Imagine walking into a car dealership with $500 in your pocket, yet driving home in a $25,000 vehicle that same day. Or picture furnishing your first apartment without draining your entire savings account. This isn’t magic; it’s the power of installment credit, a financial tool that millions of Americans use every single day to bridge the gap between what they want now and what they can afford over time.

But here’s the catch: while installment credit can be a lifeline that helps you build wealth and achieve important goals, it can also become a financial trap if you don’t understand how it works. The difference between smart borrowing and drowning in debt often comes down to knowing the fundamentals.

In this comprehensive guide, we’ll break down everything you need to know about installment credit, from the basics of how it works to the hidden costs you need to watch out for. Whether you’re considering your first auto loan or trying to decide if a personal loan makes sense for your situation, you’ll walk away with the knowledge to make confident, informed decisions.

TL;DR

- Installment credit is a type of loan where you borrow a fixed amount and repay it in regular, scheduled payments over a set period, typically with interest.

- Common types include auto loans, mortgages, student loans, and personal loans—each with different terms, rates, and purposes..

- The total cost includes the principal (amount borrowed) plus interest charges, which can add thousands of dollars to your purchase, depending on the rate and term length

- Benefits include predictable monthly payments, building credit history, and accessing large purchases you couldn’t afford upfront

- Alternatives like saving in advance, 0% APR credit cards, or buy-now-pay-later services may cost less in certain situations

What Is Installment Credit? (The Simple Definition)

In simple terms, installment credit means borrowing a specific amount of money and paying it back in fixed, regular payments over time.

Unlike a credit card, where you have a revolving line of credit that you can use, pay down, and use again, installment credit works differently. You receive the full loan amount upfront (or the lender pays the seller directly), and then you make equal monthly payments until the debt is completely paid off.

Each payment typically includes two components:

- Principal: A portion that reduces the actual amount you borrowed

- Interest: The cost of borrowing money, paid to the lender

Think of it like a subscription service for your debt; you know exactly how much you’ll pay each month, for how many months, until you’re done. This predictability is one of installment credit’s biggest advantages.

Why Installment Credit Matters

Installment credit plays a crucial role in personal finance for several reasons:

- It enables major purchases that would otherwise require years of saving

- It builds your credit history when you make payments on time

- It affects your credit score through factors like payment history and credit mix

- It represents a significant financial commitment that impacts your monthly budget

- It can either accelerate or derail your financial goals, depending on how you use it

According to the Federal Reserve, American households carry an average of over $155,000 in debt, with the majority being installment loans like mortgages and auto loans. Understanding how these loans work isn’t optional; it’s essential financial literacy.

How Installment Credit Works: The Complete Breakdown

Let’s walk through the lifecycle of an installment loan from application to final payment.

The Application Process

When you apply for installment credit, lenders evaluate several factors:

- Credit score and history: Your track record of managing debt

- Income and employment: Your ability to make payments

- Debt-to-income ratio: How much of your income already goes to debt payments

- Down payment: Money you put toward the purchase upfront (for some loans)

- Collateral: Assets that secure the loan (for secured loans)

Based on this evaluation, the lender decides whether to approve your application and what interest rate to offer.

Loan Terms and Structure

Once approved, your installment loan will have specific terms:

| Loan Component | What It Means | Example |

|---|---|---|

| Principal | Total amount borrowed | $20,000 |

| Interest Rate (APR) | Annual cost of borrowing | 6.5% |

| Loan Term | Length of repayment period | 60 months (5 years) |

| Monthly Payment | Fixed amount due each month | $391.32 |

| Total Interest | Total interest paid over the life of the loan | $3,479.20 |

| Total Repayment | Principal + Total Interest | $23,479.20 |

The Amortization Schedule

Your payments follow an amortization schedule, a predetermined plan that shows how each payment is split between principal and interest.

Here’s an important pattern: early payments consist mostly of interest, while later payments consist mostly of principal.

For example, on a $20,000 auto loan at 6.5% for 60 months:

- Payment #1: $283.33 interest + $107.99 principal = $391.32

- Payment #30: $173.85 interest + $217.47 principal = $391.32

- Payment #60: $2.12 interest + $389.20 principal = $391.32

This is why paying extra toward the principal early in the loan saves you the most money in interest charges.

Payment Methods and Schedules

Most installment loans require monthly payments, but the timing and method can vary:

- Monthly due date: Usually the same day each month

- Payment methods: Automatic bank withdrawal, online payment, check, or in-person

- Grace periods: Typically 10-15 days before a late fee applies

- Late payment consequences: Fees, credit score damage, and potential default

Types of Installment Credit: A Complete Guide

Not all installment loans are created equal. Let’s explore the most common types and how they differ.

