Picture this: You’re at a family dinner in 2025, and your uncle brags about his investment portfolio returning 15% last year. Sounds impressive, right? But here’s the kicker: the overall stock market went up 25%. Did your uncle really “win,” or did he actually underperform?

This is where understanding absolute return becomes your secret weapon. Unlike relative performance metrics that compare your gains to a benchmark, absolute return tells you the raw, unvarnished truth about whether you made or lost money. Period.

Whether you’re just starting your investment journey or looking to sharpen your financial literacy, grasping the concept of absolute return is fundamental to evaluating investment performance honestly and making smarter money decisions. Investopedia

Key Takeaways

- Absolute return measures the total gain or loss of an investment over a specific period, expressed as a percentage, without comparing it to any benchmark or index

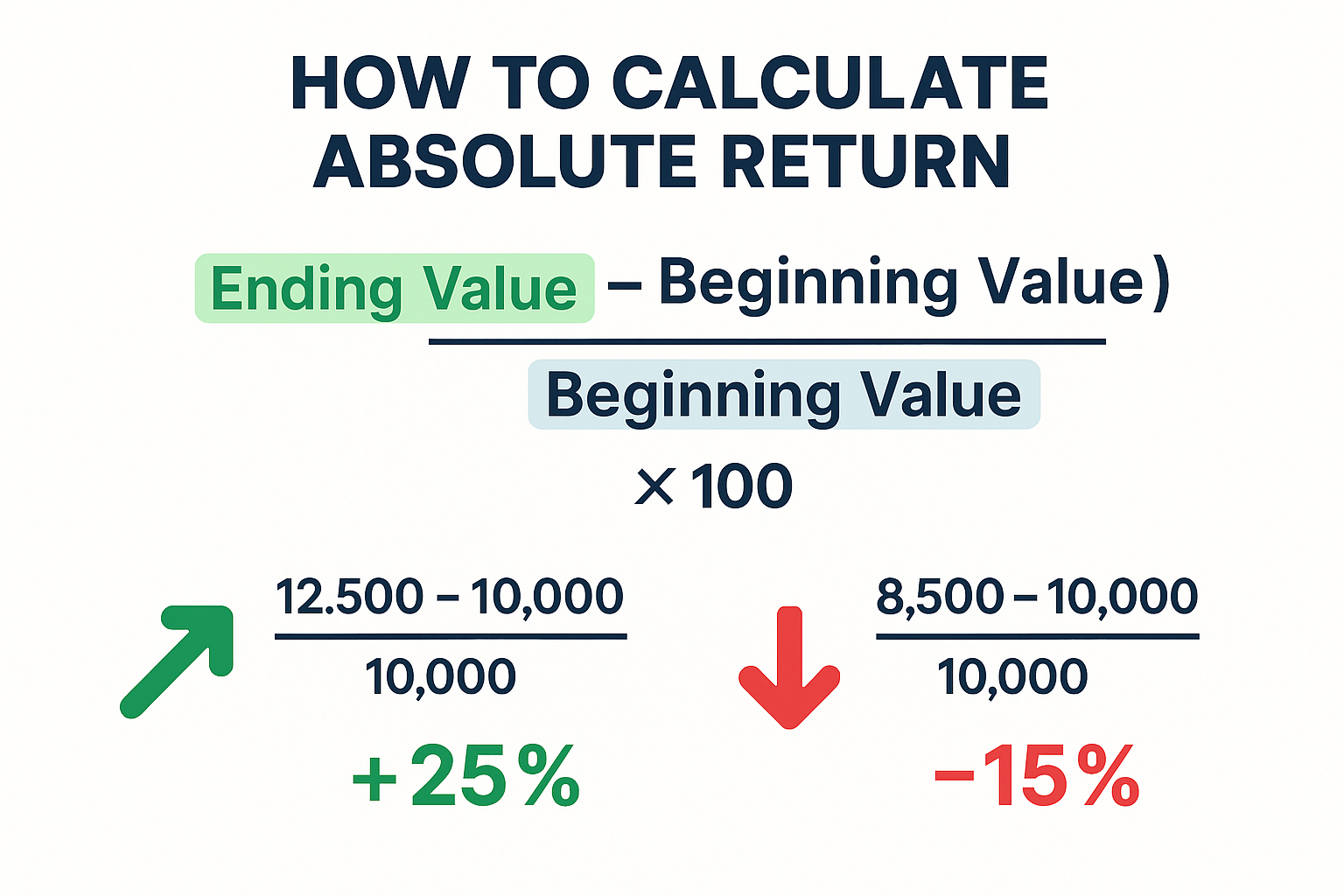

- The formula is straightforward: Absolute Return = [(Ending Value – Beginning Value) / Beginning Value] × 100

