A debt consolidation loan allows you to combine multiple high-interest balances into a single monthly payment, often with a lower interest rate and clearer payoff timeline. While this strategy can simplify repayment and reduce financial stress, it also has important implications for your credit score, total interest costs, and long-term debt management. Understanding how consolidation fits into the broader credit and debt guide helps you decide whether it’s the right move based on your income, credit profile, and financial goals.

Key Takeaways

Quick Facts About Debt Consolidation Loans:

- A debt consolidation loan combines multiple debts into a single loan with one monthly payment, often at a lower interest rate than your current debts

- Typical interest rates range from 6% to 36%, depending on your credit score, income, and debt-to-income ratio

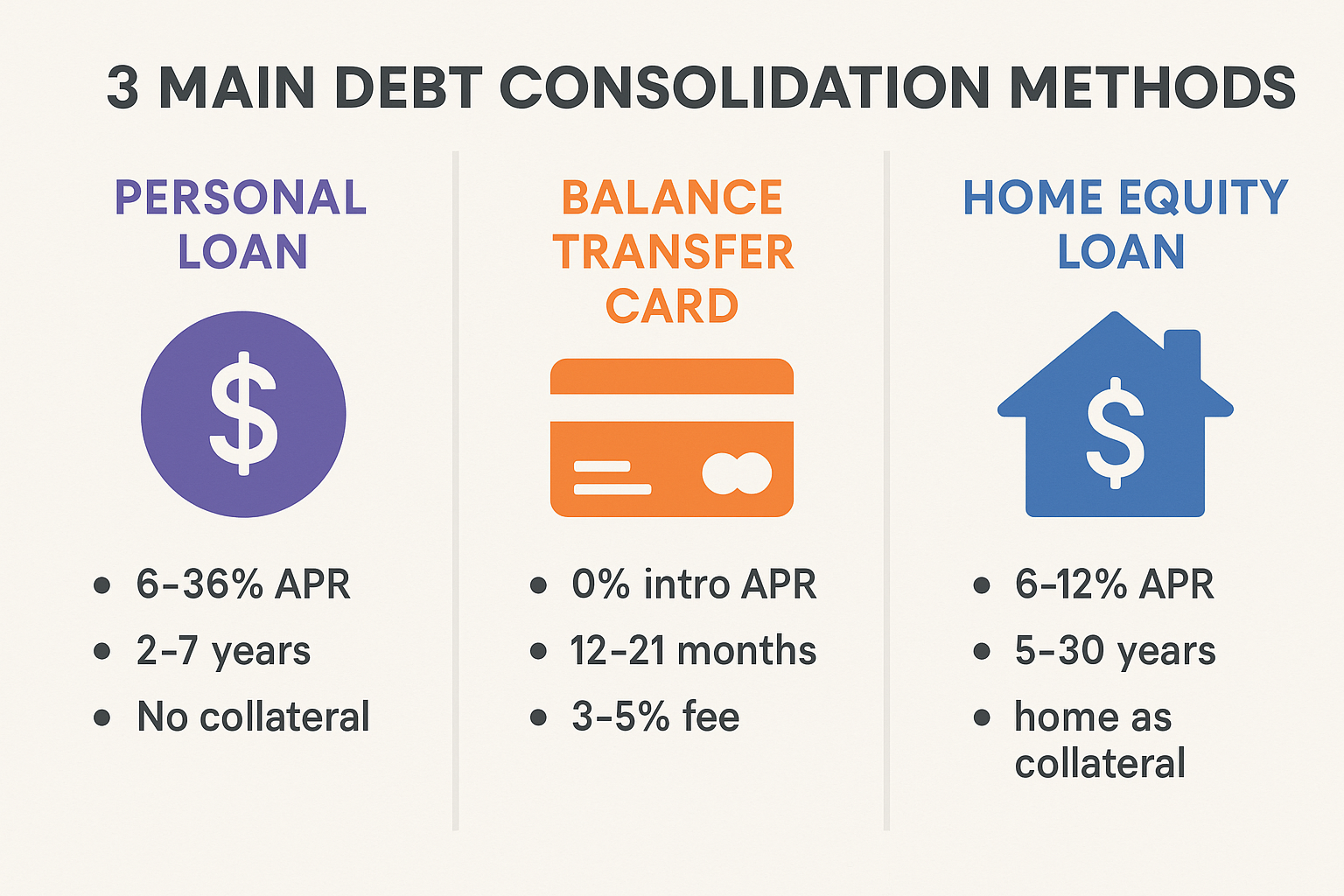

- Three main methods exist: personal loans, balance transfer credit cards, and home equity loans/HELOCs

- Major benefits include simplified payments and potential interest savings, but they don’t reduce the principal amount you owe

- Key risks involve extending your repayment period (paying more interest overall), potential fees, and the temptation to accumulate new debt after consolidating

What Is a Debt Consolidation Loan?

In simple terms, a debt consolidation loan refers to taking out a single new loan to pay off multiple existing debts. Instead of managing five different credit card payments, two student loans, and a personal loan, each with different due dates and interest rates, you consolidate everything into a single monthly payment.

The primary goal? Simplification and potential cost savings. By combining debts, you streamline your financial obligations and may qualify for a lower overall interest rate, especially if your credit score has improved since you originally took on those debts.

Why Debt Consolidation Matters in 2026

With inflation pressures and rising living costs, American consumers are carrying record levels of debt. According to the Federal Reserve, total household debt reached $17.5 trillion in early 2025. Credit card interest rates have climbed to an average of 20-24%, making minimum payments feel like running in place.

