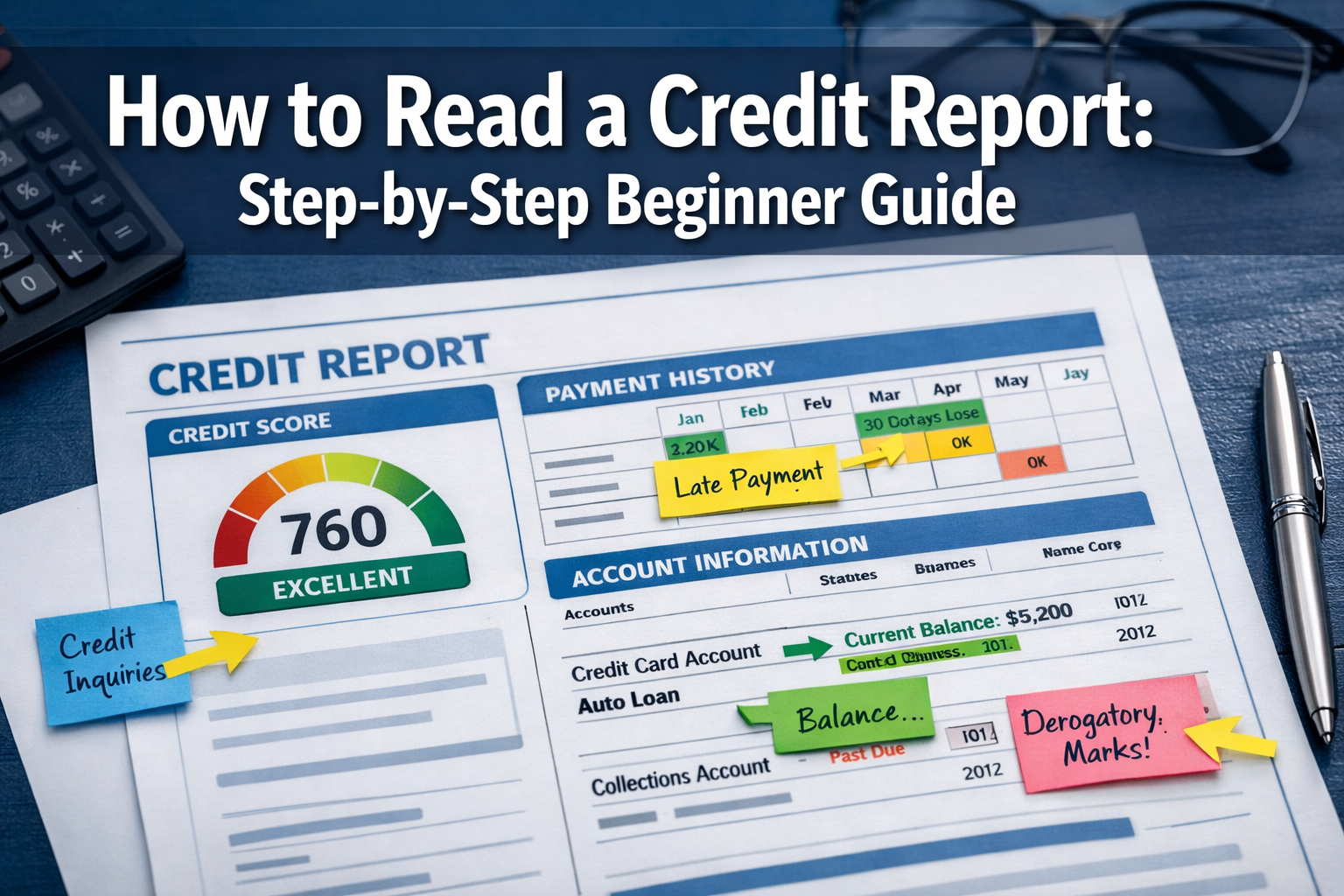

Most people open their credit report and immediately feel overwhelmed. Pages of codes, unfamiliar account numbers, payment grids filled with abbreviations, and dates stretching back years create confusion instead of clarity.

