Picture this: You’re standing at a checkout counter, wallet in hand, and the cashier asks, “Will that be credit or debit?” You choose credit, but did you know that not all credit is created equal?

Whether you’re swiping a credit card for groceries or signing paperwork for a car loan, you’re using one of two fundamental types of credit: revolving or installment. Understanding the difference between these two credit types (Revolving Credit vs Installment Credit) isn’t just financial jargon; it’s the key to building a solid credit score, managing debt wisely, and making smarter money decisions in 2025 and beyond.

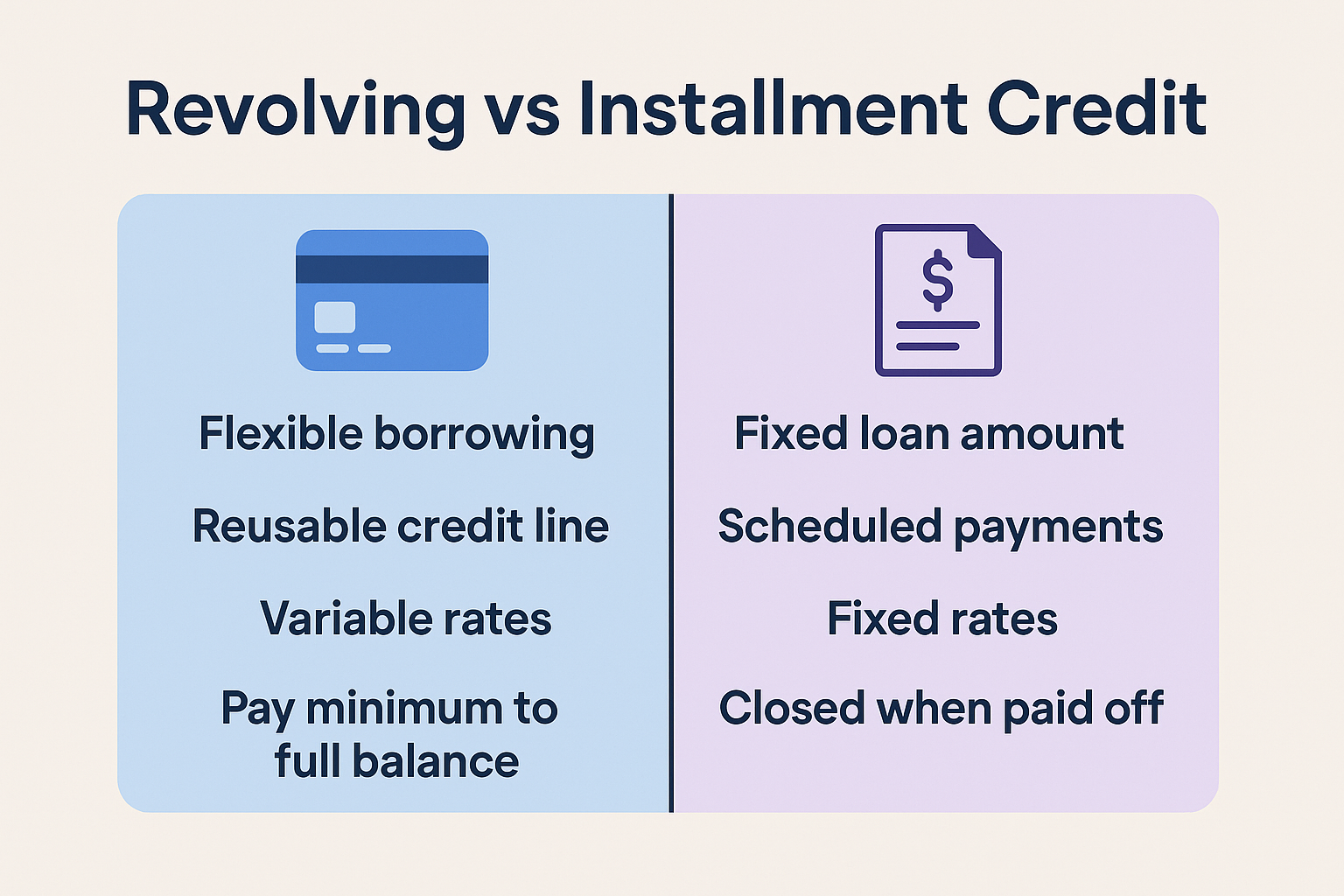

In simple terms, revolving credit is a flexible line of credit you can use repeatedly up to a certain limit (like credit cards), while installment credit is a fixed loan amount you pay back in scheduled payments over time (like mortgages or auto loans).

TL;DR

- Revolving credit allows you to borrow, repay, and borrow again up to a credit limit (credit cards, HELOCs), while installment credit provides a one-time lump sum repaid in fixed monthly payments (mortgages, auto loans, student loans)

- Interest rates on revolving credit are typically higher (15-25%+) and variable, whereas installment loans often have lower, fixed rates

- Credit utilization matters more with revolving credit—keeping balances below 30% of your limit helps your credit score significantly

- Both types of credit impact your credit score differently: revolving credit affects utilization ratios, while installment loans demonstrate payment history and credit mix

- Using a strategic combination of both revolving and installment credit can optimize your credit profile and financial flexibility

What Is Revolving Credit?

Revolving credit is a flexible type of credit that allows you to borrow money up to a predetermined credit limit, repay it, and borrow again without needing to reapply. Think of it as a financial revolving door; money goes out, money comes back in, and you can keep using it as long as your account remains in good standing.

How Revolving Credit Works

When you’re approved for revolving credit, the lender establishes a credit limit, the maximum amount you can borrow at any given time. As you make purchases or withdraw cash, your available credit decreases. When you make payments, your available credit increases again.

Here’s what makes revolving credit unique:

- No fixed repayment schedule: You can pay the minimum payment, the full balance, or anything in between

- Reusable credit line: Once you pay down your balance, that credit becomes available again

- Variable interest rates: Interest rates can change based on market conditions and your creditworthiness

- Ongoing access: The account stays open indefinitely unless you or the lender closes it

Common Types of Revolving Credit

Credit Cards

The most familiar form of revolving credit, credit cards, lets you make purchases up to your credit limit. You receive a monthly statement showing your balance, minimum payment due, and payment deadline. If you pay the full balance by the due date, you typically avoid interest charges entirely.

