Here’s a truth that surprises most people: Sarah, a 25-year-old barista earning $32,000 a year, became a millionaire by age 65. Her secret? She invested just $50 every single month starting when she was broke, stressed, and convinced she’d never have enough money to invest. That modest monthly commitment, combined with the power of compound growth, transformed her financial future completely.

If you’ve ever thought, “I don’t have enough money to start investing,” this guide will change your mind. Learning how to invest $50 a month isn’t just about the money; it’s about building a habit that compounds into life-changing wealth over time. Whether you’re paying off student loans, supporting a family, or just starting your career, $50 a month is achievable, and it’s enough to begin your wealth-building journey. SEC – Investor Education

The beauty of investing small amounts consistently lies in its simplicity and accessibility. You don’t need to be wealthy to start building wealth. You just need to start.

Key Takeaways

✅ Investing $50 monthly can grow to over $100,000 in 30 years with average market returns of 10%

✅ Automated investing removes the temptation to skip months and ensures consistency

✅ Low-cost index funds and ETFs are ideal for small monthly investments

✅ Starting early matters more than starting big; time is your greatest advantage

✅ Micro-investing apps have eliminated traditional barriers like high minimums and fees

Why $50 a Month Is More Powerful Than You Think

When most people hear “$50 a month,” they think it’s too small to matter. After all, $50 won’t buy much these days, maybe a few meals out or a streaming service subscription. But when you redirect that $50 into investments, something remarkable happens: compound interest transforms small contributions into substantial wealth.

