Picture this: You’ve just invested your entire life savings into a single stock because your neighbor swore it was the “next big thing.” Three months later, that company announces bankruptcy, and your dreams of early retirement vanish overnight.

This nightmare scenario happens more often than you’d think. According to research from the Federal Reserve, approximately 53% of American families own stocks, yet many lack proper diversification strategies, leaving them vulnerable to catastrophic losses.

Diversification isn’t just a fancy Wall Street buzzword; it’s your financial safety net. Think of it like this: if you’re carrying all your eggs in one basket and you trip, you lose everything. But if you spread those eggs across multiple baskets, a stumble might break a few eggs, but you’ll still have plenty left for breakfast.

In this comprehensive guide, we’ll explore how diversification works, why it’s crucial for protecting your hard-earned money, and practical strategies you can implement today, even if you’re just starting your investment journey. Fidelity – Guide to Diversification

Key Takeaways

- Diversification reduces risk by spreading investments across different asset classes, industries, and geographic regions

- The ideal portfolio typically includes a mix of stocks, bonds, real estate, and other assets based on your risk tolerance and timeline

- You can start diversifying with as little as $100 through index funds and ETFs

- Regular rebalancing (at least annually) ensures your portfolio stays aligned with your goals

- Over-diversification is possible; owning too many similar investments can dilute returns without reducing risk

What Is Diversification and Why Does It Matter?