Home Equity Lines of Credit (HELOCs)

A HELOC allows homeowners to borrow against the equity in their homes. You can draw funds as needed during a “draw period” (usually 5-10 years), then enter a repayment period. HELOCs often have lower interest rates than credit cards because they’re secured by your property.

Personal Lines of Credit

Similar to credit cards but without the plastic, personal lines of credit provide access to funds you can draw from as needed, often through checks or bank transfers.

Retail Store Cards

Many retailers offer their own credit cards that work like traditional credit cards but often come with higher interest rates and can only be used at specific stores or store families.

What Is Installment Credit?

Installment credit is a loan where you receive a fixed amount of money upfront and agree to repay it in regular, scheduled payments over a predetermined period. Each payment (or “installment”) typically includes both principal and interest.

A higher installment loan balance doesn’t necessarily hurt your credit score the same way high revolving credit utilization does; what matters most is making payments on time.

How Installment Credit Works

When you take out an installment loan, you agree to specific terms:

- Loan amount: The total sum you’re borrowing

- Interest rate: Usually fixed, though some loans have variable rates

- Loan term: The length of time you have to repay (months or years)

- Payment amount: Fixed monthly payments that stay the same throughout the loan term

- Payment schedule: Specific due dates for each payment

Unlike revolving credit, once you pay off an installment loan, the account closes. If you need to borrow again, you must apply for a new loan.

Common Types of Installment Credit

Mortgages

Home loans are typically the largest installment loans most people take out, with terms ranging from 15 to 30 years. Mortgages are secured by the property itself, which allows for lower interest rates compared to unsecured loans.

Auto Loans

Vehicle financing usually involves installment loans with terms between 36 and 72 months. Like mortgages, auto loans are secured; the car serves as collateral.

Student Loans

Education loans help finance college expenses and typically offer more flexible repayment options than other installment loans, including income-driven repayment plans and deferment options.

Personal Loans

These unsecured installment loans can be used for various purposes—debt consolidation, home improvements, or unexpected expenses. Terms typically range from 1 to 7 years.

Buy Now, Pay Later (BNPL)

Increasingly popular in 2025, BNPL services like Affirm, Klarna, and Afterpay offer short-term installment plans (often 4-6 payments) for purchases, though not all report to credit bureaus.

Revolving vs Installment Credit: Key Differences

Understanding the distinctions between these two credit types (Revolving vs Installment Credit) helps you make informed borrowing decisions and manage your credit profile effectively.

| Feature | Revolving Credit | Installment Credit |

|---|---|---|

| Borrowing Structure | The maximum you can borrow at once | One-time lump sum |

| Credit Limit | Once (unless requesting a limit increase) | Fixed loan amount |

| Repayment | Flexible (minimum to full balance) | Fixed monthly payments |

| Reusability | Can borrow again after repayment | Must apply for new loan |

| Interest Rate | Typically higher (15-25%+), variable | Usually lower, often fixed |

| Account Duration | Remains open indefinitely | Closes when fully repaid |

| Common Examples | Credit cards, HELOCs | Mortgages, auto loans, student loans |

| Impact on Credit Score | Payment history is most important | Must apply for a new loan |

| Collateral | Usually unsecured | Often secured (except personal loans) |

| Application Process | High utilization hurts the score | Each time you need a new loan |

Flexibility and Access

Revolving credit offers maximum flexibility. Need $500 today and $1,000 next month? No problem—as long as you stay within your credit limit. This makes revolving credit ideal for:

- Everyday expenses

- Emergency funds

- Purchases with uncertain timing

- Building credit history through regular use

Installment credit provides predictability. You know exactly how much you’ll pay each month and when the debt will be fully repaid. This structure works best for:

- Large, one-time purchases

- Planned expenses with clear costs

- Budgeting with fixed monthly obligations

- Long-term financial planning

Interest Rates and Costs

The interest rate difference between revolving and installment credit can be substantial:

Revolving Credit Interest:

- Credit cards: 15.24% to 29.99% APR (average around 20-24% in 2025)

- HELOCs: 7% to 10% APR (lower because they’re secured)

- Interest is charged only on outstanding balances

- Can avoid interest entirely by paying the full balance monthly

- Compounds daily in most cases

Installment Credit Interest:

- Mortgages: 6% to 8% APR (varies with market conditions)

- Auto loans: 5% to 12% APR (depending on credit score)

- Personal loans: 7% to 36% APR (wide range based on creditworthiness)

- Student loans: 5% to 13% APR (federal loans have fixed rates)

- Interest calculated into the fixed monthly payment

- Total interest paid decreases as principal is paid down

“The formula for calculating monthly installment payments is: M = P × [r(1 + r)^n] / [(1 + r)^n – 1], where M is the monthly payment, P is the principal loan amount, r is the monthly interest rate, and n is the number of payments.”

Credit Score Impact

Both revolving and installment credit affect your credit score, but in different ways:

How Revolving Credit Affects Your Score:

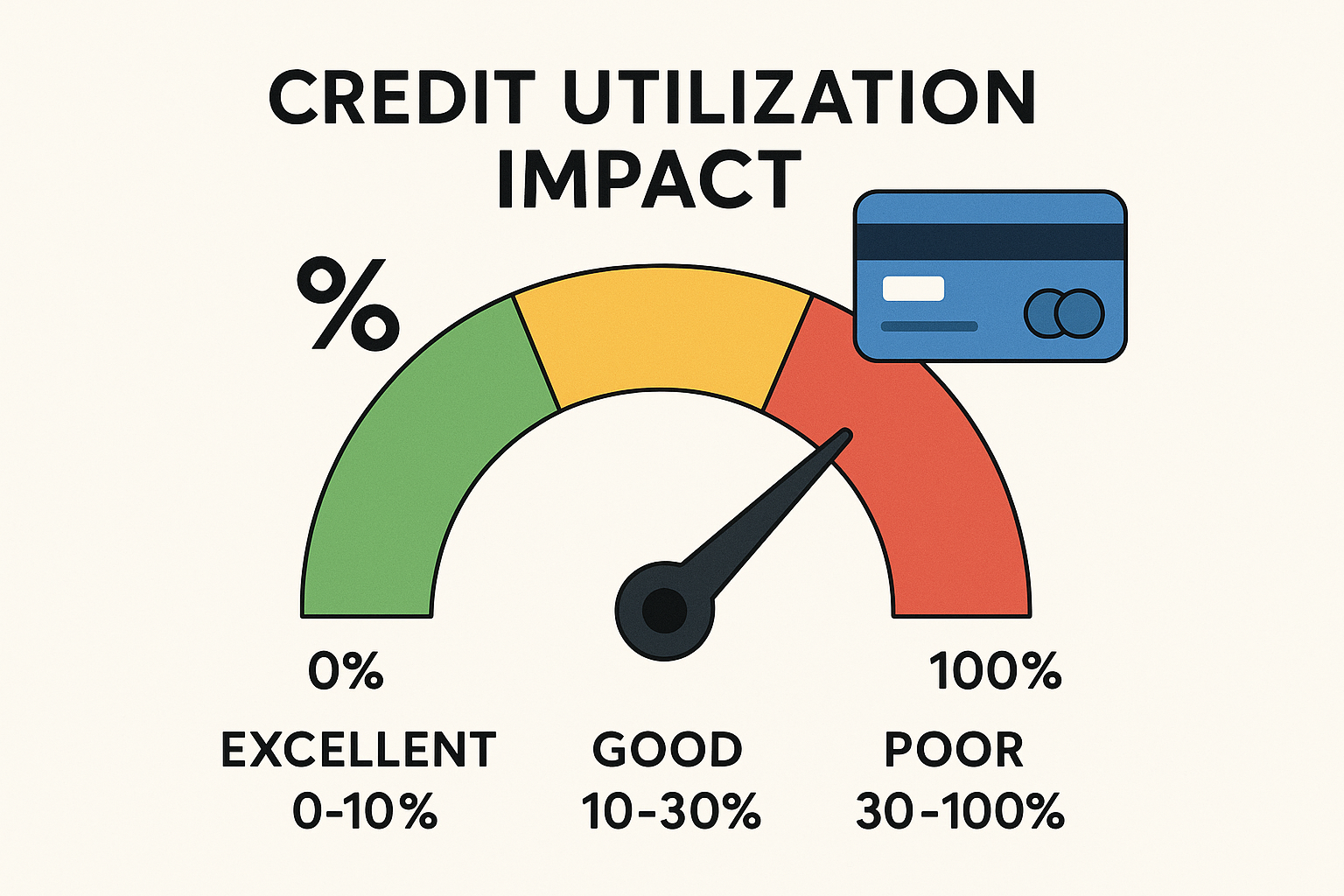

- Credit Utilization Ratio (30% of FICO score): This measures how much of your available credit you’re using. Keeping utilization below 30%—ideally below 10%—helps your score significantly.

- Example: If you have a $10,000 credit limit and a $3,000 balance, your utilization is 30%

- Payment History (35% of FICO score): Late or missed payments hurt your score severely

- Length of Credit History (15% of FICO score): Keeping old revolving accounts open, even with zero balances, helps lengthen your average account age

How Installment Credit Affects Your Score:

- Payment History (35% of FICO score): Making on-time payments consistently is the most important factor

- Credit Mix (10% of FICO score): Having both revolving and installment accounts shows you can manage different credit types

- Amounts Owed: Unlike revolving credit, having a large installment loan balance doesn’t hurt your score the same way—what matters is making payments on time

- New Credit Inquiries (10% of FICO score): Applying for new installment loans creates hard inquiries that can temporarily lower your score

Understanding these smart moves can help you make better financial decisions when managing different types of credit.

Advantages and Disadvantages of Each Credit Type

Revolving Credit Pros

- Flexibility: Borrow only what you need, when you need it

- Emergency cushion: Provides financial safety net for unexpected expenses

- Rewards programs: Many credit cards offer cash back, points, or travel rewards

- Build credit quickly: Regular use and payment can rapidly improve credit scores

- Grace periods: Pay no interest if you pay the full balance each month

- Purchase protections: Credit cards often include fraud protection, extended warranties, and dispute resolution

Revolving Credit Cons

- High interest rates: Can quickly accumulate expensive debt if not paid in full

- Temptation to overspend: Easy access can lead to impulse purchases and debt accumulation

- Variable rates: Interest rates can increase without warning

- Minimum payment trap: Paying only minimums can keep you in debt for years

- Credit utilization impact: High balances hurt your credit score

- Fees: Annual fees, late fees, cash advance fees, and balance transfer fees can add up

Installment Credit Pros

- Predictable payments: Fixed monthly amounts make budgeting easier

- Lower interest rates: Generally, more affordable than revolving credit

- Structured repayment: A Clear end date provides a debt payoff goal

- Larger borrowing amounts: Can finance major purchases like homes and vehicles

- Builds credit mix: Diversifies your credit profile

- Fixed rates: Most installment loans protect against rising interest rates

Installment Credit Cons

- Less flexibility: Can’t adjust payment amounts or borrow additional funds

- Application process: Must reapply each time you need to borrow

- Prepayment penalties: Some loans charge fees for early payoff

- Collateral risk: Secured loans put your assets at risk if you default

- Origination fees: Many loans charge upfront fees (1-8% of the loan amount)

- Hard inquiries: Each application impacts your credit score temporarily

How to Use Revolving and Installment Credit Strategically

The most financially savvy approach involves using both types of credit strategically to build wealth and maintain financial flexibility.

Building a Strong Credit Profile

Credit scoring models like FICO and VantageScore favor borrowers who demonstrate they can responsibly manage multiple types of credit. Here’s how to optimize your credit mix:

Step 1: Start with Revolving Credit

If you’re new to credit, begin with a credit card:

- Apply for a starter card or a secured credit card

- Use it for small, regular purchases (like gas or groceries)

- Pay the full balance every month

- Keep utilization below 10% for optimal credit building

Step 2: Add Installment Credit

Once you’ve established 6-12 months of positive credit card history:

- Consider a small personal loan or a credit-builder loan

- Make all payments on time and in full

- Avoid taking on more debt than you can comfortably afford

Step 3: Maintain Both Types

- Keep your oldest credit card open (even if you don’t use it regularly)

- Maintain low balances on revolving credit

- Make installment loan payments on time, every time

- Avoid opening too many new accounts at once

Smart Borrowing Strategies

Use Revolving Credit For:

- Daily expenses you can pay off monthly (to earn rewards)

- Emergency expenses when you don’t have cash reserves

- Building credit history through regular, responsible use

- Short-term financing you can repay within a few months

- Purchase protection on expensive items

Use Installment Credit For:

