Imagine standing at the edge of a cliff with a parachute on your back. You could jump and experience the thrill of a lifetime, or you could stay put and watch others soar. Investing feels exactly like this; every decision involves weighing potential gains against possible losses. But here’s the thing: understanding the risk vs reward relationship isn’t just for Wall Street pros. It’s the fundamental principle that separates successful investors from those who either lose money or never start at all.

In simple terms, risk vs reward means the potential return you can expect from an investment relative to the amount of risk you’re willing to take. Higher potential rewards typically come with higher risks, while safer investments generally offer lower returns. This trade-off is the cornerstone of every investment decision you’ll ever make.

Whether you’re putting your first $100 into stocks or planning your retirement portfolio, mastering this concept will transform how you think about money. Let’s break down exactly what the risk-reward trade-off means, how to calculate it, and most importantly, how to use it to make smarter investment decisions in 2025 and beyond.

TL;DR Summary

Risk vs reward is the fundamental investing principle that higher potential returns typically require accepting higher levels of risk

The risk-reward ratio helps investors evaluate whether a potential investment is worth the risk by comparing expected gains to potential losses

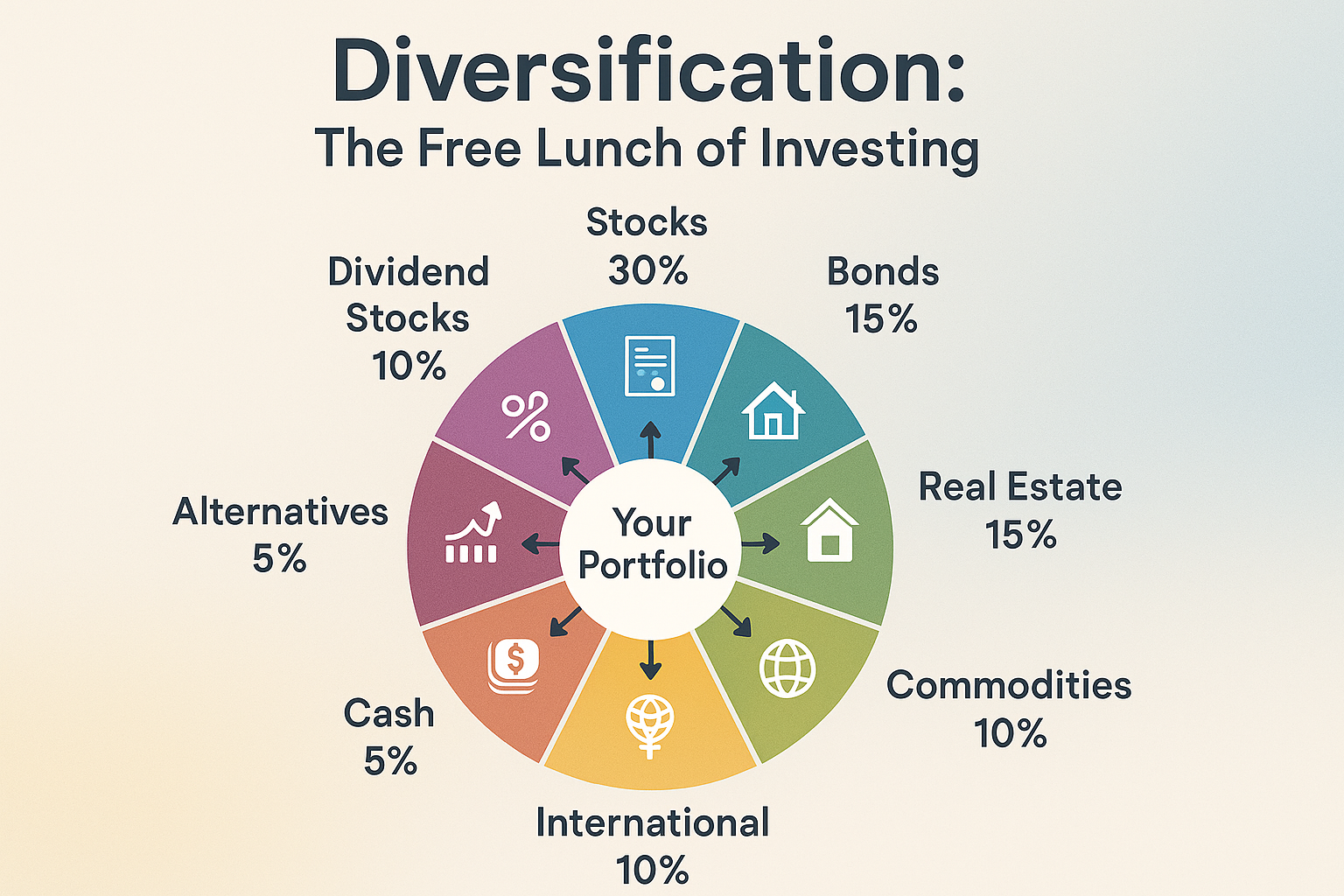

Diversification is the most powerful tool for managing the risk-reward trade-off without sacrificing long-term returns

Your personal risk tolerance (based on age, income, goals, and temperament) should guide how you balance risk and reward in your portfolio

Understanding different asset classes and their historical risk-reward profiles helps you build a portfolio aligned with your financial goals

What Is Risk vs Reward in Investing?

Risk vs reward is the relationship between the uncertainty of an investment’s outcome and its potential return. Every investment sits somewhere on this spectrum, from ultra-safe government bonds to speculative cryptocurrency ventures.

Risk in investing refers to the possibility that your investment will lose value or fail to meet your expectations. This includes:

- Market risk: Overall market declines affecting your investments

- Company-specific risk: Individual businesses failing or underperforming

- Inflation risk: Your returns failing to keep pace with rising prices

- Liquidity risk: Being unable to sell an investment quickly without losses

