Imagine waking up to find money flowing into your bank account from five different sources—even before you’ve had your morning coffee. That’s not a fantasy reserved for the ultra-wealthy; it’s the reality for anyone who builds multiple streams of income. In 2025’s uncertain economic climate, relying on a single paycheck is like walking a financial tightrope without a safety net. One unexpected job loss, health crisis, or market downturn could send everything tumbling down.

Multiple streams of income refer to the strategy of generating revenue from various independent sources rather than depending solely on one job or business. Think of it as building a financial ecosystem where each income source acts as a pillar supporting your overall wealth. If one weakens, the others keep you standing strong.

This approach isn’t just about making more money (though that’s certainly a perk). It’s about creating financial resilience, accelerating wealth-building, and gaining the freedom to live life on your terms. Whether you’re a corporate professional looking to diversify, an entrepreneur seeking stability, or someone just starting their financial journey, understanding how to develop multiple income streams can transform your financial future.

TL;DR

- Multiple streams of income mean earning money from various independent sources (employment, investments, side businesses, royalties, etc.) to build financial stability and wealth

- Diversifying income reduces risk—if one source disappears, others continue supporting you, creating a financial safety net

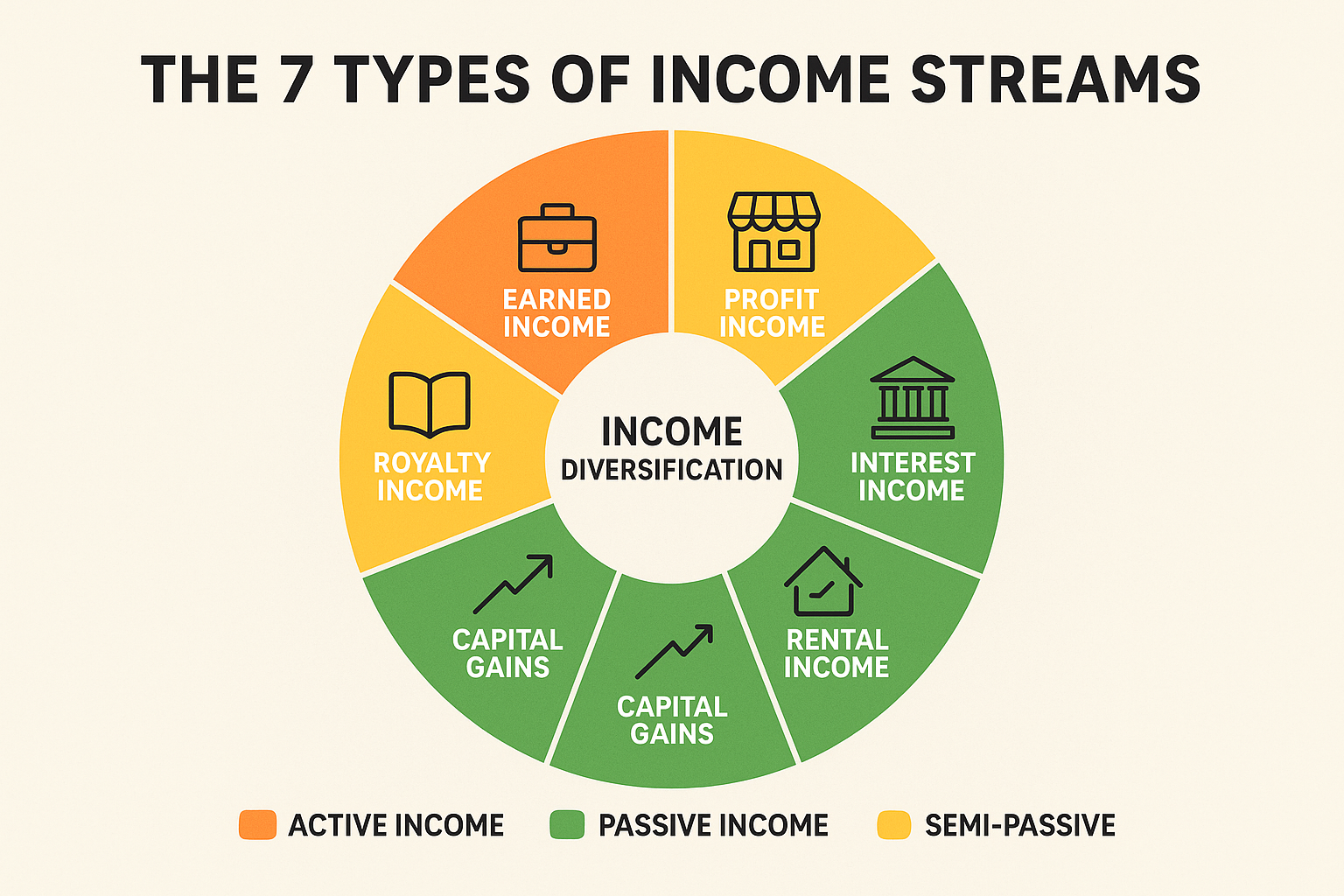

- The seven main income categories include earned income, profit income, interest income, dividend income, rental income, capital gains, and royalty income

