Imagine you’re standing at a crossroads with two paths ahead. One path is smooth, paved, and guaranteed to get you safely to your destination. The other is rocky, uncertain, but promises a potentially bigger reward. In the world of investing, that smooth, safe path represents the risk-free rate – and understanding it is the foundation of every smart financial decision you’ll ever make.

Whether you’re just starting your investment journey or trying to make sense of market volatility, the risk-free rate is the invisible benchmark that influences everything from stock market valuations to the mortgage rate on your dream home. It’s the financial world’s “baseline” – the minimum return you should expect without taking any risk at all.

TL;DR Summary

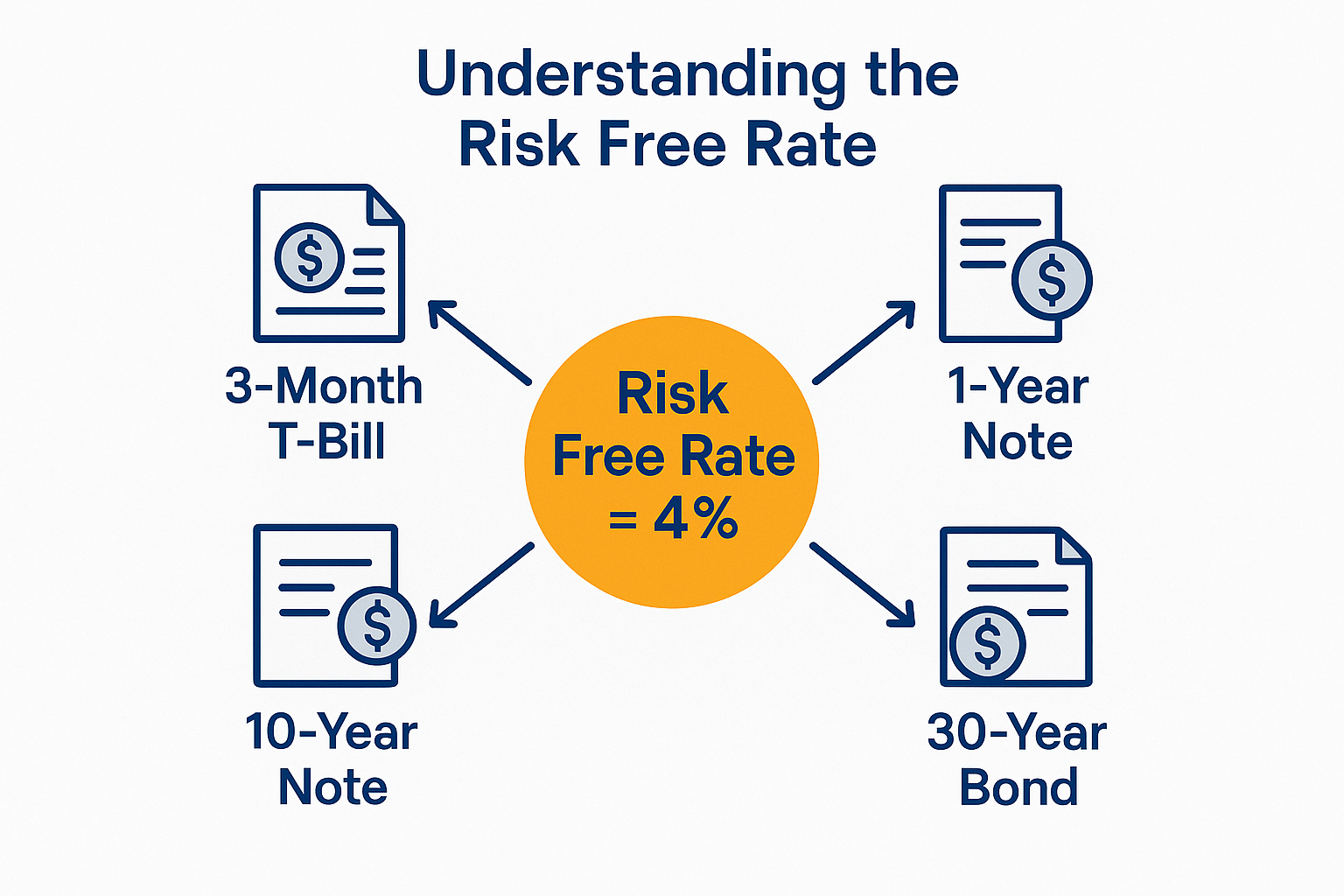

The risk-free rate is the theoretical return on an investment with zero risk, typically represented by U.S. Treasury securities

It serves as the foundation for all investment decisions, helping investors determine whether riskier assets are worth the extra return

Calculated using U.S. Treasury bills (short-term) or bonds (long-term), with the 10-year Treasury note being the most commonly referenced benchmark

Higher risk-free rates make safer investments more attractive, while lower rates often push investors toward stocks and other growth assets

Understanding the risk-free rate helps you evaluate investment opportunities, calculate expected returns, and build a balanced portfolio

What Is the Risk-Free Rate? A Clear Definition

In simple terms, the risk-free rate is the return an investor can expect from an absolutely safe investment over a specific period.

