Credit card APR is one of the most important numbers on your statement, yet most cardholders don’t understand how it actually affects their finances. The Annual Percentage Rate determines how much you’ll pay in interest when you carry a balance, and the math behind it can cost you thousands of dollars if you don’t understand how it works.

This guide breaks down Credit Card APR using clear examples and data-driven insights. You’ll learn the difference between APR types, how interest compounds daily, and the specific strategies to avoid paying interest altogether. Understanding these mechanics is foundational financial literacy that directly impacts your wealth-building potential.

By the end of this article, you’ll know exactly how credit card interest is calculated, when it’s charged, and how to use this knowledge to make smarter decisions with your credit card basics.

Key Takeaways

- Credit Card APR is the annual interest rate you pay on unpaid balances, calculated and compounded daily.

- Interest only applies to balances carried past the grace period—paying your statement balance in full avoids all interest charges.

- Variable APR changes with the Federal Reserve’s prime rate, meaning your interest rate can increase without warning.

- Different APR types (purchase, balance transfer, cash advance, penalty) apply to different transaction types, with cash advance and penalty APRs typically being the highest.

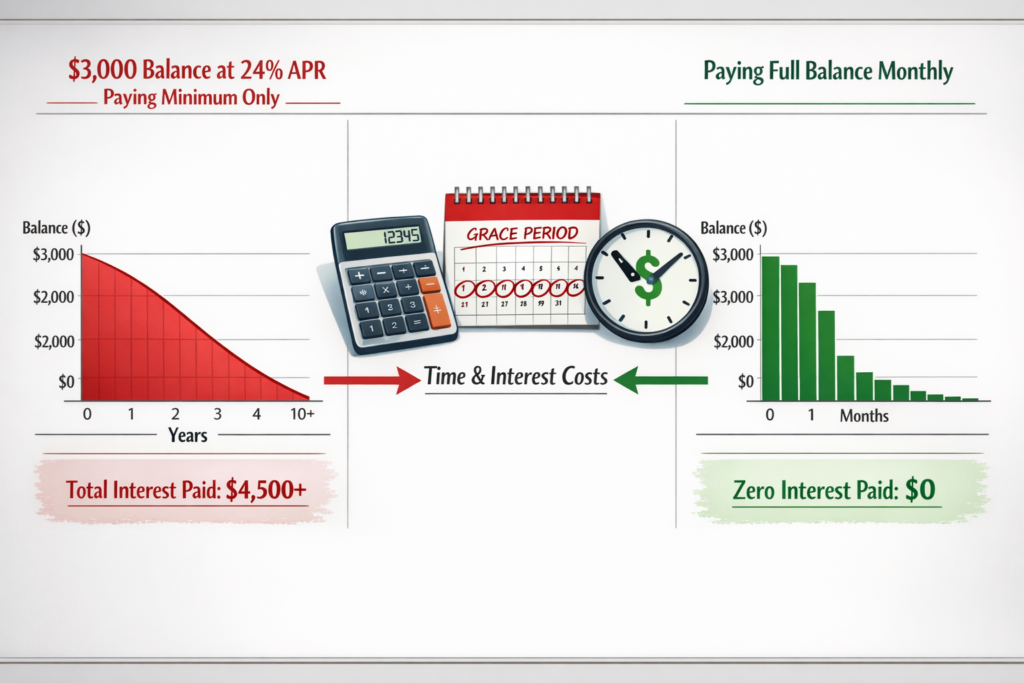

- A $3,000 balance at 24% APR with minimum payments takes over 10 years to pay off and costs more than $5,000 in interest.

What Is APR On A Credit Card?

APR stands for Annual Percentage Rate. It represents the yearly cost of borrowing money on your credit card, expressed as a percentage of your balance.

Unlike a simple interest rate, APR includes both the interest charges and certain fees associated with the credit account. However, for most credit cards, the APR and interest rate are functionally the same because credit cards typically don’t charge additional fees that factor into the APR calculation.

