Picture this: You’re sitting at your kitchen table, reviewing your small business’s bank statements. The numbers look good, really good. You’ve got money coming in, and you’re feeling pretty confident about your financial situation. But then your accountant drops a bombshell: “Your cash flow is great, but let’s talk about your actual accounting profit.” Wait, what? Aren’t they the same thing?

Welcome to one of the most fundamental concepts in business and investing, accounting profit. Whether you’re running a lemonade stand, managing a portfolio of high dividend stocks, or trying to understand company earnings reports, grasping accounting profit is essential. It’s the difference between thinking you’re making money and actually knowing whether your business is profitable.

In this comprehensive guide, we’ll break down everything about accounting profit in plain English, no confusing jargon, no complicated formulas you need a PhD to understand. Just straightforward, practical knowledge you can use right away.

Key Takeaways

- Accounting profit is the actual profit a business earns after subtracting all explicit costs from total revenue; it’s what shows up on official financial statements

- The basic formula is simple: Accounting Profit = Total Revenue – Explicit Costs

- Unlike economic profit, accounting profit doesn’t consider opportunity costs or what you could have earned elsewhere

- Understanding accounting profit helps investors evaluate company performance and make smarter investment decisions

- Accounting profit is essential for tax purposes, securing loans, attracting investors, and measuring business health

What Exactly Is Accounting Profit?

Let’s start with the basics. Accounting profit (also called financial profit or bookkeeping profit) is the money left over after a business subtracts all its explicit costs from its total revenue. Think of it as the “official” profit that appears on a company’s income statement and tax returns. Investopedia

Here’s a simple way to think about it: If you sold $100,000 worth of products this year and spent $70,000 on things like inventory, rent, salaries, and utilities, your accounting profit would be $30,000. That’s the number your accountant reports, the IRS taxes, and investors scrutinize.

The Key Components

Total Revenue

This is all the money flowing into your business from sales, services, or other income sources. If you’re a bakery that sold 10,000 cupcakes at $5 each, your total revenue is $50,000. Pretty straightforward, right?

