Picture this: You’re 22 years old, fresh out of college, and ready to rent your first apartment. The landlord runs a credit check and delivers crushing news — “Sorry, we can’t approve you. You have no credit history.”

This scenario plays out thousands of times daily across America. Young adults and immigrants face the same catch-22: you need credit to get credit, but how do you start with zero history?

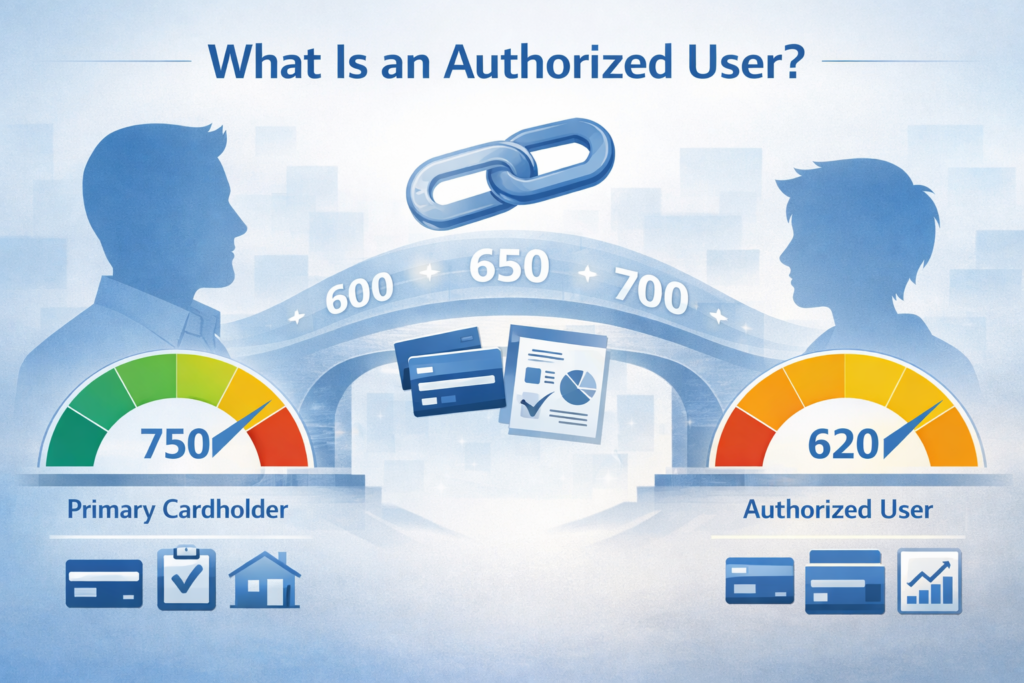

An authorized user is a person added to someone else’s credit card account who can use the card but isn’t legally responsible for the debt. This strategy represents one of the few ways to build credit without actually borrowing money or taking on financial liability.

Before diving into this strategy, it helps to understand the foundation of credit building. Start with our comprehensive guide to credit management to grasp how the entire system works.

Key Takeaways

- Authorized user status can boost credit scores by 10% within 30 days for those with poor credit, with improvements visible in 30-45 days

- You inherit the primary cardholder’s payment history, account age, and credit utilization, both positive and negative aspects

- Choose your primary cardholder carefully — they must have excellent payment history, low balances, and old accounts

- This strategy works best as a temporary stepping stone to establish credit before applying for your own cards

- Nearly 46% of authorized users achieve scores of 680 or higher, compared to 27% without authorized user status

What Is an Authorized User?

An authorized user is someone added to another person’s credit card account with permission to make purchases, but without legal responsibility for paying the debt. Think of it as borrowing someone’s credit reputation without borrowing their money.

This differs significantly from other credit relationships:

- Not a joint account holder — you don’t own the account

- Not a co-signer — you have no legal obligation to pay

- Not an account manager — the primary cardholder controls all account decisions

Here’s a simple example: Sarah adds her 19-year-old son, Michael, as an authorized user on her credit card. Michael receives a card with his name, can make purchases, but Sarah remains 100% responsible for all payments. Michael’s credit report will show Sarah’s account history, potentially boosting his credit score.

