Getting denied for a credit card stings. Watching an apartment application get rejected because of a thin credit file feels worse. Being told you need a security deposit for utilities—when others don’t- adds insult to injury.

These situations share one root cause: the absence of a proven repayment history.

Here’s the truth about how to build credit: You don’t build it by borrowing large amounts. You build credit by demonstrating predictable repayment behavior over time. Lenders want evidence that you pay obligations consistently, not proof that you can accumulate debt.

If you’re completely new to the topic, start with our complete guide to how credit basics work before choosing a strategy. Understanding the system helps you build faster and smarter.

This guide explains what lenders actually look for, the exact steps to establish credit from zero, and the realistic timeline for building a strong credit profile in 2026.

Key Takeaways

- Credit rewards consistency, not complexity—one card used responsibly beats multiple accounts managed poorly

- Payment history accounts for 35% of your score—even one 30-day late payment causes significant damage[4]

- Credit utilization under 10% optimizes scoring—on a $500 limit, report $25–$40 balances for best results[3][4]

- Timeline matters: 3–6 months generates a score, 12–24 months builds strong credit—there are no overnight shortcuts

- Multiple pathways exist beyond traditional credit cards—secured cards, credit-builder loans, and authorized user status all work[1]

First: Understand What You’re Actually Building

You are not building a number. You are building a repayment history that lenders can analyze.

Credit scores represent a mathematical prediction of future payment behavior based on past patterns. When you “build credit,” you create documented evidence that you:

- Pay obligations on time

- Use credit responsibly

- Maintain accounts over extended periods

- Manage multiple credit types effectively

The FICO scoring model—used by 90% of top lenders—evaluates five factors:

- Payment history (35%): Did you pay on time?

- Credit utilization (30%): How much available credit are you using?

- Account age (15%): How long have accounts been open?

- Credit inquiries (10%): How often do you apply for new credit?

- Credit mix (10%): Do you manage different account types?

Understanding what affects a credit score helps you prioritize actions. Payment history dominates because it directly predicts future behavior. Utilization matters because maxed accounts signal financial stress.

The math behind credit building: Consistency compounds. Each on-time payment strengthens your profile incrementally. After 12 months of perfect payments, lenders see 12 data points confirming reliability. After 24 months, they see 24 confirmations.

This is why credit building requires time. You cannot manufacture history—you must create it month by month.

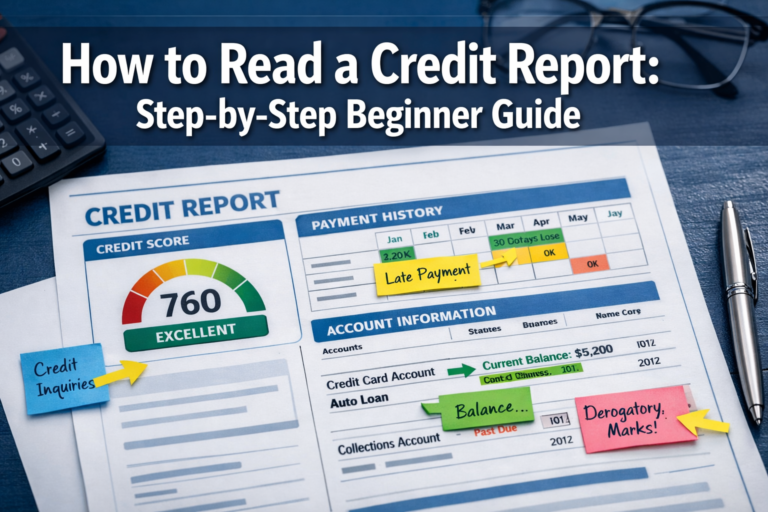

Step 1: Check If You Already Have Credit

Many beginners already possess a credit file without realizing it.

Pull your credit report from AnnualCreditReport.com (the only federally authorized source for free reports). As of 2026, U.S. consumers can access six free credit reports per year from all three credit bureaus—Equifax, TransUnion, and Experian[8].

You might discover:

- Student loans from college (even if parents cosigned)

- Collects accounts from unpaid medical bills or utilities

- Authorized user accounts where someone added you to their card

- Store credit cards you forgot about

If accounts appear on your credit report, you already have a credit history. Your next step involves optimizing existing accounts rather than opening new ones.