- Start with 2-3 income streams and gradually expand as you gain experience and resources

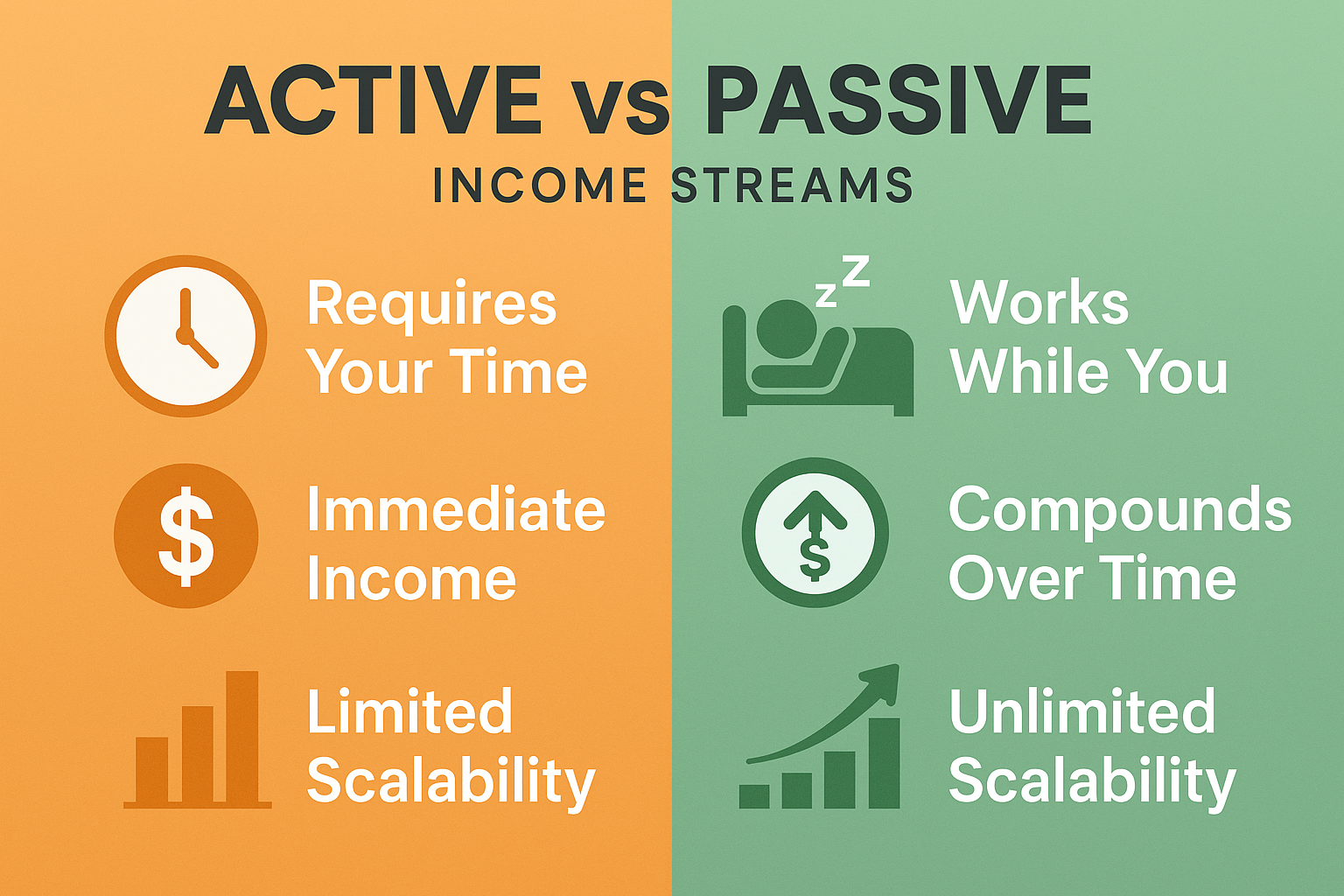

- Combining active income streams (requiring your time) with passive income streams (earning with minimal ongoing effort) creates the optimal wealth-building strategy

Why Multiple Streams of Income Matter in 2025

The traditional career path—work for one employer for 40 years, retire with a pension—has become as outdated as flip phones. According to the U.S. Bureau of Labor Statistics, the average person now changes jobs 12 times during their career, and economic volatility has made job security increasingly uncertain.

The Financial Security Advantage

Building multiple streams of income creates what financial experts call “income diversification”—the same principle that makes portfolio diversification so powerful in investing. When you rely on a single income source, you’re vulnerable to:

- Job loss or termination

- Industry downturns affecting your sector

- Health issues are preventing you from working

- Company bankruptcy or restructuring

- Economic recessions are impacting employment

With multiple income streams, losing one source becomes manageable rather than catastrophic. It’s the difference between a minor setback and a financial disaster.