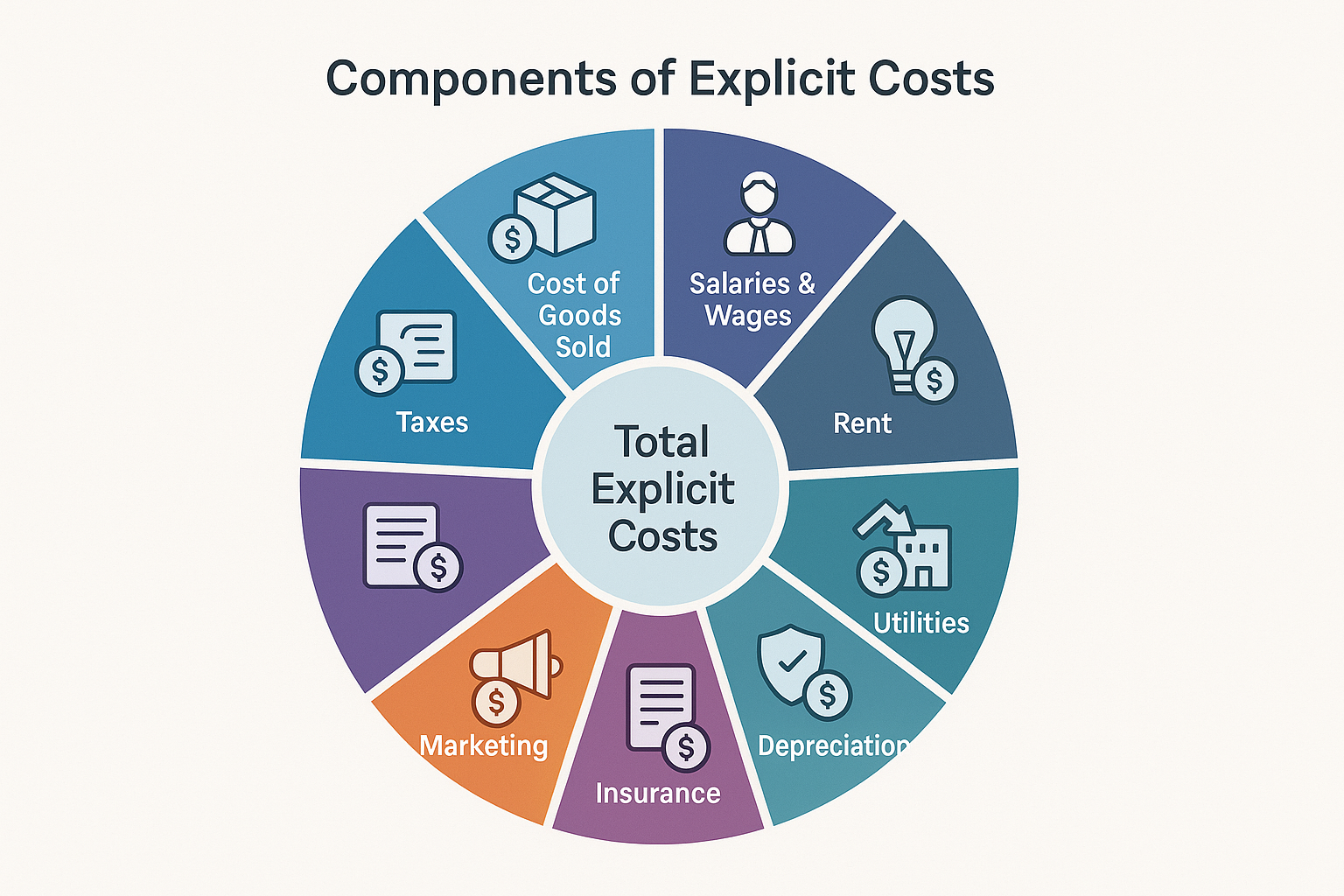

Explicit Costs

These are the actual, out-of-pocket expenses you can point to on receipts and invoices. They include:

- Cost of Goods Sold (COGS): Raw materials, inventory, manufacturing costs

- Operating Expenses: Rent, utilities, insurance, office supplies

- Salaries and Wages: What you pay employees and contractors

- Depreciation: The declining value of equipment and assets over time

- Interest Payments: Money paid on business loans

- Taxes: Business taxes owed to government entities

- Marketing and Advertising: Costs to promote your business

The beauty of explicit costs is that they’re measurable and documented. You can literally point to a bill or receipt for each one. Corporate Finance

How to Calculate Accounting Profit (The Simple Formula)

Ready for the easiest formula you’ll learn today? Here it is:

Accounting Profit = Total Revenue – Total Explicit Costs

That’s it. Seriously. Let’s walk through a real-world example to make this crystal clear.

Real-World Example: Sarah’s Coffee Shop

Sarah owns a small coffee shop. Here’s her financial snapshot for 2025:

Revenue:

- Coffee sales: $180,000

- Pastry sales: $45,000

- Merchandise sales: $15,000

- Total Revenue: $240,000

Explicit Costs:

- Coffee beans and supplies: $50,000

- Pastries from supplier: $18,000

- Rent: $30,000

- Employee salaries: $72,000

- Utilities: $9,000

- Equipment depreciation: $6,000

- Insurance: $4,000

- Marketing: $8,000

- Miscellaneous expenses: $3,000

- Total Explicit Costs: $200,000

Accounting Profit Calculation:

$240,000 (Revenue) – $200,000 (Explicit Costs) = $40,000

Sarah’s accounting profit for 2025 is $40,000. This is what appears on her income statement and what the IRS will tax.

Accounting Profit vs Economic Profit: What’s the Difference?