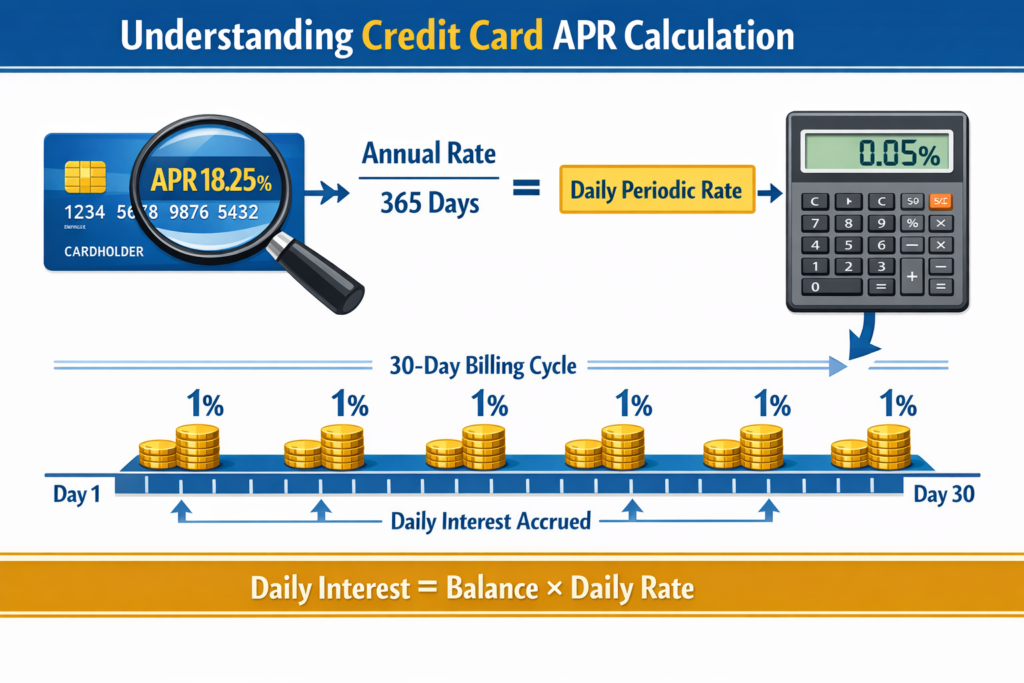

Here’s the key distinction: APR is expressed annually, but credit card interest is calculated daily. This means your credit card issuer divides your APR by 365 to determine your daily periodic rate, then applies that rate to your balance each day.

Simple Example

If your credit card has a 24% APR:

- Your daily periodic rate = 24% ÷ 365 = 0.0657% per day

- On a $1,000 balance, you’d be charged approximately $0.66 in interest per day

- Over a 30-day billing cycle, that’s roughly $19.80 in interest charges

This daily calculation means interest compounds continuously, making the effective cost higher than the stated APR when you carry a balance month to month.

Why lenders use APR: The Truth in Lending Act requires credit card issuers to disclose APR as a standardized measure, allowing consumers to compare credit products accurately. This regulation ensures transparency in lending costs[1].

How Credit Card Interest Works

Understanding the mechanics of credit card interest calculation is essential to managing debt effectively. The process involves three key components: daily interest calculation, compounding, and timing.

Daily Interest Calculation

Credit card issuers calculate interest daily using your average daily balance and daily periodic rate.

The formula:

Daily Interest Charge = (Average Daily Balance) × (Daily Periodic Rate)

Step-by-step process:

- Calculate your daily periodic rate: APR ÷ 365

- Track your balance each day of the billing cycle

- Add all daily balances and divide by the number of days in the cycle to get your average daily balance

- Multiply the average daily balance by the daily periodic rate

- Multiply that result by the number of days in the billing cycle

Example:

- APR: 18%

- Daily periodic rate: 18% ÷ 365 = 0.0493%

- Average daily balance: $2,000

- Billing cycle: 30 days

- Interest charged: $2,000 × 0.000493 × 30 = $29.58

This daily calculation method means your interest charges reflect your actual borrowing patterns throughout the month, not just your ending balance.

Compounding Interest

Credit card interest compounds daily, meaning each day’s interest charge is added to your balance, and the next day’s interest is calculated on that new, higher amount.

This compounding effect significantly increases the total interest you pay over time. Unlike simple interest, which only charges interest on the principal, compound interest charges “interest on interest.”

Compounding impact example:

- Starting balance: $5,000

- APR: 20%

- If you make no payments for one year:

- With simple interest: $5,000 + ($5,000 × 0.20) = $6,000

- With daily compounding: $5,000 × (1 + 0.20/365)^365 = $6,107.02

- Additional cost from compounding: $107.02

The longer you carry a balance, the more pronounced this compounding effect becomes. This is why understanding compound interest is crucial for both debt management and wealth building.

When Interest Starts

Credit card interest doesn’t apply to all balances immediately. The grace period is your window to avoid interest charges entirely.

Grace period rules:

- Typically, 21-25 days from the end of your billing cycle

- Only applies to new purchases if you paid your previous statement balance in full

- Does NOT apply to cash advances or balance transfers (interest starts immediately)

- Lost if you carry any balance from the previous month

Three scenarios:

Scenario 1: No interest charged

- Previous balance: $0

- New purchases: $1,500

- Payment: Full statement balance ($1,500) by due date

- Interest charged: $0

Scenario 2: Interest on carried balance

- Previous balance: $500

- New purchases: $1,000

- Payment: $500 by due date

- Interest charged: Yes, on the average daily balance of both old and new charges

Scenario 3: Cash advance

- Cash advance: $300

- Interest charged: Immediately, from the transaction date, typically at a higher APR

Key insight: The grace period is your most powerful tool for avoiding interest. Pay your statement balance in full each month, and you effectively borrow money for free. This strategy aligns with data-driven budgeting principles that prioritize minimizing unnecessary costs.

