Imagine waking up on a Monday morning and choosing whether to go to work, not because you’re broke, but because you genuinely enjoy what you do. That’s the dream, right? The secret to making this a reality lies in understanding the fundamental difference between active vs passive income and how to strategically build both into your wealth-building plan. According to the IRS Passive Activity Rules, income is considered “passive” only when you’re not materially involved in the business or rental activity generating it.

Most people spend their entire lives trading time for money, never realizing there’s another way to earn. Whether you’re a fresh college graduate, a mid-career professional, or someone planning for retirement, understanding these two income streams can completely transform your financial future. Let’s break down what each type means, how they work, and most importantly, which one (or both!) deserves your attention in 2025.

Key Takeaways

- Active income requires continuous effort and time; if you stop working, you stop earning

- Passive income generates money with minimal ongoing effort after initial setup

- The wealthiest individuals combine both income types strategically

- Building passive income streams takes time, patience, and upfront investment

- Starting with active income to fund passive investments is the most practical path for beginners

What Is Active Income?

Active income is the money you earn by actively working for it. Think of your regular paycheck, freelance gigs, consulting fees, or hourly wages. It’s the most common form of income and the one most people rely on exclusively. As Investopedia explains, passive income typically comes from investments or ventures that require minimal ongoing effort after the initial setup.

Here’s the straightforward formula: Time + Effort = Money

When you work, you get paid. When you don’t work, the money stops flowing. Simple as that.

Common Examples of Active Income

- Salaries and wages from your 9-to-5 job

- Freelance income from projects you complete

- Commission-based earnings from sales

- Consulting fees for professional advice

- Tips and bonuses from service work

- Business income where you’re actively involved daily

The beauty of active income? It’s predictable and immediate. You know exactly how much you’ll earn based on your hours or projects. The downside? You’re essentially renting out your time, and there are only 24 hours in a day. Bureau of Labor Statistics

The Active Income Trap

Sarah, a talented graphic designer, was making $80,000 per year working 50+ hours weekly. Sounds great, right? But when she got sick for two weeks, her income dropped significantly. She realized she was trapped in what financial experts call the “time-for-money trap”; her income had a ceiling determined by her available hours.

This is why understanding why you should invest becomes crucial for anyone relying solely on active income.

What Is Passive Income?

Passive income is money earned with minimal ongoing effort after an initial investment of time, money, or both. It’s the holy grail of wealth building because it breaks the direct link between your time and your earnings. As Investopedia explains, passive income typically comes from investments or ventures that require minimal ongoing effort after the initial setup.

The formula looks different: Upfront Investment + Smart Systems = Ongoing Money

Common Examples of Passive Income

- Dividend stocks that pay you quarterly (learn about dividend investing)

- Rental properties generating monthly rent

- Royalties from books, music, or patents

- Digital products like courses or ebooks

- Affiliate marketing income from recommendations

- Index funds and ETFs are growing over time

- YouTube ad revenue from evergreen content

- High-yield savings accounts and bonds

The misconception? Passive income isn’t “do nothing and get rich.” It requires significant upfront work, capital, or both. But once established, these income streams can generate money while you sleep, vacation, or focus on other projects.

Active vs Passive Income: The Direct Comparison

Let’s break down the key differences in a way that makes the choice clearer:

| Factor | Active Income | Passive Income |

|---|---|---|

| Time Investment | Continuous, ongoing | Heavy upfront, minimal ongoing |

| Scalability | Limited by hours available | Highly scalable |

| Income Stability | Predictable and immediate | Unpredictable initially, stable long-term |

| Upfront Capital | Usually minimal | Often requires significant investment |

| Risk Level | Lower (regular paycheck) | Higher (no guaranteed returns) |

| Tax Treatment | Taxed at ordinary income rates | Often taxed at favorable rates |

| Flexibility | Requires your presence | Works without you |

| Skill Requirements | Job-specific skills | Investment knowledge, business acumen |