If your report shows “no credit history found,” you’re starting from zero—which is actually easier than repairing damaged credit.

Learn how to read a credit report to identify errors, understand account status, and verify accuracy. Disputes for incorrect information can be filed directly with each bureau.

Takeaway: Half the battle is knowing your starting point. Check before you act.

Step 2: How to Build Credit by Opening Your First Account

The path you take depends on your current situation.

No Credit History

Secured credit cards represent the most reliable starting point for building credit from zero.

A secured card requires a refundable security deposit—typically $200–$500—that serves as collateral, not a fee. The deposit amount usually equals your credit limit.

How it works:

- You deposit $500 with the card issuer

- You receive a $500 credit limit

- You make purchases and payments like any credit card

- The issuer reports your payment history to credit bureaus

- After 6–12 months of responsible use, many issuers return your deposit and convert the card to unsecured

The deposit protects the lender from risk, which is why they approve applicants with no credit history. You get access to credit; they get collateral[1].

Read our complete guide to secured credit cards for issuer comparisons and approval requirements.

Low or Bad Credit

If you have a damaged credit history rather than no history, consider:

Credit-builder loans: Financial institutions hold loan proceeds (typically $300–$1,000) in a certificate of deposit while you make monthly payments over 6–24 months. After completing all payments, you receive the funds plus any interest earned[1][5].

The loan appears on your credit report as an installment account. Each on-time payment builds a positive history. Learn more about installment credit and how it differs from revolving accounts.

Starter unsecured cards: Some issuers offer cards specifically designed for credit building, though interest rates and fees tend to be higher. These work when you cannot access secured options.

Authorized User Strategy

Becoming an authorized user on someone else’s account can build credit—if the primary cardholder maintains:

- Perfect payment history (no late payments)

- Low utilization (under 30% of limit)

- Long account age (ideally 2+ years)

The entire account history—including age and payment record—can appear on your credit report. This provides instant historical depth.

The risk: If the primary cardholder misses payments or maxes the card, that negative information also affects your credit. Only become an authorized user with someone financially responsible who agrees to maintain low balances.

Important limitation: Not all issuers report authorized user accounts to all three bureaus. Verify reporting policies before pursuing this strategy.

Step 3: How to Build Credit by Using Your Card Correctly

Opening an account creates an opportunity. Using it correctly builds credit.

The optimal usage pattern:

- Make 1–3 small purchases per month (coffee, gas, subscriptions)

- Never exceed 30% of your credit limit—stay under 10% for best results

- Never carry a balance intentionally—pay in full every month

Many beginners misunderstand a dangerous myth: “You need to carry a balance to build credit.”

This is false and expensive. Credit scoring models evaluate whether you pay on time, not whether you pay interest. Carrying a balance costs money without improving your score.

Statement Date vs Due Date: The Critical Distinction

Understanding these two dates prevents mistakes:

Statement date: The day your billing cycle ends and your balance is reported to credit bureaus. This reported balance determines your utilization ratio.

Due date: The deadline for payment (typically 21–25 days after the statement date). Paying by this date avoids late fees and interest.

The optimal strategy: Make a payment before your statement date to ensure a low balance gets reported. Then pay the remaining statement balance in full before the due date.

Example timeline:

- Day 1–30: Billing cycle (you make purchases)

- Day 30: Statement closes at $45 balance (this reports to bureaus)

- Day 55: Payment due date (you pay $45 in full, no interest charged)

Learn more about when to pay your credit card and the difference between statement balance vs current balance.

Set up autopay for at least the minimum payment as insurance against forgotten due dates. You can always pay more manually, but autopay prevents disasters.

Step 4: Control Credit Utilization to Build Credit Faster

Credit utilization measures how much of your available credit you’re currently using. It accounts for 30% of your FICO score—the second-largest factor[3][4].

The formula: (Total Balances ÷ Total Credit Limits) × 100

Lenders view high utilization as a warning sign. If you’re using 90% of available credit, you might be financially stressed and more likely to default.

