Picture this: You’re running a lemonade stand on a hot summer day. You sell 100 cups at $2 each, making $200 in revenue. But after paying $80 for lemons, sugar, and cups, you only keep $120. That $120 is your profit—and profitability is all about how well you turn your sales into actual money you can keep. Whether you’re running a small business, evaluating stocks, or just trying to understand how companies make money, profitability is the single most important metric that separates thriving businesses from those barely surviving.

In simple terms, profitability means a company’s ability to generate more revenue than it spends on expenses. It’s not just about making sales—it’s about keeping enough money after all the bills are paid to grow, invest, and reward shareholders.

TL;DR

- Profitability is a company’s ability to generate profit relative to its revenue, assets, or equity—measuring how efficiently it converts sales into actual earnings.

- The main profitability ratios include gross profit margin, operating profit margin, net profit margin, return on assets (ROA), and return on equity (ROE).

- Higher profitability ratios generally indicate better financial health, operational efficiency, and competitive advantages in the marketplace.

- Investors use profitability metrics to compare companies, assess investment opportunities, and predict long-term sustainability and growth potential.

- Understanding profitability helps you make smarter decisions about investing, whether you’re analyzing individual stocks or building a diversified portfolio.

What Is Profitability?

Profitability is a financial metric that measures a company’s ability to generate earnings compared to its expenses and other costs over a specific period. It answers one fundamental question: Is this business making more money than it’s spending?

But profitability goes beyond simple profit. It’s a relative measure that compares profit to other financial metrics like revenue, assets, or shareholder equity. This makes it possible to compare companies of different sizes, industries, and business models on an equal footing.

Why Profitability Matters

Profitability is crucial for several reasons:

- Business Sustainability: Unprofitable companies eventually run out of cash and fail

- Investment Decisions: Investors seek profitable companies that can deliver returns

- Operational Efficiency: Profitability reveals how well management controls costs

- Growth Potential: Profitable companies can reinvest earnings to expand

- Competitive Position: Higher profitability often signals competitive advantages

According to the U.S. Small Business Administration, lack of profitability is one of the top reasons why 20% of small businesses fail within their first year, and 50% fail within five years.

The Core Components of Profitability

Before diving into formulas, let’s understand the building blocks of profitability:

Revenue (Sales)

Revenue is the total amount of money a company receives from selling goods or services. It’s the “top line” of the income statement and represents gross income before any expenses are deducted.

Expenses

Expenses are all the costs incurred to generate revenue, including:

- Cost of Goods Sold (COGS): Direct costs of producing products

- Operating Expenses: Salaries, rent, utilities, marketing

- Interest Expenses: Cost of borrowing money

- Taxes: Government levies on income

Profit (Earnings)

Profit is what remains after subtracting all expenses from revenue. There are different levels of profit:

- Gross Profit = Revenue – COGS

- Operating Profit = Gross Profit – Operating Expenses

- Net Profit = Operating Profit – Interest – Taxes

Key Profitability Formulas and Ratios

Profitability is measured through several key ratios, each revealing different aspects of a company’s financial health.