This is a problem because your credit report contains the exact data lenders use to approve or deny your applications. Understanding how to read a credit report is not optional—it is the foundation of financial control. Every loan decision, every interest rate, and every approval starts with this document.

This guide will walk through your credit report exactly how lenders review it. Each section will be explained in plain terms, showing what matters for approvals and what can be ignored. By the end, the codes will make sense, the payment grids will tell a clear story, and the path to better credit will be visible.

If you’re new to the topic, start with our complete guide to how credit works before reviewing your report.

Key Takeaways

- Credit reports show behavior, not just numbers: Lenders evaluate reliability through payment patterns, account management, and credit usage over time

- Payment history is the most important section: One 30-day late payment can drop your score by 50-100 points and affect approval decisions for years[2]

- Personal information doesn’t affect your score: Names, addresses, and employers are used only for identity verification, not credit decisions

- Approximately 25% of reports contain errors: Regular reviews prevent incorrect information from blocking approvals or raising interest rates[3]

- Free access is available year-round: Staggering requests from the three bureaus every four months creates continuous monitoring without cost[3]

First: Get Your Credit Report

Before learning how to read a credit report, obtain the actual document. The only federally authorized source for free credit reports is AnnualCreditReport.com.

This website provides access to reports from all three major credit bureaus:

- Equifax

- Experian

- TransUnion

Each bureau collects data independently. This means accounts may appear on one report but not others. Lenders often review all three reports simultaneously in what is called a tri-merge format, especially for mortgage applications[1].

Download the PDF Copy

After requesting the report, download the PDF version before continuing. The online view formats are helpful for quick checks, but the PDF provides the complete, unaltered report exactly as lenders receive it.

Different bureaus format reports differently, but the sections remain the same. Learning to read one bureau’s report makes the others easier to understand.

Important Reassurance

Checking your own credit report does NOT hurt your score. This is a soft inquiry, which appears only on your personal view. Hard inquiries occur when lenders check your credit for lending decisions—those are different and will be explained later.

Section 1: Personal Information

The first section of every credit report contains personal identifying information. This includes:

- Full name (including any name variations or misspellings)

- Current and previous addresses

- Date of birth

- Social Security number (often partially masked)

- Current and previous employers

This Section Does NOT Affect Your Credit Score

Personal information serves one purpose: identity verification. Lenders use this data to confirm you are who you claim to be. Incorrect addresses or old employer names do not lower your score.

However, accuracy still matters.

What to Check For

Review this section carefully for:

- Incorrect addresses: Unfamiliar addresses may indicate someone else’s information has been merged with yours

- Wrong names: Misspellings or completely different names suggest identity mix-ups

- Unfamiliar employers: Employers you never worked for signal potential identity theft

Identity Theft Warning Signs

If personal information appears that does not belong to you, this could indicate identity theft. Someone may have opened accounts using your Social Security number.

Cross-reference unfamiliar information with the account history section. If accounts appear that you never opened, immediate action is required (explained in the dispute section later).

Section 2: Account History

This is the heart of the credit report. Account history shows every credit account associated with your name, including:

- Credit cards

- Auto loans

- Personal loans

- Mortgages

- Student loans

- Retail store cards

Lenders spend the most time reviewing this section because it demonstrates how you manage credit over time.