It’s the baseline return you’d earn by parking your money in the safest possible place – typically U.S. government bonds. Think of it as the “no-brainer” investment: you lend money to the U.S. government, and they promise to pay you back with interest, guaranteed. Investopedia

The concept might sound theoretical, but it’s incredibly practical. Every day, professional investors, financial advisors, and even the Federal Reserve use the risk-free rate as a measuring stick for every other investment opportunity.

Why “Risk Free” Doesn’t Mean Zero Risk

Here’s an important nuance: while we call it “risk-free,” technically, there’s still a tiny amount of risk involved. The term “risk-free” specifically means free from default risk – the chance that the borrower won’t pay you back.

U.S. Treasury securities are considered risk-free because the U.S. government has never defaulted on its debt obligations and has the power to print currency to meet its obligations. According to the U.S. Department of the Treasury, these securities are backed by “the full faith and credit of the United States government.”

However, Treasury securities still face:

- Inflation risk: Your purchasing power might decrease

- Interest rate risk: If rates rise, existing bonds lose value

- Opportunity cost: You might miss out on higher returns elsewhere

But for practical purposes, when calculating investment returns and making financial decisions, we treat Treasury securities as having zero default risk. Corporate Finance

The Formula and Calculation of Risk-Free Rate

The formula for the risk-free rate is straightforward: it’s simply the current yield on U.S. Treasury securities.

There’s no complex calculation – you just look up the current rate! However, which Treasury security you choose depends on your investment timeframe:

| Investment Timeframe | Treasury Security | Typical Use Case |

|---|---|---|

| Very short-term (1-3 months) | Treasury Bills (T-Bills) | Cash management, short-term planning |

| Short-term (1 year) | 1-Year Treasury Note | Annual investment comparisons |

| Medium-term (5 years) | 5-Year Treasury Note | Mid-range financial planning |

| Long-term (10+ years) | 10-Year Treasury Note | Retirement planning, CAPM calculations |

| Very long-term (30 years) | 30-Year Treasury Bond | Pension funds, long-term obligations |

How to Find the Current Risk-Free Rate

Finding today’s risk-free rate is simple:

- Visit the U.S. Department of the Treasury website (TreasuryDirect.gov)

- Check the “Daily Treasury Yield Curve Rates” section

- Select the maturity that matches your investment horizon

As of early 2025, for example, the 10-year Treasury note – the most commonly used risk-free rate benchmark – typically yields between 3.5% and 4.5%, though this changes daily based on market conditions.

Real-World Example

Let’s say you’re considering investing $10,000 for the next 10 years. You check the Treasury website and find that 10-year Treasury notes are currently yielding 4.0%.

This means:

- Your risk-free rate is 4.0% annually

- Without taking any risk, you could earn $400 per year (before taxes)

- Over 10 years, you’d have approximately $14,802 (with compound interest)

Now, any other investment you consider – stocks, real estate, corporate bonds – should offer you a return higher than 4.0% to justify the additional risk you’re taking.

Why the Risk-Free Rate Matters: Importance in Investing

Understanding the risk-free rate isn’t just academic – it’s the foundation of smart financial decision-making. Here’s why it matters so much:

1. It’s Your Investment Benchmark

Every investment should be measured against the risk-free rate. If someone offers you a “great investment opportunity” that promises 5% returns, but the current risk-free rate is 4%, you’re only earning an extra 1% for taking on additional risk. Is that worth it?

The risk-free rate helps you answer that critical question.

2. It Influences All Asset Prices

When the risk-free rate changes, it ripples through the entire financial system:

- Stock valuations: Higher risk-free rates typically mean lower stock prices (and vice versa)

- Bond prices: Move inversely to rates

- Real estate: Higher rates mean higher mortgage costs and lower property values

- Business decisions: Companies use it to evaluate new projects and investments

As legendary investor Warren Buffett once said, “Interest rates are to asset prices what gravity is to the apple. When there are low interest rates, there is a very low gravitational pull on asset prices.” Stern School of Business

3. It Reflects Economic Conditions

The risk-free rate is like the economy’s thermometer:

- Rising rates often signal economic strength, higher inflation expectations, or tighter Federal Reserve policy

- Falling rates typically indicate economic weakness, low inflation, or Fed stimulus

By watching the risk-free rate, you can gain insights into where the economy might be heading.

4. It’s Essential for Financial Models

Professional investors use the risk-free rate in crucial calculations:

- Capital Asset Pricing Model (CAPM): Determines expected returns based on risk

- Sharpe Ratio: Measures risk-adjusted returns

- Discounted Cash Flow (DCF): Values companies and investments

- Options pricing: The Black-Scholes model uses risk risk-free rate

Even if you’re not running these calculations yourself, understanding that professionals rely on the risk-free rate helps you appreciate its fundamental importance.