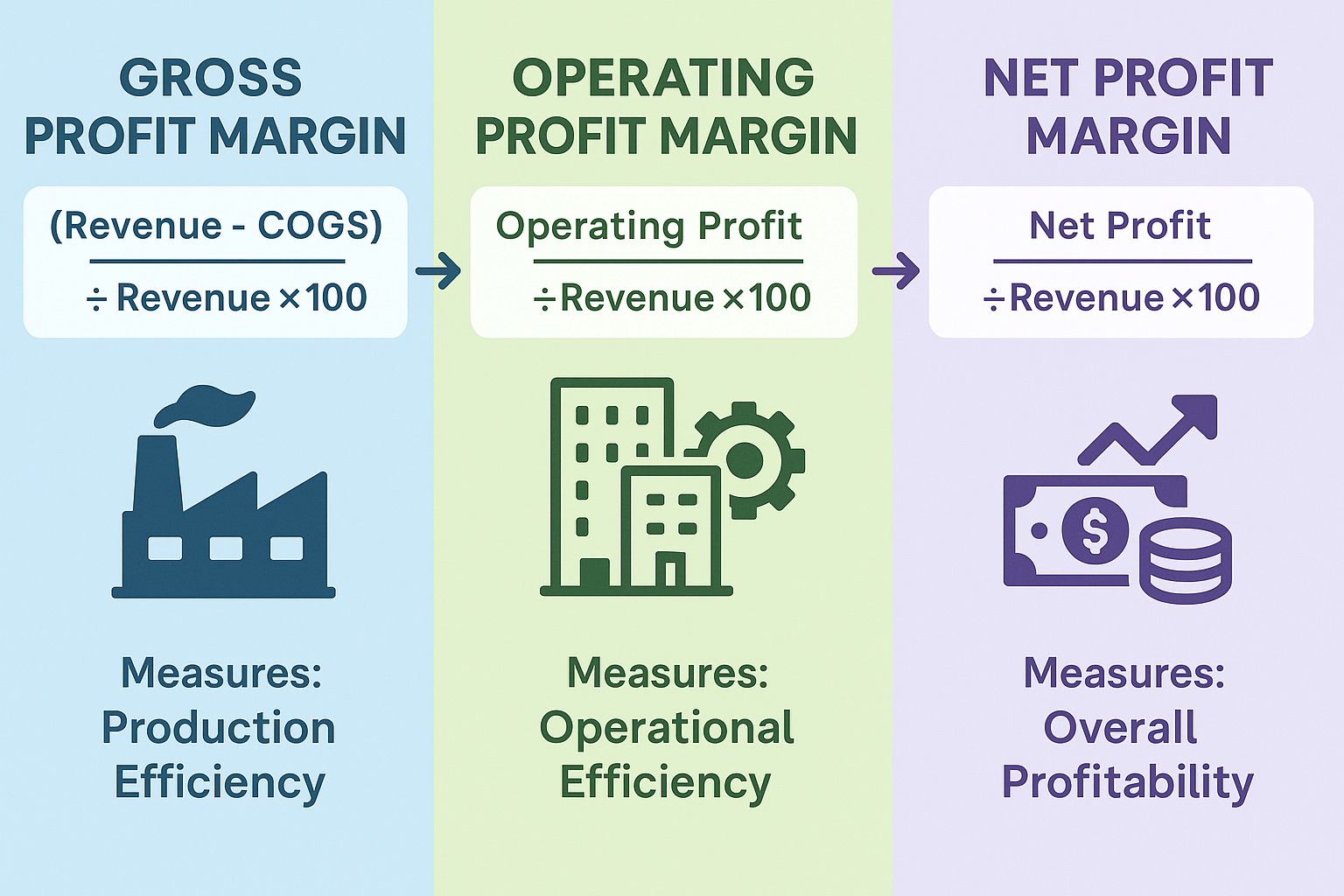

1. Gross Profit Margin

The formula for gross profit margin is:

Gross Profit Margin = (Gross Profit ÷ Revenue) × 100or

Gross Profit Margin = [(Revenue - COGS) ÷ Revenue] × 100What it measures: How efficiently a company produces its products or services.

Example: If a company has $1 million in revenue and $600,000 in COGS:

- Gross Profit = $1,000,000 – $600,000 = $400,000

- Gross Profit Margin = ($400,000 ÷ $1,000,000) × 100 = 40%

A higher gross profit margin usually indicates better production efficiency, stronger pricing power, or lower production costs.

2. Operating Profit Margin

The formula for operating profit margin is:

Operating Profit Margin = (Operating Profit ÷ Revenue) × 100What it measures: How well a company manages its core business operations.

Example: Using the previous company with $400,000 gross profit and $250,000 in operating expenses:

- Operating Profit = $400,000 – $250,000 = $150,000

- Operating Profit Margin = ($150,000 ÷ $1,000,000) × 100 = 15%

3. Net Profit Margin

The formula for net profit margin is:

Net Profit Margin = (Net Profit ÷ Revenue) × 100What it measures: The percentage of revenue that becomes actual profit after all expenses.

Example: If the company pays $30,000 in interest and $40,000 in taxes:

- Net Profit = $150,000 – $30,000 – $40,000 = $80,000

- Net Profit Margin = ($80,000 ÷ $1,000,000) × 100 = 8%

Investors use net profit margin to measure the overall profitability and efficiency of a company’s entire operation.

4. Return on Assets (ROA)

The formula for ROA is:

ROA = (Net Income ÷ Total Assets) × 100What it measures: How efficiently a company uses its assets to generate profit.

Example: If the company has $80,000 net income and $500,000 in total assets:

- ROA = ($80,000 ÷ $500,000) × 100 = 16%

5. Return on Equity (ROE)

The formula for ROE is:

ROE = (Net Income ÷ Shareholder Equity) × 100What it measures: How effectively a company generates returns for shareholders.

Example: If the company has $80,000 net income and $300,000 in shareholder equity:

- ROE = ($80,000 ÷ $300,000) × 100 = 26.7%

Profitability Metrics Comparison Table

| Metric | Formula | What It Measures | Good Benchmark |

|---|---|---|---|

| Gross Profit Margin | (Revenue – COGS) ÷ Revenue × 100 | Production efficiency | 30-50% (varies by industry) |

| Operating Profit Margin | Operating Profit ÷ Revenue × 100 | Operational efficiency | 10-20% |

| Net Profit Margin | Net Profit ÷ Revenue × 100 | Overall profitability | 5-15% |

| Return on Assets (ROA) | Net Income ÷ Total Assets × 100 | Asset efficiency | 5-20% |

| Return on Equity (ROE) | Net Income ÷ Equity × 100 | Shareholder returns | 15-25% |

See our full guide on profitability ratios

Real-World Profitability Examples

Example 1: Apple Inc. (Tech Industry)

According to Apple’s 2024 annual report:

- Revenue: $383.3 billion

- Gross Profit: $169.1 billion

- Net Income: $97.0 billion

Profitability Metrics:

- Gross Profit Margin = ($169.1B ÷ $383.3B) × 100 = 44.1%

- Net Profit Margin = ($97.0B ÷ $383.3B) × 100 = 25.3%

Apple’s exceptional profitability reflects its premium pricing power, efficient operations, and strong brand loyalty. These metrics are significantly higher than most technology companies.

Example 2: Walmart (Retail Industry)

According to Walmart’s 2024 annual report:

- Revenue: $648.1 billion

- Gross Profit: $147.6 billion

- Net Income: $15.5 billion

Profitability Metrics:

- Gross Profit Margin = ($147.6B ÷ $648.1B) × 100 = 22.8%

- Net Profit Margin = ($15.5B ÷ $648.1B) × 100 = 2.4%

Walmart operates on thin margins typical of the retail industry, but compensates with massive volume and operational efficiency.

Example 3: Small Business Example

Sarah’s Bakery (fictional example):

- Annual Revenue: $250,000

- COGS (ingredients, packaging): $100,000

- Operating Expenses (rent, salaries, utilities): $90,000

- Interest and Taxes: $15,000

Calculating Profitability:

- Gross Profit = $250,000 – $100,000 = $150,000

- Gross Profit Margin = ($150,000 ÷ $250,000) × 100 = 60%

- Operating Profit = $150,000 – $90,000 = $60,000

- Operating Profit Margin = ($60,000 ÷ $250,000) × 100 = 24%

- Net Profit = $60,000 – $15,000 = $45,000

- Net Profit Margin = ($45,000 ÷ $250,000) × 100 = 18%

Sarah’s bakery shows healthy profitability, with margins well above typical restaurant industry benchmarks (5-10% net margin).

