Picture this: You’re running a lemonade stand. You buy lemons, sugar, and cups on Monday, sell your lemonade on Saturday, but the neighbor kid who bought three cups doesn’t pay you until the following Wednesday. That gap between when you spent money and when you actually got paid? That’s the Cash Conversion Cycle in action, and it’s one of the most important metrics every business owner and investor needs to understand.

Whether you’re analyzing stocks, running a small business, or just trying to understand how successful companies manage their money, the Cash Conversion Cycle (CCC) reveals the truth about a company’s financial health that profit margins alone can’t show. A company might look profitable on paper but still run out of cash if it can’t convert its investments back into money quickly enough.

In this comprehensive guide, we’ll break down exactly what the Cash Conversion Cycle is, why it matters more than you might think, and how to calculate and improve it, all in plain English that anyone can understand. Corporate Finance Institute CCC

Key Takeaways

- The Cash Conversion Cycle measures how quickly a company converts its investments in inventory and other resources back into cash; the shorter, the better

- The CCC formula combines three key metrics: Days Inventory Outstanding (DIO), Days Sales Outstanding (DSO), and Days Payables Outstanding (DPO)

- A negative CCC is actually ideal, it means you’re getting paid before you have to pay your suppliers (like Amazon and Walmart do)

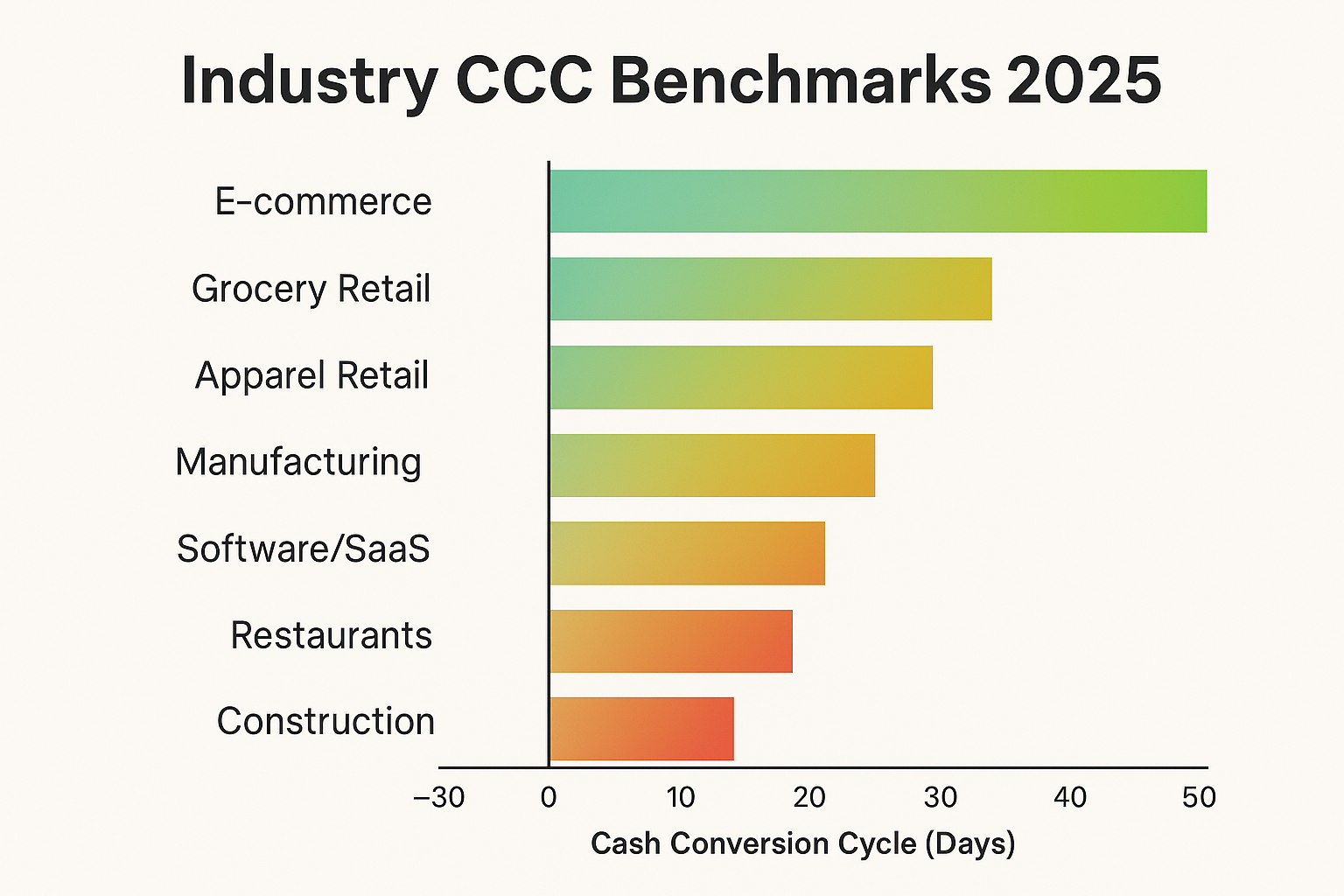

- Different industries have vastly different “normal” CCC ranges; retail and manufacturing companies typically have longer cycles than service businesses

- Improving your CCC directly improves cash flow, which is often more critical to business survival than profitability

What Is the Cash Conversion Cycle?

The Cash Conversion Cycle (also called the cash cycle or operating cycle) is a financial metric that measures how long it takes a company to convert its investments in inventory and other operational resources back into cash. Think of it as the time gap between when a business spends money and when it receives money from customers. Investopedia CCC

Here’s the simple version: The CCC tells you how many days your cash is tied up in the business before it comes back to you.

Why Should You Care About the Cash Conversion Cycle?

Cash flow problems kill more businesses than lack of profitability. You’ve probably heard the saying “cash is king”, and the Cash Conversion Cycle is the metric that proves it. A company can be profitable on paper but still go bankrupt if it runs out of cash to pay employees, suppliers, and bills.