Reward is the potential gain you might receive from an investment, typically measured as:

- Capital appreciation: Your investment increases in value

- Income generation: Dividends, interest, or rental payments

- Total return: The combination of both appreciation and income

“The stock market is a device for transferring money from the impatient to the patient.” — Warren Buffett

This quote perfectly captures the essence of the risk-reward trade-off. Those willing to accept short-term volatility (risk) are often rewarded with superior long-term returns.

According to data from the Federal Reserve and historical market analysis, U.S. stocks have returned approximately 10% annually over the past century, while government bonds have returned around 5-6%, and savings accounts even less. The higher returns from stocks come with significantly higher volatility; the stock market can drop 20-30% in a single year, while bonds rarely decline that dramatically.

The Risk-Reward Formula: How to Calculate It

The risk-reward ratio is a simple but powerful tool that helps investors quantify whether a potential investment makes sense. Here’s the formula:

Risk-Reward Ratio = Potential Profit ÷ Potential Loss

How to Calculate Your Risk-Reward Ratio

Let’s say you’re considering buying a stock currently trading at $50 per share:

- Entry price: $50

- Target price (where you’ll sell for profit): $65

- Stop-loss price (where you’ll sell to limit losses): $45

Potential profit: $65 – $50 = $15 per share

Potential loss: $50 – $45 = $5 per share

Risk-reward ratio: $15 ÷ $5 = 3:1

A 3:1 risk-reward ratio means you stand to gain three dollars for every dollar you risk. Most professional investors look for ratios of at least 2:1 or 3:1 before investing.

Real-World Example: The Conservative Investor

Meet Sarah, a 28-year-old teacher who just started investing. She has $5,000 to invest and is considering two options:

Option A: High-Yield Savings Account

- Risk: Virtually zero (FDIC insured)

- Expected return: 4% annually

- Potential gain: $200 per year

Option B: Diversified Stock Index Fund

- Risk: Moderate (could drop 10-30% in a bad year)

- Expected return: 10% annually (historical average)

- Potential gain: $500 per year

Sarah chooses to split her money: $2,000 in savings (emergency fund) and $3,000 in stocks (long-term growth). She’s accepting moderate risk with the stock portion in exchange for potentially higher rewards, while maintaining safety for short-term needs.

This is smart risk-reward balancing in action.