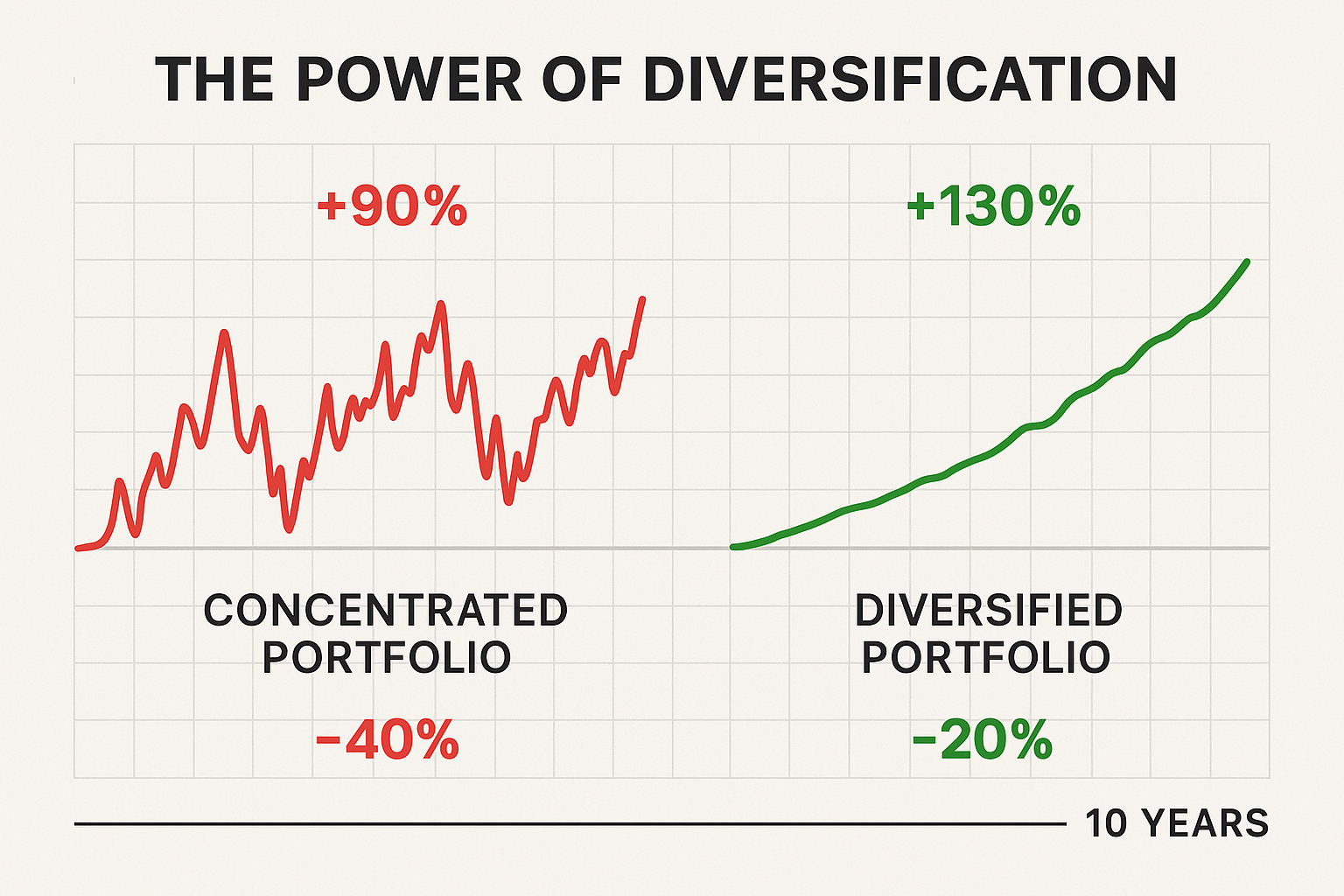

Diversification is the investment strategy of spreading your money across various financial instruments, industries, and categories to minimize the impact of any single investment’s poor performance on your overall portfolio.

Here’s the beautiful truth: diversification is the closest thing to a free lunch in investing. Nobel Prize-winning economist Harry Markowitz proved this through Modern Portfolio Theory in 1952, demonstrating that a well-diversified portfolio can achieve higher returns with lower risk than concentrated investments. Investopedia – Diversification

The Math Behind Diversification

Let’s break this down with a simple example:

Scenario A (No Diversification):

- You invest $10,000 in Company X

- Company X drops 50% due to industry disruption

- Your portfolio value: $5,000 (50% loss)

Scenario B (With Diversification):

- You invest $2,000 each in Companies X, Y, Z, W, and V

- Company X drops 50%, but Y gains 20%, Z gains 10%, W stays flat, and V gains 5%

- Your portfolio value: $9,700 (only 3% loss)

This simplified example shows how diversification cushions the blow when individual investments stumble. Understanding why people lose money in the stock market often comes down to a lack of proper diversification.