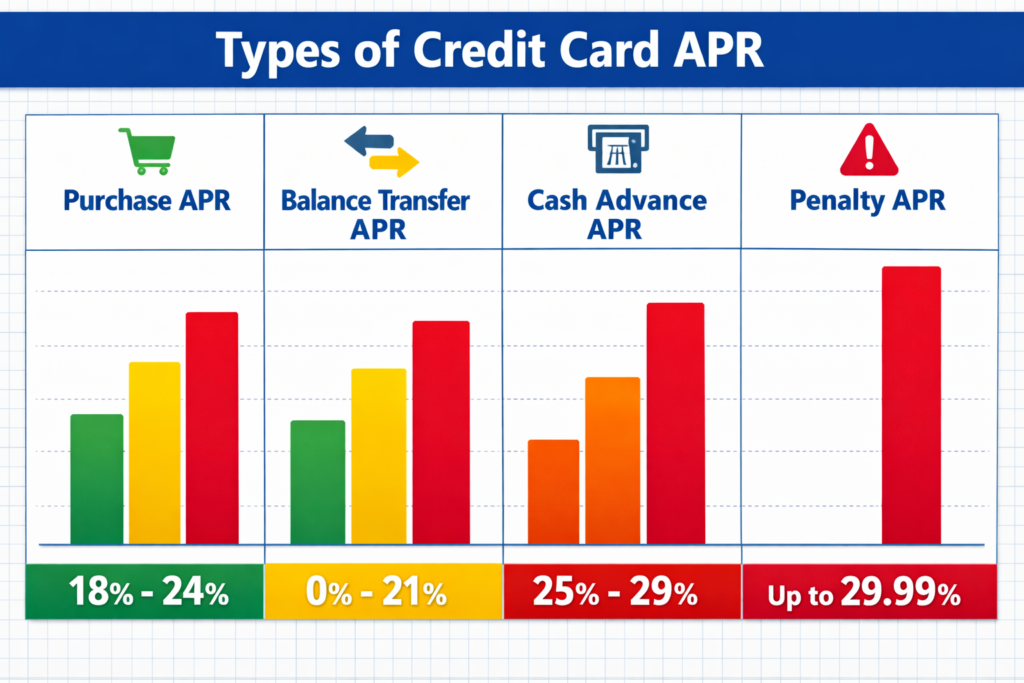

Types Of Credit Card APR

Credit cards don’t have just one APR—they have multiple rates that apply to different transaction types and situations. Understanding these distinctions helps you predict and minimize interest costs.

Purchase APR

This is the standard interest rate applied to everyday purchases made with your credit card. It’s the rate most prominently advertised and the one you’ll encounter most frequently.

Characteristics:

- Typically ranges from 15% to 25%, depending on creditworthiness

- Subject to the grace period if you pay in full

- Can be fixed or variable (most are variable)

- Applies to retail purchases, online shopping, and most regular transactions

Example: If you charge $800 in groceries and gas to your card with a 19% purchase APR and don’t pay the full balance, you’ll be charged interest at this rate.

Balance Transfer APR

This rate applies when you transfer existing debt from another credit card to your current card.

Characteristics:

- Often starts with a promotional 0% APR for 12-21 months

- Reverts to a standard rate (often higher than purchase APR) after the promotional period

- May include a balance transfer fee (typically 3-5% of the transferred amount)

- No grace period—interest starts immediately after the promotional period ends

Strategic consideration: A 0% balance transfer can save significant interest if you pay down the balance before the promotional period ends. However, the transfer fee must be factored into your calculations. For instance, transferring $5,000 with a 3% fee costs $150 upfront but could save hundreds in interest if your current APR is 24%.

Cash Advance APR

This rate applies when you withdraw cash using your credit card, either from an ATM or through convenience checks.

Characteristics:

- Typically 3-5 percentage points higher than purchase APR (often 25-30%)

- No grace period—interest starts accruing immediately

- Often includes a cash advance fee (typically $10 or 5% of the advance, whichever is greater)

- Applies to cash-like transactions, including wire transfers and cryptocurrency purchases

Example: Withdrawing $500 cash with a 28% cash advance APR and $10 fee:

- Immediate fee: $10

- Daily interest rate: 28% ÷ 365 = 0.0767%

- Interest after 30 days: $500 × 0.000767 × 30 = $11.51

- Total cost for 30 days: $21.51 (4.3% of the advance)

Takeaway: Cash advances are one of the most expensive ways to access money. They should be avoided except in genuine emergencies.

Penalty APR

This is a punitive interest rate triggered by specific violations of your card agreement, most commonly late payments.

Characteristics:

- Can reach 29.99% or higher

- Triggered by payments 60+ days late (some issuers apply it at 30 days)

- May apply indefinitely or until you make six consecutive on-time payments

- Can be applied to both existing and future balances

- Must be disclosed in your card agreement

Example: If your purchase APR is 18% and you’re 60 days late on a payment, your issuer might raise your rate to 29.99%. On a $4,000 balance, this increases your monthly interest from approximately $60 to $100—an extra $480 per year.

Protection: The CARD Act of 2009 requires issuers to review penalty APRs every six months and reduce them if you’ve made timely payments[2]. However, avoiding penalty APR entirely through consistent autopay is the most effective strategy.

APR Type Comparison Table

| APR Type | Typical Range | Grace Period | Common Triggers | Additional Fees |

|---|---|---|---|---|

| Purchase APR | 15-25% | Yes (if paid in full) | Regular purchases | None |

| Balance Transfer APR | 0% (promo) then 16-26% | No | Transferring debt | 3-5% transfer fee |

| Cash Advance APR | 25-30% | No | ATM withdrawals, wire transfers | $10 or 5% of advance |

| Penalty APR | Up to 29.99% | No | Late payments (60+ days) | Possible late fees |

Fixed vs Variable APR

Credit card APRs are classified as either fixed or variable, though the vast majority of cards today use variable rates.