Understanding Different Risk Levels and Investment Types

Not all investments carry the same risk. Here’s a breakdown of common investment types organized by their risk-reward profiles:

| Investment Type | Risk Level | Expected Annual Return | Best For |

|---|---|---|---|

| Savings Accounts | Very Low | 3-5% | Emergency funds, short-term goals |

| Government Bonds | Low | 3-6% | Capital preservation, income |

| Corporate Bonds | Low-Medium | 4-8% | Income with moderate safety |

| Dividend Stocks | Medium | 7-9% | Income + growth combination |

| Index Funds (S&P 500) | Medium | 10% (historical) | Long-term wealth building |

| Individual Growth Stocks | Medium-High | 15%+ (variable) | Aggressive growth |

| Real Estate | Medium-High | 8-12% | Diversification, income |

| Cryptocurrency | Very High | Highly variable | Speculation, high risk tolerance |

Low-Risk, Low-Reward Investments

Government bonds and savings accounts sit at the safe end of the spectrum. The U.S. Treasury has never defaulted on its debt, making Treasury bonds among the safest investments available. However, this safety comes at a cost; returns barely outpace inflation.

According to the U.S. Federal Reserve, the average 10-year Treasury yield has hovered between 3-5% in recent years. After accounting for inflation (typically 2-3% annually), your real return is minimal.

When low-risk makes sense:

- Building an emergency fund

- Saving for a goal within 1-3 years (house down payment, wedding)

- Preserving capital in retirement

- Can’t afford to lose the principal

Medium-Risk, Medium-Reward Investments

This category includes diversified stock index funds, blue-chip dividend stocks, and balanced mutual funds. These investments can fluctuate significantly year-to-year but have historically delivered solid returns over longer periods.

The S&P 500 index has returned approximately 10% annually since 1926 (according to data from Morningstar and the CFA Institute), though individual years can vary dramatically—from losses exceeding 30% to gains over 30%.

For those interested in generating income while growing wealth, dividend investing offers an attractive middle ground. High dividend stocks provide regular cash payments while still offering growth potential.

When medium-risk makes sense:

- Investing for retirement (10+ years away)

- Building long-term wealth

- You have a stable income and emergency savings

- You can tolerate temporary market drops

High-Risk, High-Reward Investments

Individual stocks, small-cap companies, emerging markets, and cryptocurrencies fall into this category. These investments can double, triple, or even 10x your money, but they can also drop to zero.

Consider the story of Mark, who invested $10,000 in a promising tech startup in 2020. By 2022, his investment had grown to $45,000, a 350% gain. But when the company faced regulatory issues and competition, the stock crashed, and his position dropped to $8,000. He experienced both the exhilarating reward and the gut-wrenching risk.

When high-risk might make sense:

- You’re young with decades to recover from losses

- You’re investing “play money” you can afford to lose

- You have a diversified core portfolio already

- You thoroughly understand what you’re investing in

Understanding why people lose money in the stock market can help you avoid common pitfalls when taking on higher-risk investments.

The Psychology of Risk: Understanding Your Risk Tolerance

Your risk tolerance is your emotional and financial ability to withstand investment losses. This isn’t just about math; it’s deeply personal and psychological.

Factors That Determine Your Risk Tolerance

1. Age and Time Horizon

Younger investors can typically accept more risk because they have decades to recover from market downturns. If you’re 25 and won’t need your investment money for 40 years, you can ride out multiple market cycles.

Conversely, if you’re 60 and planning to retire in five years, you need to protect your capital. A 30% market crash right before retirement could be devastating.

2. Financial Situation

- Do you have 6-12 months of emergency savings?

- Is your income stable or variable?

- Do you have dependents relying on you?

- How much debt do you carry?

Someone with a stable government job, no debt, and a solid emergency fund can take more investment risk than someone with irregular income and financial obligations.

3. Investment Goals

- Saving for retirement in 30 years? Higher risk is appropriate.

- Saving for a house down payment in 2 years? Stick with lower risk.

- Building passive income? Consider smart passive income strategies that balance risk and reward.

4. Emotional Temperament

This is the hardest to quantify but perhaps most important. How did you feel during the 2020 COVID market crash? Did you panic-sell, hold steady, or buy more?