The Core Principles of Portfolio Diversification

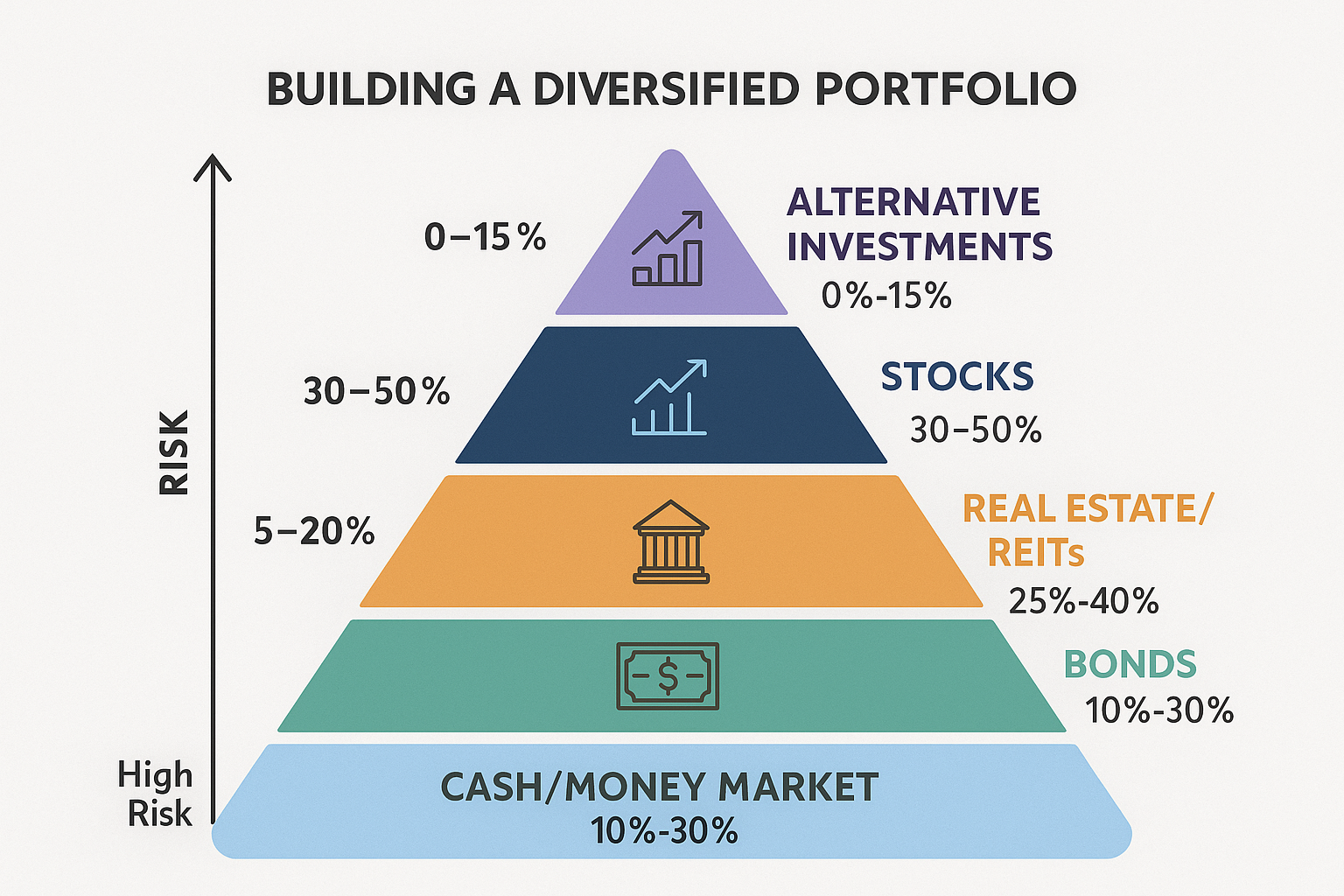

1. Asset Class Diversification

Different asset classes perform differently under various economic conditions. The main categories include:

| Asset Class | Risk Level | Potential Return | Best For |

|---|---|---|---|

| Stocks | High | High (10-12% avg) | Long-term growth |

| Bonds | Low-Medium | Moderate (3-5% avg) | Income & stability |

| Real Estate | Medium | Medium-High (8-10% avg) | Income & inflation hedge |

| Cash/Money Market | Very Low | Low (1-3% avg) | Emergency funds |

| Commodities | High | Variable | Inflation protection |

According to Morningstar research, a balanced portfolio of 60% stocks and 40% bonds has historically provided strong returns with manageable volatility over 20+ year periods.

2. Geographic Diversification

Don’t put all your money in your home country. International diversification protects against:

- Country-specific economic downturns

- Political instability

- Currency fluctuations

- Regional market crashes

A 2024 study by the Securities and Exchange Commission found that portfolios with 20-30% international exposure showed 15% less volatility during domestic market corrections.

3. Sector and Industry Diversification

The stock market consists of 11 major sectors:

- Technology

- Healthcare

- Financials

- Consumer Discretionary

- Consumer Staples

- Energy

- Utilities

- Real Estate

- Materials

- Industrials

- Communication Services

When tech stocks crashed in 2022, healthcare and energy sectors performed well, demonstrating why spreading investments across sectors matters.

4. Time Diversification (Dollar-Cost Averaging)

Investing the same amount regularly, regardless of market conditions, reduces the risk of buying everything at market peaks. This strategy, called dollar-cost averaging, is particularly effective for beginners.

Practical Diversification Strategies for Beginners

Strategy #1: The Index Fund Approach

What it is: Buying index funds that automatically track broad market indices like the S&P 500.

Why it works: Instant diversification across hundreds of companies with one purchase.

How to start:

- Open a brokerage account

- Invest in a total stock market index fund (like VTSAX or VTI)

- Add a total bond market index fund for stability

- Consider an international index fund for global exposure

Typical allocation for beginners:

- 70% Total U.S. Stock Market Index

- 20% Total International Stock Index

- 10% Total Bond Market Index

This simple three-fund portfolio provides exposure to thousands of companies worldwide with minimal effort.

Strategy #2: The Target-Date Fund Strategy

What it is: A single fund that automatically adjusts its asset allocation as you approach retirement.

Why it works: Professional management handles rebalancing and risk adjustment for you.

Best for: Hands-off investors who want simplicity.

These funds typically start aggressive (90% stocks) when you’re young and gradually shift to conservative (30% stocks) as retirement approaches.

Strategy #3: The Core-Satellite Approach

What it is: Building a “core” of index funds (70-80% of portfolio) and adding “satellite” positions in individual stocks or specialized sectors (20-30%).

Why it works: Provides stability through diversified core holdings while allowing targeted bets on high-conviction opportunities.

Example portfolio:

- Core (75%): Index funds covering U.S. stocks, international stocks, and bonds

- Satellite (25%): Individual high dividend stocks, REITs, or sector-specific ETFs

This strategy works well for investors who want to learn about dividend investing while maintaining a diversified foundation.

Strategy #4: Asset Allocation by Age

A classic rule of thumb: Subtract your age from 110 to determine your stock allocation percentage.

