Ever wondered why your business shows a profit on paper but your bank account tells a different story? The answer often lies in understanding two fundamental accounting concepts: accounts receivable and accounts payable. These two pillars of business finance can make or break your cash flow, determine your company’s financial health, and ultimately decide whether you thrive or merely survive in today’s competitive marketplace.

Whether you’re launching your first startup, managing a growing small business, or simply trying to understand the financial statements you’ve been staring at, mastering the difference between accounts receivable and accounts payable is essential. Think of them as the yin and yang of your business finances—two sides of the same coin that need to work in perfect harmony.

TL;DR

- Accounts Receivable (AR) represents money owed to your business by customers who purchased goods or services on credit—it’s an asset on your balance sheet

- Accounts Payable (AP) represents money your business owes to suppliers and vendors for goods or services received on credit—it’s a liability on your balance sheet

- AR increases cash inflow when collected, while AP decreases cash outflow when payment is delayed, both directly impacting your working capital and cash flow management

- Effective AR management means getting paid faster and reducing bad debts, while smart AP management means optimizing payment timing without damaging supplier relationships

- Understanding the Accounts Receivable vs Accounts Payable relationship is crucial for maintaining healthy cash flow, making informed financial decisions, and ensuring long-term business sustainability

What Are Accounts Receivable? (Money Coming In)

In simple terms, accounts receivable means money that customers owe to your business for products or services you’ve already delivered.

When you sell something on credit, meaning the customer doesn’t pay immediately, you create an account receivable. It’s essentially an IOU from your customer. On your balance sheet, accounts receivable appear as a current asset because you expect to convert them into cash within a relatively short period, typically within 30 to 90 days.

How Accounts Receivable Works: A Real-World Example

Let’s say you run a graphic design agency called Creative Visions. In January, you complete a website redesign project for a client worth $5,000. Instead of requiring immediate payment, you offer payment terms of “Net 30,” meaning the client has 30 days to pay.

Here’s what happens:

- Day 1 (Project completion): You deliver the final website files

- Day 1 (Accounting entry): You record $5,000 as accounts receivable (asset increases) and $5,000 as revenue (income increases)

- Day 15 (Invoice sent): You send the invoice with payment due by Day 30

- Day 28 (Payment received): Client pays the $5,000

- Day 28 (Accounting entry): You reduce accounts receivable by $5,000 and increase cash by $5,000

During those 28 days, that $5,000 existed as accounts receivable, money you earned but hadn’t yet collected.

Key Characteristics of Accounts Receivable

| Characteristic | Description |

|---|---|

| Balance Sheet Classification | Current Asset |

| Normal Balance | Debit (increases with debits, decreases with credits) |

| Represents | Money owed TO your business |

| Impact on Cash Flow | Positive when collected |

| Typical Timeline | 30-90 days (varies by industry) |

| Associated Metrics | Days Sales Outstanding (DSO), AR Turnover Ratio |

| Risk Factor | Bad debt (customers who don’t pay) |

Why Accounts Receivable Matters for Your Business

Accounts receivable directly affects your cash flow and working capital. Even if your business is profitable on paper, having too much money tied up in receivables can create cash crunches that prevent you from paying bills, investing in growth, or taking advantage of opportunities.

Think of it this way: Accounts receivable is like having money in transit; it’s yours, but you can’t spend it yet. The faster you can convert receivables into actual cash, the healthier your business finances will be.

According to data from the U.S. Federal Reserve, small businesses typically have 30-45% of their current assets tied up in accounts receivable. That’s a significant portion of your financial resources just waiting to be collected!

What Are Accounts Payable? (Money Going Out)

Accounts payable represent money that your business owes to suppliers, vendors, and service providers for goods or services you’ve received but haven’t yet paid for.