Understanding the CCC helps you:

- Evaluate business efficiency: Companies with shorter cycles are generally more efficient at managing their operations

- Assess investment opportunities: When researching stock market investments, the CCC reveals which companies manage cash effectively

- Improve your own business: If you run a business, optimizing your CCC can free up cash for growth and reduce the need for expensive loans

- Understand financial health beyond profits: Revenue and profit don’t tell the whole story; cash flow does

Real-World Example: The Tale of Two Retailers

Let me share a story that illustrates why this matters. In the early 2000s, two electronics retailers, Best Buy and Circuit City, competed head-to-head. Both appeared profitable, but Circuit City had a much longer Cash Conversion Cycle. They paid suppliers quickly, held inventory longer, and collected from customers more slowly. Best Buy, meanwhile, optimized its cycle relentlessly.

When the 2008 financial crisis hit and credit dried up, Circuit City’s poor cash management left it unable to weather the storm. They filed for bankruptcy in 2009. Best Buy survived and thrived, partly because its superior Cash Conversion Cycle meant it had cash available when it needed it most.

This isn’t just ancient history; it’s a lesson that applies to every business and every investment decision you’ll ever make.

The Cash Conversion Cycle Formula: Breaking It Down

The Cash Conversion Cycle formula might look intimidating at first, but once you understand each component, it’s actually quite logical. Here’s the formula:

CCC = DIO + DSO – DPO

Where:

- DIO = Days Inventory Outstanding

- DSO = Days Sales Outstanding

- DPO = Days Payables Outstanding

Let’s break down each component so you understand exactly what you’re measuring.

Days Inventory Outstanding (DIO)

Days Inventory Outstanding measures how long, on average, a company holds inventory before selling it. The longer inventory sits on shelves or in warehouses, the longer your cash is tied up in unsold goods.

Formula:

DIO = (Average Inventory / Cost of Goods Sold) × 365What it means: If your DIO is 45 days, it takes an average of 45 days to sell your inventory after you acquire or produce it.

Lower is generally better because it means you’re turning inventory into sales quickly. However, extremely low DIO might indicate stock shortages that could hurt sales.