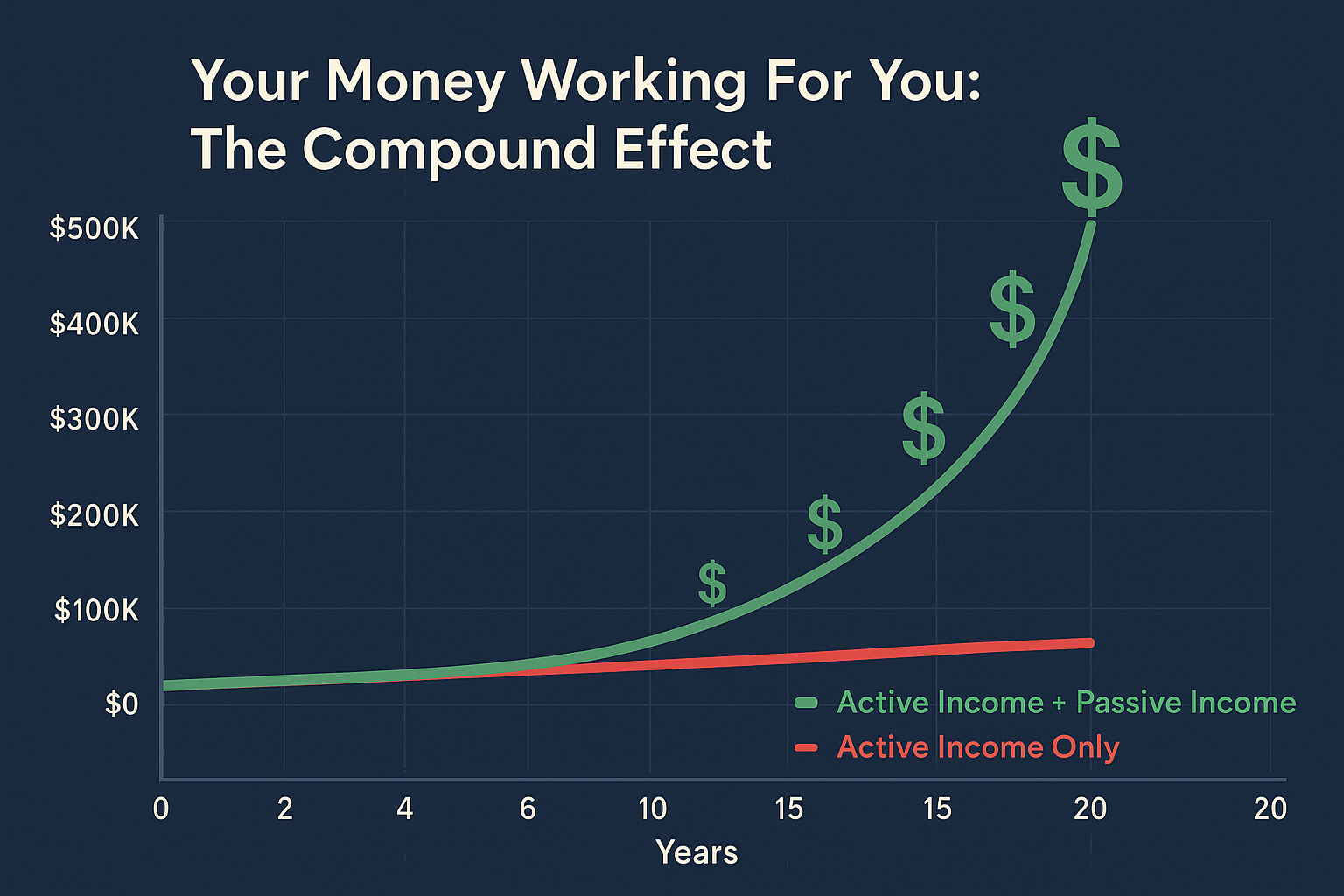

The Wealth-Building Truth: You Need Both

Here’s what the wealthy understand that most people miss: the question isn’t “active vs passive income,” it’s “how do I strategically build both?”

The reality is that most people start with active income and use it to fund passive income streams. Think of active income as the engine that gets your wealth-building car moving, and passive income as the cruise control that keeps it going with less effort.