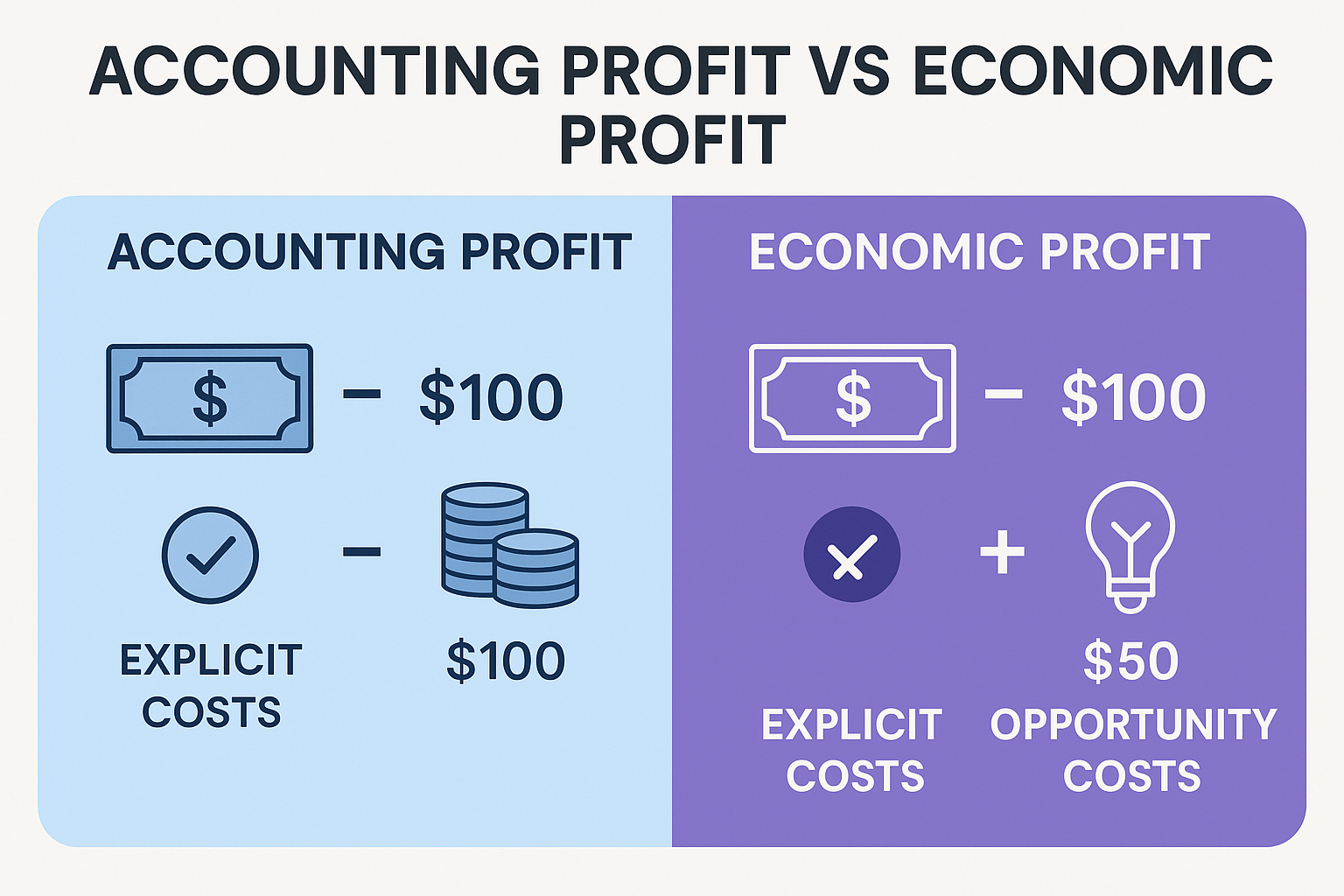

Here’s where things get interesting. While accounting profit tells you what you officially earned, economic profit tells you whether you made the smartest financial decision.