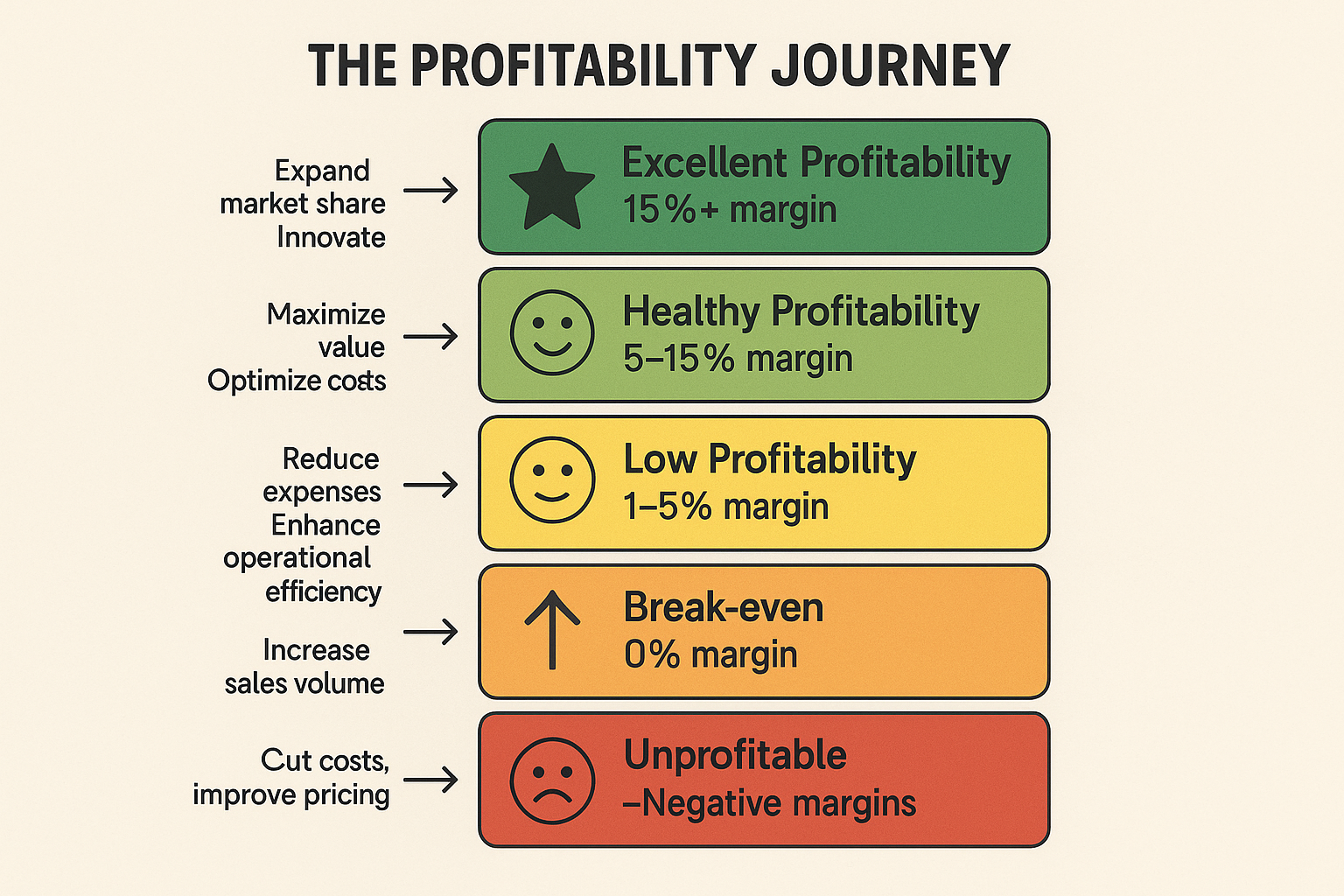

How to Interpret Profitability Ratios

Understanding the numbers is one thing—knowing what they mean is another. Here’s how to interpret profitability metrics:

Industry Context Matters

Different industries have vastly different profitability benchmarks:

- Software/Technology: High margins (20-40% net margin) due to low marginal costs

- Retail: Low margins (2-5% net margin) due to intense competition

- Banking/Financial Services: Moderate margins (15-25% net margin)

- Manufacturing: Variable margins (5-15% net margin) depending on sector

- Healthcare/Pharmaceuticals: High margins (15-30% net margin)

Never compare profitability across different industries. A 5% net margin might be excellent for a grocery store but terrible for a software company.

Trend Analysis Is Critical

A single profitability ratio is just a snapshot. The trend over time reveals much more:

- Improving margins: Suggests growing efficiency, pricing power, or economies of scale

- Declining margins: May indicate rising costs, increased competition, or operational challenges

- Stable margins: Often reflect mature, well-managed businesses

Comparison to Competitors

The best way to evaluate profitability is by comparing a company to its direct competitors:

- Higher profitability than peers suggests competitive advantages

- Lower profitability may indicate inefficiencies or strategic disadvantages

- Similar profitability suggests a level playing field

Advantages and Limitations of Profitability Metrics

Advantages

1. Universal Language of Business

Profitability metrics provide a standardized way to evaluate any business, regardless of size or industry.

2. Easy to Calculate

The formulas are straightforward and require only basic financial statement data.

3. Reveals Operational Efficiency

Profitability ratios expose how well management controls costs and generates returns.

4. Helps Investment Decisions

Investors can quickly screen for profitable companies and avoid money-losing ventures. When building a portfolio of high dividend stocks, profitability is essential for sustainable payouts.

5. Tracks Performance Over Time

Monitoring profitability trends helps identify improving or deteriorating business conditions.

Limitations

1. Doesn’t Show Cash Flow

A company can be profitable on paper but still face cash flow problems. Profitability measures accrual accounting, not actual cash.

