When legendary investor Warren Buffett buys stocks, he doesn’t simply look for good companies—he looks for good companies trading at prices far below their intrinsic value. This gap between price and value is called the margin of safety, and it’s the mathematical cushion that separates successful investors from those who lose money when markets turn volatile.

The margin of safety isn’t just a safety net—it’s a strategic calculation that quantifies how much room for error exists in an investment decision. Whether you’re buying stocks, evaluating business projects, or planning production levels, understanding this concept transforms how you assess risk and make financial decisions.

In this comprehensive guide, you’ll learn exactly what margin of safety means, how to calculate it across different contexts, and why it remains one of the most powerful tools in both investing and business management.

Key Takeaways

- Margin of safety measures the gap between actual or expected performance and the break-even point, providing a buffer against losses

- In investing, it represents the difference between a stock’s intrinsic value and its current market price

- In business, it shows how much sales can decline before a company reaches its break-even point

- A higher margin of safety indicates lower risk and greater protection against unfavorable changes

- The concept was popularized by Benjamin Graham and remains central to value investing strategies in 2025

What Is Margin of Safety?

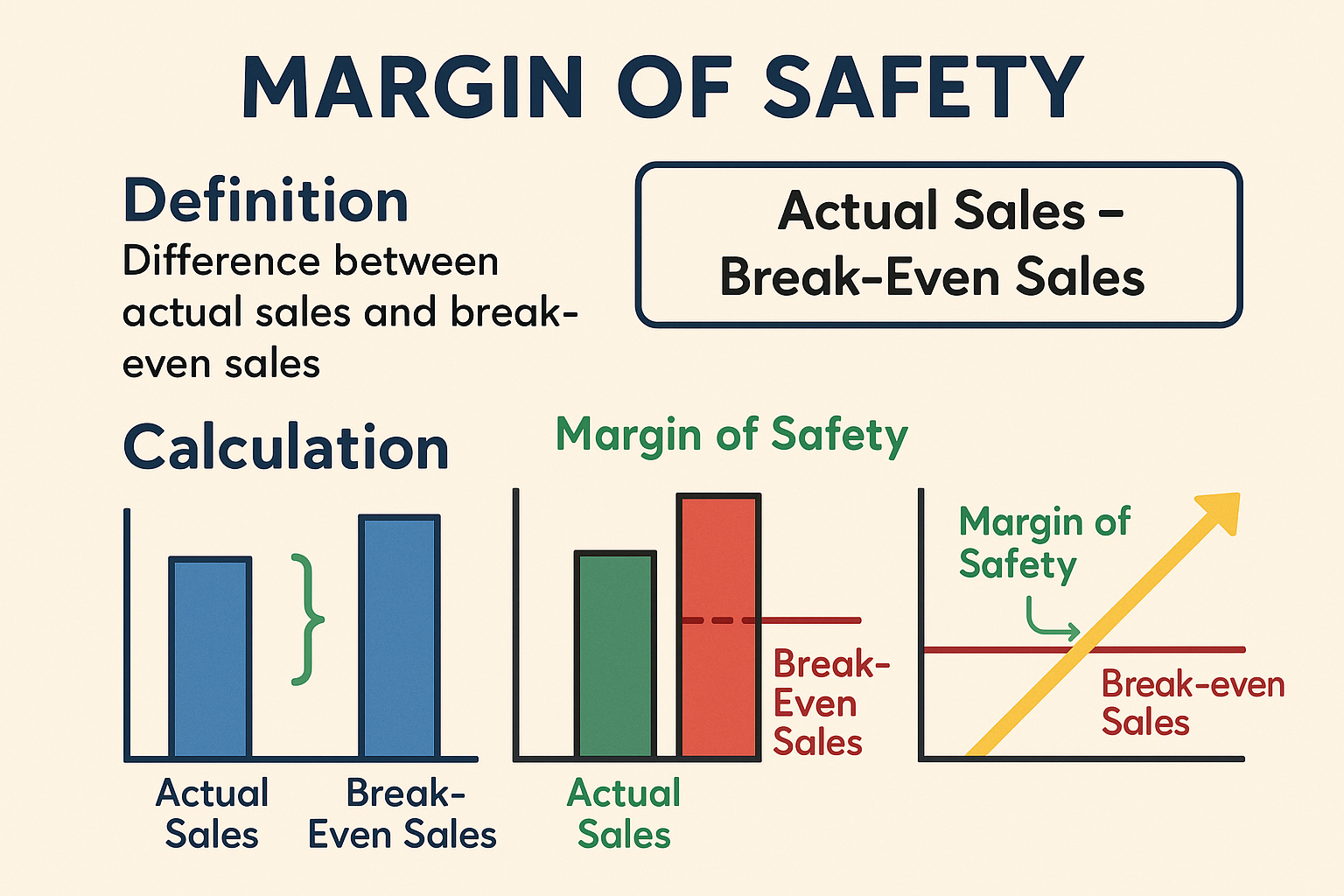

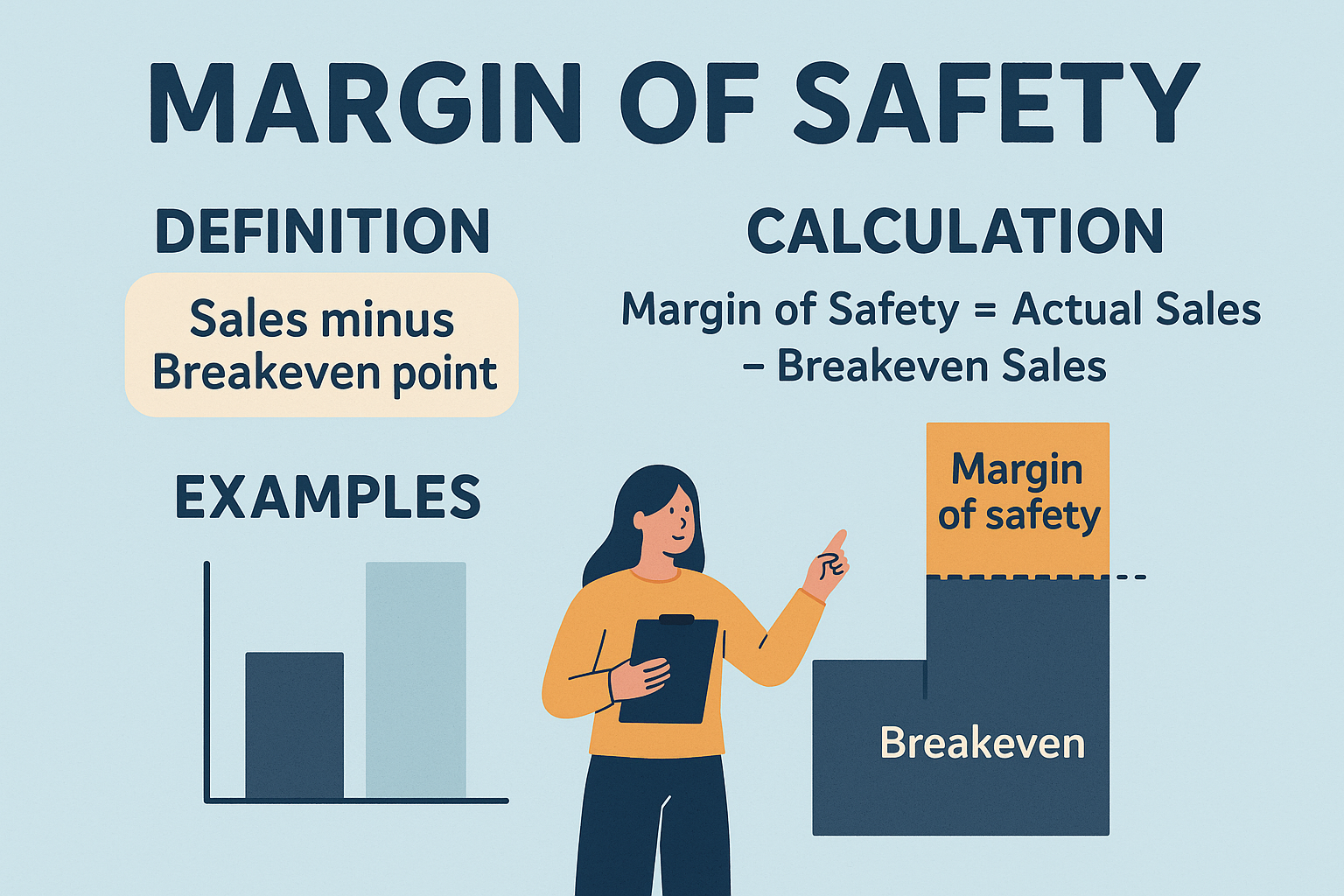

Margin of safety is a risk management principle that measures the difference between the actual (or expected) level of activity and the break-even level. This buffer zone represents how much room for error exists before an investment or business operation becomes unprofitable.

The concept serves two primary functions:

First, it quantifies risk by showing exactly how much cushion exists between current conditions and the point where losses begin. A larger margin means greater protection against adverse changes.

Second, it provides a decision-making framework that prioritizes preservation of capital over maximizing returns. By requiring a substantial margin before committing resources, investors and managers build protection directly into their strategy.

The margin of safety principle applies across multiple domains:

- Investment analysis: The gap between intrinsic value and market price

- Business operations: The distance between actual sales and break-even sales

- Project management: The buffer between expected performance and minimum acceptable performance

- Engineering: The difference between maximum load capacity and normal operating load

In each context, the underlying logic remains consistent: create a buffer that absorbs unexpected problems without causing catastrophic failure.