The math behind this strategy is straightforward: credit scoring models reward proven payment history and account longevity. As an authorized user, you inherit both without the traditional qualification requirements.

How Authorized User Accounts Affect Your Credit Score

When you become an authorized user, participating credit card issuers report the account information to major credit bureaus (Experian, Equifax, and TransUnion). This reporting typically includes:

Payment History (35% of your credit score):

- Every on-time payment from the primary cardholder

- Any late payments or missed payments

- Account status (current, past due, closed)

Account Age (15% of your credit score):

- Original account opening date

- Length of credit history calculation

- Average age of all accounts

Credit Utilization (30% of your credit score):

- Current balance on the account

- Credit limit

- Utilization ratio calculation

Credit Mix (10% of your credit score):

- Account type (revolving credit)

- Diversity of credit products

These details become part of your permanent credit history. To understand exactly what appears on your report, read our detailed guide on what a credit report is and how lenders use this information.

Important note: Not all credit card companies report authorized user activity. Before proceeding, confirm the issuer reports to all three major credit bureaus.

Why This Strategy Works: The FICO Explanation

Credit scoring algorithms reward demonstrated financial responsibility over time. The challenge for credit newcomers is proving reliability without existing history — a mathematical impossibility under traditional lending models.

FICO score components work as follows:

| Component | Weight | Authorized User Benefit |

|---|---|---|

| Payment History | 35% | Inherits primary holder’s history |

| Credit Utilization | 30% | Benefits from established limits |

| Length of Credit History | 15% | Gains account age instantly |

| Credit Mix | 10% | Adds revolving credit type |

| New Credit Inquiries | 10% | Inherits the primary holder’s history |

The mathematical advantage is clear: Instead of starting with zero credit history, authorized users immediately inherit years of established credit behavior. Research shows authorized users average a credit score of 661 compared to 657 for non-members — a modest but measurable improvement[1].

For individuals with poor credit, the impact is dramatic: Those with scores below 550 see a 10% improvement within 30 days and up to 30% improvement after 12 months[2].

Authorized User vs Joint Account Holder vs Co-Signer

Understanding these three credit relationships is crucial for making informed decisions:

| Role | Can Use Card | Responsible for Debt | Builds Credit | Risk Level |

|---|---|---|---|---|

| Authorized User | Yes | No | Yes | Low |

| Joint Account Holder | Yes | Yes | Yes | High |

| Co-Signer | No | Yes | Yes | High |

Authorized User Benefits:

- Zero financial liability

- Credit building potential

- Easy removal process

- No income requirements

Joint Account Holder Characteristics:

- Equal account ownership

- Shared debt responsibility

- Both names on account

- Harder to separate

Co-Signer Responsibilities:

- Guarantees debt payment

- No card access

- Full liability for missed payments

- Difficult to remove

For credit-building purposes, authorized user status offers the best risk-to-reward ratio. You gain credit benefits without assuming debt obligations.

How to Become an Authorized User: Step-by-Step Process

Step 1: Choose Your Primary Cardholder

Select someone with excellent credit who trusts you completely. This person will have full control over your credit-building success.

Step 2: Primary Cardholder Contacts Card Issuer

They call the customer service number or log into their online account to request adding an authorized user.

Step 3: Provide Required Information

You’ll need to share:

- Full legal name

- Date of birth

- Social Security number

- Current address

Step 4: Card Issuance

The issuer mails a card with your name within 7-10 business days. Some issuers charge a small annual fee ($25-$100) for additional cards.

Step 5: Credit Bureau Reporting Begins

Account information typically appears on your credit report within 1-2 billing cycles (30-60 days).

Step 6: Monitor Credit Score Changes

Check your credit score monthly to track improvements. Most people see initial changes within 30-45 days.

Important: You don’t need to physically use the card to build credit. The account’s mere presence on your credit report provides the scoring benefit.