- Major purchases like homes, vehicles, or education

- Debt consolidation to simplify payments and potentially lower interest rates

- Planned expenses with clear costs and timelines

- Building a credit mix to diversify your credit profile

- Long-term financing when you need predictable payments

Avoiding Common Credit Mistakes

Revolving Credit Mistakes:

- Carrying high balances: Keeping utilization above 30% hurts your credit score and costs you interest

- Making only minimum payments: Extends debt for years and maximizes interest paid

- Opening too many cards: Multiple applications create hard inquiries and lower average account age

- Closing old accounts: Reduces available credit and shortens credit history

- Cash advances: Extremely expensive with high fees and immediate interest accrual

Installment Credit Mistakes:

- Borrowing more than needed: Larger loans mean more interest paid over time

- Extending loan terms unnecessarily: Longer terms mean lower payments, but much more total interest

- Missing payments: Severely damages credit and can lead to default

- Not shopping around: Interest rates vary significantly between lenders

- Ignoring total cost: Focus on total amount paid, not just the monthly payment

Just as understanding market emotions helps with investing, recognizing emotional triggers around spending can prevent credit mistakes.

Real-World Example: Revolving vs Installment Credit in Action

Let’s see how Sarah, a 28-year-old professional, uses both types of credit strategically:

Sarah’s Credit Profile

Revolving Credit:

- Credit Card #1: $10,000 limit, $500 balance (5% utilization)

- Credit Card #2: $5,000 limit, $0 balance (0% utilization)

- Overall revolving utilization: 3.3%

Installment Credit:

- Auto loan: $18,000 remaining balance, $350/month, 4.5% APR

- Student loans: $25,000 remaining balance, $280/month, 5.8% APR

Sarah’s Strategy

For Monthly Expenses (Revolving):

Sarah charges approximately $1,500 per month to Credit Card #1 for:

- Groceries: $400

- Gas: $150

- Utilities: $200

- Dining and entertainment: $500

- Miscellaneous: $250

She pays the full balance every month, earning 2% cash back ($30/month = $360/year) while paying $0 in interest. Her low utilization ratio (never exceeding 10%) helps maintain her excellent 760 credit score.

For Large Purchases (Installment):

When Sarah needed a reliable car for her commute, she:

- Saved $5,000 for a down payment

- Shopped around for the best auto loan rate

- Choose a $20,000 car with a 60-month loan at 4.5% APR

- Monthly payment: $350

- Total interest paid over 5 years: $2,371

The Results:

- Credit score: 760 (excellent)

- Credit mix: Diverse (revolving and installment)

- Monthly interest paid: $0 on credit cards, ~$70 on installment loans

- Annual rewards earned: $360

- Financial flexibility: Maintains $14,500 in available revolving credit for emergencies

Sarah’s balanced approach demonstrates how strategic use of both credit types optimizes financial health while building wealth through rewards and maintaining emergency access to funds.

How Lenders View Revolving vs Installment Credit

When you apply for new credit, lenders evaluate your existing credit profile to assess risk. Understanding how they view each credit type can help you position yourself as a strong borrower.

Lender Perspectives on Revolving Credit

What Lenders Like to See:

- Low utilization: Below 30%, ideally below 10%

- Long payment history: Years of on-time payments

- Diverse accounts: Multiple cards managed responsibly

- Low balance-to-limit ratios: Shows restraint and financial discipline

Red Flags for Lenders:

- Maxed-out cards: Suggests financial distress

- Recent late payments: Indicates payment reliability issues

- Multiple new accounts: May signal desperation for credit

- High overall utilization: Even if individual cards are below 30%

Lender Perspectives on Installment Credit

What Lenders Like to See:

- Consistent on-time payments: Demonstrates reliability

- Variety of loan types: Shows ability to manage different obligations

- Loans in good standing: No defaults, settlements, or collections

- Progression: Successfully paid-off loans show completion ability

Red Flags for Lenders:

- Missed or late payments: A Major concern for any new lending

- Recent defaults: Serious risk indicator

- Too many recent inquiries: Suggests possible financial trouble

- Very short credit history: Unproven track record

Strategies for Paying Down Different Credit Types

Managing debt repayment differs significantly between revolving and installment credit.

Paying Down Revolving Credit

The Avalanche Method

Pay minimums on all cards, then put extra money toward the card with the highest interest rate. This minimizes total interest paid.

Example:

- Card A: $3,000 at 24% APR

- Card B: $2,000 at 18% APR

- Card C: $1,000 at 15% APR

Focus extra payments on Card A first, then B, then C.

The Snowball Method

Pay minimums on all cards, then put extra money toward the card with the smallest balance. This provides psychological wins and momentum.

Using the same example, you’d focus on Card C first (smallest balance), then B, then A.

Balance Transfer Strategy

Transfer high-interest revolving debt to a card with a 0% introductory APR (typically 12-21 months). Pay aggressively during the promotional period to eliminate debt interest-free.

Important considerations:

- Balance transfer fees (typically 3-5%)

- Regular APR after promotional period

- Payment discipline is required to pay off before the promotion ends

Paying Down Installment Credit

Extra Principal Payments

Making additional payments directly to the principal reduces total interest and shortens the loan term.

Example: $200,000 mortgage at 7% APR for 30 years

- Regular payment: $1,331/month

- Total interest paid: $279,016

- With an extra $200/month to the principal:

- Total interest paid: $201,073

- Loan paid off in 22.5 years

- Savings: $77,943

Refinancing

When interest rates drop or your credit improves, refinancing can reduce your rate and monthly payment or shorten your loan term.

Bi-Weekly Payments

Paying half your monthly payment every two weeks results in 26 half-payments (13 full payments) per year instead of 12, accelerating payoff.

Debt Consolidation

Combining multiple installment loans into one can simplify payments and potentially reduce interest rates, though it’s important to compare total costs carefully.

Much like diversifying your investment portfolio, balancing different types of credit and repayment strategies creates financial stability.

The Role of Credit in Wealth Building

While debt often gets a bad reputation, strategic use of both revolving and installment credit can actually accelerate wealth building when used properly.