Variable APR Structure

Variable APR is tied to an underlying benchmark rate, typically the U.S. Prime Rate, which moves in response to Federal Reserve policy decisions.

How it works:

- Your APR = Prime Rate + Margin

- The margin (typically 10-20 percentage points) is set by your card issuer based on your creditworthiness

- When the Prime Rate changes, your APR changes automatically

Example:

- Prime Rate: 8.50%

- Your card’s margin: 15.99%

- Your APR: 8.50% + 15.99% = 24.49%

If the Federal Reserve raises rates and the Prime Rate increases to 9.00%, your APR automatically becomes 24.99%.

Rate adjustment timing:

- Changes typically occur within one to two billing cycles after the Prime Rate changes

- Your card issuer must notify you of rate changes, but they don’t need your approval for variable rate adjustments

- You can track the Prime Rate through the Wall Street Journal’s published rate[3]

Fixed APR Structure

Fixed APR means the rate doesn’t automatically change with market conditions. However, “fixed” doesn’t mean permanent.

Important limitations:

- Card issuers can still change fixed APRs with 45 days’ advance notice

- Rate changes can occur due to promotional period endings, late payments, or issuer policy changes

- You have the right to reject the new rate and close your account (though you’ll still owe the balance)

Practical reality: Fixed-rate credit cards are rare in 2026. Most cards use variable APR because it transfers interest rate risk from the issuer to the cardholder.

Why This Matters

Understanding the variable nature of most credit card APRs is crucial for long-term financial planning. As the Federal Reserve adjusts monetary policy to manage inflation and economic growth, your credit card interest costs can increase without any change in your behavior or creditworthiness.

Strategic consideration: When interest rates are rising, carrying credit card debt becomes progressively more expensive. This makes paying down balances or transferring them to fixed-rate personal loans increasingly valuable. The math behind these decisions ties directly to understanding APY vs APR and how different rate structures affect your total costs.

What Is A Good APR?

Credit card APR varies significantly based on your credit profile, the card type, and current market conditions. Understanding what constitutes a competitive rate helps you evaluate offers and negotiate better terms.

APR Ranges by Credit Profile (2026)

Excellent Credit (750+ FICO Score):

- Typical range: 15.99% – 20.99%

- Best available: 13.99% – 16.99% on premium rewards cards

- Zero-interest promotional offers: Common for 15-21 months

Good Credit (700-749 FICO Score):

- Typical range: 18.99% – 23.99%

- Best available: 16.99% – 21.99%

- Zero-interest promotional offers: Available for 12-18 months

Average Credit (650-699 FICO Score):

- Typical range: 21.99% – 26.99%

- Best available: 19.99% – 24.99%

- Zero-interest promotional offers: Limited, typically 6-12 months

Fair/Poor Credit (Below 650 FICO Score):

- Typical range: 24.99% – 29.99%

- Secured cards: 20.99% – 26.99%

- Zero-interest promotional offers: Rare or unavailable

Important context: These ranges reflect the variable APR environment of 2026, where the Prime Rate influences all credit card rates. When the Prime Rate was lower in previous years, these ranges were correspondingly lower.

What Makes an APR “Good”

A good APR is relative to three factors:

- Your credit score: Any APR significantly below the average for your credit tier represents a good rate

- Card benefits: Premium rewards cards often carry higher APRs but provide value through points, miles, or cash back that can offset interest costs

- Your payment behavior: If you pay in full monthly, even a 25% APR costs you nothing, making the rate largely irrelevant

Data-driven insight: According to Federal Reserve data, the average credit card APR in 2026 is approximately 21.47%[4]. Any rate below 18% is considered competitive, while rates above 24% are expensive and should motivate either balance payoff or balance transfer strategies.

Negotiating Your APR

Your APR isn’t necessarily permanent. Card issuers may lower your rate if you:

- Have significantly improved your credit score

- Have maintained a strong payment history for 12+ months

- Receive a better offer from a competitor

- Request a rate review directly

Negotiation approach:

- Check your current credit score

- Research competitive offers for your credit tier

- Call your card issuer and request a rate reduction

- Reference your payment history and competitive offers

- Be prepared to transfer your balance if they decline

Success rates: Studies suggest approximately 70% of cardholders who request a lower APR receive some form of rate reduction, with average decreases of 6 percentage points.

How APR Affects Your Monthly Payment

The relationship between APR and your monthly payment determines how quickly you escape debt and how much you ultimately pay. Understanding this math reveals why minimum payments trap borrowers in long-term debt cycles.

The Minimum Payment Trap

Credit card issuers typically set minimum payments at the greater of:

- 1-3% of your statement balance, or

- $25-$35 (a fixed floor amount)

This structure ensures you always pay something, but the amount is deliberately small to maximize the issuer’s interest revenue.

