Imagine two friends starting their careers at age 25. Sarah puts $500 every month into a high-yield savings account earning 2% annually. Meanwhile, Mike invests the same $500 monthly into a diversified portfolio averaging 8% returns. Fast forward 30 years to age 55, Sarah has accumulated around $246,000, while Mike’s portfolio has grown to approximately $745,000. That’s a difference of nearly half a million dollars from the same monthly contribution. This stark contrast illustrates exactly why investing is a more powerful tool to build long-term wealth than saving.

Key Takeaways

- Compound growth through investing significantly outpaces the modest interest earned in savings accounts over time

- Historical stock market returns average 8-10% annually, while savings accounts typically offer 1-3%

- Inflation erodes the purchasing power of saved money, but investing helps preserve and grow wealth beyond inflation

- Time in the market amplifies the power of compounding, making early investing crucial for wealth building

- Strategic asset allocation and diversification reduce risk while maximizing long-term growth potential

Disclaimer: This article is for educational and informational purposes only and should not be construed as financial advice. Investing involves risk, including the potential loss of principal. Past performance does not guarantee future results. Please consult with a qualified financial advisor before making investment decisions based on your individual circumstances, risk tolerance, and financial goals.

Understanding the Fundamental Difference Between Saving and Investing

Saving means setting aside money in secure, easily accessible accounts like savings accounts, money market accounts, or certificates of deposit (CDs). The primary goal is preservation of capital with minimal risk and guaranteed (though modest) returns.

Investing, on the other hand, involves purchasing assets such as stocks, bonds, real estate, or mutual funds with the expectation that they will generate returns over time through appreciation, dividends, or interest. While investing carries more risk than saving, it offers substantially higher potential returns. Investopedia

Both saving and investing serve important roles in a comprehensive financial strategy. Savings provide liquidity and security for emergencies and short-term goals, while investing builds wealth for long-term objectives like retirement, education funding, or financial independence.

| Feature | Saving | Investing |

|---|---|---|

| Goal | Preserve money | Grow money |

| Risk level | Very low | Moderate to high |

| Return potential | 1%–3% (typical bank rates) | 6%–10% (historical average market returns) |

| Time horizon | Short-term goals | Long-term wealth |

| Liquidity | Immediate access | May take time to sell assets |

| Inflation impact | Loses value over time | It may take time to sell assets |

In short:

- Saving = safety + liquidity.

- Investing = risk + growth.

You need both, but only one builds wealth.

The Role of Each in Your Financial Life

Think of saving as your financial foundation, the emergency fund that protects you from unexpected expenses. Most financial experts recommend maintaining 3-6 months of living expenses in readily accessible savings.

Investing represents your financial growth engine, the mechanism that transforms your money into meaningful wealth over decades. Once your emergency fund is established, directing additional funds toward investments becomes the pathway to long-term prosperity.

The Power of Compound Growth: Why Time Is Your Greatest Asset

Albert Einstein allegedly called compound interest “the eighth wonder of the world,” and for good reason. Compound growth occurs when your investment earnings generate their own earnings, creating a snowball effect that accelerates wealth accumulation over time.

Formula:

A = P(1+r)^t

Where:

- A = final amount

- P = principal

- r = annual rate of return

- t = years invested

How Compounding Works in Practice

When you invest $10,000 at an 8% annual return:

- Year 1: You earn $800, bringing your total to $10,800

- Year 2: You earn 8% on $10,800 ($864), totaling $11,664

- Year 3: You earn 8% on $11,664 ($933), reaching $12,597

Notice how your earnings increase each year, even though the percentage remains constant. This exponential growth becomes dramatically more powerful over longer periods. Kiplinger

| Time Period | Initial Investment | Annual Return | Final Value |

|---|---|---|---|

| 10 years | $10,000 | 8% | $21,589 |

| 20 years | $10,000 | 8% | $46,610 |

| 30 years | $10,000 | 8% | $100,627 |

| 40 years | $10,000 | 8% | $217,245 |

The table above demonstrates that waiting just 10 additional years to start investing can cost you hundreds of thousands of dollars in potential wealth. Understanding how the stock market works helps beginners appreciate this growth potential.