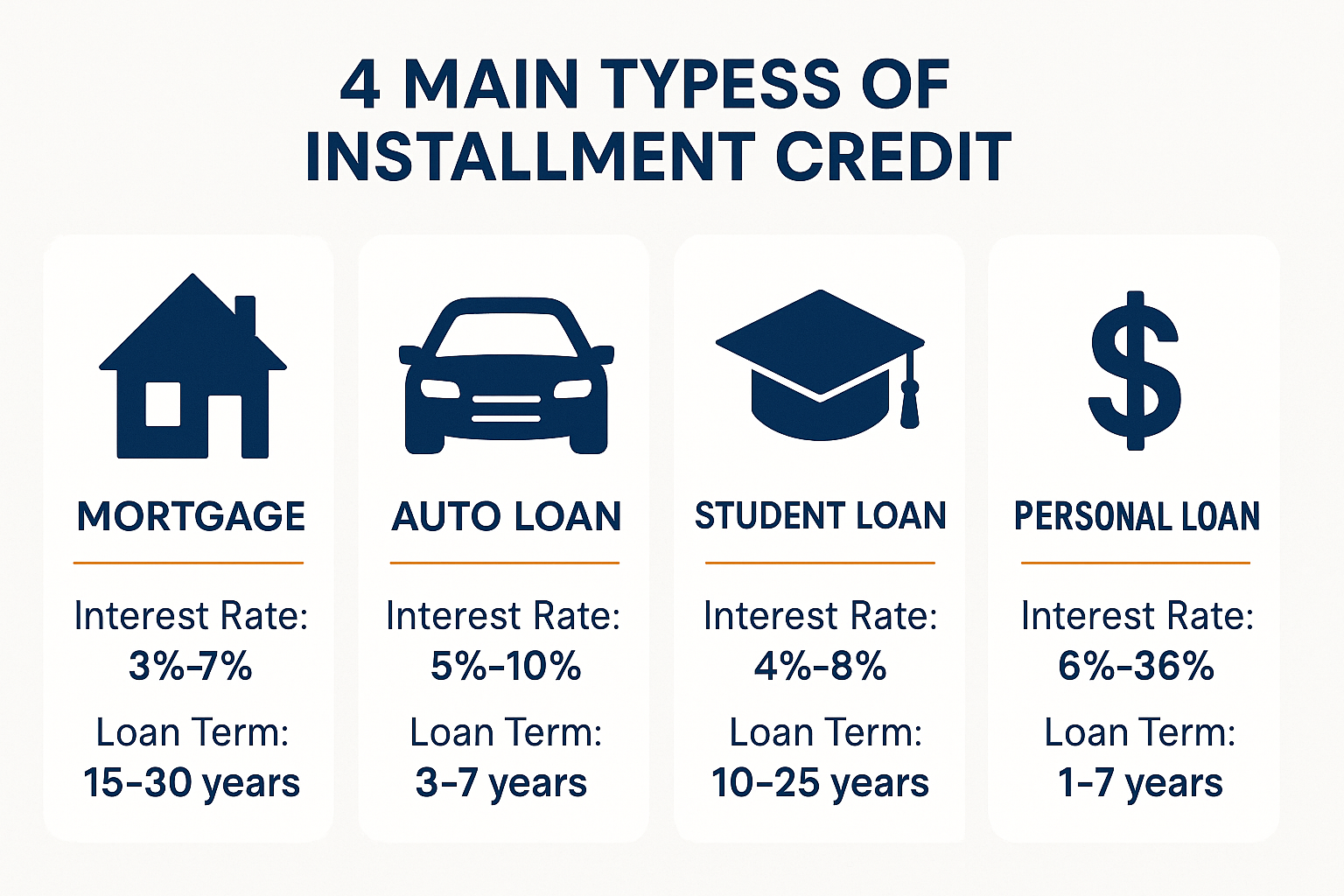

1. Mortgages

Purpose: Financing the purchase of real estate

Typical characteristics:

- Loan amounts: $100,000 to $500,000+ (varies by location)

- Interest rates: 3% to 8% (as of 2025)

- Terms: 15, 20, or 30 years are most common

- Security: The property itself serves as collateral

- Down payment: Typically 3% to 20% of purchase price

Special features:

- Tax-deductible interest (for many borrowers)

- Builds equity as you pay down principal

- Fixed-rate or adjustable-rate options

- Escrow accounts for property taxes and insurance

Mortgages represent the largest installment debt most people will ever take on. According to data from the Federal Reserve, the median home price in the U.S. exceeded $400,000 in 2024, making mortgages essential for homeownership.

2. Auto Loans

Purpose: Financing vehicle purchases (new or used)

Typical characteristics:

- Loan amounts: $15,000 to $50,000

- Interest rates: 4% to 15% depending on credit

- Terms: 36, 48, 60, or 72 months

- Security: The vehicle serves as collateral

- Down payment: 10% to 20% recommended

Special considerations:

- New cars typically get lower rates than used cars

- Longer terms mean lower payments but more total interest

- Vehicle depreciates while you still owe money

- Gap insurance may be needed if you owe more than the car’s value

3. Student Loans

Purpose: Financing education expenses

Two main categories:

Federal student loans:

- Fixed interest rates set by Congress

- Income-driven repayment options

- Loan forgiveness programs are available

- No credit check required (for most)

- Deferment and forbearance options

Private student loans:

- Variable or fixed rates based on creditworthiness

- Fewer repayment options

- May require a cosigner

- Less flexible if you experience financial hardship

Typical characteristics:

- Loan amounts: $5,000 to $200,000+ (for advanced degrees)

- Interest rates: 4% to 14%

- Terms: 10 to 25 years

- Grace period: Usually 6 months after graduation

According to the Federal Reserve, Americans collectively owe over $1.7 trillion in student loan debt, making it the second-largest category of consumer debt after mortgages.

4. Personal Loans

Purpose: General-purpose borrowing for various needs

Common uses:

- Debt consolidation

- Home improvements

- Medical expenses

- Major purchases

- Emergency expenses

Typical characteristics:

- Loan amounts: $1,000 to $50,000

- Interest rates: 6% to 36%

- Terms: 1 to 7 years

- Usually unsecured (no collateral required)

- Fixed monthly payments

Advantages:

- Flexible use of funds

- Often lower rates than credit cards

- Fixed repayment schedule

- May help consolidate high-interest debt

Disadvantages:

- Higher rates than secured loans

- Origination fees (1% to 8% of loan amount)

- Prepayment penalties with some lenders

5. Buy Now, Pay Later (BNPL) Installment Plans

Purpose: Short-term financing for retail purchases

Typical characteristics:

- Loan amounts: $50 to $2,000

- Interest rates: Often 0% if paid on time

- Terms: 4 to 12 weeks (split into equal payments)

- Approval: Instant, often with minimal credit check

- Popular providers: Affirm, Klarna, Afterpay, PayPal Credit

How they differ:

- Much shorter terms than traditional installment loans

- Often interest-free if paid on schedule

- Late fees instead of interest charges

- May not report to credit bureaus (varies by provider)

6. Other Types of Installment Credit

Medical financing: Specialized loans for healthcare expenses, often with promotional 0% periods

Equipment loans: For businesses purchasing machinery or equipment

Recreational vehicle loans: Similar to auto loans but for RVs, boats, or motorcycles

Home improvement loans: Secured or unsecured loans specifically for renovations

The True Cost of Installment Credit: What You’ll Actually Pay

Understanding the total cost of borrowing is critical to making smart decisions. Let’s break down all the ways installment credit costs you money.

1. Interest Charges

The interest rate determines how much you pay to borrow money.

Interest rates vary based on:

- Your credit score: Higher scores get lower rates

- Loan type: Secured loans typically have lower rates

- Loan term: Shorter terms often have lower rates

- Market conditions: Federal Reserve rates influence all lending

- Lender competition: Shop around for the best rate

APR vs. Interest Rate: The Annual Percentage Rate (APR) includes both the interest rate and certain fees, giving you a more complete picture of borrowing costs.

