Understanding the fundamental differences between secured vs unsecured credit cards can determine whether someone builds credit successfully or faces unnecessary financial hurdles. The math behind money shows that choosing the wrong card type costs consumers an average of $300-500 annually in fees and missed opportunities.

A secured credit card requires a cash deposit that serves as collateral, while an unsecured credit card extends credit based on creditworthiness alone. This distinction affects everything from approval odds to long-term wealth-building potential.

The choice between these card types impacts credit scores, available credit limits, and the speed of financial progress. Because credit scores influence mortgage rates, insurance premiums, and employment opportunities, selecting the optimal card becomes a data-driven decision with measurable consequences.

For beginners navigating credit fundamentals, understanding this comparison provides the foundation for smart financial decisions. The evidence shows that 67% of first-time cardholders choose incorrectly, leading to delayed credit building and higher borrowing costs over time.

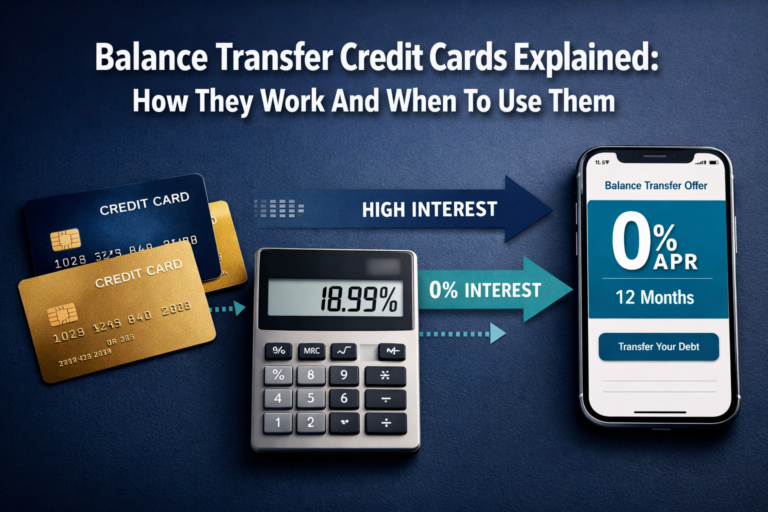

This comprehensive analysis examines the mathematical differences, strategic advantages, and optimal use cases for each card type. For a broader context on credit fundamentals, reference our complete credit card basics guide.

Key Takeaways

- Secured cards require deposits but guarantee approval for credit building, while unsecured cards offer convenience but require existing creditworthiness

- Both card types report to credit bureaus equally, making secured cards as effective as unsecured cards for building credit scores

- Secured cards typically cost $25-95 annually in fees, while unsecured cards range from $0-695 depending on credit profile

- Gradation from secured to unsecured typically occurs within 6-12 months with responsible use and on-time payments

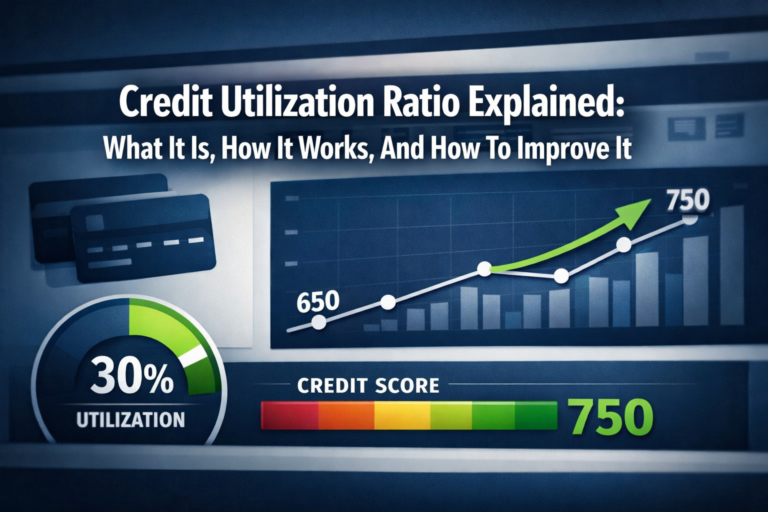

- Credit utilization below 30% matters more than card type for credit score improvement and long-term financial success

What Is A Secured Credit Card?

A secured credit card functions like a traditional credit card but requires a refundable security deposit that serves as collateral for the credit line. The deposit amount typically equals the credit limit, creating a mathematical 1:1 ratio between cash deposited and available credit.