Breaking Down Each Column

Credit reports display account information in columns. Understanding each column is essential for knowing how to read a credit report effectively.

| Column | What It Shows | Why Lenders Care |

|---|---|---|

| Creditor Name | The company that issued the credit | Identifies the account source |

| Account Number | Partial account number (last 4 digits often shown) | Confirms account identity |

| Open Date | When the account was opened | Shows account age and credit history length |

| Account Type | Revolving (credit cards) or Installment (loans) | Indicates credit mix and management variety[1] |

| Credit Limit/Loan Amount | Maximum credit available or original loan amount | Used to calculate utilization and original debt |

| Current Balance | Amount owed as of reporting date | Shows current debt level |

| Monthly Payment | Minimum or scheduled payment amount | Indicates payment obligation |

| Account Status | Open, Closed, Paid, Charged Off | Shows current account standing |

| Payment Status | Current, 30 days late, 60 days late, etc. | Most critical factor for approval decisions |

Credit Mix Assessment

Reports categorize accounts into types:

Revolving credit: Credit cards and lines of credit where balances fluctuate, and minimum payments vary based on balance.

Installment loans: Fixed-payment loans like auto loans, personal loans, and mortgages with set repayment schedules.

Lenders view a mix of both types as an indicator of responsible credit management[1]. Someone who successfully manages both a mortgage and credit cards demonstrates broader financial capability than someone with only one type.

Account Age Tracking

Each account shows its individual age, and reports calculate the average age of accounts. Someone with accounts averaging 10 years appears more established than someone averaging six months[1].

This is why closing old accounts can sometimes hurt credit scores—it reduces average account age.

Teaching Point: Behavior Over Debt

Lenders care more about payment behavior than total debt.

A borrower with $50,000 in debt but perfect payment history presents less risk than a borrower with $5,000 in debt and multiple late payments. The report shows whether obligations are met consistently, which predicts future reliability.

These accounts are what your credit score is calculated from, which is explained in our guide to credit score factors.

Understanding the Payment History Grid

The payment history grid is where behavior becomes visible. This section shows month-by-month payment performance for each account, typically covering 24 months of history.

How to Read the Grid

Each account has a row of boxes representing months. Inside each box is a code indicating payment status for that month.

Payment Status Codes

| Code | Meaning | Impact |

|---|---|---|

| OK or ✓ | Paid on time | Positive—builds credit |

| 30 | 30 days late | Negative—significant score drop |

| 60 | 60 days late | Severe—major score damage |

| 90 | 90+ days late | Critical—serious delinquency |

| CO | Charge-off | Extreme—account written off as loss |

The Impact of Late Payments

Payment history comprises approximately 35% of your FICO score[2]. Even one 30-day late payment can drop your score by 50-100 points[2].

The damage compounds with severity:

- 30 days late: Significant drop, recoverable within months of good behavior

- 60 days late: Major drop, takes longer to recover

- 90+ days late: Severe drop, remains damaging for years

Real-Life Example

Consider a credit card account with perfect payment history (24 consecutive “OK” codes). The score reflects this reliability with a strong rating.

Then, one month, a payment is missed by 31 days. The code changes to “30.”

Result: The score drops from 740 to 680 overnight. This single event affects approval odds for the next seven years, though the impact diminishes over time.

This demonstrates why understanding how to read a credit report matters—one overlooked payment creates years of consequences.

Section 3: Inquiries

Every time someone checks your credit, it creates an inquiry. Credit reports separate inquiries into two categories with very different impacts.

Hard Inquiries

Hard inquiries occur when you apply for credit:

- Credit card applications

- Auto loan applications

- Mortgage applications

- Personal loan applications

Hard inquiries appear on your credit report and are visible to other lenders. Each hard inquiry can lower your score by 2-5 points temporarily.

Why Hard Inquiries Matter

Too many hard inquiries in a short period signal risk to lenders. It suggests:

- Desperation for credit

- Potential financial distress

- Higher likelihood of default

Exception: Multiple inquiries for the same type of loan (like mortgage shopping) within a 14-45 day window typically count as a single inquiry. Credit scoring models recognize rate shopping as responsible behavior.

Soft Inquiries

Soft inquiries occur when:

- You check your own credit

- Employers conduct background checks

- Credit card companies pre-approve you for offers

- Existing creditors review your account

Soft inquiries do NOT affect your credit score and are not visible to lenders reviewing your report for approval decisions.