The Wealth Acceleration Effect

Here’s where things get exciting: multiple income streams don’t just protect you—they supercharge your wealth-building capacity. When you have extra income flowing in beyond your primary job, you can:

Invest more aggressively in dividend-paying stocks and other assets

Pay off debt faster, eliminating interest payments

Build emergency funds that actually cover 6-12 months of expenses. Retire earlier by reaching financial independence sooner

Take calculated risks, knowing you have backup income sources

A study by the IRS found that millionaires have an average of seven income streams. While correlation doesn’t equal causation, the pattern is clear: wealthy individuals understand that diversified income creates exponential growth opportunities.

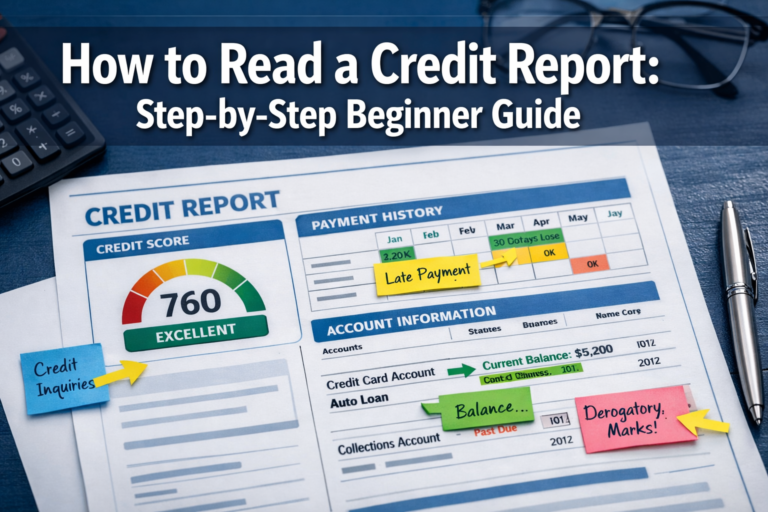

Understanding the Seven Types of Income Streams

The IRS recognizes seven distinct types of income, each with unique characteristics, tax implications, and wealth-building potential. Understanding these categories helps you strategically build a diversified income portfolio.

1. Earned Income (Active)

What it is: Money you exchange your time and labor for—your salary, hourly wages, commissions, or tips.

Examples:

- Full-time employment salary

- Freelance consulting fees

- Part-time job wages

- Commission-based sales

Pros: Predictable, immediate, and often includes benefits

Cons: Limited by time, the highest tax rate, and stops when you stop working

2. Profit Income (Active/Semi-Passive)

What it is: Revenue generated from buying and selling goods or services through a business you own.

Examples:

- E-commerce store profits

- Service business revenue

- Dropshipping margins

- Product manufacturing

Pros: Unlimited earning potential, can be systematized

Cons: Requires initial capital and effort, business risk

3. Interest Income (Passive)

What it is: Money earned from lending your capital to others, typically through banks or bonds.

Examples:

- High-yield savings accounts

- Certificates of deposit (CDs)

- Treasury bonds

- Peer-to-peer lending platforms

Pros: Extremely low risk (especially FDIC-insured accounts), predictable

Cons: Lower returns, inflation can erode purchasing power

4. Dividend Income (Passive)

What it is: Regular payments received from owning shares in profitable companies that distribute earnings to shareholders.

Examples:

- Individual dividend stocks

- Dividend-focused ETFs

- Real Estate Investment Trusts (REITs)

- Dividend mutual funds

Pros: Passive, compounds over time, tax advantages

Cons: Market volatility, requires capital to start

Learning how to start earning passive income through dividend investing is one of the most accessible ways for beginners to create their first passive income stream.

5. Rental Income (Semi-Passive)

What it is: Money received from allowing others to use property you own.

Examples:

- Residential real estate rentals

- Commercial property leasing

- Vacation rental properties (Airbnb)

- Equipment or vehicle rentals

Pros: Tangible asset appreciation, steady cash flow, tax benefits

Cons: Property management responsibilities, vacancy risk, maintenance costs

6. Capital Gains (Semi-Passive)

What it is: Profit from selling an asset for more than you paid for it.

Examples:

- Stock market investments

- Real estate appreciation

- Collectibles and art

- Cryptocurrency gains

Pros: Potential for significant returns, favorable tax treatment for long-term gains

Cons: Market risk, timing dependent, requires capital

Understanding why the stock market goes up over time helps you appreciate the wealth-building power of capital gains.

7. Royalty Income (Passive)

What it is: Payment for the ongoing use of your intellectual property or creative work.

Examples:

- Book royalties

- Music streaming payments

- Patent licensing fees

- Online course sales

- Stock photography

Pros: Truly passive after creation, scalable

Cons: Upfront effort required, competitive markets

How to Start Building Multiple Streams of Income: A Step-by-Step Guide

Creating multiple income streams doesn’t happen overnight, and trying to launch five different ventures simultaneously is a recipe for burnout. Here’s a strategic, beginner-friendly approach:

Step 1: Assess Your Current Financial Situation

Before adding income streams, understand where you stand:

- Calculate your monthly expenses and income needs

- Evaluate your available time for additional ventures

- Identify your starting capital for investments

- Review your skills and expertise that could generate income

- Determine your risk tolerance for different income types

Create a simple spreadsheet listing your current income sources, monthly amount, and stability rating (1-10). This baseline helps you identify gaps and opportunities.