2. Fees and Additional Costs

Beyond interest, watch for these charges:

| Fee Type | Typical Amount | When It Applies |

|---|---|---|

| Origination fee | 2% to 5% of the balance | Personal loans, mortgages |

| Application fee | $25 to $500 | Mortgages, some personal loans |

| Late payment fee | $25 to $50 | When payment is late |

| Prepayment penalty | 2% to 5% of balance | If you pay off early (some loans) |

| Annual fee | $0 to $100 | Some credit-builder loans |

| Returned payment fee | $25 to $35 | If payment bounces |

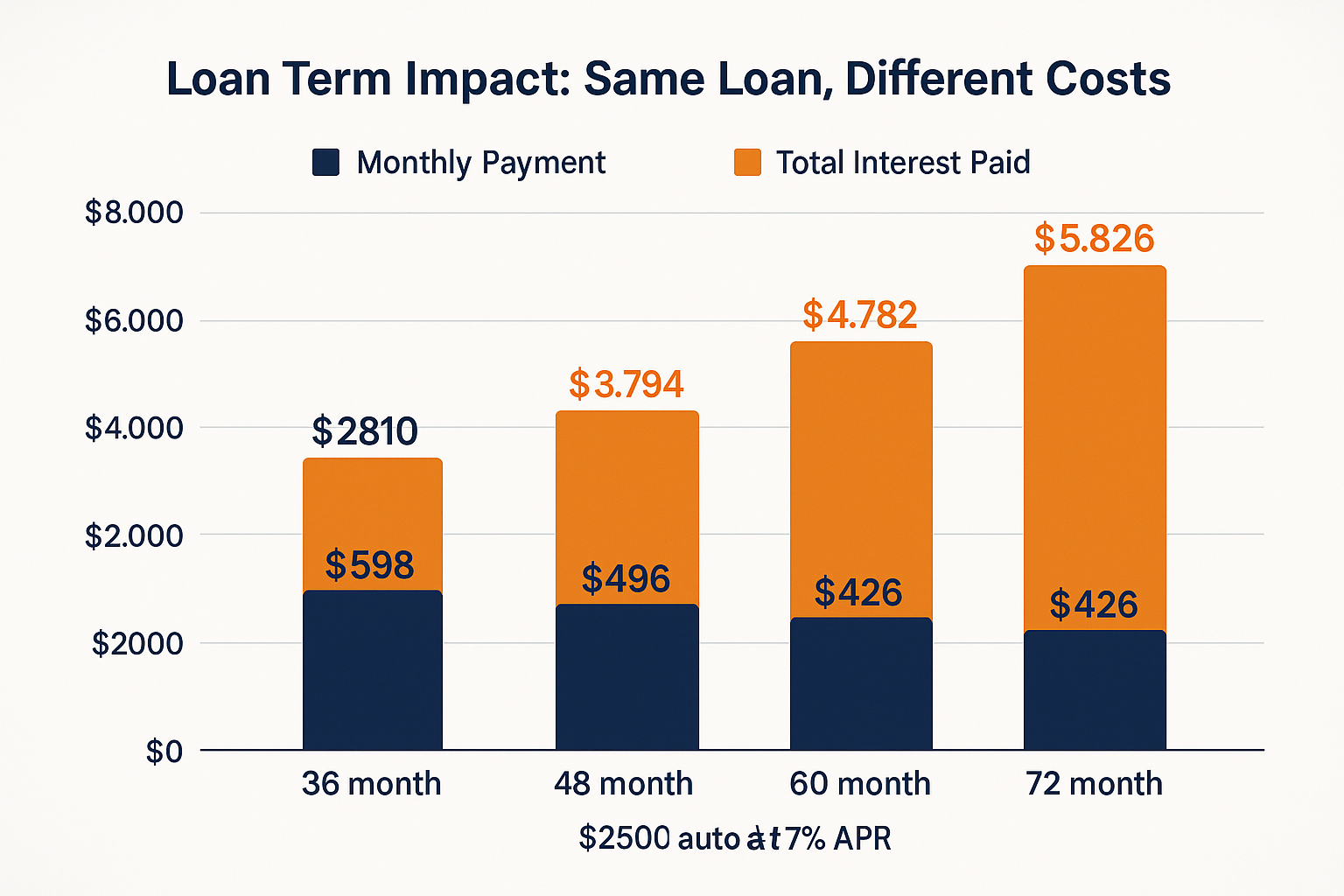

3. The Impact of Loan Term Length

Here’s a crucial insight: longer terms mean lower monthly payments but significantly more total interest.

Let’s compare a $25,000 auto loan at 7% APR:

| Term | Monthly Payment | Total Interest | Total Paid |

|---|---|---|---|

| 36 months | $772.50 | $2,810 | $27,810 |

| 48 months | $598.49 | $3,727 | $28,727 |

| 60 months | $495.03 | $4,702 | $29,702 |

| 72 months | $425.78 | $5,656 | $30,656 |

Notice: Stretching from 36 to 72 months cuts your payment nearly in half but costs you an extra $2,846 in interest, more than doubling your interest expense!

4. Opportunity Cost

There’s also an invisible cost: the opportunity cost of tying up your money in debt payments instead of investing it.

If you’re paying $500/month on an auto loan instead of investing that money in the stock market, you’re missing out on potential returns. Over 5 years, that $500/month invested at an 8% average annual return could grow to nearly $37,000.

This doesn’t mean you should never borrow—but it highlights why minimizing debt and maximizing investments is a core principle of building wealth. Learning about smart financial moves can help you balance these competing priorities.

Benefits of Installment Credit: When It Makes Sense

Despite the costs, installment credit offers several legitimate advantages when used strategically.

1. Access to Large Purchases You Couldn’t Otherwise Afford

Some purchases are nearly impossible to make with cash:

- Homes: Few people can save $300,000+ in cash

- Education: Investing in your earning potential may require borrowing

- Reliable transportation: Needed for work and daily life

Without installment credit, many people would be unable to access these essential assets and opportunities.

2. Predictable Monthly Budgeting

Unlike variable-rate credit cards, installment loans offer fixed monthly payments that make budgeting easier:

- You know exactly what you’ll pay each month

- You know exactly when the debt will be paid off

- You can plan other financial goals around these fixed obligations

This predictability helps with smart financial planning and reduces financial stress.

3. Building and Improving Credit History

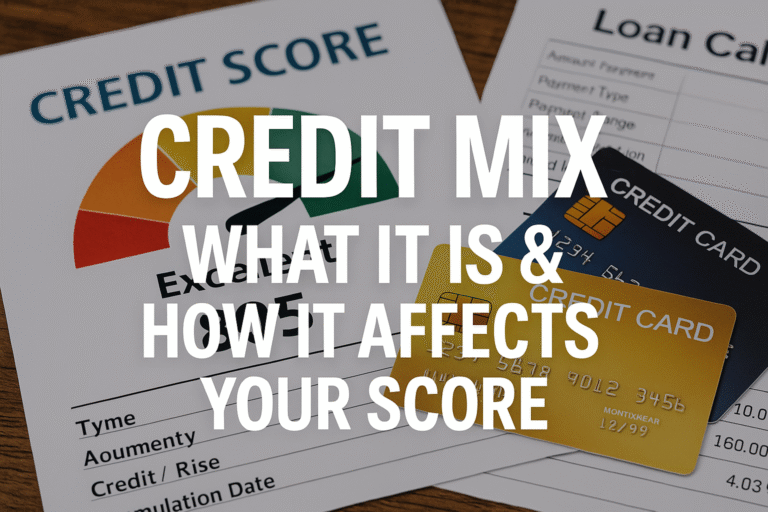

Installment credit is one of the best ways to build a strong credit profile.