The “Rule of 72”

A quick way to estimate how long it takes for money to double is the Rule of 72. Simply divide 72 by your expected annual return rate:

- At 2% (typical savings account): 72 ÷ 2 = 36 years to double

- At 8% (historical stock market average): 72 ÷ 8 = 9 years to double

- At 10% (aggressive growth portfolio): 72 ÷ 10 = 7.2 years to double

This simple calculation reveals why investing accelerates wealth building so dramatically compared to saving. Bankrate

The Inflation Factor: Protecting Your Purchasing Power

One of the most overlooked dangers of relying solely on savings is inflation, the gradual increase in prices that erodes purchasing power over time.

Real Returns vs Nominal Returns

If your savings account pays 2% annual interest but inflation runs at 3%, your real return is actually -1%. You’re losing purchasing power despite seeing your account balance grow in nominal terms.

Consider this example:

- You save $50,000 in a savings account earning 2% annually

- Inflation averages 3% per year

- After 20 years, your account shows $74,297

- But you’d need $90,306 to maintain the same purchasing power you had initially

- You’ve effectively lost $16,009 in real wealth

Conversely, investments that return 8-10% annually not only outpace inflation but also grow your real wealth significantly. This is why investing is essential for maintaining and increasing purchasing power over time, especially when planning for long-term passive income. nominal vs real return

Invest smartly – with low-cost, diversified funds – ensures your real growth stays positive

Historical Inflation Rates

Since 1925, inflation in the United States has averaged approximately 2.9% annually. During the same period, the S&P 500 has returned approximately 10% annually. This 7+ percentage point difference represents the real wealth creation that investing provides.

Risk vs Reward: Understanding the Investment Advantage

Many people avoid investing because they perceive it as “risky” compared to the “safety” of savings accounts. While this perception contains some truth, it oversimplifies the relationship between risk and reward.

Short-Term Volatility vs Long-Term Growth

Yes, investments fluctuate in value, sometimes dramatically. The cycle of market emotions can test even experienced investors. However, the time horizon is the critical factor that transforms risk into opportunity.

Short-term perspective (1-3 years):

- The stock market can be highly volatile

- Potential for temporary losses

- Savings accounts provide stability

Long-term perspective (10+ years):

- Market volatility smooths out significantly

- Historical data shows positive returns in virtually all 20-year periods

- Inflation risk becomes more dangerous than market risk

“The stock market is a device for transferring money from the impatient to the patient.” — Warren Buffett

Diversification: The Risk Management Tool

Smart investors don’t put all their eggs in one basket. Diversification, spreading investments across different asset classes, sectors, and geographic regions, reduces risk while maintaining growth potential.

A well-diversified portfolio might include:

- Domestic stocks (large, mid, and small-cap companies)

- International stocks (developed and emerging markets)

- Bonds (government and corporate)

- Real estate (REITs or direct ownership)

- Cash equivalents (for liquidity and stability)

Understanding the difference between index funds vs individual stocks helps beginners build diversified portfolios efficiently.