Optimal utilization targets:

- Under 30%: Acceptable range

- Under 10%: Optimal for score maximization

- 1–5%: Ideal for the highest scores

Real example:

- Credit limit: $500

- Optimal reported balance: $25–$40 (5–8% utilization)

- Maximum recommended: $150 (30% utilization)

How to maintain low utilization:

- Make multiple payments per month to keep balances low

- Request credit limit increases after 6–12 months of on-time payments (increases the denominator without changing spending)

- Use the card for small recurring charges rather than large purchases

Utilization is calculated both per-card and across all cards combined. If you have multiple cards, spreading small balances across them can be more effective than concentrating usage on one card.

Read our detailed guide on the credit utilization ratio for advanced optimization strategies.

Data point: Credit utilization should stay below 30% of available credit limits to maintain a healthy profile[3][4]. This ratio continues to be a critical factor in credit scoring models for 2026[3].

Step 5: Always Pay On Time—No Exceptions

Payment history represents 35% of your credit score—the single most influential factor[4].

One 30-day late payment can:

- Drop your score by 60–110 points (depending on previous score)

- Remain on your credit report for 7 years

- Disqualifies you from premium credit cards and loans

The damage is disproportionate to the mistake. Missing one payment by one day (29 days late) causes no credit damage. Missing by two days (30 days late) triggers catastrophic consequences.

Protection strategy:

Set autopay for the minimum payment on every credit account. This creates a safety net.

You can—and should—pay more than the minimum manually. But autopay ensures that even if you forget, travel, or face an emergency, the minimum payment processes automatically.

Additional safeguards:

- Set calendar reminders 5 days before due dates

- Enable text/email alerts from card issuers

- Link accounts to budgeting apps that track due dates

The math: If you have a 720 credit score and miss one payment, your score might drop to 640. Rebuilding to 720 could take 12–24 months of perfect payment history. The cost of one mistake: years of progress.

Consistency beats perfection in credit building. Little, steady progress through on-time payments month after month is more effective than attempting quick fixes[4].

Step 6: Let Time Work—The Credit Building Timeline

Credit building is not a sprint. It’s a demonstration of sustained behavior.

Account age contributes 15% to your FICO score. Older accounts prove long-term reliability. This is why closing your first credit card, even if you no longer use it, can hurt your score.