Your credit score benefits from:

- Payment history (35% of FICO score): On-time installment payments build positive history

- Credit mix (10% of FICO score): Having both installment and revolving credit improves your score

- Length of credit history (15% of FICO score): Long-term installment loans add to your average account age

A strong credit score saves you money on all future borrowing, insurance, and can even help with employment opportunities.

4. Potential Tax Benefits

Some types of installment credit offer tax advantages:

- Mortgage interest: Deductible on loans up to $750,000 (for most taxpayers)

- Student loan interest: Deductible up to $2,500 annually (income limits apply)

- Business loans: Interest may be deductible as a business expense

Always consult a tax professional for advice specific to your situation.

5. Lower Interest Rates Than Credit Cards

For large purchases, installment loans typically offer much lower interest rates than credit cards:

- Credit cards: 15% to 25+ APR

- Personal loans: 6% to 20% APR

- Auto loans: 4% to 15% APR

- Mortgages: 3% to 8% APR

Using installment credit instead of credit cards for major expenses can save thousands in interest charges.

6. Debt Consolidation Opportunities

A personal installment loan can consolidate multiple high-interest debts into one lower-rate payment:

Example:

- Credit Card 1: $5,000 at 22% APR

- Credit Card 2: $3,000 at 19% APR

- Medical bill: $2,000 at 0% but in collections

Consolidated: $10,000 personal loan at 10% APR

This strategy can:

- Lower your total monthly payment

- Reduce total interest paid

- Simplify your finances to one payment

- Help you pay off debt faster

Drawbacks and Risks of Installment Credit

While installment credit has benefits, it also carries significant risks you need to understand.

1. Long-Term Financial Commitment

Once you sign the loan agreement, you’re legally obligated to make payments for years:

- A 30-year mortgage means 360 monthly payments

- Missing payments can lead to repossession or foreclosure

- Life changes (job loss, illness) don’t eliminate the obligation

- You’re locked in, even if your financial situation changes

2. Interest Costs Add Up Significantly

As we showed earlier, interest can add thousands—or tens of thousands—to the cost of your purchase:

- A $300,000 mortgage at 6.5% for 30 years costs $382,633 in interest

- That’s more than the original loan amount!

- You’re paying nearly double the purchase price over the loan term

3. Risk of Repossession or Foreclosure

Secured loans put your assets at risk:

- Auto loans: The lender can repossess your vehicle after just a few missed payments

- Mortgages: Foreclosure can result in losing your home and damaging your credit for years

- Deficiency balances: You may still owe money even after the asset is taken

According to the Consumer Financial Protection Bureau, even one missed payment can trigger the repossession process with many auto lenders.

4. Negative Equity (“Being Underwater”)

With depreciating assets like cars, you can end up owing more than the asset is worth:

- New cars lose 20% of their value in the first year

- If you financed 100% or took a long-term loan, you’ll be underwater

- If the car is totaled, insurance may not cover the full loan amount

- You can’t sell the asset without paying the difference

5. Credit Score Damage from Missed Payments

Payment history is the single most important factor in your credit score.

The consequences of late or missed payments include:

- Immediate credit score drop (30+ points)

- Late payment stays on the credit report for 7 years

- Higher interest rates on future loans

- Difficulty getting approved for new credit

- Potential employment consequences (some employers check credit)

6. Prepayment Penalties

Some lenders charge fees if you pay off the loan early:

- Typically, 2% to 5% of the remaining balance

- Lenders lose expected interest income when you prepay

- More common with mortgages and some personal loans

- Always check the loan terms before signing

7. Temptation to Overborrow

Easy access to credit can lead to poor financial decisions:

- Buying more house or a car than you need

- Financing wants instead of needs

- Ignoring the total cost and focusing only on the monthly payment

- Taking on debt that prevents you from building passive income

How to Use Installment Credit Wisely: Best Practices

Smart borrowing requires discipline and knowledge. Follow these guidelines to use installment credit responsibly.

1. Only Borrow What You Truly Need

Ask yourself critical questions before borrowing:

- Is this purchase necessary or just desired?

- Can I afford a less expensive option?

- What’s the minimum I need to borrow?

- How will this debt affect my other financial goals?

Remember: The best loan is the one you don’t need to take.

2. Shop Around for the Best Rates

Interest rates can vary significantly between lenders:

- Get quotes from at least 3-5 lenders

- Compare APR, not just interest rate

- Check credit unions (often offer lower rates)

- Use online comparison tools

- Negotiate—rates aren’t always fixed

A difference of just 1% on a $20,000 loan can save you hundreds of dollars.

3. Choose the Shortest Term You Can Afford

While longer terms offer lower payments, they cost much more:

- Prioritize: Short-term with a payment you can comfortably afford

- Rule of thumb: Total debt payments shouldn’t exceed 36% of gross income

- Buffer: Make sure you can still handle payments if income drops 10-20%

4. Make Extra Payments Toward Principal

Paying extra reduces interest and shortens the loan:

- Even $50/month extra makes a significant difference

- Specify that extra payments go toward the principal

- Pay biweekly instead of monthly (results in one extra payment per year)

- Make lump-sum payments when you receive bonuses or tax refunds

Example: Adding $100/month to a $20,000 auto loan at 6.5% for 60 months saves $1,089 in interest and pays off the loan 13 months early.

5. Maintain an Emergency Fund

Never take on installment debt without an emergency fund:

- Aim for 3-6 months of expenses in savings

- This protects you if you lose income

- Prevents missed payments during emergencies

- Reduces stress and financial anxiety

Having an emergency fund is one of the smart financial moves that protects your long-term financial health.

6. Read the Fine Print

Before signing any loan agreement:

- Understand all fees: Origination, late payment, and prepayment penalties

- Know the interest rate: Fixed or variable? What can cause it to change?

- Clarify the terms: Payment due date, grace period, and consequences of late payment

- Check for insurance requirements: Gap insurance, life insurance, disability insurance

- Ask questions: If you don’t understand something, ask before signing

7. Monitor Your Credit Report

Your installment loans should help, not hurt, your credit:

- Check your credit report annually (free at AnnualCreditReport.com)

- Verify that payments are being reported correctly

- Dispute any errors immediately

- Track your credit score to see improvement

8. Avoid These Common Mistakes

DON’T:

- Focus only on the monthly payment (ignore the total cost)

- Take the maximum loan amount offered

- Skip reading the loan agreement

- Missed payments (even one damage your credit.

- Cosign loans for others (you’re equally responsible)

- Use installment credit for depreciating wants

- Ignore the opportunity cost of debt payments

Alternatives to Installment Credit: Other Options to Consider

Before taking on installment debt, consider these alternatives that might cost less or better fit your situation.

1. Save and Pay Cash

The cheapest option is always paying with money you already have.

Advantages:

- Zero interest charges

- No monthly obligation

- No credit check required

- No risk of repossession

- Full ownership immediately

Strategy: Delay the purchase and save systematically:

- Set up automatic transfers to a dedicated savings account

- Calculate how long it will take to save the full amount

- Consider a less expensive option you can afford sooner

When it makes sense: For wants rather than needs, and when the purchase can wait.