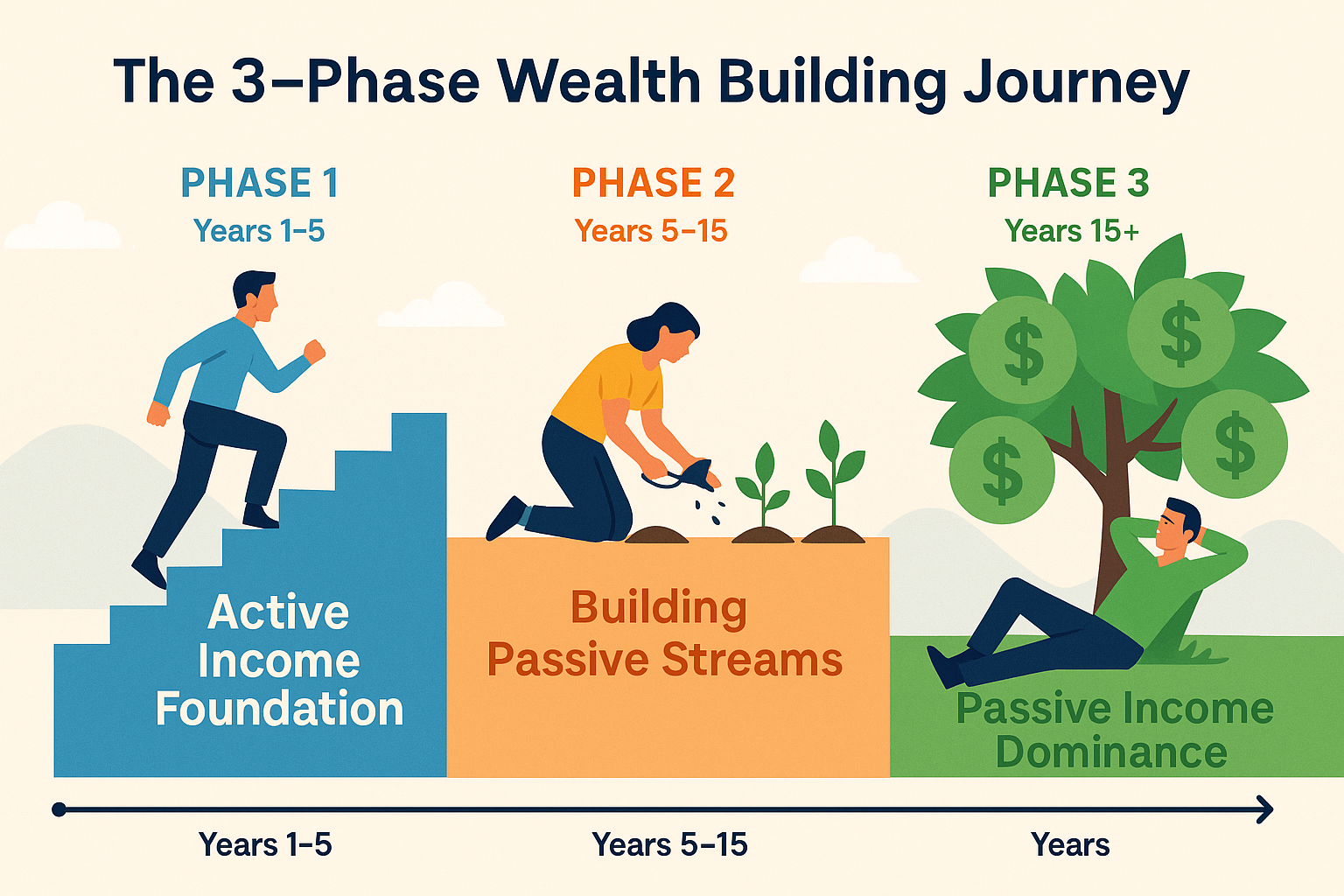

The Three-Phase Wealth Building Strategy

Phase 1: Active Income Foundation (Years 1-5)

Focus on maximizing your active income through career advancement, skill development, and side hustles. Save aggressively, aim for 20-30% of your income.

Phase 2: Passive Income Building (Years 5-15)

Use your active income savings to invest in passive income streams. Start with dividend stocks, index funds, or real estate. The goal isn’t to quit your job yet, but to build streams that supplement your income.

Phase 3: Passive Income Dominance (Year 15+)

Your passive income grows to match or exceed your active income. Now you have true financial freedom, you work because you want to, not because you have to.

Building Passive Income: Real Strategies for Beginners

Let’s get practical. Here are proven passive income strategies you can start implementing today:

1. Dividend Investing

Investing in dividend-paying stocks means owning pieces of companies that share their profits with shareholders. Companies like Coca-Cola, Johnson & Johnson, and Procter & Gamble have paid dividends for decades.

Getting Started:

- Open a brokerage account (Fidelity, Vanguard, or Charles Schwab)

- Start with dividend ETFs like VYM or SCHD for diversification

- Reinvest dividends to compound your returns

- Aim for a diversified portfolio of 15-20 dividend stocks

Understanding how the stock market works and why it tends to go up over time is essential before diving in.