Economic profit considers opportunity costs, which are what you gave up to pursue your current business. Let’s continue with Sarah’s coffee shop example.

Sarah’s Full Picture

Before opening her coffee shop, Sarah was earning $55,000 per year as a marketing manager. She also invested $100,000 of her savings (which could have earned 5% annually in a safe investment, or $5,000 per year) to start the business.

Accounting Profit: $40,000 (as calculated above)

Economic Profit Calculation:

- Accounting Profit: $40,000

- Minus Opportunity Cost of Salary: $55,000

- Minus Opportunity Cost of Investment: $5,000

- Economic Profit: -$20,000

Ouch! While Sarah’s accounting profit looks decent at $40,000, her economic profit is actually negative. She’s technically losing $20,000 compared to what she could have earned by keeping her job and investing her money elsewhere.

This doesn’t mean Sarah made a bad decision; maybe she values being her own boss, loves the work, or expects the business to grow significantly. However, it’s essential information for making informed decisions.

Accounting Profit vs Economic Profit

| Aspect | Accounting Profit | Economic Profit |

|---|---|---|

| Definition | Revenue minus explicit costs | Revenue minus explicit AND implicit costs |

| Includes Opportunity Costs? | No | Yes |

| Used For | Financial reporting, taxes, investor relations | Strategic decision-making, true profitability assessment |

| Typically Higher or Lower? | Higher | Lower (often negative) |

| Appears on Financial Statements? | Yes | No |

Understanding both concepts helps you make smart moves in business and investing.

Why Accounting Profit Matters (More Than You Think)

You might be wondering: “If economic profit is more ‘truthful,’ why should I care about accounting profit?” Great question! Accounting profit serves several crucial purposes:

1. Tax Reporting and Compliance

The IRS doesn’t care about your opportunity costs or what you could have earned elsewhere. They tax your accounting profit. Having accurate accounting profit calculations ensures you:

- Pay the correct amount of taxes

- Avoid penalties and audits

- Maximize legitimate deductions

- Maintain proper documentation

2. Attracting Investors and Securing Loans

When you approach investors or banks for funding, they want to see your accounting profit. It’s the standardized measure everyone understands and trusts. Positive accounting profit demonstrates:

- Your business generates more money than it spends

- You can potentially repay loans

- The company is worth investing in

- Management is effectively controlling costs

Many investors use accounting profit metrics when evaluating stock market opportunities and deciding which companies deserve their capital.

3. Performance Measurement and Benchmarking

Accounting profit lets you:

- Compare your performance year-over-year

- Benchmark against competitors in your industry

- Identify trends and patterns

- Set realistic goals and targets

- Make data-driven decisions about expansion or cost-cutting

4. Understanding Company Health

For investors analyzing potential stock purchases, accounting profit (and related metrics like earnings per share) provides insight into:

- Whether a company is actually making money

- How efficiently management uses resources

- If the business model is sustainable

- Whether dividend payments are sustainable

5. Legal and Regulatory Requirements

Public companies must report accounting profit in their quarterly and annual financial statements. These reports follow Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), ensuring consistency and transparency.

Common Mistakes When Calculating Accounting Profit

Even experienced business owners sometimes stumble when calculating accounting profit. Here are the most common pitfalls:

Mistake #1: Confusing Cash Flow with Profit

Just because money is in your bank account doesn’t mean it’s profit. You might have:

- Received customer deposits for future work

- Taken out a loan

- Collected accounts receivable from previous periods

- Not yet paid all your expenses

The Fix: Always use accrual accounting principles that match revenue with the expenses incurred to generate that revenue.

Mistake #2: Forgetting Non-Cash Expenses

Depreciation and amortization are real expenses that reduce accounting profit, even though no cash changes hands. A $50,000 piece of equipment doesn’t hit your profit all at once; it depreciates over its useful life.

The Fix: Work with an accountant to properly calculate depreciation schedules for all assets.

Mistake #3: Including Owner’s Salary as Profit

If you pay yourself a salary, that’s an expense, not profit. Many small business owners confuse taking money out of the business with actual profit.

