-5%) and the interest rate after the promotional period ends.

5. The Credit Building Strategy

For those with limited or damaged credit:

- Start with a secured credit card ($200-500 deposit)

- Use it for small, regular purchases (gas, groceries)

- Pay in full every month

- After 6-12 months, upgrade to an unsecured card

- Gradually increase credit limits

6. The Utilization Management Strategy

Advanced technique: Make multiple payments per month to keep your reported balance low.

Example:

- Credit limit: $5,000

- Monthly spending: $2,000

- Make a $1,000 payment mid-cycle

- Make the final payment after the statement

- Reported balance: $1,000 (20% utilization) instead of $2,000 (40%)

Revolving Credit for Business: Special Considerations

Business revolving credit operates similarly to personal credit but with some key differences:

Types of Business Revolving Credit

- Business Credit Cards

- Limits: $5,000 to $100,000+

- Often offer business-specific rewards (office supplies, advertising)

- May require a personal guarantee

- Business Lines of Credit

- Limits: $10,000 to $5,000,000+

- Lower interest rates than credit cards

- Can be secured or unsecured

- Merchant Cash Advances

- Quick approval, but very expensive

- Repayment through daily credit card sales

- APRs can exceed 50-100%

Business Credit Benefits

Separate business and personal finances

Build business credit history

Manage seasonal cash flow fluctuations

Larger credit limits than personal cards

Employee cards for expense management

Business Credit Risks

Personal guarantee risk – Your personal assets may be on the line

Can affect personal credit – Many business cards report to personal bureaus

Higher fees – Annual fees of $95-$595 are common

Revenue requirements – May need $50,000+ in annual revenue

Common Mistakes to Avoid with Revolving Credit

Learning from others’ mistakes can save you thousands of dollars and years of financial stress:

1: Only Making Minimum Payments

The problem: On a $5,000 balance at 20% APR with 2% minimum payments, you’ll pay over $7,000 total and take 30+ years to pay off.

The solution: Always pay more than the minimum. Even an extra $25-50 per month makes a huge difference.

2: Maxing Out Credit Cards

The problem: Using 100% of your credit limit:

- Severely damages your credit score

- Leaves no emergency cushion

- Signals financial distress to lenders

The solution: Keep utilization under 30%, ideally under 10%.

3: Ignoring Interest Rates

The problem: Not knowing your APR or assuming all cards have similar rates.

The solution: Know your rates. Prioritize paying off the highest-interest debt first (avalanche method).

4: Closing Old Accounts

The problem: Closing your oldest credit card:

- Reduces your total available credit (increases utilization)

- Shortens your credit history

- Can drop your score 20-50 points

The solution: Keep old accounts open, even if you don’t use them regularly. Put a small recurring charge on them (like Netflix) and set up autopay.

5: Cash Advances

The problem: Cash advances typically come with:

- Higher APR (25-30%)

- Immediate interest accrual (no grace period)

- Cash advance fees (3-5%)

The solution: Avoid cash advances except in dire emergencies. Almost any alternative is better.

6: Not Reading the Fine Print

The problem: Surprise fees, rate changes, and terms you didn’t know about.

The solution: Read your cardholder agreement. Understand:

- When rates can increase

- What triggers penalty APRs

- All fee structures

- Grace period terms

7: Applying for Too Many Cards

The problem: Each application triggers a hard inquiry, which can lower your score 5-10 points and stay on your report for 2 years.

The solution: Be strategic. Only apply for credit you genuinely need, and space applications at least 3-6 months apart.

How to Choose the Right Revolving Credit Product

Not all revolving credit is created equal. Here’s how to select the best option for your situation:

For Building Credit

Best choice: Secured credit card or student credit card

Look for:

- Low or no annual fee

- Reports to all three credit bureaus

- Graduation path to an unsecured card

- Low minimum deposit requirement

Recommended providers:

- Discover it® Secured

- Capital One Platinum Secured

- Citi® Secured Mastercard®

For Everyday Spending

Best choice: Cash back or rewards credit card

Look for:

- No annual fee (or fee justified by rewards)

- High cash back rates in your spending categories

- Sign-up bonus

- No foreign transaction fees

Recommended providers:

- Chase Freedom Unlimited® (1.5% on everything)

- Citi® Double Cash Card (2% total)

- Blue Cash Preferred® from American Express (6% groceries)

For Large Purchases

Best choice: 0% APR promotional card

Look for:

- 12-21 months of 0% APR

- Low or no balance transfer fee

- Reasonable post-promotional APR

- No annual fee

Strategy: Pay off the purchase before the promotional period ends.