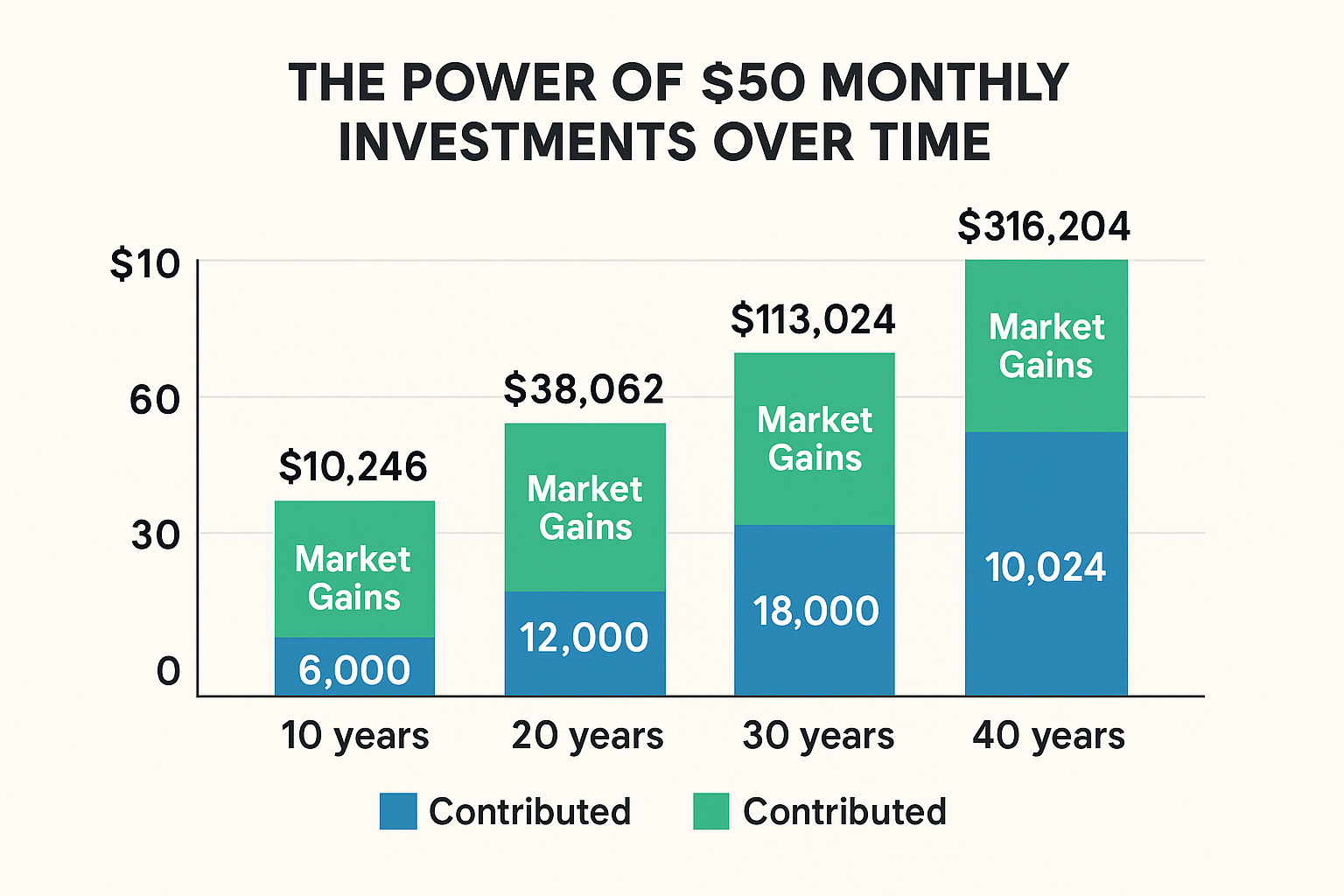

The Math Behind Small Investments

Let’s break down exactly what happens when you invest $50 monthly:

| Time Period | Total Contributed | Value at 10% Annual Return |

|---|---|---|

| 5 years | $3,000 | $3,870 |

| 10 years | $6,000 | $10,246 |

| 20 years | $12,000 | $38,062 |

| 30 years | $18,000 | $113,024 |

| 40 years | $24,000 | $316,204 |

Notice the pattern? Your actual contributions over 30 years total just $18,000, but the account value exceeds $113,000. That extra $95,000+ comes entirely from compound growth, your money making money, which then makes more money.

Understanding why the stock market goes up over time helps explain why this strategy works so reliably.

Starting Early Beats Starting Big

Consider two investors:

Emma starts investing $50 per month at age 25 and continues until age 65 (40 years).

James waits until age 35, then invests $100 per month until age 65 (30 years).

Despite James contributing more total dollars ($36,000 vs. Emma’s $24,000), Emma’s account grows to approximately $316,000 while James’s reaches only $226,000. Emma’s extra decade gave her investments more time to compound, resulting in $90,000 more wealth, all because she started earlier with less money. Investopedia – Wealth Building

The lesson? Time in the market beats timing the market, and starting small beats not starting at all.

Where to Invest $50 a Month: Best Options for Beginners

Choosing where to invest your $50 monthly matters tremendously. The right platform and investment vehicle can maximize growth while minimizing fees that eat into small contributions. Morningstar Investment Research

1. Robo-Advisors: The Hands-Off Approach

Best for: Complete beginners who want professional portfolio management without the effort.

Robo-advisors use algorithms to build and manage diversified portfolios automatically. They’re perfect for learning how to invest $50 a month because they:

- Require low or no minimums (many accept accounts starting at $0)

- Automatically rebalance your portfolio to maintain target allocations

- Offer tax-loss harvesting on larger accounts to minimize taxes

- Charge minimal fees (typically 0.25% annually)

Top robo-advisors for $50 monthly investing:

- Betterment: No minimum, 0.25% annual fee, automatic rebalancing

- Wealthfront: $500 minimum (reachable in 10 months), excellent tax features

- M1 Finance: No fees, customizable portfolios, automatic dividend reinvestment

2. Low-Cost Index Funds and ETFs

Best for: Investors who want to keep costs ultra-low and don’t need hand-holding.

Index funds and exchange-traded funds (ETFs) track market indexes like the S&P 500, providing instant diversification across hundreds of companies. They’re the foundation of smart, long-term investing.