2. 0% APR Credit Cards

Many credit cards offer promotional 0% APR periods:

Typical terms:

- 0% APR for 12 to 21 months

- Applies to purchases, balance transfers, or both

- Reverts to regular APR (15-25%) after promotional period

Advantages:

- No interest if paid off during the promotional period

- Flexible payments (minimum payment required)

- Rewards or cash back on purchases

- No collateral required

Disadvantages:

- High interest rate if not paid off in time

- Requires good to excellent credit

- Balance transfer fees (typically 3-5%)

- Temptation to overspend

Best for: Purchases you can pay off within the promotional period.

3. Home Equity Line of Credit (HELOC)

If you own a home with equity, a HELOC provides access to low-interest credit:

How it works:

- Borrow against your home’s equity

- Revolving credit line (like a credit card)

- Variable interest rates

- Interest may be tax-deductible

Advantages:

- Lower interest rates than unsecured loans

- Flexible borrowing and repayment

- Only pay interest on what you borrow

Disadvantages:

- Your home is collateral (risk of foreclosure)

- Variable rates can increase

- Closing costs and fees

- Reduces your home equity

Best for: Home improvements or consolidating high-interest debt (use cautiously).

4. Borrowing from Family or Friends

Personal loans from people you know can offer favorable terms:

Potential advantages:

- Lower or zero interest

- Flexible repayment terms

- No credit check

- Understanding during hardship

Critical precautions:

- Put everything in writing: Terms, interest rate, payment schedule

- Treat it like a real loan: Make payments on time

- Consider the relationship: Can it withstand potential conflict?

- Have a backup plan: What if you can’t pay?

Best for: Small amounts when other options aren’t available, and only with clear written agreements.

5. Employer Loans or Advances

Some employers offer loans or paycheck advances:

Typical features:

- Low or no interest

- Automatic payroll deduction

- Small amounts ($500 to $5,000)

- Quick approval

Considerations:

- Limited to employment relationship

- May affect job flexibility

- Not all employers offer this benefit

6. Peer-to-Peer (P2P) Lending

Online platforms connect borrowers with individual investors:

Popular platforms: LendingClub, Prosper, Upstart

Advantages:

- May offer better rates than traditional banks

- Faster approval process

- More flexible credit requirements

Disadvantages:

- Still charges interest

- Origination fees apply

- Not available in all states

7. Buy Now, Pay Later (BNPL) Services

Short-term installment plans for retail purchases:

How they work:

- Split purchase into 4-12 payments

- Often 0% interest if paid on time

- Automatic deductions from debit/credit card

Advantages:

- Interest-free if paid on schedule

- Easy approval

- No hard credit check

- Short commitment

Disadvantages:

- Late fees can be substantial

- Easy to overextend across multiple BNPL accounts

- May not build credit history

- Can encourage impulse purchases

Best for: Necessary purchases you can pay off within weeks, not months.

8. Negotiate Payment Plans

Many service providers offer payment plans without formal loans:

- Medical providers often offer interest-free payment plans

- Utility companies: Hardship programs during financial difficulty

- Educational institutions: Tuition payment plans

- Tax authorities: IRS payment plans for tax debt

Advantages:

- Often interest-free or low-interest

- No credit check

- Flexible terms

- Avoids collections

Strategy: Always ask before assuming you need a traditional loan.

Installment Credit vs Revolving Credit: Key Differences

Understanding the distinction between installment vs revolving credit helps you choose the right tool for each situation.

| Feature | Installment Credit | Revolving Credit |

|---|---|---|

| Structure | Fixed loan amount, fixed term | Credit line you can use repeatedly |

| Examples | Auto loan, mortgage, personal loan | Credit cards, HELOC, lines of credit |

| Payment | Fixed monthly payment | Variable (based on balance) |

| Borrowing | One-time lump sum | Borrow, repay, borrow again |

| Interest | Charged on full loan amount | Affects the credit utilization ratio |

| Term | Predetermined end date | No end date (ongoing) |

| Credit impact | Improves credit mix | Charged on the full loan amount |

| Best for | Large, one-time purchases | Ongoing or variable expenses |

See our full guide on Revolving Credit

When to Use Each Type

Choose installment credit when:

- You need a specific amount for a one-time purchase

- You want predictable monthly payments

- You’re buying something that requires a large sum

- You want to consolidate debt into a fixed payment

Choose revolving credit when:

- You have variable or ongoing expenses

- You want flexibility in borrowing and repayment

- You can pay off the balance quickly

- You want to earn rewards on purchases

Ideal strategy: Use both types strategically to build a diverse credit profile while minimizing interest costs.

How Installment Credit Affects Your Credit Score

Your installment loans significantly impact your credit score through several factors.

The Five Components of Your Credit Score

According to FICO, your credit score is calculated using:

- Payment history (35%): Most important factor

- On-time installment payments build a positive history

- Even one late payment (30+ days) damages your score

- Severity increases with how late and how often

- Amounts owed (30%): Credit utilization and debt levels

- Total debt across all accounts

- How much you owe relative to the original loan amounts

- Number of accounts with balances

- Length of credit history (15%): Average age of accounts

- Longer installment loans increase average account age

- Closing old accounts can hurt this factor

- A mix of old and new accounts is ideal

- Credit mix (10%): Variety of credit types

- Having both installment and revolving credit helps

- Shows you can manage different types of debt

- Not necessary to have every type, but diversity helps

- New credit (10%): Recent credit inquiries and new accounts

- Hard inquiries from loan applications temporarily lower the score

- Multiple inquiries for the same loan type (rate shopping) count as one

- Opening several new accounts quickly is a red flag

Strategies to Maximize Credit Score Benefits

DO:

- Make every payment on time (set up autopay)

- Keep old installment accounts on your credit report

- Maintain a mix of installment and revolving credit

- Pay down balances to show progress

- Shop for rates within a 14-45 day window (counts as one inquiry)

DON’T:

- Miss payments or pay late

- Close installment accounts immediately after payoff

- Apply for multiple new loans in a short period

- Max out your borrowing capacity

- Ignore errors on your credit report

Understanding market cycles and emotional decisions can help you avoid taking on debt during times of poor judgment—the same emotional discipline applies to credit decisions as investing.

Common Mistakes to Avoid with Installment Credit

Even well-intentioned borrowers make these costly errors:

1. Focusing Only on Monthly Payment

The mistake: Choosing a loan based solely on whether you can afford the monthly payment.

Why it’s costly: You ignore the total cost and may choose a longer term that costs thousands more in interest.

Better approach: Compare total cost across different terms, then choose the shortest term with an affordable payment.

2. Not Shopping Around

The mistake: Accepting the first loan offer without comparing alternatives.

Why it’s costly: Interest rates can vary by 2-5 percentage points between lenders, costing thousands over the loan term.