Good Debt vs Bad Debt

Good Debt (Potentially Wealth-Building):

- Mortgages: Real estate typically appreciates over time, and mortgage interest may be tax-deductible

- Student loans: Education can increase earning potential (though rising costs make this increasingly complex)

- Business loans: Financing business growth can generate returns exceeding interest costs

- Low-interest installment loans: When borrowed amounts are invested in appreciating assets

Bad Debt (Wealth-Destroying):

- High-interest credit card debt: Carrying balances at 20%+ APR erodes wealth rapidly

- Payday loans: Extremely high effective APRs (often 400%+)

- Unnecessary consumer debt: Financing depreciating assets like electronics or vacations

- Car loans on expensive vehicles: Cars depreciate quickly; expensive auto loans accelerate wealth loss

Leveraging Credit for Financial Growth

Credit Card Rewards and Cash Back

Using credit cards strategically for purchases you’d make anyway can generate significant returns:

- 2% cash back on $30,000 annual spending = $600/year

- Travel rewards can provide even higher effective returns

- Sign-up bonuses can be worth $500-$1,000+ per card

The key: Pay balances in full monthly to avoid interest charges that would negate rewards.

Building Credit for Future Opportunities

Excellent credit (750+ score) unlocks:

- Lower interest rates: Can save tens of thousands on mortgages and auto loans

- Better insurance rates: Many insurers use credit scores in pricing

- Rental applications: Landlords often require good credit

- Business opportunities: Strong personal credit helps secure business financing

- Employment prospects: Some employers check credit for certain positions

Using Debt to Invest

Advanced strategy (proceed with caution): Some investors use low-interest debt to invest in higher-returning assets.

Example:

- HELOC at 7% APR

- Invested in a diversified portfolio targeting a 10% average annual return

- Potential 3% spread (before taxes and risk considerations)

Major risks:

- Market volatility can result in losses

- No guaranteed returns

- Debt payments are required regardless of investment performance

- Tax implications

This strategy requires a sophisticated understanding of both markets and personal risk tolerance. Similar to understanding why the stock market goes up over long periods, this approach requires a long-term perspective and risk management.

Credit Utilization: The Critical Revolving Credit Metric

Credit utilization is one of the most important factors in your credit score, yet it’s also one of the easiest to control.

What Is Credit Utilization?

Credit utilization is the percentage of your available revolving credit that you’re currently using. It’s calculated both per account and overall across all revolving accounts.

Formula: (Total Credit Card Balances) ÷ (Total Credit Limits) × 100 = Utilization %

Why Utilization Matters So Much

Credit utilization accounts for approximately 30% of your FICO score—the second-largest factor after payment history. Here’s why lenders care:

- High utilization signals risk: Using most of your available credit suggests you might be overextended financially

- Low utilization shows restraint: Using only a small portion of available credit demonstrates financial discipline

- It’s a real-time indicator: Unlike payment history (which is historical), utilization reflects your current financial situation

Optimal Utilization Rates

Research and credit expert recommendations suggest:

- Below 30%: Generally acceptable, won’t significantly hurt your score

- Below 10%: Optimal range for maximizing credit score

- Below 7%: Some studies suggest this is ideal for the highest scores

- 0%: Contrary to popular belief, 0% utilization isn’t harmful, though showing some activity is beneficial

Strategies to Lower Credit Utilization

1. Pay Down Balances

The most direct approach—reduce what you owe.

2. Request Credit Limit Increases

If your income has increased or your credit score has improved, request higher limits. This increases your denominator, lowering the utilization percentage.

Example:

- Before: $3,000 balance ÷ $10,000 limit = 30% utilization

- After limit increase: $3,000 balance ÷ $15,000 limit = 20% utilization

Important: Only request increases if you won’t be tempted to spend more.

3. Make Multiple Payments Per Month

Since most credit card companies report to bureaus once a month (usually at statement close), making payments throughout the month keeps reported balances lower.

4. Use Multiple Cards Strategically

Spreading purchases across several cards keeps individual utilization low, though overall utilization is what matters most.

5. Time Large Purchases Carefully

If you need to make a large credit card purchase, consider timing it right after your statement closes so it doesn’t appear on your credit report until the following month.

Utilization Doesn’t Apply to Installment Loans

Important distinction: Credit utilization only applies to revolving credit. Having a large mortgage or auto loan balance doesn’t hurt your credit score the same way high credit card balances do.

Installment loans are evaluated based on:

- Payment history

- Original loan amount

- Remaining balance

- Payment-to-income ratio

How Credit Types Affect Major Financial Decisions

Your mix of revolving and installment credit significantly impacts major life decisions and opportunities.

Mortgage Applications

When applying for a mortgage, lenders evaluate:

Debt-to-Income Ratio (DTI)

- Includes both revolving and installment debt payments

- Most lenders prefer a DTI below 43%

- Lower DTI = better mortgage rates

Example calculation:

- Monthly gross income: $6,000

- Credit card minimum payments: $200

- Auto loan: $350

- Student loans: $280

- Total monthly debt: $830

- DTI: $830 ÷ $6,000 = 13.8% (excellent)

Credit Score Requirements

- Conventional loans: Typically 620+ (740+ for best rates)

- FHA loans: As low as 580

- VA loans: No official minimum (lenders usually want 620+)

Credit Mix Considerations

- Lenders like seeing both revolving and installment credit managed well

- Long history of on-time payments on both types strengthens the application

- Recent late payments on either type can disqualify or increase rates

Auto Loan Applications

Auto lenders focus heavily on:

Payment History on Existing Installment Loans

- Previous auto loans are especially relevant

- Student loan and personal loan payment history are also considered

Current Debt Load

- High revolving credit balances may indicate financial strain

- Existing installment loans factor into affordability calculations

Credit Score Tiers

- Superprime (740+): Best rates, often 4-6% APR

- Prime (680-739): Good rates, often 6-9% APR

- Nonprime (620-679): Higher rates, often 9-15% APR

- Subprime (580-619): Very high rates, often 15-20%+ APR

- Deep subprime (<580): Extremely high rates or denial

Rental Applications

Landlords typically review:

Overall Credit Profile

- Both revolving and installment accounts

- Looking for a responsible payment history

- Red flags: collections, evictions, recent late payments

Credit Score Benchmarks

- 700+: Generally approved easily

- 650-699: Usually acceptable with good income

- 600-649: May require additional deposit or co-signer

- Below 600: Often requires a co-signer or may face denial

Debt Obligations

- Landlords want rent to be ≤30% of gross income

- High debt payments reduce available income for rent

Employment Opportunities

Certain employers check credit for:

Positions Involving Financial Responsibility

- Banking and finance roles

- Positions with access to company finances

- Jobs requiring security clearances

What Employers See

- Modified credit report (no credit score)

- Payment history on all accounts

- Outstanding debts and collections

- Bankruptcies and judgments

Legal Protections

- Employers must get written permission

- Adverse decisions must be disclosed

- Some states limit or prohibit employment credit checks

Understanding these impacts helps you maintain credit that opens doors rather than closes them—much like how making smart financial moves creates opportunities in other areas of life.