How to Use the Risk-Free Rate in Your Investment Decisions

Now that you understand what the risk-free rate is and why it matters, let’s talk about how to actually use it in your day-to-day investment decisions.

Step 1: Establish Your Personal Baseline

First, determine which Treasury maturity matches your investment timeline. Planning for retirement in 30 years? Look at the 30-year Treasury rate. Saving for a down payment in 5 years? Use the 5-year note.

This becomes your personal risk-free rate – your guaranteed return if you choose the safest path.

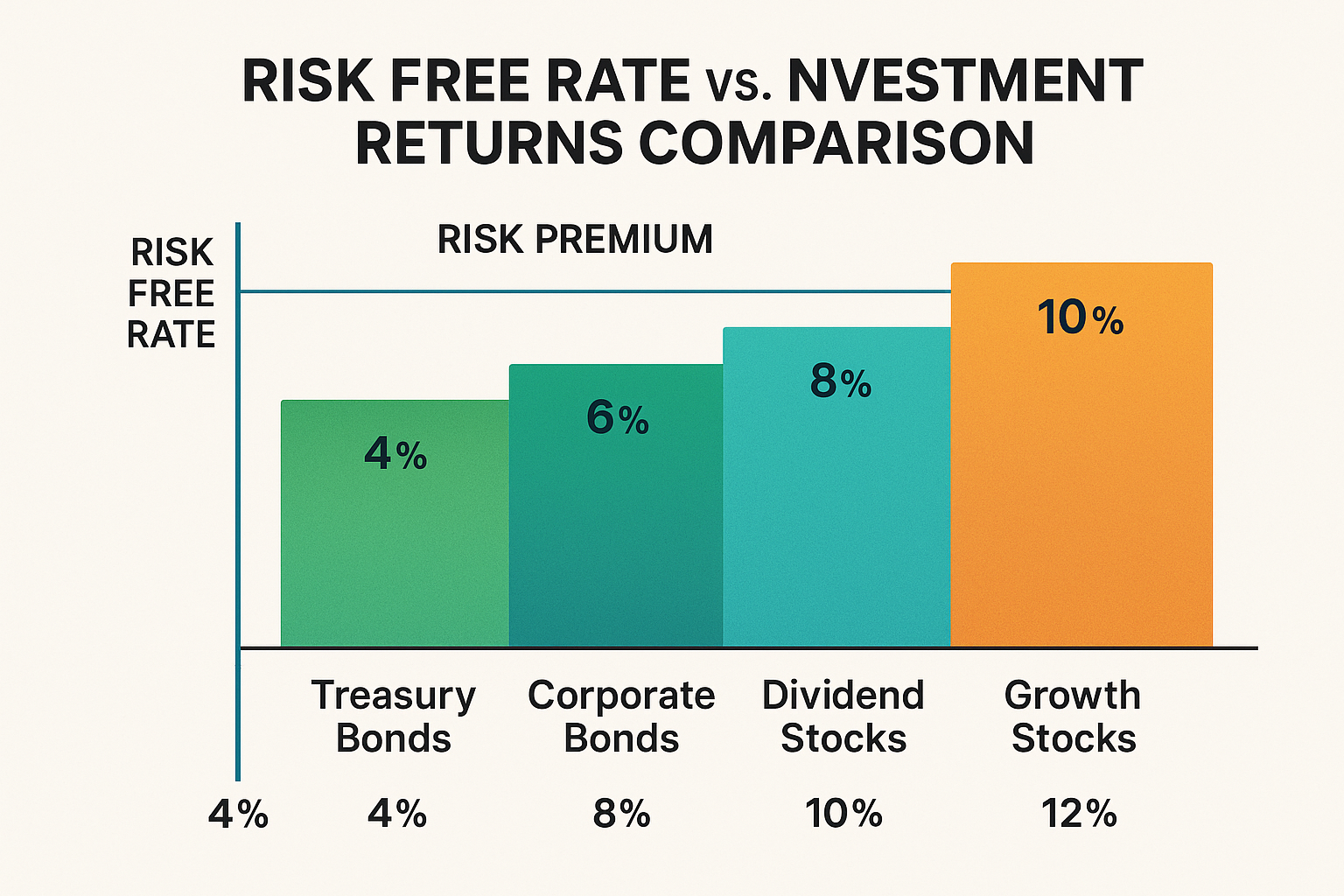

Step 2: Calculate the Risk Premium

For any investment you’re considering, calculate the risk premium – the extra return you’d earn above the risk-free rate.

Risk Premium Formula:

Risk Premium = Expected Return - Risk Free RateExample:

- You’re considering a dividend stock that historically returns 8% annually

- The current 10-year Treasury rate is 4%

- Risk Premium = 8% – 4% = 4%

This 4% risk premium is your compensation for taking on the volatility and uncertainty of stock ownership. Is it enough? That depends on your risk tolerance and the specific investment’s characteristics.