For Homeowners

Best choice: Home Equity Line of Credit (HELOC)

Look for:

- Competitive interest rate

- Low or no closing costs

- Flexible draw period

- No early payoff penalties

Best for:

- Home renovations

- Debt consolidation

- Large, planned expenses

Warning: Your home is collateral. Failure to repay can result in foreclosure.

For Business Owners

Best choice: Business line of credit or business credit card

Look for:

- Rewards for business categories

- High credit limits

- Expense management tools

- Doesn’t report to personal credit (if possible)

Real-World Case Studies

Case Study 1: The Successful Credit Builder

Profile: Sarah, 24, recent college graduate with limited credit history

Starting situation:

- Credit score: 630

- No credit cards

- Student loans: $25,000

Strategy:

- Applied for a secured credit card ($300 deposit)

- Used it for gas and groceries only ($200/month)

- Paid the full balance every month

- After 8 months, I upgraded to an unsecured card

- After 18 months, I applied for a rewards card

Results after 24 months:

- Credit score: 745

- Three credit cards with $15,000 total limit

- $0 in credit card debt

- $847 in cash back rewards earned

Key lesson: Consistent, responsible use of revolving credit is the fastest way to build excellent credit.

Case Study 2: The Debt Trap

Profile: Mike, 35, family of four, household income $75,000

Starting situation:

- Credit score: 680

- Credit card debt: $8,500 across 3 cards

- Average APR: 22%

- Making minimum payments only

What happened:

- Continued making only minimum payments

- Used cards for additional purchases

- After 3 years: Debt grew to $12,300

- Credit score dropped to 590

- Annual interest charges: $2,700+

Recovery strategy:

- Stopped all new credit card purchases

- Create a strict budget

- Applied for 0% balance transfer card

- Transferred $10,000 at 3% fee

- Paid $575/month for 18 months

- Paid off the remaining balance

Results after recovery:

- Credit score: 710

- $0 credit card debt

- Total interest saved: ~$3,000

Key lesson: Minimum payments keep you in debt. Aggressive repayment and balance transfers can break the cycle—similar to how smart financial moves can transform your overall financial picture.

Case Study 3: The Rewards Maximizer

Profile: Jennifer, 42, business consultant, income $120,000

Strategy:

- Uses 3 different rewards cards strategically

- Groceries/gas: 5% cash back card

- Travel: 3x points card

- Everything else: 2% cash back card

- Pays all cards in full monthly

Annual results:

- Total spending: $48,000

- Cash back/points earned: $1,680

- Interest paid: $0

- Annual fees: $95

- Net benefit: $1,585

Additional benefits:

- Free travel insurance

- Purchase protection

- Extended warranties

- Airport lounge access

Key lesson: Revolving credit can be profitable when used strategically and paid off monthly.

Revolving Credit and Financial Planning

Revolving credit should fit into your broader financial strategy:

The Financial Priority Hierarchy

- Emergency fund (3-6 months expenses)

- Employer 401(k) match (free money)

- High-interest debt payoff (>7% APR)

- Retirement savings (consider dividend investing)

- Other goals (house, education, etc.)

When Revolving Credit Makes Sense

Building credit history

Earning rewards on planned purchases

Emergency expenses (when the emergency fund is insufficient)

Short-term cash flow management

Taking advantage of 0% promotional offers

When to Avoid Revolving Credit

Funding lifestyle beyond your means

Making impulse purchases

When you can’t pay it off quickly

For long-term financing (use installment loans instead)

When you’re already carrying high balances

Integration with Investment Strategy

Smart financial planning means balancing debt management with wealth building. While you’re managing revolving credit responsibly, you should also be:

- Building passive income streams through dividend investing

- Understanding market dynamics, like what moves the stock market

- Avoiding emotional investing mistakes by understanding the cycle of market emotions

Key principle: If your revolving credit interest rate is 18% and the stock market historically returns 10%, paying off that debt gives you a guaranteed 18% “return” on your money—better than most investments.