- Unlike relative return, absolute return focuses solely on whether your investment made money, regardless of how the broader market performed

- Absolute return strategies aim to generate positive returns in any market condition, making them popular during volatile periods

- Understanding both absolute and relative returns gives you a complete picture of your investment performance and helps you make informed decisions

What Is Absolute Return? (Definition)

In simple terms, absolute return means the actual percentage gain or loss your investment generated over a specific time period.

Unlike relative return, which compares your performance to a benchmark index like the S&P 500, absolute return stands alone. It answers one fundamental question: Did my investment make or lose money?

For example, if you invested $10,000 in a stock and it’s now worth $11,500, your absolute return is 15%—regardless of whether the stock market as a whole went up 30% or down 10%. The absolute return simply reflects your investment’s standalone performance.

Why Absolute Return Matters

Understanding absolute return is crucial for several reasons:

Clarity: It gives you a clear, unambiguous picture of your investment’s performance

Goal Tracking: It helps you track progress toward specific financial goals (like saving $50,000 for a down payment)

Risk Assessment: It reveals the actual profit or loss you’ve experienced

Strategy Evaluation: It helps determine if your investment approach is working on its own merits

Many investors get caught up in market emotions and focus solely on beating benchmarks. But if your goal is simply to grow your wealth, absolute return tells you whether you’re succeeding.

The Absolute Return Formula

The beauty of absolute return lies in its simplicity. Here’s the formula:

Absolute Return = [(Ending Value – Beginning Value) / Beginning Value] × 100

Let’s break this down step by step:

- Determine the Beginning Value: The initial amount you invested

- Determine the Ending Value: The current value of your investment

- Calculate the Difference: Subtract the beginning value from the ending value

- Divide by Beginning Value: This gives you the decimal return

- Multiply by 100: Convert to a percentage

How To Calculate Absolute Return

Practical Example

Let’s say you bought shares of a company:

- Beginning Value: $5,000

- Ending Value: $6,250

Calculation:

- Difference: $6,250 – $5,000 = $1,250

- Decimal Return: $1,250 ÷ $5,000 = 0.25

- Percentage Return: 0.25 × 100 = 25%

Your absolute return is 25%. You made $1,250 on your $5,000 investment, plain and simple.

Negative Absolute Return Example

Not all investments go up. Here’s a loss scenario:

- Beginning Value: $8,000

- Ending Value: $6,800

Calculation:

- Difference: $6,800 – $8,000 = -$1,200

- Decimal Return: -$1,200 ÷ $8,000 = -0.15

- Percentage Return: -0.15 × 100 = -15%

Your absolute return is -15%. You lost $1,200, or 15% of your initial investment.