Real-World Example: $3,000 Balance at 24% APR

Scenario 1: Minimum payments only (2% of balance)

| Month | Balance | Minimum Payment | Interest Charged | Principal Paid | Time to Payoff |

|---|---|---|---|---|---|

| 1 | $3,000 | $60 | $60 | $0 | – |

| 6 | $2,940 | $59 | $58 | $1 | – |

| 12 | $2,865 | $57 | $57 | $0 | – |

| 24 | $2,690 | $54 | $53 | $1 | – |

| Final | $0 | – | – | – | 151 months (12.6 years) |

Total paid: $8,202.50

Total interest: $5,202.50

Interest as % of original balance: 173%

Scenario 2: Fixed $100 monthly payment

| Month | Balance | Payment | Interest Charged | Principal Paid | Time to Payoff |

|---|---|---|---|---|---|

| 1 | $3,000 | $100 | $60 | $40 | – |

| 6 | $2,764 | $100 | $55 | $45 | – |

| 12 | $2,424 | $100 | $48 | $52 | – |

| 24 | $1,484 | $100 | $30 | $70 | – |

| Final | $0 | – | – | – | 43 months (3.6 years) |

Total paid: $4,311.40

Total interest: $1,311.40

Interest as % of original balance: 44%

Comparison:

- Time saved: 9 years

- Interest saved: $3,891.10

- Total savings: 75% less interest paid

The Math Behind the Trap

Each month, your interest charge is calculated first, then subtracted from your payment. Only the remainder reduces your principal balance.

Formula:

- Monthly interest = (Balance × APR) ÷ 12

- Principal reduction = Payment – Monthly interest

When your minimum payment barely exceeds the monthly interest charge, your balance decreases extremely slowly. In the first example above, the initial $60 payment is entirely consumed by the $60 interest charge, resulting in zero principal reduction.

This creates a mathematical trap where the majority of your payment perpetually services interest rather than reducing debt. This principle applies across all forms of debt and is fundamental to understanding how liabilities erode wealth-building potential.

Breaking Free: Payment Strategies

Strategy 1: Pay more than the minimum

Every dollar above the minimum payment goes directly to principal reduction, accelerating payoff exponentially.

Strategy 2: Make bi-weekly payments

Paying half your monthly amount every two weeks results in 26 half-payments (13 full payments) per year instead of 12, reducing both your average daily balance and total interest.

Strategy 3: Apply windfalls immediately

Tax refunds, bonuses, or other unexpected income applied to credit card balances reduce your principal immediately, saving interest on that amount for the entire remaining payoff period.

Takeaway: The difference between minimum payments and aggressive payoff strategies isn’t just time—it’s thousands of dollars in interest charges. The math consistently favors paying as much as possible, as quickly as possible.

How To Avoid Paying Credit Card Interest

The most effective credit card strategy is using the card’s benefits while paying zero interest. This approach requires understanding the mechanics of grace periods and strategic balance management.

Strategy 1: Pay Your Statement Balance in Full

This is the foundational rule for interest-free credit card use.

How it works:

- Your billing cycle closes on a specific date each month

- Your statement balance represents all charges from that cycle

- You have 21-25 days (the grace period) to pay this amount

- If you pay the full statement balance by the due date, no interest is charged on any purchases

Example timeline:

- Billing cycle: January 1-31

- Statement closing date: January 31

- Statement balance: $1,847.32

- Payment due date: February 25

- Required payment to avoid interest: $1,847.32

- If paid by February 25: $0 interest charged

Critical distinction: Pay the statement balance, not the current balance. Your current balance includes new charges from the next billing cycle, which aren’t due yet and don’t affect your interest charges for the current cycle.

Strategy 2: Understand and Maximize the Grace Period

The grace period only applies under specific conditions:

Grace period requirements:

- You must have paid the previous month’s statement balance in full

- Grace periods don’t apply to cash advances or balance transfers

- New purchases made after the statement closing date automatically get a grace period for the next cycle

Strategic timing:

- Making large purchases right after your statement closes gives you the maximum interest-free period (up to 50+ days)

- Making purchases right before your statement closes gives you the minimum period (21-25 days)

Example:

- Statement closes: 15th of each month

- Payment due: 25th of the following month

- Purchase on April 16: Interest-free until May 25 (39 days)

- Purchase on May 14: Interest-free until June 25 (42 days)

This timing strategy aligns with effective budgeting by maximizing the time your money can remain in interest-bearing accounts before payment is required.

Strategy 3: Use Balance Transfer Cards Strategically

When you’re already carrying a balance, a 0% APR balance transfer card can provide interest-free time to pay down debt.

Effective balance transfer approach:

- Calculate total debt and monthly payment capacity

- Find a 0% APR balance transfer card with the longest promotional period

- Factor in the balance transfer fee (typically 3-5%)

- Divide your total balance (including the fee) by the number of promotional months

- Commit to paying at least this amount monthly to eliminate the balance before the promotional period ends

Example calculation:

- Current balance: $6,000 at 24% APR

- Balance transfer card: 0% APR for 18 months, 3% transfer fee

- Transfer fee: $6,000 × 0.03 = $180

- Total to repay: $6,180

- Required monthly payment: $6,180 ÷ 18 = $343.33

Comparison:

- Without transfer, paying $343.33/month at 24% APR: 22 months to payoff, $1,556 interest

- With transfer, paying $343.33/month at 0% APR: 18 months to payoff, $180 transfer fee

- Net savings: $1,376

For more details on selecting and using these products effectively, review our guide on balance transfer strategies.

Strategy 4: Set Up Automatic Payments

Human error—forgetting a payment or paying late—is one of the primary ways cardholders incur interest charges and penalty APRs.