Emerging Credit Trends in 2025

The credit landscape continues evolving, with new products and technologies changing how consumers access and manage credit.

Buy Now, Pay Later (BNPL) Evolution

BNPL services have exploded in popularity, blurring the lines between revolving and installment credit:

How BNPL Works:

- Split purchases into 4-6 installment payments

- Often interest-free if paid on time

- Instant approval at checkout

- Typically for purchases $50-$3,000

Credit Reporting Changes:

- Major BNPL providers increasingly report to credit bureaus

- On-time payments can help build credit

- Missed payments can hurt credit scores

- Multiple BNPL accounts may affect loan applications

Advantages:

- No hard credit inquiry for most applications

- Interest-free when paid on schedule

- Accessible to those with limited credit history

Risks:

- Easy to overextend across multiple platforms

- Late fees can be substantial

- May encourage impulse purchases

- A growing number of accounts can complicate budgeting

Alternative Credit Scoring

Traditional credit scores don’t capture the full picture, leading to alternative scoring models:

Expanded Data Sources:

- Rent payments

- Utility bill payments

- Bank account history

- Employment history

- Education level

Benefits:

- Helps “credit invisible” consumers (those with no traditional credit history)

- May provide access to credit for underserved populations

- More holistic view of financial responsibility

Providers:

- FICO XD

- VantageScore 4.0

- Experian Boost

- UltraFICO

Digital-First Credit Products

Technology is transforming credit access and management:

AI-Powered Underwriting

- Faster approval decisions

- More personalized rates based on individual risk

- Potential for more inclusive lending

Real-Time Credit Monitoring

- Instant alerts for account changes

- Proactive fraud detection

- Credit score simulators showing the impact of financial decisions

Flexible Revolving Credit

- Apps that adjust credit limits based on spending patterns

- Automated payments timed to your paycheck

- Built-in budgeting and spending controls

Environmental, Social, and Governance (ESG) Credit

Some lenders now offer preferential rates for:

- Energy-efficient home improvements

- Electric vehicle purchases

- Solar panel installations

- Other environmentally friendly financing

Interactive Credit Management Tools

Managing both revolving and installment credit requires tracking multiple accounts, due dates, and balances. Here are essential tools and strategies:

Credit Monitoring Services

Free Options:

- Credit Karma: Free credit scores and reports from TransUnion and Equifax

- Credit Sesame: Free credit score and monitoring

- AnnualCreditReport.com: Free annual reports from all three bureaus (now available weekly)

- Experian Free Membership: Free Experian credit score and monitoring

Paid Options:

- MyFICO: Access to FICO scores from all three bureaus ($19.95-$39.95/month)

- IdentityForce: Credit monitoring plus identity theft protection ($17.95-$23.95/month)

- PrivacyGuard: Comprehensive monitoring across all bureaus ($19.95-$24.95/month)

Budgeting Apps with Credit Features

Mint (Free)

- Tracks all accounts in one place

- Shows credit score

- Alerts for unusual activity

- Bill payment reminders

YNAB (You Need A Budget) ($14.99/month)

- Zero-based budgeting approach

- Debt payoff planning

- Goal tracking for both revolving and installment debt

Personal Capital (Free)

- Focuses on net worth tracking

- Investment and debt overview

- Retirement planning tools

Debt Payoff Calculators

Online calculators help visualize payoff strategies:

- Credit card payoff calculators: Show time and interest for different payment amounts

- Loan amortization calculators: Break down principal vs. interest over loan term

- Debt avalanche vs. snowball calculators: Compare different payoff strategies

- Refinance calculators: Determine if refinancing makes financial sense

Automation Strategies

Set Up Automatic Payments:

For revolving credit:

- Minimum payment automation (as a safety net)

- Full balance automation (if you have a consistent income)

- Fixed amount automation (to pay down debt systematically)

For installment credit:

- Always automate to avoid missed payments

- Consider bi-weekly payments for accelerated payoff

- Set calendar reminders before payment dates to ensure sufficient funds

Important: Maintain a buffer in the checking account to prevent overdrafts from automated payments.

Building Credit from Scratch

If you’re new to credit or rebuilding after financial setbacks, understanding how to establish both revolving and installment credit is crucial.

Starting with Revolving Credit

Option 1: Secured Credit Card

How it works:

- Deposit $200-$2,000 as collateral

- Receive a credit card with a limit equal to the deposit

- Use responsibly for 6-12 months

- Graduate to an unsecured card and get the deposit back

Best secured cards for 2025:

- Discover it® Secured: Cash back rewards, no annual fee

- Capital One Platinum Secured: Low deposit options

- Citi® Secured Mastercard®: Reports to all three bureaus

Option 2: Student Credit Card

For college students:

- Easier approval with limited credit history

- Lower credit limits ($500-$1,000)

- Often includes educational resources

- May offer rewards programs

Option 3: Authorized User

Become an authorized user on someone else’s account:

- Their positive history can appear on your report

- No responsibility for payments

- Can build credit without applying for your own card

- Choose someone with excellent payment history and low utilization

Adding Installment Credit

Once you have 6-12 months of positive revolving credit history:

Credit-Builder Loan

Specifically designed for credit building:

- Borrow $300-$1,000

- Funds held in a savings account

- Make monthly payments for 6-24 months

- Receive funds plus interest at the end

- Payment history reported to bureaus

Available from:

- Credit unions

- Community banks

- Online lenders (Self, Credit Strong)

Small Personal Loan

If you need to borrow money anyway:

- Start with a small amount ($1,000-$3,000)