Days Sales Outstanding (DSO)

Days Sales Outstanding measures how long it takes to collect payment after making a sale. This is also called the “collection period.”

Formula:

DSO = (Average Accounts Receivable / Revenue) × 365What it means: If your DSO is 30 days, customers take an average of 30 days to pay their bills after purchase.

Lower is better because you want cash in hand quickly. High DSO means your money is stuck in accounts receivable; you’ve made the sale, but haven’t been paid yet.

Days Payables Outstanding (DPO)

Days Payables Outstanding measures how long a company takes to pay its suppliers and vendors.

Formula:

DPO = (Average Accounts Payable / Cost of Goods Sold) × 365What it means: If your DPO is 60 days, you take an average of 60 days to pay your suppliers after receiving goods or services.

Higher is actually better (to a point) because it means you’re holding onto your cash longer. However, taking too long to pay suppliers can damage relationships and credit terms.

Putting It All Together

Now let’s see how these three metrics combine into the Cash Conversion Cycle:

CCC = DIO + DSO – DPO

The logic is straightforward:

- Add the days your cash is tied up in inventory (DIO)

- Add the days waiting for customer payments (DSO)

- Subtract the days you get to delay paying suppliers (DPO)

The result tells you how many days your cash is tied up in operations.

Calculating the Cash Conversion Cycle: A Step-by-Step Example

Let’s walk through a practical example using a fictional company called “TechGadgets Inc.” to see how this works in practice.

TechGadgets Inc. Financial Data

Here’s what we know about TechGadgets for the year 2025:

| Financial Metric | Amount |

|---|---|

| Average Inventory | $500,000 |

| Cost of Goods Sold (COGS) | $2,000,000 |

| Average Accounts Receivable | $300,000 |

| Annual Revenue | $3,000,000 |

| Average Accounts Payable | $400,000 |

Step 1: Calculate DIO

DIO = (Average Inventory / COGS) × 365

DIO = ($500,000 / $2,000,000) × 365

DIO = 0.25 × 365

DIO = 91.25 daysTechGadgets holds inventory for about 91 days before selling it.

Step 2: Calculate DSO

DSO = (Average Accounts Receivable / Revenue) × 365

DSO = ($300,000 / $3,000,000) × 365

DSO = 0.10 × 365

DSO = 36.5 daysTechGadgets takes about 37 days to collect payment from customers.

Step 3: Calculate DPO

DPO = (Average Accounts Payable / COGS) × 365

DPO = ($400,000 / $2,000,000) × 365

DPO = 0.20 × 365

DPO = 73 daysTechGadgets takes about 73 days to pay its suppliers.

Step 4: Calculate CCC

CCC = DIO + DSO - DPO

CCC = 91.25 + 36.5 - 73

CCC = 54.75 daysTechGadgets has a Cash Conversion Cycle of approximately 55 days. This means that from the time they invest cash in inventory until they collect cash from customers, about 55 days pass.

Understanding Your CCC Results: What Do the Numbers Mean?

Now that you know how to calculate the Cash Conversion Cycle, what do the results actually tell you? The interpretation depends on the number itself and your industry context.

Positive CCC

A positive CCC (like our TechGadgets example of 55 days) means there’s a gap between when you pay for resources and when you get paid by customers. During this gap, you need working capital to keep operations running.

What it means:

- You’re funding operations with your own cash or borrowing

- The higher the number, the more cash you need tied up in operations

- Most businesses have positive CCCs; it’s normal, but shorter is better

Negative CCC

A negative CCC is actually the ideal situation. It means you’re getting paid by customers before you have to pay your suppliers.

What it means:

- You’re essentially funding operations with other people’s money

- You have strong negotiating power with suppliers

- Your business model is highly efficient from a cash perspective

Real-world example: Amazon has historically operated with a negative CCC. They collect money from customers almost immediately (online payments) but negotiate extended payment terms with suppliers. They’re using supplier money to fund operations, a beautiful position to be in!