Example:

- Age 25: 85% stocks, 15% bonds

- Age 40: 70% stocks, 30% bonds

- Age 60: 50% stocks, 50% bonds

This approach automatically reduces risk as you approach retirement when you have less time to recover from market downturns. Morningstar – Diversification Strategies

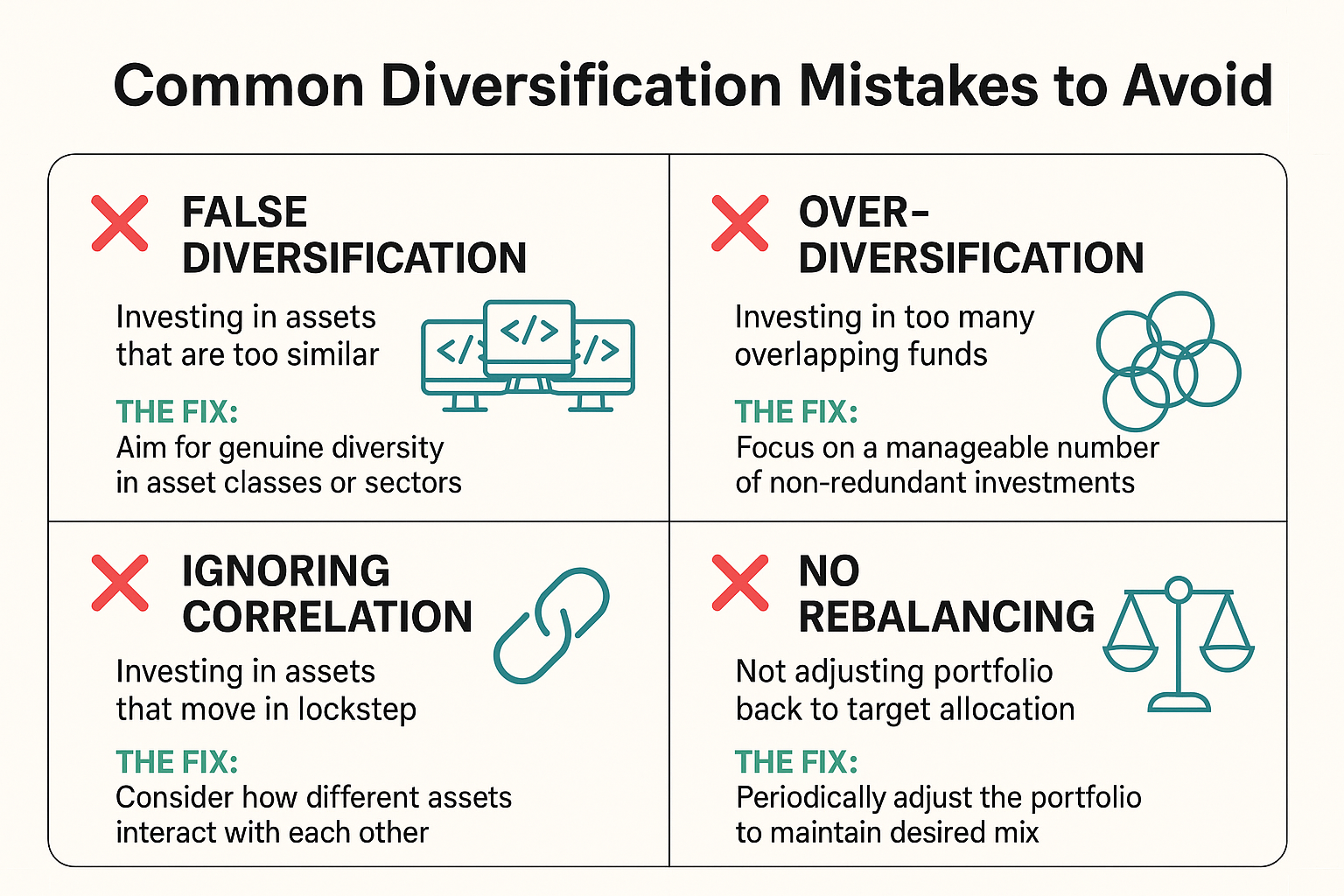

Common Diversification Mistakes to Avoid

Mistake #1: False Diversification

Owning 10 different technology stocks doesn’t provide real diversification. They’ll likely all fall together during a tech sector downturn.

The fix: Ensure your holdings span different sectors, asset classes, and geographies.

Mistake #2: Over-Diversification

Owning 200 individual stocks or 50 mutual funds creates “diversification”; too many holdings that dilute returns without meaningfully reducing risk.

The fix: Most investors achieve optimal diversification with 20-30 quality holdings or a handful of broad index funds.

Mistake #3: Ignoring Correlation

Some assets move together (high correlation), offering little diversification benefit. For example, large-cap U.S. stocks and large-cap international stocks often move similarly during global events.

The fix: Include truly uncorrelated assets like bonds, commodities, or real estate investment trusts (REITs).

Mistake #4: Set-It-and-Forget-It

Market movements cause your carefully planned allocation to drift. That 60/40 stock/bond split might become 75/25 after a bull market.