2. Can Be Manipulated

Creative accounting can temporarily boost profitability metrics through revenue recognition tricks, expense deferral, or one-time gains.

3. Ignores Growth Investments

High-growth companies often sacrifice short-term profitability to invest in long-term expansion, making them appear less profitable than they truly are.

4. Industry Variations

As mentioned, profitability benchmarks vary wildly across industries, making cross-sector comparisons misleading.

5. Doesn’t Measure Risk

Two companies with identical profitability may have vastly different risk profiles, debt levels, or market volatility.

Profitability vs Other Financial Metrics

Understanding how profitability relates to other key metrics provides a complete financial picture:

Profitability vs Revenue Growth

- Revenue measures the top line (total sales)

- Profitability measures the bottom line (earnings after expenses)

A company can have explosive revenue growth but still lose money. Amazon famously operated at low or negative profitability for years while growing revenue, reinvesting everything into expansion.

Profitability vs Cash Flow

- Profitability uses accrual accounting (recognizes revenue when earned, not when cash is received)

- Cash Flow tracks actual money moving in and out

A profitable company can still run out of cash if customers pay slowly or inventory ties up capital.

Profitability vs Liquidity

- Profitability measures long-term earning power

- Liquidity measures the ability to pay short-term obligations

A profitable company can face bankruptcy if it can’t pay immediate bills, while an unprofitable company with strong cash reserves can survive for years.

Profitability vs Profit

| Aspect | Profit | Profitability |

|---|---|---|

| Definition | The amount of money left after expenses | The efficiency of generating profit relative to revenue or assets |

| Type | Absolute number | Relative percentage |

| Use | Financial statement item | Performance measure |

| Example | $10,000 net profit | 10% profit margin |

In short, profit is the result, while profitability is the rate of success. See our full guide on profitability analysis

How Investors Use Profitability to Make Decisions

Understanding profitability is essential for making smart investment choices, whether you’re buying individual stocks or building a diversified portfolio.

Stock Selection and Screening

Investors use profitability metrics to:

- Screen for quality companies: Filter for businesses with net margins above the industry average

- Identify value opportunities: Find temporarily unprofitable companies poised for turnaround

- Avoid value traps: Eliminate chronically unprofitable businesses unlikely to recover

When evaluating opportunities in the stock market, profitability serves as a critical quality filter.

Dividend Sustainability Analysis

For dividend investors, profitability determines payout sustainability:

- High profitability = More cash available for dividends

- Low profitability = Dividend cuts may be necessary

- Negative profitability = Dividends paid from reserves (unsustainable)

If you’re interested in earning passive income through dividend investing, always verify that profits can comfortably cover dividend payments.

Valuation Context

Profitability provides context for valuation multiples:

- Price-to-Earnings (P/E) Ratio: Directly incorporates profitability (earnings)

- High profitability justifies higher P/E multiples

- Low profitability suggests lower valuations may be appropriate

Risk Assessment

Profitability indicates financial strength and resilience:

- Consistently profitable companies weather economic downturns better

- Unprofitable companies face a higher bankruptcy risk during recessions

- Improving profitability suggests declining business risk

Understanding what moves the stock market includes recognizing how profitability announcements affect investor sentiment and stock prices.

Common Profitability Mistakes to Avoid

Mistake #1: Ignoring Industry Context

The Error: Comparing profitability across different industries.

Why It’s Wrong: A 3% net margin is excellent for a grocery chain but terrible for a software company.

The Fix: Always compare companies within the same industry or sector.

Mistake #2: Focusing Only on Net Margin

The Error: Looking at net profit margin while ignoring gross and operating margins.

Why It’s Wrong: Net margin can be distorted by one-time events, tax changes, or financing decisions.

The Fix: Analyze all three margin levels (gross, operating, net) to understand the complete picture.

Mistake #3: Ignoring Profitability Trends

The Error: Making decisions based on a single quarter or year of data.

Why It’s Wrong: Profitability can fluctuate due to temporary factors.

The Fix: Examine at least 3-5 years of profitability trends to identify patterns.

Mistake #4: Confusing Profit with Cash Flow

The Error: Assuming profitable companies always have plenty of cash.

Why It’s Wrong: Accrual accounting can show profits while cash is tied up in receivables or inventory.

The Fix: Always review cash flow statements alongside profitability metrics.

Mistake #5: Overlooking Capital Intensity

The Error: Not considering how much capital is required to generate profits.

Why It’s Wrong: Some businesses need massive ongoing investment to maintain profitability.

The Fix: Use ROA and ROE to assess capital efficiency, not just profit margins.

How to Improve Business Profitability

Whether you’re a business owner or evaluating management effectiveness as an investor, these strategies drive profitability improvements:

Strategy #1: Increase Prices

Impact: Directly improves gross, operating, and net margins

Considerations:

- Only works if customers perceive sufficient value

- May reduce sales volume

- Requires a strong brand or competitive advantages

Strategy #2: Reduce Cost of Goods Sold

Impact: Improves gross profit margin

Methods:

- Negotiate better supplier terms

- Improve production efficiency

- Reduce waste and defects

- Achieve economies of scale

Strategy #3: Cut Operating Expense

Impact: Improves operating and net margins

Methods:

- Automate repetitive tasks

- Renegotiate leases and contracts

- Reduce headcount or freeze hiring

- Eliminate low-value activities

Warning: Excessive cost-cutting can harm long-term growth and competitiveness.