Regulatory Protections and Your Rights

Understanding your legal protections helps you use revolving credit more safely:

The Credit CARD Act of 2009

This federal law provides important consumer protections:

21-day payment period – You must have at least 21 days from the statement date to the due date

Rate increase limitations – Can’t increase rates on existing balances (with exceptions)

Clear disclosure – Terms must be clearly explained

Payment allocation – Payments above minimum must go to the highest-rate balances first

Under-21 protections – Stricter requirements for young adults

Fair Credit Reporting Act (FCRA)

Your rights regarding credit reporting:

Free annual credit reports – Get free reports from AnnualCreditReport.com

Dispute errors – You can challenge incorrect information

Know who’s checking – You must be notified of credit inquiries

Old information removal – Most negative items removed after 7 years

Truth in Lending Act (TILA)

Requires lenders to disclose:

- APR (Annual Percentage Rate)

- Finance charges

- Payment schedules

- Total cost of credit

Your Rights for Fraud Protection

Under federal law, your maximum liability for unauthorized credit card charges is $50—and most issuers offer $0 liability policies.

Steps if your card is compromised:

- Report it immediately to your issuer

- Review recent transactions

- Request a new card

- Update automatic payments

- Monitor your credit report

Resources:

- Federal Trade Commission: IdentityTheft.gov

- Consumer Financial Protection Bureau: ConsumerFinance.gov

Alternatives to Revolving Credit

Sometimes, revolving credit isn’t the best solution. Consider these alternatives:

1. Personal Installment Loans

Best for: Large, one-time purchases or debt consolidation

Pros:

- Fixed interest rate

- Fixed monthly payment

- Clear payoff date

- Often lower rates than credit cards (7-15% APR)

Cons:

- Less flexible

- Can’t reborrow without a new application

- May have origination fees

2. Buy Now, Pay Later (BNPL)

Best for: Specific retail purchases

Pros:

- Often 0% interest

- Split into 4 payments

- Quick approval

- No hard credit check

Cons:

- Late fees can be steep

- Limited to participating retailers

- Can encourage overspending

- May affect your credit if you default

Popular providers: Affirm, Afterpay, Klarna, PayPal Pay in 4

3. Emergency Fund

Best for: Unexpected expenses

Pros:

- No interest charges

- No debt created

- Immediate access

- Peace of mind

Cons:

- Requires planning

- Opportunity cost of cash sitting idle

Recommendation: Build 3-6 months of expenses in a high-yield savings account before relying heavily on revolving credit.

4. Family Loans

Best for: Those with supportive family and clear boundaries

Pros:

- Low or no interest

- Flexible terms

- No credit check

Cons:

- Can strain relationships

- No legal protections

- May have tax implications

Best practice: Always put terms in writing, even with family.

5. 401(k) Loans

Best for: Major expenses when other options aren’t available (use cautiously)

Pros:

- Borrow from yourself

- No credit check

- Relatively low interest rate

- Interest goes back to your account

Cons:

- Reduces retirement savings

- Opportunity cost of market growth

- Must repay if you leave your job

- No tax deduction for interest

Warning: Should be a last resort. Missing retirement contributions and market growth can cost you hundreds of thousands in retirement.

The Future of Revolving Credit in 2025 and Beyond

The revolving credit landscape is evolving rapidly:

Emerging Trends

1. Fintech Innovation

- Digital-only banks offering revolving credit with lower fees

- AI-powered spending insights and alerts

- Real-time credit score monitoring

- Automated debt payoff optimization

2. Cryptocurrency Integration

- Crypto-backed credit lines

- Rewards paid in cryptocurrency

- Blockchain-based credit reporting

3. Personalized Interest Rates

- Dynamic pricing based on individual behavior

- Rewards for healthy financial habits

- Lower rates for autopay and full-balance payers

4. Enhanced Consumer Protections

- Stricter regulations on fees

- Improved transparency requirements

- Better fraud prevention technology

5. Alternative Credit Scoring

- Rent and utility payments count toward credit

- Bank account history considered

- Employment and education data integration

What This Means for Consumers

More options – Increased competition benefits consumers

Better technology – Easier to manage and optimize credit use

Greater responsibility – More tools mean less excuse for mismanagement

Continued education needs – Staying informed is more important than ever

Conclusion: Mastering Revolving Credit for Financial Success

Revolving credit is neither inherently good nor bad—it’s a powerful financial tool that can either build wealth or create devastating debt, depending on how you use it.