The Origin of Margin of Safety

Benjamin Graham, known as the father of value investing, introduced the margin of safety concept in his 1949 book The Intelligent Investor. Graham argued that investors should never pay full price for a security, regardless of its quality.

Instead, Graham advocated purchasing securities only when they traded at significant discounts to their intrinsic value. This discount—the margin of safety—protected investors from three primary risks:

- Calculation errors: Even careful analysis can misjudge a company’s true worth

- Bad luck: Unforeseen events can damage even well-run businesses

- Market volatility: Prices fluctuate for reasons unrelated to fundamental value

Graham’s student, Warren Buffett, later described margin of safety as “the three most important words in investing.” This endorsement from one of history’s most successful investors cemented the concept’s place in modern financial theory.

Takeaway: Margin of safety originated as an investment principle but has expanded to become a universal risk management tool across finance and business operations.

Margin of Safety in Investing

In investment contexts, margin of safety represents the percentage difference between a security’s intrinsic value and its current market price. This calculation answers a critical question: How much are you overpaying or underpaying for this asset?

Understanding Intrinsic Value

Before calculating the margin of safety, investors must first determine intrinsic value—the true economic worth of a security based on fundamental analysis. This requires examining:

- Cash flow generation: Present value of future cash flows the business will produce

- Asset values: The worth of tangible and intangible assets on the balance sheet

- Earnings power: Sustainable profit-generating capacity of the business

- Growth prospects: Realistic expectations for future expansion

- Competitive position: Strength of economic moats and market position

Various valuation methods exist for estimating intrinsic value, including discounted cash flow analysis, dividend discount models, and asset-based valuations. Each approach has strengths and limitations, which is why conservative investors often use multiple methods and select the most conservative estimate.

The Investment Margin of Safety Formula

Once intrinsic value is established, the margin of safety calculation is straightforward:

Margin of Safety (%) = [(Intrinsic Value – Current Market Price) / Intrinsic Value] × 100

For example:

- Intrinsic value of Stock ABC: $100 per share

- Current market price: $60 per share

- Margin of Safety = [($100 – $60) / $100] × 100 = 40%

This 40% margin means the stock trades at a 40% discount to its estimated true value, providing substantial protection against valuation errors or business setbacks.

What Constitutes a Good Margin of Safety?