Reassurance

Checking your own report through AnnualCreditReport.com creates only a soft inquiry. Regular monitoring is encouraged and has zero negative impact.

Learn the full impact in our explanation of hard vs soft credit inquiries.

Section 4: Collections and Public Records

This section contains the most damaging items on a credit report. It includes:

- Collections: Accounts sent to collection agencies after non-payment

- Charge-offs: Accounts written off as losses by creditors

- Bankruptcies: Legal declarations of inability to repay debts

- Foreclosures: Property repossessions due to mortgage default

- Tax liens: Government claims for unpaid taxes (less common now)

- Civil judgments: Court-ordered debt payments

Collections

When an account becomes severely delinquent (typically 180 days past due), creditors often sell the debt to collection agencies. The original account shows a charge-off, and a new collection account appears.

Collections affect approval more than balances. A $200 medical collection can prevent mortgage approval even when income and other credit are strong.

Charge-Offs

A charge-off means the creditor has written off the debt as a loss for accounting purposes. This does NOT mean the debt is forgiven. You still owe the money, and it severely damages your credit.

Bankruptcies

Bankruptcy timeline varies by type:

- Chapter 7: Remains on report for 10 years from filing date[1]

- Chapter 13: Remains on report for 7 years[1]

Bankruptcy is the most damaging credit event, making new credit extremely difficult to obtain for years.

Foreclosures

Foreclosures appear for 7 years[1]. Recent data from March 2025 showed increased mortgage delinquency rates year-over-year, indicating consumer stress in some segments[1].

Tax Liens and Judgments

While many tax liens were recently removed from credit reports, unpaid tax liens and civil judgments can still appear in certain circumstances[1].

Paid Collections Still Matter

Paid collections remain on your report for seven years from the original delinquency date. However, their impact decreases over time, especially if the recent payment history is perfect.

Some newer scoring models reduce the weight of paid collections, but many lenders still view them negatively.

Red Flags to Look For Immediately

Certain errors and fraudulent items appear frequently on credit reports. Approximately 25% of credit reports contain errors[3], including incorrect balances and accounts that don’t belong to the consumer.

Critical Items to Identify

Review your report for these red flags:

- Accounts you never opened: A clear sign of identity theft or reporting error

- Duplicate accounts: Same account reported multiple times, artificially inflating debt

- Incorrect late payments: Payments marked late when they were paid on time

- Wrong balances: Balances higher or lower than the actual amounts owed

- Closed accounts marked as open: Can affect utilization calculations and credit mix

- Accounts belonging to someone else: Often occurs with similar names or family members

- Incorrect credit limits: Lower limits inflate utilization ratios

Why These Matter

These are the most common reasons scores drop unexpectedly. A single incorrect late payment can lower your score by 50+ points. A fraudulent account can destroy credit entirely.

Regular monitoring catches these issues before they block approvals.

How to Dispute an Error on Your Credit Report

When errors appear, the law provides a clear dispute process. Credit bureaus must investigate and respond within 30 days[4].

Step-by-Step Dispute Process

Step 1: Identify the Error

Document exactly what is wrong:

- Account number

- Creditor name

- Specific error (incorrect balance, wrong date, etc.)

- Correct information

Step 2: Contact the Bureau Reporting It

Each bureau maintains independent records. Dispute with every bureau showing the error:

- Equifax: equifax.com/personal/credit-report-services

- Experian: experian.com/disputes

- TransUnion: transunion.com/credit-disputes

Step 3: Submit Documentation

Provide evidence supporting your claim:

- Bank statements showing payment

- Canceled checks

- Account statements

- Identity documents (for fraud)

Step 4: Investigation Period

The bureau has 30 days to investigate[4]. They contact the creditor to verify the information.

