Picture this: It’s 2025, and you’re at a bustling Wall Street coffee shop. At one table, you see a sharply dressed banker pitching investment opportunities to clients. At another, an analyst is buried in spreadsheets, researching which companies to invest in. These two professionals represent opposite sides of the same financial coin, the sell side and the buy side. Understanding the difference between Sell Side vs Buy Side isn’t just insider knowledge; it’s essential for anyone looking to navigate the stock market or pursue a career in finance. Investopedia – Sell Side vs Buy Side

Whether you’re a beginner investor trying to understand who’s who in the financial ecosystem or someone curious about career paths in finance, this guide will break down everything you need to know about sell-side vs buy-side in simple, digestible terms.

Key Takeaways

- Sell-side firms create and sell investment products (investment banks, brokerages) while buy-side firms purchase and manage investments (hedge funds, mutual funds, pension funds)

- Sell-side professionals earn money through commissions and fees on transactions; buy-side professionals earn through performance-based compensation tied to investment returns

- Career paths differ significantly: sell side focuses on client relationships and deal-making; buy side emphasizes research and portfolio management

- The two sides work together symbiotically; the sell side provides opportunities and research, the buy side provides capital and demand

- Understanding this distinction helps investors recognize potential conflicts of interest and make smarter investment decisions

What Is the Sell Side?

The sell side of finance refers to the part of the financial industry that creates, promotes, and sells securities and investment products. Think of them as the “makers” and “sellers” in the investment marketplace.

Who Works on the Sell Side?

Sell-side institutions include:

- Investment banks (Goldman Sachs, Morgan Stanley, JPMorgan)

- Brokerage firms (Charles Schwab, Fidelity)

- Market makers and trading desks

- Research firms that produce equity research

What Do Sell-Side Professionals Do?

Sell-side professionals wear many hats, but their core functions include:

- Underwriting securities – Helping companies go public through IPOs or issue bonds

- Facilitating trades – Acting as intermediaries between buyers and sellers

- Providing research – Publishing reports and recommendations on stocks and bonds

- Market making – Providing liquidity by buying and selling securities

- Advisory services – Helping companies with mergers, acquisitions, and restructuring

“The sell side is where deals are born. We create the opportunities that the market invests in.” – Senior Investment Banker

How the Sell Side Makes Money

The sell side generates revenue primarily through:

- Transaction fees and commissions

- Underwriting fees (typically 3-7% of deal value)

- Spreads (the difference between buy and sell prices)

- Advisory fees for M&A and strategic consulting

The incentive structure here is important: sell-side firms make money when transactions happen, which can sometimes create conflicts of interest that investors should be aware of when understanding market dynamics.

What Is the Buy Side?

The buy side represents the portion of the financial industry that purchases and manages investments on behalf of clients or their own accounts. They’re the “buyers” who deploy capital into investment opportunities.

Who Works on the Buy Side?

Buy-side institutions include:

- Mutual funds (Vanguard, Fidelity, T. Rowe Price)

- Hedge funds (Bridgewater, Renaissance Technologies)

- Pension funds (CalPERS, Teacher retirement funds)

- Private equity firms (Blackstone, KKR, Carlyle Group)

- Insurance companies with investment portfolios

- Family offices managing wealth for ultra-high-net-worth individuals

What Do Buy-Side Professionals Do?

Buy-side professionals focus on:

- Investment research and analysis – Deep-diving into companies, industries, and economic trends

- Portfolio management – Deciding which securities to buy, hold, or sell

- Asset allocation – Determining the right mix of stocks, bonds, and alternative investments

- Risk management – Protecting portfolios from downside risks

- Performance optimization – Maximizing returns for clients or fund investors

The buy side is where the real investment decisions happen. These professionals are responsible for generating returns, which directly impacts their compensation and career trajectory.