The Mathematics of Wealth Building: Comparing Scenarios

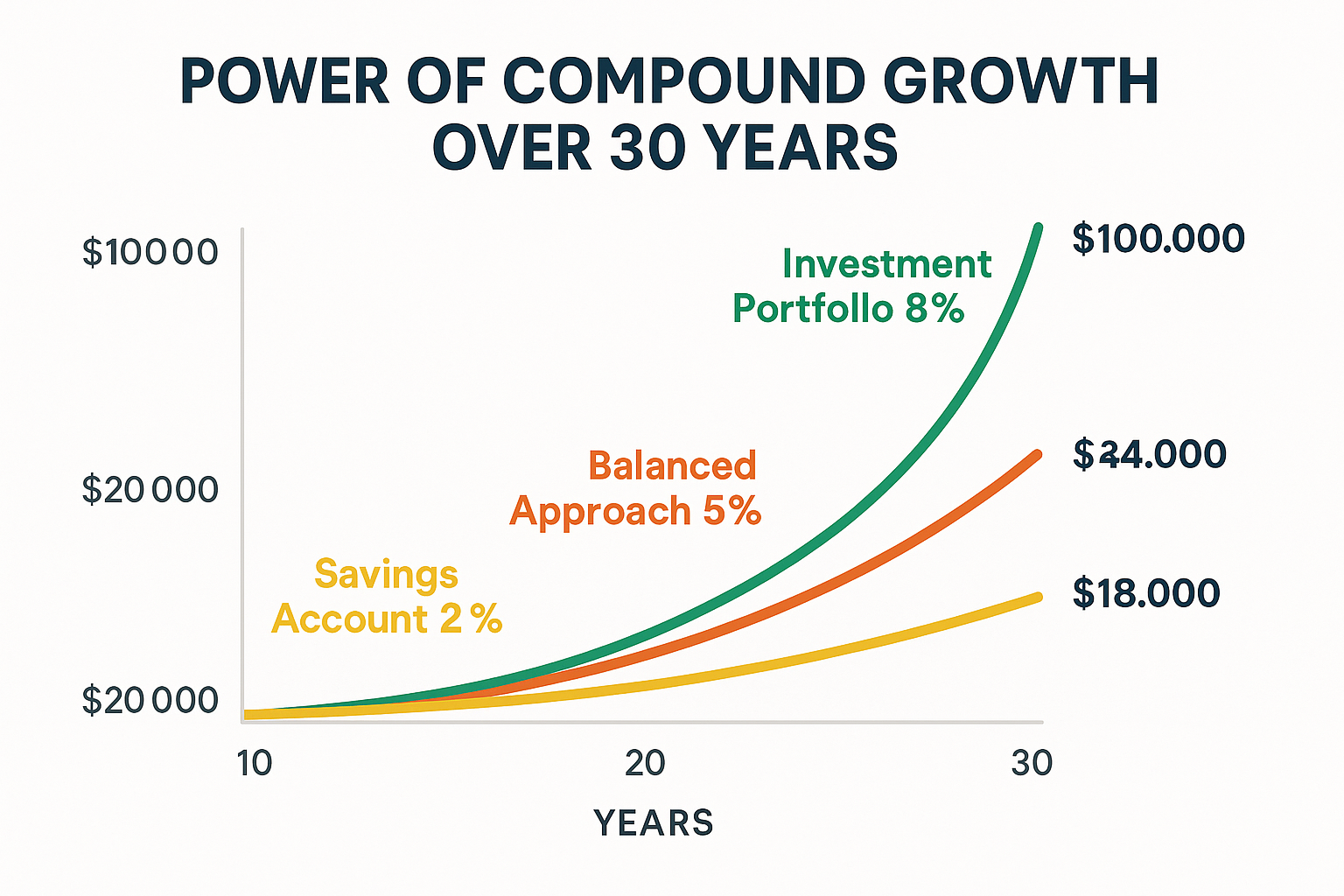

Let’s examine three different approaches to see why investing is a more powerful tool to build long-term wealth than saving:

Scenario Comparison: Three 30-Year Journeys

Scenario 1: Pure Savings Approach

- Monthly contribution: $500

- Average annual return: 2%

- After 30 years: $246,529

Scenario 2: Balanced Approach

- Monthly contribution: $500 ($250 to savings, $250 to investments)

- Savings return: 2% | Investment return: 8%

- After 30 years: $495,976 ($123,264 from savings + $372,712 from investments)

Scenario 3: Investment-Focused Approach

- Monthly contribution: $500

- Average annual return: 8%

- After 30 years: $745,425

The investment-focused approach generates $498,896 more than pure savings, which is more than triple the wealth from the same contributions. This dramatic difference explains why financial advisors consistently recommend investing for long-term goals.