📊 Absolute Return Calculator

Your Absolute Return

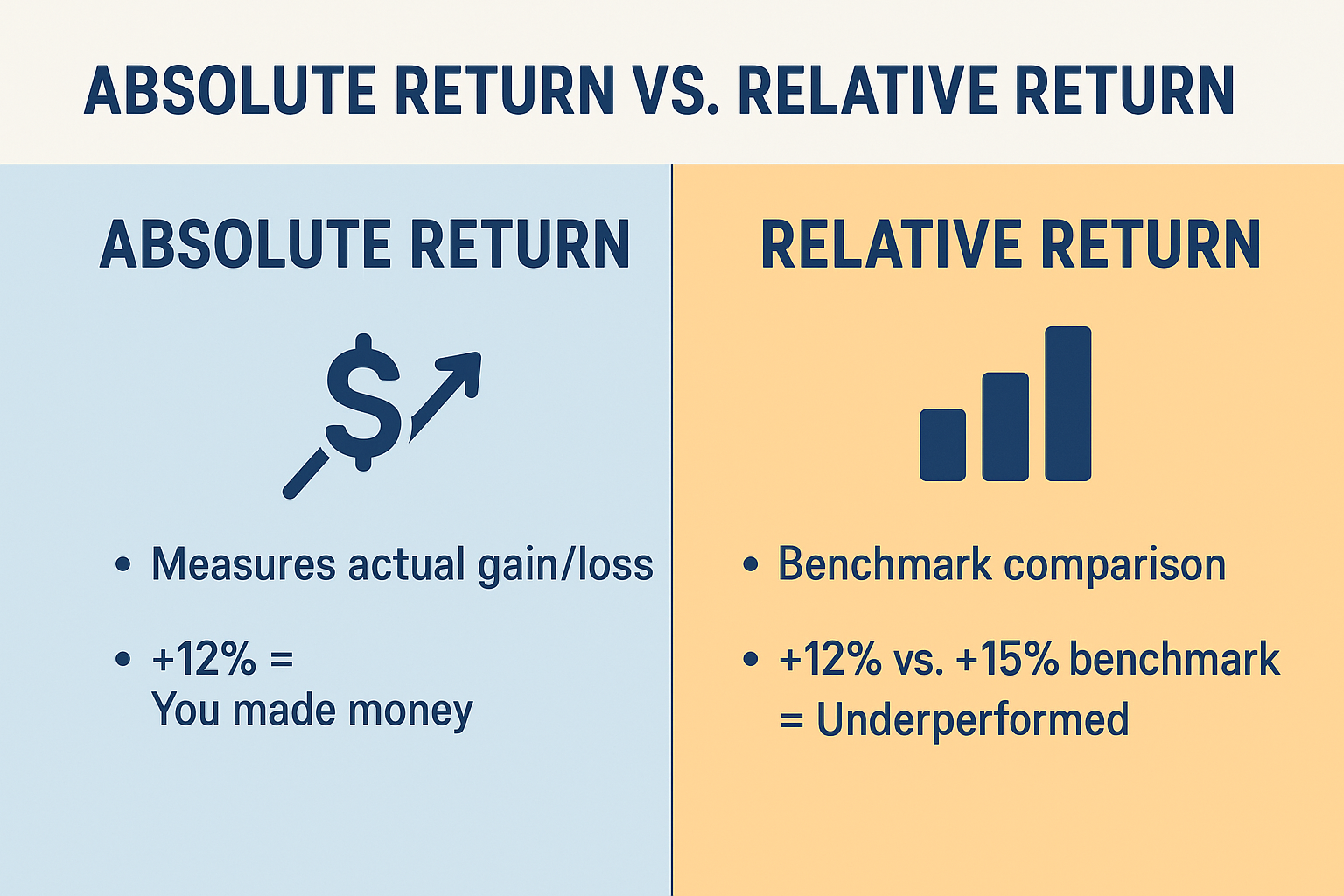

Absolute Return vs Relative Return: What’s the Difference?

Here’s where things get interesting. Many investors confuse absolute return with relative return, but they measure completely different things.

| Aspect | Absolute Return | Relative Return |

|---|---|---|

| Definition | Total gain/loss of investment | Performance compared to a benchmark |

| Benchmark | None required | Requires a benchmark (e.g., S&P 500) |

| Focus | Did you make money? | Did you beat the market? |

| Example | Your portfolio returned 12% | Your portfolio returned 12% vs the S&P 500’s 15% |

| Good For | Evaluating actual profit/loss | Your portfolio returned 12% vs the S&P 500’s 15% |

Real-World Story: The Tale of Two Investors

Let me share a story that perfectly illustrates this difference.

Meet Sarah and Tom, two friends who started investing in early 2022 with $50,000 each. By the end of 2022, Sarah’s portfolio was worth $48,000 (a -4% absolute return), while Tom’s was worth $42,000 (a -16% absolute return).

Both lost money in absolute terms. However, the S&P 500 fell approximately -18% that year.

- Sarah’s relative return: -4% vs. -18% benchmark = outperformed by 14%

- Tom’s relative return: -16% vs. -18% benchmark = outperformed by 2%

While both experienced negative absolute returns (they lost money), both actually beat the market on a relative basis. Sarah, in particular, demonstrated a strong investment strategy by limiting her losses.

This example shows why understanding both metrics matters. Absolute return tells you if you made money; relative return tells you if you made smart decisions given market conditions.

How Investors Use Absolute Return in Investment Decisions

Absolute return isn’t just an academic concept; it’s a practical tool that shapes real investment strategies.