The cycle of market emotions affects every investor. Understanding your emotional responses helps you choose investments you can stick with during turbulent times.

“The investor’s chief problem—and even his worst enemy—is likely to be himself.” — Benjamin Graham

The Risk Tolerance Quiz

Ask yourself these questions:

- If your portfolio dropped 20% in one month, would you:

- A) Panic and sell everything

- B) Feel nervous but hold steady

- C) See it as a buying opportunity

- Your primary investment goal is:

- A) Preserving what you have

- B) Steady growth with some safety

- C) Maximum growth, accepting volatility

- You would describe your financial knowledge as:

- A) Beginner—I’m still learning

- B) Intermediate—I understand the basics

- C) Advanced—I research investments thoroughly

Mostly A’s: Conservative investor—focus on bonds, dividend stocks, and index funds

Mostly B’s: Moderate investor—balanced mix of stocks and bonds

Mostly C’s: Aggressive investor—can handle individual stocks and alternative investments

Diversification: The Ultimate Risk Management Tool

If there’s one “free lunch” in investing, it’s diversification—spreading your money across different investments to reduce risk without necessarily reducing returns. See our full guide on Risk Management

How Diversification Works

Imagine you put all your money into one company’s stock. If that company thrives, you could double your money. But if it fails, you could lose everything. That’s concentrated risk.

Now imagine you split that same money across 100 different companies in various industries. Some will do poorly, some will do okay, and some will excel. Your overall portfolio becomes much more stable because losses in one area are offset by gains in another.

According to research from the CFA Institute, a portfolio of just 20-30 stocks from different sectors can eliminate most company-specific risk while maintaining the growth potential of the stock market.

Types of Diversification

1. Asset Class Diversification

Don’t put all your eggs in one basket. Spread investments across:

- Stocks (ownership in companies)

- Bonds (loans to governments/companies)

- Real estate (property investments)

- Cash equivalents (savings, money market funds)

2. Geographic Diversification

Invest in both domestic and international markets. When the U.S. market struggles, emerging markets might thrive, and vice versa.

3. Sector Diversification

Spread stocks across different industries:

- Technology

- Healthcare

- Consumer goods

- Energy

- Financial services

- Utilities

4. Time Diversification

Instead of investing all your money at once, consider dollar-cost averaging—investing fixed amounts regularly over time. This reduces the risk of investing everything right before a market crash.

The 60/40 Portfolio: A Classic Risk-Reward Balance

For decades, financial advisors recommended a simple formula: 60% stocks and 40% bonds. This provides growth potential from stocks while bonds cushion against market volatility.

Here’s how this might look for someone with $10,000 to invest:

- $6,000 in a diversified stock index fund (S&P 500)

- $3,000 in a bond index fund

- $1,000 in cash or high-yield savings

This balanced approach has historically delivered around 8-9% annual returns with significantly less volatility than a 100% stock portfolio.

However, the ideal allocation depends on your personal situation. Younger investors might go 80/20 or even 90/10 (stocks/bonds), while those nearing retirement might prefer 40/60 or 30/70.

Common Risk-Reward Mistakes (And How to Avoid Them)

Even experienced investors make these errors. Learning to recognize them can save you thousands of dollars and years of frustration.

1: Chasing Returns Without Understanding Risk

The scenario: Your friend brags about making 50% on a cryptocurrency investment. Excited by the potential gains, you invest heavily without understanding the technology, market dynamics, or risk factors.

The reality: For every person who made 50%, several others lost 50% or more. You’re seeing the winners, not the losers.

The solution: Before investing in anything, ask yourself:

- Do I understand how this investment generates a return?

- What could cause this investment to fail?

- Am I comfortable losing this money?

- Does this fit my overall investment strategy?

2: Being Too Conservative

The scenario: Burned by a market downturn or naturally risk-averse, you keep all your money in savings accounts earning 3-4% annually.

The reality: Over 30 years, $10,000 growing at 4% becomes $32,434. The same amount growing at 10% (historical stock market average) becomes $174,494. That’s a $142,060 difference, the cost of being too conservative.