Who You Should Choose as Your Primary Cardholder

The ideal primary cardholder exhibits these characteristics:

Perfect Payment History:

- Never missed a payment in 24+ months

- No late fees or penalty rates

- Consistent on-time payment patterns

Low Credit Utilization:

- Maintains balances below 10% of credit limits

- Pays balances in full monthly

- Never maxes out credit cards

Established Account Age:

- Account open for 2+ years minimum

- A longer history provides greater benefit

- Multiple old accounts indicate stability

High Credit Limits:

- $5,000+ credit limit preferred

- Higher limits improve utilization ratios

- Demonstrates creditworthiness to lenders

Financial Stability:

- Steady income source

- Emergency fund coverage

- Responsible money management habits

Trust and Communication:

- Willing to share account information

- Understands mutual responsibilities

- Commits to maintaining good habits

Warning signs to avoid:

- Recent late payments

- High credit card balances

- Multiple recent credit applications

- Financial stress or instability

- Unwillingness to discuss account details

Remember: their credit mistakes become your credit mistakes. Choose wisely.

When Being an Authorized User Can Hurt Your Credit

While authorized user status typically helps credit scores, certain situations can cause damage:

Late Payments:

Every missed payment by the primary cardholder appears on your credit report. A single 30-day late payment can drop credit scores by 50-100 points.

High Credit Utilization:

If the primary cardholder carries high balances, your credit utilization ratio increases accordingly. High balances affect something called the credit utilization ratio guide, which represents 30% of your credit score calculation.

Maxed-Out Cards:

Credit cards at or near their limits signal financial distress to scoring algorithms. This can lower your score even if you never touched the card.

Account Closure:

When primary cardholders close accounts, you lose the credit history benefit. Sudden account closures can temporarily lower your average account age.

Negative Account Status:

Charge-offs, collections, or other derogatory marks transfer to your credit report. These negative items can remain for seven years.

Identity Theft or Fraud:

If the primary cardholder’s account experiences fraud, the investigation process might temporarily impact your credit access.

Relationship Deterioration:

Personal conflicts with family members or friends can lead to unexpected account removal, eliminating your credit-building progress.

Risk mitigation strategies:

- Monitor your credit report monthly

- Maintain open communication with the primary cardholder

- Have a backup credit-building plan

- Consider multiple authorized user relationships

- Prepare to transition to independent credit products

How Fast Authorized User Status Builds Credit

Timeline for Credit Score Improvements:

| Timeframe | Expected Results | Score Improvement Range |

|---|---|---|

| 30 days | Account appears on credit report | 10% increase (poor credit) |

| 60 days | Credit score generated/updated | 15-20% increase |

| 90 days | Noticeable score improvements | 20-25% increase |

| 6 months | Substantial credit building | 25-30% increase |

| 12 months | Maximum benefit achieved | Up to 30% increase |

Results vary by starting credit score:

Below 550 (Poor Credit):

- 30 days: 10% improvement

- 12 months: 30% improvement

550-649 (Fair Credit):

- 30 days: 9.6% improvement

- 12 months: 28% improvement

650-699 (Good Credit):

- 30 days: 9.6% improvement

- 12 months: 20% improvement

700+ (Excellent Credit):

- 30 days: 3.5% improvement

- 12 months: 9% improvement

Research shows nearly 46% of authorized users achieve scores of 680 or higher, compared to 27% without authorized user status[1].

Factors affecting improvement speed:

- Primary cardholder’s credit profile

- Your starting credit score

- Number of other credit accounts

- Overall credit utilization across accounts

- Payment history on existing accounts

Real-world impact: Authorized users are 2.7 percentage points more likely to gain auto loan approval and 2.9 percentage points more likely to receive mortgage approval than borrowers without this status[3].

Do You Need to Use the Authorized User Card?

No, you don’t need to use the card to build credit. This represents a common misconception about how credit scoring works.

Credit building comes from account reporting, not spending activity. Here’s the mathematical reality:

What Builds Credit:

- Account presence on the credit report

- Payment history from the primary cardholder

- Credit limit and utilization reporting

- Account age contribution

What Doesn’t Build Credit:

- Your personal spending on the card

- Purchase categories or amounts

- Card activation or usage frequency

- Physical possession of the card

Many authorized users never receive or activate their cards. The credit-building benefit comes entirely from the account’s appearance on your credit report and the primary cardholder’s responsible management.