Why they’re perfect for $50 monthly investments:

- Expense ratios as low as 0.03% mean more money stays invested

- Broad diversification reduces risk compared to individual stocks

- Proven track record of matching market returns over time

- No active management needed after initial setup

Recommended index funds/ETFs:

- VTI (Vanguard Total Stock Market ETF): Owns virtually every U.S. stock

- VOO (Vanguard S&P 500 ETF): Tracks the 500 largest U.S. companies

- VT (Vanguard Total World Stock ETF): Global diversification in one fund

Many brokerages like Fidelity, Schwab, and Vanguard allow fractional share purchases, meaning your $50 can buy portions of expensive ETFs without waiting to accumulate enough for a full share. Federal Reserve – Personal Finance Resources

Understanding how the stock market works helps build confidence in these investment choices.

3. Micro-Investing Apps

Best for: People who need extra motivation, gamification, or want to start with even less than $50.

Micro-investing apps revolutionized accessible investing by eliminating traditional barriers. They make investing feel effortless and even fun.

Popular micro-investing platforms:

- Acorns: Rounds up purchases to the nearest dollar and invests the change, plus accepts recurring investments starting at $5

- Stash: Allows investing in fractional shares with as little as $1, and offers banking features

- Robinhood: Commission-free trading with fractional shares, simple interface

Pros: Ultra-low barriers to entry, mobile-first design, educational resources

Cons: Monthly subscription fees can be high relative to small balances

4. Employer Retirement Plans (401k/403b)

Best for: Anyone with access to an employer-sponsored retirement plan, especially with matching.

If your employer offers a 401(k) or 403(b) with matching contributions, this should be your priority for investing $50 monthly. Why? Because employer matching is literally free money, an instant 50% to 100% return on your contribution.

Example: If your employer matches 50% of contributions up to 6% of salary, and you earn $30,000 annually:

- Contributing $50/month = $600/year = 2% of salary

- Your employer adds $300/year (50% match)

- Total invested: $900/year from your $600 contribution

That’s a guaranteed 50% return before any market growth!

5. Roth IRA: Tax-Free Growth Forever

Best for: Long-term investors who want tax-free retirement income.

A Roth IRA allows your investments to grow completely tax-free, and you’ll never pay taxes on withdrawals in retirement. For 2025, you can contribute up to $7,000 annually ($583/month), but even $50 monthly builds meaningful wealth over time.

Why Roth IRAs are perfect for small investors:

- Contributions can be withdrawn anytime without penalty (though growth cannot until age 59½)

- No required minimum distributions in retirement

- Tax-free growth means you keep every penny of gains

- Available at most brokerages with no minimum balance requirements

Many investors use a “split strategy”: contribute enough to their 401(k) to capture the full employer match, then direct additional savings to a Roth IRA for tax diversification.

Exploring smart ways to make passive income can help you find extra money to invest beyond your initial $50.

Step-by-Step: How to Start Investing $50 a Month

Ready to begin? Follow this proven process to transform your $50 monthly commitment into lasting wealth.

Step 1: Set Your Financial Foundation First

Before investing, ensure you have:

Emergency starter fund: At least $500-$1,000 in a savings account for unexpected expenses. This prevents you from selling investments at the worst possible time to cover emergencies.

High-interest debt under control: If you’re carrying credit card debt at 18-25% interest, paying that down often provides better “returns” than investing. However, don’t let this become an excuse to delay investing forever; you can do both simultaneously.

Clear budget: Know exactly where your money goes each month. Use apps like Mint, YNAB, or a simple spreadsheet to track income and expenses.

Step 2: Choose Your Investment Account

Based on your situation, select the best account type:

- Have an employer 401(k) with matching? → Start there, at least up to the match

- No employer plan, or already getting a full match? → Open a Roth IRA

- Want the simplest possible approach? → Use a robo-advisor

- Comfortable with DIY investing? → Open a brokerage account for index funds/ETFs

Most people benefit from a combination: employer 401(k) for the match, then a Roth IRA for additional contributions.

Step 3: Automate Your $50 Monthly Investment

Automation is the secret weapon that separates successful small investors from those who never build wealth. When investing happens automatically, you remove willpower from the equation.