Step 2: Optimize Your Primary Income Stream First

Your main job or business is typically your largest income source—maximize it before diversifying:

- Negotiate a raise or promotion at your current position

- Develop high-value skills that increase your market value

- Switch to a higher-paying role if you’re significantly underpaid

- Improve your business margins if you’re self-employed

This foundation provides the capital and stability needed to build additional streams effectively.

Step 3: Choose Your Second Income Stream Strategically

Your first additional income stream should align with these criteria:

Low barrier to entry: Doesn’t require massive upfront investment

Leverages existing skills: Uses knowledge you already possess

Flexible timing: Fits around your primary income obligations

Growth potential: Can scale beyond initial earnings

Beginner-friendly options include:

| Income Stream | Time Investment | Startup Cost | Potential Monthly Income |

|---|---|---|---|

| Freelance consulting | 5-10 hrs/week | $0-$500 | $500-$3,000+ |

| Dividend investing | 2-5 hrs/month | $1,000+ | $30-$100+ (grows over time) |

| Online course creation | 20-40 hrs upfront | $0-$300 | $100-$2,000+ |

| Rental property (house hacking) | 5-10 hrs/month | $10,000+ | $500-$1,500+ |

| Affiliate marketing blog | 10-15 hrs/week | $100-$500 | $100-$1,000+ |

Step 4: Implement and Test Your New Income Stream

Launch your chosen income stream with a testing mindset:

- Set a 90-day trial period to evaluate viability

- Track time invested versus income generated

- Document processes for efficiency improvements

- Gather feedback from customers or clients

- Adjust your approach based on results

Sarah, a marketing manager, started freelance social media consulting in early 2024. She committed to working 6 hours every Saturday for three months. By the end of her trial period, she was earning an extra $1,200 monthly—enough to validate continuing and eventually scaling the service.

Step 5: Automate and Systematize Before Adding More

Before launching a third income stream, make your second one as efficient as possible:

- Create templates for repetitive tasks

- Use automation tools (scheduling software, payment processors)

- Outsource low-value activities when financially viable

- Develop standard operating procedures (SOPs)

- Set boundaries to prevent burnout

The goal is reaching a point where your second income stream requires minimal active management, freeing capacity for additional ventures.

Step 6: Add Passive Income Streams Progressively

Once you’ve established 1-2 active income streams, focus on building passive income that works while you sleep:

Investment-based passive income:

- Start with smart ways to make passive income through dividend stocks

- Open a high-yield savings account for emergency funds

- Invest in index funds for long-term capital gains

- Consider REITs for real estate exposure without property management

Creation-based passive income:

- Write and self-publish an ebook

- Create digital products (templates, planners, guides)

- Build an online course teaching your expertise

- Develop a YouTube channel or podcast with ad revenue

The beauty of passive income is its compounding effect. A $10,000 investment in dividend stocks yielding 4% generates $400 annually with zero additional effort—and that grows as you reinvest dividends and add more capital.

The Ideal Income Stream Portfolio: Balancing Active and Passive

Financial independence doesn’t require dozens of income streams; it requires the right mix of streams that balance effort, risk, and reward.

The 3-Stream Foundation (Beginner Level)

Stream 1: Primary employment (earned income)

Stream 2: Side business or freelancing (profit/earned income)

Stream 3: Investment account (dividend/capital gains income)

This foundation provides stability (primary job), growth potential (side business), and passive wealth building (investments). It’s manageable for most people working full-time while building financial security.

The 5-Stream Growth Portfolio (Intermediate Level)

Stream 1: Primary employment or main business

Stream 2: Scalable side business

Stream 3: Dividend stock portfolio

Stream 4: Real estate investment (rental or REIT)

Stream 5: Digital product or royalty income

This portfolio balances active effort with increasing passive income, creating multiple wealth-building engines working simultaneously.

The 7+ Stream Wealth Portfolio (Advanced Level)

Stream 1: Optimized primary business (possibly passive management)

Stream 2: Secondary business or consulting

Stream 3: Dividend stock portfolio

Stream 4: Growth stock investments

Stream 5: Rental property income

Stream 6: Royalty income (books, courses, patents)

Stream 7: Interest income from bonds or high-yield accounts

Stream 8+: Additional investments or businesses

At this level, passive income often exceeds active income, enabling true financial independence. However, reaching this point typically takes 5-10+ years of consistent effort and reinvestment.

Common Mistakes to Avoid When Building Multiple Income Streams

1: Spreading Too Thin Too Fast

The biggest error beginners make is launching multiple ventures simultaneously, resulting in:

- Mediocre execution across all streams

- Burnout and exhaustion from overcommitment

- Financial losses from inadequate attention

- Abandoning promising streams before they mature

Solution: Master one additional income stream before adding another. Quality over quantity wins every time.