However, using the card responsibly can provide additional benefits:

- Building personal spending discipline

- Learning credit card management

- Earning rewards or cash back

- Establishing purchase protection

If you choose to use the card:

- Keep spending minimal

- Pay the primary cardholder immediately

- Communicate all purchases

- Never exceed agreed-upon limits

- Treat it like borrowed money (because it is)

Bottom line: The credit score improvement comes from association with the account, not from your individual spending behavior.

Authorized User vs Secured Credit Card: Which Is Better?

Both strategies help build credit, but they serve different purposes and timelines:

Authorized User Advantages:

- Faster results: Credit improvement visible in 30-45 days

- No deposit required: Zero upfront investment

- Inherits established history: Immediately gains years of credit age

- No credit check: Approval doesn’t depend on your creditworthiness

- Higher credit limits: Access to established credit lines

Authorized User Disadvantages:

- Depends on another person: Success relies on someone else’s behavior

- Limited control: Cannot manage the account directly

- Temporary solution: Not sustainable long-term

- Relationship risk: Personal conflicts can end the arrangement

- No guaranteed reporting: Some issuers don’t report to all bureaus

Secured Credit Card Advantages:

- Complete independence: You control all account decisions

- Guaranteed approval: Approval based on deposit, not credit score

- Builds personal history: Establishes your own credit profile

- Long-term solution: Can keep account indefinitely

- Graduation potential: Many convert to unsecured cards

Secured Credit Card Disadvantages:

- Slower results: 6-12 months for significant improvement

- Deposit required: $200-$500 upfront investment

- Lower credit limits: Usually equal to the deposit amount

- No inherited history: Start from zero account age

- Annual fees: Many charge $25-$95 annually

Best approach: Use authorized user status for immediate credit building, then transition to a secured card for long-term independence. If you don’t have someone to add you as an authorized user, learn how to build credit step-by-step through secured cards and other strategies.

Timeline comparison:

- Authorized user: 30-60 days for initial impact

- Secured card: 3-6 months for initial impact

- Combined strategy: Maximum credit building potential

Should You Stay an Authorized User Forever?

No — authorized user status works best as a temporary credit-building tool, not a permanent strategy.

The goal is credit independence: Use authorized user status to establish credit history, then transition to your own credit products. This approach provides maximum long-term financial flexibility.

Recommended exit strategy:

Phase 1: Establish Foundation (Months 1-6)

- Become an authorized user on 1-2 excellent accounts

- Monitor credit score improvements monthly

- Learn about credit management and financial responsibility

Phase 2: Build Independence (Months 6-12)

- Apply for your own secured or student credit card

- Maintain authorized user status while building personal history

- Keep credit utilization below 10% on all accounts

Phase 3: Transition to Independence (Months 12-18)

- Apply for unsecured credit cards

- Consider removing authorized user accounts (optional)

- Focus on building a diverse credit mix

Phase 4: Full Independence (18+ Months)

- Manage multiple credit accounts independently

- Use authorized user experience to help others

- Continue building wealth through responsible credit use

When to remove authorized user status:

- After establishing 12+ months of personal credit history

- When you have 2-3 credit accounts in your own name

- If the primary cardholder’s habits deteriorate

- When relationship dynamics change

Benefits of staying long-term:

- Continued account age contribution

- Higher total credit limits

- Lower overall utilization ratios

- Backup credit access

Risks of staying long-term:

- Continued dependence on another person

- Potential relationship complications

- Limited control over credit profile

- Missed opportunities for credit diversity

The optimal strategy balances immediate credit building with long-term financial independence. This approach connects to broader wealth building strategies that emphasize financial self-reliance.

Common Mistakes to Avoid

Mistake #1: Choosing the Wrong Primary Cardholder

Many people ask family members without checking their credit habits first. Always verify payment history, credit scores, and account management before proceeding.

Solution: Request to see recent credit card statements and credit reports before committing.

Mistake #2: Applying for Credit Too Early

Eager authorized users often apply for their own credit cards before seeing score improvements, leading to unnecessary hard inquiries and rejections.