The solution: Match your risk level to your time horizon. Money you won’t need for 10+ years can afford to take more risk. Understanding why the stock market tends to rise over time can help alleviate excessive fear.

3: Panic Selling During Downturns

The scenario: The market drops 15% in a month. Fearing further losses, you sell everything and move to cash, “planning to get back in when things stabilize.”

The reality: By the time things “feel safe,” the market has already recovered, and you’ve locked in losses. You bought high and sold low, the opposite of successful investing.

The solution: Before investing, decide your strategy for downturns. Many successful investors actually buy more during crashes, getting stocks “on sale.” Having a plan before emotions kick in is crucial.

4: Ignoring Fees and Taxes

The scenario: You actively trade stocks, paying commissions on each trade and generating short-term capital gains taxed at your ordinary income rate (potentially 22-37%).

The reality: A 1% annual fee doesn’t sound like much, but over 30 years, it can reduce your final portfolio value by 25% or more. Similarly, short-term trading can cut your after-tax returns significantly.

The solution: Favor low-cost index funds with expense ratios under 0.20%. Hold investments for at least one year to qualify for lower long-term capital gains tax rates (0-20% depending on income).

5: Putting All Your Money in One Investment

The scenario: You’re convinced a particular company or sector is the “next big thing” and invest your entire portfolio accordingly.

The reality: Even the best companies can stumble. Remember Enron? Lehman Brothers? Countless others that seemed invincible until they weren’t.

The solution: No single investment should represent more than 5-10% of your portfolio. Diversification isn’t exciting, but it works.

Building Your Personal Risk-Reward Strategy

Now that you understand the principles, let’s create a practical framework for your investing journey.

1: Assess Your Current Situation

Financial inventory:

- Emergency fund: Do you have 3-6 months of expenses saved?

- Debt: What’s your interest rate on debt? (Pay off high-interest debt before investing)

- Income stability: Secure job or variable income?

- Time horizon: When will you need this money?

Risk tolerance assessment:

- Review the quiz results from earlier

- Consider past experiences with financial stress

- Discuss with a partner if you have joint finances

2: Define Clear Goals

Vague goals like “make money” don’t work. Be specific:

Bad goal: “I want to invest and make money”

Good goal: “I want to accumulate $500,000 for retirement in 25 years by investing $500 monthly in diversified index funds.”

Different goals require different risk-reward approaches:

- Short-term goals (1-3 years): Lower risk—savings accounts, CDs, short-term bonds

- Medium-term goals (3-10 years): Moderate risk—balanced funds, dividend stocks

- Long-term goals (10+ years): Higher risk acceptable—growth stocks, index funds

Teaching your children about investing early can set them up for lifetime success. Learn how to make your kid a millionaire through smart, long-term investing strategies.

3: Choose Your Asset Allocation

Based on your age, goals, and risk tolerance, select an appropriate mix. Here are some common strategies:

Aggressive (Ages 20-35, high risk tolerance):

- 90% stocks (mix of index funds and individual stocks)

- 10% bonds

- Expected return: 9-10% annually

- Volatility: High (could drop 30-40% in bad years)

Moderate (Ages 35-55, medium risk tolerance):

- 70% stocks

- 25% bonds

- 5% cash/alternatives

- Expected return: 7-8% annually

- Volatility: Medium (could drop 20-25% in bad years)

Conservative (Ages 55+, low risk tolerance):

- 40% stocks

- 50% bonds

- 10% cash

- Expected return: 5-6% annually

- Volatility: Low (could drop 10-15% in bad years)

4: Implement and Automate

The best investment strategy is one you’ll actually stick with. Make it automatic:

- Set up automatic transfers from your checking to investment accounts

- Enable automatic reinvestment of dividends

- Schedule annual reviews, but avoid checking daily (reduces emotional decisions)

- Rebalance annually to maintain your target allocation

5: Monitor and Adjust

Your risk-reward strategy isn’t set in stone. Review and adjust as life changes:

- Got a raise? Increase your monthly investment amount

- Approaching retirement? Gradually shift toward more conservative investments

- Major life change (marriage, children, job loss)? Reassess your risk tolerance

- Market crash? Stick to your plan (or buy more if you have cash available)

Risk-Reward in Different Life Stages

Your optimal risk-reward balance evolves throughout your life. Here’s how it typically changes:

Your 20s: Maximum Growth Phase

Advantages:

- Decades until retirement

- Can recover from losses

- Compound interest has maximum time to work

- Usually fewer financial obligations

Recommended approach:

- 80-90% stocks

- Focus on growth over income

- Can afford to take calculated risks

- Learn by investing (even small amounts)

Example portfolio:

- 70% Total Stock Market Index Fund

- 20% International Stock Index Fund

- 10% Bond Index Fund

Your 30s-40s: Wealth Building Phase

Considerations:

- Peak earning years begin

- May have a mortgage, children, and other obligations

- Still have 20-30 years until retirement

- Balancing growth with increasing stability

Recommended approach:

- 70-80% stocks

- Begin adding more bonds for stability

- Consider dividend-paying stocks for income

- Maximize retirement contributions

Example portfolio:

- 50% Total Stock Market Index Fund

- 20% International Stock Index Fund

- 20% Dividend Stock Fund

- 10% Bond Index Fund

Your 50s-60s: Preservation Phase

Considerations:

- Retirement approaching

- Less time to recover from major losses

- May want to reduce volatility

- Still need growth to outpace inflation

Recommended approach:

- 50-60% stocks

- Increase bond allocation

- Focus on capital preservation with moderate growth

- Consider annuities or other guaranteed income sources

Example portfolio:

- 30% Total Stock Market Index Fund

- 20% Dividend Stock Fund

- 40% Bond Index Fund

- 10% Cash/Money Market

Retirement: Income and Preservation Phase

Considerations:

- Living off investments

- Can’t afford major losses

- Still need some growth (retirement might last 30+ years)

- Inflation protection remains important

Recommended approach:

- 30-40% stocks (for growth and inflation protection)

- 50-60% bonds (for stability and income)

- 10% cash (for liquidity and emergencies)

Example portfolio:

- 20% Dividend Stock Fund

- 10% Total Stock Market Index Fund

- 50% Bond Index Fund

- 20% Cash/CDs/Money Market

Advanced Risk-Reward Concepts

Once you’ve mastered the basics, these advanced concepts can further refine your strategy.

The Sharpe Ratio: Risk-Adjusted Returns

The Sharpe Ratio measures how much return you’re getting per unit of risk taken. It’s calculated as:

Sharpe Ratio = (Investment Return – Risk-Free Rate) ÷ Standard Deviation

A higher Sharpe Ratio means better risk-adjusted returns. According to Morningstar research, a Sharpe Ratio above 1.0 is considered good, above 2.0 is very good, and above 3.0 is excellent.

This helps you compare investments with different risk levels. An investment returning 15% with high volatility might actually be less attractive than one returning 10% with low volatility.

Modern Portfolio Theory

Developed by Nobel Prize winner Harry Markowitz, Modern Portfolio Theory suggests that investors can construct an “efficient frontier” of optimal portfolios offering maximum expected return for a given level of risk.

The key insight: by combining assets that don’t move in perfect correlation, you can reduce overall portfolio risk without sacrificing returns. This is why diversification works mathematically, not just intuitively.

Black Swan Events

Popularized by Nassim Taleb, Black Swan events are rare, unpredictable occurrences with massive impact, like the 2008 financial crisis or the 2020 pandemic.

The lesson for investors: traditional risk models often underestimate the probability of extreme events. Maintaining some defensive positions (cash, bonds, gold) provides insurance against these scenarios.

Behavioral Finance and Risk

Behavioral finance studies how psychological factors affect investment decisions. Key biases that distort risk-reward assessment:

- Recency bias: Overweighting recent events (thinking the market will keep rising because it has recently)

- Loss aversion: Feeling losses more intensely than equivalent gains

- Overconfidence: Believing you can time the market or pick winners

- Herd mentality: Following the crowd into overvalued investments

Recognizing these biases in yourself is the first step to making more rational risk-reward decisions. Understanding smart moves in investing can help you avoid common behavioral pitfalls.