2. Real Estate Investing

Rental properties can generate monthly cash flow, but they require significant capital and aren’t entirely passive (tenants call at 2 AM!).

Alternatives for Beginners:

- REITs (Real Estate Investment Trusts): Buy shares like stocks, receive rental income as dividends

- Real Estate Crowdfunding: Invest in properties with as little as $500

- House Hacking: Live in one unit, rent out others

3. Create Digital Products

Your knowledge is valuable. Package it into:

- Online courses teaching your expertise

- Ebooks on topics you know well

- Templates, spreadsheets, or tools that others can use

- Photography or design assets

The upfront work is significant, but once created, these products can sell indefinitely with minimal maintenance.

4. Index Fund Investing

This is arguably the most accessible passive income strategy. Index funds track the entire market, providing diversification and historically strong returns (averaging 10% annually over the long term).

Why Index Funds Work:

- Low fees (often under 0.1% annually)

- Automatic diversification across hundreds of companies

- Historically reliable growth over 10+ year periods

- Minimal time required (set it and forget it)

Check out smart moves for more investment strategies.

5. High-Yield Savings and Bonds 🏦

While returns are lower (3-5% in 2025), these options provide:

- Guaranteed returns

- FDIC insurance (for savings accounts)

- Zero market risk

- Perfect for emergency funds and short-term goals

The Risks Nobody Talks About

Let’s be honest, passive income isn’t a magic bullet. Here are the real risks:

Market Volatility

Your dividend stocks can lose value. Understanding the cycle of market emotions helps you avoid panic-selling during downturns.

Upfront Capital Requirements

Building meaningful passive income often requires $10,000-$50,000+ in initial investment. That’s why starting with active income is crucial.

Time to Profitability

Don’t expect passive income to replace your salary in year one. It typically takes 5-10 years of consistent investing to build substantial passive income streams.

The “Passive” Myth

Most passive income requires ongoing management, monitoring investments, updating digital products, and managing tenants. It’s “less active,” not “zero active.”

Scams and Get-Rich-Quick Schemes

If someone promises you can earn $10,000/month in passive income with no money and no work, run. Real passive income takes time and investment.

Tax Implications: Why Passive Income Often Wins

Here’s where passive income really shines: favorable tax treatment.

Active Income Taxes:

- Taxed at ordinary income rates (10%-37% federally in 2025)

- Subject to Social Security and Medicare taxes (7.65% for employees)

- Few deductions available for W-2 employees

Passive Income Taxes:

- Qualified dividends: Taxed at 0%, 15%, or 20% (usually lower than ordinary rates)

- Long-term capital gains: Same favorable rates as qualified dividends

- Rental income: Can offset with depreciation and expenses

- Municipal bond interest: Often tax-free

This tax efficiency means your passive income dollars go further than active income dollars at the same gross amount. Financial analysts at Morningstar note that dividend-paying stocks and real estate investment trusts (REITs) are among the most consistent sources of passive income.

The Psychological Shift: From Employee to Investor

Building passive income requires a fundamental mindset change. You’re no longer just an employee trading time for money; you’re becoming an investor who makes money work for you.

Marcus’s Story:

Marcus worked as a software engineer, making $120,000 annually. For five years, he lived on $60,000 and invested the rest in dividend stocks and index funds. By year seven, his passive income reached $2,000/month, enough to cover his rent. By year twelve, it hit $6,000/month, giving him the freedom to take a lower-paying but more fulfilling job. He didn’t quit working, but he gained the freedom to choose his work.

This shift from “what job pays the most” to “what work fulfills me” is the true power of passive income.

Common Mistakes to Avoid

1. Putting All Eggs in One Basket

Diversify across multiple passive income streams. Don’t invest everything in one stock or one rental property.

2. Ignoring Active Income Growth

While building passive income, don’t neglect your career. A 20% raise accelerates your passive income building significantly.

3. Expecting Overnight Results

Passive income is a marathon, not a sprint. Consistent investing over decades beats trying to time the market or find the “perfect” investment.

4. Not Educating Yourself

Understanding why people lose money in the stock market helps you avoid common pitfalls.

5. Lifestyle Inflation

As your active income grows, resist the urge to upgrade your lifestyle proportionally. Keep investing the difference.

Active vs Passive Income: Which Income Type Is Best for YOU?