How the Buy Side Makes Money

Buy-side compensation typically comes from:

- Management fees (usually 1-2% of assets under management annually)

- Performance fees (typically 20% of profits above a certain threshold for hedge funds)

- Carried interest (share of profits in private equity, usually 20%)

- Salary and bonuses tied to investment performance

Unlike the sell-side, buy-side firms succeed when their investments perform well over time, aligning their interests more closely with their clients, though understanding market emotions remains crucial for success.

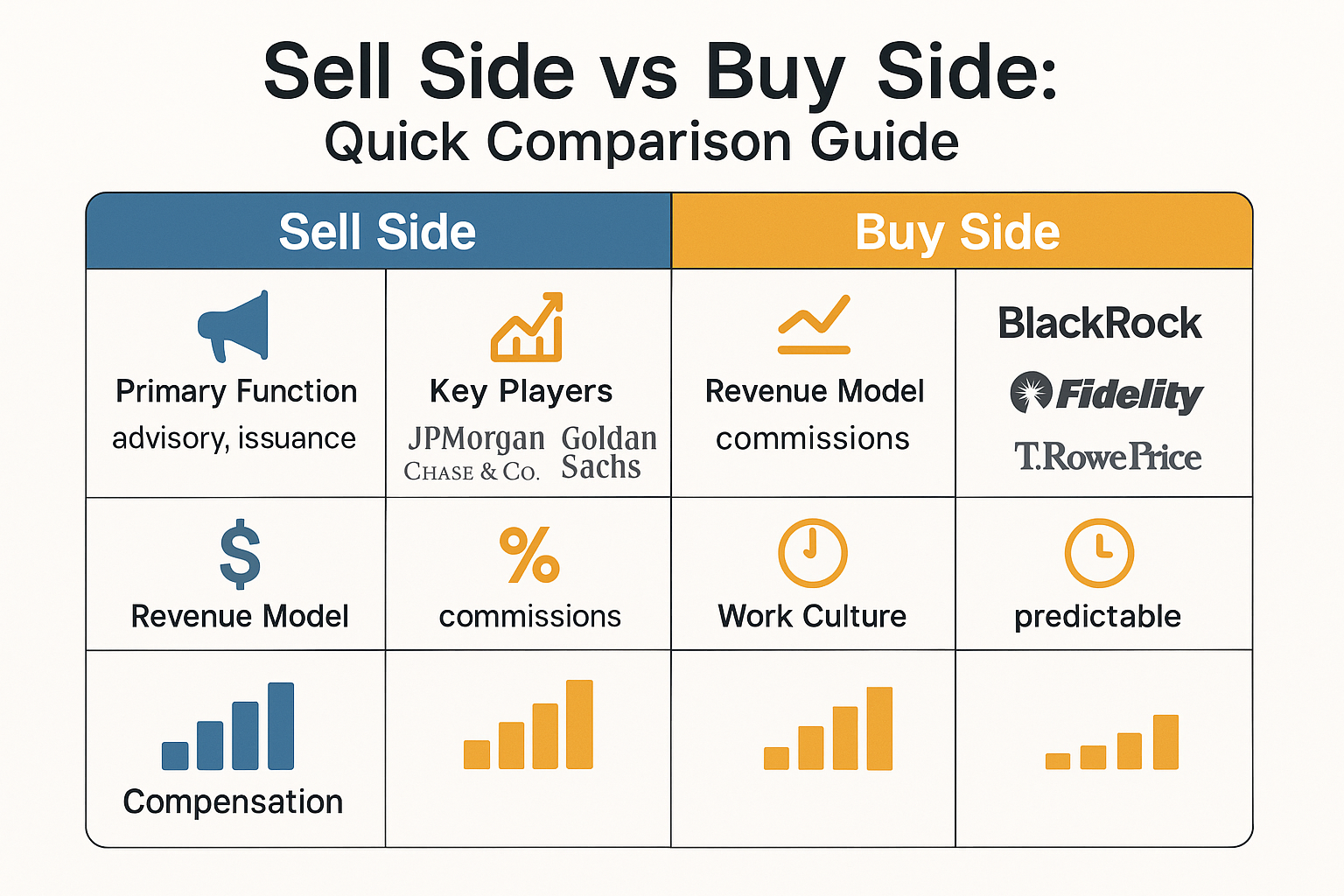

Sell Side vs Buy Side: The Key Differences

Let’s break down the fundamental differences between these two sides of finance:

| Aspect | Sell Side | Buy Side |

|---|---|---|

| Primary Function | Create and sell investment products | Purchase and manage investments |

| Main Clients | Corporations, governments, buy-side firms | Individual investors, institutions, pension beneficiaries |

| Revenue Model | Transaction fees, commissions, spreads | Management fees, performance fees |

| Time Horizon | Short-term (deal-focused) | Long-term (investment performance) |

| Work Culture | Fast-paced, client-facing, deal-driven | Research-intensive, analytical, portfolio-focused |

| Typical Hours | 80-100+ hours/week (banking) | 60-80 hours/week (varies by firm) |

| Career Progression | Analyst → Associate → VP → Director → MD | Analyst → Senior Analyst → Portfolio Manager → Partner |

| Compensation Structure | Base + bonus (deal-based) | Base + bonus (performance-based) |

Corporate Finance Institute (CFI) – Sell Side vs Buy Side Explained

The Relationship Dynamic

Here’s something fascinating: the sell side and buy side aren’t competitors—they’re partners in a financial ecosystem.

The sell side needs the buy side to purchase the securities they underwrite and to generate trading commissions. Without buyers, there’s no market.

The buy side needs the sell side to access deal flow, execute trades efficiently, and receive market research and insights.

It’s a symbiotic relationship, though one that requires investors to understand potential biases and conflicts of interest.

Career Paths: Sell Side vs Buy Side

Starting on the Sell Side

Many finance professionals begin their careers on the sell side, particularly in investment banking. Here’s why:

Advantages:

- Structured training programs

- Exposure to multiple industries and deal types

- Strong exit opportunities

- Prestigious brand names on your resume

- Clear career progression path

Challenges:

- Extremely long hours (100+ hour weeks are common)

- High-pressure environment

- Significant travel requirements

- Work-life balance can be challenging

Real Story: Sarah, a former investment banking analyst, recalls: “My first year at a bulge bracket bank was brutal. I once worked 36 hours straight on a merger pitch. But the skills I learned about financial modeling, deal structuring, and client management were invaluable. After two years, I transitioned to private equity with a much better work-life balance and higher compensation.”

Starting on the Buy Side

The buy side attracts professionals who love research, analysis, and investing:

Advantages:

- Direct involvement in investment decisions

- Performance-based compensation can be extremely lucrative

- Intellectually stimulating work

- Better work-life balance (relatively speaking)

- Satisfaction from investment performance

Challenges:

- Fewer entry-level positions

- Highly competitive recruitment

- Performance pressure (your track record follows you)