Strategy #4: Improve Product Mix

Impact: Shift sales toward higher-margin products

Methods:

- Emphasize premium offerings

- Phase out low-margin products

- Bundle products creatively

- Upsell and cross-sell effectively

Strategy #5: Increase Sales Volume

Impact: Spreads fixed costs over more units, improving margins

Methods:

- Expand into new markets

- Improve marketing effectiveness

- Enhance sales processes

- Increase customer retention

Strategy #6: Improve Asset Utilization

Impact: Increases ROA by generating more profit from existing assets

Methods:

- Reduce excess inventory

- Improve receivables collection

- Sell or lease underutilized assets

- Increase production capacity utilization

Profitability Across Different Business Models

Different business models have characteristic profitability profiles:

Subscription Businesses (SaaS, Streaming)

Typical Characteristics:

- High gross margins (70-90%)

- Initially unprofitable due to customer acquisition costs

- Improving profitability as the customer base matures

- Predictable recurring revenue

Example: Netflix operates with 40%+ gross margins but spent years unprofitable while building a subscriber base.

Retail Businesses

Typical Characteristics:

- Low gross margins (20-40%)

- Very low net margins (2-5%)

- High inventory requirements

- Volume-dependent profitability

Example: Traditional retailers compete on thin margins, requiring massive scale to succeed.

Manufacturing Businesses

Typical Characteristics:

- Moderate gross margins (30-50%)

- Moderate net margins (5-15%)

- High capital requirements

- Cyclical profitability

Example: Auto manufacturers face volatile profitability tied to economic cycles.

Professional Services

Typical Characteristics:

- High gross margins (50-70%)

- Moderate net margins (10-20%)

- Low capital requirements

- Scalability challenges

Example: Consulting firms maintain high margins but face capacity constraints based on available professionals.

The Relationship Between Profitability and Stock Performance

Does higher profitability lead to better stock returns? The relationship is complex but important:

Short-Term Impact

Earnings surprises drive immediate stock price reactions:

- Better-than-expected profitability → Stock price increases

- Worse-than-expected profitability → Stock price decreases

This is one reason why the stock market goes up over time—companies generally improve profitability through innovation and efficiency.

Long-Term Correlation

Research from the CFA Institute shows:

- Companies with consistently high ROE outperform over 10+ year periods

- Profitability is more predictive of returns than revenue growth

- The relationship is stronger in developed markets than in emerging markets

The Profitability Premium

Academic studies have identified a “profitability premium”:

- Portfolios of highly profitable companies outperform low-profitability peers

- This effect persists across different time periods and markets

- It’s one of the factors behind smart beta and factor investing strategies

Exceptions to the Rule

Some highly successful stocks have been unprofitable for years:

- Amazon: Unprofitable for much of its early history

- Tesla: Years of losses before achieving sustained profitability

- Uber: Still working toward consistent profitability

These exceptions typically involve:

- Massive growth opportunities

- Winner-take-all market dynamics

- Path to eventual profitability

- Strong investor conviction in long-term vision

Profitability in Different Market Conditions

How profitability behaves during various economic environments:

During Economic Expansions

- Profitability generally improves across most sectors

- Revenue growth outpaces expense growth

- Companies invest in growth, sometimes sacrificing short-term margins

- Competitive pressures may limit margin expansion

During Recession

- Profitability typically declines as revenue falls

- Companies focus on cost-cutting to preserve margins

- Highly profitable companies weather downturns better

- Unprofitable companies face bankruptcy risk

During Inflationary Periods

- Input costs rise, pressuring gross margins

- Companies with pricing power maintain profitability

- Companies without pricing power see margin compression

- Real profitability may decline even if nominal profits rise

During Market Volatility

Profitability becomes even more important during uncertain times. Understanding market volatility helps investors recognize when profitability serves as an anchor of stability.

Using Technology to Track Profitability

Modern investors have powerful tools to analyze profitability:

Financial Websites and Platforms

Free Resources:

- Yahoo Finance: Basic profitability metrics for public companies

- FRED (Federal Reserve Economic Data): Aggregate profitability trends

- SEC.gov: Original company filings with complete financial statements

Premium Platforms:

- Morningstar: Detailed profitability analysis and industry comparisons

- Bloomberg Terminal: Professional-grade financial data

- FactSet: Comprehensive financial analytics

Spreadsheet Analysis

Building your own profitability tracking system:

- Download historical financial statements

- Calculate profitability ratios for 5-10 years

- Create charts showing trends

- Compare to industry benchmarks

- Update quarterly as new data becomes available

Automated Screening Tools

Many platforms offer stock screeners based on profitability:

- Filter for minimum net margin thresholds

- Screen for improving profitability trends

- Identify companies with ROE above benchmarks

- Find undervalued profitable companies

The Future of Profitability Analysis

How profitability measurement and analysis are evolving:

ESG and Sustainable Profitability

Growing focus on sustainable profitability:

- Environmental costs are increasingly factored into profitability

- Social responsibility investments may reduce short-term margins

- Governance improvements can enhance long-term profitability

- ESG-focused investors prioritize sustainable profit generation

Technology and Real-Time Analysis

Emerging trends:

- AI-powered analysis: Machine learning identifies profitability patterns

- Real-time data: More frequent profitability updates beyond quarterly reports

- Alternative data: Web traffic, satellite imagery, and other signals predict profitability changes

- Blockchain transparency: Potential for more reliable profitability reporting

Changing Business Models

New challenges for profitability measurement:

- Platform businesses: Network effects create non-linear profitability curves

- Gig economy: Variable cost structures change traditional margin analysis

- Crypto and DeFi: New frameworks needed for decentralized business profitability

📊 Profitability Calculator

Calculate key profitability metrics for any business

Real-World Data: Profitability Across S&P 500 Sectors (2024)

According to data from Morningstar and FactSet, here’s how profitability varies across major S&P 500 sectors:

| Sector | Average Net Margin | Average ROE | Average ROA |

|---|---|---|---|

| Information Technology | 21.3% | 32.4% | 11.2% |

| Healthcare | 12.8% | 18.6% | 7.4% |

| Financials | 19.2% | 11.3% | 1.1% |

| Consumer Discretionary | 8.4% | 22.1% | 6.8% |

| Communication Services | 15.7% | 24.3% | 8.9% |

| Industrials | 8.9% | 17.2% | 5.3% |

| Consumer Staples | 6.2% | 24.8% | 7.1% |

| Energy | 10.4% | 14.6% | 6.2% |

| Materials | 9.1% | 13.8% | 5.9% |

| Utilities | 9.8% | 9.7% | 2.8% |

| Real Estate | 11.2% | 7.4% | 3.2% |

Key Observations:

- Technology companies dominate profitability metrics across all measures

- Financial companies show high net margins but lower ROA due to asset-heavy business models

- Consumer staples demonstrate modest net margins but strong ROE due to efficient capital structures

- Utilities and real estate show lower profitability due to capital intensity and regulation

Advanced Profitability Concepts

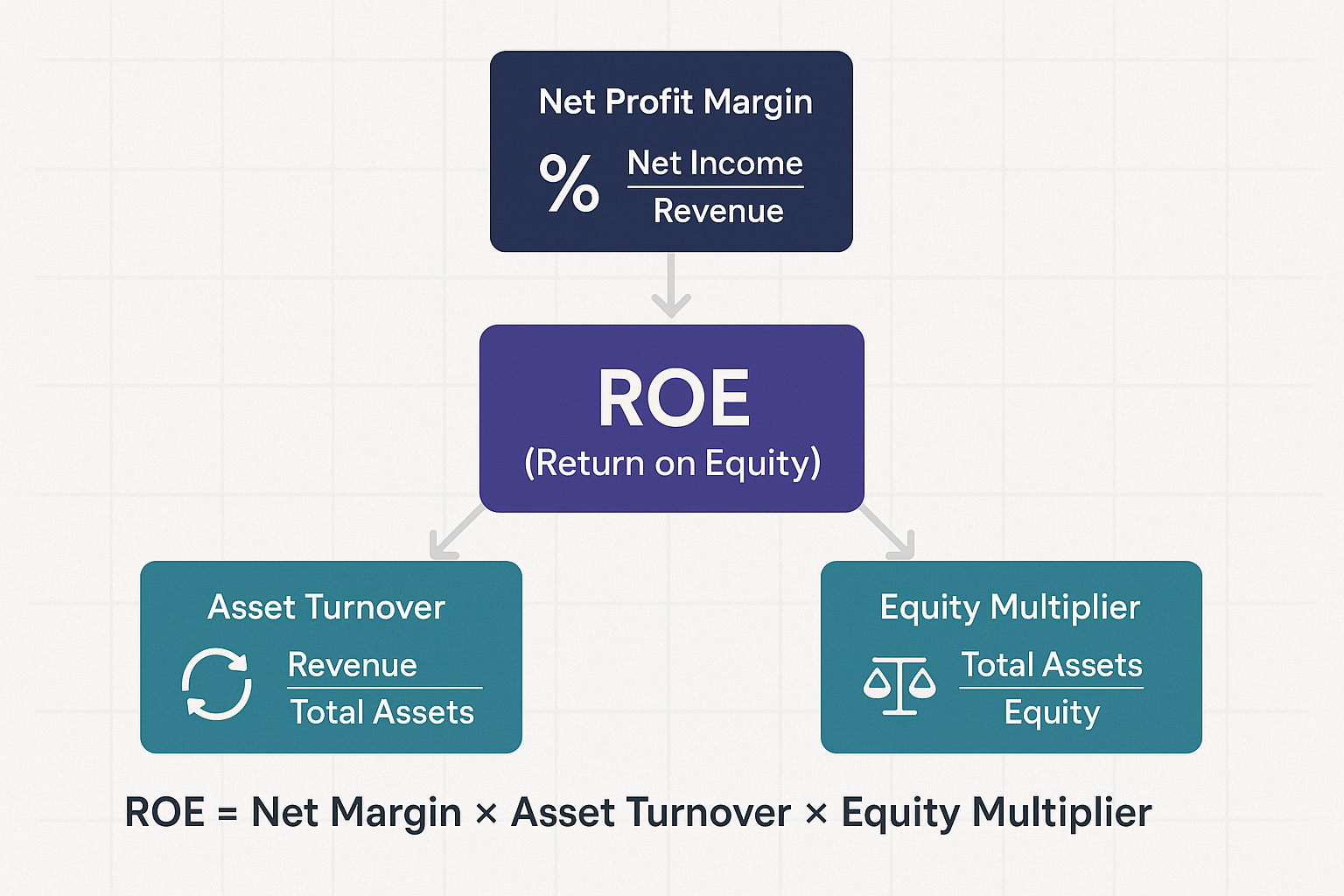

DuPont Analysis

The DuPont formula breaks down ROE into three components:

ROE = Net Margin × Asset Turnover × Equity MultiplierThis reveals three paths to improving ROE:

- Increase net margin (operational efficiency)

- Increase asset turnover (asset efficiency)

- Increase equity multiplier (financial leverage)

Economic Profit vs Accounting Profit

Accounting profit (shown in financial statements) may differ from economic profit:

- Accounting Profit = Revenue – Explicit Costs

- Economic Profit = Revenue – Explicit Costs – Opportunity Costs

Economic profit considers the opportunity cost of capital—what investors could earn elsewhere with similar risk. See our full guide on Economic Profit vs Accounting Profit

Sustainable Growth Rate

Profitability determines how fast a company can grow without external financing:

Sustainable Growth Rate = ROE × (1 - Dividend Payout Ratio)Higher profitability enables faster self-funded growth.

Profitability and Personal Finance

While profitability is primarily a business metric, the concepts apply to personal finances:

Personal “Profitability”

Think of your personal finances as a business:

- Revenue = Your income (salary, investments, side hustles)

- Expenses = Your spending (housing, food, transportation, entertainment)

- Profit = Your savings and investments

Your personal “net margin” = (Savings ÷ Income) × 100

If you earn $100,000 and save $20,000, your personal net margin is 20%—excellent profitability!