2: Chasing Shiny Objects and Trends

Cryptocurrency millionaires, NFT fortunes, and viral TikTok success stories create FOMO (fear of missing out) that leads to poor decisions:

- Jumping into unfamiliar markets without research

- Investing in speculative assets beyond your risk tolerance

- Abandoning solid strategies for unproven trends

- Losing capital in get-rich-quick schemes

Solution: Build income streams aligned with your skills, interests, and risk profile. Sustainable wealth beats lottery-ticket thinking.

3: Neglecting Tax Implications

Different income streams have vastly different tax treatments:

- Earned income: Taxed at ordinary income rates (up to 37%)

- Long-term capital gains: Taxed at preferential rates (0%, 15%, or 20%)

- Dividend income: Qualified dividends taxed at capital gains rates

- Business income: Subject to self-employment tax plus income tax

Solution: Consult a tax professional as you build income streams. Proper planning can save thousands annually. The IRS provides comprehensive guidance on different types of income at IRS.gov.

4: Forgetting to Reinvest for Growth

Many people treat additional income streams as “fun money” rather than wealth-building tools:

- Spending every dollar earned from side hustles

- Failing to reinvest business profits

- Not compounding investment returns

- Lifestyle inflation matches income increases

Solution: Establish a reinvestment percentage (30-50% is ideal) for each new income stream. This accelerates wealth building exponentially.

5: Ignoring the Time-Money Trade-off

Not all income streams are created equal when you factor in time investment:

A freelance gig paying $50/hour that requires 20 hours weekly ($1,000/month) might be less valuable than a dividend portfolio generating $800/month passively—because the latter frees 20 hours for higher-leverage activities or quality of life.

Solution: Calculate your effective hourly rate for each income stream and prioritize those with the best time-to-income ratio. Understanding the cycle of market emotions helps you avoid impulsive decisions about your investment income streams.

Real-World Example: Building from One to Five Income Streams

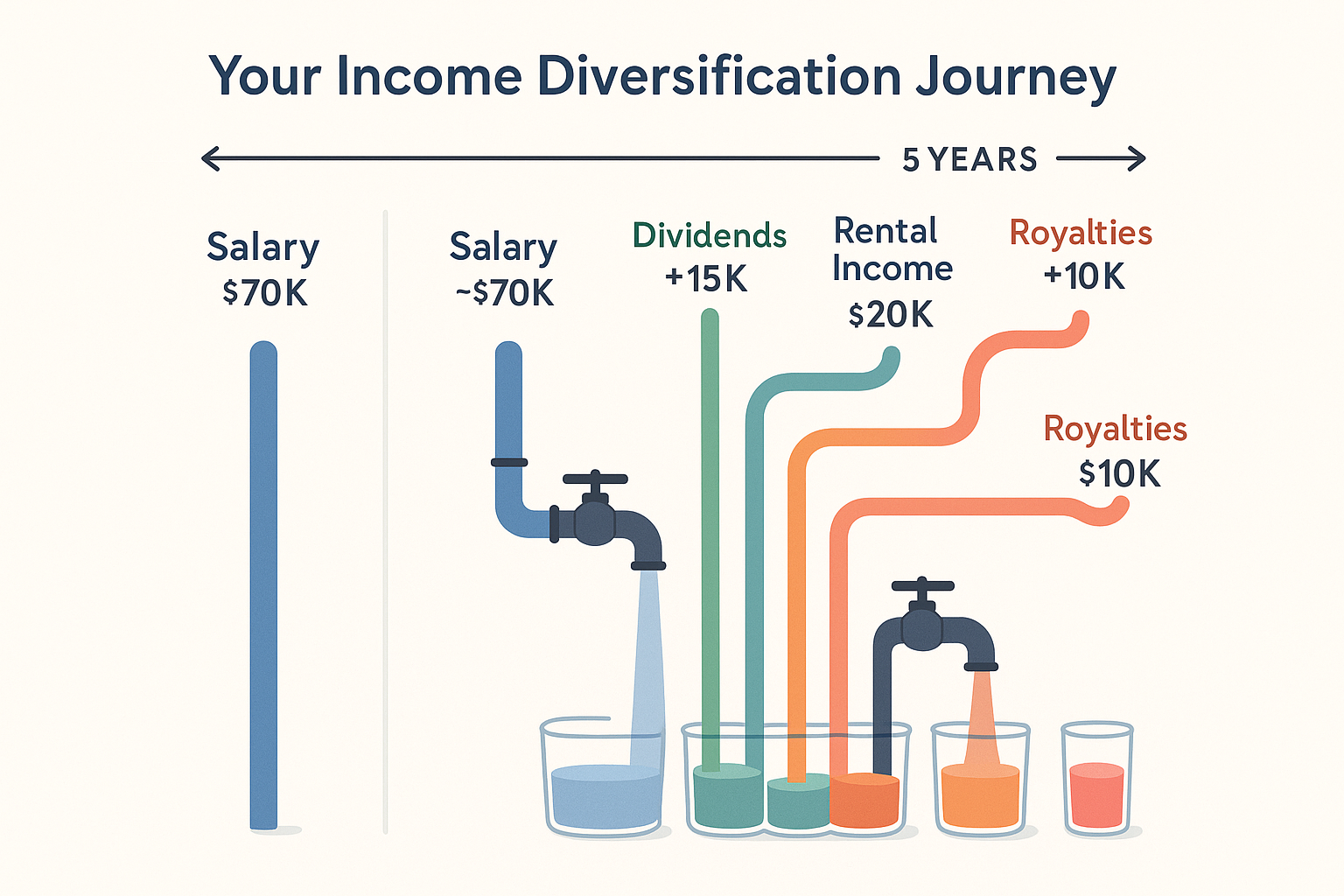

Let’s follow Marcus, a 32-year-old software developer, through his income diversification journey:

Year 1: Single Income Stream

- Primary job: $85,000 annually

- Monthly take-home: ~$5,300

- Savings rate: 15% ($795/month)

Marcus felt financially vulnerable. One job loss would derail everything.

Year 2: Adding Stream #2 (Side Business)

- Primary job: $85,000

- Freelance coding: $1,200/month (10 hrs/week)

- Total monthly: ~$6,500

- Savings rate: 25% ($1,625/month)

Marcus started taking freelance projects on weekends, focusing on his specialty (mobile app development). He reinvested 50% of his freelance income into building his skills and equipment.

Year 3: Adding Stream #3 (Dividend Investing)

- Primary job: $92,000 (got a raise)

- Freelance coding: $1,800/month (systematized, same hours)

- Dividend portfolio: $40/month (started with $12,000 invested)

- Total monthly: ~$7,500

- Savings rate: 30% ($2,250/month)

Marcus used his accumulated savings and freelance income to build a dividend stock portfolio, following strategies from resources on dividend investing.

Year 4: Adding Stream #4 (Digital Product)

- Primary job: $92,000

- Freelance coding: $2,000/month (raised rates)

- Dividend portfolio: $95/month (grew to $28,000 invested)

- Online course: $600/month (created once, sells passively)

- Total monthly: ~$8,400

- Savings rate: 35% ($2,940/month)

Marcus created an online course teaching mobile app development basics. After 60 hours of upfront work, it generated passive income with minimal maintenance.

Year 5: Adding Stream #5 (Real Estate)

- Primary job: $98,000 (another raise)

- Freelance coding: $2,200/month

- Dividend portfolio: $180/month (grew to $54,000 invested)

- Online course: $900/month (updated content, more sales)

- Rental property: $400/month net (house-hacked duplex)

- Total monthly: ~$10,500

- Savings rate: 40% ($4,200/month)

Marcus purchased a duplex, living in one unit and renting the other. His tenant’s rent covered most of the mortgage, creating positive cash flow and building equity.

Results after 5 years:

- Income increased 58% (from $85K to $134K annually)

- Net worth grew to $185,000 (from nearly zero)

- Financial security multiplied by five independent income sources

- Freedom increased with passive income covering 15% of expenses

Marcus’s journey illustrates the power of sequential income stream building—each new stream was funded and enabled the next.

How to Choose the Right Income Streams for Your Situation

Not every income stream makes sense for every person. Here’s how to identify the best opportunities for your unique circumstances:

Consider Your Starting Capital

Low capital ($0-$1,000):

- Freelancing or consulting

- Service-based side businesses

- Content creation (YouTube, blogging)

- Affiliate marketing

- Small dividend investing

Medium capital ($1,000-$25,000):

- Substantial dividend portfolio

- E-commerce business

- Online course creation with marketing

- Peer-to-peer lending

- Equipment rental business

High capital ($25,000+):

- Rental real estate

- Franchise ownership

- Angel investing

- Larger dividend portfolio generating meaningful income

- Business acquisition

Evaluate Your Available Time

Limited time (5-10 hours/month):

- Dividend investing (nearly zero time after setup)

- Automated online businesses

- Royalty income from existing creations

- REIT investments

Moderate time (10-20 hours/week):

- Freelancing or consulting

- E-commerce store

- Content creation

- Part-time business

Significant time (20+ hours/week):

- Building a substantial side business

- Real estate investing with active management

- Creating multiple digital products

- Developing a personal brand

Leverage Your Existing Skills and Interests

The most successful income streams align with what you already know and enjoy:

Professional skills: Consulting, freelancing, teaching

Creative abilities: Content creation, design services, digital products

Technical knowledge: Software development, data analysis, technical writing

People skills: Coaching, event planning, community building

Financial acumen: Investing, financial planning, investment education

When you enjoy the work, it doesn’t feel like a burden—and you’re more likely to persist through the challenging early stages.

Scaling Your Income Streams Over Time

Building multiple streams of income isn’t a one-time project—it’s an evolving strategy that grows with you.

Phase 1: Foundation (Years 1-2)

Focus: Establish 2-3 reliable income streams

Priority: Consistency over optimization

Goal: Generate an additional $500-$2,000 monthly

Phase 2: Growth (Years 3-5)

Focus: Optimize existing streams and add 1-2 more

Priority: Increasing passive income percentage

Goal: Additional income equals 50-75% of primary income

Phase 3: Acceleration (Years 6-10)

Focus: Maximize passive income, minimize active effort

Priority: Reinvestment and compounding

Goal: Passive income covers 50%+ of living expenses

Phase 4: Financial Independence (Years 10+)

Focus: Living off passive income, active income optional

Priority: Wealth preservation and legacy building

Goal: Passive income exceeds expenses, work becomes a choice

This timeline varies dramatically based on starting point, income level, and commitment—but the pattern holds: consistent effort over years creates exponential results.