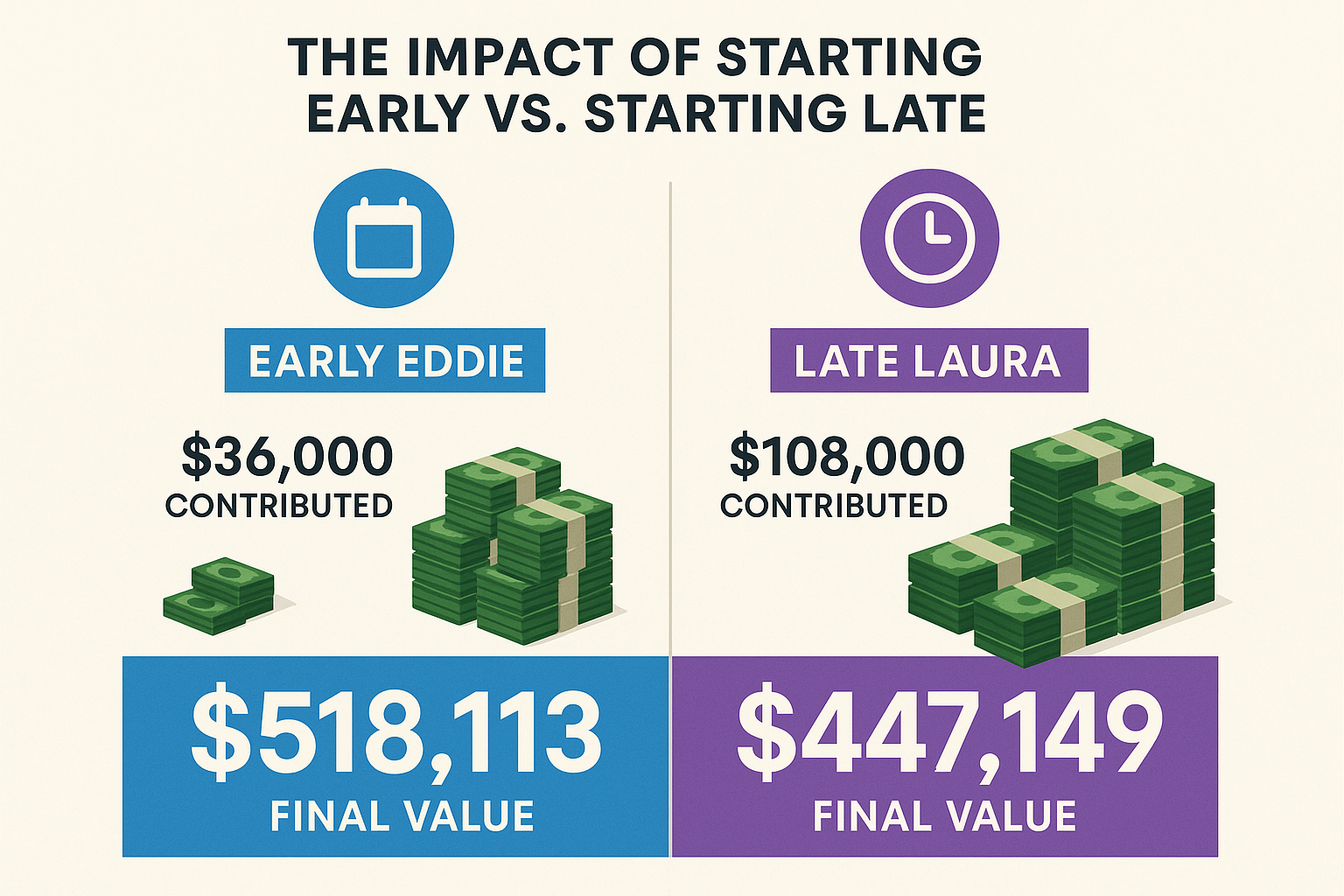

The Impact of Starting Early

Consider two investors:

Early Eddie:

- Invests $300/month from age 25 to 35 (10 years)

- Then stops contributing but leaves money invested until age 65

- Total contributions: $36,000

- Value at age 65 (assuming 8% annual return): $518,113

Late Laura:

- Starts investing $300/month at age 35

- Continues until age 65 (30 years)

- Total contributions: $108,000

- Value at age 65 (assuming 8% annual return): $447,149

Eddie contributed $72,000 less but ended up with $70,964 more simply by starting 10 years earlier. This demonstrates the extraordinary power of time and compound growth in investing.