The required margin of safety varies based on several factors:

Quality of the business: Higher-quality companies with predictable cash flows may require smaller margins (20-30%), while speculative or cyclical businesses demand larger buffers (50%+).

Certainty of valuation: When intrinsic value can be estimated with high confidence, smaller margins suffice. When valuation involves significant assumptions, larger margins compensate for uncertainty.

Market conditions: During periods of market volatility, wider margins provide additional protection against price swings.

Investment timeframe: Long-term investors can accept smaller margins since time allows businesses to grow into their valuations. Short-term investors need larger margins for immediate protection.

Benjamin Graham typically required at least a 30-50% margin of safety before recommending a stock purchase. Modern value investors often apply similar standards, though specific requirements vary by strategy and market environment.

Real-World Investment Example

Consider an investor analyzing Company XYZ in early 2025:

Fundamental Analysis:

- Annual free cash flow: $500 million

- Appropriate discount rate: 10%

- Expected growth rate: 5% annually

- Using a perpetual growth model: Intrinsic Value = $500M / (0.10 – 0.05) = $10 billion

- Shares outstanding: 100 million

- Intrinsic value per share: $100

Market Price:

- Current trading price: $65 per share

- Market capitalization: $6.5 billion

Margin of Safety Calculation:

- Margin of Safety = [($100 – $65) / $100] × 100 = 35%

This 35% margin suggests the stock offers meaningful protection against valuation errors or business deterioration. Even if the intrinsic value estimate is 20% too optimistic (actual value = $80), the investor still purchases at a discount ($65 vs. $80).

Takeaway: In investing, the margin of safety quantifies the discount between price and value, creating a mathematical buffer that protects against analytical errors and unforeseen problems.

Margin of Safety in Business Operations

Beyond investing, the margin of safety serves as a critical metric for business managers evaluating operational risk. In this context, it measures how far sales can decline before a company reaches its break-even point.

Understanding Break-Even Analysis

Break-even analysis identifies the sales level at which total revenues exactly equal total costs, resulting in zero profit. At this point:

Total Revenue = Total Fixed Costs + Total Variable Costs

Sales above break-even generate profit; sales below break-even produce losses. The margin of safety measures the buffer between actual sales and this critical threshold.

The Operational Margin of Safety Formula

The business margin of safety can be expressed in three ways:

1. Dollar Amount:

Margin of Safety ($) = Actual Sales ($) – Break-Even Sales ($)

2. Unit Amount:

Margin of Safety (units) = Actual Sales (units) – Break-Even Sales (units)

3. Percentage:

Margin of Safety (%) = [(Actual Sales – Break-Even Sales) / Actual Sales] × 100

The percentage format provides the most useful comparison across different businesses and time periods.

Calculating Break-Even Sales

To determine the margin of safety, managers must first calculate the break-even point:

Break-Even Sales ($) = Fixed Costs / Contribution Margin Ratio

Where:

- Fixed Costs = Expenses that don’t change with production volume (rent, salaries, insurance)

- Contribution Margin Ratio = (Sales – Variable Costs) / Sales

Alternatively, in units:

Break-Even Sales (units) = Fixed Costs / Contribution Margin per Unit

Where:

- Contribution Margin per Unit = Selling Price per Unit – Variable Cost per Unit

Business Margin of Safety Example

Consider a manufacturing company with the following 2025 financial data:

Cost Structure:

- Fixed costs: $500,000 annually

- Variable cost per unit: $30

- Selling price per unit: $50

- Contribution margin per unit: $50 – $30 = $20

Break-Even Calculation:

- Break-even units = $500,000 / $20 = 25,000 units

- Break-even sales = 25,000 units × $50 = $1,250,000

Actual Performance:

- Actual sales: 40,000 units

- Actual revenue: 40,000 × $50 = $2,000,000

Margin of Safety:

- Dollar amount = $2,000,000 – $1,250,000 = $750,000

- Unit amount = 40,000 – 25,000 = 15,000 units

- Percentage = [($2,000,000 – $1,250,000) / $2,000,000] × 100 = 37.5%

This 37.5% margin means sales could decline by more than one-third before the company reaches break-even. This substantial buffer protects against economic downturns, competitive pressures, or operational challenges.

Interpreting Business Margin of Safety

The operational margin of safety reveals critical information about business risk:

High Margin (>40%): Indicates strong protection against sales declines. The business can withstand significant revenue drops without becoming unprofitable. This typically characterizes mature, stable companies with diversified revenue streams.

Moderate Margin (20-40%): Provides reasonable protection but requires careful monitoring. Economic downturns or competitive pressures could threaten profitability. Most healthy businesses operate in this range.

Low Margin (10-20%): Signals elevated risk. Small sales declines could quickly eliminate profits. Management should focus on either reducing fixed costs or increasing sales volume.

Very Low Margin (<10%): Indicates precarious financial position. The business operates close to break-even with minimal room for error. Immediate action is needed to improve the situation.

Strategic Applications

Business managers use the margin of safety for several strategic purposes:

Risk Assessment: Quantifies vulnerability to revenue fluctuations, enabling prioritization of risk management efforts.

Pricing Decisions: Informs whether the company can afford to lower prices to gain market share without risking losses.

Cost Management: Highlights the importance of controlling fixed costs, which directly impact the break-even point.

Expansion Planning: Helps evaluate whether the business can absorb the fixed costs associated with growth initiatives.

Performance Monitoring: Provides an early warning system when sales trends threaten profitability.

Takeaway: In business operations, the margin of safety measures the buffer between current sales and the break-even point, quantifying how much revenue can decline before profits disappear.

Step-by-Step: Calculating Margin of Safety

Whether analyzing investments or business operations, calculating the margin of safety follows a systematic process. Here’s how to perform the calculation in both contexts.

For Investment Analysis

Step 1: Estimate Intrinsic Value

Select an appropriate valuation method based on the security type and available information:

- Discounted Cash Flow (DCF): Project future cash flows and discount to present value

- Dividend Discount Model: Calculate the present value of expected future dividends

- Asset-Based Valuation: Determine the liquidation or replacement value of assets

- Comparable Company Analysis: Compare valuation multiples to similar businesses

- Earnings Power Value: Capitalize normalized earnings at an appropriate rate

Conservative investors often use multiple methods and select the lowest reasonable estimate.