The fix: Rebalance at least annually by selling winners and buying underperformers to restore target allocations.

Mistake #5: Emotional Rebalancing

Selling everything during market crashes or going all-in during bubbles destroys diversification benefits. Understanding the cycle of market emotions helps you stick to your strategy.

The fix: Create a written investment policy statement and follow it regardless of market conditions.

Advanced Diversification Techniques

Alternative Investments

Once you’ve mastered basic diversification, consider these alternatives:

Real Estate Investment Trusts (REITs)

- Provide exposure to real estate without buying property

- Typically offer high dividend yields

- Low correlation with stocks and bonds

Commodities

- Gold, silver, oil, and agricultural products

- Hedge against inflation

- Historically negative correlation with stocks

Peer-to-Peer Lending

- Lend money directly to borrowers

- Higher yields than bonds

- Higher risk and less liquidity

Cryptocurrencies ₿

- Emerging asset class with high volatility

- Should represent only 1-5% of the portfolio for risk-tolerant investors

- Extremely speculative

Geographic Allocation Strategy

According to Vanguard research, optimal international exposure ranges from 20-40% of equity holdings:

- Developed Markets (15-25%): Europe, Japan, Australia, Canada

- Emerging Markets (5-15%): China, India, Brazil, South Korea

This geographic spread protects against U.S.-specific economic challenges while capturing global growth.

Building Your Personalized Diversification Plan

Step 1: Assess Your Risk Tolerance

Ask yourself:

- How would you react to a 30% portfolio decline?

- When do you need this money?

- What’s your investment timeline?

Conservative investors: Higher bond allocation, focus on stability

Aggressive investors: Higher stock allocation, focus on growth

Step 2: Define Your Investment Goals

Different goals require different strategies:

Goal: Retirement in 30 years

- Aggressive stock allocation (80-90%)

- Focus on growth

- Can weather volatility

Goal: House down payment in 3 years

- Conservative allocation (30-40% stocks)

- Capital preservation priority

- Lower risk tolerance

Goal: Passive income stream

- Dividend investing strategy

- A mix of dividend stocks and bonds

- Focus on yield and stability

Step 3: Choose Your Implementation Method

Option A: Do-It-Yourself

- Lower fees

- Complete control

- Requires time and knowledge

- Best for: Engaged learners willing to research

Option B: Robo-Advisors

- Automated diversification

- Low fees (0.25-0.50% annually)

- Professional algorithms

- Best for: Hands-off investors

Option C: Financial Advisor

- Personalized guidance

- Higher fees (1-2% annually)

- Comprehensive planning

- Best for: Complex situations or those wanting personal attention

Step 4: Monitor and Rebalance

Set calendar reminders to review your portfolio:

Quarterly: Quick check to ensure nothing catastrophic happened

Annually: Full review and rebalancing

Major life events: Reassess allocation (marriage, children, job change)

Real-World Diversification Success Story

Meet Sarah, a 32-year-old teacher who started investing in 2020 with $5,000. Initially, she put everything into three popular tech stocks because they were “hot.” When the tech correction hit in 2022, her portfolio dropped 45%.

Devastated but determined, Sarah educated herself on diversification. She restructured her portfolio:

- 50% Total U.S. Stock Market Index

- 20% International Stock Index

- 20% Bond Index

- 10% REIT Index

She also started contributing $300 monthly through dollar-cost averaging. During the 2022 market downturn, while her tech-heavy friends panicked, Sarah’s diversified portfolio only dropped 18%. By late 2024, she’d recovered completely and was up 22% overall.

The lesson? Diversification won’t prevent losses, but it makes them survivable and faster recovery. Sarah’s experience mirrors what many investors discover: smart moves in investing often mean protecting what you have, not just chasing returns.