Solution: Wait 3-6 months after becoming an authorized user before applying for independent credit products.

Mistake #3: Becoming Permanently Dependent

Some authorized users never transition to independent credit building, limiting their long-term financial growth.

Solution: Set a specific timeline (12-18 months) for transitioning to your own credit accounts.

Mistake #4: Using the Card Irresponsibly

Overspending on authorized user cards can strain relationships and create financial problems for primary cardholders.

Solution: Treat authorized user cards like borrowed money. Communicate all purchases and pay immediately.

Mistake #5: Not Monitoring Credit Reports

Failing to track credit report changes means missing both positive improvements and potential problems.

Solution: Check credit reports monthly through free services like Credit Karma or AnnualCreditReport.com.

Mistake #6: Ignoring Account Changes

Primary cardholders sometimes change spending habits, miss payments, or close accounts without warning authorized users.

Solution: Maintain regular communication about account status and have backup credit-building plans.

Mistake #7: Adding Too Many Authorized User Accounts

Multiple authorized user accounts can create confusion and potential credit complications.

Solution: Start with one excellent account, then add others only if needed for specific credit goals.

Mistake #8: Not Understanding the Removal Process

Some people don’t realize they can request removal from authorized user accounts if circumstances change.

Solution: Understand that removal is simple — either you or the primary cardholder can contact the issuer to remove your access.

Mistake #9: Expecting Overnight Results

Credit building takes time, even with authorized user status. Unrealistic expectations lead to poor financial decisions.

Solution: Plan for 30-60 days for initial changes and 6-12 months for substantial improvements.

Mistake #10: Not Having an Exit Strategy

Many authorized users lack clear plans for transitioning to credit independence.

Solution: Create a timeline with specific milestones for applying for your own credit products and building financial independence.

Understanding these common pitfalls helps maximize the benefits of authorized user status while avoiding potential complications.

The Future of Credit Building

The credit industry continues evolving, with new opportunities emerging for credit building beyond traditional methods.

Alternative Credit Data Integration:

In 2026, credit scoring models increasingly consider payment history from utility bills, rent payments, and subscription services. This expansion provides more credit-building opportunities for individuals with limited traditional credit history[5].

Consumer-Permissioned Data Growth:

The rise of consumer-permissioned data allows individuals to share additional financial information with lenders. Users move an average of 4.6 more bills to credit-building accounts within a single quarter of enrollment[6].

Enhanced Authorized User Reporting:

More credit card issuers now report authorized user activity to all three major credit bureaus, increasing the effectiveness of this strategy.

Expanded Access for Young Adults:

About 16% of 21-year-olds are now authorized users, nearly doubling since 2010[3]. This trend reflects growing awareness of early credit-building benefits.

Integration with Digital Banking:

Modern banking apps provide real-time credit monitoring and automated credit-building recommendations, making it easier to track authorized user benefits.

These developments complement traditional authorized user strategies, providing multiple pathways for establishing and building credit in 2026.

Authorized User Credit Score Impact Calculator

Conclusion

Becoming an authorized user represents one of the most effective ways to build credit quickly without taking on debt or financial liability. Research demonstrates clear benefits: authorized users average higher credit scores, gain faster loan approvals, and qualify for better interest rates compared to those without this status.

The math behind authorized user success is straightforward: You inherit years of established credit history, payment patterns, and account age that would otherwise take years to develop independently. For individuals with poor credit, improvements of 10% within 30 days and up to 30% within 12 months are achievable with the right primary cardholder.

However, success depends entirely on choosing the right person. The primary cardholder must demonstrate excellent payment history, low credit utilization, and long-term account management. Their financial mistakes become your financial mistakes, making this decision crucial for your credit-building success.

Use authorized user status as a stepping stone, not a permanent solution. The goal is to establish enough credit history to qualify for your own credit products, building toward complete financial independence. This strategy works best when combined with broader wealth-building principles that emphasize financial literacy and long-term planning.

Remember: Credit building is just one component of financial success. While authorized user status can improve your credit score quickly, lasting wealth comes from understanding the math behind money, making data-driven financial decisions, and building multiple income streams over time.