Step 2: Determine Current Market Price

Identify the current trading price from reliable financial data sources. For publicly traded securities, this is straightforward. For private investments, determining fair market value may require a professional appraisal.

Step 3: Calculate the Difference

Subtract the current market price from the intrinsic value estimate:

Value Gap = Intrinsic Value – Market Price

Step 4: Convert to Percentage

Divide the value gap by intrinsic value and multiply by 100:

Margin of Safety (%) = (Value Gap / Intrinsic Value) × 100

Step 5: Evaluate Against Requirements

Compare the calculated margin to your minimum acceptable threshold based on the investment’s risk characteristics and your confidence in the valuation.

For Business Operations

Step 1: Identify Cost Structure

Separate total costs into fixed and variable components:

- Fixed Costs: Rent, insurance, salaries, depreciation, etc.

- Variable Costs: Raw materials, direct labor, sales commissions, etc.

Step 2: Calculate Contribution Margin

Determine either the contribution margin ratio or contribution margin per unit:

- Contribution Margin Ratio = (Sales – Variable Costs) / Sales

- Contribution Margin per Unit = Selling Price – Variable Cost per Unit

Step 3: Determine Break-Even Point

Calculate break-even sales using the contribution margin:

- Break-Even Sales ($) = Fixed Costs / Contribution Margin Ratio

- Break-Even Sales (units) = Fixed Costs / Contribution Margin per Unit

Step 4: Identify Actual Sales

Determine current or projected sales levels in both dollars and units.

Step 5: Calculate Margin of Safety

Apply the appropriate formula:

- Margin of Safety ($) = Actual Sales ($) – Break-Even Sales ($)

- Margin of Safety (%) = [(Actual Sales – Break-Even Sales) / Actual Sales] × 100

Step 6: Interpret Results

Evaluate whether the margin provides adequate protection given the business’s risk profile and market conditions.

Common Calculation Mistakes

Overestimating intrinsic value: Optimistic assumptions inflate value estimates, creating illusory margins of safety. Use conservative projections and stress-test assumptions.

Ignoring hidden costs: Variable costs often contain fixed elements, and fixed costs may increase with volume. Careful cost analysis prevents miscalculation of break-even points.

Using outdated information: Both market prices and business conditions change rapidly. Regular recalculation ensures margins remain valid.

Failing to account for taxes: After-tax cash flows and profits differ substantially from pre-tax figures. Use after-tax numbers for accurate analysis.

Neglecting qualitative factors: Numbers alone don’t capture management quality, competitive dynamics, or technological disruption. Quantitative margins should complement, not replace, qualitative assessment.

Takeaway: Accurate margin-of-safety calculations require careful data gathering, conservative assumptions, and regular updates as conditions change.

Margin of Safety vs Other Risk Metrics

Margin of safety doesn’t exist in isolation—it’s one of several tools investors and managers use to assess risk. Understanding how it relates to other metrics provides context for its strengths and limitations.

Margin of Safety vs. Beta

Beta measures a security’s price volatility relative to the overall market. A beta of 1.0 means the stock moves in line with the market; higher betas indicate greater volatility.

Key Differences:

| Aspect | Margin of Safety | Beta |

|---|---|---|

| Focus | Fundamental value vs. price | Price movement correlation |

| Time horizon | Long-term value protection | Short-term price volatility |

| Calculation basis | Business fundamentals | Historical price data |

| Risk type | Permanent capital loss | Temporary price fluctuation |

| Investor type | Value investors | Modern portfolio theorists |

Complementary Use: A stock can have high beta (volatile prices) but a large margin of safety (undervalued fundamentals). Value investors prioritize margin of safety; traders focus on beta. Investopedia

Margin of Safety vs Margin of Error

Margin of error quantifies the uncertainty range in statistical estimates, commonly used in surveys and scientific research.

Key Differences:

While both concepts involve buffers against uncertainty, the margin of error measures statistical confidence intervals, whereas the margin of safety measures the gap between value and price or between actual and break-even performance.

Margin of error tells you how precise your measurement is; margin of safety tells you how much room for error you have in your decision.

Margin of Safety vs Operating Leverage

Operating leverage measures how sensitive operating income is to changes in sales volume. High operating leverage means small sales changes produce large profit swings.

Relationship:

Companies with high operating leverage (high fixed costs relative to variable costs) typically have lower margins of safety. As a result, their profitability is more vulnerable to sales declines.

Conversely, businesses with low operating leverage (mostly variable costs) tend to have higher margins of safety because their break-even point is lower.

Example:

- Company A: 80% fixed costs, 20% variable costs → High operating leverage, low margin of safety

- Company B: 20% fixed costs, 80% variable costs → Low operating leverage, high margin of safety

Understanding this relationship helps managers make strategic decisions about cost structure and pricing.

Margin of Safety vs Sharpe Ratio

The Sharpe ratio measures risk-adjusted return by comparing excess return to volatility (standard deviation).

Key Differences:

Sharpe ratio evaluates past performance efficiency; margin of safety evaluates current valuation attractiveness. The Sharpe ratio asks, “How much return did I get per unit of volatility?” Margin of safety asks, “How much am I paying relative to true value?”

Modern portfolio theory emphasizes Sharpe ratios; value investing emphasizes margin of safety.

Takeaway: Margin of safety complements other risk metrics by focusing specifically on the gap between value and price or between actual and break-even performance, providing a unique perspective on downside protection.

Why Margin of Safety Matters

The margin of safety principle endures because it addresses fundamental challenges inherent in all financial decision-making: uncertainty, complexity, and the asymmetry between gains and losses.

Protection Against Valuation Errors

No valuation method produces perfect accuracy. Every estimate of intrinsic value involves assumptions about future growth, discount rates, competitive dynamics, and countless other variables.

