Let’s Be Honest: Tracking Expenses Can Feel Like a Chore

Ever looked at your bank account and wondered: Where did all my money go?

You’re not alone. Managing expenses isn’t just about cutting back—it’s about gaining control and building a life where your money supports your goals (instead of draining them).

So no, this isn’t another “stop buying lattes” lecture.

This guide is about awareness, strategy, and freedom.

Why Managing Expenses = Building Wealth from the Ground Up

Wealth doesn’t just happen. It starts with understanding what’s coming in and what’s going out.

When you manage expenses well:

- You save without feeling squeezed

- You invest more confidently

- You sleep better knowing bills are covered

Think of it as building your financial foundation brick by brick—with purpose.

The #1 Mistake Most People Make With Expenses

They start slashing expenses before knowing what they’re even spending on.

It’s like throwing clothes away before checking if they still fit—wasteful and random.

Let’s fix that.

Step 1: Track Where Your Money Actually Goes

Action Step: Pull up your last 1–3 months of bank and credit card statements.

Look for patterns—dining out, subscriptions, weekend splurges.

Write it down or use an app like Mint, YNAB, or Monarch Money.

Pro Tip: Categorize your spending. Seeing the numbers in black and white? Eye-opening.

Step 2: Break Expenses Into Clear Categories

Here’s how to make sense of the chaos:

- Housing: Rent, mortgage, utilities

- Transportation: Gas, insurance, car maintenance

- Food: Groceries and eating out

- Lifestyle: Subscriptions, entertainment, shopping

- Debt: Loan payments, credit cards

- Savings & Investing: Emergency fund, IRA, 401(k)

Now ask yourself:

Is my spending aligned with what I value most right now?

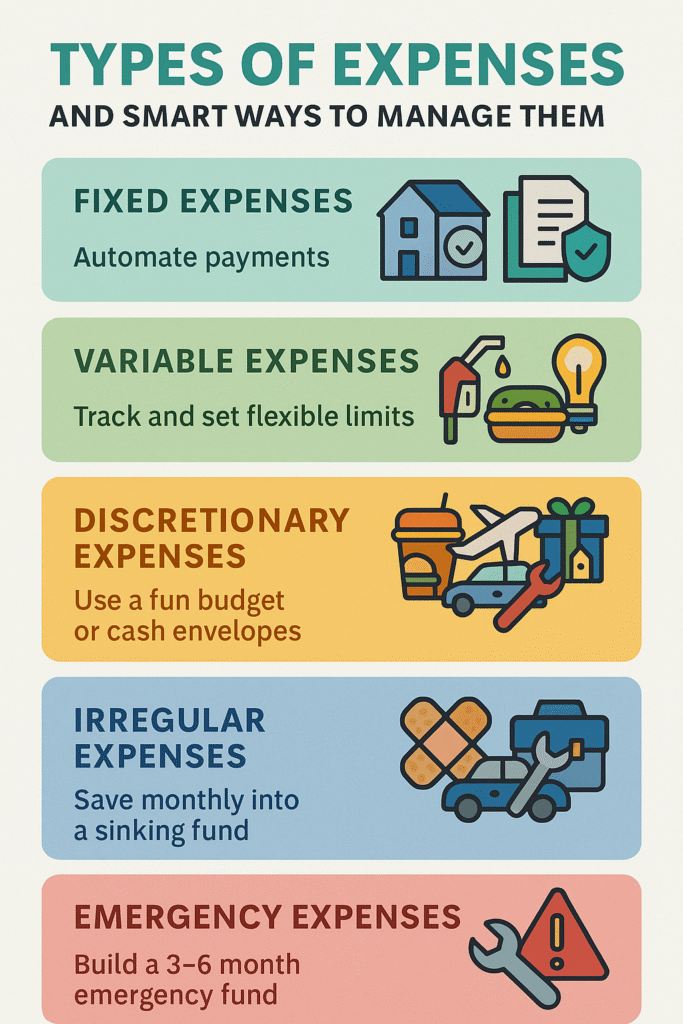

Types of Expenses You Should Know

Knowing the types of expenses helps you plan, prioritize, and prevent surprises.

Fixed Expenses

- Rent or mortgage

- Insurance

- Subscription services

Tip: Set these on auto-pay. Done and dusted.

Variable Expenses

- Groceries

- Fuel

- Utilities

Tip: Track trends monthly. Use flexible limits, not rigid ones.

Discretionary Expenses

- Eating out

- Travel

- Shopping

Tip: Use a “fun money” allowance to avoid guilt.

Irregular Expenses

- Car repairs

- Holidays

- School fees

Tip: Start a sinking fund. $30/month beats a $600 surprise later.

Emergency Expenses

- Medical emergencies

- Job loss

- Urgent home repairs

Tip: Build a 3–6 month emergency fund (start small, build steady).

Step 3: Cut Waste Without Cutting Joy

Ask yourself:

Do I even use this?

Can I find a cheaper option?

Would I rather have this… or fund my dream goal?

This isn’t about deprivation—it’s about spending on what truly matters.

Step 4: Use the 50/30/20 Rule to Rebalance Your Spending

It’s simple, flexible, and makes budgeting feel doable:

- 50% Needs (housing, food, minimum payments)

- 30% Wants (fun stuff, entertainment)

- 20% Financial Goals (debt payoff, saving, investing)

Tip: If your “wants” are eating into your goals, nudge it back by 5–10%. Small shifts = big impact.

Step 5: Automate and Simplify

- Set bills on auto-pay to avoid late fees

- Use spending limits on lifestyle categories

- Create separate accounts for bills vs. fun money

- Turn on alerts when spending spikes

Tip: Automating removes friction and reduces emotional spending.

Bonus Tip: Use Budgeting Apps That Do the Work for You

Top tools:

- YNAB – For hands-on planners

- Mint – Great for beginners

- PocketGuard – See what’s “safe to spend”

- Monarch Money – Best for couples or goal-driven budgets

Pick one and try it for 7 days. You’ll be shocked what you discover.

FAQ: About Managing Expenses

Track, categorize, and cut low-value spending. Start with subscriptions and impulse purchases.

At first, yes! Later, you can focus on the big categories.

Expense control becomes even more powerful. Small savings = huge relief.

Weekly works best. 10–15 mins max.

Final Thoughts: Spend on Purpose, Not by Habit

You don’t need to cancel everything fun to win with money.

You just need to know what you truly care about—and redirect your dollars accordingly.

Track your expenses. Question them. Align them.

Your bank account will reflect your values, not just your habits.