The key principles for success:

Understand the mechanics – Know how interest, payments, and credit limits work

Pay in full when possible – Avoid interest charges and maximize rewards

Monitor your utilization – Keep balances below 30%, ideally below 10%

Use strategically – Leverage rewards and benefits without overspending

Protect your credit score – Payment history and utilization are critical

Avoid common traps – Minimum payments, cash advances, and maxed-out cards

Integrate with broader goals – Balance debt management with wealth building through investments

Your Action Plan for 2025

If you’re building credit:

- Apply for a starter credit card (secured if necessary)

- Make small, regular purchases

- Pay in full every month

- Monitor your credit score monthly

- Graduate to better cards after 6-12 months

If you’re carrying balances:

- Stop new purchases immediately

- List all debts with interest rates

- Consider a balance transfer to 0% APR card

- Pay more than the minimum (aim for 5-10% of balance)

- Use the avalanche method (highest interest first)

If you’re optimizing rewards:

- Audit your spending categories

- Choose cards that match your spending

- Set up autopay for the full balance

- Track rewards and redemption options

- Review annually and adjust strategy

If you’re a business owner:

- Separate business and personal credit

- Build business credit history

- Choose cards with business-specific rewards

- Use credit for cash flow management, not long-term financing

- Monitor business credit reports regularly

Final Thoughts

In 2025’s complex financial landscape, understanding revolving credit is more important than ever. Whether you’re using it to build credit, earn rewards, manage cash flow, or handle emergencies, the principles remain the same: discipline, strategy, and education.

Remember that revolving credit is just one component of a healthy financial life. Combine smart credit management with consistent investing, understanding market dynamics, and building multiple income streams to create lasting wealth.

The difference between financial stress and financial freedom often comes down to how well you understand and manage the tools available to you. Master revolving credit, and you’ll have taken a significant step toward financial confidence and success.

💳 Revolving Credit Calculator

Calculate your payoff timeline and total interest costs

📊 Your Payoff Results

💡 Compare Payment Strategies

FAQ: Revolving Credit

A good revolving credit utilization rate is below 30%, but excellent credit scores typically require below 10%. For example, if you have $10,000 in total credit limits, keeping your balances below $1,000 is ideal for maximizing your credit score.

Revolving credit allows you to borrow, repay, and borrow again up to a credit limit with variable payments, while a personal loan provides a one-time lump sum with fixed monthly payments over a set term. Revolving credit offers more flexibility, but personal loans typically have lower interest rates and a clear payoff date.

Yes, closing a credit card typically hurts your credit score by reducing your total available credit (increasing your utilization ratio) and potentially shortening your average credit history. Unless the card has a high annual fee you can’t justify, it’s usually better to keep it open with minimal use.

Maxing out your revolving credit can severely damage your credit score (potentially dropping it 50-100 points), trigger over-limit fees, increase your interest rate to a penalty APR, and signal financial distress to other lenders. It also leaves you with no emergency cushion.

While having high total credit limits isn’t necessarily bad, having too many open accounts can be problematic if you can’t manage them responsibly, face temptation to overspend, or apply for many cards in a short period (causing multiple hard inquiries). Most financial experts recommend 3-5 credit cards for personal use.

With responsible use of revolving credit, you can build a good credit score (680-700) in 6-12 months, starting from no credit history. Reaching excellent credit (750+) typically takes 18-24 months of consistent on-time payments, low utilization, and avoiding negative marks.

Generally, you should maintain a small emergency fund ($1,000-2,000) first, then aggressively pay off high-interest revolving credit (above 7-10% APR), then build a full emergency fund (3-6 months expenses), then focus on other savings and investment goals. Paying off 20% APR credit card debt gives you a guaranteed 20% return—better than almost any investment.

Your credit limit is the maximum amount you’re approved to borrow, while available credit is your credit limit minus your current balance. For example, with a $5,000 credit limit and a $2,000 balance, you have $3,000 in available credit.

Disclaimer

This article is for educational purposes only and does not constitute financial advice. Revolving credit products vary significantly in terms, rates and features. Always read the terms and conditions carefully, consider your individual financial situation, and consult with a qualified financial advisor before making significant credit decisions. Past performance and historical data do not guarantee future results. The author and TheRichGuyMath.com are not responsible for any financial decisions made based on this information.

About the Author

Written by Max Fonji — With over a decade of experience in personal finance education and investment strategy, Max is your go-to source for clear, data-backed investing education. Max has helped thousands of readers understand complex financial concepts and make smarter money decisions through TheRichGuyMath.com. His mission is to demystify finance and empower everyday people to build wealth through knowledge and disciplined action.