How to automate:

- Set up direct deposit from your paycheck if possible, routing $50 directly to your investment account

- Schedule automatic transfers from your checking account to your investment account on the same day each month (ideally right after payday)

- Enable automatic investment so that transferred money immediately purchases your chosen funds/ETFs

With automation, you’ll never “forget” to invest, never be tempted to skip a month, and never have to make the decision repeatedly. It happens whether you’re motivated or not.

Step 4: Select Your Investments

For most beginners investing $50 monthly, the optimal strategy is simple and diversified:

The Simple Three-Fund Portfolio:

- 70% Total U.S. Stock Market Fund (VTI or equivalent)

- 20% Total International Stock Fund (VXUS or equivalent)

- 10% Total Bond Market Fund (BND or equivalent)

This provides global diversification across thousands of companies with just three holdings. As you age, gradually increase the bond allocation for stability.

The Even Simpler One-Fund Portfolio:

- 100% Target-Date Retirement Fund (choose the year closest to when you’ll turn 65)

Target-date funds automatically adjust from aggressive (more stocks) to conservative (more bonds) as you approach retirement. They’re the ultimate “set and forget” investment.

Learning about dividend investing can add another dimension to your strategy as your portfolio grows.

Step 5: Stay Consistent Through Market Ups and Downs

Here’s where most investors fail: they panic when markets drop and sell at exactly the wrong time. Understanding the cycle of market emotions helps you recognize and overcome these destructive impulses.

The truth about market downturns: They’re temporary setbacks that create buying opportunities. When you invest $50 monthly regardless of market conditions (a strategy called “dollar-cost averaging”), you automatically buy more shares when prices are low and fewer when prices are high.

Example:

- Month 1: Market high, your $50 buys 2 shares at $25 each

- Month 2: Market drops 20%, your $50 buys 2.5 shares at $20 each

- Month 3: Market recovers to $25, you now own 4.5 shares worth $112.50

By investing consistently through the downturn, you profited from the recovery. Investors who stopped during Month 2 missed this opportunity entirely.

Never stop your $50 monthly investment because markets are down. That’s precisely when your money works hardest for you.

Common Mistakes to Avoid When Investing $50 Monthly

Even with a simple strategy, certain pitfalls can derail your wealth-building journey. Avoid these common errors:

Mistake #1: Paying High Fees

With small account balances, fees have an outsized impact. A $5 monthly account fee represents 10% of your $50 contribution—a devastating drag on returns.

Solution: Choose platforms with no monthly fees or fees that are waived below certain balances. Prioritize low expense ratios (under 0.20%) for funds and ETFs.

Mistake #2: Trying to Pick Individual Stocks

Stock picking is exciting but dangerous for small investors. Buying individual companies concentrates risk dramatically. If that company fails, your investment could become worthless.

Solution: Stick with diversified index funds and ETFs that spread risk across hundreds or thousands of companies. Save stock picking for when you have a larger portfolio and can afford to dedicate a small “play money” portion to it.

Mistake #3: Stopping During Market Downturns

When markets crash and your $1,000 portfolio drops to $800, the emotional urge to “stop the bleeding” becomes overwhelming. But stopping contributions during downturns is one of the worst financial decisions possible.

Solution: Remember that you’re investing for decades, not months. Market downturns are temporary. Your $50 monthly purchases during downturns will be your most profitable investments years later. Understanding why people lose money in the stock market helps you avoid their mistakes.

Mistake #4: Neglecting to Increase Contributions

While $50 monthly is an excellent start, keeping contributions frozen forever limits your wealth potential. As your income grows, your investments should grow proportionally.

Solution: Commit to increasing your monthly investment by $10-25 whenever you receive a raise, bonus, or pay off a debt. This “lifestyle creep prevention” accelerates wealth building dramatically.

Mistake #5: Checking Your Portfolio Too Often

Obsessively monitoring your small, growing portfolio creates unnecessary stress and increases the likelihood of emotional decisions.

Solution: Check your investments quarterly at most. Better yet, review them only during your annual financial checkup. Your job is to contribute consistently, not to react to daily market noise.