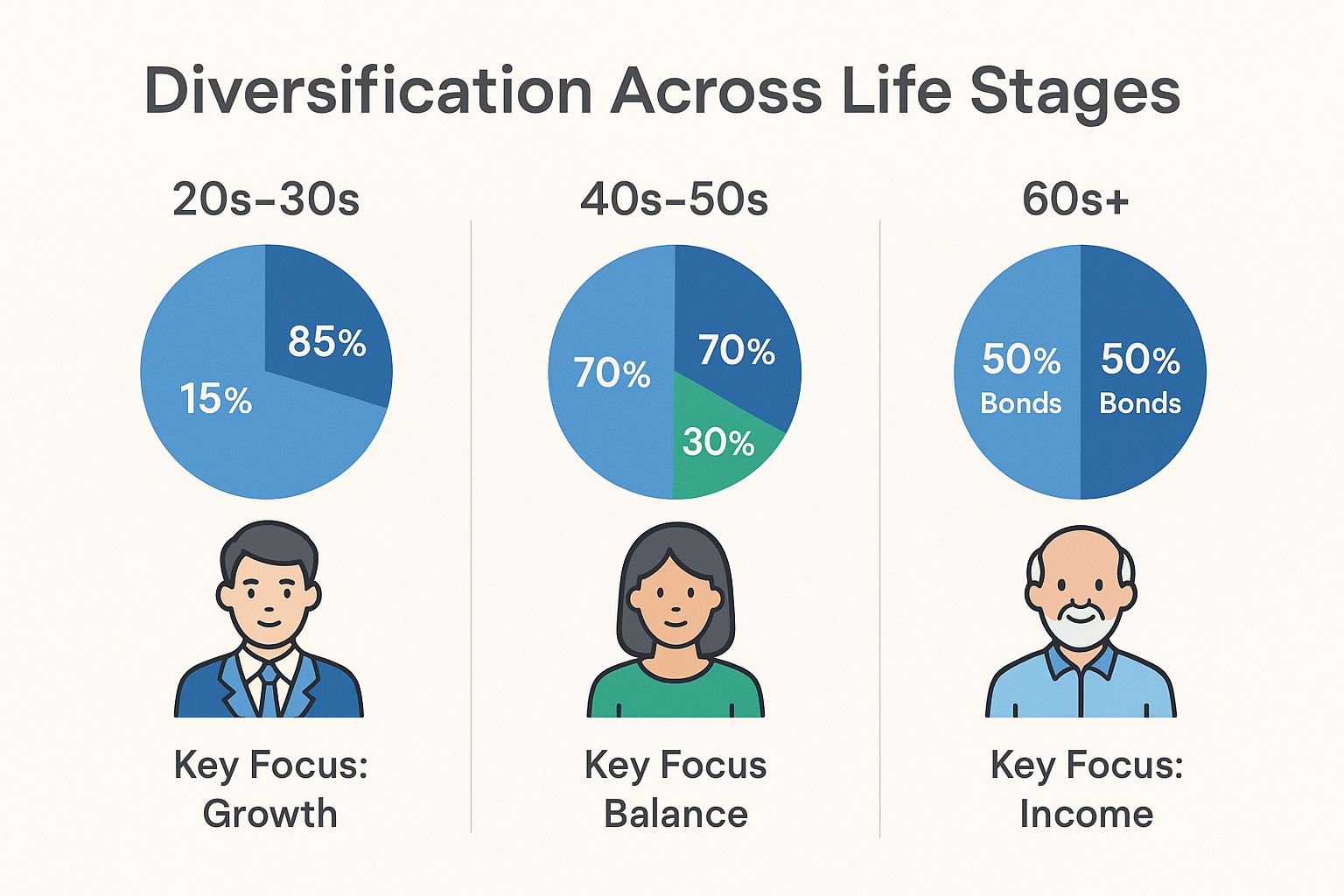

Diversification Across Different Life Stages

In Your 20s and 30s

Advantages: Long time horizon, can recover from downturns

Recommended allocation: 85-90% stocks, 10-15% bonds

Focus areas:

- Maximum growth potential

- Tax-advantaged retirement accounts

- Learning through experience

- Building an emergency fund alongside investments

Consider learning how to make your kid a millionaire by starting early with compound growth.

In Your 40s and 50s

Advantages: Peak earning years, established career

Recommended allocation: 70-80% stocks, 20-30% bonds

Focus areas:

- Balancing growth with stability

- Maximizing retirement contributions

- Paying down high-interest debt

- College savings for children

In Your 60s and Beyond

Advantages: Clear retirement timeline, accumulated wealth

Recommended allocation: 40-60% stocks, 40-60% bonds

Focus areas:

- Capital preservation

- Income generation

- Reduced volatility

- Estate planning

The Role of Bonds in Diversification

Many beginners overlook bonds, but they’re crucial for diversification. Here’s why:

Benefits of bonds:

- Provide a steady income through interest payments

- Less volatile than stocks

- Often move inversely to stocks (when stocks fall, bonds may rise)

- Preserve capital

Types of bonds to consider:

- Treasury bonds: Safest, backed by the U.S. government

- Corporate bonds: Higher yields, moderate risk

- Municipal bonds: Tax advantages for high earners

- Bond index funds: Instant diversification across bond types

According to Bureau of Labor Statistics data, portfolios with 30-40% bond allocation experienced 35% less volatility during the 2008 financial crisis compared to all-stock portfolios.