Practical Tools for Managing Risk vs Reward

1: The Stop-Loss Order

A stop-loss order automatically sells an investment if it drops to a predetermined price, limiting your downside risk.

Example: You buy a stock at $100 and set a stop-loss at $90. If the stock drops to $90, it automatically sells, limiting your loss to 10%.

Pros: Protects against catastrophic losses, removes emotion from selling decisions

Cons: Can trigger on temporary dips, might sell right before a recovery

2: Position Sizing

Never invest more in a single position than you can afford to lose. A common rule: no single stock should exceed 5% of your portfolio.

Example: If you have a $50,000 portfolio, no single stock position should exceed $2,500.

This ensures that even if one investment goes to zero, your overall portfolio survives.

3: Regular Rebalancing

Over time, your best-performing assets will grow to represent a larger portion of your portfolio, increasing your risk concentration.

Rebalancing means selling some winners and buying underperformers to return to your target allocation.

Example: Your target is 70% stocks, 30% bonds. After a strong stock market year, you’re now 80% stocks, 20% bonds. You sell some stocks and buy bonds to return to 70/30.

Most investors should rebalance annually or when allocations drift more than 5% from targets.

4: Dollar-Cost Averaging

Instead of investing a lump sum all at once, dollar-cost averaging spreads investments over time, reducing the risk of buying at a market peak.

Example: You have $12,000 to invest. Instead of investing it all today, you invest $1,000 monthly for 12 months.

Benefit: You automatically buy more shares when prices are low and fewer when prices are high, averaging out your cost.

Drawback: If the market rises steadily, you miss out on early gains. However, for most beginners, the psychological comfort is worth this potential opportunity cost.

The Role of Alternative Investments

Beyond traditional stocks and bonds, alternative investments offer different risk-reward profiles:

Real Estate

Risk level: Medium to Medium-High

Potential returns: 8-12% annually (including appreciation and rental income)

Pros: Tangible asset, passive income potential, tax advantages, inflation hedge

Cons: Illiquid, requires significant capital, management responsibilities, and location-dependent

Real estate can provide excellent diversification from stock market volatility, though it comes with its own risks.

Commodities (Gold, Oil, etc.)

Risk level: Medium to High

Potential returns: Highly variable, often used as an inflation hedge rather than growth

Pros: Inflation protection, low correlation with stocks, diversification benefits

Cons: No income generation, high volatility, storage costs (for physical commodities)

Gold, in particular, often performs well during market crises, making it a popular portfolio insurance option at a 5-10% allocation.

Cryptocurrency

Risk level: Very High

Potential returns: Extremely variable (can double or halve in months)

Pros: High growth potential, portfolio diversification, inflation hedge (debated)

Cons: Extreme volatility, regulatory uncertainty, security risks, limited track record

Most financial advisors recommend limiting cryptocurrency to no more than 5% of your portfolio, treating it as a speculative position rather than a core holding.

Conclusion: Your Action Plan for Smart Risk-Reward Investing

Understanding risk vs reward isn’t just theoretical knowledge; it’s the foundation of every successful investment strategy. The investors who build lasting wealth aren’t necessarily the ones who take the biggest risks or play it safest. They’re the ones who understand their personal risk tolerance, match it to appropriate investments, and stick with their strategy through market ups and downs.

Here’s what we’ve covered:

Risk and reward are inseparable: Higher potential returns require accepting higher risk, but you can manage that risk intelligently

Calculate before you invest: Use the risk-reward ratio to evaluate whether investments make mathematical sense

Diversification works: Spreading investments across asset classes, sectors, and geographies reduces risk without sacrificing long-term returns

Your situation is unique: The “right” balance depends on your age, goals, income, and emotional capacity for volatility

Avoid common mistakes: Don’t chase returns blindly, panic-sell during downturns, or put all your eggs in one basket

Your Next Steps

This week:

- Complete the risk tolerance assessment in this article

- Calculate your current asset allocation (what percentage is in stocks, bonds, cash, etc.)