Real-Life Success Stories: $50 Monthly Investors

Marcus: The Late Starter Who Caught Up

Marcus didn’t start investing until age 35, when a financial wake-up call made him realize he had zero retirement savings. Feeling overwhelmed and far behind, he committed to investing just $50 monthly, all he could afford while paying down debt.

Ten years later, at age 45, Marcus’s disciplined $50 monthly contributions had grown to over $10,000. More importantly, the habit became ingrained. As his income increased and debts disappeared, he gradually raised contributions to $200 monthly. By age 55, his portfolio exceeded $85,000.

Marcus’s story proves that starting late is infinitely better than never starting. His consistent $50 monthly habit, maintained through job changes, market crashes, and life challenges, transformed his financial trajectory completely.

Jessica: The College Student Who Started With Pennies

Jessica opened her first investment account during her junior year of college with $27, literally every dollar she could spare after rent and ramen noodles. She committed to investing $50 monthly, though some months she could only manage $30 or $40.

Starting at age 21 gave Jessica an enormous advantage: time. By age 30, her modest contributions had grown to $7,500. By 40, assuming she maintained just the $50 monthly commitment, her account will exceed $25,000. If she increases contributions as her career advances (which she has), she’ll easily become a millionaire by retirement.

Jessica’s story illustrates that starting young with small amounts beats starting later with large amounts every single time.

Advanced Strategies: Maximizing Your $50 Monthly Investment

Once you’ve mastered the basics, these advanced techniques can amplify your wealth building:

Strategy 1: The “Raise Redirect”

Every time you receive a salary increase, immediately redirect 50% of the after-tax raise to your investment account. If a 3% raise adds $60 monthly to your paycheck, increase your investment from $50 to $80 monthly.

This strategy prevents lifestyle inflation while dramatically accelerating wealth accumulation. You still enjoy half of every raise, but the other half compounds into financial freedom.

Strategy 2: The “Debt Payoff Pivot”

When you finish paying off a loan, whether a car payment, student loan, or credit card, immediately redirect the full payment amount to investments. If you were paying $150 monthly on a car loan, redirect that entire $150 to your investment account once the loan is paid off.

Your budget already accommodated that expense, so you won’t miss it. This strategy can transform small investors into substantial investors overnight.

Strategy 3: The “Tax Refund Boost”

If you receive a tax refund, consider it a windfall investment opportunity. Add your entire refund (or a substantial portion) to your investment account as a lump sum while maintaining your regular $50 monthly contributions.

A $1,200 tax refund invested at age 30 will grow to approximately $20,000 by age 65 at 10% annual returns. Combined with your regular $50 monthly contributions, this accelerates your wealth building significantly.

Strategy 4: The “Side Hustle Funnel”

Develop a small side income stream, freelancing, selling items online, gig economy work, and commit to investing 100% of that income. Your regular job covers living expenses; your side hustle builds wealth.

Even an extra $100 monthly from side income, added to your $50 regular contribution, triples your investment rate and dramatically accelerates your path to financial independence.

Exploring high dividend stocks can provide income that you reinvest for compounding growth.

Taking Action: Your 30-Day Challenge

Knowledge without action creates zero wealth. Here’s your challenge to transform from someone who “should start investing” to someone who actually does:

Week 1: Research and Decide

- Read about smart financial moves to solidify your foundation

- Compare 2-3 investment platforms (robo-advisors or brokerages)

- Calculate your exact monthly budget to confirm you can invest $50

- Choose your account type (Roth IRA, 401k, or taxable brokerage)

Week 2: Open Your Account

- Complete the account application (usually 10-15 minutes online)

- Link your checking account for transfers

- Verify your identity and fund your account with your first $50

- Select your investments (target-date fund or simple index fund portfolio)

3: Automate Everything

- Set up automatic monthly transfers from checking to investment account

- Enable automatic investment of transferred funds

- Schedule calendar reminders to review quarterly (not more often!)