Possible outcomes:

- Error confirmed: Information corrected or removed

- Error not confirmed: Information remains (you can add a statement)

- Partial correction: Some information changed

Online vs. Mail Disputes

Online disputes are faster and easier to track. Most bureaus provide portals for submitting disputes with document uploads.

Mail disputes create a paper trail. Send via certified mail with a return receipt for proof of delivery.

Dispute Directly with Creditors

You can also report errors directly to the creditor reporting the information. If they agree, they update information with all three bureaus[4].

This approach sometimes works faster than bureau disputes, especially for accounts you currently hold with the creditor.

Before disputing, make sure you understand what a credit report is and how bureaus update information.

What Lenders Actually Focus On When Reading Your Credit Report

Understanding how to read a credit report means thinking like a lender. Approval decisions follow predictable patterns based on specific data points.

Lender Priority Ranking

1. Payment History (Highest Priority)

Lenders evaluate:

- Recent payment patterns (last 12-24 months)

- Severity of any late payments

- Recency of delinquencies

A recent perfect payment history can offset older issues. A borrower with a 90-day late payment from five years ago but 60 consecutive on-time payments since then presents acceptable risk.

2. Current Delinquencies (Deal-Breaker)

Any account currently past due creates immediate concern. Active delinquencies often result in automatic denials regardless of other factors.

3. Credit Utilization (Major Factor)

Credit utilization accounts for about 30% of your FICO score[3][4]. This measures how much available credit you’re using.

Formula: (Total Current Balances ÷ Total Credit Limits) × 100

Lenders prefer utilization below 30%, with ideal levels under 10%[3][4].

Example:

- Total credit limits: $20,000

- Total balances: $6,000

- Utilization: 30%

Utilization is one of the biggest factors affecting approval—here’s how credit utilization works.

4. Recent Credit Activity (Risk Indicator)

Multiple new accounts or inquiries in a short period suggest:

- Financial stress

- Increased debt burden

- Higher default risk

Lenders prefer stable, established credit patterns over rapid expansion.

5. Account Age and Mix (Stability Indicator)

Longer average account age demonstrates stability[1]. A mix of revolving and installment accounts shows diverse credit management capability[1].

The “Aha” Insight

Lenders are evaluating reliability, not wealth.

A high-income borrower with erratic payment behavior presents more risk than a moderate-income borrower with perfect payment history. The report shows whether you honor obligations consistently—the single best predictor of future behavior.

This is the math behind money: Behavior patterns predict outcomes more accurately than current financial position.

📊 Credit Report Payment History Decoder

Understand how payment codes affect your credit score and lender decisions

Conclusion: Your Credit Report Shows the Story Behind Your Score

Your credit score is a three-digit summary. Your credit report is the complete story behind that number.

Approvals are based on the report, not just the score. Lenders review payment patterns, account management, delinquencies, and credit behavior over the years. They evaluate reliability through documented evidence.

Understanding how to read a credit report transforms it from an intimidating document into a clear financial roadmap. Each section reveals specific information lenders use to make decisions. The personal information verifies identity. The account history demonstrates management capability. The payment grid shows reliability. The inquiries indicate credit-seeking behavior. The public records reveal serious financial events.

Checking your report regularly prevents surprises. Errors appear on approximately 25% of reports[3]. A single incorrect late payment can cost thousands in higher interest rates or block approvals entirely. Early detection allows correction before applications.

The math behind money applies here: Small actions compound into significant outcomes. One missed payment creates years of consequences. Conversely, consistent on-time payments build creditworthiness that opens doors to better rates, higher limits, and easier approvals.

Next Steps

- Download your free credit report from AnnualCreditReport.com today

- Review each section using this guide as a reference

- Identify any errors or unfamiliar accounts immediately

- Dispute inaccuracies through bureau websites or mail

- Set a calendar reminder to check again in four months

Financial control begins with information. Your credit report contains the data that shapes your financial opportunities. Reading it correctly is not optional—it is foundational to wealth building and financial security.