When you purchase inventory, office supplies, or services on credit, you create accounts payable. It’s your IOU to someone else. On your balance sheet, accounts payable appear as a current liability because you’re expected to pay them within a short timeframe, usually 30 to 60 days. Investopedia – Accounts Payable

How Accounts Payable Works: A Real-World Example

Using our Creative Visions design agency again, let’s say you need to purchase new computers and software for your team in February, totaling $8,000. Your technology supplier offers payment terms of “Net 60.”

Here’s the timeline:

- Day 1 (Equipment received): The computers and software are delivered and set up

- Day 1 (Accounting entry): You record $8,000 as equipment/expense and $8,000 as accounts payable (liability increases)

- Day 30 (Invoice reminder): Supplier sends a payment reminder

- Day 55 (Payment made): You pay the $8,000 to the supplier

- Day 55 (Accounting entry): You reduce accounts payable by $8,000 and reduce cash by $8,000

During those 55 days, that $8,000 existed as accounts payable—money you owed but hadn’t yet paid.

Key Characteristics of Accounts Payable

| Characteristic | Description |

|---|---|

| Balance Sheet Classification | Current Liability |

| Normal Balance | Credit (increases with credits, decreases with debits) |

| Represents | Money owed BY your business |

| Impact on Cash Flow | Negative when paid |

| Typical Timeline | 30-60 days (varies by supplier) |

| Associated Metrics | Days Payable Outstanding (DPO), AP Turnover Ratio |

| Risk Factor | Damaged supplier relationships, late fees |

Why Accounts Payable Matters for Your Business

Accounts payable is actually a strategic tool for managing cash flow. By negotiating favorable payment terms with suppliers, you can keep cash in your business longer, earning interest or using it for other investments before you have to pay your bills.

However, there’s a delicate balance. While delaying payments can improve short-term cash flow, paying too late can damage supplier relationships, result in late fees, or cause you to miss out on early payment discounts.

Industry data suggests that businesses that optimize their accounts payable processes can improve cash flow by 15-25% without negatively impacting supplier relationships.

Accounts Receivable vs Accounts Payable: The Core Differences

Now that we understand each concept individually, let’s directly compare accounts receivable vs accounts payable to highlight the key differences that every business owner needs to know.

Side-by-Side Comparison Table

| Aspect | Accounts Receivable (AR) | Accounts Payable (AP) |

|---|---|---|

| Definition | The money customers owe you | Money you owe TO suppliers |

| Balance Sheet Category | Current Asset | Current Liability |

| Direction of Money Flow | Incoming (when collected) | Outgoing (when paid) |

| Your Business Role | Creditor (you extended credit) | Debtor (you received credit) |

| Goal | Collect as quickly as possible | Pay strategically (on time, not early) |

| Impact on Working Capital | Increases working capital | Decreases working capital |

| Associated Documents | Sales invoices, receipts | Purchase orders, vendor invoices |

| Aging Concern | Older = higher risk of non-payment | Older = risk of penalties, damaged relationships |

| Optimization Strategy | Faster collection, better credit policies | Negotiate better terms, optimize payment timing |

The Fundamental Relationship

Here’s the beautiful symmetry: Your accounts receivable is someone else’s accounts payable, and your accounts payable is someone else’s accounts receivable.

When you invoice a customer, you create AR on your books and AP on theirs. When a supplier invoices you, they create AR on their books and AP on yours. Understanding this relationship helps you appreciate both sides of the credit transaction.

The Cash Flow Connection: How AR and AP Work Together

Cash flow is the lifeblood of any business, and the relationship between accounts receivable vs accounts payable determines much of your cash flow health. Let’s break down this critical connection. FASB – Accounting Standards