Tax-Efficient Diversification

Where you hold investments matters as much as what you hold:

Tax-Advantaged Accounts (401k, IRA, Roth IRA)

Best for:

- High-growth stocks (no taxes on gains until withdrawal)

- High-dividend stocks

- Bonds (interest taxed as ordinary income)

- REITs (distributions taxed as ordinary income)

Taxable Brokerage Accounts

Best for:

- Tax-efficient index funds

- Long-term buy-and-hold stocks (capital gains tax advantages)

- Municipal bonds (tax-free interest)

This strategic placement, called “asset location,” can save thousands in taxes over decades. Understanding why the stock market goes up over time makes tax-efficient strategies even more valuable.

Measuring Your Diversification Success

Key Metrics to Track

1. Portfolio Beta

- Measures volatility compared to the overall market

- Beta of 1.0 = moves with the market

- Beta < 1.0 = less volatile (well-diversified)

- Beta > 1.0 = more volatile (concentrated)

2. Correlation Coefficient

- Ranges from -1 to +1

- Assets with low/negative correlation improve diversification

- Goal: Hold assets with a correlation below 0.7

3. Sharpe Ratio

- Measures risk-adjusted returns

- Higher is better

- Compares your returns to the risk taken

- Well-diversified portfolios typically have higher Sharpe ratios

4. Maximum Drawdown

- Largest peak-to-trough decline

- Well-diversified portfolios have smaller maximum drawdowns

- Helps assess worst-case scenarios

You don’t need to calculate these manually—most brokerage platforms provide these metrics in portfolio analysis tools.

Diversification in Different Market Conditions

During Bull Markets

Challenges:

- Temptation to chase hot sectors

- Portfolio drift toward stocks

- Overconfidence

Strategies:

- Stick to the rebalancing schedule

- Take profits from winners

- Resist abandoning diversification

During Bear Markets

Challenges:

- Fear and panic

- Desire to sell everything

- Analysis paralysis

Strategies:

- Remember your long-term plan

- Rebalance by buying undervalued assets

- Focus on dividend income if applicable

- Review, but don’t abandon diversification

During Volatile Markets

Challenges:

- Emotional decision-making

- Whipsaw effect

- Media fear-mongering

Strategies:

- Reduce news consumption

- Focus on fundamentals

- Dollar-cost average through volatility

- Trust your diversification strategy

Creating Multiple Income Streams Through Diversification

Diversification isn’t just about asset types; it’s about income sources too. Consider building:

Investment Income:

- Dividend stocks

- Bond interest

- REIT distributions

- Rental property income

Active Income:

- Primary job salary

- Side business

- Freelance work

- Consulting

Passive Income:

- Royalties

- Automated online businesses

- Peer-to-peer lending returns

Explore various smart ways to make passive income to complement your investment diversification strategy.

The Psychological Benefits of Diversification

Beyond numbers, diversification provides peace of mind:

Better Sleep

Knowing that one bad investment won’t destroy your financial future reduces anxiety.

Reduced Decision Fatigue

A solid diversification plan eliminates constant second-guessing.

Emotional Stability

Smaller portfolio swings mean fewer emotional reactions and better decisions.

Long-Term Perspective

Diversification encourages patient, strategic thinking over reactive trading.

A 2023 study published in the Journal of Financial Planning found that investors with diversified portfolios reported 40% less financial stress than those with concentrated holdings.

Tools and Resources for Diversification

Portfolio Analysis Tools

Free Options:

- Personal Capital (portfolio tracker and analyzer)

- Morningstar X-Ray (fund overlap checker)

- Portfolio Visualizer (backtesting and optimization)

Brokerage Tools:

- Vanguard Portfolio Watch

- Fidelity Full View

- Charles Schwab Portfolio Checkup

Educational Resources

- SEC Investor.gov: Free, unbiased investment education

- Morningstar: Research and analysis on funds and stocks

- Investopedia: Comprehensive financial dictionary and tutorials

- TheRichGuyMath.com: Beginner-friendly guides on investing fundamentals

Recommended Reading

- “The Intelligent Asset Allocator” by William Bernstein

- “A Random Walk Down Wall Street” by Burton Malkiel

- “The Little Book of Common Sense Investing” by John Bogle

Frequently Asked Questions

Q: How many stocks do I need for proper diversification?

A: Research suggests 20-30 individual stocks across different sectors provide adequate diversification. However, a single total market index fund instantly diversifies across thousands of companies.

Q: Can you be too diversified?

A: Yes. Owning too many similar investments (over-diversification) increases costs and complexity without meaningfully reducing risk. Focus on quality over quantity.

Q: Should I diversify within my 401(k) even if it’s already in a target-date fund?

A: No. Target-date funds are already diversified. Adding other funds creates overlap and disrupts the intended allocation.