Debt consolidation offers a strategic path forward for those struggling with:

- Multiple high-interest credit cards

- Overwhelming monthly payment schedules

- Difficulty tracking various due dates

- Desire to improve credit scores through better payment management

This guide breaks down everything you need to know about debt consolidation loans—from the different methods available to the pros, cons, and potential pitfalls that could derail your financial recovery.

Understanding How Debt Consolidation Loans Work

Before diving into specific consolidation methods, let’s clarify the mechanics. A debt consolidation loan doesn’t eliminate your debt—it restructures it.

The Basic Process

- Assessment: Total all your current debts (credit cards, personal loans, medical bills, etc.).

- Application: You apply for a consolidation loan equal to or greater than your total debt amount

- Approval: Lenders evaluate your creditworthiness, income, and debt-to-income ratio

- Payoff: Once approved, you use the new loan to pay off all existing debts

- Repayment: You now make a single monthly payment to your new lender

Key Formula to Understand

Debt-to-Income Ratio (DTI) = (Total Monthly Debt Payments ÷ Gross Monthly Income) × 100

Lenders typically prefer a DTI below 43% for approval. For example, if your monthly debt payments total $2,000 and your gross monthly income is $5,000:

DTI = ($2,000 ÷ $5,000) × 100 = 40%

This ratio significantly impacts your approval odds and the interest rate you’ll receive.

Three Primary Debt Consolidation Methods

Not all debt consolidation loans are created equal. Let’s explore the three most common approaches, each with distinct advantages and limitations.

1. Personal Loans for Debt Consolidation

What it is: An unsecured personal loan from a bank, credit union, or online lender specifically used to pay off multiple debts.

How it works:

- Loan amounts typically range from $1,000 to $50,000

- Fixed interest rates (usually 6-36% APR)

- Repayment terms of 2-7 years

- No collateral required

Best for:

- Borrowers with good to excellent credit (FICO 670+)

- Those seeking predictable monthly payments

- People consolidating $5,000-$40,000 in unsecured debt

Example:

Sarah has $15,000 spread across four credit cards with an average interest rate of 22%. She qualifies for a personal loan at 10% APR for 4 years. Her monthly payment drops from $625 to $380, and she saves over $8,000 in interest.

2. Balance Transfer Credit Cards

What it is: A credit card offering 0% APR for an introductory period (typically 12-21 months) on transferred balances.

How it works:

- Transfer existing credit card balances to the new card

- Pay no interest during the promotional period

- Usually involves a 3-5% balance transfer fee

- Must pay off balance before promotional period ends

Best for:

- Borrowers with excellent credit (FICO 720+)

- Those who can pay off debt within 12-18 months

- Credit card debt specifically (not other loan types)

Example:

Mike transfers $8,000 in credit card debt to a card with 0% APR for 18 months and a 3% transfer fee ($240). If he pays $450/month, he’ll be debt-free in 18 months, saving approximately $2,500 in interest compared to keeping the original cards.

3. Home Equity Loans & HELOCs

What it is: Borrowing against the equity in your home to consolidate debts.

How it works:

- Home Equity Loan: Lump sum with fixed rate and term

- HELOC (Home Equity Line of Credit): Revolving credit line with variable rate

- Typically offers lower interest rates (6-12%)

- Your home serves as collateral

Best for:

- Homeowners with significant equity (20%+ recommended)

- Consolidating large debt amounts ($25,000+)

- Those comfortable using their home as collateral

Major warning: Defaulting on a home equity loan could result in foreclosure. This method carries substantially more risk than unsecured options.

Comparing Debt Consolidation Methods: At-a-Glance

| Method | Interest Rate Range | Typical Term | Credit Score Needed | Collateral Required | Best For |

|---|---|---|---|---|---|

| Personal Loan | 6-36% APR | 2-7 years | 670+ | No | Most debt types, moderate amounts |

| Balance Transfer Card | 0% (intro), then 15-25% | 12-21 months (promo) | 720+ | No | Credit card debt only, short-term payoff |

| Home Equity Loan | 6-12% APR | 5-30 years | 620+ | Yes (your home) | Large debt amounts, long-term payoff |

| HELOC | 7-13% APR (variable) | 10-20 years | 620+ | Yes (your home) | Flexible borrowing needs |