Industry Benchmarks Matter

There’s no universal “good” or “bad” CCC number. Context is everything:

| Industry | Typical CCC Range | Why |

|---|---|---|

| Retail (Grocery) | 5-30 days | Fast inventory turnover, mostly cash sales |

| Retail (Apparel) | 60-120 days | Seasonal inventory, slower turnover |

| Manufacturing | 60-150 days | Long production cycles, complex supply chains |

| Technology/Software | 30-90 days | Lower inventory, but accounts receivable can be longer |

| Restaurants | Negative to 15 days | Immediate cash payments, delayed supplier payments |

When evaluating a company’s CCC, always compare it to:

- Industry peers (is it better or worse than competitors?)

- The company’s historical trend (is it improving or deteriorating?)

- The company’s business model (does the number make sense given how they operate?)

Why the Cash Conversion Cycle Matters for Investors

If you’re interested in dividend investing or searching for high dividend stocks, the Cash Conversion Cycle should be part of your analysis toolkit. Here’s why:

1. Cash Flow Reliability

Companies with shorter CCCs generate cash more quickly and reliably. This means they can:

- Pay dividends more consistently

- Fund growth without excessive borrowing

- Weather economic downturns better

- Invest in new opportunities quickly

When you’re building a passive income strategy through dividends, you want companies that can reliably generate the cash to pay those dividends.

2. Competitive Advantage Indicator

A company that maintains a significantly better CCC than its competitors likely has competitive advantages:

- Superior supplier relationships (better payment terms)

- Stronger brand power (customers pay faster or upfront)

- Operational excellence (more efficient inventory management)

- Better business model (structurally advantaged)

These advantages often translate into better long-term investment returns.

3. Warning Sign Detection

A deteriorating CCC can be an early warning sign of trouble:

- Rising DIO: Inventory piling up—are sales slowing?

- Rising DSO: Customers paying slower—are they struggling financially? Is the company loosening credit terms to boost sales?

- Falling DPO: Paying suppliers faster—are credit terms tightening because suppliers are worried?

Smart investors monitor CCC trends to spot problems before they show up in earnings reports.

4. Capital Efficiency

Companies with excellent CCCs need less capital to grow. They can:

- Reinvest profits more effectively

- Grow without constant equity dilutions or debt increases

- Generate higher returns on invested capital

This capital efficiency often correlates with superior stock performance over time, which is one reason why the stock market goes up for well-managed companies.

How to Improve Your Cash Conversion Cycle

Whether you’re running a business or analyzing investments, understanding how to improve the Cash Conversion Cycle gives you valuable insights. Here are proven strategies for each component:

Reducing Days Inventory Outstanding (DIO)

Goal: Sell inventory faster without stockouts

Strategies:

- Improve demand forecasting: Use data analytics to predict what will sell and when

- Implement just-in-time inventory: Order smaller quantities more frequently

- Eliminate slow-moving items: Identify and discount or discontinue products that sit too long

- Improve product mix: Focus on faster-turning items

- Enhance marketing: Better promotion drives faster sales

- Negotiate consignment arrangements: Let suppliers hold inventory until you need it

Reducing Days Sales Outstanding (DSO)

Goal: Collect payments faster

Strategies:

- Offer early payment discounts: “2/10 Net 30” (2% discount if paid within 10 days, otherwise due in 30)

- Tighten credit policies: More rigorous credit checks before extending terms

- Invoice immediately: Don’t delay billing after delivery

- Accept multiple payment methods: Make it easy for customers to pay

- Follow up promptly: Contact customers as soon as payments are late

- Require deposits or progress payments: Get partial payment upfront

- Switch to subscription models: Recurring automatic payments

Increasing Days Payables Outstanding (DPO)

Goal: Extend payment terms without damaging supplier relationships

Strategies:

- Negotiate better terms: Ask for 60 or 90-day terms instead of 30

- Build strong supplier relationships: Reliable, high-volume customers get better terms

- Pay on the last day: Don’t pay early unless there’s a meaningful discount

- Consolidate suppliers: Bigger orders with fewer suppliers = more negotiating power

- Explore supply chain financing: Programs that benefit both you and suppliers

- Maintain excellent credit: Better creditworthiness = better terms

The Balancing Act

Here’s the critical insight: Don’t optimize one component at the expense of others or your business relationships.