The Fix: Clearly separate owner compensation (an expense) from business profit (what’s left after all expenses).

Mistake #4: Ignoring Accrued Expenses

Just because you haven’t paid a bill yet doesn’t mean it’s not an expense. If you received inventory in December but won’t pay for it until January, it still counts as a December expense.

The Fix: Use accrual accounting to record expenses when incurred, not when paid.

How Investors Use Accounting Profit

If you’re interested in building wealth through the stock market, understanding how companies report accounting profit is essential. Here’s what savvy investors look for:

Earnings Per Share (EPS)

This metric divides accounting profit by the number of outstanding shares:

EPS = Net Income (Accounting Profit) / Number of Outstanding Shares

Higher EPS generally indicates a more profitable company, though context matters. Investors often compare EPS across quarters and years to identify growth trends.

Price-to-Earnings (P/E) Ratio

This compares a company’s stock price to its earnings per share:

P/E Ratio = Stock Price / Earnings Per Share

A high P/E might indicate investors expect strong future growth, while a low P/E could suggest the stock is undervalued, or that the company faces challenges.

Profit Margins

Investors calculate various profit margins to assess efficiency:

- Gross Profit Margin = (Revenue – COGS) / Revenue × 100

- Operating Profit Margin = Operating Income / Revenue × 100

- Net Profit Margin = Net Income / Revenue × 100

These ratios help investors understand why the stock market goes up for certain companies and not others.

Red Flags to Watch For

Experienced investors scrutinize accounting profit for warning signs:

- Declining profit margins over multiple quarters

- Revenue growth without profit growth (suggests rising costs)

- Inconsistent or manipulated accounting practices

- One-time gains inflate profit artificially

- Heavy reliance on debt to maintain profitability

Understanding these patterns helps you avoid losing money in the stock market and recognize when emotions might cloud judgment during the cycle of market emotions.

Accounting Profit in Different Business Structures

How accounting profit works varies slightly depending on your business structure:

Sole Proprietorships and Partnerships

- Profit “passes through” to owners’ personal tax returns

- Reported on Schedule C (sole proprietor) or Form 1065 (partnership)

- Owners pay self-employment tax on profits

- Simpler accounting requirements

Corporations (C-Corp)

- The company pays corporate income tax on accounting profit

- Shareholders pay taxes again on dividends (double taxation)

- More complex accounting and reporting requirements

- Must follow GAAP standards strictly

S-Corporations

- Profit passes through to shareholders

- Avoids double taxation

- Still requires formal accounting practices

- Limited to 100 shareholders

Limited Liability Companies (LLC)

- Can choose how to be taxed (sole proprietor, partnership, or corporation)

- Flexible accounting requirements depending on the election

- Provides liability protection with simpler accounting than corporations

Improving Your Accounting Profit: Practical Strategies

Want to boost your accounting profit? Here are actionable strategies that actually work:

1. Increase Revenue Without Proportional Cost Increases

- Raise prices strategically on high-demand products

- Upsell and cross-sell to existing customers (cheaper than acquiring new ones)

- Expand into new markets with existing products

- Improve customer retention (retaining customers costs less than acquiring new ones)

2. Reduce Cost of Goods Sold

- Negotiate better terms with suppliers

- Buy in bulk when it makes financial sense

- Reduce waste in production or service delivery

- Find alternative suppliers without sacrificing quality

- Improve inventory management to minimize spoilage and obsolescence

3. Cut Operating Expenses

- Audit recurring expenses monthly, and cancel what you don’t use

- Negotiate a lower rent or consider relocating

- Reduce energy costs with efficient equipment

- Outsource non-core functions when it’s cheaper than hiring

- Embrace remote work to reduce office space needs

4. Optimize Tax Strategy

- Maximize legitimate deductions (work with a tax professional)