Step 3: Evaluate Investment Opportunities

Use the risk-free rate as your decision-making filter:

Investment offers returns significantly above the risk-free rate → Worth considering (after additional research)

Investment offers returns barely above or below the risk-free rate → Probably not worth the extra risk

Investment promises returns far above typical risk premiums → Be skeptical; it might be too good to be true

Step 4: Adjust Your Portfolio Based on Rate Changes

When the risk-free rate changes significantly, consider rebalancing:

When rates rise:

- Safer investments become more attractive

- Consider increasing allocation to bonds and cash

- Stock valuations typically decrease

- Great time to lock in higher yields

When rates fall:

- Riskier assets become relatively more attractive

- Stocks often perform well

- Bonds you already own increase in value

- Consider whether it’s time to take more calculated risks

The Risk-Free Rate and Different Investment Strategies

Different investors use the risk-free rate in different ways, depending on their strategy:

For Conservative Investors

If you’re risk-averse or nearing retirement, the risk-free rate might represent a significant portion of your portfolio. When Treasury yields are healthy (4-5%), you can build a meaningful income stream with virtually no risk.

Story: Meet Sarah, a 62-year-old teacher planning to retire in three years. In 2025, with 10-year Treasury notes yielding around 4%, she’s gradually shifting her portfolio from stocks to Treasuries. She knows that $500,000 in 10-year notes would generate about $20,000 annually in risk-free income – a solid foundation for her retirement budget.

For Growth Investors

If you’re younger and focused on growth, the risk-free rate serves as your minimum acceptable return. You’re willing to take risks, but only when properly compensated.

Understanding why the stock market goes up over time helps growth investors appreciate that taking calculated risks above the risk-free rate has historically been rewarded.

For Balanced Investors

Most investors fall somewhere in the middle, maintaining a mix of safe and risky assets. The risk-free rate helps you decide how to allocate between them.

A common approach is the “100 minus your age” rule:

- Subtract your age from 100

- Invest that percentage in stocks

- Keep the rest in safer assets (including Treasury securities)

At age 30: 70% stocks, 30% safer assets

At age 60: 40% stocks, 60% safer assets

The risk-free rate helps you evaluate whether your “safer” allocation is earning enough to justify its role in your portfolio.

Risk-Free Rate vs Other Important Rates

To fully understand the risk-free rate, it helps to compare it with related concepts:

Risk Free Rate vs. Federal Funds Rate

Federal Funds Rate: The interest rate at which banks lend to each other overnight, set by the Federal Reserve

Risk-Free Rate: The yield on Treasury securities

Relationship: The Fed Funds Rate influences the risk-free rate, but they’re not the same. When the Fed raises rates, Treasury yields typically rise too, but not always in lockstep.

Risk Free Rate vs Discount Rate

Discount Rate: The rate used to calculate the present value of future cash flows

Risk-Free Rate: Often serves as the base for discount rates

Relationship: The discount rate usually equals the risk-free rate plus a risk premium. For risky investments, you’d use a higher discount rate.

Risk Free Rate vs Required Rate of Return

Required Rate of Return: The minimum return an investor demands for taking on a specific investment’s risk

Risk-Free Rate: The foundation of the required rate of return

Relationship: Required Rate of Return = Risk Free Rate + Risk Premium

Risk Free Rate vs Expected Return

Expected Return: What you actually anticipate earning from an investment

Risk Free Rate: What you’re guaranteed to earn from Treasuries

Relationship: Expected returns on risky assets should exceed the risk-free rate, or the investment isn’t worth making.

Common Mistakes When Using the Risk-Free Rate

Even experienced investors sometimes misuse the risk-free rate. Avoid these common pitfalls:

1: Using the Wrong Maturity

The Problem: Using the 3-month T-Bill rate when evaluating a 20-year investment

The Fix: Match the Treasury maturity to your investment time horizon. Long-term investments should be compared to long-term Treasury rates.

2: Ignoring Inflation

The Problem: Focusing only on the nominal risk-free rate without considering inflation

The Fix: Consider the real risk-free rate (nominal rate minus inflation). If Treasuries yield 4% but inflation is 3%, your real return is only 1%.

3: Assuming the Rate Is Constant

The Problem: Making long-term plans based on today’s risk-free rate

The Fix: Remember that rates change. Build flexibility into your financial plans and review them regularly.

4: Comparing Apples to Oranges

The Problem: Comparing pre-tax Treasury yields to after-tax returns from other investments

The Fix: Always compare on an after-tax basis. Treasury interest is exempt from state and local taxes, which can make a significant difference.

5: Forgetting That “Risk Free” Has Limits

The Problem: Assuming Treasury securities are perfect for every situation

The Fix: Remember that while default risk is essentially zero, inflation risk, interest rate risk, and opportunity cost are still real concerns.

The Risk-Free Rate and Market Psychology

Here’s something fascinating: the risk-free rate doesn’t just influence investment returns – it shapes investor psychology and behavior.