- Pushing too hard for extended payment terms might anger suppliers and result in worse pricing or service

- Being too aggressive in collections might drive away good customers

- Cutting inventory too lean might result in stockouts and lost sales

The goal is balanced optimization, improving your CCC while maintaining healthy business relationships and operational effectiveness.

Cash Conversion Cycle vs. Other Financial Metrics

The CCC doesn’t exist in isolation. Understanding how it relates to other financial metrics gives you a more complete picture of business health.

CCC vs. Cash Flow

Cash flow measures actual money moving in and out of the business, while CCC measures the time it takes for cash to complete the operating cycle.

- A company can have positive cash flow but a poor CCC (perhaps due to one-time events)

- A company can have a great CCC, but a temporary negative cash flow (seasonal businesses)

- Long-term, shorter CCC usually leads to better, more consistent cash flow

CCC vs Profitability

Profitability (profit margins, net income) measures how much you earn on each dollar of sales. CCC measures how quickly you can reinvest that dollar.

The relationship:

- High profitability + short CCC = excellent business (you earn well AND quickly)

- High profitability + long CCC = good business, but cash-intensive

- Low profitability + short CCC = volume business (thin margins but fast turnover)

- Low profitability + long CCC = struggling business (poor margins AND slow cash)

CCC vs Return on Equity (ROE)

Return on Equity measures how effectively a company uses shareholder money to generate profits. Companies with shorter CCCs often achieve higher ROE because they:

- Need less working capital

- Can reinvest profits more quickly

- Generate more “turns” of their capital

CCC vs Working Capital

Working capital (current assets minus current liabilities) is the absolute dollar amount available for operations. CCC measures how efficiently you use that working capital.

- Two companies with the same working capital can have vastly different CCCs

- A shorter CCC means you need less working capital to support the same level of sales

- Improving CCC can free up working capital for growth or reduce borrowing needs

SEC Guidance on Working Capital

Common Mistakes When Using the Cash Conversion Cycle

Even experienced analysts sometimes misinterpret or misuse the CCC. Avoid these common pitfalls:

1: Ignoring Industry Context

Comparing a grocery store’s CCC to a construction company’s makes no sense. Always compare within the same industry and understand the business model differences.

2: Looking at a Single Point in Time

One quarter’s or one year’s CCC doesn’t tell the full story. Look at:

- Multi-year trends (is it improving or deteriorating?)

- Seasonal patterns (many businesses have seasonal variation)

- Industry-wide changes (are all competitors seeing similar shifts?)

3: Focusing Only on the Total

The total CCC number matters, but so do the individual components. A company might have the same total CCC as a competitor but achieve it differently:

- Company A: Low DIO, high DSO, low DPO

- Company B: High DIO, low DSO, high DPO

These represent very different operational profiles and risk characteristics.

4: Assuming Shorter Is Always Better

While generally true, an extremely short CCC might indicate:

- Inventory shortages are harming customer satisfaction

- Overly aggressive collection practices are damaging customer relationships

- Strained supplier relationships from delayed payments

Balance matters.

5: Using Incorrect Data

Make sure you’re using:

- Average balances (not just end-of-period numbers) for inventory, receivables, and payables

- Consistent time periods (annual data with annual data, quarterly with quarterly)

- The right denominators (COGS for DIO and DPO, Revenue for DSO)

The Cash Conversion Cycle in Different Business Models

Different business models naturally produce different CCC patterns. Understanding these patterns helps you set realistic expectations and identify what’s normal versus concerning.

E-commerce and Online Retail

Typical CCC: Negative to 30 days

Characteristics:

- Often collect payment immediately (credit cards)

- May ship from supplier warehouses (dropshipping = low DIO)

- Can negotiate extended supplier terms due to volume

Example: Amazon’s negative CCC comes from immediate customer payments, efficient inventory management, and extended supplier payment terms.

Traditional Brick-and-Mortar Retail

Typical CCC: 30-90 days

Characteristics:

- Must hold inventory in stores

- Mix of cash and credit sales

- Seasonal fluctuations (holidays, back-to-school, etc.)

Challenge: Balancing enough inventory to prevent stockouts without tying up excessive cash.