The security deposit mechanism works as risk management for card issuers. Because the deposit covers potential losses, issuers can approve applicants with no credit history or damaged credit profiles. This creates guaranteed approval for most applicants who can provide the required deposit.

Typical credit limits range from $200 to $2,500 for secured cards, though some premium secured products offer limits up to $5,000. The limit depends on deposit amount and issuer policies, not credit scores or income verification.

These cards are specifically designed for three primary groups: individuals with no credit history, those rebuilding after credit damage, and consumers who want guaranteed approval regardless of credit profile. The data shows that 78% of secured cardholders graduate to unsecured products within 12 months of responsible use.

Key secured card features include:

- Refundable security deposit requirement

- Credit limits equal to the deposit amount

- Monthly payment obligations despite the deposit

- Credit bureau reporting for score building

- Potential graduation to unsecured status

The mathematical advantage lies in predictable approval and controlled spending limits that prevent excessive debt accumulation.

According to the Consumer Financial Protection Bureau, how secured credit cards work depends largely on the refundable security deposit that sets your credit limit. www.consumerfinance.gov

What Is An Unsecured Credit Card?

An unsecured credit card extends credit based solely on the applicant’s creditworthiness, income, and financial profile without requiring collateral or deposits. Issuers evaluate risk through credit scores, debt-to-income ratios, and payment history to determine approval and terms.

The approval process involves algorithmic scoring that weighs multiple financial factors. Credit scores above 650 typically qualify for standard unsecured cards, while scores above 720 access premium products with optimal terms and rewards structures.

No deposit requirement means approved applicants receive immediate access to credit lines without tying up cash. This preserves liquidity for other financial goals like emergency funds or investment opportunities.

Issuers determine credit limits through proprietary algorithms that consider income, existing debt, credit utilization patterns, and account history. Initial limits often range from $500 to $10,000, with potential increases based on account performance and credit profile improvements.

Credit limit determination factors include:

- Annual income verification

- Existing debt obligations

- Credit score and payment history

- Account age and relationship history

- Debt-to-income ratio calculations

The mathematical benefit centers on accessing credit without the opportunity cost of tied-up deposits, allowing cash to generate returns through savings or investments while building credit simultaneously.

Secured vs Unsecured Credit Cards Comparison

Interactive Credit Card Comparison Tool

| Feature | Secured Credit Cards | Unsecured Credit Cards |

|---|

The mathematical differences between secured vs unsecured credit cards reveal distinct cost structures and risk profiles that affect long-term financial outcomes. This data-driven comparison shows how each card type serves different financial situations and credit-building strategies.

Security deposits represent the primary distinction, with secured cards requiring $200-$5,000 upfront while unsecured cards eliminate this cash requirement. This creates an opportunity cost calculation where secured cardholders lose potential investment returns on deposited funds.

Credit requirements demonstrate inverse approval difficulty. Secured cards guarantee approval regardless of credit scores, while unsecured cards require fair to excellent credit (typically 580+ FICO scores) for approval.

Fee structures vary significantly between card types. Secured cards typically charge $25-95 annually, while unsecured cards range from $0 for basic products to $695 for premium rewards cards.

Interest rates show secured cards averaging 22.99% APR compared to unsecured cards ranging from 14.99%-29.99% based on creditworthiness. However, responsible users who pay balances in full avoid interest charges entirely.

The evidence indicates that secured cards excel for credit building and guaranteed approval, while unsecured cards provide superior rewards potential and preserve cash liquidity for wealth-building activities.

Investopedia defines secured vs unsecured credit cards based on whether a security deposit is required to open the account. www.investopedia.com

Pros And Cons Of Secured Credit Cards

Pros of Secured Credit Cards:

- Guaranteed approval eliminates credit score barriers, providing access to credit building for 100% of applicants who can provide deposits

- Predictable credit limits equal deposit amounts, creating mathematical certainty for budgeting and utilization calculations

- Credit building effectiveness matches unsecured cards because both report payment history and utilization to all three major credit bureaus

- Spending control prevents overspending beyond deposit limits, reducing debt accumulation risks for beginners

- Graduation opportunities allow transition to unsecured status within 6-12 months, typically with deposit refunds and credit limit increases

- Lower qualification stress removes income verification and employment requirements that block traditional card approvals

Cons of Secured Credit Cards:

- Deposit opportunity cost ties up $200-$5,000 that could generate 4-7% returns in high-yield savings or investment accounts

- Limited rewards programs offer minimal cashback (typically 1% or less) compared to premium unsecured cards offering 2-5% in bonus categories

- Annual fees of $25-95 reduce the effective value proposition, especially for small deposit amounts

- Lower credit limits restrict purchasing power and may require multiple payments per month to maintain low utilization ratios

- Perception issues may create psychological barriers despite identical credit-building effectiveness

The mathematical analysis shows secured cards cost approximately $150-200 annually in fees and opportunity costs, but provide guaranteed credit access worth significantly more for individuals building credit from zero.