- Less structured career path

- Compensation is directly tied to market performance

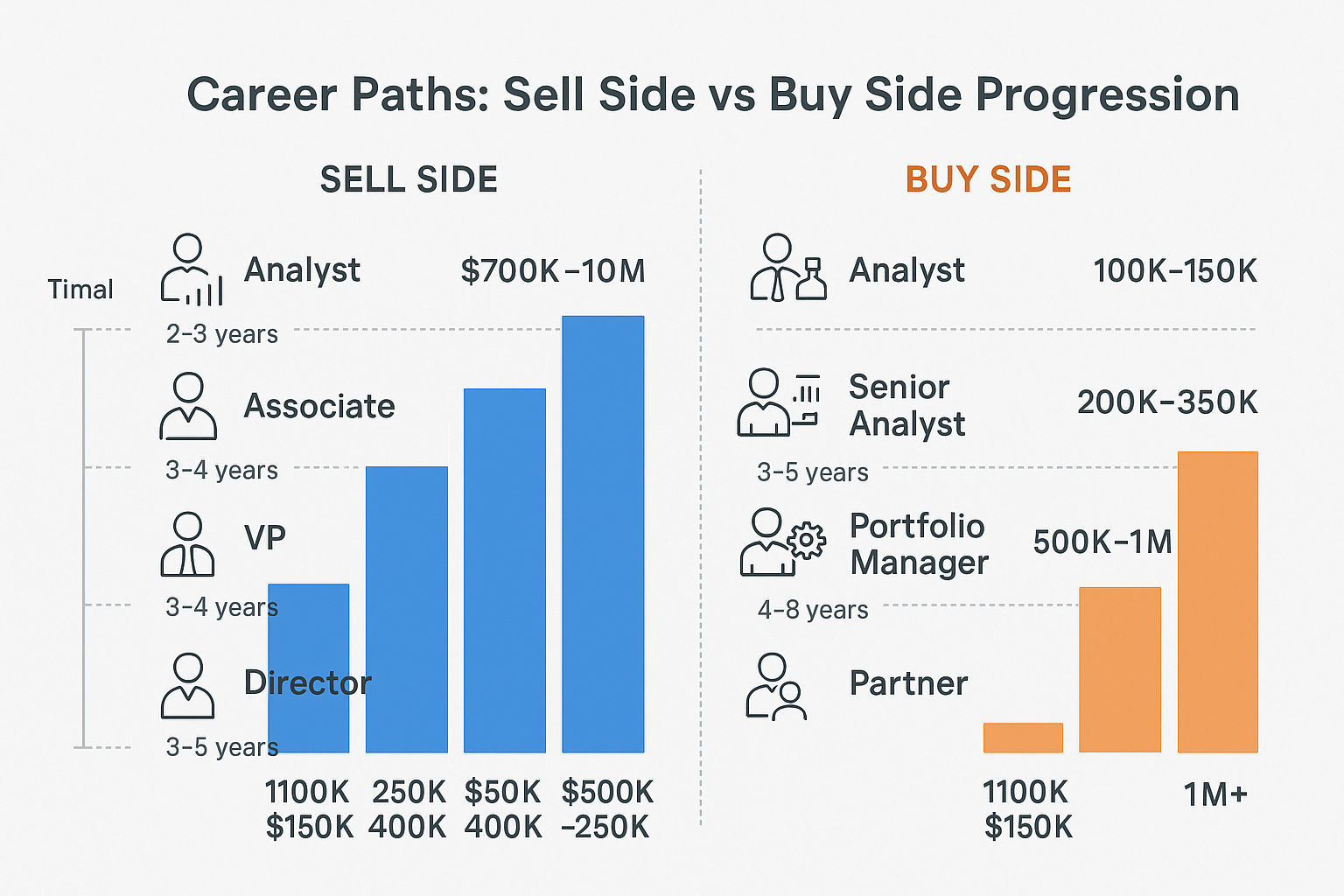

The Common Career Trajectory

Many professionals follow this path:

- Start: Investment banking analyst (sell side) – 2-3 years

- Move: Private equity or hedge fund analyst (buy side) – 3-5 years

- Advance: Senior analyst or portfolio manager – 5-10 years

- Peak: Partner, Managing Director, or start own fund – 10+ years

This trajectory leverages the training and network from the sell side while capitalizing on the potentially higher compensation and investment focus of the buy side.

Wall Street Prep – Sell Side vs Buy Side Roles and Careers

Research: Sell Side vs Buy Side Perspectives

One of the most interesting differences between the sell side and buy side is how they approach research.

Sell Side Research

Purpose: Generate trading commissions and support investment banking relationships

Characteristics:

- Publicly available (to clients)

- Broader coverage across many companies

- More optimistic bias (more “buy” ratings than “sell”)

- Focuses on catalysts and near-term events

- Supports deal-making and client relationships

Conflict of Interest: Sell-side analysts work for firms that also have investment banking relationships with the companies they cover. This can create pressure to issue favorable ratings. According to research, sell-side analysts issue “buy” recommendations about 50% of the time, “hold” 40%, and “sell” only 10%, even though not all stocks can be above average.