The “Risk-On, Risk-Off” Dynamic

When the risk-free rate is low (say, 1-2%), investors often feel they have “no choice” but to take risks to earn meaningful returns. This creates risk-on sentiment:

- Stock markets tend to rise

- Investors chase higher yields

- Speculative assets gain popularity

- The cycle of market emotions tends toward greed

Conversely, when the risk-free rate is high (5-6% or more), many investors are happy earning “safe” returns. This creates risk-off sentiment:

- Money flows out of stocks into bonds

- Volatility often increases

- Investors become more selective

- Safer investments become fashionable again

Understanding this dynamic helps explain why people lose money in the stock market – they often chase risk at exactly the wrong time, when the risk-free rate is already signaling danger.

The TINA Phenomenon

During periods of extremely low interest rates (like 2020-2021), investors coined the acronym TINA: “There Is No Alternative.”

When Treasury yields fell below 1%, many investors felt forced into stocks, real estate, and other riskier assets simply because the risk-free rate was so unattractive. This drove asset prices to historic highs.

The lesson? The risk-free rate doesn’t just provide information – it influences behavior and can create self-fulfilling prophecies in markets.

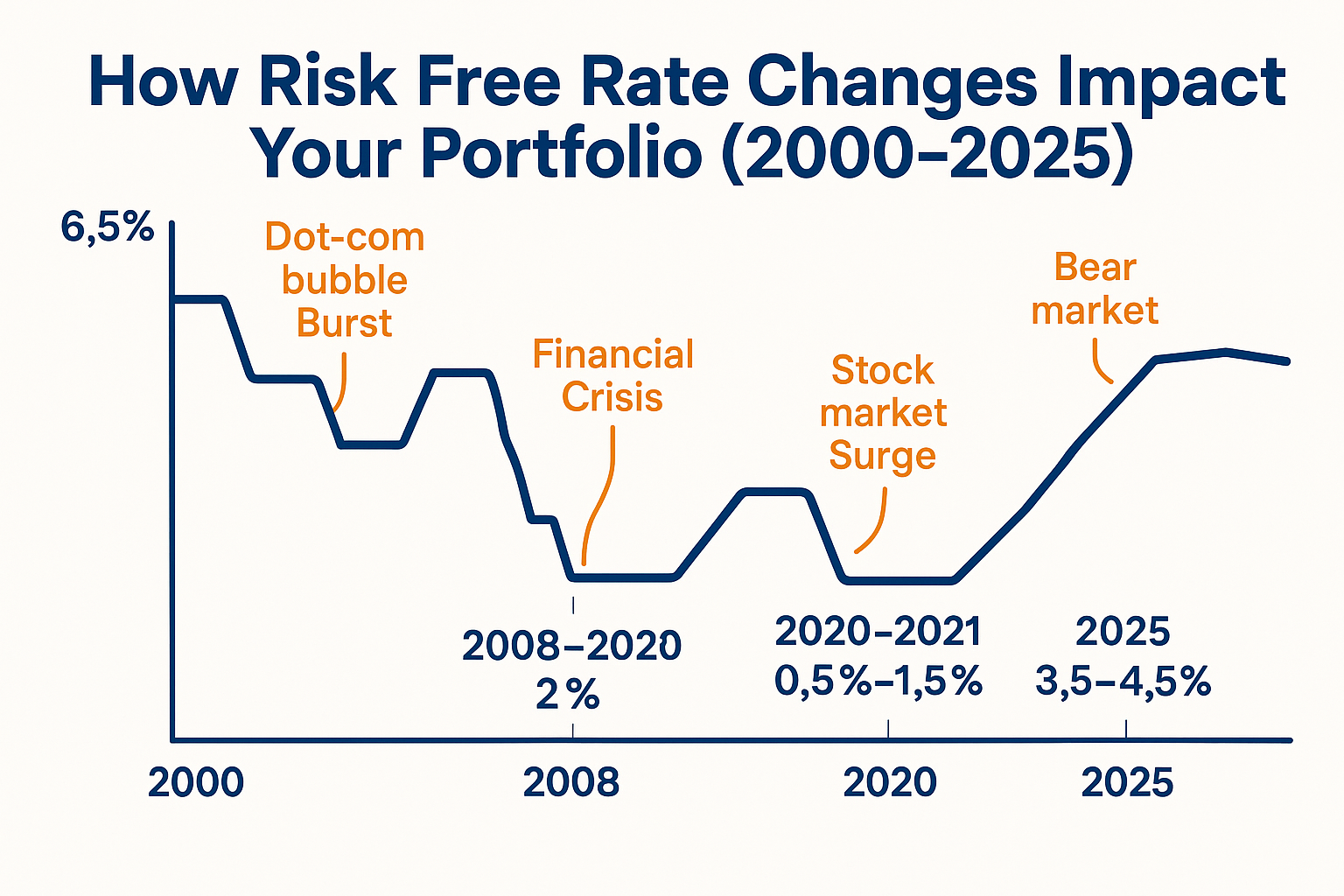

Real Data Example: Risk-Free Rate Over Time

Let’s look at how the risk-free rate has changed and what it means for investors:

2000-2001: The 10-year Treasury yielded around 6.5%. Investors could earn attractive returns with zero risk, making stocks less appealing. The dot-com bubble burst partly because the risk premium for stocks became unattractive.