1. Goal-Based Investing

When you’re saving for a specific goal, like retirement, a house down payment, or your child’s education, absolute return is what counts. If you need $100,000 in five years and you start with $70,000, you need an absolute return that gets you there. Whether the market goes up 50% or down 20% is secondary to hitting your target.

Many investors focus on making their kids millionaires through consistent absolute returns over time, rather than trying to beat market benchmarks.

2. Risk Management

Absolute return strategies specifically aim to generate positive returns regardless of market direction. These strategies often use:

- Hedging techniques (like options and short selling)

- Alternative investments (real estate, commodities, private equity)

- Market-neutral strategies (going long and short simultaneously)

During the 2008 financial crisis, many traditional portfolios lost 30-40% in absolute terms. Investors with absolute return strategies often fared better, preserving capital when it mattered most.

3. Performance Evaluation

When evaluating mutual funds or investment managers, absolute return provides crucial context:

- A fund with a +8% absolute return during a year when the market dropped 10% demonstrated excellent risk management

- A fund with a +15% absolute return when the market gained 25% actually underperformed significantly

Both pieces of information matter for making informed decisions about where to invest.

4. Withdrawal Planning

For retirees living off their portfolios, absolute return is critical. A -20% absolute return means less money to withdraw for living expenses, regardless of how the broader market performed. This is why many retirees shift toward absolute return strategies that prioritize capital preservation and passive income generation.

Absolute Return Investment Strategies

Several investment approaches specifically target positive absolute returns in all market conditions:

Long/Short Equity Strategies

These funds buy undervalued stocks (going long) while simultaneously selling overvalued stocks (going short). The goal is to profit from stock selection regardless of overall market direction.

Example: A fund might be long $100 million in tech stocks it believes will outperform and short $60 million in retail stocks it expects to decline, creating a net exposure of $40 million.

Market-Neutral Strategies

These aim for zero correlation with the broader market by balancing long and short positions equally. The focus is purely on stock selection skill.

Example: For every dollar invested long, a dollar is also shorted, creating a market exposure of zero. Profits come from the spread between winners and losers.

Global Macro Strategies

These make directional bets on currencies, commodities, interest rates, and global economic trends, seeking opportunities wherever they exist.

Example: A fund might short the Japanese yen, go long on oil futures, and buy emerging market bonds, all based on macroeconomic analysis.

Arbitrage Strategies

These exploit price discrepancies between related securities, aiming for low-risk profits.

Example: If Company A announces it will acquire Company B for $50/share, but Company B trades at $48, an arbitrageur might buy Company B stock to capture the $2 spread.

Multi-Strategy Approaches

These combine multiple absolute return strategies to diversify risk and smooth returns across different market environments.

Performance Note: According to research from the CFA Institute, absolute return strategies have historically delivered lower volatility than traditional equity portfolios, though often with more modest returns during strong bull markets.

Advantages of Focusing on Absolute Return

Understanding and prioritizing absolute return offers several key benefits:

Clarity and Simplicity

Absolute return answers the most fundamental question: “Am I richer or poorer?” There’s no need to understand complex benchmarks or worry about index composition changes.

Goal Alignment

Your financial goals are absolute, not relative. You need $500,000 for retirement, not “10% more than the S&P 500.” Focusing on absolute return keeps you aligned with what actually matters.

Risk Awareness

Absolute return forces you to confront actual losses. A -15% absolute return stings, even if you “only” underperformed the market by 5%. This awareness can improve risk management.

Downside Protection

Absolute return strategies often emphasize capital preservation. During market downturns, protecting what you have (positive or less negative absolute returns) can be more valuable than chasing relative outperformance.

Flexibility

Without the constraint of beating a specific benchmark, absolute return strategies can invest anywhere opportunities exist, stocks, bonds, commodities, currencies, alternatives, maximizing flexibility.

Limitations and Risks of Absolute Return Strategies

Nothing in investing is perfect, and absolute return approaches have their drawbacks:

Opportunity Cost During Bull Markets

When markets soar, absolute return strategies often lag. A +12% absolute return sounds great until you realize the S&P 500 gained 28%. You made money, but you missed a significant upside.

Historical Example: During the 2013-2017 bull market, many hedge funds using absolute return strategies delivered positive returns but dramatically underperformed simple index funds.

Higher Fees

Absolute return strategies, especially hedge funds, typically charge higher fees (the infamous “2 and 20″—2% management fee plus 20% of profits). These fees can significantly erode returns over time.