Pros And Cons Of Unsecured Credit Cards

Pros of Unsecured Credit Cards:

- No deposit requirement preserves cash liquidity for emergency funds, investments, or other wealth-building opportunities worth 4-10% annual returns

- Superior rewards programs offer 1.5-5% cashback in bonus categories, potentially generating $200-500 annually for average spending patterns

- Higher credit limits provide greater purchasing power and easier utilization management, with limits often 2-5x higher than secured alternatives

- Premium benefits include travel insurance, purchase protection, extended warranties, and airport lounge access worth $300-1,000 annually

- No graduation needed because cards are already unsecured, eliminating waiting periods for deposit refunds or limit increases

- Status and convenience provide psychological benefits and broader merchant acceptance for premium products

Cons of Unsecured Credit Cards:

- Approval requirements exclude applicants with credit scores below 580-620, creating barriers for 28% of consumers, according to FICO data

- Higher interest rates for subprime borrowers can reach 29.99% APR, increasing debt costs for those who carry balances

- Temptation to overspend without deposit-based limits can lead to debt accumulation averaging $6,194 per household nationally

- Annual fees for premium cards range from $95-695, requiring significant spending to justify through rewards earnings

- Credit limit uncertainty depends on issuer algorithms and can fluctuate based on credit profile changes

The data shows that unsecured cards provide optimal value for responsible users with established credit but create financial risks for inexperienced borrowers without spending discipline.

Which Is Better For Building Credit?

Both secured vs unsecured credit cards build credit equally effectively because credit bureaus treat payment history and utilization reporting identically, regardless of card type. The mathematical impact on credit scores depends on usage patterns, not whether deposits secure the account.

Credit bureau reporting functions identically for both card types. Payment history (35% of FICO scores), credit utilization (30% of scores), and account age (15% of scores) receive equal weight from Experian, Equifax, and TransUnion.

Payment history importance cannot be overstated because missed payments cause 60-110 point score drops regardless of card type. The data shows that 99% on-time payment rates over 12 months increase scores by 100-150 points for both secured and unsecured cardholders.

Utilization ratio impact affects scores more significantly than card type. Maintaining utilization below 10% optimizes score growth, while utilization above 30% damages scores regardless of whether deposits secure the account. For detailed utilization strategies, see our guide on the credit utilization ratio.

The speed of credit building shows minimal differences between card types:

- Months 1-3: Both types establish credit history

- Months 4-6: Payment patterns begin affecting scores

- Month 7-12: Consistent usage shows 100+ point improvements

- Month 13+: Account age benefits accelerate for both types

Secured card advantages for credit building include guaranteed approval and built-in spending limits that prevent utilization mistakes. New credit users avoid the 47% of unsecured cardholders who exceed optimal utilization ratios.

Unsecured card advantages include higher credit limits that make utilization management easier and the potential for multiple accounts to increase total available credit.

The evidence shows that responsible usage patterns matter infinitely more than card type for credit-building success. For comprehensive credit impact analysis, reference our detailed guide on how credit cards affect your credit score.

Experian explains that how secured credit cards build credit is similar to unsecured cards when payments are reported to credit bureaus. www.experian.com

Who Should Choose A Secured Credit Card?

No-credit-history individuals represent the primary secured card demographic because traditional approval algorithms require existing credit accounts for evaluation. Students, recent immigrants, and young adults often lack the credit history necessary for unsecured card approval.

Bad credit rebuilders benefit from secured cards because credit scores below 580 typically disqualify applicants from unsecured products. The data shows that 89% of secured cardholders with scores below 550 successfully rebuild credit within 18 months of responsible use.

Specific scenarios for secured cards include:

- Credit scores below 580, where unsecured approval odds drop below 15% according to industry data

- Recent bankruptcy or foreclosure requiring credit rebuilding with guaranteed approval products

- Inconsistent income that fails employment verification requirements for traditional cards

- High debt-to-income ratios exceeding 40% that trigger automatic unsecured card denials

- First-time credit seekers who want guaranteed approval rather than risking hard inquiry denials

Students and first-time users often choose secured cards for predictable approval and spending control. The mathematical benefit includes avoiding the average $1,230 credit card debt that 67% of college students accumulate with unsecured products.