2008-2009: During the financial crisis, the 10-year Treasury fell to around 2% as investors fled to safety and the Fed cut rates aggressively. This low rate made stocks look more attractive by late 2009, helping fuel the subsequent bull market.

2020-2021: The 10-year Treasury dropped to historic lows around 0.5-1.5% during the pandemic. With virtually no risk-free returns available, money poured into stocks, real estate, and cryptocurrencies.

2022-2023: As inflation surged and the Fed raised rates aggressively, the 10-year Treasury climbed to around 4-5%. This made safer investments attractive again and contributed to significant stock market declines.

2025: With rates stabilizing in the 3.5-4.5% range, investors face a more balanced decision between safe Treasury yields and riskier assets.

The pattern is clear: The risk-free rate acts as a gravitational force on all other investments. When it rises, it pulls money away from risky assets. When it falls, it pushes money toward them.

How to Build a Portfolio Around the Risk-Free Rate

Here’s a practical framework for constructing your investment portfolio with the risk-free rate as your foundation:

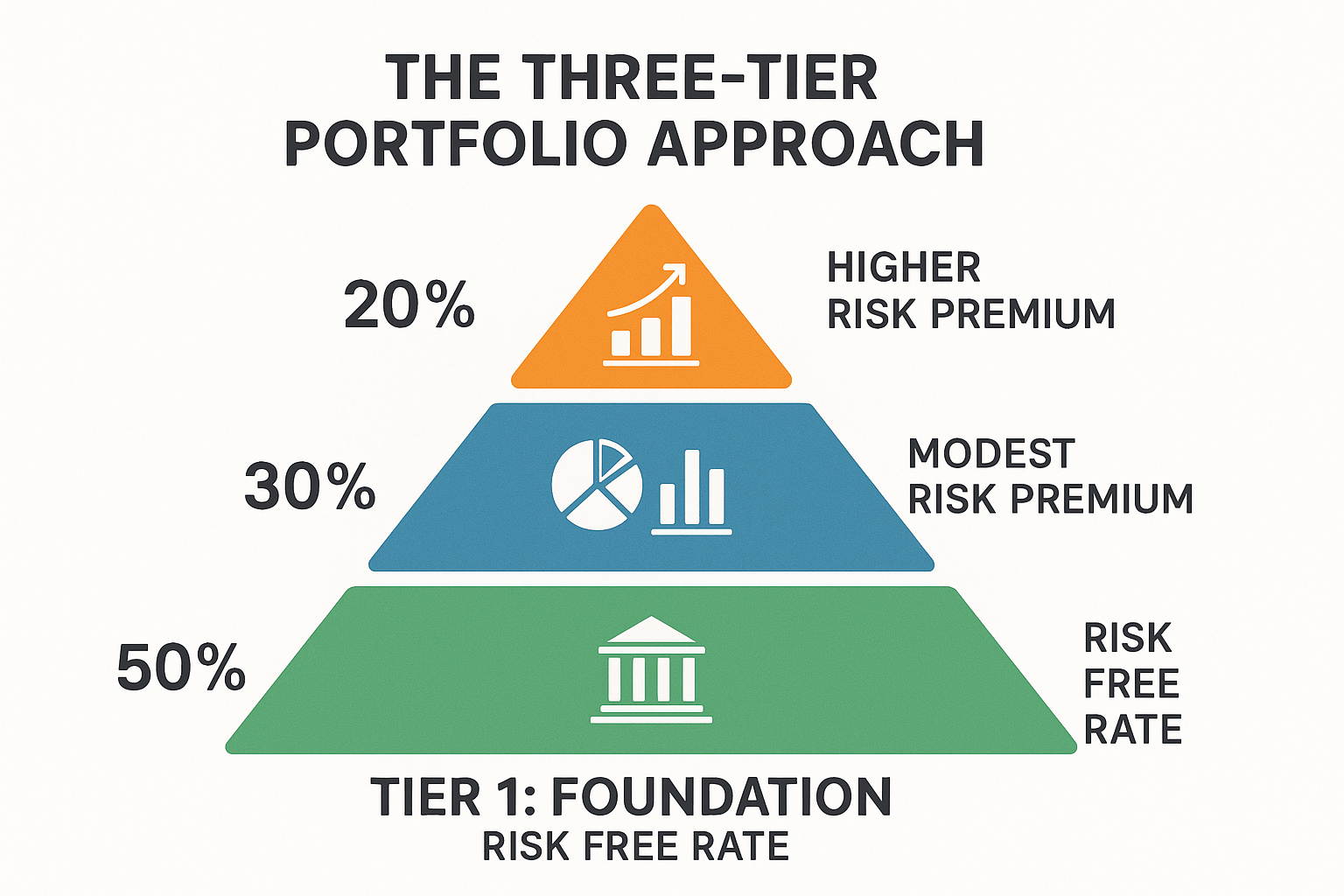

The Three-Tier Approach

Tier 1: The Foundation (Risk Free Rate)