Better approach: Get quotes from at least 3-5 lenders, including banks, credit unions, and online lenders.

3. Borrowing the Maximum Amount Approved

The mistake: Taking the full loan amount that the lender approves.

Why it’s costly: Lenders approve you for more than you may comfortably afford, and borrowing more means paying more interest.

Better approach: Borrow only what you truly need, not what you’re approved for.

4. Ignoring the Fine Print

The mistake: Signing loan documents without reading or understanding all terms.

Why it’s costly: Hidden fees, prepayment penalties, or variable rate clauses can significantly increase costs.

Better approach: Read every page, ask questions about anything unclear, and walk away if you’re being pressured.

5. Missing or Making Late Payments

The mistake: Failing to make payments on time.

Why it’s costly: Late fees, credit score damage, potential default, and repossession or foreclosure.

Better approach: Set up automatic payments, maintain a payment calendar, and communicate with lenders if you’re struggling.

6. Not Having an Emergency Fund First

The mistake: Taking on installment debt without savings to cover emergencies.

Why it’s costly: One unexpected expense can cause you to miss loan payments, starting a cycle of financial distress.

Better approach: Build at least a small emergency fund before taking on new debt obligations.

7. Using Installment Credit for Depreciating Wants

The mistake: Financing purchases that lose value and aren’t necessary.

Why it’s costly: You pay interest on something worth less by the time you pay it off.

Better approach: Use installment credit for appreciating assets (homes) or essential needs (reliable transportation), and save cash for wants.

8. Cosigning Without Understanding the Risk

The mistake: Cosigning a loan for someone without fully understanding you’re equally responsible.

Why it’s costly: If they don’t pay, you’re legally obligated, and it damages your credit and financial position.

Better approach: Only cosign if you’re willing and able to pay the entire loan yourself, and monitor the account regularly.

Real-World Example: Comparing Installment Credit Options

Let’s walk through a realistic scenario to see how different installment credit choices play out.

The Situation

Sarah needs to replace her unreliable car. She’s found a certified pre-owned vehicle for $22,000. She has:

- $3,000 saved for a down payment

- Credit score of 720 (good)

- Monthly budget of $400 for a car payment

- Stable job with $55,000 annual income

Option 1: Dealership Financing

- Loan amount: $19,000 (after $3,000 down)

- Interest rate: 7.9% APR

- Term: 72 months

- Monthly payment: $325.18

- Total interest: $4,413

- Total paid: $23,413

Pros: Easy approval at the dealership, lower monthly payment

Cons: Highest interest rate, longest commitment, most total interest paid

Option 2: Credit Union Auto Loan

- Loan amount: $19,000

- Interest rate: 5.5% APR

- Term: 60 months

- Monthly payment: $361.63

- Total interest: $2,698

- Total paid: $21,698

Pros: Lower rate, saves $1,715 in interest, paid off one year sooner

Cons: Slightly higher monthly payment, requires credit union membership

Option 3: Personal Loan

- Loan amount: $19,000

- Interest rate: 9.5% APR

- Term: 60 months

- Monthly payment: $399.33

- Total interest: $4,960

- Total paid: $23,960

Pros: No collateral (car can’t be repossessed for this loan), flexible use of funds

Cons: Highest interest rate, most expensive option overall

Option 4: Save for 6 More Months

- Additional savings: $400/month × 6 months = $2,400

- Total down payment: $5,400

- Loan amount: $16,600

- Interest rate: 5.5% APR (credit union)

- Term: 48 months

- Monthly payment: $385.37

- Total interest: $1,898

- Total paid: $18,498

Pros: Lowest total cost, smaller loan, paid off quickest, saves $3,915 compared to Option 1

Cons: Requires waiting 6 months, needs reliable transportation during that time

Sarah’s Decision

After comparing all options, Sarah chooses Option 2 (credit union loan) because:

- The $361 payment fits her budget comfortably

- She saves significantly compared to dealership financing

- She can’t wait 6 more months due to her current car’s unreliability

- The secured loan offers a better rate than a personal loan

Smart move: Sarah also decides to pay an extra $50/month toward principal, which will save her an additional $325 in interest and pay off the loan 6 months early.

This example shows how comparing options and understanding the numbers can save thousands of dollars on the same purchase.

Interactive Calculator: Compare Your Installment Loan Options

Key Risks and Common Mistakes to Watch For

Understanding potential pitfalls helps you avoid costly errors with installment credit.

Risk 1: Overextending Your Budget

The problem: Taking on monthly payments that strain your budget leaves no room for savings, emergencies, or other goals.

How to avoid it: Use the 28/36 rule—housing costs shouldn’t exceed 28% of gross income, and total debt payments shouldn’t exceed 36%. Always maintain a buffer for unexpected expenses.

Risk 2: Falling for Extended Warranties and Add-Ons

The problem: Lenders and dealers often bundle expensive add-ons (extended warranties, gap insurance, credit insurance) into the loan, increasing your total debt.

How to avoid it: Decline add-ons at the point of sale and research them independently. Many are overpriced or unnecessary, especially if you have adequate emergency savings.

Risk 3: Not Understanding Variable vs. Fixed Rates

The problem: Variable-rate loans can increase significantly when interest rates rise, making payments unaffordable.

How to avoid it: Choose fixed-rate loans for predictability, or ensure you can afford payments even if variable rates increase by 2-3 percentage points.

Risk 4: Ignoring Total Cost of Ownership

The problem: Focusing only on the loan payment while ignoring insurance, maintenance, taxes, and other ongoing costs.

How to avoid it: Budget for the full cost of ownership, not just the loan payment. For cars, include insurance, gas, maintenance, and registration. For homes, include property taxes, insurance, HOA fees, and maintenance.

Risk 5: Taking on Debt During Market Uncertainty

The problem: Economic downturns can lead to job loss or reduced income, making debt payments difficult or impossible.

How to avoid it: Time major borrowing during stable employment and economic conditions when possible. Understanding what moves the stock market and broader economic trends can help you gauge financial stability before taking on major debt.

How to Interpret Loan Offers and Use Installment Credit in Financial Decisions

Making smart borrowing decisions requires understanding how to evaluate and compare loan offers.

Reading the Truth in Lending Disclosure

Federal law requires lenders to provide a Truth in Lending disclosure that includes:

- Annual Percentage Rate (APR): The total cost of borrowing, including interest and certain fees

- Finance charge: Total dollar amount of interest and fees you’ll pay

- Amount financed: The actual amount you’re borrowing

- Total of payments: What you’ll pay over the life of the loan

- Payment schedule: Number, amount, and frequency of payments

Key insight: Always compare APR, not just interest rate, as APR includes fees and gives a more accurate cost comparison.

Evaluating Loan Terms

Ask these critical questions about any loan offer:

- What is the total cost? (principal + all interest and fees)

- Can I afford the monthly payment comfortably? (with a 20% income buffer)

- Are there any prepayment penalties?