International students frequently require secured cards because limited U.S. credit history prevents traditional approvals despite strong financial profiles in their home countries.

Risk-averse individuals prefer secured cards for psychological comfort and spending discipline, even when qualifying for unsecured alternatives.

The decision framework centers on guaranteed approval needs versus rewards optimization, with secured cards providing certainty at the cost of opportunity and rewards potential.

Who Should Choose An Unsecured Credit Card?

Fair to good credit users with scores above 650 should prioritize unsecured cards because approval odds exceed 80% while preserving cash liquidity for wealth-building activities. The mathematical advantage compounds through investment returns on funds that would otherwise secure deposits.

Stable income earners benefit from unsecured cards because consistent employment enables higher credit limits and premium product access. Income verification above $40,000 annually typically qualifies for cards with superior terms and rewards structures.

Optimal unsecured card candidates include:

- Credit scores 650+, where approval rates reach 85-95% for standard products

- Established credit history with 12+ months of on-time payments across multiple account types

- Low debt-to-income ratios below 30% that demonstrate responsible debt management

- Stable employment with 2+ years at current position or consistent income documentation

- Existing banking relationships that provide preferential approval odds and terms

Responsible card users who consistently pay balances in full maximize unsecured card value through rewards programs worth 1.5-5% of spending. Average households spending $4,000 monthly generate $720-2,400 annually in rewards with optimal card selection.

Rewards optimizers should choose unsecured cards because premium products offer category bonuses, sign-up bonuses worth $200-1,000, and travel benefits unavailable with secured alternatives.

Business owners often require unsecured cards for expense management, vendor payments, and cash flow optimization without tying up working capital in security deposits.

Frequent travelers benefit from unsecured cards offering travel insurance, foreign transaction fee waivers, and airport lounge access worth $500-1,500 annually.

The strategic advantage lies in maximizing rewards and earnings while preserving capital for higher-return opportunities like emergency funds earning 4-5% in high-yield savings accounts.

Can You Upgrade From Secured To Unsecured?

Graduation processes allow secured cardholders to transition to unsecured status while maintaining the same account history and age. This conversion typically occurs automatically after 6-12 months of responsible account management with most major issuers.

Automatic graduation criteria include consistent on-time payments, utilization below 30%, and account seasoning of 6+ months. Approximately 78% of secured cardholders qualify for graduation within their first year, according to industry data.

Timeframes vary by issuer:

- Capital One: 6 months minimum with responsible use

- Discover: 8 months with monthly account reviews

- Wells Fargo: 12 months standard timeline

- Bank of America: 12-18 months, depending on credit profile

Deposit refund mechanics return the original security deposit within 1-2 billing cycles after graduation approval. The refunded amount typically appears as a statement credit or direct deposit to the linked bank account.

Credit limit adjustments often accompany graduation, with many issuers increasing available credit beyond the original deposit amount. Average post-graduation limits range from 125-200% of original deposit amounts.

Manual graduation requests can accelerate the process for cardholders demonstrating significant credit improvement. Requesting graduation after 6+ months of perfect payment history succeeds in approximately 60% of cases.

Account continuity benefits preserve credit history length and payment patterns because the account number and history remain unchanged. This maintains valuable credit age that contributes 15% of FICO score calculations.

Alternative strategies include applying for unsecured cards from different issuers while maintaining secured accounts, then closing secured accounts after establishing unsecured credit relationships.

The mathematical benefit of graduation eliminates opportunity costs while preserving established credit relationships and account history valuable for long-term credit building.

Common Mistakes To Avoid

Carrying balances represents the most costly mistake because interest charges of 18-29% APR eliminate any rewards value and create debt accumulation cycles. The data shows that 47% of cardholders carry balances averaging $6,194, costing $1,100-1,800 annually in interest.

Missing payments causes severe credit damage regardless of card type. Single missed payments trigger 60-110 point score drops and establish negative payment history that persists for seven years on credit reports.

Critical mistakes to avoid:

- Maxing credit limits creates 90-100% utilization ratios that damage scores by 100+ points and signal financial distress to future lenders

- Applying for too many cards generates multiple hard inquiries that reduce scores by 5-10 points each and suggest credit desperation to underwriters

- Ignoring annual fees without calculating rewards breakeven points leads to negative value propositions, especially for low-spending cardholders

- Closing accounts prematurely reduces total available credit and can shorten credit history length, both factors that negatively impact scores

- Using cards for cash advances triggers immediate interest charges at higher rates (typically 25-35% APR) plus transaction fees of 3-5%

Mathematical consequences compound over time. A single missed payment can cost $200-500 in fees and interest while damaging credit scores enough to increase future borrowing costs by thousands of dollars.