Disclaimer

This article provides educational information about credit reports and credit management. It does not constitute financial, legal, or credit repair advice. Credit reporting practices, scoring models, and regulations may change over time. Individual credit situations vary significantly based on personal financial history, account types, and specific creditor reporting practices.

Credit scores are calculated using proprietary algorithms that consider multiple factors beyond those discussed in this article. The score impacts and timelines mentioned represent general patterns and may not reflect your specific situation. Always verify information with credit bureaus and consult qualified financial professionals for personalized guidance.

Disputing credit report information should only be done for legitimate errors. Fraudulent disputes or attempts to remove accurate negative information may violate federal law. For specific credit issues, consider consulting a certified credit counselor or attorney specializing in consumer credit law.

The Rich Guy Math provides data-driven financial education but does not offer individualized financial planning, credit repair services, or legal advice. Readers should conduct independent research and seek professional guidance before making significant financial decisions.

Author Bio

Max Fonji is the founder of The Rich Guy Math, a data-driven financial education platform that explains the math behind money with precision and authority. With expertise in credit systems, investment analysis, and wealth-building strategies, Max teaches financial concepts through evidence-based frameworks and quantitative analysis.

Max specializes in translating complex financial mechanisms into clear, actionable insights that empower readers to make informed decisions. His approach combines analytical rigor with educational clarity, focusing on cause-and-effect relationships that drive financial outcomes.

Through The Rich Guy Math, Max has helped thousands of readers understand credit scoring, investment fundamentals, risk management, and the compound growth principles that build long-term wealth. His teaching philosophy emphasizes financial literacy through numbers, logic, and verifiable data rather than speculation or hype.

References

[1] Understanding Trimerge Credit Reports In What Mortgage Borrowers Need To Know – https://www.amerisave.com/learn/understanding-trimerge-credit-reports-in-what-mortgage-borrowers-need-to-know

[2] How To Improve Your Credit Score In 2026 – https://elevatecu.com/blog/how-to-improve-your-credit-score-in-2026?hsLang=en

[3] Tips To Improve Your Credit Score In 2026 – https://www.spencersavings.com/tips-to-improve-your-credit-score-in-2026/

[4] Ways To Improve Credit – https://www.experian.com/blogs/ask-experian/ways-to-improve-credit/

Frequently Asked Questions

Does checking my credit report lower my score?

No. Checking your own credit report creates a soft inquiry, which does not affect your credit score. Only hard inquiries from lenders reviewing your credit for lending decisions impact your score. You can check your report as often as you want without any negative consequences.

Why are my three credit reports different?

The three major credit bureaus (Equifax, Experian, and TransUnion) collect data independently. Not all creditors report to all three bureaus. Some may report only to one or two, and reporting timing can differ. Because of this, balances and payment statuses may vary slightly between reports. This is normal and expected.

Can I remove late payments from my credit report?

Late payments can only be removed if they are inaccurate. If you actually paid late, the record is valid and will remain for seven years. However, you can dispute inaccurate late payments by providing documentation proving on-time payment. In some cases, creditors may agree to a goodwill adjustment for a one-time mistake, but this is not guaranteed.

How often should I check my credit report?

Check your credit report at least once every four months by staggering requests from the three credit bureaus. This allows you to monitor your credit throughout the year at no cost. You may want to check monthly if you are actively improving your credit, preparing for a loan, or worried about identity theft.

Do closed accounts disappear from my credit report?

No. Closed accounts remain on your credit report for years. Positive closed accounts with good payment history can stay for up to 10 years. Negative closed accounts with late payments or charge-offs remain for 7 years from the first delinquency date. Closed accounts continue to influence your credit score during that time.

How long do collections stay on my credit report?

Collection accounts remain on your credit report for 7 years from the date of the first delinquency that led to the collection. Paying the collection does not remove it or restart the clock. However, paid collections generally hurt your score less than unpaid collections, especially under newer credit scoring models.