Manufacturing

Typical CCC: 60-150+ days

Characteristics:

- Long production cycles

- Raw materials → work in progress → finished goods

- Often sell on credit terms to business customers

- Complex supply chains

Challenge: Long cycles require substantial working capital; improvements require operational excellence across the entire value chain.

Software and SaaS

Typical CCC: 30-90 days (or negative)

Characteristics:

- Minimal inventory (digital products)

- Subscription models often collect payment up front (monthly or annually)

- Operating expenses are paid monthly

Advantage: Recurring revenue models with upfront payment create very favorable cash dynamics.

Professional Services

Typical CCC: 30-60 days

Characteristics:

- No inventory

- Bill for time and expertise

- Collection period depends on client type (corporate clients are slower than individuals)

Challenge: DSO is the primary driver; managing receivables is critical.

Real-World Cash Conversion Cycle Examples

Let’s look at how some well-known companies manage their Cash Conversion Cycles:

Walmart: Retail Giant Efficiency

Walmart has historically maintained a negative CCC, which is remarkable for a traditional retailer.

How they do it:

- Extremely efficient inventory management: Sophisticated systems minimize DIO

- Mostly cash sales: Customers pay immediately, keeping DSO very low

- Supplier leverage: As the world’s largest retailer, they negotiate extended payment terms (high DPO)

This negative CCC is a massive competitive advantage, essentially allowing suppliers to finance Walmart’s operations.

Apple: Premium Brand Power

Apple typically maintains a negative to very low CCC despite being a manufacturer.

How they do it:

- Pre-orders and immediate payment: Customers often pay before products ship

- Just-in-time manufacturing: Minimal finished goods inventory

- Component contracts: Negotiate favorable terms with suppliers

- Retail stores: Many sales are cash/credit card (immediate payment)

Tesla: Manufacturing Challenges

Tesla has worked to improve its CCC but faces typical manufacturing challenges:

Their situation:

- High DIO: Building cars takes time; finished vehicles sit in inventory

- Low DSO: Many customers pay upfront or finance through partners

- Variable DPO: Depends on supplier relationships and cash position

As Tesla has matured, improving their CCC has been a key focus for generating sustainable positive cash flow.

Interactive Calculator

💰 Cash Conversion Cycle Calculator

Calculate how efficiently your business converts investments into cash

Advanced CCC Strategies for Business Owners

If you’re running a business and want to take your Cash Conversion Cycle optimization to the next level, here are some advanced strategies:

1. Segment Your Analysis

Don’t just calculate one overall CCC; break it down by:

- Product lines: Which products have the best/worst cycles?

- Customer segments: Which customers pay fastest? Which are slow?

- Geographic regions: Do different markets have different payment patterns?

- Seasonal periods: How does your CCC vary throughout the year?

This granular analysis reveals where to focus improvement efforts.

2. Implement Dynamic Pricing and Terms

Consider offering:

- Volume discounts for prepayment: Encourage customers to pay upfront for larger orders

- Tiered payment terms based on creditworthiness: Best customers get better terms

- Early payment discounts: 2% discount for payment within 10 days can significantly reduce DSO

- Penalties for late payment: Enforce terms consistently

3. Use Technology and Automation

Modern tools can dramatically improve your CCC:

- Inventory management systems: Real-time tracking prevents overstocking

- Automated invoicing: Bill immediately upon delivery

- Payment reminders: Automated follow-ups on overdue accounts

- Cash flow forecasting tools: Predict and manage working capital needs

- Supply chain software: Better coordination with suppliers

4. Build Strategic Relationships

Your CCC is partly determined by your relationships:

- Become a preferred customer: Reliable, high-volume buyers get better terms

- Offer value beyond payment: Help suppliers improve their business, and they’ll help you

- Communicate proactively: If you need extended terms, ask, don’t just pay late

- Pay critical suppliers on time: Prioritize relationships that matter most

5. Consider Financing Solutions

Sometimes, external financing can optimize your CCC:

- Supply chain financing: Third-party pays suppliers early, while you pay later

- Factoring: Sell receivables at a discount for immediate cash

- Inventory financing: Borrow against inventory to free up cash

- Line of credit: Bridge temporary gaps without disrupting operations

The key is using financing strategically, not as a permanent crutch for poor CCC management.