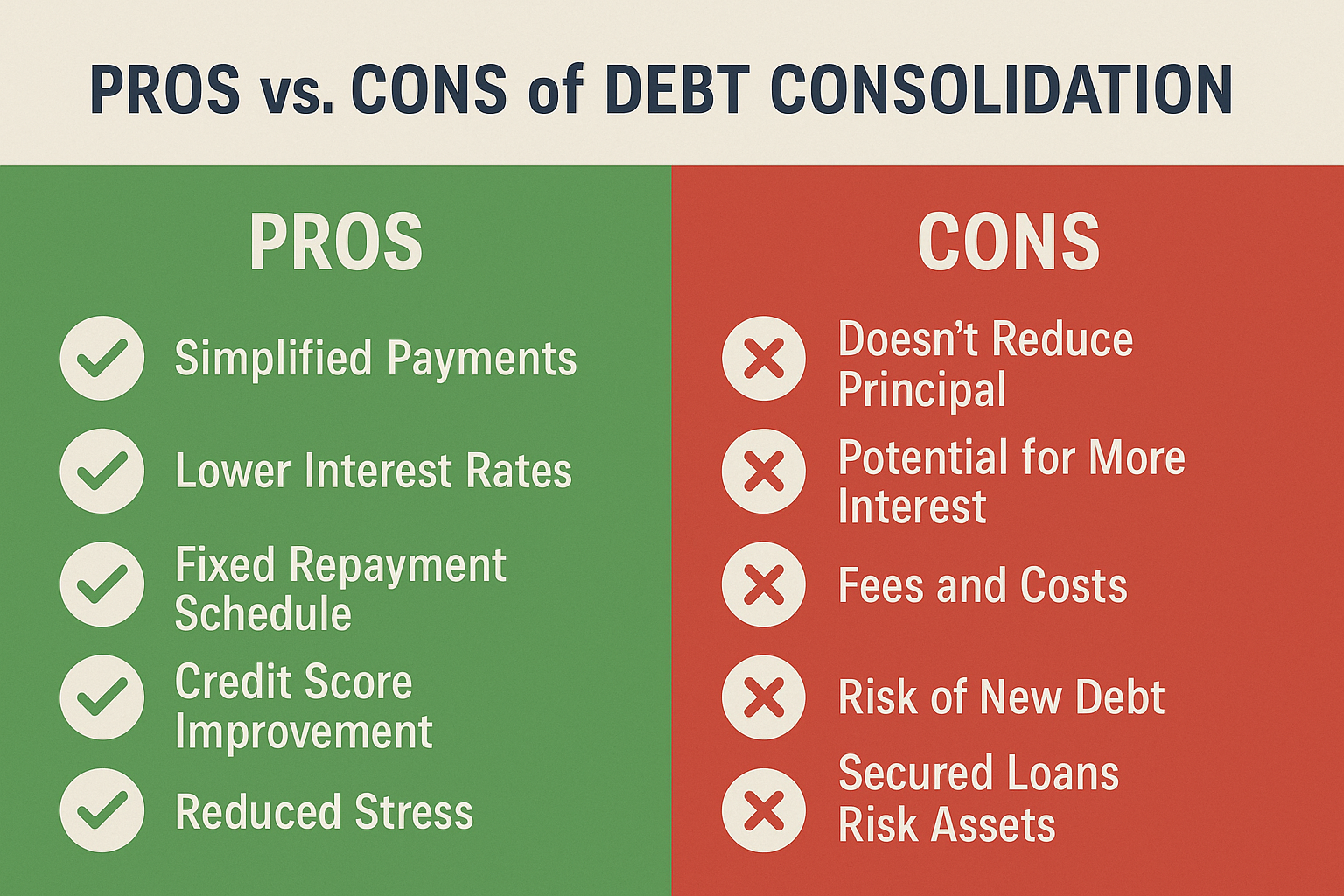

The Advantages of Debt Consolidation Loans

1. Simplified Financial Management

Managing one payment instead of five, seven, or ten separate obligations dramatically reduces mental load and the risk of missed payments. You’ll have:

- One due date to remember

- One lender to communicate with

- Easier budgeting and financial planning

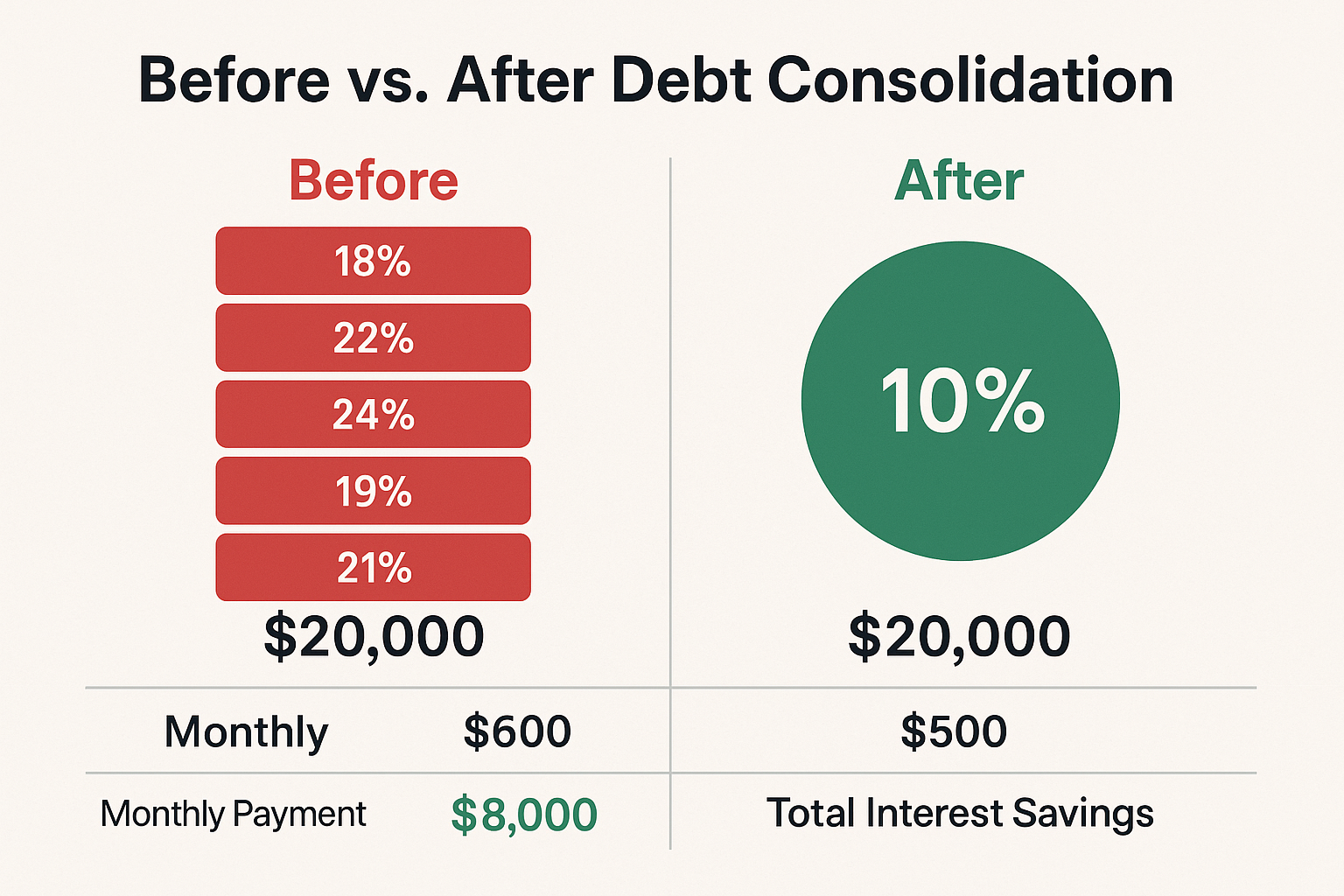

2. Potential Interest Rate Savings

If you qualify for a lower interest rate than your current average, you could save thousands over the life of the loan. Credit card rates averaging 22% consolidated into a 10% personal loan represent substantial savings.

3. Fixed Repayment Schedule

Unlike credit cards with revolving balances, most consolidation loans offer fixed terms. You’ll know exactly when you’ll be debt-free, creating a clear finish line and motivation to stay on track.

4. Possible Credit Score Improvement

Debt consolidation can positively impact your credit in several ways:

- Lower credit utilization ratio: Paying off credit cards reduces your utilization percentage

- Improved payment history: One payment is easier to manage consistently

- Diversified credit mix: Adding an installment loan to your credit card accounts

However, there’s an initial dip when lenders run hard credit inquiries and when you open a new account.

5. Reduced Financial Stress

The psychological benefit of consolidation shouldn’t be underestimated. Feeling in control of your debt rather than overwhelmed by it can improve overall well-being and decision-making.

The Risks and Disadvantages You Must Understand

While debt consolidation offers genuine benefits, it’s not a magic solution. Understanding the risks is crucial to making an informed decision.

1. You’re Not Actually Reducing Debt

This is the most critical point many borrowers miss: Consolidation reorganizes debt; it doesn’t eliminate it. You still owe the same principal amount. If you consolidate $20,000 in debt, you still owe $20,000—just to a different lender.

2. Potential for Paying More Interest Overall

Extending your repayment period might lower monthly payments but increase total interest paid. Consider this example:

Before consolidation:

- $15,000 debt at 20% APR

- Paying $500/month

- Paid off in 42 months

- Total interest: $5,800

After consolidation:

- $15,000 loan at 12% APR

- Paying $334/month

- Paid off in 60 months

- Total interest: $5,040

While the interest rate is lower, stretching payments over 60 months instead of 42 means you’re in debt longer. Run the numbers carefully.

3. Fees Can Eat Into Savings

Common fees include:

- Origination fees: 1-8% of the loan amount

- Balance transfer fees: 3-5% of the transferred amount

- Closing costs (for home equity products): 2-5% of the loan amount

- Prepayment penalties: Some lenders charge for early payoff

A $15,000 loan with a 5% origination fee costs $750 upfront—calculate whether your interest savings justify these costs.

4. Risk of Accumulating New Debt

Here’s a dangerous pattern: After consolidating and paying off credit cards, those cards now have zero balances. The temptation to use them again is enormous, and many people end up with both the consolidation loan AND new credit card debt.

Statistics show that roughly 30% of people who consolidate debt accumulate new debt within 12 months.

5. Secured Loans Put Assets at Risk

Home equity loans and HELOCs use your home as collateral. If you default, you could lose your house. This transforms unsecured debt (credit cards) into secured debt—a significantly riskier proposition.

6. Doesn’t Address Underlying Spending Habits

Debt consolidation treats the symptom, not the disease. If overspending, lack of budgeting, or lifestyle inflation caused your debt, consolidation alone won’t fix the problem. Without behavioral changes, you’ll likely end up in debt again.

Step-by-Step: How to Get a Debt Consolidation Loan

Ready to move forward? Here’s the detailed process:

Step 1: Calculate Your Total Debt

List every debt you want to consolidate:

- Credit card balances

- Personal loans

- Medical bills

- Store credit accounts

- Student loans (private only—federal loans have unique benefits)

Total the balances and note the interest rate for each.

Step 2: Check Your Credit Score

Your credit score determines:

- Whether you’ll be approved

- What interest rate do you receive

- Which lenders will work with you

| Credit Score Range | Loan Likelihood | Expected Rate |

|---|---|---|

| 750+ (Excellent) | Very High | 6-10% |

| 700-749 (Good) | High | 10-15% |

| 650-699 (Fair) | Moderate | 15-22% |

| 600-649 (Poor) | Low | 22-30% |

| Below 600 | Very Low | 30%+ or denied |

Free credit score resources include Credit Karma, Credit Sesame, and your credit card issuer’s app.