Even sophisticated analysts using rigorous methodologies regularly misjudge value by 20-30% or more. The margin of safety acknowledges this reality by building error tolerance directly into the investment decision.

Example: If you estimate intrinsic value at $100 but purchase at $50 (50% margin), your estimate can be 50% too high, and you still break even. This mathematical cushion transforms uncertainty from a fatal flaw into a manageable risk.

Defense Against Unforeseen Events

Business environments constantly evolve in unpredictable ways. Technological disruption, regulatory changes, management mistakes, economic recessions, and competitive threats can damage even well-analyzed companies.

The margin of safety doesn’t prevent these events—it absorbs their impact. When unexpected problems reduce a company’s value by 20%, a 40% margin of safety still leaves you with a profitable investment.

As Warren Buffett observed: “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” However, buying wonderful companies at wonderful prices—with substantial margins of safety—provides the best of both approaches.

Alignment with Loss Aversion

Behavioral finance research confirms that losses hurt approximately twice as much as equivalent gains feel good. Losing $10,000 causes more pain than gaining $10,000 provides pleasure.

This psychological reality means preserving capital matters more than maximizing returns. A 50% loss requires a 100% gain just to break even—an asymmetry that makes downside protection critically important.

Margin of safety directly addresses this asymmetry by prioritizing capital preservation. The strategy accepts potentially lower returns in exchange for substantially reduced risk of permanent capital loss.

Competitive Advantage in Volatile Markets

During periods of market volatility, prices often deviate significantly from fundamental values. Panic selling creates opportunities to purchase quality assets at substantial discounts.

Investors who understand and apply margin of safety principles can capitalize on these dislocations. While others flee in fear, disciplined value investors deploy capital into securities trading far below intrinsic value.

This contrarian approach—buying when others sell—has generated exceptional long-term returns for investors like Benjamin Graham, Warren Buffett, and Seth Klarman.

Business Resilience

For operating companies, the margin of safety provides resilience against economic downturns and competitive pressures. Businesses with substantial margins can weather temporary sales declines without facing existential threats.

This stability enables:

Strategic patience: Management can focus on long-term value creation rather than short-term survival

Competitive positioning: The ability to maintain prices or invest in growth while competitors struggle

Stakeholder confidence: Employees, suppliers, and customers trust businesses with demonstrated stability

Financial flexibility: Banks and investors provide better terms to companies with proven resilience

Objective Decision Framework

Margin of safety transforms subjective judgment into quantitative analysis. Instead of vague notions of “cheap” or “expensive,” it provides specific numerical thresholds for decision-making.

This objectivity offers several advantages:

Reduces emotional bias: Numbers counteract fear and greed that cloud judgment

Enables comparison: Standardized metrics allow direct comparison across different opportunities

Creates accountability: Clear criteria make it possible to evaluate decision quality over time

Facilitates communication: Quantitative frameworks help teams align on investment criteria

Takeaway: Margin of safety matters because it directly addresses the core challenges of financial decision-making—uncertainty, unforeseen events, and the critical importance of avoiding permanent capital loss.

Practical Examples Across Different Scenarios

The margin of safety principle applies across diverse financial contexts. These examples illustrate how the concept works in practice.

Example 1: Stock Investment Analysis

Scenario: An investor analyzes a regional bank stock in March 2025.

Valuation Analysis:

- Book value per share: $45

- Normalized earnings per share: $5.00

- Historical P/E range: 10-15

- Conservative P/E estimate: 12

- Intrinsic value estimate: $5.00 × 12 = $60 per share

Market Price:

- Current trading price: $42 per share

Margin of Safety:

- Dollar margin: $60 – $42 = $18 per share

- Percentage margin: ($18 / $60) × 100 = 30%

Decision: The 30% margin of safety provides reasonable protection given the bank’s stable business model and predictable earnings. The investor purchases shares, knowing the valuation could be 30% optimistic and still break even.

Outcome Scenarios:

- If intrinsic value is accurate ($60), the investment offers 43% upside

- If the valuation is 20% too high (actual value = $48), still 14% upside remains

- If the valuation is 30% too high (actual value = $42), the investor breaks even

- Only if the valuation is >30% too high does permanent capital loss occur

Example 2: Business Expansion Decision

Scenario: A restaurant chain considers opening a new location in 2025.

Financial Projections:

- Fixed costs (rent, equipment, base staff): $300,000 annually

- Variable costs per meal: $8

- Average meal price: $20

- Contribution margin per meal: $12

Break-Even Analysis:

- Break-even meals = $300,000 / $12 = 25,000 meals annually

- Break-even meals per day = 25,000 / 365 = 68 meals daily

Demand Projection:

- Conservative estimate: 100 meals per day

- Annual sales: 100 × 365 = 36,500 meals

- Annual revenue: 36,500 × $20 = $730,000

Margin of Safety:

- Meal margin: 36,500 – 25,000 = 11,500 meals

- Percentage margin: (11,500 / 36,500) × 100 = 31.5%

Decision: The 31.5% margin means daily traffic could decline by nearly one-third (from 100 to 68 meals) before the location becomes unprofitable. This buffer provides adequate protection against slower-than-expected adoption, making the expansion viable.

Example 3: Dividend Stock Evaluation

Scenario: An investor seeks stable passive income through dividend investing.

Company Analysis:

- Annual dividend per share: $3.00

- Required return: 8%

- Dividend discount model value: $3.00 / 0.08 = $37.50

- Current market price: $28.00

Margin of Safety:

- Dollar margin: $37.50 – $28.00 = $9.50

- Percentage margin: ($9.50 / $37.50) × 100 = 25.3%

Additional Considerations:

- Current yield: $3.00 / $28.00 = 10.7%

- Dividend coverage ratio: 2.1x (earnings support dividend)

- 10-year dividend growth rate: 5% annually

Decision: The 25.3% margin of safety, combined with strong dividend coverage and growth history, suggests the stock offers both income security and capital appreciation potential. The investor allocates capital, knowing the dividend can be sustained even if business conditions deteriorate moderately.