The Emotional Side of Cash Flow Management

Here’s something most finance articles won’t tell you: managing cash flow and the Cash Conversion Cycle isn’t just about numbers; it’s deeply emotional and stressful.

I once spoke with a small business owner named Maria who ran a successful boutique clothing store. On paper, her business was profitable. She had healthy margins and growing sales. But she was constantly stressed about money.

Why? Her Cash Conversion Cycle was killing her.

She’d buy inventory for spring fashion in January (cash out), it would arrive in February, sell through March and April, and she’d collect payment from credit card sales a few days later. But she’d already committed to summer inventory before spring fully sold through. She was always scrambling for cash, even though her business was “profitable.”

Once Maria understood her CCC and implemented some basic improvements, negotiating 60-day terms instead of 30-day terms with her suppliers, reducing her inventory orders to match actual sales patterns, and offering small discounts for immediate payment, her stress levels dropped dramatically. Her business didn’t become more profitable on paper, but she finally had breathing room.

The lesson: Understanding and improving your Cash Conversion Cycle isn’t just about financial efficiency; it’s about peace of mind and business sustainability. Much like understanding the cycle of market emotions helps investors make better decisions, understanding your cash cycle helps business owners sleep better at night.

Limitations and Considerations of the CCC

While the Cash Conversion Cycle is incredibly useful, it’s important to understand its limitations:

It’s a Backward-Looking Metric

The CCC tells you what happened in the past, not what will happen in the future. A company’s CCC can deteriorate quickly if:

- Market conditions change

- Competitors emerge

- Customer payment behaviors shift

- Supplier terms change

Always look at trends, not just current numbers.

It Doesn’t Account for Quality

A short DIO might mean efficient inventory management, or it might mean you’re cutting corners on quality or risking stockouts. A short DSO might mean efficient collections, or it might mean you’re only selling to cash customers and missing credit-worthy business opportunities.

Context matters.

Industry and Business Model Variations

The CCC can be misleading when comparing:

- Companies in different industries

- Different business models (B2B vs. B2C)

- Companies at different growth stages

- Companies in different geographic markets

Always compare apples to apples.

Seasonal Businesses Face Special Challenges

Retailers with heavy holiday sales, agricultural businesses, and construction companies in cold climates, these businesses have highly seasonal CCCs. An annual average might hide critical cash crunches during the off-season.

It Doesn’t Capture All Cash Flows

The CCC focuses on operational cash flow (inventory → sales → collections → payments). It doesn’t include:

- Capital expenditures

- Debt payments

- Dividend payments

- Tax obligations

- One-time expenses or income

For a complete picture, combine CCC analysis with comprehensive cash flow statements.

Putting It All Together: Your Action Plan

Understanding the Cash Conversion Cycle is just the first step. Here’s your action plan to put this knowledge to work:

For Investors

- Add CCC to your analysis toolkit: When researching stocks, calculate and compare the CCC of companies in the same industry

- Look for trends: Is the CCC improving or deteriorating over time?

- Compare to competitors: Which companies in the sector manage cash most efficiently?

- Consider it alongside other metrics: CCC + profitability + growth = complete picture

- Watch for warning signs: Rapidly deteriorating CCC can signal operational problems before they show up in earnings

Before you invest in the stock market, understanding how companies manage cash gives you an edge in identifying quality businesses.

For Business Owners

- Calculate your current CCC: Use the calculator above or create a spreadsheet

- Benchmark against competitors: Research industry averages or analyze public competitors

- Break down by component: Which part of your CCC needs the most improvement?

- Set improvement targets: Aim for realistic, incremental improvements

- Implement changes systematically: Don’t try to fix everything at once

- Monitor monthly: Track your progress and adjust strategies as needed

- Communicate with stakeholders: Help employees understand why these metrics matter

For Finance Students and Professionals

- Practice calculating CCC: Use real company financial statements

- Analyze case studies: Study how successful companies optimized their cycles

- Understand industry variations: Learn typical CCC ranges for different sectors

- Connect to other concepts: See how CCC relates to working capital, cash flow, and valuation

- Stay current: Follow how changing business models (subscription, platform, etc.) affect cash cycles

FAQ

The Cash Conversion Cycle (CCC) measures how long it takes a company to convert its investments in inventory and other resources into cash from sales. It tracks the time between when cash leaves the business (for inventory or production) and when it comes back in (from customer payments).