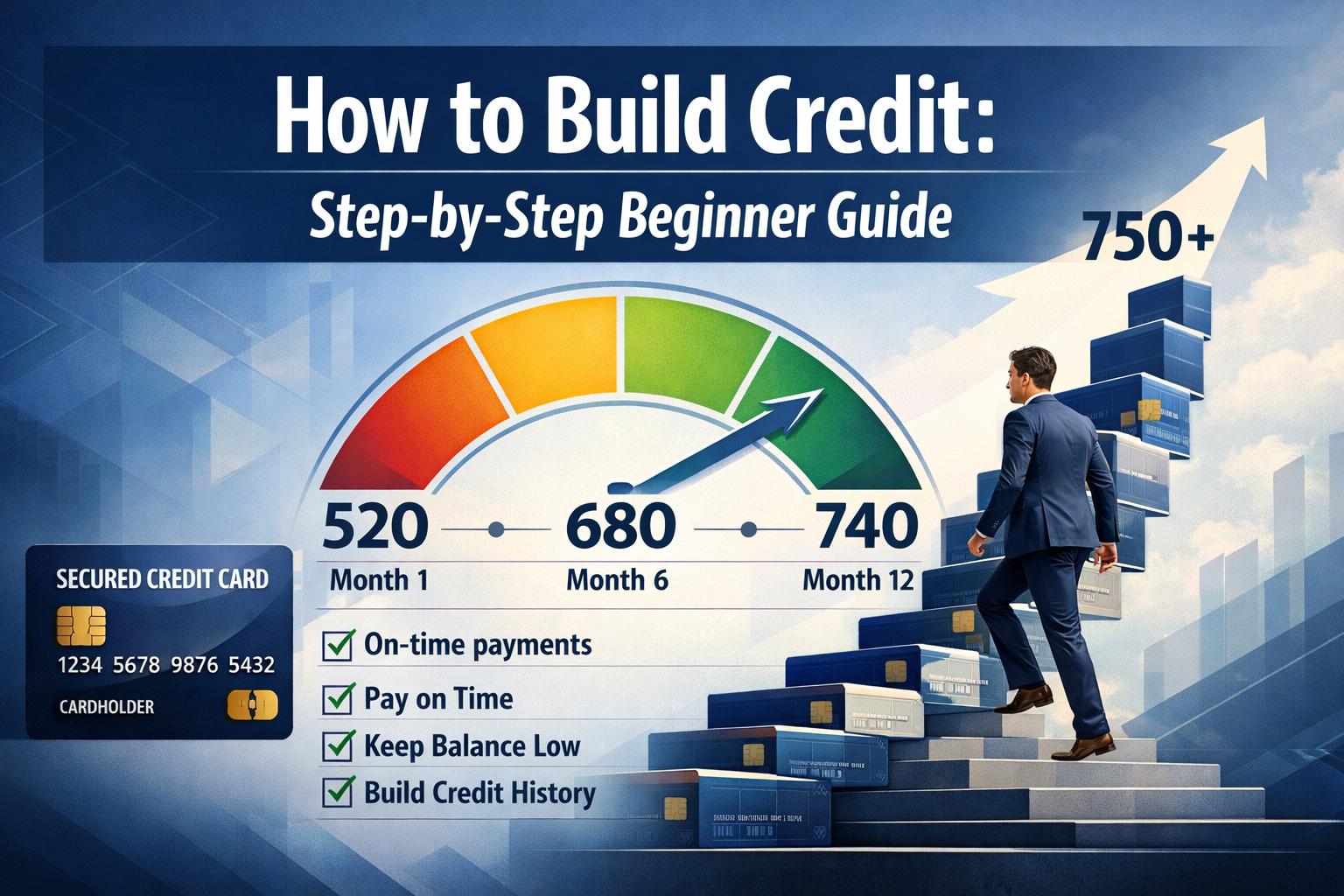

Realistic Timeline for How to Build Credit

| Time Period | Result |

|---|---|

| 1–2 months | Credit score generated (usually 580–650 range) |

| 3 months | Visible score movement based on payment patterns |

| 6 months | Stable FICO score with predictable trajectory |

| 12 months | Good credit possible (680–720 range with perfect history) |

| 24 months | Strong credit profile (720–760+ range) |

What happens at each stage:

Months 1–2: Your first account reports to credit bureaus. FICO requires at least one account open for 6 months to generate a score, but VantageScore can generate a score after one month of reporting.

Month 3: Bureaus have multiple data points showing payment behavior. Your score begins responding to utilization changes and payment consistency.

Month 6: You meet FICO’s minimum requirements. Lenders can now evaluate your creditworthiness. Some premium cards become accessible.

Month 12: With perfect payment history and low utilization, you’ve proven one full year of responsible behavior. This unlocks better interest rates and higher credit limits.

Month 24: Two years of demonstrated reliability position you for excellent credit products. Many lenders consider 24+ months of history as the threshold for “established credit.”

The compound effect: Each month of positive history makes the next month more valuable. Your 24th on-time payment carries more weight than your 3rd because it demonstrates sustained behavior.

Patience is a mathematical requirement, not a virtue. You cannot accelerate time, and credit scoring models specifically measure duration.

Mistakes That Will Hurt Your Credit Building Progress

Avoid these common errors that derail credit building:

1. Applying for Multiple Cards Simultaneously

Each credit card application triggers a hard inquiry that:

- Reduces your score by 5–10 points

- Remains on your credit report for 2 years

- Signals credit-seeking behavior to lenders

Multiple inquiries in a short period compound the damage. Apply for one card, use it responsibly for 6–12 months, then consider a second if needed.

Learn the difference between hard vs soft inquiries to understand which credit checks affect your score.

2. Closing Your First Credit Card

Closing accounts reduces:

- Total available credit (increases utilization ratio)

- Average account age (shortens credit history)

Keep your first card open and active with a small recurring charge (like a $10 monthly subscription) even after you qualify for better cards.

3. Missing a Single Payment

As explained earlier, one 30-day late payment causes disproportionate damage. The prevention cost (setting up autopay) is zero. The recovery cost (12–24 months of rebuilding) is enormous.