Improving Personal Profitability

The same strategies that improve business profitability work for personal finances:

- Increase income (like increasing revenue)

- Reduce expenses (like cutting costs)

- Improve “asset efficiency” (maximize returns on investments)

Understanding profitability helps you make smart financial moves in both investing and personal money management.

Building a Profitability-Focused Investment Strategy

Here’s how to incorporate profitability into your investment approach:

Step 1: Define Profitability Criteria

Set minimum thresholds:

- Net profit margin > 10% (or industry average)

- ROE > 15%

- Positive profitability for at least 5 consecutive years

- Improving or stable profitability trends

Step 2: Screen for Candidates

Use stock screeners to identify companies meeting your criteria:

- Filter by profitability ratios

- Eliminate unprofitable companies

- Focus on consistent performers

Step 3: Analyze Profitability Trends

For each candidate:

- Chart profitability over 5-10 years

- Identify improving, stable, or declining patterns

- Compare to competitors and industry benchmarks

- Investigate major changes or anomalies

Step 4: Assess Sustainability

Evaluate whether profitability is sustainable:

- Competitive advantages: Patents, brands, network effects

- Industry dynamics: Growing or declining markets

- Management quality: Track record of value creation

- Capital requirements: How much investment is needed to maintain profitability

Step 5: Diversify Across Profitable Companies

Build a portfolio of highly profitable companies:

- Spread across different sectors

- Include various market capitalizations

- Balance growth and value stocks

- Consider both high dividend stocks and growth companies

This approach aligns with strategies for generating smart passive income through quality investments.

Case Study: Profitability Turnaround

Let’s examine a fictional but realistic profitability transformation:

Company: TechGadgets Inc.

Year 1 (Struggling):

- Revenue: $50 million

- COGS: $35 million (70% of revenue)

- Operating Expenses: $18 million (36% of revenue)

- Net Loss: -$3 million

- Net Margin: -6%

Problems Identified:

- Excessive production costs

- Bloated overhead

- Low-margin product mix

- Inefficient operations

Turnaround Strategy Implemented:

- Renegotiated supplier contracts (-10% COGS)

- Automated production processes (-5% COGS)

- Reduced headcount by 15% (-$2.7M operating expenses)

- Phased out low-margin products

- Focused on premium product lines

Year 3 (Recovered):

- Revenue: $55 million (+10% growth)

- COGS: $30.25 million (55% of revenue, down from 70%)

- Operating Expenses: $13.3 million (24% of revenue, down from 36%)

- Net Profit: $11.45 million

- Net Margin: 20.8%

Results:

- Transformed from -6% net margin to +20.8%

- Achieved industry-leading profitability

- The stock price increased 250% over three years

- Able to invest in growth and innovation

This demonstrates how focused profitability improvements can transform struggling businesses into market leaders.

The Relationship Between Profitability and Valuation

Understanding how profitability affects company valuation:

Price-to-Earnings (P/E) Ratio

The most common valuation metric directly incorporates profitability:

P/E Ratio = Stock Price ÷ Earnings Per ShareHigher profitability typically justifies higher P/E multiples because:

- More certainty of continued earnings

- Better quality of earnings

- Lower business risk

- Stronger competitive position

PEG Ratio (P/E to Growth)

Combines profitability (P/E) with growth expectations:

PEG Ratio = P/E Ratio ÷ Expected Earnings Growth RateA PEG ratio below 1.0 may indicate an undervalued stock with strong profitability and growth.

Enterprise Value to EBITDA (EV/EBITDA)

Measures valuation relative to operating profitability:

EV/EBITDA = Enterprise Value ÷ EBITDALower ratios suggest better value relative to profitability, though industry context is critical.

Profitability Red Flags

Watch for these warning signs when analyzing profitability:

1. Declining Margins Over Time

Red Flag: Net margin decreasing for 3+ consecutive years

What it suggests:

- Losing competitive position

- Rising input costs without pricing power

- Operational inefficiencies

- Industry headwinds

2. Profitability Dependent on One-Time Gains

Red Flag: Profitability only positive due to asset sales or one-time events

What it suggests:

- Core business is unprofitable

- Management may be masking poor performance

- Unsustainable profitability

3. Profitability Significantly Below Peers

Red Flag: Net margin 50%+ below industry average

What it suggests:

- Competitive disadvantages

- Poor management execution

- Structural business model problems

4. Profitability Inconsistency

Red Flag: Wildly fluctuating profitability year-to-year

What it suggests:

- High business risk

- Cyclical industry challenges

- Unpredictable operations

5. Revenue Growth Without Profitability Improvement

Red Flag: Revenue increasing but margins declining

What it suggests:

- Buying growth through discounting

- Operational leverage not materializing

- Scaling problems

Profitability Best Practices for Investors

Do’s

- Always compare profitability within the same industry

- Analyze 5-10 years of profitability trends

- Use multiple profitability metrics (margin, ROE, ROA)

- Consider both profitability and cash flow

- Investigate major profitability changes

- Factor in business model and growth stage

- Read management’s discussion of profitability in annual reports

Don’ts

- Don’t compare profitability across different industries

- Don’t rely on a single quarter’s profitability

- Don’t ignore the reason for profitability changes

- Don’t assume higher profitability always means better investment

- Don’t overlook the sustainability of profitability

- Don’t ignore profitability quality (one-time gains vs. recurring)

- Don’t forget to adjust for accounting changes

Profitability Resources and Tools

Free Resources

Educational:

- SEC.gov: Official company filings with complete financial statements

- Investopedia: Comprehensive profitability definitions and tutorials

- Federal Reserve Economic Data (FRED): Aggregate profitability trends

- CFA Institute: Professional standards for profitability analysis

Data and Analysis:

- Yahoo Finance: Basic profitability metrics for public companies

- Google Finance: Quick profitability snapshots

- Finviz: Stock screener with profitability filters

- TradingView: Charting profitability trends

Premium Resources

Professional Platforms:

- Morningstar Premium: Detailed profitability analysis and comparisons

- Bloomberg Terminal: Professional-grade financial data ($24,000/year)

- FactSet: Comprehensive financial analytics

- S&P Capital IQ: In-depth company profitability data

Books:

- “The Intelligent Investor” by Benjamin Graham

- “Financial Statement Analysis” by Martin Fridson

- “Quality Investing” by Lawrence Cunningham

- “Accounting for Value” by Stephen Penman

Conclusion: Mastering Profitability for Investment Success

Profitability is the ultimate measure of business success—it separates companies that create value from those that destroy it. Whether you’re evaluating individual stocks, building a diversified portfolio, or analyzing your own business, understanding profitability is non-negotiable for financial success.