CCC helps investors and managers understand how efficiently a company manages working capital.

A shorter CCC means the company is quickly turning its investments into cash.

A longer CCC could signal cash flow problems or inventory inefficiencies.

Efficient CCC management improves liquidity, profitability, and operational health.

The standard formula is:

CCC = DIO + DSO – DPO

Where:

DIO (Days Inventory Outstanding) = How long inventory sits before being sold.

DSO (Days Sales Outstanding) = How long it takes to collect payment from customers.

DPO (Days Payables Outstanding) = How long a company takes to pay suppliers.

A negative CCC means the company collects cash from customers before paying its suppliers.

This is excellent for cash flow and is often seen in companies like Amazon or Walmart, which sell goods quickly and have strong supplier terms.

There’s no universal “good” CCC — it varies by industry.

Retailers and e-commerce companies often have low or negative CCCs.

Manufacturers or construction firms usually have longer CCCs due to production cycles.

Benchmark your CCC against industry averages from sources like Morningstar, Yahoo Finance, or SEC filings.

Companies can improve CCC by:

Reducing DIO: Faster inventory turnover.

Lowering DSO: Quicker collections from customers.

Increasing DPO: Negotiating longer payment terms with suppliers.

Using automation tools or efficient inventory systems can also help shorten the cycle.

Conclusion: Cash Is Still King

The Cash Conversion Cycle might seem like just another financial metric, but it’s actually one of the most revealing indicators of business health and operational excellence. While profit margins tell you if you’re making money on paper, the CCC tells you if you’re actually getting that money in hand when you need it.

Remember the core insight: It’s not just about how much money you make, it’s about how quickly you can make it, collect it, and reinvest it.

Whether you’re:

- An investor looking for quality companies that manage cash efficiently

- A business owner trying to improve operations and reduce financial stress

- A finance professional analyzing a company’s performance

- Someone learning about business fundamentals

…understanding the Cash Conversion Cycle gives you a powerful lens for evaluating financial health that goes beyond traditional profitability metrics.

The businesses that thrive long-term aren’t always the ones with the highest profit margins—they’re often the ones that master their cash cycles. They understand that smart financial moves include not just what you earn, but how efficiently you convert those earnings back into usable cash.

Start paying attention to the Cash Conversion Cycle in your own business or investment analysis. Calculate it, track it, and work to improve it. The companies and investors who master this metric have a significant advantage in building sustainable, cash-generating wealth.

Your Next Steps

- Calculate your own or a company’s CCC using the interactive calculator above

- Compare it to industry benchmarks to understand if it’s competitive

- Identify the biggest opportunity (DIO, DSO, or DPO) for improvement

- Implement one change this month to begin optimizing your cash cycle

- Track your progress and refine your approach over time

The journey to financial mastery, whether in business or investing built on understanding fundamentals like the Cash Conversion Cycle. Now you know. It’s time to put it into action.

Disclaimer

The information provided in this article is for educational and informational purposes only and should not be construed as financial, investment, or business advice. While we strive for accuracy, financial metrics and business conditions change over time. Always consult with qualified financial advisors, accountants, or business consultants before making significant financial or business decisions. Past performance and financial metrics do not guarantee future results. TheRichGuyMath.com and its authors are not responsible for any financial decisions made based on this content.

About the Author

Max Fonji is a financial educator and content strategist with over 15 years of experience helping individuals understand complex financial concepts. Through TheRichGuyMath.com, Max breaks down investing, business finance, and wealth-building strategies into clear, actionable guidance for beginners and experienced investors alike. His mission is to demystify finance and empower readers to make informed decisions about their money. When he’s not writing about finance, Max enjoys analyzing market trends, reading financial statements, and finding undervalued investment opportunities.