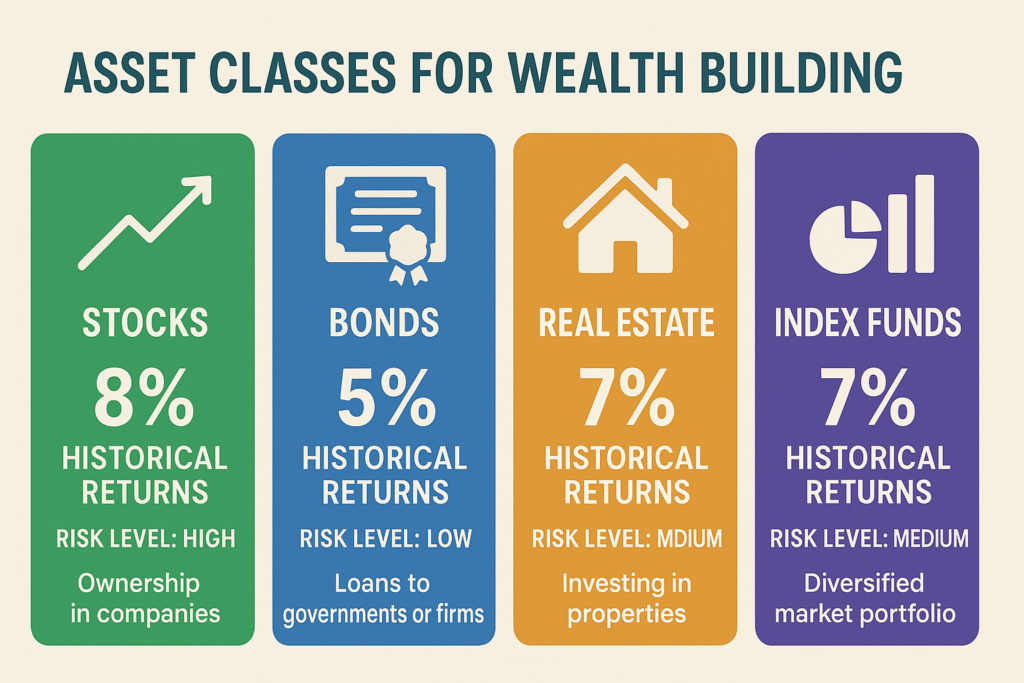

Asset Classes: Where Your Money Can Grow

Understanding different investment vehicles helps explain why investing outperforms saving for long-term wealth building.

Stocks: Ownership in Growing Companies

When you buy stocks, you own a piece of an actual business. As companies grow, innovate, and generate profits, shareholders benefit through:

- Price appreciation (capital gains)

- Dividends (profit distributions)

Historically, stocks have provided the highest long-term returns of any major asset class. Learning about high dividend stocks can help you generate income while building wealth.

Bonds: Lending for Steady Income

Bonds represent loans to governments or corporations. They typically offer:

- Lower returns than stocks (3-6% historically)

- Lower volatility

- Predictable income streams

- Diversification benefits when combined with stocks

Real Estate: Tangible Assets with Multiple Benefits

Real estate investments provide:

- Potential appreciation

- Rental income

- Tax advantages

- Inflation hedge (property values and rents typically rise with inflation)

Index Funds and ETFs: Instant Diversification

These investment vehicles allow you to own hundreds or thousands of securities with a single purchase, providing:

- Automatic diversification

- Low fees

- Professional management (passive index tracking)

- Accessibility for beginners

Many experts recommend index funds as the foundation for long-term wealth building due to their simplicity and proven track record.

Tax Advantages: Keeping More of What You Earn

Strategic investing offers significant tax benefits that amplify wealth building beyond what savings can provide.

Tax-Advantaged Retirement Accounts

401(k) Plans:

- Pre-tax contributions reduce current taxable income

- Tax-deferred growth (no taxes until withdrawal)

- Employer matching (free money that boosts returns)

Traditional IRAs:

- Potential tax deduction on contributions

- Tax-deferred growth

- Contribution limits for 2025: $7,000 ($8,000 if age 50+)

Roth IRAs:

- After-tax contributions (no immediate deduction)

- Tax-free growth and withdrawals in retirement

- No required minimum distributions

- Contribution limits for 2025: $7,000 ($8,000 if age 50+)

Capital Gains Tax Treatment

Long-term capital gains (assets held over one year) receive preferential tax treatment:

- 0%, 15%, or 20% tax rates depending on income

- Significantly lower than ordinary income tax rates (10-37%)

Meanwhile, savings account interest is taxed as ordinary income at your highest marginal rate, reducing your already modest returns even further.