Buy Side Research

Purpose: Make profitable investment decisions

Characteristics:

- Proprietary (not shared publicly)

- Deeper, more focused analysis

- More balanced perspective (willing to short stocks)

- Focuses on long-term value and risks

- Drives actual investment decisions

Alignment: Buy-side analysts’ compensation depends on their investment recommendations performing well, creating better alignment with generating actual returns.

“When I moved from sell side to buy side research, the biggest difference was honesty. On the buy side, if a stock is overvalued, we say it—and we short it. On the sell side, you’d find creative ways to say ‘hold’ instead of ‘sell.'” – Former Equity Research Analyst

For investors learning about making smart investment moves, understanding this research bias is crucial.

Compensation: Following the Money

Let’s talk numbers, because compensation differs significantly between the sell side and the buy side.

Sell Side Compensation (2025)

Investment Banking:

- First-year analyst: $100,000-$125,000 base + $50,000-$75,000 bonus

- Third-year analyst: $125,000-$150,000 base + $100,000-$150,000 bonus

- Associate: $175,000-$250,000 base + $100,000-$300,000 bonus

- Vice President: $250,000-$350,000 base + $200,000-$500,000 bonus

- Managing Director: $300,000-$500,000 base + $500,000-$5,000,000+ bonus

Equity Research:

- Analyst: $85,000-$120,000 base + $30,000-$80,000 bonus

- Senior Analyst: $150,000-$250,000 base + $100,000-$300,000 bonus

Buy Side Compensation (2025)

Hedge Funds:

- Analyst: $100,000-$150,000 base + $50,000-$100,000 bonus (first year)

- Senior Analyst: $150,000-$300,000 base + $200,000-$1,000,000+ bonus

- Portfolio Manager: $200,000-$500,000 base + $500,000-$10,000,000+ (performance-dependent)

Private Equity:

- Analyst: $100,000-$150,000 base + $50,000-$100,000 bonus

- Associate: $150,000-$250,000 base + $100,000-$300,000 bonus

- Vice President: $250,000-$400,000 base + $300,000-$800,000 bonus

- Partner: $500,000+ base + carried interest (can reach tens of millions)

Mutual Funds:

- Analyst: $80,000-$120,000 base + $20,000-$60,000 bonus

- Portfolio Manager: $150,000-$500,000 base + $100,000-$2,000,000 bonus

The key difference? Sell-side compensation is more predictable and tied to seniority, while buy-side compensation has higher upside potential but is more variable and performance-dependent.

How Investors Should Think About Sell Side vs Buy Side

Understanding the sell-side vs buy-side distinction isn’t just academic; it has practical implications for your investment strategy.

Evaluating Sell Side Research

When you see a “strong buy” recommendation from a sell-side analyst:

- Check for conflicts – Does the firm have an investment banking relationship with the company?

- Look at the track record – How accurate have this analyst’s past recommendations been?

- Read the fine print – The detailed analysis often reveals concerns buried beneath the positive headline

- Compare multiple sources – Don’t rely on a single sell-side report

- Follow the money – Who benefits if you act on this recommendation?

Understanding Buy Side Behavior

The buy side’s actions often speak louder than the sell side words:

- 13F filings reveal what major hedge funds and institutions actually own

- Insider buying shows what company executives (the ultimate insiders) are doing

- Fund flows indicate where smart money is moving

For those interested in building passive income through dividend investing, tracking what quality buy-side funds own can provide valuable insights.

The Information Asymmetry

Here’s an uncomfortable truth: the sell side and buy side have better information, tools, and resources than individual investors. They get:

- Direct access to company management

- Proprietary research and data

- Advanced analytical tools

- Teams of specialists

But don’t let this discourage you. Individual investors have advantages too:

- No career risk from short-term underperformance

- Ability to hold investments indefinitely

- No pressure to deploy capital immediately

- Lower fee structures (keeping more returns)

- Can invest in areas too small for institutions

Understanding why people lose money in the stock market helps you avoid common pitfalls that even professionals fall into.