- Set up or verify your emergency fund (3-6 months of expenses in a high-yield savings account)

This month:

- Open an investment account if you don’t have one (consider low-cost brokers like Vanguard, Fidelity, or Schwab)

- Choose your target asset allocation based on your age and risk tolerance

- Set up automatic monthly investments to start building your portfolio

This year:

- Maximize your retirement account contributions (401(k), IRA)

- Build a diversified portfolio aligned with your goals

- Schedule your first annual portfolio review

- Continue your financial education, explore more investing strategies and insights

Remember: investing is a marathon, not a sprint. The risk-reward trade-off isn’t about finding the “perfect” investment; it’s about building a portfolio you can stick with through market volatility, one that grows your wealth while letting you sleep at night.

Start where you are. Use what you have. Do what you can. Your future self will thank you for taking that first step today.

Interactive Risk-Reward Calculator

📊 Risk vs Reward Calculator

Calculate your risk-reward ratio and make smarter investment decisions

FAQ: Risk vs Reward in Investing

A good risk-reward ratio for beginners is at least 2:1 or 3:1, meaning you should expect to gain at least two to three dollars for every dollar you risk. This provides a margin of safety and ensures that even if only half your investments succeed, you still come out ahead. Beginners should avoid investments with ratios below 1:1, where potential losses exceed potential gains.

Your risk tolerance depends on four main factors: your age and time horizon (younger investors can take more risk), your financial situation (emergency savings, debt, income stability), your investment goals (retirement vs. short-term needs), and your emotional temperament (how you react to market volatility). A simple test: if a 20% portfolio drop would cause you to panic-sell, you’ve taken too much risk. If you can view it as a buying opportunity, you have a higher risk tolerance.

No, you cannot eliminate risk when investing. Even “safe” investments like savings accounts carry inflation risk—the risk that your purchasing power decreases over time. However, you can manage and minimize risk through diversification, appropriate asset allocation, regular rebalancing, and matching your investments to your time horizon. The goal isn’t to eliminate risk but to take calculated risks aligned with your goals and tolerance.

Volatility measures how much an investment’s price fluctuates over time, while risk is the possibility of permanent loss. An investment can be volatile (price swings up and down frequently) without being risky if its long-term trend is upward. For example, stocks are volatile but historically have always recovered from downturns over 10+ year periods. True risk is when an investment loses value permanently, like a company going bankrupt.

Generally, yes. When you’re young, you have decades for your investments to recover from market downturns, allowing you to take advantage of higher-risk, higher-reward opportunities like stock-heavy portfolios. Time is your greatest asset for managing risk. A 25-year-old can afford a 90% stock allocation because they won’t need the money for 40+ years, while a 60-year-old approaching retirement should be more conservative. However, even young investors should maintain an emergency fund and avoid taking risks with money they’ll need in the next few years.

Most investors should rebalance once or twice per year, or whenever their asset allocation drifts more than 5% from their target. For example, if your target is 70% stocks and 30% bonds, rebalance when you reach 75% stocks or 65% stocks. Rebalancing too frequently can generate unnecessary taxes and trading costs, while rebalancing too infrequently allows your risk level to drift from your target. Annual rebalancing strikes a good balance for most investors.

Historically, lump-sum investing has outperformed dollar-cost averaging about two-thirds of the time because markets trend upward over time. However, dollar-cost averaging (investing fixed amounts regularly over time) provides psychological benefits, reducing the risk of investing everything right before a market crash and making it easier to stick with your plan. For most beginners, dollar-cost averaging through automatic monthly investments is the more practical and emotionally sustainable approach, even if it’s not mathematically optimal.

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Investing involves risk, including the potential loss of principal. Past performance does not guarantee future results. Before making any investment decisions, consider consulting with a qualified financial advisor who understands your personal financial situation, goals, and risk tolerance. The information provided is based on historical data and general principles, but cannot predict future market performance or guarantee specific outcomes.

Written by Max Fonji — With a decade of experience in financial education and investment strategy, Max is your go-to source for clear, data-backed investing education. Through TheRichGuyMath.com, Max helps everyday investors understand complex financial concepts and build wealth through smart, informed decisions.