Step 3: Calculate Your Debt-to-Income Ratio

Use the formula mentioned earlier:

DTI = (Total Monthly Debt Payments ÷ Gross Monthly Income) × 100

Most lenders want to see DTI below 43%, though some may work with up to 50% for well-qualified borrowers.

Step 4: Shop Around for Lenders

Compare offers from multiple sources:

- Traditional banks: Often offer competitive rates for existing customers

- Credit unions: Typically provide lower rates and more flexible terms

- Online lenders: Fast approval and funding, a wide range of credit profiles

- Peer-to-peer platforms: May work with lower credit scores

Get pre-qualified (soft credit check) from at least 3-5 lenders before formally applying.

Step 5: Compare Total Costs, Not Just Rates

When evaluating offers, calculate:

- Monthly payment amount

- Total interest over the loan term

- All fees (origination, processing, etc.)

- Prepayment penalties

- Annual Percentage Rate (APR) (includes fees and interest)

The lowest interest rate doesn’t always mean the best deal if fees are high.

Step 6: Apply and Provide Documentation

You’ll typically need:

- Proof of identity (driver’s license, passport)

- Proof of income (pay stubs, tax returns)

- Proof of address (utility bill, lease)

- List of debts to be consolidated

- Employment verification

Step 7: Use Funds to Pay Off Existing Debts

Critical step: Once approved, immediately pay off the debts you consolidated. Some lenders send funds directly to creditors; others deposit money in your account.

Keep confirmation records of all paid-off accounts.

Step 8: Close Paid-Off Accounts (Strategically)

Don’t close all credit cards immediately—this can hurt your credit utilization ratio and average account age. Consider:

- Keeping your oldest card open

- Maintaining 1-2 cards with small, manageable balances

- Closing newer accounts or those with annual fees

Common Mistakes to Avoid

1: Not Addressing the Root Cause

Consolidating debt without fixing spending habits is like bailing water from a sinking boat without plugging the hole. Create a realistic budget and identify what led to debt accumulation.

2: Choosing the Wrong Consolidation Method

A balance transfer card is useless if you can’t pay off the balance during the promotional period. A home equity loan is dangerous if your income is unstable. Match the method to your specific situation.

3: Ignoring the Fine Print

Variable interest rates can increase. Promotional periods end. Prepayment penalties exist. Read the entire loan agreement before signing.

4: Continuing to Use Credit Cards

The fastest way to derail consolidation is racking up new credit card debt. Consider freezing cards or using cash/debit only until you’ve proven you can manage credit responsibly.

5: Skipping the Math

Always calculate the total cost over the entire loan term. A lower monthly payment might feel better, but if you’re paying for twice as long, you could end up paying significantly more.

When Debt Consolidation Makes Sense

Consider consolidation if you:

- Have multiple high-interest debts (especially credit cards above 18%)

- Have a steady income and can afford the new monthly payment

- Have you improved your credit score since taking on original debts

- Are committed to not accumulating new debt

- Can qualify for an interest rate at least 3-5% lower than your current average

- Want to simplify payment management

When to Avoid Debt Consolidation

Skip consolidation if you:

- Haven’t addressed underlying spending problems

- Would barely qualify for a lower rate

- Have mostly low-interest debt already

- Are you considering bankruptcy (consult an attorney first)

- Can’t afford the new monthly payment

- Would need to use your home as collateral, but have unstable income

- Have only a small amount of debt you could pay off in 6-12 months anyway

Alternative Debt Relief Options

Debt consolidation isn’t the only path. Consider these alternatives:

1. Debt Snowball or Avalanche Method

Pay off debts systematically without consolidating:

- Snowball: Pay the smallest balance first for psychological wins

- Avalanche: Pay the highest interest rate first for maximum savings

Both require discipline, but avoid fees and new loans. Learning about smart financial moves can help you develop the discipline needed for these methods.

2. Debt Management Plan (DMP)

Work with a nonprofit credit counseling agency to negotiate lower rates and create a repayment plan. You make one payment to the agency, which distributes funds to creditors.

Pros: Professional guidance, potentially lower rates

Cons: May require closing credit accounts, takes 3-5 years

3. Debt Settlement

Negotiate with creditors to accept less than you owe. This severely damages credit and should be a last resort before bankruptcy.

4. Bankruptcy

Chapter 7 or Chapter 13 bankruptcy eliminates or restructures debt but has long-lasting credit consequences. Consult a bankruptcy attorney to understand the implications.

Protecting Your Financial Future After Consolidation

Successfully consolidating debt is just the beginning. Here’s how to ensure you don’t end up back in the same situation:

Build an Emergency Fund

Start with $1,000, then work toward 3-6 months of expenses. This prevents reliance on credit cards when unexpected costs arise.

Create and Stick to a Budget

Use the 50/30/20 rule as a starting point:

- 50% of income for needs (housing, food, utilities)

- 30% for wants (entertainment, dining out)

- 20% for savings and debt repayment

Automate Your Consolidation Payment

Set up automatic payments to ensure you never miss the due date. Payment history accounts for 35% of your credit score.

Monitor Your Credit Regularly

Check your credit report quarterly for errors and to track progress. You’re entitled to free reports from all three bureaus at AnnualCreditReport.com.

Consider Additional Income Streams

Just as investors explore passive income opportunities to build wealth, finding additional income sources can accelerate debt payoff and prevent future financial stress.

Educate Yourself Financially

Understanding personal finance principles helps prevent future debt. Explore resources on building wealth through investing to shift your mindset from debt management to wealth building.