The Evolving Landscape in 2025

The sell-side vs buy-side distinction is evolving in several important ways:

Technology Disruption

- Algorithmic trading has reduced the need for traditional sell-side traders

- Robo-advisors are competing with traditional buy-side wealth managers

- AI and machine learning are changing how both sides conduct research

- Blockchain and DeFi may disintermediate some traditional functions

Regulatory Changes

- MiFID II in Europe has disrupted the traditional model of bundled research and trading

- Increased transparency requirements are reducing information advantages

- Fiduciary standards are aligning interests better with end investors

Fee Compression

Both sides face pressure:

- Passive investing is challenging for active buy side managers

- Commission-free trading has reduced sell side brokerage revenue

- Performance-based fees are becoming more common

Consolidation

The industry is consolidating:

- Smaller sell side research shops are closing

- Buy side firms are merging to achieve scale

- Multi-strategy platforms are becoming dominant

Despite these changes, the fundamental sell side vs buy side distinction remains relevant—though the specific roles and business models continue to evolve.

Practical Tips for Aspiring Finance Professionals

If you’re considering a career in finance, here’s how to think about sell side vs buy side:

Choose Sell Side If You:

- Thrive in fast-paced, deal-driven environments

- Enjoy client interaction and relationship building

- Want structured training and clear career progression

- Can handle extreme hours (at least initially)

- Value prestige and brand-name experience

Choose Buy Side If You:

- Love research, analysis, and investing

- Prefer deeper work over broader exposure

- Want direct involvement in investment decisions

- Are comfortable with performance-based compensation

- Value relative work-life balance (emphasis on “relative”)

Networking Strategies

For sell side positions:

- Target investment banking analyst programs

- Leverage university alumni networks

- Attend industry conferences and events

- Build relationships with recruiters

- Excel in financial modeling and PowerPoint

For buy side positions:

- Develop a track record (even with a personal portfolio)

- Demonstrate investment thesis development

- Network with buy side professionals (they hire less frequently)

- Consider starting sell side for training and transitions

- Master investment research and valuation

Skills That Matter on Both Sides

Regardless of which side you choose, these skills are essential:

- Financial modeling – Excel mastery is non-negotiable

- Valuation – DCF, comparable companies, precedent transactions

- Communication – Writing and presenting complex ideas clearly

- Industry knowledge – Deep understanding of specific sectors

- Work ethic – Both sides demand excellence and dedication

For those thinking about creating wealth for the next generation, understanding these career paths can inform educational and career guidance.

Common Misconceptions About Sell Side vs Buy Side

Let’s bust some myths:

Myth 1: “Buy Side Is Always Better”

Reality: It depends on your goals, personality, and career stage. Sell side offers better training early in your career and can be extremely lucrative at senior levels.

Myth 2: “Sell Side Research Is Worthless”

Reality: While conflicts exist, many sell side analysts provide valuable insights, particularly on smaller companies with limited coverage. The key is understanding the bias and using research appropriately.

Myth 3: “You Need an Ivy League Degree”

Reality: While top schools help, plenty of successful professionals come from state schools and non-traditional backgrounds. Skills, work ethic, and networking matter more than your diploma.

Myth 4: “Buy Side Has Better Work-Life Balance”

Reality: Both sides demand long hours. Buy side might have fewer all-nighters, but performance pressure can be equally intense. The stress is different, not necessarily less.

Myth 5: “The Sell Side Is Just Sales”

Reality: Sell side professionals, especially in investment banking and research, do sophisticated analytical work. It’s not just about schmoozing clients.

The Investor’s Perspective: Using This Knowledge

So, how does understanding sell side vs buy side make you a better investor?

1. Recognize Incentives

Always ask: “Who benefits if I act on this information?”

- A sell side broker recommending frequent trading? They earn commissions.

- A sell side analyst rating everything a “buy”? They maintain banking relationships.

- A buy side fund manager promoting their strategy? They attract assets and fees.

2. Diversify Information Sources

Don’t rely solely on:

- Sell side research (potential conflicts)

- Buy side marketing (they’re selling their fund)

- Financial media (they need clicks and viewers)

Instead, combine multiple sources and do your own analysis.