- Choose a 12-24 month term

- Make all payments on time

- Demonstrates installment credit management

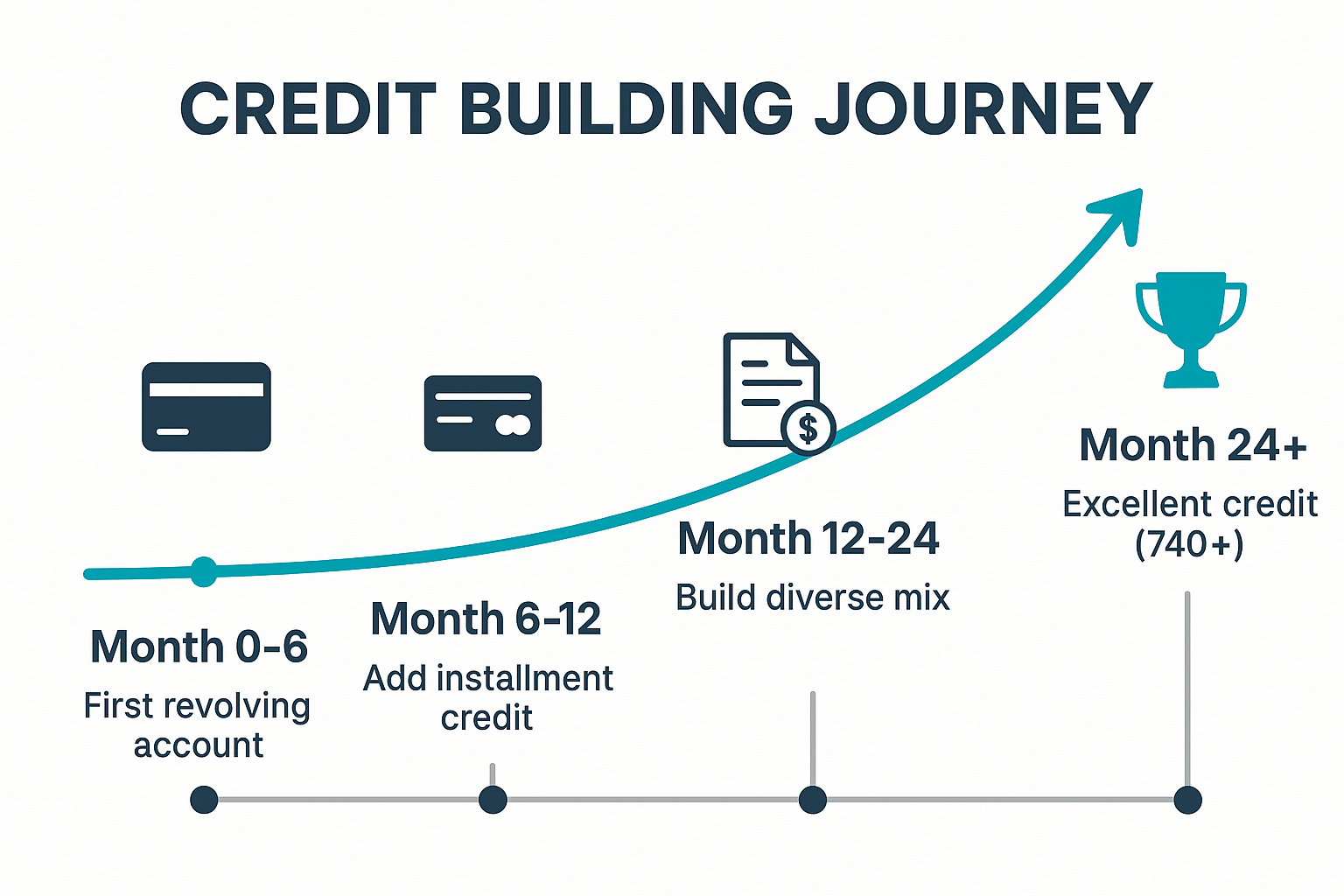

Timeline for Building Strong Credit

Months 0-6:

- Open a secured credit card or become an authorized user

- Use for small purchases monthly

- Pay in full each month

- Keep utilization below 10%

Months 6-12:

- Continue responsible revolving credit use

- Consider a second credit card for a better credit mix

- May qualify for a credit-builder loan

- Credit score typically reaches 650-680

Months 12-24:

- Add installment credit (if needed)

- Request credit limit increases

- Consider graduating to a rewards credit card

- Credit score typically reaches 680-720

Months 24+:

- Maintain a diverse credit mix

- Keep the oldest accounts open

- Continue low utilization and on-time payments

- A credit score can reach 740+

Building credit is similar to building passive income—it requires patience, consistency, and strategic planning over time.

Common Credit Myths Debunked

Misinformation about credit can lead to costly mistakes. Let’s address common myths about revolving and installment credit:

1: “Carrying a small balance on credit cards helps your credit score.”

Reality: This is completely false. Paying your full balance every month is ideal. Credit scoring models don’t reward you for paying interest—they reward responsible use and on-time payments.

What to do instead: Use your card regularly, but pay the full statement balance by the due date to avoid interest while building a positive payment history.

2: “Closing paid-off credit cards improves your credit score.”

Reality: Closing revolving credit accounts usually hurts your score by:

- Reducing total available credit (increasing utilization)

- Potentially shortening average account age

- Reducing the total number of accounts

What to do instead: Keep old cards open, even with zero balances. Make a small purchase once every 6-12 months to keep them active.

3: “Checking your credit score hurts your credit.”

Reality: Checking your own credit is a “soft inquiry” that doesn’t affect your score. Only “hard inquiries” from credit applications can impact your score, and even then, the effect is usually minor (5-10 points) and temporary.

What to do instead: Monitor your credit regularly through free services to catch errors and track progress.

4: “You need to carry debt to have good credit.”

Reality: You can have excellent credit while being completely debt-free. What matters is having credit accounts and using them responsibly, not carrying balances.

What to do instead: Use credit cards for regular purchases and pay them off monthly. Keep installment loans in good standing, but pay them off according to schedule (or early if there’s no prepayment penalty).

5: “All debt is bad debt”

Reality: Strategic use of low-interest debt for appreciating assets (like real estate) or income-producing investments can build wealth. The key is distinguishing between productive debt and consumptive debt.

What to do instead: Evaluate debt based on interest rate, purpose, and potential return. A 3.5% mortgage on an appreciating home is very different from 24% credit card debt on restaurant meals.

6: “Income affects your credit score”

Reality: Your income is not a factor in credit scoring models. However, income does affect:

- Credit applications (lenders want to know you can repay)

- Credit limits (higher income may qualify for higher limits)

- Debt-to-income ratios (affect loan approvals)

What to do instead: Focus on payment history, utilization, and credit mix rather than income level.

7: “Paying off an installment loan early always helps your credit.”

Reality: Paying off an installment loan removes an active account from your mix, which can sometimes cause a small, temporary score decrease. However, the financial benefits of eliminating debt and interest usually outweigh any minor credit score impact.