Example 4: Manufacturing Cost Analysis

Scenario: A manufacturer evaluates profitability in a competitive market.

Current Situation (2025):

- Monthly fixed costs: $150,000

- Variable cost per unit: $15

- Selling price per unit: $25

- Contribution margin: $10 per unit

- Break-even units: $150,000 / $10 = 15,000 units monthly

- Actual production: 22,000 units monthly

Margin of Safety:

- Unit margin: 22,000 – 15,000 = 7,000 units

- Percentage margin: (7,000 / 22,000) × 100 = 31.8%

Competitive Threat:

A competitor announces a 15% price reduction. Management evaluates response options:

Option A: Match price reduction

- New price: $21.25

- New contribution margin: $6.25

- New break-even: $150,000 / $6.25 = 24,000 units

- Current production: 22,000 units

- Result: Negative margin (below break-even)

Option B: Reduce costs

- Target variable cost: $13 per unit

- Contribution margin at $25: $12

- New break-even: $150,000 / $12 = 12,500 units

- Margin of safety: (9,500 / 22,000) = 43.2%

Decision: The margin of safety analysis reveals that matching competitor prices eliminates profitability, while cost reduction improves the safety margin. Management pursues efficiency improvements rather than price cuts.

Example 5: Real Estate Investment

Scenario: An investor evaluates a rental property in 2025.

Property Analysis:

- Purchase price: $400,000

- Annual rental income: $36,000

- Annual expenses: $12,000

- Net operating income: $24,000

- Capitalization rate: $24,000 / $400,000 = 6%

Valuation:

- Market cap rate for similar properties: 5%

- Intrinsic value: $24,000 / 0.05 = $480,000

- Current asking price: $400,000

Margin of Safety:

- Dollar margin: $480,000 – $400,000 = $80,000

- Percentage margin: ($80,000 / $480,000) × 100 = 16.7%

Risk Assessment:

- If rental income declines 10%: NOI = $21,600, value = $432,000 (still above purchase price)

- If cap rates rise to 6%: Value = $400,000 (break-even)

- If both occur: NOI = $21,600, cap rate = 6%, value = $360,000 (10% loss)

Decision: The 16.7% margin provides moderate protection. The investor negotiates to $380,000, increasing the margin to 21%, then proceeds with the purchase.

Takeaway: Across investing, business operations, and financial planning, the margin of safety provides a quantitative framework for evaluating how much protection exists against adverse changes.

Limitations and Considerations

While the margin of safety is a powerful tool, it has limitations that users must understand to apply it effectively.

Subjectivity in Valuation

The margin of safety calculation depends entirely on the accuracy of intrinsic value estimates. Since valuation involves subjective assumptions about growth rates, discount rates, competitive advantages, and countless other variables, different analysts often reach dramatically different conclusions.

Challenge: Two investors analyzing the same stock might estimate intrinsic values of $50 and $100, leading to completely different margin of safety calculations at a $60 market price.

Mitigation: Use multiple valuation methods, stress-test assumptions, and err on the side of conservatism. Recognize that valuation is an art informed by science, not a precise calculation.

Opportunity Cost

Requiring large margins of safety means passing on many investment opportunities. While this protects against losses, it also limits participation in profitable investments.

Challenge: A stock trading at 80% of its intrinsic value (20% margin) might appreciate substantially, but investors requiring 40% margins miss the opportunity.

Mitigation: Balance margin requirements with opportunity availability. In expensive markets, slightly lower margins may be acceptable for exceptional businesses. In cheap markets, higher margins should be achievable.

Market Timing Implications

Margin of safety investing tends to be contrarian—buying when others sell and selling when others buy. This approach can result in extended periods of underperformance relative to market indices.

Challenge: During bull markets, stocks with adequate margins of safety become scarce. Value investors may hold cash for extended periods while growth stocks soar.

Mitigation: Maintain conviction in the long-term logic of the approach. Historical data shows that value investing outperforms over complete market cycles, even if it lags during speculative bubbles.

Static vs. Dynamic Analysis

Traditional margin of safety calculations represent a single point in time. However, both intrinsic values and market prices change continuously.

Challenge: A stock purchased with a 40% margin might see its intrinsic value decline due to competitive pressures, eliminating the safety buffer even if the price remains stable.

Mitigation: Regularly reassess both valuations and margins. Monitor business fundamentals to detect deterioration early. Be willing to sell when margins erode.

Industry-Specific Applicability

Margin of safety works best for stable, predictable businesses with tangible assets. It’s less effective for high-growth technology companies, biotech firms, or other businesses where value derives primarily from uncertain future developments.

Challenge: How do you calculate intrinsic value for a pre-revenue software startup or a pharmaceutical company awaiting FDA approval?

Mitigation: Recognize when the margin of safety analysis is inappropriate. For speculative investments, use different frameworks like option value theory or scenario analysis.

False Precision

Expressing margins as precise percentages (e.g., 27.3%) can create an illusion of accuracy that doesn’t reflect the underlying uncertainty.

Challenge: A calculated 30% margin might actually range from 10% to 50% depending on assumption variations.

Mitigation: Think in ranges rather than point estimates. Consider “adequate margin” vs. “inadequate margin” rather than fixating on specific percentages.

Behavioral Challenges

Even with clear margin of safety criteria, investors often struggle to execute the strategy due to psychological factors:

Fear: Buying when stocks are cheap often means buying during market panics when fear is intense

Impatience: Waiting for adequate margins requires patience that many investors lack

Regret: Watching stocks appreciate without you after passing due to insufficient margins causes regret

Mitigation: Establish clear investment criteria in advance. Maintain a watchlist of quality companies and predetermined purchase prices. Focus on process rather than outcomes.

Not a Complete Investment Strategy

Margin of safety addresses valuation and risk, but doesn’t encompass all aspects of successful investing:

Portfolio construction: How many positions? What concentration levels?

Position sizing: How much capital per investment?

Selling discipline: When to exit profitable or deteriorating positions?

Tax efficiency: How to minimize tax drag on returns?