Tax-Loss Harvesting

Sophisticated investors use strategic selling of losing positions to offset gains, reducing tax liability while maintaining investment exposure, a strategy impossible with simple savings accounts.

How to Start Investing the Smart Way

You don’t need thousands to begin. You just need a system.

Step-by-step roadmap:

- Build your emergency fund (3–6 months of expenses).

- Set clear financial goals (retirement, house, freedom).

- Pick your vehicles — index funds, ETFs, or robo-advisors.

- Automate monthly contributions — consistency beats timing.

- Diversify — spread risk across asset classes.

- Rebalance annually to maintain target allocations.

- Stay patient — focus on decades, not days.

Understanding why the stock market goes up over time helps maintain this perspective.

Common Objections to Investing (And Why They’re Misconceptions)

“I don’t have enough money to invest.”

Reality: Many brokerages now offer:

- Zero minimum account balances

- Fractional shares (buy portions of expensive stocks)

- Commission-free trading

You can start investing with as little as $5-10 per transaction. The key is starting, not the amount.

“Investing is too complicated.”

Reality: While advanced strategies exist, basic investing is remarkably simple:

- Open a brokerage account (15 minutes online)

- Choose a low-cost index fund

- Set up automatic monthly contributions

- Leave it alone

This straightforward approach has created more wealth than complex trading strategies for the vast majority of successful investors.

“I’ll wait until the market drops to invest.”

Reality: Timing the market is nearly impossible, even for professionals. Studies show that:

- Missing just the 10 best market days over 30 years reduces returns by approximately 50%

- Time in the market beats timing the market

- Starting today, even at market highs, beats waiting for the “perfect” entry point

“The market is too risky right now.”

Reality: The market has always faced uncertainties:

- Wars, pandemics, recessions, and political turmoil

- Yet it has consistently trended upward over long periods

- Today’s concerns feel unique, but uncertainty is constant

The question isn’t whether risks exist; they always do, but whether your time horizon allows you to weather temporary volatility.

The Psychological Advantage: Building Financial Confidence

Beyond mathematics, investing builds crucial psychological and behavioral advantages:

Developing Financial Literacy

Investors naturally become more financially educated, learning about:

- Economic principles

- Business fundamentals

- Market dynamics

- Tax strategies

This knowledge creates a positive feedback loop, improving all financial decisions.

Creating Active Engagement

Unlike passive savings, investing encourages active participation in wealth building. This engagement fosters:

- Better spending discipline

- Increased savings rates

- Long-term thinking

- Financial goal setting

Building Resilience

Experiencing market cycles—both ups and downs—develops emotional resilience and perspective that serves you throughout life. Learning to stay calm during volatility is a valuable life skill extending beyond finance.

When Saving Makes More Sense Than Investing

While this article emphasizes investing’s superior long-term wealth-building power, saving remains appropriate for:

Short-Term Goals (Less Than 3-5 Years)

If you need money soon for:

- Emergency fund

- House down payment

- Wedding expenses

- Car purchase

- Upcoming vacation

The certainty and liquidity of savings outweigh the growth potential of investments for these timeframes.

Risk-Averse Individuals Near Retirement

Those within 5-10 years of retirement should gradually shift from growth-focused investments to more stable assets, including savings, to protect accumulated wealth from market volatility.

Peace of Mind

If market fluctuations cause severe stress affecting your health or sleep, a more conservative approach with higher savings allocation may be appropriate, even if mathematically suboptimal. Financial strategies should support overall well-being.

The Hybrid Approach: Balancing Security and Growth

The most effective financial strategy typically combines both saving and investing in a complementary framework:

Foundation Layer (Savings):

- 3-6 months emergency fund

- Short-term goal funding

- Provides security and flexibility

Growth Layer (Investments):

- Retirement accounts (401k, IRA)

- Taxable brokerage accounts

- Real estate investments

- Builds long-term wealth

Optimization Layer (Advanced):

- Tax optimization strategies

- Estate planning

- Alternative investments

- Maximizes wealth preservation and transfer

This layered approach provides both security and growth, adapting to different life stages and changing circumstances. Reading more about smart financial moves can help refine your strategy.