Complexity and Opacity

Many absolute return strategies use complex instruments and techniques that can be difficult to understand. This complexity can hide risks and make it hard to evaluate a manager’s skill versus luck.

No Guarantee of Positive Returns

Despite the name, absolute return strategies don’t guarantee positive returns. Many hedge funds have posted negative absolute returns during challenging periods.

Data Point: According to HFR (Hedge Fund Research), the HFRI Fund Weighted Composite Index posted negative returns in 2008 (-19%), 2011 (-5%), and 2018 (-4%), demonstrating that absolute return strategies can and do lose money.

Liquidity Constraints

Some absolute return investments have lock-up periods or limited redemption windows, restricting your access to your money.

Common Mistakes When Interpreting Absolute Return

Even experienced investors sometimes misinterpret absolute return data. Here are pitfalls to avoid:

Ignoring Time Frames

A 50% absolute return sounds fantastic—but over what period? Over one year, it’s exceptional. Over ten years, it’s mediocre (approximately 4.2% annualized). Always consider the time horizon.

Forgetting About Inflation

A 3% absolute return means you made money in nominal terms. But if inflation ran at 4%, you actually lost purchasing power. Real returns (adjusted for inflation) matter for long-term wealth building.

Overlooking Risk

Two investments might both deliver 10% absolute returns, but one might be a stable dividend stock while the other is a volatile cryptocurrency. The risk profiles are completely different. Returning without context about risk is incomplete information.

Comparing Apples to Oranges

Don’t compare absolute returns across different asset classes or time periods without context. A 15% return on stocks isn’t directly comparable to a 15% return on bonds—they carry different risk levels.

Neglecting Relative Performance

While absolute return is important, completely ignoring relative performance can be a mistake. Consistent underperformance versus benchmarks might indicate poor investment decisions, even if absolute returns are positive.

Understanding why people lose money in the stock market often comes down to these types of misinterpretations and emotional reactions to returns.

Real Data Example: Absolute Return in Action

Let’s examine a real-world scenario using actual market data to see absolute return in practice.

Case Study: Three Investment Approaches in 2022

2022 was a challenging year for investors. Here’s how three different $100,000 portfolios performed:

Portfolio A: Traditional 60/40 (60% stocks, 40% bonds)

- Beginning Value: $100,000

- Ending Value: $83,200

- Absolute Return: -16.8%

- Dollar Loss: -$16,800

Portfolio B: 100% S&P 500 Index

- Beginning Value: $100,000

- Ending Value: $81,700

- Absolute Return: -18.3%

- Dollar Loss: -$18,300

Portfolio C: Absolute Return Strategy (multi-strategy hedge fund average)

- Beginning Value: $100,000

- Ending Value: $96,400

- Absolute Return: -3.6%

- Dollar Loss: -$3,600

Analysis

All three portfolios experienced negative absolute returns; nobody made money. However, Portfolio C’s absolute return strategy significantly limited losses compared to traditional approaches.

Key Insight: In 2022, even a small negative absolute return represented strong performance. An investor who preserved 96% of their capital was in a much better position to recover than one who lost 18%.

This demonstrates why understanding market context matters alongside absolute return figures. According to data from Morningstar, investors who maintained lower negative absolute returns during 2022 recovered their losses much faster during the 2023 rally.

How to Interpret Absolute Return Data

When you see absolute return figures, here’s how to properly interpret them:

1. Consider the Time Period

Always note whether returns are:

- Annual: One year of performance

- Annualized: Average yearly return over multiple years

- Cumulative: Total return over the entire period

A 100% cumulative return over 10 years equals approximately 7.2% annualized—good but not spectacular.

2. Adjust for Inflation

Calculate the real absolute return by subtracting inflation:

Real Return = Nominal Absolute Return – Inflation Rate

If your investment returned 8% but inflation was 3%, your real absolute return is 5%.

3. Compare to Your Goals

The most important comparison is against your personal financial objectives:

- Are you on track to meet your retirement target?

- Will this return help you reach your down payment goal?

- Does this align with your risk tolerance?

4. Evaluate Risk-Adjusted Returns

Consider volatility and drawdowns alongside returns. Tools like the Sharpe Ratio help evaluate whether returns justified the risk taken.

5. Look at Consistency

A fund with 8%, 9%, 7%, 10% absolute returns over four years is generally preferable to one with -15%, 45%, -10%, 30%, even if the average is similar. Consistency reduces emotional stress and market emotion cycles.