Real-World Case Studies

Case Study 1: Successful Personal Loan Consolidation

Background: Jennifer, 34, had $22,000 in credit card debt across six cards with rates between 18-26%. Her monthly minimum payments totaled $680, and she was barely making progress.

Action: She qualified for a $22,000 personal loan at 11.5% APR with a 5-year term and 3% origination fee.

Results:

- New monthly payment: $485 (saving $195/month)

- Total interest with original cards: ~$19,500

- Total interest with consolidation loan: ~$7,100

- Total savings: $12,400 (even after $660 origination fee)

- Debt-free date: Fixed 5-year timeline vs. 12+ years with minimums

Key to success: Jennifer cut up her credit cards and committed to a strict budget.

Case Study 2: Balance Transfer Gone Wrong

Background: Marcus, 28, had $12,000 in credit card debt and qualified for a 0% APR balance transfer card for 18 months with a 3% fee.

Action: He transferred the full balance, paying $360 in fees, with a plan to pay $667/month to clear it before the promotional period ended.

Results:

- Paid consistently for 6 months ($4,002 paid down)

- Had a medical emergency and stopped payments for 3 months

- Resumed smaller payments, but couldn’t catch up

- After 18 months, $5,000 remained

- Balance jumped to 24.99% APR

- Ended up paying more than if he’d kept original cards

Lesson: Balance transfers require discipline and financial stability. Life happens—have a backup plan.

Case Study 3: Home Equity Loan Success

Background: Robert and Linda, both 52, had $45,000 in various debts (credit cards, personal loans, and medical bills) with an average rate of 19%. They owned their home with $180,000 in equity.

Action: They took a $45,000 home equity loan at 7.5% APR over 10 years.

Results:

- Monthly payment: $535 (down from $1,100)

- Interest savings: Over $75,000 over the loan term

- Tax deduction on interest (consult a tax professional)

- Successfully paid off in 8 years by making extra payments

Key to success: Stable dual income, commitment to not accumulating new debt, and treating their home as sacred collateral worth protecting.

Understanding the Impact on Your Credit Score

Debt consolidation affects your credit score in multiple ways:

Short-Term Impacts (First 3-6 Months)

Negative effects:

- Hard inquiry: -5 to 10 points (temporary)

- New account: Lowers average account age

- Multiple applications: Each inquiry dings your score

Positive effects:

- Lower credit utilization: Paying off credit cards can significantly boost your score

- Debt diversification: Adding an installment loan to revolving credit improves your credit mix

Long-Term Impacts (6+ Months)

Positive effects:

- Consistent payment history: On-time payments rebuild your score

- Lower overall debt: As you pay down the consolidation loan

- Improved utilization ratio: Keeping paid-off credit cards open (but unused) maintains available credit

Potential negative effects:

- Closing accounts: Reduces total available credit and average account age

- New debt accumulation: If you rack up new credit card balances

Credit Score Timeline Example

| Time Period | Expected Change | Reason |

|---|---|---|

| Application | -5 to -15 points | Hard inquiry, new account |

| 1-3 months | -10 to +20 points | Utilization drops, new account ages |

| 6-12 months | +20 to +50 points | Payment history builds, utilization stays low |

| 12+ months | +30 to +100 points | Strong payment history, lower debt, aged accounts |

Individual results vary based on starting credit profile

The Psychology of Debt: Why Consolidation Helps (and When It Doesn’t)

Understanding the psychological aspects of debt is crucial to consolidation success.

The Mental Load of Multiple Debts

Research shows that managing multiple debts creates a significant cognitive burden. Each separate debt requires:

- Remembering different due dates

- Tracking different balances

- Managing different interest rates

- Dealing with multiple customer service departments

This mental complexity leads to:

- Missed payments (even when you have the money)

- Feeling overwhelmed and avoiding the problem

- Decision fatigue affects other life areas

Consolidation removes this complexity, creating a single, manageable focus point.

The “Fresh Start” Effect

Behavioral economists have identified the “fresh start effect”—people are more likely to pursue goals after temporal landmarks (new year, birthday, Monday, etc.). Debt consolidation creates a powerful, fresh start moment.

When you consolidate:

- Old debts are “closed out” (psychologically satisfying)

- You have a clear, defined payoff date

- Progress is easier to track

- The slate feels wiped clean

This psychological reset can motivate better financial behavior—if you’re ready for it.

When Psychology Works Against You

The same fresh start that motivates some people creates complacency in others. The danger signs:

- Feeling like the debt problem is “solved” just because it’s consolidated

- Viewing paid-off credit cards as “available money.”

- Relaxing spending discipline because monthly payments are lower

- Not addressing the behaviors that created debt in the first place

Consolidation is a tool, not a cure. Without addressing underlying financial habits, it becomes a temporary Band-Aid on a chronic problem.

Debt Consolidation and Wealth Building: The Connection

Once you’ve successfully consolidated and are on a path to debt freedom, the next step is building wealth. Understanding this connection is crucial for long-term financial success.

From Debt Payoff to Wealth Accumulation

The discipline required to successfully pay off a consolidation loan transfers directly to wealth-building habits:

Consistent monthly payments → Consistent monthly investing

Tracking debt balance decrease → Tracking investment portfolio growth

Avoiding new debt → Avoiding lifestyle inflation

Many people who successfully eliminate debt discover they’ve built the exact habits needed for investing. The fundamentals of stock market investing become much more accessible once you’re no longer fighting debt.