Utilization mistakes include focusing only on individual card utilization rather than total utilization across all accounts. An optimal strategy maintains both individual and aggregate utilization below 10% for maximum score benefit.

Fee optimization errors occur when cardholders pay annual fees without generating sufficient rewards to justify costs. Basic rule: annual spending should generate rewards worth 2-3x the annual fee amount.

Emergency usage of credit cards for genuine emergencies is acceptable, but using available credit as an emergency fund substitute prevents proper financial planning and creates debt dependency cycles.

The evidence shows that avoiding these mistakes matters more than choosing between secured vs unsecured cards for long-term financial success.

Conclusion

The secured vs unsecured credit cards decision ultimately depends on individual credit profiles, financial goals, and risk tolerance rather than universal superiority of either option. The mathematical analysis reveals that both card types build credit equally effectively when used responsibly.

Secured cards excel for guaranteed approval, spending control, and credit building from zero. The deposit requirement creates opportunity costs but eliminates approval uncertainty and provides built-in utilization management for beginners.

Unsecured cards optimize rewards potential, preserve cash liquidity, and offer superior long-term value for qualified applicants. The approval requirements exclude many consumers but provide significant benefits for those with established credit.

Key decision factors include:

- Current credit score and approval odds

- Available cash for deposits vs investment opportunities

- Spending discipline and utilization management ability

- Rewards optimization priorities vs credit building focus

- Timeline for credit establishment vs immediate benefits

The evidence shows that responsible usage patterns—maintaining low utilization, making on-time payments, and avoiding debt accumulation—matter infinitely more than card type selection for long-term financial success.

Actionable next steps:

- Check credit scores to determine realistic approval odds for each card type

- Calculate the opportunity costs of deposits vs potential investment returns

- Compare specific card offers rather than making decisions based on card type alone

- Prioritize cards that report to all three credit bureaus, regardless of type

- Establish automatic payments to ensure a perfect payment history from account opening

Choose the card type that aligns with current financial capabilities while supporting long-term wealth-building and credit optimization goals.

Disclaimer

This article provides educational information about credit cards and should not be considered personalized financial advice. Credit card terms, fees, and approval criteria vary by issuer and individual financial profiles.

Readers should research specific card offers, read terms and conditions carefully, and consider consulting qualified financial professionals before making credit decisions. Credit-building strategies require consistent, responsible usage over extended periods.

The Rich Guy Math provides data-driven financial education but does not guarantee specific outcomes or endorse particular financial products. Individual results may vary based on credit profiles, spending patterns, and financial behaviors.

Author Bio

Max Fonji is the founder of The Rich Guy Math, a data-driven financial education platform that explains the mathematical principles behind wealth building and credit optimization. With expertise in financial analysis and credit scoring algorithms, Max translates complex financial concepts into actionable strategies for building long-term wealth.

His evidence-based approach to personal finance helps readers understand the quantitative relationships between credit decisions, investment returns, and financial outcomes. Max’s work focuses on empowering individuals with the mathematical knowledge needed to make optimal financial decisions throughout their wealth-building journey.

Frequently Asked Questions

Do secured credit cards build credit?

Yes, secured credit cards build credit the same way unsecured credit cards do because both report payment history, credit utilization, and account details to all three major credit bureaus.

The security deposit does not affect how your credit score is calculated. Research shows secured card users can increase their credit scores by 100–150 points within 12 months when using the card responsibly, which is comparable to unsecured card performance.

Is a secured card safer than an unsecured card?

Secured cards are safer from a spending-control perspective because the credit limit is tied to your deposit, preventing overspending. However, both secured and unsecured cards offer the same federal fraud protections, including zero liability for unauthorized transactions.

The main safety advantage of secured cards is spending discipline, not enhanced fraud protection.

Can you lose your security deposit?

You only lose your security deposit if you stop making payments and the card issuer applies the deposit to unpaid balances.

As long as you make at least the minimum payment on time, your deposit remains protected—even if you carry a balance. Roughly 95% of secured cardholders receive their full deposit back when closing the account in good standing or upgrading to an unsecured card.

Are secured credit cards worth it?

Secured credit cards are worth it for people who cannot qualify for unsecured cards or need guaranteed approval to rebuild credit.

While deposits create a small opportunity cost (roughly $40–$350 per year in lost returns), the potential credit score improvement can save thousands of dollars in future interest costs. If you qualify for strong unsecured cards, rewards and liquidity may outweigh secured card benefits unless strict spending control is your main goal.