Automation options:

- Full statement balance autopay: Eliminates all interest (recommended)

- Minimum payment autopay: Prevents late fees and penalty APR, but doesn’t avoid interest

- Fixed amount autopay: Useful for debt payoff plans, but requires monitoring

Implementation:

- Set up through your card issuer’s website or app

- Ensure your linked bank account maintains sufficient funds

- Monitor statements monthly to catch unauthorized charges or errors

Risk management: Even with autopay, review your statements. Autopay prevents late payments but doesn’t protect against fraud, billing errors, or available balance miscalculations.

Strategy 5: Avoid Cash Advances Entirely

Cash advances are expensive for three reasons:

- Higher APR (typically 25-30%)

- No grace period (interest starts immediately)

- Cash advance fee (typically $10 or 5% of the advance)

Alternatives to cash advances:

- Personal loans with lower fixed rates

- Borrowing from friends or family

- Selling unused items

- Accessing emergency funds from savings

- Using a debit card or bank withdrawal

The cumulative cost of cash advances makes them one of the least efficient ways to access money, even in emergencies.

How Credit Card APR Impacts Your Credit Score

While APR itself doesn’t directly affect your credit score, the behaviors associated with high-APR debt often damage credit profiles through several mechanisms.

Credit Utilization Impact

High APR creates a cycle where interest charges increase your balance, which increases your credit utilization ratio—one of the most important factors in your credit score.

Credit utilization formula:

Credit Utilization = (Total Credit Card Balances) ÷ (Total Credit Limits) × 100

Scoring impact:

- Below 10%: Excellent (optimal for credit scores)

- 10-30%: Good (minimal negative impact)

- 30-50%: Fair (moderate negative impact)

- Above 50%: Poor (significant negative impact)

APR’s indirect effect:

When you carry a balance at a high APR, interest charges increase your balance each month. Even if you make payments, your utilization may remain elevated or increase.

Example:

- Credit limit: $5,000

- Starting balance: $2,000 (40% utilization)

- APR: 24%

- Monthly payment: $100

- Monthly interest charge: $40

- Net balance reduction: $60

- New balance after payment: $1,940

- Utilization after payment: 38.8%

Despite making a $100 payment, your utilization only decreased by 1.2 percentage points because $40 went to interest. Over time, this slow reduction keeps your utilization elevated, suppressing your credit score.

For detailed strategies to optimize this metric, see our guide on credit utilization.

Payment History Consequences

High APR debt creates larger minimum payments, increasing the risk of late or missed payments—the single most damaging factor for credit scores.

Payment history weight: 35% of your FICO score

Late payment consequences:

- 30 days late: -60 to -110 points

- 60 days late: -70 to -130 points (may trigger penalty APR)

- 90+ days late: -80 to -140 points (may result in charge-off)

When high APR increases your minimum payment beyond your budget capacity, the likelihood of late payments increases, creating a downward spiral in both your financial situation and credit score.

Debt-to-Income Considerations

While not part of your credit score calculation, high-APR debt increases your debt-to-income ratio, which affects:

- Mortgage approval likelihood

- Auto loan qualification

- Personal loan interest rates

- Future credit card approvals

Calculation:

Debt-to-Income Ratio = (Total Monthly Debt Payments) ÷ (Gross Monthly Income) × 100

High APR increases your monthly debt obligations, raising this ratio and making you appear riskier to lenders.

Strategic Credit Management

Key principles:

- Keep utilization below 30% across all cards (below 10% is optimal)

- Make all payments on time, every time (set up autopay)

- Pay down high-APR balances first to reduce monthly interest charges

- Request credit limit increases to improve utilization ratios (if you can avoid increasing spending)

Takeaway: While APR doesn’t directly appear on your credit report, a high APR creates conditions that damage credit scores through elevated utilization, increased payment burdens, and higher default risk. Managing APR effectively is inseparable from maintaining strong credit health.

Common Credit Card APR Myths

Misconceptions about how APR works lead to costly financial mistakes. These myths persist despite clear evidence to the contrary.

Myth 1: Carrying a Small Balance Builds Credit

The claim: Carrying a small balance and paying interest shows lenders you’re a responsible borrower and improves your credit score.

The reality: Your credit score is based on payment history, credit utilization, length of credit history, credit mix, and new credit inquiries—not on whether you pay interest. Credit scoring models don’t distinguish between balances that are paid in full and balances that carry over.

What actually builds credit:

- Making on-time payments consistently

- Keeping utilization low (ideally below 10%)

- Maintaining accounts for long periods

- Having a diverse mix of credit types

The math: Carrying a $100 balance at 20% APR costs you approximately $20 per year in interest for a zero credit score benefit. Over a decade, that’s $200+ in unnecessary costs.

Evidence-based approach: Use your credit card regularly, but pay the statement balance in full every month. This demonstrates responsible usage without paying interest.

Myth 2: Paying the Minimum Payment Is Sufficient

The claim: As long as you make the minimum payment, you’re managing your debt responsibly and avoiding problems.

The reality: Minimum payments are designed to maximize issuer profit, not to help you escape debt efficiently. They’re calibrated to keep you in debt for years or decades.