The Role of Passive Income in Long-Term Wealth

While active income streams (freelancing, side businesses) can generate quick cash flow, passive income is the true key to financial freedom. Here’s why:

Time Freedom Multiplier Effect

Active income requires your continuous presence and effort. Miss a week of work, earn a week less money. Passive income breaks this equation:

- Dividend stocks pay you whether you’re working, sleeping, or on vacation

- Rental properties generate income without daily involvement

- Digital products sell while you focus on other priorities

- Royalties compound from work you did years ago

This time, freedom allows you to:

- Pursue passion projects without financial pressure

- Spend more time with family

- Take career risks you couldn’t otherwise afford

- Retire decades earlier than traditional timelines

The Compound Growth Advantage

Passive income streams, particularly investments, benefit from compounding—Albert Einstein’s “eighth wonder of the world.”

A $50,000 dividend portfolio yielding 4% generates $2,000 annually. Reinvest those dividends, add $500 monthly, and maintain that 4% yield:

- Year 5: Portfolio worth $89,000, generating $3,560 annually

- Year 10: Portfolio worth $142,000, generating $5,680 annually

- Year 20: Portfolio worth $317,000, generating $12,680 annually

- Year 30: Portfolio worth $611,000, generating $24,440 annually

That’s the power of passive income compounding over time. Resources like smart moves can help you make better investment decisions to maximize this effect.

Building Your Passive Income Foundation

Start building passive income streams early, even with small amounts:

- Automate investment contributions ($100-500/month to start)

- Reinvest all passive income initially for faster growth

- Focus on consistency over perfect timing

- Diversify across asset types (stocks, bonds, real estate)

- Increase contributions as active income grows

Even modest passive income provides psychological benefits—knowing money flows in regardless of your daily activities reduces financial anxiety significantly.

Protecting Your Multiple Income Streams

Once you’ve built multiple income streams, protection becomes crucial:

Diversification Across Risk Profiles

Don’t make all your income streams high-risk or dependent on similar factors:

Low risk: Dividend stocks from established companies, government bonds, savings accounts

Medium risk: Rental property, diversified stock portfolio, established side business

High risk: Growth stocks, cryptocurrency, startup ventures, speculative investments

A balanced portfolio might include 50% low-risk, 35% medium-risk, and 15% high-risk income streams.

Legal Protection Strategies

As income streams grow, legal protection becomes essential:

- Form an LLC for business income streams to separate personal and business liability

- Maintain adequate insurance (liability, property, professional)

- Use contracts for all business relationships

- Separate business and personal finances completely

- Consult legal professionals before major decisions

Emergency Fund Considerations

Multiple income streams reduce (but don’t eliminate) the need for emergency funds:

Single income stream: 6-12 months of expenses recommended

2-3 income streams: 4-6 months of expenses adequate

5+ income streams with passive income: 3-4 months of expenses are sufficient

Your emergency fund can be smaller because losing one income source doesn’t eliminate all income, but maintaining some cash cushion remains essential for true financial security.

Teaching Your Family About Multiple Income Streams

Building generational wealth means passing financial knowledge to the next generation. Teaching children and young adults about income diversification creates a lasting impact.

Age-Appropriate Income Stream Education

Ages 5-10: Basic concepts

- Money can come from different places

- Allowance for chores (earned income)

- Savings accounts earning interest (interest income)

- Simple explanations of how parents earn money

Ages 11-15: Expanding understanding

- Different types of income streams are explained simply

- Starting small businesses (lemonade stand, lawn care)

- Introduction to investing concepts

- Compound interest demonstrations

Ages 16-18: Practical application

- Part-time jobs (earned income)

- Starting investment accounts with parental guidance

- Creating digital products or services

- Understanding taxes and financial responsibility

Ages 18+: Independence

- Building their own income stream portfolio

- Investment account management

- Business creation opportunities

- Long-term wealth planning

Resources like How to Make Your Kid a Millionaire provide specific strategies for building generational wealth through early financial education.

FAQ

There’s no magic number, but most financial experts recommend 3-7 income streams for optimal diversification without overwhelming complexity. Start with 2-3 and expand gradually as you gain experience. Quality matters more than quantity—three strong, reliable income streams beat seven struggling ones.

Dividend investing is typically the most accessible passive income stream for beginners. With as little as $500-1,000, you can start building a dividend portfolio through commission-free brokerages. While returns start small, the compounding effect and minimal time requirement make it ideal for those new to passive income.

Realistically, expect 2-3 years to establish 2-3 solid income streams generating an additional $1,000-3,000 monthly. Reaching financial independence where passive income covers all expenses typically takes 10-20 years, depending on starting point, income level, and reinvestment rate. Quick schemes promising faster results usually involve unsustainable risk.