Q: How often should I rebalance?

A: Most experts recommend annually or when allocations drift 5-10% from targets. More frequent rebalancing increases trading costs without significant benefits.

Q: Is diversification still important in retirement?

A: Absolutely. Retirees may live 30+ years in retirement, requiring continued growth and inflation protection through diversified holdings.

Q: Do I need international stocks?

A: While not mandatory, international exposure (20-30% of stocks) provides geographic diversification and access to global growth opportunities.

Conclusion: Your Path to Diversification Success

Diversification isn’t complicated; it’s simply refusing to bet your entire financial future on one outcome. Whether you’re investing $100 or $100,000, spreading risk across different assets, sectors, and geographies protects your wealth while positioning you for long-term growth.

Remember these key principles:

✅ Start simple with index funds covering stocks and bonds

✅ Expand gradually as you learn and accumulate wealth

✅ Rebalance regularly to maintain target allocations

✅ Stay disciplined during market extremes

✅ Focus on what you control (costs, allocation, behavior) rather than market predictions

Your Action Steps Today

- Assess your current portfolio using the diversification principles outlined above

- Identify concentration risks in specific stocks, sectors, or asset classes

- Create a target allocation based on your age, goals, and risk tolerance

- Open accounts if needed (IRA, brokerage, etc.)

- Make your first diversifying investment this week, even if it’s just $50 in an index fund

- Set a calendar reminder for your annual portfolio review

The best time to diversify was when you made your first investment. The second-best time is today. Your future self will thank you for spreading risk and building a resilient portfolio that can weather any market storm.

Remember: investing success isn’t about hitting home runs with individual stocks—it’s about consistently getting on base through smart, diversified strategies that compound over decades. Start small, stay consistent, and let diversification do the heavy lifting.

📊 Portfolio Diversification Calculator

Analyze your investment allocation and get personalized recommendations

Your Current Allocation

Portfolio Analysis

💡 Recommendations

While the two terms are related, diversification and asset allocation are not identical.

Diversification refers to spreading investments across various assets—such as stocks, bonds, and real estate—to reduce exposure to any single risk.

Asset allocation, on the other hand, is the strategy of deciding how much of your portfolio should go into each asset class based on your goals and risk tolerance.

Think of asset allocation as the plan, and diversification as the execution of that plan.

Most experts recommend rebalancing your diversified portfolio at least once or twice a year, or whenever your asset mix drifts significantly (more than 5%) from your target allocation.

Rebalancing ensures that your portfolio stays aligned with your risk profile. For example, if stocks outperform bonds and now make up 70% instead of your target 60%, rebalancing brings it back in line.

Tip: Use automatic rebalancing tools offered by robo-advisors or brokerages to stay consistent without constant manual adjustments.

No, diversification can reduce but not eliminate risk.

It protects primarily against unsystematic risk, which is the risk specific to individual companies or sectors. However, it cannot shield you from systematic risk, such as recessions, inflation spikes, or market-wide downturns that affect nearly all assets. The goal of diversification is risk reduction, not risk elimination.

Yes, international diversification can help reduce overall portfolio volatility.

When you invest globally, your portfolio benefits from different economic cycles—for example, when U.S. markets are flat, emerging markets or European equities might perform better.

However, international investing also comes with additional currency risk, political risk, and tax implications.

A balanced approach might include 10–30% of your equity exposure in international assets, depending on your comfort level.

Diversification can both help and complicate tax efficiency.

By spreading your investments across taxable, tax-deferred, and tax-exempt accounts, you can optimize where you hold different asset types:

Tax-inefficient assets (like bonds or REITs) often belong in retirement accounts.

Tax-efficient assets (like index funds or ETFs) are better suited for taxable accounts.

The key is asset location, placing investments in accounts that minimize the overall tax drag while maintaining proper diversification.

Disclaimer

The information provided in this article is for educational purposes only and should not be considered financial advice. Investing involves risk, including the potential loss of principal. Past performance does not guarantee future results. Before making any investment decisions, consult with a qualified financial advisor who understands your specific situation, goals, and risk tolerance. The author and TheRichGuyMath.com are not registered investment advisors and do not provide personalized investment recommendations.

About the Author

Max Fonji is a financial educator and content strategist with over a decade of experience helping everyday investors build wealth through smart, evidence-based strategies. With a background in economics and a passion for making complex financial concepts accessible, Max has helped thousands of readers take control of their financial futures. When not researching investment strategies, Max enjoys hiking, reading behavioral economics books, and experimenting with new data visualization techniques.

Connect with Max and explore more beginner-friendly investing guides at TheRichGuyMath.com.