4. Maxing Out Your Card

Using 100% of your credit limit—even if you pay it off immediately—can hurt your score if the high balance reports to bureaus before you make the payment.

Solution: Make a payment before your statement closes to ensure a low balance gets reported.

5. Co-Signing Loans

Co-signing makes you legally responsible for someone else’s debt. If they miss payments, your credit suffers. The account appears on your credit report and affects your debt-to-income ratio.

Only co-sign when you’re prepared to make payments yourself and can afford the financial consequences.

The Fastest Way to Build Credit (The Truth)

There is no overnight credit-building method. Anyone promising “750 credit score in 30 days” is either lying or selling something that won’t work.

The genuinely fastest approach:

- Open a secured credit card (approval within 1–2 weeks)

- Make 1–2 small purchases per month (under 10% of limit)

- Pay in full before the statement date (ensures low utilization reporting)

- Set autopay for the minimum payment (prevents late payments)

- Wait 6 months (minimum for FICO score generation)

This method maximizes the two largest scoring factors—payment history and utilization—while meeting the minimum time requirements.

Credit-building apps can accelerate progress slightly by reporting additional payment types:

- Grow Credit: Reports subscription payments (Netflix, Spotify, Amazon Prime) to credit bureaus with no upfront cost[5]

- Self: Offers credit-builder loans reporting to all three bureaus[5]

- Credit Strong: Requires monthly payments of $15–$110 for an installment loan reporting[5]

These tools add payment diversity but cannot replace time. They supplement traditional credit building rather than replacing it.

The 2026 advantage: Credit scoring models are expanding to increasingly consider payment history from utility and rent payments, providing new opportunities for individuals with limited traditional credit history[6]. Some services now report rent and utility payments to bureaus, creating credit history from expenses you already pay.

How Long Does It Take to Build Credit: The Realistic Answer

Short answer: 3–6 months to establish a credit score, 12–24 months to build strong credit.

Detailed breakdown:

3–6 months: You can generate a credit score and qualify for basic credit products. Your score will likely range from 620 to 680 with a perfect payment history and low utilization.

12 months: With consistent on-time payments and utilization under 10%, you can reach the 680–720 range, considered “good credit.” This qualifies you for competitive interest rates on auto loans and most credit cards.

24 months: Two years of perfect history can position you in the 720–760+ range—”very good” to “excellent” credit. This unlocks premium rewards cards, the best mortgage rates, and negotiating power with lenders.

Factors that accelerate building:

- Multiple account types (revolving + installment)

- Credit limit increases (improves utilization without changing spending)

- Authorized user status on aged accounts

- Rent/utility payment reporting services

Factors that slow building:

- Late payments (even one)

- High utilization (above 30%)

- Frequent credit applications

- Collections accounts or public records

The mathematical reality: Credit scoring models weight recent behavior more heavily than old behavior, but they require sufficient data points to establish patterns. You cannot compress 12 months of payment history into 3 months.

What a Good Beginner Credit Profile Looks Like

From a lender’s perspective, an ideal beginner credit profile includes:

One revolving account (credit card) with 6–12 months of history

Perfect payment history (zero late payments)

Low balances (utilization under 10%)

No collections or derogatory marks

Minimal hard inquiries (1–2 in the past 12 months)

Optional but beneficial:

- One installment loan (student loan, auto loan, or credit-builder loan)

- Authorized user status on an aged account

- Rent/utility payment reporting

You don’t need:

- Multiple credit cards

- High credit limits

- A mortgage or auto loan

- Perfect 850 credit score

The goal: Demonstrate that you can borrow money and repay it consistently. One card used responsibly for 12 months proves this more effectively than five cards managed inconsistently.

Different lenders use different scoring models—FICO and VantageScore are the most common—so understanding which model your specific lender uses helps you focus on relevant credit habits[3]. Ask your lender directly about their scoring preferences when applying for credit products.

A diversified credit mix positively impacts your score, including credit cards, installment loans, and mortgages[3]. However, responsible use of one or two accounts can be more effective than juggling multiple lines of credit[4].

📊 Credit Building Timeline Calculator

See your personalized credit building journey and projected milestones

Your Projected Timeline

Conclusion: How to Build Credit Through Consistent Action

Credit building rewards consistency, not complexity.