Start with an authorized user status if you have access to an excellent primary cardholder. If not, explore secured credit cards and alternative credit-building methods. Either way, begin building your credit foundation today — your future financial opportunities depend on it.

Disclaimer

This article provides educational information about credit scores and should not be considered personalized financial advice. Credit scoring models and lending criteria vary by institution and change over time. Always consult with qualified financial professionals before making major financial decisions. The author is not responsible for any financial decisions made based on this information.

Author Bio

Max Fonji is a data-driven financial educator and the founder of The Rich Guy Math. With expertise in financial analysis and wealth building strategies, Max translates complex financial concepts into actionable insights for everyday investors. His evidence-based approach helps readers understand the math behind money and make informed financial decisions. Max holds advanced certifications in financial planning and regularly contributes to major financial publications.

References

[1] How Much How Quick Score Increase As Authorized User – https://www.tidalloans.com/how-much-how-quick-score-increase-as-authorized-user/

[2] Authorized User Affects Credit Score – https://www.creditsesame.com/blog/credit-score/authorized-user-affect-credit-score/

[3] Authorized Users Build Credit Riskier Borrowers – https://money.com/authorized-users-build-credit-riskier-borrowers/

Frequently Asked Questions

Does an authorized user need to use the card?

No. An authorized user does not have to make purchases for the account to help their credit.

Credit scoring models (like FICO®) mainly care about account history, not spending activity. When you’re added:

- The card’s age can appear on your credit report

- The payment history may transfer to your profile

- The credit limit can affect your utilization ratio

You benefit simply from being attached to a well-managed account.

However: If the primary cardholder starts missing payments, your credit can be affected even if you never touched the card.

Takeaway: The value comes from the history, not the swiping.

How much will my score increase?

There is no guaranteed number, but here are realistic ranges based on common situations:

| Starting Situation | Possible Score Change |

|---|---|

| No credit history | +80 to +150 points (sometimes more) |

| Thin credit file | +40 to +100 points |

| Poor credit | +20 to +80 points |

| Already good credit | Small or no change |

Why it varies:

- Age of the card (older = stronger impact)

- Credit limit

- Utilization on the card

- Negative items already on your report

An authorized user account cannot override collections, charge-offs, or late payments already on your credit.

Important: Scores usually update within 30–60 days after the card reports to the bureaus.

Can I be removed anytime?

Yes. Either you or the primary cardholder can remove you at any time by contacting the card issuer.

After removal:

- The account typically disappears from your credit report

- Your score may drop if it was helping your age or utilization

This is why authorized user status should be treated as temporary credit training wheels—not a permanent solution.

Do all cards report authorized users?

No — and this is one of the most misunderstood parts.

Credit card companies are not required to report authorized users to the credit bureaus (Experian, Equifax, TransUnion). Most major issuers do, but not all accounts actually appear.

Some reasons it may not report:

- Small regional banks or credit unions

- Business credit cards

- Store cards

- The issuer reports only to one bureau

Before being added, ask the issuer: “Do you report authorized users to all three credit bureaus?”

If they don’t, you get zero credit benefit.

Can this hurt my credit?

Yes — this is the real risk. You inherit both the good and the bad behavior of the primary cardholder.

You can be hurt if:

- They miss a payment

- They max out the card

- The account goes to collections

- The card is closed suddenly

Your score can drop even if you never had the card in your wallet.

Rule: Only become an authorized user on a card owned by someone financially responsible.

This is why parents helping children works well — and friendships often don’t.

Is it better than a secured card?

It depends on your goal.

| Authorized User | Secured Credit Card |

|---|---|

| Fastest way to get a score | Builds independent credit |

| No deposit required | Requires deposit ($200–$500) |

| You don’t control the account | You control all behavior |

| Risk depends on someone else | Risk depends on you |

| Temporary boost | Long-term credit foundation |

Best strategy (what usually works):

- Become an authorized user

- Wait 1–2 months for the account to report and a score to update

- Then open your own secured card

This creates both:

- Instant credibility (authorized user account)

- Permanent credit history (your own account)

Lenders care far more about accounts you manage yourself over time.