- What happens if I miss a payment?

- Is the rate fixed or variable?

- What fees are included? (origination, application, late payment)

- What collateral is required?

- How does this compare to at least 3 other offers?

Using Installment Credit Strategically

Smart uses of installment credit:

- Purchasing appreciating assets (real estate)

- Investing in education that increases earning potential

- Buying reliable transportation for work

- Consolidating high-interest debt at a lower rate

- Emergency needs when no other option exists

Poor uses of installment credit:

- Financing vacations or entertainment

- Buying depreciating luxury items

- Covering regular living expenses

- Making impulse purchases

- Keeping up with others’ spending

Integrating Debt into Your Financial Plan

Installment credit should fit within a comprehensive financial strategy:

- Emergency fund first: Save 3-6 months of expenses before taking on optional debt

- High-interest debt payoff: Eliminate credit card debt before new borrowing

- Retirement contributions: Don’t skip retirement savings to afford debt payments

- Investment opportunities: Consider whether passive income strategies might serve you better than borrowing

- Long-term goals: Ensure debt payments don’t prevent achieving important objectives

Just as understanding why people lose money in the stock market helps you avoid investing mistakes, understanding installment credit helps you avoid borrowing mistakes that can derail your financial future.

Installment Credit and Your Overall Financial Health

Installment credit doesn’t exist in isolation—it affects every aspect of your financial life.

Impact on Monthly Cash Flow

Every dollar committed to debt payments is a dollar unavailable for:

- Emergency savings

- Retirement contributions

- Investment opportunities

- Discretionary spending

- Other financial goals

Strategy: Before taking on new debt, model how the payment affects your monthly budget. Can you still save 20% of your income? Fund your retirement accounts? Build an emergency fund?

Effect on Long-Term Wealth Building

Debt payments create an opportunity cost—the returns you miss by not investing that money.

Example comparison:

- Scenario A: Pay $500/month on a car loan for 5 years = $0 at the end

- Scenario B: Invest $500/month for 5 years at 8% return = $36,738

This doesn’t mean never borrow—but it highlights why minimizing debt and maximizing investments is crucial for building wealth. Learning about high dividend stocks and other investment vehicles helps you understand the opportunities you might be sacrificing when you take on debt.

Relationship Between Debt and Financial Freedom

Financial freedom means having enough passive income and assets to cover your expenses without working.

Installment debt works against this goal by:

- Requiring ongoing income to service

- Reducing the money available for investment

- Creating fixed obligations that limit flexibility

- Extending the time needed to achieve financial independence

Insight: Every month you shave off a loan term accelerates your path to financial freedom.

Balancing Debt and Investment

The key question: Should I invest or pay off debt?

Generally, pay off debt first when:

- Interest rate exceeds 6-7%

- You have high-interest credit card debt

- The debt causes stress or financial instability

- You lack an emergency fund

Consider investing while paying debt when:

- Interest rate is very low (under 4%)

- You get an employer 401(k) match (free money)

- You have a long time horizon for investments

- You’re comfortable managing both simultaneously

Balanced approach: Pay minimums on low-rate debt while investing, but aggressively pay off high-rate debt before investing beyond employer matches.

Real Data and Industry Benchmarks

Understanding how your installment credit compares to national averages and industry standards provides valuable context.

Average Installment Debt by Type (2025)

According to Federal Reserve and Experian data:

| Debt Type | Average Balance | Average Interest Rate | Average Monthly Payment |

|---|---|---|---|

| Mortgage | $244,000 | 6.8% | $1,650 |

| Auto Loan | $23,500 | 7.2% | $525 |

| Student Loan | $38,800 | 5.8% | $393 |

| Personal Loan | $18,200 | 11.5% | $430 |

Credit Score Impact on Interest Rates

Your credit score dramatically affects the rates you’re offered:

Auto Loan Rates by Credit Score (2025 averages):

- Excellent (750+): 4.5% – 6.0%

- Good (700-749): 6.0% – 8.5%

- Fair (650-699): 8.5% – 12.0%

- Poor (600-649): 12.0% – 16.0%

- Bad (below 600): 16.0%+ or declined

Cost difference: On a $25,000 auto loan for 60 months, the difference between excellent and fair credit is approximately $3,200 in total interest.

Debt-to-Income Ratios

Lenders use the debt-to-income (DTI) ratio to evaluate your ability to repay:

DTI = Total Monthly Debt Payments ÷ Gross Monthly Income

Lending standards:

- Below 36%: Excellent, qualifies for best rates

- 36-43%: Acceptable for most loans

- 43-50%: May qualify but with restrictions

- Above 50%: Difficult to qualify, signals financial stress

Example: If you earn $5,000/month gross and have $1,500 in debt payments, your DTI is 30% (acceptable).

Industry Benchmarks for Loan Terms

Typical term lengths by loan type:

- Mortgages: 15, 20, or 30 years

- Auto loans: 36, 48, 60, or 72 months (60 most common)

- Personal loans: 24, 36, 48, or 60 months

- Student loans: 10, 15, 20, or 25 years

Trend: Average auto loan terms have increased from 60 months in 2010 to 69 months in 2025, resulting in higher total interest costs despite lower monthly payments.

Expert Tips for Managing Installment Credit Successfully

Financial professionals recommend these strategies for optimal installment credit management.

Tip 1: Use the 20/4/10 Rule for Auto Loans

- 20% down payment: Reduces the loan amount and shows the lender’s commitment

- 4-year maximum term: Limits total interest and matches depreciation

- 10% of gross income: Maximum monthly payment, including insurance

This conservative approach prevents being underwater on your loan and ensures affordability. See our full guide on 20/4/10 Rule

Tip 2: Make Biweekly Payments Instead of Monthly

Paying half your monthly payment every two weeks results in 26 half-payments (13 full payments) per year instead of 12:

Benefits:

- One extra payment annually

- Reduces interest significantly

- Shortens the loan term

- Aligns with biweekly paychecks

Example: On a $250,000 mortgage at 6.5% for 30 years, biweekly payments save approximately $48,000 in interest and pay off the loan 5 years early.

Tip 3: Refinance When Rates Drop or Credit Improves

Refinancing replaces your current loan with a new one at better terms:

When to consider refinancing:

- Interest rates drop 1% or more below your current rate

- Your credit score improves by 50+ points

- You can shorten the term without significantly increasing the payment

- You can eliminate PMI on a mortgage

Watch out for: Refinancing costs (typically 2-5% of the loan amount for mortgages), prepayment penalties on existing loans, and extending the term unnecessarily.

Tip 4: Automate Payments for On-Time History

Set up automatic payments to ensure you never miss a due date:

Advantages:

- Perfect payment history (35% of credit score)

- Often qualifies for a 0.25% rate discount

- Eliminates late fees

- Reduces mental burden

Precaution: Maintain an adequate buffer in your checking account to prevent overdrafts.