Mitigation: Integrate a margin of safety within a comprehensive investment framework that addresses these additional considerations.

Takeaway: Margin of safety is a powerful tool, but not a perfect one. An effective application requires understanding its limitations and combining it with other analytical frameworks and sound judgment.

How to Improve Your Margin of Safety

Both investors and business managers can take specific actions to increase their margins of safety, thereby reducing risk and improving long-term outcomes.

For Investors

1. Enhance Valuation Skills

The accuracy of your margin of safety depends on valuation quality. Invest time in learning:

- Multiple valuation methods: DCF, comparable company analysis, asset-based valuation

- Financial statement analysis: Understanding earnings quality and cash flow generation

- Industry dynamics: How competitive forces affect long-term profitability

- Economic moat assessment: Identifying sustainable competitive advantages

Resources like CFA Institute materials, investment courses, and books by Graham, Buffett, and Klarman provide foundational knowledge.

2. Expand Your Investment Universe

Margins of safety are easier to find in less-efficient markets:

- Small-cap stocks: Less analyst coverage creates pricing inefficiencies

- International markets: Emerging markets often offer better valuations than developed markets

- Out-of-favor sectors: Industries experiencing temporary challenges may offer opportunities

- Special situations: Spinoffs, bankruptcies, and restructurings can create dislocations

Broader search parameters increase the probability of finding adequate margins.

3. Develop Patience and Discipline

The ability to wait for the right opportunities is often more valuable than analytical skill:

- Maintain a watchlist: Track quality companies and predetermined purchase prices

- Build cash reserves: Having capital available when opportunities arise is essential

- Resist FOMO: Don’t abandon margin requirements because others are making money

- Think long-term: Focus on 5-10 year outcomes rather than quarterly performance

Warren Buffett famously said investing is like baseball, where there are no called strikes—you can wait for the perfect pitch.

4. Use Conservative Assumptions

Build conservatism into every valuation input:

- Growth rates: Use historical averages or below-market expectations

- Discount rates: Apply higher rates to riskier businesses

- Terminal values: Avoid assuming perpetual high growth

- Margin sustainability: Question whether current profitability is sustainable

This approach creates an implicit additional margin beyond the explicit calculation.

5. Diversify Appropriately

While the margin of safety reduces individual position risk, diversification provides portfolio-level protection:

- Multiple positions: Even with large margins, individual investments can fail

- Industry diversification: Avoid concentration in sectors facing systemic challenges

- Geographic diversification: Reduce country-specific risks

- Asset class diversification: Consider bonds, real estate, and other assets

The appropriate diversification level depends on conviction and margin size—larger margins justify higher concentration.

For Business Managers

1. Reduce Fixed Costs

Lower fixed costs directly improve the margin of safety by reducing the break-even point:

- Lease vs. buy: Consider leasing equipment to convert fixed costs to variable

- Outsourcing: Contract services rather than maintaining permanent staff

- Technology: Automate processes to reduce labor costs

- Flexible workspaces: Use co-working spaces or remote work to minimize real estate costs

Every dollar of fixed cost reduction improves the safety margin.

2. Increase Contribution Margins

Higher contribution margins (price minus variable costs) improve margins of safety:

- Premium positioning: Charge higher prices for differentiated products

- Cost efficiency: Negotiate better supplier terms or improve production efficiency

- Product mix: Emphasize higher-margin products and services

- Value-added services: Offer services that command premium pricing

A business with 50% contribution margins has twice the margin of safety as one with 25% margins, all else equal.

3. Diversify Revenue Streams

Multiple revenue sources reduce dependence on any single product or customer:

- Product diversification: Offer complementary products that appeal to different segments

- Customer diversification: Avoid excessive concentration in a few customers

- Geographic expansion: Enter new markets to reduce regional economic risk

- Recurring revenue: Develop subscription or maintenance revenue for stability

Diversified revenue is more stable and predictable, supporting larger margins of safety.

4. Build Strategic Reserves

Financial reserves provide a buffer against unexpected challenges:

- Cash reserves: Maintain 3-6 months of operating expenses in liquid assets

- Credit facilities: Establish lines of credit before you need them

- Inventory management: Balance efficiency with buffer stock for supply disruptions

- Capacity planning: Maintain some excess capacity for demand surges

These reserves complement the operational margin of safety with financial flexibility.

5. Monitor Leading Indicators

Early warning systems allow proactive response before margins erode:

- Sales pipeline: Track leading indicators of future revenue

- Customer satisfaction: Monitor metrics that predict retention

- Competitive intelligence: Stay informed about market changes

- Cost trends: Identify cost pressures before they impact profitability

Regular monitoring enables course corrections that preserve margins of safety.

Takeaway: Improving margin of safety requires both analytical skill and operational discipline, whether you’re investing capital or managing a business.

Margin of Safety in 2025: Current Market Context

Understanding how to apply margin of safety principles in current market conditions helps translate theory into practice.

Valuation Environment in 2025

As of 2025, equity markets present a mixed picture for value-oriented investors:

Large-cap growth stocks continue trading at elevated valuations, with many technology leaders showing price-to-earnings ratios above historical averages. Finding adequate margins of safety in this segment remains challenging.

Small and mid-cap value stocks offer more attractive opportunities, with many trading below historical valuation multiples despite solid fundamentals. Patient investors willing to look beyond headline indices can find reasonable margins.

International markets, particularly emerging markets, provide better value propositions than U.S. markets in many cases. Currency risks and geopolitical concerns have created pricing dislocations that disciplined investors can exploit.

Fixed income securities have become more attractive as interest rates have normalized from the near-zero levels of previous years, offering genuine return potential with defined risk parameters.

Sector-Specific Opportunities

Different sectors present varying margins of safety prospects:

Financial services: Regional banks and insurance companies often trade at discounts to book value, offering tangible asset support for valuations.

Energy: Despite long-term transition risks, many traditional energy companies generate substantial cash flows and trade at low multiples.

Consumer staples: Defensive characteristics make these stocks expensive during uncertain times, but occasional market rotations create opportunities.