What to do instead: Pay off high-interest debt aggressively. For low-interest debt, balance the benefits of being debt-free against the value of maintaining a credit mix.

Conclusion: Mastering Both Credit Types for Financial Success

Understanding the difference between revolving vs installment credit isn’t just about knowing financial terminology—it’s about strategically managing the tools that can either build or destroy your financial foundation.

Revolving credit offers flexibility and opportunity. When used wisely—charging only what you can pay off monthly, keeping utilization low, and earning rewards—credit cards become powerful financial tools. When misused, they create expensive debt traps that can take years to escape.

Installment credit provides structure and enables major life purchases. Mortgages, auto loans, and student loans allow you to acquire assets and opportunities you couldn’t afford with cash alone. The key is borrowing only what you need, securing the best possible rates, and maintaining consistent payments.

The most successful credit users understand that both types serve different purposes and complement each other in a healthy financial profile. They leverage revolving credit for short-term flexibility and rewards while using installment credit for planned, long-term purchases. They monitor their credit regularly, keep utilization low, make all payments on time, and view credit as a tool rather than free money.

Your Next Steps

Immediate Actions (This Week):

- Check your credit reports from all three bureaus at AnnualCreditReport.com

- Calculate your credit utilization across all revolving accounts

- Review all account due dates and set up payment reminders or automation

- Identify your highest-interest debt and create a payoff plan

Short-Term Goals (Next 3 Months):

- Lower revolving credit utilization to below 30%, ideally below 10%

- Set up automatic payments for all installment loans to ensure a perfect payment history

- Request credit limit increases if you have a good payment history and won’t be tempted to spend more

- Review your credit mix and consider adding the type you’re missing (if appropriate)

Long-Term Strategy (Next 6-12 Months):

- Build an emergency fund to reduce reliance on revolving credit for unexpected expenses

- Pay off high-interest revolving debt using the avalanche or snowball method

- Maintain a diverse credit mix with both revolving and installment accounts in good standing

- Monitor credit score progress monthly and adjust strategies as needed

- Research the best rates before taking on new installment credit for major purchases

Remember, credit is simply a financial tool—neither inherently good nor bad. Your financial success depends not on avoiding credit, but on understanding and using it strategically. Whether you’re building credit from scratch, recovering from past mistakes, or optimizing an already-strong profile, the principles remain the same: pay on time, keep balances low, maintain a mix of credit types, and view every credit decision through the lens of long-term financial health.

Just as successful investors understand what moves the stock market and avoid common investing mistakes, successful credit users understand the mechanics of revolving and installment credit and use both strategically to build wealth rather than debt.

Your credit profile is one of your most valuable financial assets. Invest the time to understand it, protect it, and leverage it wisely—the returns will compound for decades to come.

Sources and References

This article incorporates information and best practices from the following authoritative sources:

- Consumer Financial Protection Bureau (CFPB): consumerfinance.gov – Federal agency providing consumer credit education and protection

- Federal Trade Commission (FTC): ftc.gov/credit – Credit rights and consumer protection information

- MyFICO: myfico.com – Official FICO score information and credit education

- Experian: experian.com/blogs/ask-experian – Credit bureau insights and educational content

- Federal Reserve: federalreserve.gov – Consumer credit data and economic research

- Investopedia: investopedia.com – Financial education and credit management strategies

💳 Credit Type Comparison Calculator

Compare revolving vs installment credit to make informed decisions

FAQ: Revolving vs Installment Credit

Revolving credit provides a credit line you can use repeatedly up to a limit (like credit cards), while installment credit is a one-time loan repaid in fixed monthly payments over a set term (like mortgages or auto loans). Revolving credit offers flexibility; installment credit offers predictability.

Neither type is inherently "better"—both contribute positively when managed responsibly. The ideal credit profile includes both types, demonstrating you can handle different credit obligations. Revolving credit affects your utilization ratio significantly, while installment credit primarily impacts payment history and credit mix.

Having too many revolving credit accounts can be problematic if you: (1) carry high balances, increasing utilization, (2) have difficulty tracking multiple accounts, or (3) recently opened many accounts, creating multiple hard inquiries. However, having several cards with low or zero balances and long histories actually helps your score by lowering overall utilization and lengthening credit history.

Credit utilization accounts for approximately 30% of your FICO score. Keeping utilization below 30%—ideally below 10%—significantly benefits your score. Utilization is calculated both per card and overall across all revolving accounts. This metric only applies to revolving credit, not installment loans.

Paying off installment loans early eliminates interest costs and frees up monthly cash flow, which usually outweighs any minor, temporary credit score impact. However, check for prepayment penalties first, and ensure you maintain emergency savings rather than depleting all cash to pay off low-interest debt.

Having multiple credit cards (when managed responsibly) typically benefits your credit score by: (1) increasing total available credit and lowering utilization, (2) providing backup if one card is compromised, (3) lengthening average account age over time, and (4) potentially earning more rewards. The key is never carrying balances you can't pay off and tracking all accounts carefully.

With responsible management, you can typically achieve a "good" credit score (670-739) within 12-24 months of opening your first account. Reaching "very good" (740-799) or "excellent" (800+) scores usually takes 2-5+ years of consistent positive history across multiple account types. There are no shortcuts—time and consistency are essential.

No, credit utilization only applies to revolving credit accounts. Having a large mortgage or auto loan balance doesn't increase your utilization ratio. Installment loans are evaluated based on payment history, original loan amount, and payment-to-income ratio, but not utilization percentage.

Disclaimer

This article is for educational purposes only and does not constitute financial advice. Credit products, interest rates, and lending criteria vary by institution and individual circumstances. While we strive for accuracy, credit industry practices and regulations change frequently. Before making credit decisions, consult with qualified financial advisors and carefully review all terms and conditions from lenders. Your individual financial situation, credit history, and goals should guide your specific credit choices. Past credit performance does not guarantee future results.

About the Author

Written by Max Fonji — With over a decade of experience in personal finance education and credit strategy, Max is your go-to source for clear, data-backed financial guidance. Through TheRichGuyMath.com, Max helps readers build wealth through informed credit decisions, strategic investing, and practical money management. Max's approach combines financial expertise with accessible explanations, making complex credit concepts understandable for everyone from beginners to experienced borrowers.

For more financial insights and wealth-building strategies, explore our comprehensive guides on investing fundamentals, dividend investing, and high-dividend stocks.