3. Follow the Smart Money (Carefully)

Tracking what successful buy side investors own can provide ideas, but remember:

- They have different time horizons than you

- Their position sizes and entry points differ from yours

- They may be exiting while you’re entering

- Past performance doesn’t guarantee future results

4. Understand Market Structure

Knowing that sell side market makers provide liquidity helps you:

- Use limit orders effectively

- Understand bid-ask spreads

- Time your trades better

- Avoid unnecessary transaction costs

5. Build Your Own Edge

The best investors develop their own analytical frameworks rather than depending entirely on sell side or buy side research. This might mean:

- Focusing on areas you understand professionally

- Developing expertise in specific industries

- Creating your own valuation models

- Building a long-term, patient approach

For those interested in identifying high-dividend stocks, combining sell-side research with your own analysis creates a powerful approach.

🔍 Sell Side vs Buy Side Interactive Comparison

Select a category to compare key differences

Real-World Examples: Sell Side and Buy Side in Action

Let’s bring these concepts to life with some real-world scenarios.

Example 1: The IPO Process

When a company like Airbnb decided to go public in 2020:

Sell Side Role:

- Morgan Stanley and Goldman Sachs (lead underwriters) worked with Airbnb to structure the offering

- They set the IPO price range, marketed the shares to institutional investors

- Their equity research teams published initial coverage after the IPO

- They earned approximately $100 million in underwriting fees

Buy Side Role:

- Fidelity, BlackRock, and other mutual funds evaluated whether to participate

- Their analysts built financial models to determine fair value

- They decided how many shares to purchase for their funds

- Their investment decisions determined whether the IPO was successful

Example 2: Merger Advisory

When Microsoft acquired Activision Blizzard for $69 billion in 2022:

Sell Side Role:

- Allen & Company advised Activision Blizzard

- They negotiated terms, structured the deal, and managed the process

- Investment bankers worked around the clock to close the transaction

- They earned substantial advisory fees (typically 0.5-1% of deal value)

Buy Side Role:

- Microsoft’s corporate development team (acting as the buy side) evaluated the strategic fit

- Private equity firms considered competing bids

- Hedge funds took positions based on merger arbitrage opportunities

- Institutional investors decided whether to tender their Activision shares

Example 3: Equity Research Impact

In 2021, when several sell-side analysts downgraded Tesla:

Sell Side Action:

- GLJ Research maintained a “sell” rating with a $67 price target (when the stock was at $800+)

- Their research cited valuation concerns and competition risks

- The firm faced criticism from Tesla supporters but stood by its analysis

Buy Side Reaction:

- Some hedge funds used the research to support short positions

- Other buy-side funds ignored the sell-side research, maintaining their Tesla holdings

- The divergence showed how buy-side managers make independent decisions

This example illustrates why understanding market emotions and behavior matters as much as fundamental analysis.

Regulatory Considerations and Conflicts of Interest

The sell-side vs buy-side distinction has important regulatory implications designed to protect investors.

Key Regulations

For Sell Side:

- Regulation FD (Fair Disclosure): Companies must disclose material information to all investors simultaneously, not just favored sell-side analysts

- FINRA Rules: Govern how sell-side firms can compensate analysts and separate research from investment banking

- Global Settlement (2003): Required Chinese walls between research and investment banking after conflicts led to inflated ratings during the dot-com bubble

For Buy Side:

- Investment Advisers Act: Requires fiduciary duty to clients

- 13F Filings: Large institutional investors must disclose holdings quarterly

- Insider Trading Laws: Both sides face strict penalties for trading on material non-public information

Managing Conflicts

Smart investors should:

- Read disclosures – Sell-side research includes disclaimers about potential conflicts

- Diversify sources – Don’t rely on a single analyst or firm

- Follow actions, not words – What institutions actually buy matters more than what they recommend

- Understand incentives – Remember who pays whom and how

The Future of Sell Side vs Buy Side

As we move through 2025 and beyond, several trends are reshaping both sides:

Trend 1: Technology Integration

Artificial Intelligence and Machine Learning are transforming both sides:

- Sell-side firms use AI for trade execution and client matching

- Buy-side funds employ machine learning for pattern recognition and alpha generation

- Both sides face competition from purely algorithmic strategies

Trend 2: Fee Compression

Pressure on Fees continues:

- Passive investing has forced active buy side managers to justify higher fees

- Sell side commission rates have fallen dramatically with electronic trading

- Both sides must demonstrate clear value-add to survive

Trend 3: ESG Integration

Environmental, Social, and Governance factors are now mainstream:

- Sell side banks face pressure to avoid financing certain industries

- Buy side investors increasingly incorporate ESG into investment decisions

- Both sides see this as both risk management and opportunity

Trend 4: Democratization of Finance

Retail Investor Empowerment:

- Commission-free trading apps reduce sell side brokerage revenue

- Social media and forums challenge traditional sell side research

- Buy side strategies (like index funds) are accessible to everyone

For those exploring smart ways to make passive income, these trends create new opportunities outside traditional structures.

Examples include hedge funds, mutual funds, pension funds, and private equity firms. These firms purchase financial products to generate long-term returns.

Sell-side analysts provide research and recommendations to clients, while buy-side analysts use that research to make investment decisions for their funds.

Sell-side roles often pay high early-career bonuses, but buy-side careers, especially in hedge funds and private equity, can offer much higher long-term earnings.

Conclusion: Putting It All Together

Understanding sell side vs buy side isn’t just about knowing financial industry jargon—it’s about understanding how markets actually work, who the key players are, and how to navigate the financial ecosystem more effectively.

Key Insights to Remember:

- The sell side creates and sells investment products; the buy side purchases and manages them

- Incentives differ fundamentally – sell side earns from transactions, buy side from performance

- Both sides are essential to market functioning, working together in a symbiotic relationship

- Information quality varies – understand the bias inherent in sell side research

- Career paths differ significantly – choose based on your personality, goals, and values

Your Next Steps

Whether you’re an aspiring finance professional or an investor trying to make better decisions:

For Career Seekers:

- Build strong financial modeling and analytical skills

- Network with professionals on both sides to understand the culture

- Consider starting sell side for training, then moving buy side for performance upside

- Develop a specialty or sector expertise that differentiates you

- Create a track record (even with a personal portfolio) to demonstrate investment acumen

For Investors:

- Critically evaluate sell side research, understanding potential conflicts

- Track what successful buy side investors actually own (via 13F filings)

- Develop your own analytical framework rather than relying solely on others

- Continue learning about market dynamics and investment strategies

- Remember that individual investors have unique advantages, use them

The financial world of 2025 offers more opportunities than ever before, but also more complexity. By understanding the fundamental sell side vs buy side distinction, you’re better equipped to navigate this landscape, whether you’re building a career or building wealth.

The most successful investors and finance professionals not only understand these concepts but also use them to make better decisions every day. Now it’s your turn to apply this knowledge to your own financial journey.

Disclaimer

This article is for informational and educational purposes only and should not be construed as financial, investment, or career advice. The financial industry is complex and constantly evolving. Compensation figures, career paths, and market dynamics can vary significantly based on individual circumstances, geographic location, firm type, and market conditions. Always conduct your own research and consult with qualified financial advisors, career counselors, or other professionals before making significant financial or career decisions. Past performance does not guarantee future results. The author and publisher are not responsible for any actions taken based on the information provided in this article.

About the Author

Max Fonji is a financial educator and investment strategist with over a decade of experience in both buy-side and sell-side roles. After starting his career in investment banking at a bulge-bracket firm, Max transitioned to the buy side, where he managed portfolios for a multi-billion-dollar hedge fund. Today, he dedicates his time to making complex financial concepts accessible to everyday investors through TheRichGuyMath.com. Max holds an MBA in Finance and is a CFA charterholder. When he’s not analyzing markets or writing about investing, you can find him teaching financial literacy workshops in his community or spending time with his family. His mission is simple: help people make smarter financial decisions through education, not intimidation.