Absolute Return and Tax Implications

One often-overlooked aspect of absolute return is its interaction with taxes, which can significantly impact your actual take-home gains.

Tax Drag on Returns

Your pre-tax absolute return might be 12%, but after accounting for:

- Capital gains taxes (0%, 15%, or 20% depending on income)

- Dividend taxes

- State taxes

- Short-term vs. long-term treatment

Your after-tax absolute return might only be 9% or less.

Tax-Efficient Strategies

To maximize after-tax absolute returns:

Hold investments longer than one year to qualify for lower long-term capital gains rates

Use tax-advantaged accounts (401(k), IRA, HSA) where appropriate

Consider tax-loss harvesting to offset gains

Focus on tax-efficient investments like index funds with low turnover

Explore municipal bonds for tax-free interest income in high tax brackets

According to research from Vanguard, tax-efficient investing can add 0.5% to 1% to annual returns over time, a significant boost to absolute return.

Building Your Own Absolute Return Strategy

You don’t need to be a hedge fund manager to implement absolute return thinking in your portfolio. Here’s how:

1: Define Your Goals

What absolute return do you need to achieve your objectives? Work backward from your goal:

- Goal: $1 million in 20 years

- Starting capital: $300,000

- Required absolute return: Approximately 6.1% annualized

2: Determine Your Risk Tolerance

How much volatility can you stomach? Your risk tolerance should align with your time horizon and emotional capacity to handle drawdowns.

3: Diversify Across Asset Classes

Build a portfolio that can generate positive absolute returns in various market conditions:

- Stocks for growth potential

- Bonds for stability and income

- Real estate for inflation protection and passive income

- Alternatives for diversification

4: Implement Downside Protection

Consider strategies to limit losses:

- Stop-loss orders on individual positions

- Put options for portfolio insurance

- Inverse ETFs for hedging (use cautiously)

- Cash reserves for opportunistic buying during downturns

5: Rebalance Regularly

Systematic rebalancing helps maintain your target allocation and can enhance absolute returns by forcing you to “buy low, sell high.”

6: Monitor and Adjust

Track your absolute return quarterly and annually. Are you on pace to meet your goals? If not, adjust your strategy, savings rate, or time horizon.

Absolute Return in Different Market Environments

Understanding how absolute return strategies perform across market cycles helps set realistic expectations.

Bull Markets (Rising Prices)

Traditional Portfolios: Often deliver strong double-digit absolute returns

Absolute Return Strategies: Typically lag, delivering mid-single to low-double-digit returns

Winner: Traditional portfolios

Why: When everything is going up, hedging and market-neutral positions limit upside participation.

Bear Markets (Falling Prices)

Traditional Portfolios: Often suffer significant negative absolute returns

Absolute Return Strategies: Aim for flat to slightly positive returns, or smaller losses

Winner: Absolute return strategies

Why: Hedging, short positions, and alternative investments can offset equity losses.

Sideways Markets (Range-Bound)

Traditional Portfolios: Deliver low single-digit absolute returns

Absolute Return Strategies: Can outperform through active trading and arbitrage

Winner: Absolute return strategies

Why: Stock selection and tactical positioning matter more when the broad market direction is unclear.

Volatile Markets (High Uncertainty)

Traditional Portfolios: Experience significant swings in absolute return

Absolute Return Strategies: Aim to smooth volatility through diversification

Winner: Depends on risk tolerance

Why: Lower volatility may be worth accepting lower returns for many investors.

Understanding why the stock market goes up over the long term helps contextualize short-term absolute return fluctuations.

FAQ

A “good” absolute return depends on your goals, time horizon, and risk tolerance. Generally, 6-8% annualized absolute returns have historically outpaced inflation and built wealth over time. However, even 3-4% might be excellent if it comes with low volatility and meets your specific needs.

Calculate absolute return using this formula: [(Ending Value – Beginning Value) / Beginning Value] × 100. For example, if you invested $10,000 and it grew to $12,000, your absolute return is 20% [($12,000 – $10,000) / $10,000 × 100].

These terms are often used interchangeably. Both measure the complete gain or loss of an investment, including price appreciation and income (dividends, interest). Some sources distinguish “total return” as including reinvested dividends, while “absolute return” might refer only to price changes, but this isn’t universal.