- Time major purchases strategically for tax benefits

- Take advantage of depreciation schedules

- Consider tax credits for hiring, research, or green initiatives

- Choose the right business structure for your situation

5. Improve Operational Efficiency

- Automate repetitive tasks to reduce labor costs

- Streamline processes to eliminate waste

- Invest in employee training to boost productivity

- Use technology to do more with fewer resources

Interactive Accounting Profit Calculator

💰 Accounting Profit Calculator

Calculate your business’s accounting profit by entering revenue and expenses

Total Revenue

Explicit Costs

Accounting Profit and Long-Term Wealth Building

Understanding accounting profit isn't just for business owners; it's crucial for anyone building long-term wealth. Here's how it connects to your financial future:

Building a Business for Passive Income

Many people dream of earning passive income through business ownership. Accounting profit tells you whether that business actually generates the income you need. Before quitting your day job, ensure your business's accounting profit can:

- Replace your current salary

- Cover healthcare and benefits you'll lose

- Provide a buffer for slow months

- Allow for reinvestment and growth

- Build emergency reserves

Teaching Financial Literacy to the Next Generation

If you're interested in making your kid a millionaire, teaching them about accounting profit early gives them a massive advantage. Even a simple lemonade stand can teach:

- The difference between revenue and profit

- How to track expenses

- The importance of pricing strategy

- Basic financial record-keeping

- Decision-making based on numbers, not feelings

Evaluating Investment Opportunities

Whether you're analyzing individual stocks or considering a franchise opportunity, accounting profit metrics help you:

- Compare similar investment options objectively

- Identify trends in company performance

- Spot red flags before investing

- Understand what drives stock prices

- Make rational decisions during market volatility

Advanced Concepts: Beyond Basic Accounting Profit

Once you've mastered the basics, these advanced concepts will deepen your understanding:

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization)

EBITDA is a modified version of accounting profit that adds back certain expenses to show operating performance more clearly. It's useful for:

- Comparing companies with different capital structures

- Analyzing businesses in capital-intensive industries

- Evaluating companies in different tax jurisdictions

- Assessing core operational efficiency

Formula: EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization

Operating Profit vs Net Profit

Operating profit (also called EBIT (Earnings Before Interest and Taxes) focuses on profit from core business operations, excluding financing and tax effects.

Net Profit: Definition, Formula & Why It’s Important is the final accounting profit after all expenses, including interest and taxes.

Understanding both helps you see whether a company makes money from its actual business or relies on financial engineering and tax strategies.

Quality of Earnings

Not all accounting profits are created equal. "Quality of earnings" refers to how sustainable and reliable the profit is. High-quality earnings come from:

- Recurring revenue sources

- Cash-backed profits (not just accounting entries)

- Conservative accounting practices

- Organic growth rather than acquisitions

- Core business operations rather than one-time gains

Low-quality earnings might involve:

- Aggressive revenue recognition

- Unsustainable cost-cutting

- One-time asset sales

- Accounting gimmicks

- Channel stuffing or pulling forward future sales

Real-World Success Story: From Negative to Positive

Let me share a quick story about Marcus, a friend who started a digital marketing agency in 2022. His first year looked like this:

Year 1 (2022):

- Revenue: $85,000

- Expenses: $92,000

- Accounting Profit: -$7,000

Marcus was discouraged but analyzed his numbers carefully. He discovered:

- He was undercharging clients (pricing too low)

- He had expensive software subscriptions that he barely used

- His office space cost more than necessary

- He was spending heavily on ads with poor ROI

Year 2 (2023) - After Making Changes:

- Revenue: $145,000 (raised prices, focused on better clients)

- Expenses: $78,000 (cut unnecessary costs, went remote, improved ad targeting)

- Accounting Profit: $67,000

Year 3 (2024):

- Revenue: $210,000

- Expenses: $95,000

- Accounting Profit: $115,000

By 2025, Marcus's agency will generate a consistent six-figure accounting profit. The key? He didn't just work harder; he understood his numbers, made data-driven decisions, and focused relentlessly on improving his accounting profit. Coursera

Absolutely! This happens when you receive cash that isn't revenue (like loans or customer deposits) or when you have non-cash expenses like depreciation. Cash flow and accounting profit measure different things.