The system doesn’t care about your income, your education, or your intentions. It measures one thing: Do you pay obligations on time?

Small, reliable actions beat big financial moves. A $25 purchase paid on time every month for 12 months builds more credit than a $3,000 purchase paid once.

Your action plan:

- Check your credit report at AnnualCreditReport.com

- Open a secured credit card if you have no credit history

- Make 1–3 small purchases monthly (under 10% of limit)

- Pay in full before the statement date (low utilization)

- Set autopay for the minimum payment (late payment insurance)

- Wait 6–12 months while time compounds your efforts

The math behind credit building is simple: Consistency × Time = Strong Credit

Start today. Make your first on-time payment. Then make another next month. And another the month after.

In 12 months, you’ll have a credit profile that opens financial doors. In 24 months, you’ll have credit that saves you thousands in interest over your lifetime.

The question isn’t whether you can build credit. The question is whether you’ll commit to the consistent behavior required to build it.

Disclaimer

This article provides educational information about credit-building strategies and should not be considered financial advice. Credit-building results vary based on individual circumstances, credit history, and financial behavior. The Rich Guy Math does not guarantee specific credit score outcomes or approval for credit products. Consult with a qualified financial advisor or credit counselor for personalized guidance. Credit decisions should be made after careful consideration of your financial situation, goals, and ability to manage credit responsibly. All credit products mentioned are for educational purposes; research terms, fees, and conditions before applying.

Author Bio

Max Fonji is a data-driven financial educator and the founder of The Rich Guy Math. With a background in financial analysis and a passion for teaching the math behind money, Max breaks down complex credit, investing, and wealth-building concepts into clear, actionable insights. His work focuses on evidence-based strategies that help readers understand how financial systems actually work, not how they’re marketed. Max believes financial literacy begins with understanding cause and effect, and every article at The Rich Guy Math is designed to build that understanding through data, logic, and real-world application.

References

[1] Building Credit – https://www.experian.com/blogs/ask-experian/credit-education/improving-credit/building-credit/

[3] Your 2026 Credit Score Playbook – https://www.myconsumers.org/blog/post/New-Site-Blog-Posts/2026/01/29/your-2026-credit-score-playbook

[4] How To Improve Your Credit Score In 2026 – https://www.americanbankusa.com/education-center/how-to-improve-your-credit-score-in-2026/

[5] Best Credit Building Apps – https://www.edvisors.com/money-management/credit/best-credit-building-apps/

[6] Your 2026 Credit Score Playbook: The Biggest Changes And What They Mean For You – https://www.elgacu.com/your-2026-credit-score-playbook-the-biggest-changes-and-what-they-mean-for-you/

[8] Fixing Your Credit Faqs – https://consumer.ftc.gov/articles/fixing-your-credit-faqs

Frequently Asked Questions

Can you build credit without a credit card?

Yes. Credit-builder loans, installment loans (such as auto or student loans), and certain rent or utility reporting services can help build credit without using a credit card. However, credit cards remain the most accessible and flexible option for most beginners.

How fast can a credit score increase?

Credit scores can increase 20–40 points within 1–2 months after correcting major negative factors, such as paying down high balances or removing reporting errors. Building from no credit to a good score (680+) typically takes 6–12 months of consistent positive behavior.

Does paying rent help build credit?

Rent only helps build credit if payments are reported to the credit bureaus. Most landlords do not report rent automatically. However, third-party rent-reporting services can report your rent payment history for a fee.

Should I carry a balance to build credit?

No. This is a common myth. Credit scores reward on-time payments and responsible usage, not interest payments. Carrying a balance only costs you money and does not improve your score. Always pay your statement balance in full whenever possible.

What credit score do you start with?

You do not begin with a credit score. A score is generated after at least one account reports activity for a minimum period—about one month for VantageScore and about six months for FICO scoring models. Your first score typically falls between 580 and 650 depending on how the account is used.

Can a debit card build credit?

No. Debit cards use your own bank funds and are not reported to credit bureaus. Only credit accounts involving borrowing and repayment—such as credit cards and loans—create a credit history and build a credit score.