- Allocate based on your need for safety and near-term cash needs

- Use Treasury securities, FDIC-insured savings, or money market funds

- This tier earns the risk-free rate

- Typical allocation: 10-50% depending on age and risk tolerance

Tier 2: The Core (Modest Risk Premium)

- Diversified stock index funds

- Investment-grade corporate bonds

- Real estate investment trusts (REITs)

- Target returns 3-5% above the risk-free rate

- Typical allocation: 30-60%

Tier 3: The Growth Engine (Higher Risk Premium)

- Individual stocks

- Small-cap funds

- International investments

- Alternative investments

- Target returns 6-10%+ above the risk-free rate

- Typical allocation: 10-40%

Rebalancing Based on Rate Changes

Set a rule for yourself: When the risk-free rate changes by 1% or more, review your portfolio allocation.

Example rebalancing rule:

- If the 10-year Treasury yield rises above 5%, consider increasing Tier 1 to 40-50%

- If it falls below 2%, consider reducing Tier 1 to 10-20%

- Always maintain at least some exposure to each tier for diversification

This disciplined approach helps you make smart moves without getting caught up in market emotion.

Advanced Concepts: The Risk-Free Rate in Professional Finance

For those who want to go deeper, here are some advanced applications of the risk-free rate:

Capital Asset Pricing Model (CAPM)

The CAPM formula is:

Expected Return = Risk Free Rate + Beta × (Market Return - Risk Free Rate)This model helps investors determine whether a stock is fairly priced based on its risk level (beta) and the current risk-free rate.

Example:

- Risk Free Rate = 4%

- Market Expected Return = 10%

- Stock Beta = 1.5 (50% more volatile than the market)

Expected Return = 4% + 1.5 × (10% – 4%) = 4% + 9% = 13%

If this stock is currently offering less than 13% expected return, it’s theoretically overpriced according to CAPM.

Sharpe Ratio

The Sharpe Ratio measures risk-adjusted returns:

Sharpe Ratio = (Portfolio Return - Risk Free Rate) / Portfolio Standard DeviationA higher Sharpe Ratio means better risk-adjusted performance. The risk-free rate is crucial here because it represents the return you could have earned without any volatility.

Example:

- Your portfolio returned 12% with a standard deviation of 15%

- Risk Free Rate = 4%

Sharpe Ratio = (12% – 4%) / 15% = 0.53

Generally, a Sharpe Ratio above 1.0 is considered good, above 2.0 is very good, and above 3.0 is excellent.

Discounted Cash Flow (DCF) Valuation

When valuing companies or investments, analysts discount future cash flows back to present value using a discount rate that starts with the risk-free rate:

Discount Rate = Risk Free Rate + Equity Risk Premium + Company-Specific Risk PremiumThe risk-free rate forms the foundation of this crucial valuation method used by professional investors worldwide.

The Risk-Free Rate in Different Countries

While we’ve focused on U.S. Treasury securities, every country has its own risk-free rate based on its government bonds:

Developed Markets:

- Germany: Bunds (German government bonds) serve as Europe’s risk-free benchmark

- Japan: Japanese Government Bonds (JGBs), historically offering very low yields

- United Kingdom: Gilts (UK government bonds)

Emerging Markets:

- Higher risk-free rates due to greater default risk

- Examples: Brazil, India, South Africa

- Rates are often 5-10% higher than U.S. Treasuries

Important note: For U.S. investors, foreign government bonds aren’t truly “risk-free” because they carry currency risk and potentially higher default risk. The U.S. Treasury remains the global gold standard.

Putting It All Together: Your Action Plan

Understanding the risk-free rate is one thing – using it to improve your financial life is another. Here’s your step-by-step action plan:

Step 1: Find Today’s Risk-Free Rate

- Visit TreasuryDirect.gov

- Note the yields for 1-year, 10-year, and 30-year Treasury securities

- Write these down as your current benchmarks

Step 2: Audit Your Current Investments

- List all your investments and their expected returns

- Calculate the risk premium for each (Expected Return – Risk Free Rate)

- Identify any investments with insufficient risk premiums

Step 3: Establish Your Personal Allocation

- Decide what percentage should be in “risk-free” assets based on your age and goals

- Consider the “100 minus your age” rule as a starting point

- Adjust based on your personal risk tolerance and financial situation

Step 4: Create a Rebalancing Trigger

- Set calendar reminders to check the risk-free rate quarterly

- Establish rules for when you’ll rebalance (e.g., when rates change by 1%+)

- Commit to reviewing your allocation at least annually

Step 5: Educate Yourself Continuously

- Follow Federal Reserve announcements and economic news

- Understand how rate changes might affect your investments

- Read more about smart ways to make passive income that work in different rate environments

Step 6: Consider the Next Generation

- If you have children, teach them about the risk-free rate early

- Learn about how to make your kid a millionaire by understanding compound growth above the risk-free rate

- Use Treasury securities as a teaching tool for safe investing

Conclusion

The risk-free rate is far more than just a number on a financial website – it’s the foundation of every investment decision you make. Think of it as the financial world’s sea level: everything else is measured from this baseline.