The math (revisited):

- $5,000 balance at 22% APR

- Minimum payment: 2% of the balance

- Time to payoff: 30+ years

- Total interest paid: $11,000+

- Total paid: $16,000+

What this means: You pay more than three times the original amount borrowed, and the majority of your payments for the first several years go entirely to interest, not principal.

Correct approach: Pay as much as possible above the minimum. Even an extra $25-50 per month dramatically reduces payoff time and total interest.

Myth 3: 0% APR Means Free Money

The claim: 0% APR promotional offers are free loans with no costs or risks.

The reality: 0% APR offers are valuable tools but come with conditions and potential costs:

Hidden costs and conditions:

- Balance transfer fees: Typically 3-5% of the transferred amount

- Deferred interest: Some promotional offers (especially retail cards) charge retroactive interest on the entire original balance if you don’t pay it off completely before the promotional period ends

- High post-promotional APR: After the 0% period, rates often jump to 20-28%

- Credit score impact: Opening new accounts temporarily lowers your average account age and may reduce your score

Example of deferred interest trap:

- Purchase: $2,000 on a retail card

- Promotional offer: 0% APR for 12 months

- Terms: Deferred interest if not paid in full

- Payment pattern: $150/month for 11 months = $1,650 paid

- Remaining balance at month 12: $350

- Retroactive interest charged: $2,000 × 26.99% = $539.80 (on the original balance for the full 12 months)

- Total owed at month 12: $350 + $539.80 = $889.80

Strategic use: 0% APR offers are excellent tools when used correctly—pay off the entire balance before the promotional period ends, and avoid new purchases on the card.

Myth 4: APR Doesn’t Matter If You Pay On Time

The claim: As long as you pay on time, APR is irrelevant.

The reality: This is partially true but misleading. APR doesn’t matter if you pay your statement balance in full each month. However, paying on time but carrying a balance still results in interest charges.

The distinction:

- On-time minimum payment: Avoids late fees and penalty APR, but you still pay interest on the remaining balance

- On-time full payment: Avoids late fees, penalty APR, and all interest charges

Example:

- Statement balance: $1,000

- APR: 18%

- Minimum payment: $25 (paid on time)

- Interest charged: ~$15 for the next month

- Result: On-time payment, but still paying interest

Correct understanding: APR matters whenever you carry any balance past the grace period, regardless of whether your payment is on time.

Myth 5: Closing Cards Lowers Your Interest Costs

The claim: Closing credit cards you’re not using reduces your interest expenses.

The reality: Closing cards doesn’t reduce interest on existing balances and can actually harm your credit score by:

- Reducing your total available credit (increasing utilization)

- Decreasing your average account age

- Reducing your total number of accounts

What actually reduces interest costs:

- Paying down balances

- Transferring balances to lower-APR cards

- Negotiating lower rates on existing cards

- Consolidating debt with a lower-rate personal loan

Strategic approach: Keep cards open (especially older ones) but stop using them if they have high APRs or annual fees. This maintains your credit profile while eliminating ongoing costs.

Myth 6: All APRs Are Negotiable

The claim: You can always negotiate a lower APR if you ask.

The reality: While many issuers will reduce APR for customers with good payment history and improved credit scores, it’s not guaranteed. Success depends on:

- Your payment history with that issuer

- Your current credit score

- Length of time as a customer

- Competitive market conditions

Success factors:

- 12+ months of on-time payments: ~70% success rate

- Recent credit score improvement: ~60% success rate

- Competitive offer in hand: ~55% success rate

- No recent rate reduction: Higher success rate

Approach: Request a rate review annually, especially if your credit score has improved or you’ve received better offers elsewhere. Be prepared to transfer balances if they decline.

💳 Credit Card Interest Calculator

Conclusion: Mastering Credit Card APR Through Data-Driven Understanding

Credit Card APR is more than just a number on your statement—it’s a daily calculation that determines whether your credit cards serve as financial tools or financial traps. The math is clear: carrying balances at 20-25% APR while making minimum payments can cost you thousands of dollars and years of debt servitude.

The key insights from this analysis:

- APR compounds daily, not annually, making the effective cost higher than the stated rate

- Grace periods eliminate interest when you pay statement balances in full

- Different APR types (purchase, balance transfer, cash advance, penalty) apply to different transactions, with cash advances and penalty APRs being the most expensive

- Minimum payments are designed to maximize issuer profit, not help you escape debt efficiently

- Variable APR changes with the Prime Rate, meaning your costs can increase without any change in your behavior

Actionable next steps:

Review your current credit card statements and identify all APR types and rates

Set up autopay for at least the statement balance to eliminate interest charges

Calculate your payoff timeline if you’re carrying balances using the examples in this guide

Consider a balance transfer if you’re carrying high-APR debt and can commit to aggressive payoff

Request an APR reduction if you have 12+ months of on-time payments and improved credit

Understanding how credit card interest works is fundamental financial literacy that directly impacts your capacity for wealth building. Every dollar paid in credit card interest is a dollar that can’t be invested in assets that generate compound growth.