The Opportunity Cost of Debt

Every dollar paid in interest is a dollar that could have been invested. Consider:

$300/month in credit card interest payments over 10 years = $36,000 paid to lenders

$300/month invested in index funds at 8% average return over 10 years = $54,800

The difference: $90,800 in wealth creation potential

This is why understanding what moves the stock market and building investment knowledge matters—even while you’re still in debt. You’re preparing for the next chapter.

Transitioning from Debt Freedom to Financial Independence

Once your consolidation loan is paid off:

- Continue the same payment to yourself by redirecting it to investments

- Build your emergency fund to 6 months of expenses

- Start investing in tax-advantaged accounts (401k, IRA)

- Consider dividend investing for passive income streams

Learning about dividend investing and high-dividend stocks can help you create income that eventually exceeds your expenses—true financial freedom.

Expert Tips from Financial Professionals

From Credit Counselors

“The biggest mistake we see is people consolidating without a budget.” – National Foundation for Credit Counseling

Before consolidating:

- Track spending for 30 days

- Identify discretionary expenses to cut

- Create a realistic budget that includes the new payment

- Build a small emergency fund ($500-1,000) before applying

From Debt Consolidation Lenders

“Borrowers who succeed treat consolidation as a one-time opportunity, not a recurring solution.” – Marcus by Goldman Sachs

Successful borrowers:

- Close or freeze credit cards after payoff

- Set up automatic payments

- Make extra principal payments when possible

- Don’t consolidate again within 5 years

From Behavioral Finance Experts

“Make your new payment visible and celebrate milestones.” – Financial Psychology Institute

Strategies that work:

- Create a visual debt payoff tracker

- Celebrate every 10% paid off

- Share your goal with an accountability partner

- Visualize your debt-free date and what you’ll do with the freed-up money

The Role of Financial Education in Debt Prevention

The best debt consolidation loan is the one you never need. Financial education is the ultimate prevention strategy.

Key Financial Literacy Concepts

Understanding these principles prevents future debt:

- Compound interest works both ways: It builds wealth in investments but multiplies debt

- Emergency funds are non-negotiable: 80% of Americans will face an unexpected $1,000+ expense each year

- Lifestyle inflation is the silent killer: Spending increases with income unless consciously managed

- Credit is a tool, not income: Available credit isn’t money you have; it’s money you’ll owe

Resources for Financial Education

- SEC.gov Investor Education: Free, authoritative resources on investing and money management

- CFPB (Consumer Financial Protection Bureau): Tools and guides for managing debt and credit

- Investopedia: Comprehensive financial dictionary and educational articles

- Local credit unions: Many offer free financial counseling and education workshops

Understanding broader financial concepts—like why the stock market goes up over time or why people lose money in the stock market—helps you think long-term and resist short-term temptations that create debt.

Regulatory Protections and Consumer Rights

Understanding your rights as a borrower protects you from predatory practices.

Truth in Lending Act (TILA)

Lenders must disclose:

- Annual Percentage Rate (APR)

- Finance charges

- Amount financed

- Total payments over the loan term

- Payment schedule

You have the right to: Receive these disclosures before signing, and a 3-day rescission period for home equity loans.

Fair Credit Reporting Act (FCRA)

You have the right to:

- Free annual credit reports from all three bureaus

- Dispute inaccurate information

- Know who has accessed your credit

- Limit pre-approved credit offers

Fair Debt Collection Practices Act (FDCPA)

Debt collectors cannot:

- Call before 8 AM or after 9 PM

- Harass, threaten, or abuse you

- Lie about the amount you owe

- Contact you at work if you’ve asked them not to

Report violations to: Consumer Financial Protection Bureau (CFPB) at consumerfinance.gov

Red Flags: Predatory Lending Practices to Avoid

Warning signs of predatory lenders:

- Pressure to act immediately

- Fees exceeding 8% of the loan amount

- Prepayment penalties exceeding 5%

- Balloon payments (huge final payment)

- Loan flipping (encouraging frequent refinancing)

- Mandatory arbitration clauses

- Lack of licensing (check your state’s banking department)

Always verify lender legitimacy through your state’s Department of Financial Institutions or the Better Business Bureau.

Creating Your Debt Consolidation Action Plan

Ready to move forward? Here’s your step-by-step action plan:

Week 1: Assessment and Preparation

- [ ] List all debts with balances, interest rates, and minimum payments

- [ ] Calculate total debt amount

- [ ] Check credit score from all three bureaus

- [ ] Calculate debt-to-income ratio

- [ ] Review budget and identify available monthly payment amount

- [ ] Gather financial documents (pay stubs, tax returns, bank statements)

Week 2: Research and Comparison

- [ ] Research 5-7 potential lenders (banks, credit unions, online lenders)

- [ ] Get pre-qualified from at least 3 lenders (soft pull only)

- [ ] Compare offers using APR, total cost, fees, and terms

- [ ] Read reviews and check lender legitimacy

- [ ] Calculate total interest savings vs. current debt

- [ ] Determine if consolidation makes financial sense

Week 3: Application and Approval

- [ ] Submit formal application to chosen lender

- [ ] Provide all requested documentation promptly

- [ ] Review the loan agreement carefully before signing

- [ ] Clarify any unclear terms or fees

- [ ] Confirm there are no prepayment penalties

- [ ] Sign the agreement if terms are acceptable

Week 4: Implementation

- [ ] Receive loan funds

- [ ] Immediately pay off all consolidated debts

- [ ] Confirm with each creditor that accounts are paid in full

- [ ] Request written confirmation of zero balances

- [ ] Set up automatic payments for the new consolidation loan

- [ ] Decide which credit cards to keep open (if any)

- [ ] Create debt payoff tracker

Ongoing: Maintenance and Progress

- [ ] Make monthly payments on time (automate if possible)

- [ ] Make extra principal payments when possible

- [ ] Monitor credit report quarterly

- [ ] Build emergency fund to $1,000, then 3-6 months’ expenses

- [ ] Avoid accumulating new debt

- [ ] Celebrate milestones (25%, 50%, 75% paid off)

- [ ] Plan for post-debt financial goals (investing, saving, etc.)