Generally, no—your primary job provides the stability and capital needed to build other income streams. The ideal approach is building side income streams while employed, then transitioning when passive income consistently covers 50-75% of expenses for at least 12 months. Quitting prematurely often forces you to treat side ventures as desperate income replacement rather than strategic wealth building.

Active income requires your ongoing time and effort to generate money—when you stop working, income stops (employment, freelancing, active businesses). Passive income continues flowing with minimal ongoing effort after initial setup (dividends, rental income, royalties, interest). The most effective wealth-building strategy combines both: active income provides immediate cash flow and investment capital, while passive income builds long-term financial freedom.

Prevent burnout by: (1) Adding only one new income stream at a time, (2) Setting realistic time boundaries (e.g., 10 hours weekly maximum for side projects), (3) Automating and systematizing before expanding, (4) Choosing income streams you genuinely enjoy, and (5) Maintaining work-life balance as a non-negotiable priority. Remember: building wealth is a marathon, not a sprint.

Absolutely—but only when approached strategically. Multiple income streams provide financial security that single-income reliance cannot match, accelerate wealth building through diversification, and create freedom to make life choices based on preference rather than financial necessity. However, poorly executed attempts that spread you too thin create stress without reward. The key is strategic, sequential building aligned with your skills and resources.

Taking Action: Your 30-Day Multiple Income Streams Starter Plan

Ready to begin building your income stream portfolio? Here’s a concrete 30-day action plan:

Week 1: Assessment and Planning

- Day 1-2: Complete a comprehensive financial assessment (income, expenses, debt, assets)

- Day 3-4: List your skills, expertise, and interests that could generate income

- Day 5-7: Research 3-5 potential income streams aligned with your assessment

Week 2: Deep Dive and Selection

- Day 8-10: Research each potential income stream thoroughly (time requirements, startup costs, earning potential)

- Day 11-12: Calculate realistic projections for each option

- Day 13-14: Select your first additional income stream and create a 90-day implementation plan

Week 3: Setup and Launch Preparation

- Day 15-17: Complete necessary setup (business registration, platform accounts, investment account opening)

- Day 18-20: Create systems and processes (templates, schedules, automation)

- Day 21: Launch your first income stream activity

Week 4: Implementation and Optimization

- Day 22-25: Execute your income stream plan consistently

- Day 26-28: Track results and gather feedback

- Day 29-30: Analyze performance and adjust approach for the next 60 days

Following this plan creates momentum while maintaining focus—the perfect balance for sustainable income stream building.

Conclusion: Your Path to Financial Freedom Through Multiple Income Streams

Building multiple streams of income isn’t about working yourself to exhaustion or chasing every money-making opportunity that crosses your path. It’s about strategically creating a diversified income portfolio that provides security, accelerates wealth building, and ultimately delivers the freedom to live life on your terms.

The journey from single-income dependence to multiple-stream financial independence follows a clear path:

Start where you are with your current resources and skills

Add income streams sequentially, mastering each before expanding

Balance active and passive income for immediate cash flow and long-term wealth

Reinvest consistently to compound your results

Protect and optimize as your portfolio grows

Think generationally by teaching these principles to others

Remember Marcus’s story, he didn’t transform his financial life overnight. He committed to consistent action over five years, building one income stream at a time, reinvesting profits strategically, and making deliberate choices aligned with his long-term vision.

You can do the same, regardless of your starting point. Whether you’re earning $30,000 or $300,000 annually, the principles remain identical: diversify income sources, balance active and passive streams, reinvest for growth, and maintain patience through the process.

The best time to start building multiple income streams was ten years ago. The second-best time is today. Take the first step by completing Week 1 of the 30-day starter plan above. Your future self—financially secure, stress-free, and living with genuine freedom—will thank you for starting now.

For more strategies on building wealth and financial security, explore our comprehensive guides on personal finance and investing.

References and Further Reading

- Internal Revenue Service (IRS) – Types of Income – Official guidance on income classification and taxation

- U.S. Bureau of Labor Statistics – Employment and Career Statistics – Data on career changes and employment trends

- Investopedia – Multiple Streams of Income – Comprehensive financial education resource

- Securities and Exchange Commission (SEC) – Investor.gov – Investment education and protection resources

Disclaimer

This article is for educational purposes only and does not constitute financial, investment, tax, or legal advice. Multiple income stream strategies involve varying degrees of risk, and past performance does not guarantee future results. Consult with qualified financial, tax, and legal professionals before making significant financial decisions. Investment values fluctuate, and you may lose money. The author and publisher assume no liability for actions taken based on information contained in this article.

Author Bio

Written by Max Fonji — With over a decade of experience in personal finance education and wealth-building strategies, Max is your go-to source for clear, data-backed investing education. As the founder of TheRichGuyMath.com, Max has helped thousands of readers build financial security through practical, actionable strategies. His expertise spans dividend investing, income diversification, and long-term wealth creation, with a focus on making complex financial concepts accessible to everyone.

💼 Build Your Income Stream Portfolio

Select income streams and enter monthly amounts to visualize your diversification