Here’s what you should remember:

The risk-free rate represents the return you can earn with zero default risk, typically using U.S. Treasury securities as the benchmark. It changes over time based on Federal Reserve policy, economic conditions, and inflation expectations. Every investment you consider should offer returns above this rate to justify the additional risk you’re taking.

Whether you’re just starting your investment journey or you’re a seasoned investor, the risk-free rate provides crucial context for your decisions. When rates are high, safer investments become attractive. When they’re low, you may need to take calculated risks to meet your financial goals.

The beauty of understanding the risk-free rate is that it empowers you to make rational, informed decisions rather than emotional ones. You can evaluate whether that “hot stock tip” really offers enough potential return to justify the risk. You can decide whether it makes sense to pay down debt or invest. You can build a portfolio that balances safety and growth in a way that makes sense for your unique situation.

As you move forward on your financial journey, keep the risk-free rate in mind. Check it regularly. Use it as your benchmark. Let it guide your decisions. And remember: there’s no shame in choosing the risk-free path when it makes sense for your goals. After all, guaranteed returns without risk are nothing to scoff at.

The most successful investors aren’t necessarily those who take the biggest risks – they’re the ones who take smart, calculated risks when the potential rewards justify them. The risk-free rate is your tool for making that determination.

Your next step? Visit TreasuryDirect.gov right now and check today’s risk-free rate. Write it down. Then look at your current investments and ask yourself: “Am I being adequately compensated for the risks I’m taking?” That simple question, grounded in the concept of the risk-free rate, can transform your financial future.

Interactive Risk Free Rate Calculator

💰 Risk Free Rate Investment Calculator

Compare your investment returns against the risk-free benchmark

–

FAQ: Risk-Free Rate

There’s no single “good” risk-free rate – it depends on economic conditions. Historically, the real risk-free rate (after inflation) has averaged around 1-2%. A nominal rate of 3-5% is generally considered healthy in a stable economy with moderate inflation.

You don’t calculate it – you simply look up the current yield on U.S. Treasury securities. Visit TreasuryDirect.gov and check the “Daily Treasury Yield Curve Rates” for the maturity that matches your investment timeline.

No. The Federal Reserve sets the Federal Funds Rate (the rate banks charge each other for overnight loans). The risk-free rate is the yield on Treasury securities. The Fed’s rate influences the risk-free rate, but they’re different metrics.

Technically, yes, though it’s rare in the U.S. Some countries (like Japan and Switzerland) have experienced negative government bond yields. This means investors essentially pay the government to hold their money, usually during extreme uncertainty or deflationary periods.

Generally, rising risk-free rates put downward pressure on stock prices for two reasons: (1) safer investments become more attractive, and (2) higher discount rates reduce the present value of future corporate earnings. However, if rates rise because the economy is strengthening, stocks may still perform well.

Not necessarily. While risk-free assets provide safety, they typically offer lower returns than riskier investments over long periods. Most investors benefit from a diversified portfolio that includes both safe and growth-oriented assets. Your allocation should depend on your age, goals, risk tolerance, and time horizon.

The risk-free rate changes daily based on supply and demand for Treasury securities. However, significant changes (1% or more) typically occur over months or years, driven by Federal Reserve policy, economic conditions, and inflation expectations.

Financial Disclaimer

This article is for educational purposes only and does not constitute financial advice. The information provided is general in nature and should not be relied upon as a substitute for professional financial advice tailored to your individual circumstances. Investment decisions should be made based on your own research, risk tolerance, and financial situation, preferably in consultation with a qualified financial advisor.

The risk-free rate and investment returns discussed are based on historical data and current market conditions, which can change. Past performance does not guarantee future results. All investments carry some degree of risk, including the potential loss of principal.

Treasury securities, while considered “risk-free” from a default perspective, still carry inflation risk, interest rate risk, and opportunity cost. Before making any investment decisions, please consult with a licensed financial professional.

About the Author

Written by Max Fonji — your go-to source for clear, data-backed investing education. We break down complex financial concepts into simple, actionable insights that help everyday investors build wealth with confidence. Our mission is to democratize financial knowledge and empower you to make smarter money decisions.

For more investing guides, market insights, and wealth-building strategies, visit our blog and join thousands of readers on their journey to financial freedom.