Conclusion: Is Debt Consolidation Right for You?

Debt consolidation is a powerful financial tool—but it’s not magic, and it’s not for everyone.

It works best when you:

- Have multiple high-interest debts that are genuinely burdensome

- Can qualify for a significantly lower interest rate

- We are committed to changing the behaviors that created debt

- Have a stable income to support consistent payments

- Understand that you’re reorganizing debt, not eliminating it

It’s likely the wrong choice if you:

- Haven’t addressed underlying spending problems

- Would barely save on interest

- Can pay off debt in under a year without consolidating

- Are you considering bankruptcy (consult an attorney first)

- Would need to risk your home for consolidation

Your Next Steps

If you decide to consolidate:

- Use the action plan above to move systematically through the process

- Choose the right method for your situation (personal loan, balance transfer, or home equity)

- Calculate total costs, not just monthly payments

- Read every word of your loan agreement

- Pay off debts immediately upon receiving funds

- Set up automatic payments and tracking

- Commit to not accumulating new debt

If you decide consolidation isn’t right:

- Consider the debt snowball or avalanche method

- Explore debt management plans through nonprofit credit counseling

- Focus on increasing income and decreasing expenses

- Build an emergency fund to prevent future debt

- Seek professional financial advice if needed

The Bigger Picture: From Debt to Wealth

Eliminating debt is just the beginning of your financial journey. The real goal is building lasting wealth and financial security.

Once you’re on solid ground, explore opportunities to grow your money through informed investing. Understanding market emotions and cycles helps you make rational decisions during both debt payoff and wealth building.

Remember: The habits you build paying off debt—consistency, discipline, tracking progress, delaying gratification—are the exact habits that build wealth. You’re not just eliminating debt; you’re building the foundation for financial independence.

Take the first step today. Whether that’s calculating your total debt, checking your credit score, or getting pre-qualified for a consolidation loan, action creates momentum. You’ve got this.

FAQ

A good interest rate depends on your credit score and current debt rates. Generally, if you can secure a rate at least 3-5 percentage points lower than your current average, consolidation makes financial sense. For borrowers with excellent credit (750+), rates of 6-10% are achievable. Those with fair credit (650-699) might see 15-20%. The key is comparing your new rate to your weighted average current rate—not just your lowest current rate.

Initially, yes—but long-term, it can help. You’ll see a temporary dip (5-15 points) from the hard credit inquiry and new account. However, if you make consistent on-time payments and reduce your credit utilization ratio, your score typically improves within 6-12 months, often surpassing your pre-consolidation score by 30-100 points.

Yes, but your options are limited and more expensive. With credit scores below 600, you’ll likely face:

Higher interest rates (25-36%)

Secured loan requirements (collateral needed)

Smaller loan amounts

Stricter approval criteria

Consider working with credit unions, which often have more flexible requirements, or focus on improving your credit score before consolidating.

Generally, no—federal student loans offer unique protections that you’ll lose if you consolidate them with a private debt consolidation loan:

Income-driven repayment plans

Loan forgiveness programs

Deferment and forbearance options

Death and disability discharge

Keep federal student loans separate and only consolidate private student loans or other consumer debt.

The timeline varies by method:

Personal loan: 1-7 days for approval, 1-7 days for funding

Balance transfer card: Instant to 2 weeks for approval, 7-21 days for transfer completion

Home equity loan: 2-6 weeks for approval and closing

Once funded, you should pay off existing debts immediately—usually within 1-3 business days.

Debt consolidation reorganizes debt; debt settlement reduces it.

Consolidation: You pay the full amount owed, just restructured into one loan

Settlement: You negotiate to pay less than you owe (typically 40-60% of the balance)

Settlement severely damages your credit (similar to bankruptcy) and should only be considered as a last resort. Consolidation can actually improve your credit over time.

Yes, but you’ll need to provide additional documentation:

2 years of tax returns

Bank statements showing consistent deposits

Profit and loss statements

Business license or proof of business

Self-employed borrowers often face stricter scrutiny but can qualify with strong income documentation and good credit.

Financial Disclaimer

This article is for educational purposes only and does not constitute financial advice. Debt consolidation decisions should be made based on your individual financial situation. Consider consulting with a licensed financial advisor, credit counselor, or attorney before making significant financial decisions. Interest rates, terms, and lender requirements vary and change frequently. Always read and understand loan agreements before signing.

About the Author

Written by Max Fonji — With over a decade of experience in personal finance education and investment strategy, Max is your go-to source for clear, data-backed financial guidance. Through TheRichGuyMath.com, Max has helped thousands of readers navigate debt elimination, build investment portfolios, and achieve financial independence. Max combines practical experience with thorough research to deliver actionable insights that work in the real world.