Yes, absolutely. A negative absolute return means your investment lost value. For example, if you invested $5,000 and it’s now worth $4,200, your absolute return is -16%.

Neither is “better”—they serve different purposes. Absolute return tells you if you made money; relative return tells you if you made smart decisions compared to alternatives. Savvy investors track both metrics for a complete performance picture.

Absolute return can refer to any time period (one month, one year, five years). Annualized return converts multi-year absolute returns into an average yearly figure, making it easier to compare investments with different time horizons.

Key Risks and Common Mistakes to Avoid

To wrap up your understanding, here are the most critical pitfalls to avoid when working with absolute return:

Chasing Past Performance

Just because a fund delivered 15% absolute returns last year doesn’t guarantee future success. Past performance is not indicative of future results—this SEC warning exists for good reason.

Ignoring Fees

A 10% absolute return minus 2% fees equals 8% net return. Over 20 years, that 2% fee difference can cost you hundreds of thousands of dollars. Always calculate returns net of fees.

Overlooking Sequence of Returns Risk

The order of returns matters, especially for retirees. A -20% absolute return in year one of retirement is far more damaging than in year 15, even if the average return is the same.

Focusing Only on Returns

Return is only half the equation. Risk, volatility, drawdowns, and recovery time all matter. A 12% return with 30% volatility might be worse than an 8% return with 10% volatility, depending on your situation.

Emotional Decision-Making

Absolute return data can trigger emotional responses. A -15% absolute return might cause panic selling at the worst time. Maintaining discipline through market emotion cycles is crucial.

External Resources and Further Reading

For those wanting to dive deeper into absolute return concepts, here are authoritative sources:

CFA Institute – Offers extensive research on absolute return strategies and performance measurement

SEC.gov – Provides investor bulletins on understanding investment returns and hedge fund strategies

Morningstar – Tracks and analyzes absolute return mutual funds and hedge fund performance

Investopedia – Comprehensive definitions and examples of absolute return calculations

Federal Reserve Economic Data (FRED) – Historical market return data for context and comparison

These resources provide data-backed insights to supplement your understanding of absolute return investing.

Conclusion: Making Absolute Return Work for You

Understanding absolute return is fundamental to becoming a smarter, more informed investor. It’s the most straightforward measure of whether your investments are actually making you money—no smoke, no mirrors, just the bottom line.

Here’s what you should take away:

Absolute return measures your actual gain or loss, calculated simply as [(Ending Value – Beginning Value) / Beginning Value] × 100

Both absolute and relative returns matter—one tells you if you made money, the other tells you if you made smart decisions

Absolute return strategies aim for positive performance in any market, though they often lag during strong bull markets

Context is everything—always consider time horizon, inflation, taxes, and risk when evaluating absolute returns

Your personal goals should drive your strategy, not just benchmark comparisons

Your Next Steps

Ready to apply this knowledge? Here’s what to do now:

- Calculate your current absolute returns using the formula and interactive calculator above

- Assess whether your returns align with your financial goals and timeline

- Review your portfolio’s risk level and consider whether it matches your tolerance

- Explore diversification strategies, including dividend investing for steady absolute returns

- Set up a tracking system to monitor your absolute returns quarterly

- Consider consulting a financial advisor if your returns consistently miss your targets

Remember, investing isn’t about beating the market every single year; it’s about generating the absolute returns you need to achieve your life goals. Whether that’s retirement security, financial independence, or building generational wealth, understanding and tracking absolute return puts you in control.

Start with clarity, invest with purpose, and let the math work in your favor.

Disclaimer

This article is for educational purposes only and does not constitute financial advice. Investment decisions should be based on your individual circumstances, risk tolerance, and financial goals. Past performance does not guarantee future results. Absolute return strategies, including hedge funds and alternative investments, carry risks, including potential loss of principal. Always consult with a qualified financial advisor before making investment decisions. The examples and data presented are for illustrative purposes and may not reflect actual investment performance.

About The Author

Written by Max Fonji — your go-to source for clear, data-backed investing education.

Max Fonji is the founder of therichguymath.com. Max helps everyday investors build wealth through straightforward financial education. Max breaks down complex investing concepts into actionable insights you can use to make smarter money decisions. Whether you’re just starting or looking to refine your strategy, we’re here to help you understand the math behind building lasting wealth.

Explore more investing insights on our blog and discover smart financial moves to accelerate your journey to financial freedom.