- Tell one trusted friend about your commitment to accountability

Week 4: Educate Yourself

- Read one investing book or take a free online course

- Learn about how banks work to understand the broader financial system

- Join an online investing community for support and learning

- Plan how you’ll increase contributions when possible

By day 30, you’ll be an active investor with automated wealth building happening in the background. Most people never take this step. You will.

💰 $50 Monthly Investment Calculator

See how your small monthly investment grows into substantial wealth

Your Future Portfolio Value

Total Contributed

Investment Gains

Growth Breakdown

Absolutely. While $50 won't make you wealthy overnight, it builds the investing habit and compounds into substantial wealth over decades. More importantly, starting with $50 overcomes the psychological barrier that prevents most people from ever beginning. You can always increase contributions later.

Both serve different purposes. Keep 3-6 months of expenses in a high-yield savings account for emergencies. Once that's established, invest additional money for long-term growth. Savings accounts protect against short-term needs; investments build long-term wealth.

Consistency matters more than the exact amount. If you can only contribute $30 one month, that's infinitely better than contributing $0. The habit of regular investing, even with varying amounts, produces better results than perfect contributions that stop when life gets difficult.

Set aside money during high-income months to cover investments during low-income months. Alternatively, invest a percentage of each paycheck rather than a fixed dollar amount. If you commit to investing 5% of every payment you receive, you'll automatically adjust to income fluctuations while maintaining the habit.

Prioritize tax-advantaged retirement accounts (401k, IRA) first because they offer tax benefits that amplify your returns. Once you've maxed out retirement account contributions, then invest in taxable brokerage accounts for additional wealth building.

Conclusion: Your Wealth-Building Journey Starts Today

The difference between people who build wealth and those who don't isn't intelligence, luck, or even income level. It's an action. Specifically, it's the decision to start investing consistently, even with amounts that seem insignificant.

Learning how to invest $50 a month isn't about the specific dollar amount; it's about building the habit that transforms financial futures. It's about proving to yourself that you can prioritize your future self over immediate gratification. It's about harnessing the mathematical certainty of compound growth to work in your favor.

Sarah, the barista from our opening story, didn't become a millionaire because she earned a massive salary or received an inheritance. She became a millionaire because she started investing $50 monthly and never stopped. Through job changes, market crashes, recessions, and countless life challenges, she maintained the habit. That consistency, more than any other factor, created her wealth.

You now have everything needed to replicate her success:

✅ Understanding of why small amounts matter

✅ Knowledge of where to invest

✅ Step-by-step implementation plan

✅ Awareness of common mistakes to avoid

✅ Strategies to accelerate growth over time

The only missing ingredient is your decision to begin.

Don't wait for the "perfect" time to start investing. Don't wait until you earn more, know more, or feel more confident. The perfect time was yesterday. The second-best time is today.

Your action steps for this week:

- Today: Choose your investment platform and begin the account opening process

- Within 3 days: Fund your account with your first $50

- Within 7 days: Set up automatic monthly investments

- Within 30 days: Complete the 30-day challenge outlined above

Ten years from now, you'll look back at today as the moment everything changed. The moment you stopped waiting and started building. The moment you joined the minority of people who actually take control of their financial future.

Your $50 monthly investment might not seem like much today. But compounded over decades, it represents something far more valuable: financial security, reduced stress, expanded opportunities, and ultimately, freedom.

The wealth-building journey of a lifetime begins with a single $50 investment. Make yours today.

Disclaimer

This article is for educational and informational purposes only and should not be considered financial advice. Investing involves risk, including the potential loss of principal. Past performance does not guarantee future results. Before making any investment decisions, consult with a qualified financial advisor who understands your specific situation, goals, and risk tolerance. The author is not responsible for any financial decisions made based on information in this article.

Author Bio

Max Fonji is dedicated to making financial literacy accessible to everyone, regardless of income level or background. Max believes that smart money management and strategic investing are skills anyone can learn, and we're committed to providing clear, actionable guidance that helps readers build lasting wealth. Max content is thoroughly researched, regularly updated, and designed to empower beginners and experienced investors alike to make informed financial decisions.