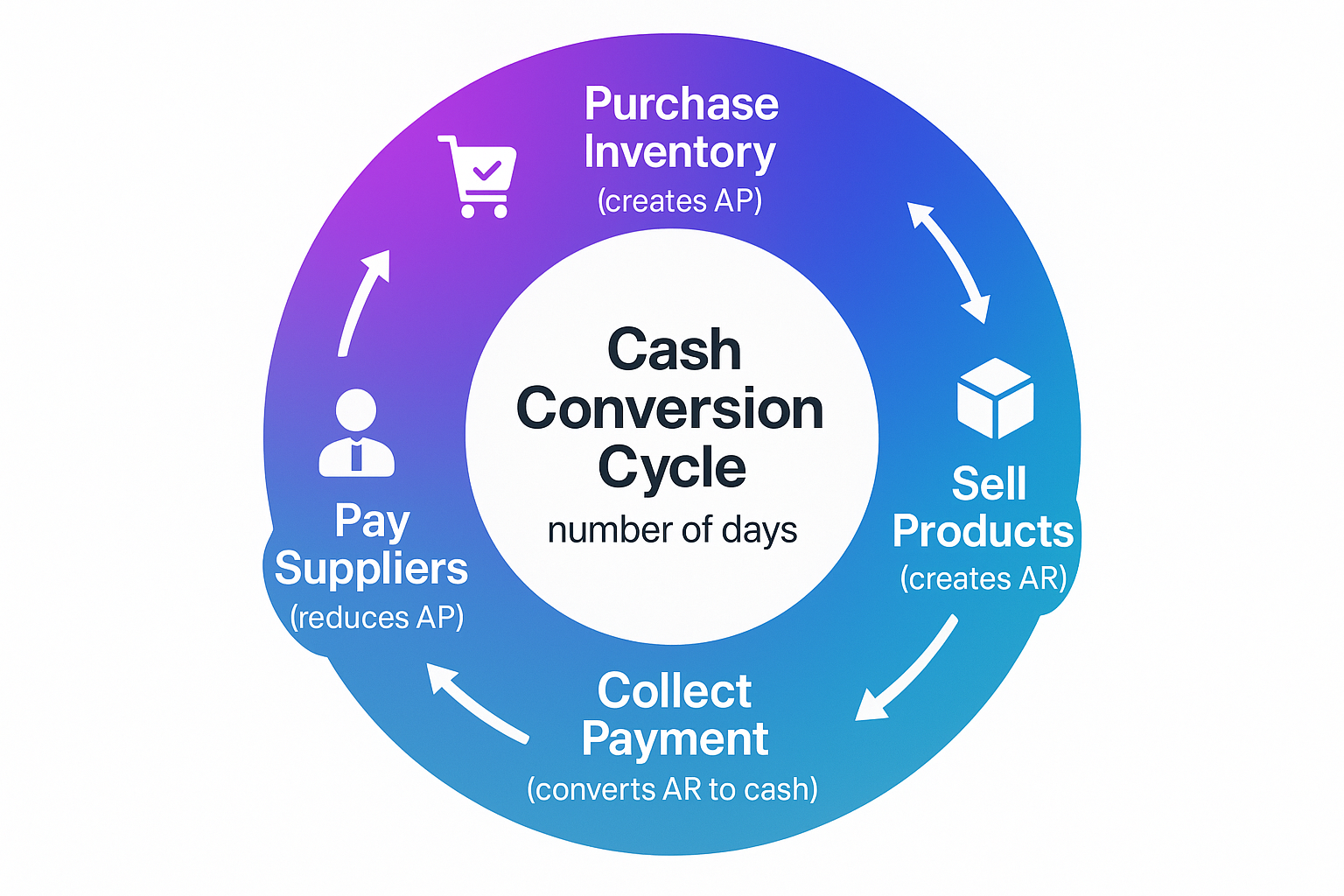

The Cash Conversion Cycle

The cash conversion cycle measures how long it takes your business to convert investments in inventory and other resources back into cash. It’s calculated as:

Cash Conversion Cycle = Days Inventory Outstanding + Days Sales Outstanding – Days Payable Outstanding

Where:

- Days Sales Outstanding (DSO) measures how long it takes to collect accounts receivable

- Days Payable Outstanding (DPO) measures how long you take to pay accounts payable

A shorter cash conversion cycle means your business converts investments into cash faster, improving liquidity and financial flexibility.