Real-World Success Stories: The Evidence Speaks

The power of investing over saving isn’t theoretical; it’s demonstrated by countless success stories:

The Millionaire Next Door

Research by Thomas Stanley revealed that most millionaires didn’t inherit wealth or earn astronomical salaries. Instead, they:

- Lived below their means

- Invested consistently in stocks and real estate

- Maintained patience over decades

- Let compound growth work its magic

The Power of Employer Matching

Consider someone earning $50,000 annually who contributes 6% to their 401(k) with a 50% employer match:

- Employee contribution: $3,000/year

- Employer match: $1,500/year

- Total annual investment: $4,500

Over 30 years at 8% returns, this grows to $611,729, with $135,000 being free money from the employer. No savings account offers this kind of matching benefit.

Index Fund Investors

Investors who simply bought and held S&P 500 index funds:

- From 1995-2025 (30 years) saw average annual returns of approximately 10%

- Turned $10,000 into over $174,000

- Required minimal knowledge or active management

- Outperformed the vast majority of active traders and professional fund managers

These examples demonstrate that investing success doesn’t require genius, luck, or perfect timing, just consistency, patience, and time.

Conclusion: Taking Action Toward Financial Freedom

Why is investing a more powerful tool to build long-term wealth than saving? The answer is clear: compound growth, inflation protection, higher returns, tax advantages, and time all work together to create exponential wealth accumulation that saving simply cannot match.

Savings serve an important purpose, providing security, liquidity, and peace of mind for short-term needs and emergencies. But for long-term wealth building, retirement security, and financial independence, investing is not just superior, it’s essential.

The difference between someone who saves and someone who invests isn’t just financial’s the difference between preserving money and multiplying it, between keeping pace with inflation and beating it decisively, between financial survival and financial freedom.

Your Next Steps

- Establish your emergency fund (3-6 months of expenses in a high-yield savings account)

- Open an investment account (brokerage, IRA, or contribute to your employer’s 401(k))

- Start with index funds (broad market exposure with low fees)

- Automate contributions (set up monthly transfers you won’t miss)

- Increase gradually (raise contribution amounts as income grows)

- Stay educated (continue learning about investing fundamentals and strategies)

- Remain patient (let time and compound growth work their magic)

The best time to start investing was 20 years ago. The second-best time is today. Every day you delay represents lost compound growth that can never be recovered. Take that first step now, your future self will thank you.

Remember: wealth building isn’t about getting rich quickly; it’s about getting rich slowly, steadily, and surely through the proven power of investing.

Wealth Building Calculator

💰 Saving vs. Investing Wealth Calculator

FAQ’s

You can start investing with as little as $5-10. Many modern brokerages offer fractional shares and zero minimum account balances, making investing accessible to everyone regardless of income level.

For time horizons of 10+ years, investing in diversified portfolios has historically been safer than saving when accounting for inflation risk. While investments fluctuate short term, inflation steadily erodes savings’ purchasing power.

Low-cost index funds that track broad market indices (like the S&P 500 or total stock market) are ideal for beginners. They provide instant diversification, require minimal knowledge, and have consistently outperformed most actively managed funds.

Generally, yes, especially high-interest debt like credit cards (15%+ interest). However, you might invest simultaneously while paying off low-interest debt (like mortgages) and always contribute enough to your 401(k) to capture full employer matching.

While returns vary yearly, most investors see meaningful compound growth over 5-10+ year periods. The longer your time horizon, the more powerful compounding becomes. Patience is essential for investment success.

Market downturns are temporary and normal. If you’re investing for the long term (10+ years), crashes actually present buying opportunities. Continue investing consistently through downturns using dollar-cost averaging to purchase more shares at lower prices.

About the Author

Max Fonji is a financial educator dedicated to helping individuals build wealth through smart investing, passive income strategies, and financial literacy. Max’s mission is to demystify investing and empower beginners to take control of their financial futures. With evidence-based insights and practical guidance, Max makes complex financial concepts accessible to everyone, regardless of their starting point. Visit our blog for more wealth-building strategies and financial education.