In simple terms, profitability means a company’s ability to generate more revenue than it spends, measured through ratios like net profit margin, ROE, and ROA that enable meaningful comparisons across companies and industries.

Key Takeaways to Remember

- Profitability is relative, not absolute: A 5% margin might be excellent for retail but poor for software

- Trends matter more than snapshots: Improving profitability signals effective management

- Multiple metrics tell the complete story: Use gross margin, operating margin, net margin, ROE, and ROA together

- Industry context is essential: Always compare profitability to direct competitors

- Sustainability matters: One-time profitable events don’t indicate long-term success

Your Next Steps

Ready to put profitability analysis into action? Here’s what to do:

Immediate Actions:

- Choose 3-5 companies you’re interested in investing in

- Calculate their profitability ratios using the formulas in this article

- Compare them to industry peers using free tools like Yahoo Finance or Finviz

- Chart 5-year profitability trends to identify patterns

- Use the profitability calculator above to practice with different scenarios

Ongoing Practices:

- Monitor profitability quarterly when companies report earnings

- Read management discussions of profitability changes in annual reports

- Build a profitability tracking spreadsheet for your portfolio

- Set profitability criteria for new investments

- Continuously learn about industry-specific profitability drivers

Further Learning:

- Explore how profitability connects to dividend sustainability

- Understand the broader context of what moves stock prices

- Learn about fundamental investing principles that incorporate profitability

- Discover additional smart investing strategies to build wealth

Remember: Profitability isn’t everything, but it’s the foundation of sustainable investing. Companies that consistently generate profits create value for shareholders, fund innovation, weather economic storms, and deliver long-term returns. By mastering profitability analysis, you’re equipping yourself with one of the most powerful tools in the investor’s toolkit.

The difference between successful and unsuccessful investors often comes down to focusing on profitability over hype, substance over story, and sustainable earnings over temporary excitement. Start analyzing profitability today, and you’ll make smarter investment decisions for decades to come.

FAQ: Profitability

A good profitability ratio depends entirely on the industry. For net profit margin, software companies should target 20-40%, while retail businesses may only achieve 2-5%. Compare profitability ratios to industry peers rather than absolute benchmarks. Generally, higher profitability than competitors indicates competitive advantages, while improving profitability trends suggest effective management.

The formula for profitability varies by metric, but the most common is net profit margin: (Net Profit ÷ Revenue) × 100. To calculate: (1) Find net income on the income statement, (2) Find total revenue, (3) Divide net income by revenue, (4) Multiply by 100 to get a percentage. For example, $100,000 net income ÷ $1,000,000 revenue × 100 = 10% net profit margin.

Profit is an absolute dollar amount (e.g., $50,000 in net income), while profitability is a relative measure comparing profit to another metric like revenue, assets, or equity (e.g., 10% net margin). A company can have high profit but low profitability if it requires massive revenue to generate that profit. Profitability enables apples-to-apples comparisons between companies of different sizes.

Yes, absolutely. Profitability uses accrual accounting, recognizing revenue when earned (not when cash is received) and expenses when incurred (not when paid). A profitable company can face cash shortages if customers pay slowly, inventory ties up capital, or rapid growth requires constant investment. This is why investors examine both profitability and cash flow statements.

Some companies deliberately sacrifice short-term profitability for long-term growth, particularly in winner-take-all markets. Amazon operated unprofitably for years while building market share and infrastructure. Tesla lost money for over a decade while developing electric vehicle technology. These strategies work when: (1) The company has a clear path to eventual profitability, (2) The market opportunity is massive, (3) Investors believe in the long-term vision.

There’s no single “most important” metric—different ratios reveal different insights. Net profit margin shows overall profitability, ROE measures shareholder returns, ROA indicates asset efficiency, and gross margin reveals production efficiency. For investors, ROE is often considered most important because it directly measures returns on shareholder capital. Analyze multiple metrics together for a complete picture.

Profitability directly impacts stock prices through several mechanisms: (1) Higher profits enable dividend payments, (2) Profitable companies can reinvest in growth, (3) Profitability reduces bankruptcy risk, (4) Earnings determine valuation multiples like P/E ratio. In the short term, profitability surprises (beating or missing expectations) drive immediate price movements. Long-term, consistently profitable companies tend to deliver superior returns.

Disclaimer

This article is for educational purposes only and does not constitute financial advice. The information provided is based on publicly available data and general financial principles. Investing involves risk, including the potential loss of principal. Past profitability does not guarantee future results. Before making any investment decisions, please consult with a qualified financial advisor who understands your specific situation, goals, and risk tolerance. The author and publisher are not responsible for any financial decisions made based on this content.

About the Author

Written by Max Fonji — With over a decade of experience in financial markets and investment analysis, Max is your go-to source for clear, data-backed investing education. Through TheRichGuyMath.com, Max breaks down complex financial concepts into actionable insights that help everyday investors build wealth intelligently. Max’s mission is to democratize financial knowledge and empower readers to make informed investment decisions based on solid fundamentals, not speculation.