Real-World Cash Flow Scenario

Let’s see how AR and AP interact in a practical business scenario:

Scenario: You run an e-commerce business selling handmade furniture.

Month 1:

- You purchase $20,000 in wood and materials on 60-day payment terms (creates AP)

- You manufacture furniture throughout the month

- You sell $35,000 worth of furniture on 30-day payment terms (creates AR)

Month 2:

- You collect $35,000 from Month 1 customers (AR converts to cash)

- You purchase another $20,000 in materials on 60-day terms (creates new AP)

- You sell another $35,000 in furniture on 30-day terms (creates new AR)

- You pay $20,000 to suppliers for Month 1 materials (AP paid with cash)

Cash Flow Impact:

- Cash in: $35,000 (from AR collections)

- Cash out: $20,000 (from AP payments)

- Net positive cash flow: $15,000

This example shows how managing the timing between when you collect AR and when you pay AP creates breathing room in your cash flow. Understanding how to make smart financial moves with these timing differences can significantly improve your business’s financial position.

The Working Capital Formula

Working Capital = Current Assets – Current Liabilities

Since AR is a current asset and AP is a current liability, they both directly impact your working capital:

- Increasing AR (more customers owe you) = Higher working capital

- Increasing AP (you owe more suppliers) = Lower working capital

- Collecting AR (customers pay) = Convert one asset (AR) to another (cash), working capital stays the same

- Paying AP (you pay suppliers) = Reduces both assets (cash) and liabilities (AP), working capital stays the same

The key insight? The timing of AR collection and AP payment determines your cash position, while the amounts of AR and AP determine your working capital.

How to Manage Accounts Receivable Effectively

Proper AR management is crucial for maintaining healthy cash flow and minimizing bad debts. Here are proven strategies to optimize your accounts receivable process.

1. Establish Clear Credit Policies

Before extending credit to customers, create written credit policies that include:

- Credit application requirements: What information do new customers need to provide?

- Credit limits: How much can each customer purchase on credit?

- Payment terms: Net 15, Net 30, or Net 60?

- Late payment consequences: What are the penalties for overdue payments?

Having clear policies protects your business and sets proper expectations with customers from day one.

2. Invoice Promptly and Accurately

The faster you invoice, the faster you get paid. Aim to send invoices immediately after delivering products or services. Your invoice should include:

- Clear description of products/services provided

- Itemized pricing

- Payment terms and due date

- Multiple payment options

- Your contact information for questions

Pro tip: Electronic invoicing typically results in 20-30% faster payment than paper invoices.

3. Offer Multiple Payment Methods

Remove barriers to payment by accepting:

- Credit and debit cards

- ACH/bank transfers

- Digital payment platforms (PayPal, Venmo, Stripe)

- Checks (though these are the slowest)

The easier you make it to pay, the faster customers will pay.

4. Implement Early Payment Incentives

Consider offering discounts for early payment, such as:

- 2/10 Net 30: 2% discount if paid within 10 days, otherwise full payment due in 30 days

- 1/15 Net 45: 1% discount if paid within 15 days, otherwise full payment due in 45 days

While you sacrifice a small percentage of revenue, you gain faster cash conversion and reduced collection risk.

5. Monitor AR Aging Reports

An AR aging report categorizes your receivables by how long they’ve been outstanding:

| Age Category | Amount | Percentage | Collection Priority |

|---|---|---|---|

| Current (0-30 days) | $45,000 | 60% | Normal follow-up |

| 31-60 days | $18,000 | 24% | Increased attention |

| 61-90 days | $9,000 | 12% | Urgent collection efforts |

| 90+ days | $3,000 | 4% | Consider a collection agency |

The older a receivable gets, the less likely you are to collect it. Industry data shows that receivables over 90 days old have only a 50% collection rate. SEC – Understanding Company Liabilities

6. Follow Up Consistently

Create a systematic follow-up schedule:

- Day 15: Friendly reminder email

- Day 30: Payment due reminder

- Day 35: First follow-up phone call

- Day 45: Second follow-up with late fee notice

- Day 60: Final notice before collections

- Day 75: Send to collections agency

Consistent, professional follow-up dramatically improves collection rates without damaging customer relationships.