Industrials: Cyclical nature means valuations fluctuate significantly, creating periodic opportunities for patient investors.

Technology: While many leaders are expensive, smaller software and semiconductor companies occasionally offer value.

Adapting to Market Conditions

Effective margin of safety investing in 2025 requires flexibility:

In expensive markets: Raise margin requirements, increase cash positions, and focus on exceptional businesses worth paying up for.

In volatile markets, Use price fluctuations to accumulate positions in quality companies at varying prices.

In cheap markets: Deploy capital aggressively when widespread fear creates broad-based opportunities.

In transitioning markets, Monitor whether what moves the stock market is shifting from growth to value or vice versa.

Technology and Information Advantages

Modern investors have access to tools that enhance margin of safety analysis:

Screening software: Quickly identify stocks meeting specific valuation criteria across global markets.

Financial databases: Access comprehensive historical data for trend analysis and valuation.

Analytical tools: Use spreadsheet models and specialized software for scenario analysis.

Information access: Real-time access to company filings, conference calls, and industry research.

These tools don’t replace judgment, but they enable more efficient identification and analysis of opportunities.

Long-Term Perspective

Despite short-term market fluctuations, the fundamental logic of margin of safety investing remains sound:

Markets periodically misprice securities, creating opportunities for disciplined investors. Why the stock market goes up over time—growing earnings and dividends—means buying at discounts to value produces superior long-term returns.

Economic cycles continue to create periods of fear and greed, generating the price dislocations that margin of safety investors exploit.

The increasing complexity of markets and proliferation of algorithmic trading may actually create more opportunities for patient, fundamental investors willing to think differently than machines.

Takeaway: While specific opportunities change with market conditions, the margin of safety principle remains relevant in 2025 and will continue to guide successful investors and managers in the future. Morningstar

📊 Margin of Safety Calculator

Calculate your investment or business margin of safety

Interpretation:

Interpretation:

Conclusion

Margin of safety stands as one of the most powerful concepts in both investing and business management. By quantifying the buffer between current conditions and the point where losses begin, it transforms abstract risk into measurable protection.

For investors, the margin of safety provides mathematical discipline that counteracts the emotional forces of fear and greed. Rather than chasing hot stocks or panicking during downturns, investors with clear margin requirements can make rational decisions based on the relationship between price and value. This approach has generated exceptional long-term returns for practitioners like Benjamin Graham, Warren Buffett, and countless other successful value investors.

For business managers, margin of safety offers a vital metric for assessing operational resilience. Understanding how far sales can decline before profitability disappears enables better strategic planning, risk management, and resource allocation. Companies with substantial margins can invest for the long term rather than constantly fighting for survival.

The beauty of the margin of safety lies in its simplicity. The core principle—create a buffer between where you are and where problems begin—applies universally across financial contexts. Whether you’re buying stocks, evaluating business projects, or planning production levels, asking “How much room for error do I have?” leads to better decisions.

As you apply margin of safety principles to your own financial decisions, remember several key points:

Conservatism beats optimism: Use conservative assumptions in all calculations. It’s better to pass on a good opportunity than to suffer permanent capital loss.

Patience pays: Adequate margins require waiting for the right opportunities. Resist the temptation to lower standards just to put money to work.

Continuous monitoring: Both valuations and business conditions change. Regular reassessment ensures your margins remain valid.

Integration with judgment: Numbers inform decisions but don’t replace judgment. Consider qualitative factors alongside quantitative margins.

Long-term perspective: Margin of safety investing sacrifices short-term performance for long-term capital preservation and growth. Stay focused on multi-year outcomes.

Your Next Steps

To implement the margin of safety principles in your financial life:

- For investors: Create a watchlist of quality companies, determine intrinsic values using conservative assumptions, and establish clear purchase prices that provide adequate margins. Review opportunities regularly and deploy capital when markets provide attractive entry points.

- For business owners and managers: Calculate your current margin of safety using the formulas provided. If it’s inadequate, develop specific action plans to reduce fixed costs, increase contribution margins, or grow sales. Monitor the metric monthly to track progress.

- For continued learning: Study the works of Benjamin Graham (The Intelligent Investor), Warren Buffett (Berkshire Hathaway shareholder letters), and Seth Klarman (Margin of Safety). These sources provide deeper insights into value investing philosophy and practice.

- For portfolio building: Explore smart ways to make passive income and consider how margin of safety principles apply to different income-generating strategies.

The margin of safety concept has guided successful investors and managers for over 75 years. Its enduring relevance stems from addressing fundamental aspects of financial decision-making: uncertainty, risk, and the asymmetry between gains and losses. By building protection directly into your investment and business strategies, you position yourself to weather inevitable storms and capitalize on opportunities others miss.

In the words of Warren Buffett: “Rule No. 1: Never lose money. Rule No. 2: Never forget Rule No. 1. Margin of safety is the mathematical expression of these rules—a quantitative framework that prioritizes capital preservation while creating the conditions for long-term wealth creation.

Start applying margin of safety principles today, and you’ll join a distinguished lineage of investors and managers who understand that the math behind money isn’t about maximizing returns—it’s about making smart moves that protect capital while allowing it to compound over time. SEC

About the Author

Written by Max Fonji, founder of TheRichGuyMath.com—a finance educator and investor who explains the “math behind money” in simple, actionable terms. With experience in investment strategy, personal finance, and wealth-building systems, Max helps readers understand how financial decisions create lasting results. His mission is to demystify complex financial concepts and empower individuals to make informed decisions that build sustainable wealth.

Connect with Max and explore more financial education resources at TheRichGuyMath.com.

Disclaimer

Disclaimer: The content on TheRichGuyMath.com is for educational purposes only and does not constitute financial or investment advice. Margin of safety calculations involve estimates and assumptions that may prove incorrect. Past performance does not guarantee future results. Always consult a qualified financial professional before making investment decisions or significant business changes. The examples provided are for illustration only and do not represent recommendations to buy or sell specific securities or implement particular business strategies