Tip 5: Round Up Payments to Accelerate Payoff

Rounding your payment to the nearest $50 or $100 adds a painless extra principal:

Example: If your payment is $387, round to $400 or $450.

On a $20,000 loan at 6.5% for 60 months:

- Standard payment: $391.32/month = $3,479 interest

- Rounded to $450/month: $2,806 interest, paid off 11 months early

- Savings: $673 in interest

Tip 6: Maintain Detailed Records

Keep organized documentation of all installment loans:

- Original loan agreement and disclosures

- Payment history and receipts

- Correspondence with the lender

- Payoff statements when loans are satisfied

- Annual statements for tax purposes

This documentation helps resolve disputes, prove payments, and provides tax records.

Tip 7: Review Your Credit Report Quarterly

Monitor how your installment loans are being reported:

- Verify all accounts are listed correctly

- Check that payments are reported on time

- Ensure closed accounts show “paid as agreed”

- Dispute any errors immediately

Free resource: AnnualCreditReport.com provides free reports from all three bureaus.

Credible Sources and Further Reading

For authoritative information on installment credit and personal finance:

Government Resources

- Consumer Financial Protection Bureau (CFPB): consumerfinance.gov – Consumer protection information, complaint filing, and educational resources

- Federal Trade Commission (FTC): consumer.ftc.gov – Consumer protection and credit information

- Federal Reserve: federalreserve.gov – Economic data and consumer credit statistics

Financial Education

- Investopedia: Comprehensive financial dictionary and educational articles

- National Foundation for Credit Counseling: Non-profit credit counseling and debt management

- Financial Industry Regulatory Authority (FINRA): Investor education and tools

Credit Reporting

- Annual Credit Report: annualcreditreport.com – Free annual credit reports

- MyFICO: Credit score information and monitoring

- Experian, Equifax, TransUnion: The three major credit bureaus

Conclusion: Making Installment Credit Work for You

Installment credit is neither inherently good nor bad—it’s a powerful financial tool that can either accelerate your path to financial success or become a burden that holds you back for years. The difference comes down to knowledge, discipline, and strategic decision-making.

The key principles to remember:

- Borrow intentionally: Only use installment credit for purchases that genuinely improve your life or financial position

- Minimize costs: Shop around, negotiate rates, choose the shortest affordable term, and make extra payments when possible

- Protect your credit: Make every payment on time, monitor your credit reports, and maintain a healthy debt-to-income ratio

- Balance debt and investment: Don’t let debt payments prevent you from building wealth through saving and investing

- Plan for the unexpected: Maintain an emergency fund so temporary setbacks don’t derail your loan obligations

By following the strategies outlined in this guide, you can use installment credit as a stepping stone to financial goals rather than a stumbling block. Whether you’re buying your first home, financing education, or consolidating debt, informed decisions today create financial freedom tomorrow.

Your Next Steps

If you’re considering installment credit:

- Calculate exactly how much you need to borrow (not the maximum approved)

- Get quotes from at least 3-5 lenders and compare total costs

- Use the interactive calculator in this article to compare your options

- Review your budget to ensure comfortable affordability with a 20% buffer

- Read all loan documents carefully before signing

If you currently have installment debt:

- List all your loans with balances, rates, terms, and monthly payments

- Identify opportunities to refinance at lower rates

- Set up automatic payments if you haven’t already

- Calculate how much extra payment toward the principal would save in interest

- Create a debt payoff strategy that balances minimum payments with extra principal payments on the highest-rate loans

To build overall financial health:

- Explore smart ways to make passive income that can supplement debt payments

- Learn about dividend investing to build wealth while managing debt

- Understand market fundamentals to make better long-term financial decisions

- Develop a comprehensive financial plan that balances debt payoff with wealth building

Remember: Every financial decision you make today shapes your tomorrow. Use installment credit wisely, and it can help you achieve goals that would otherwise take years of saving. Use it carelessly, and it can trap you in a cycle of payments that prevents you from building the financial future you deserve.

The choice, and the power, is yours.

💰 Installment Loan Comparison Calculator

FAQ: Installment Credit

A good interest rate depends on the type of loan and your credit profile. As of 2025, competitive rates include: mortgages (6-7%), auto loans (4-8%), and personal loans (6-15%). Rates below these ranges are excellent, while rates significantly above suggest you might benefit from improving your credit score before borrowing.

Yes, installment credit can significantly improve your credit score when managed responsibly. Making on-time payments builds positive payment history (35% of your score), while having a mix of installment and revolving credit improves your credit mix (10% of your score). However, late payments or defaults will damage your score severely.

Missing a payment triggers several consequences: immediate late fees ($25-$50), potential credit score damage if 30+ days late, increased interest charges, and possible acceleration of the entire loan balance. Contact your lender immediately if you’re struggling—many offer hardship programs or temporary payment modifications.

Paying off installment loans early can save significant interest, but check for prepayment penalties first. If there’s no penalty, paying extra toward principal reduces total interest and shortens the loan term. However, consider whether investing that extra money might yield better returns, especially for low-rate loans (under 4-5%).

Financial experts recommend keeping total debt payments (including mortgage) below 36% of your gross monthly income, with non-mortgage debt below 20%. If your debt payments exceed these thresholds, you may struggle to save, invest, or handle emergencies. Use the debt-to-income ratio as a key indicator of financial health.

Initially, applying for an installment loan causes a small, temporary credit score decrease (usually 5-10 points) due to the hard inquiry. However, if you make on-time payments, installment loans typically help your score over time by building positive payment history and improving your credit mix.

Yes, but you’ll face higher interest rates and may need a cosigner or collateral. Options include credit union loans, secured personal loans, or credit-builder loans designed specifically for people rebuilding credit. Avoid predatory lenders offering extremely high rates or unreasonable terms.

Disclaimer

This article is for educational purposes only and does not constitute financial advice. Installment credit products vary significantly by lender, location, and individual circumstances. Interest rates, terms, fees, and eligibility requirements change frequently and depend on factors including credit score, income, debt-to-income ratio, and market conditions.

Before making any financial decisions, consult with qualified financial advisors, tax professionals, and legal experts who can evaluate your specific situation. The examples and calculations provided are illustrative and may not reflect actual costs you would incur. Always read and understand all loan documents before signing, and verify current rates and terms directly with lenders.

TheRichGuyMath.com and the author are not liable for any financial decisions made based on information in this article.

About the Author

Written by Max Fonji — With over a decade of experience in personal finance education and investment strategy, Max is your go-to source for clear, data-backed financial guidance. Through TheRichGuyMath.com, Max helps thousands of readers make smarter money decisions, avoid costly mistakes, and build lasting wealth through accessible, actionable education.

Max’s mission is simple: demystify complex financial concepts and empower readers to take control of their financial futures with confidence.