Generally, yes, but context matters. A company might sacrifice short-term profit to invest in growth, research, or market share. Compare profit to revenue (profit margin) and to previous periods for better insight.

Most businesses calculate it monthly for internal management and quarterly/annually for official reporting. More frequent monitoring helps you spot problems and opportunities faster.

For very small businesses, you might manage with accounting software. However, a professional accountant ensures accuracy, maximizes tax benefits, and helps you avoid costly mistakes, usually worth the investment.

It varies dramatically by industry. Software companies might have 20-40% margins, while grocery stores might operate on 1-3%. Research your specific industry benchmarks for meaningful comparisons.

Unfortunately, yes. Companies can use aggressive accounting practices to inflate profits temporarily. This is why investors should look at cash flow statements alongside profit and understand the accounting methods used.

Resources for Further Learning

Want to dive deeper? Here are authoritative resources:

- SEC's EDGAR Database (sec.gov/edgar): Access public company financial statements

- Financial Accounting Standards Board (FASB): Learn about GAAP standards

- IRS Publication 334: Tax guide for small businesses

- Investopedia: Comprehensive financial education resources

- Bureau of Labor Statistics: Industry benchmarking data

Conclusion: Your Next Steps

Accounting profit isn't just an abstract concept for accountants and business students; it's a fundamental tool for making smarter financial decisions, whether you're running a business, investing in stocks, or planning your financial future.

Let's recap what we've covered:

✅ Accounting profit is total revenue minus explicit costs, the "official" profit on financial statements

✅ It differs from economic profit, which also considers opportunity costs

✅ Understanding accounting profit helps with taxes, securing funding, measuring performance, and making investment decisions

✅ You can improve accounting profit by increasing revenue, reducing costs, and operating more efficiently

✅ Investors use accounting profit metrics like EPS and profit margins to evaluate companies

Take Action Today

Ready to put this knowledge to work? Here's what to do next:

- If you own a business, calculate your accounting profit for the last quarter using the formula and calculator above. Identify your three biggest expenses and brainstorm ways to reduce them by 10%.

- If you're an investor: Review the financial statements of companies in your portfolio. Look at their accounting profit trends over the past 3-5 years. Are they growing, stable, or declining?

- If you're planning to start a business, create a projected income statement estimating your first-year revenue and expenses. Calculate your expected accounting profit to see if the venture makes financial sense.

- If you're teaching others: Use the concepts here to explain business fundamentals to children, students, or team members. Start with a simple example like a lemonade stand.

- Keep learning: Explore related topics on TheRichGuyMath.com to build your financial knowledge systematically.

Remember, financial literacy is a journey, not a destination. Every business owner who seems to have it all figured out started exactly where you are now, learning the fundamentals and applying them consistently. Understanding accounting profit is one of those fundamental building blocks that support everything else you'll learn about business and investing.

The difference between financial success and struggle often comes down to understanding your numbers and making informed decisions based on them. Now you know, go use it!

Disclaimer

The information provided in this article is for educational purposes only and should not be considered financial, tax, or legal advice. Accounting practices, tax laws, and financial regulations vary by jurisdiction and change over time. Always consult with qualified professionals, including certified public accountants, tax advisors, and financial planners, before making significant business or investment decisions. The examples used are for illustration purposes and may not reflect actual business results. Past performance does not guarantee future results.

About the Author

Max Fonji is a financial educator and content strategist dedicated to making complex financial concepts accessible to everyone. With a passion for helping people build wealth through smart investing and sound business practices, Max creates practical, actionable content that empowers readers to take control of their financial futures. When not writing about finance, Max enjoys analyzing market trends, exploring new investment strategies, and teaching financial literacy to the next generation.