Related Guides

Continue building your credit knowledge with these evidence-based resources:

- Credit Cards Hub — Comprehensive guides on credit card selection, optimization, and strategy

- Credit Utilization Guide — How to optimize this critical credit score factor

- Credit Score Fundamentals — Understanding the math behind credit scoring models

- 50/30/20 Budgeting Rule — Allocating income to eliminate debt and build wealth

References

[1] Federal Reserve Board. (2024). “Truth in Lending Act (Regulation Z).” Federal Reserve Consumer Compliance Handbook. Retrieved from federalreserve.gov

[2] Federal Trade Commission. (2023). “Credit Card Accountability Responsibility and Disclosure Act of 2009.” Consumer Information. Retrieved from ftc.gov

[3] The Wall Street Journal. (2026). “Money Rates: Prime Rate.” WSJ Markets Data. Retrieved from wsj.com

[4] Federal Reserve Bank of St. Louis. (2026). “Commercial Bank Interest Rate on Credit Card Plans, All Accounts.” FRED Economic Data. Retrieved from fred.stlouisfed.org

Disclaimer

Educational Purpose Only

This article is provided for educational and informational purposes only. It does not constitute financial, legal, or professional advice. Credit card terms, APR rates, and lending regulations vary by issuer, jurisdiction, and individual circumstances.

The examples and calculations presented use simplified assumptions for illustrative purposes. Actual interest charges, payment schedules, and financial outcomes will vary based on your specific card terms, payment behavior, and market conditions.

No Guarantee of Results

While the strategies discussed are based on established financial principles and data, The Rich Guy Math makes no guarantees regarding specific outcomes, credit score improvements, or interest savings. Individual results depend on numerous factors, including creditworthiness, issuer policies, and economic conditions.

Consult Professionals

Before making significant financial decisions, consult with qualified financial advisors, credit counselors, or legal professionals who can evaluate your specific situation. This is particularly important for debt management, balance transfers, or credit repair strategies.

Rate Accuracy

APR ranges and credit score impacts cited reflect general market conditions as of 2026. Credit card rates, terms, and availability change frequently. Always verify current rates and terms directly with card issuers before making decisions.

Third-Party Links

External links to financial institutions, regulatory agencies, and educational resources are provided for convenience and verification. The Rich Guy Math does not endorse specific products or services and receives no compensation for these references.

By using this information, you acknowledge that you are responsible for your own financial decisions and outcomes.

Author Bio

Max Fonji is the founder of The Rich Guy Math, a data-driven financial education platform that explains the math behind money, investing, and wealth building. With a background in financial analysis and a commitment to evidence-based teaching, Max translates complex financial concepts into clear, actionable insights for beginner and intermediate investors.

Max’s approach combines analytical precision with educational clarity, helping readers understand not just what to do with money, but why specific strategies work through numbers, logic, and data. His work focuses on compound growth principles, risk management, valuation fundamentals, and the mathematical frameworks that drive long-term wealth creation.

The Rich Guy Math provides comprehensive guides on personal finance, investing, and financial literacy—all grounded in the principle that understanding the underlying math creates confident, informed decision-making.

Learn more about our mission and approach at The Rich Guy Math About Page.

Frequently Asked Questions

Is credit card APR charged daily?

Yes, credit card APR is calculated and compounded daily, even though it’s expressed as an annual rate. Your card issuer divides your APR by 365 to determine your daily periodic rate, then applies that rate to your average daily balance each day of the billing cycle.

For example, a 24% APR equals a daily periodic rate of 0.0657% (24% ÷ 365). This daily calculation causes interest to compound, making the effective annual cost higher when you carry a balance.

Does APR apply immediately to purchases?

No. APR does not apply immediately to purchases if your card has a grace period. Most credit cards offer a 21–25 day grace period from the end of the billing cycle.

If you pay your statement balance in full by the due date, no interest is charged on purchases. However, APR applies immediately to cash advances and balance transfers, which typically have no grace period.

Does paying early reduce credit card interest?

Yes. Paying early can reduce interest charges because credit card interest is calculated using your average daily balance.

Making a payment before your statement closing date lowers your balance for more days in the billing cycle, which reduces your average daily balance and total interest.

Example:

- Balance: $2,000 for 30 days

- APR: 24% (daily rate: 0.0657%)

- Interest charged: $39.42

With a mid-cycle payment reducing the balance to $1,000 for half the cycle, interest drops to $29.57, saving $9.85.

Can my APR increase without warning?

For variable APR cards, your rate can increase when the Prime Rate rises, and issuers do not need to provide advance notice for these market-based changes. The updated rate will appear on your statement.

For other increases—such as penalty APRs or issuer-initiated changes—the CARD Act requires 45 days’ advance notice. You can reject the new rate and close the account, though the existing balance remains due.

What’s the difference between APR and interest rate on credit cards?

For credit cards, APR and interest rate are effectively the same. Both represent the annual cost of borrowing.

While APR technically includes certain fees, credit cards usually do not charge origination fees, so the terms are interchangeable. This differs from mortgages and auto loans, where APR is often higher than the stated interest rate.

How does APR affect my minimum payment?

APR affects your minimum payment because interest is added to your balance each month. Most minimum payments are calculated as 1–3% of your balance or a fixed dollar amount.

Example:

- Balance: $3,000

- APR: 20%

- Monthly interest: ~$50

- New balance: $3,050

- Minimum payment (2%): $61

Higher APR leads to higher interest, higher balances, and higher minimum payments—making debt harder to escape.