The answer depends on where you are in your financial journey:

Choose to Focus on Active Income If:

- You’re early in your career with limited savings

- You have high-interest debt to pay off

- You lack emergency funds (3-6 months’ expenses)

- You’re developing valuable skills that increase earning potential

- You need an immediate, predictable income

Choose to Focus on Passive Income If:

- You have substantial savings ($10,000+) to invest

- Your active income exceeds your expenses comfortably

- You’re planning for retirement or financial independence

- You want location and time freedom

- You’ve maxed out your active income potential

The Ideal Strategy for Most People:

Maximize active income → Build an emergency fund → Pay off high-interest debt → Invest in passive income streams → Gradually shift balance toward passive income over time.

Your Action Plan: Getting Started This Month: Active vs Passive Income

Ready to begin? Here’s your 30-day roadmap:

Week 1: Assessment

- Calculate your current active income

- Track all expenses for one week

- Identify how much you can save monthly

- Set a passive income goal (be realistic, maybe $500/month in 5 years)

Week 2: Education

- Read about smart ways to make passive income

- Research different passive income strategies

- Choose 1-2 strategies that fit your situation

- Learn the basics of investing if you haven’t already

Week 3: Setup

- Open a brokerage account if you don’t have one

- Set up automatic transfers from checking to investment account

- Create a simple budget that prioritizes saving/investing

- Start your first investment (even if it’s just $100)

Week 4: Optimization

- Review your active income. Can you negotiate a raise, take on a side project, or develop new skills?

- Automate your investing so it happens without thinking

- Join online communities focused on passive income and investing

- Set quarterly check-ins to review progress

Remember, the best time to start was yesterday. The second-best time is today.

The Future of Income: Trends to Watch in 2025 and Beyond

The landscape of both active and passive income is evolving rapidly:

Remote Work Revolution

Active income is no longer tied to location, enabling people to earn U.S. salaries while living in lower-cost countries, accelerating passive income building.

Democratization of Investing

Fractional shares, micro-investing apps, and lowered barriers mean anyone can start building passive income with minimal capital.

AI and Automation

While AI threatens some active income sources, it also creates opportunities for new passive income streams (AI-generated content, automated businesses, algorithmic trading).

Creator Economy Explosion

Platforms like YouTube, Substack, and Patreon make it easier than ever to turn expertise into passive income through content creation.

Cryptocurrency and DeFi

While volatile and risky, crypto staking and decentralized finance offer new passive income opportunities (approach with caution and education).

Conclusion: Building Your Wealth with Both Income Streams

The active vs passive income debate isn’t about choosing one over the other; it’s about understanding how both fit into your wealth-building strategy. Active income provides the foundation, stability, and capital you need. Passive income provides the freedom, scalability, and long-term wealth that transform your financial life.

Think of it this way: active income is your shovel, and passive income is your garden. You use the shovel (active work) to plant seeds (investments), and over time, those seeds grow into a garden (passive income) that feeds you with minimal daily effort.

The wealthiest people aren’t necessarily those who earn the most—they’re the ones who’ve mastered the art of making their money work as hard as they do.

Your Next Steps:

- Calculate how much you can invest monthly from your active income

- Choose one passive income strategy to start with (dividend investing is beginner-friendly)

- Set up automatic investments so consistency happens without willpower

- Commit to learning for 30 minutes weekly about investing and wealth-building

- Review your progress quarterly and adjust as needed

The journey from active income dependence to passive income freedom takes time, but every dollar invested today is a soldier working for your financial future. Start small, stay consistent, and watch your wealth-building snowball grow.

For more insights on building wealth and making smart financial decisions, explore our comprehensive blog for beginner-friendly guides and strategies.

Disclaimer: This article is for educational and informational purposes only and should not be construed as financial advice. Investing involves risk, including the potential loss of principal. Past performance does not guarantee future results. Please consult with a qualified financial advisor before making investment decisions. The strategies discussed may not be suitable for all investors.

About the Author

Max Fonji is a financial educator and wealth-building strategist with over a decade of experience helping everyday people achieve financial independence. Through TheRichGuyMath.com, Max breaks down complex financial concepts into actionable strategies that anyone can implement. His mission is to democratize wealth-building knowledge and help readers escape the paycheck-to-paycheck cycle through smart investing and income diversification.

💰 Income Strategy Calculator

Discover your path to financial freedom