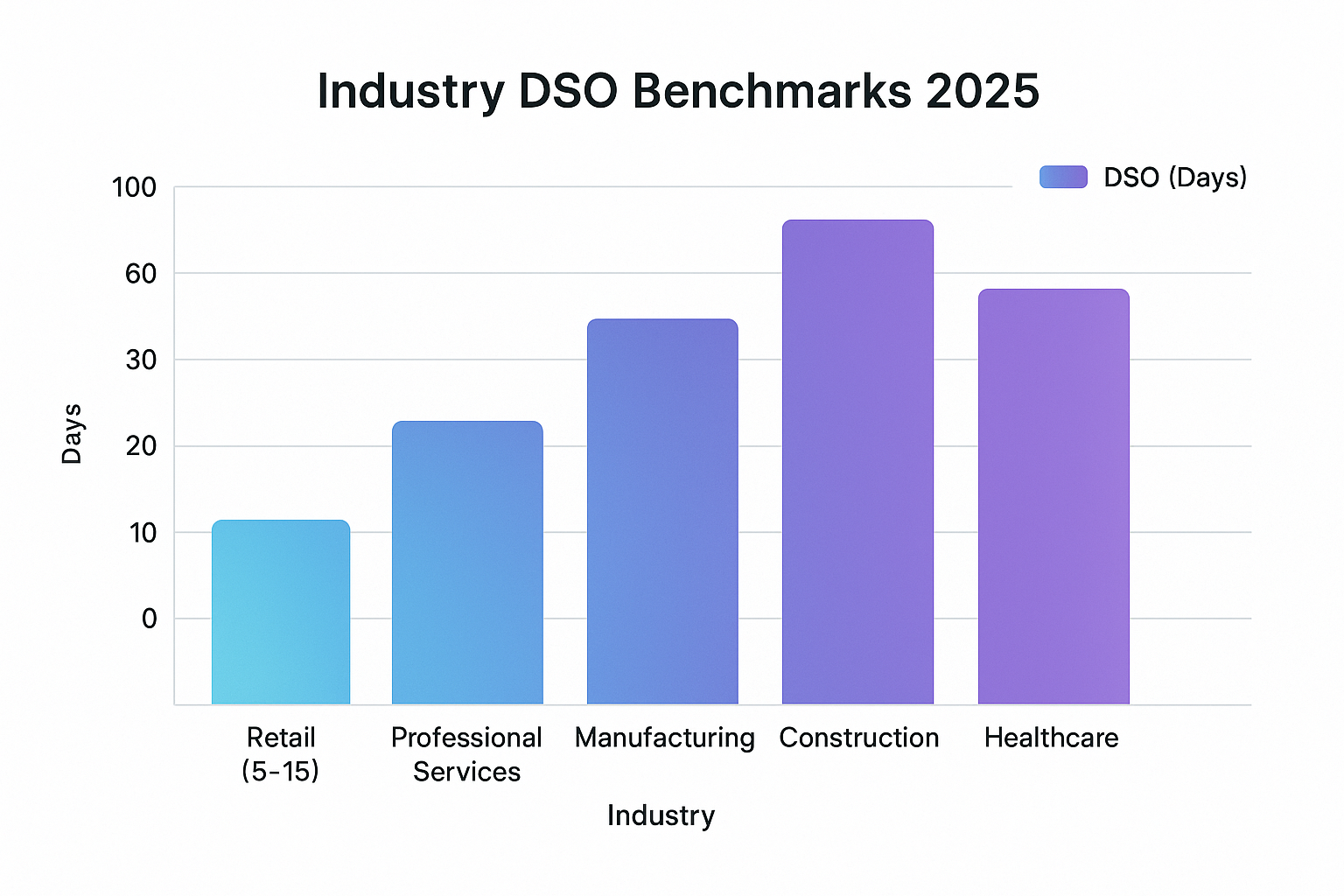

Key AR Metrics to Track

Monitor these metrics to gauge your AR performance:

Days Sales Outstanding (DSO) = (Accounts Receivable / Total Credit Sales) × Number of Days

A lower DSO means you’re collecting payments faster. Industry benchmarks vary, but most businesses aim for a DSO of 30-45 days.

AR Turnover Ratio = Net Credit Sales / Average Accounts Receivable

A higher ratio indicates you’re collecting receivables more efficiently.

How to Manage Accounts Payable Strategically

While AR is about collecting money owed to you, AP management focuses on optimizing when and how you pay suppliers while maintaining strong relationships.

1. Negotiate Favorable Payment Terms

Don’t accept the first payment terms offered. Negotiate with suppliers for:

- Longer payment windows: Request Net 60 or Net 90 instead of Net 30

- Early payment discounts: If you have excess cash, take advantage of 2/10 Net 30 offers

- Volume discounts: Commit to larger orders for better pricing

- Flexible terms: Seasonal businesses might negotiate variable payment schedules

Remember: Your suppliers’ accounts receivable is your accounts payable, so they’re motivated to negotiate terms that work for both parties.

2. Centralize AP Processing

Implement a centralized AP system to:

- Prevent duplicate payments

- Ensure all invoices are properly approved

- Track payment due dates

- Maintain organized records for audits and tax purposes

- Identify spending patterns and cost-saving opportunities

Many businesses lose thousands annually to duplicate payments and missed early payment discounts simply due to disorganized AP processes.

3. Prioritize Payments Strategically

Not all payables are created equal. Prioritize based on:

- Critical suppliers: Vendors essential to operations

- Early payment discounts: High ROI on taking discounts

- Vendors with strict policies: Those who charge significant late fees

- Relationship value: Long-term strategic partners

- Routine expenses: Utilities, rent, insurance

This strategic approach ensures you maintain operations while optimizing cash flow.

4. Take Advantage of Early Payment Discounts (When It Makes Sense)

A 2/10 Net 30 discount might seem small, but let’s do the math:

- You save 2% by paying 20 days early

- Annualized return: (2% / 20 days) × 365 days = 36.5% annual return

That’s an incredible return on investment! If you have available cash, taking early payment discounts often beats any other investment opportunity.

However, only take these discounts if:

- You have sufficient cash reserves

- You won’t create cash flow problems elsewhere

- The discount rate justifies the early payment

5. Automate AP Processes

Modern AP automation can:

- Automatically match invoices to purchase orders

- Route invoices for approval based on your workflows

- Schedule payments to hit exactly on due dates

- Generate reports on spending patterns

- Reduce processing costs by 60-80%

Automation reduces errors, prevents fraud, and frees up your team to focus on strategic financial management rather than administrative tasks.

6. Monitor AP Aging and Metrics

Just like with AR, track your AP aging:

| Age Category | Amount | Status | Action Needed |

|---|---|---|---|

| Not yet due | $65,000 | On schedule | Monitor |

| 1-15 days overdue | $8,000 | Slightly late | Pay immediately |

| 16-30 days overdue | $2,000 | Late | Pay and apologize |

| 30+ days overdue | $500 | Very late | Pay, apologize, repair relationship |

Consistently paying late damages your business reputation and can result in:

- Loss of credit privileges

- Higher prices from suppliers

- Requirement for prepayment

- Difficulty securing credit from new suppliers

Key AP Metrics to Track

Days Payable Outstanding (DPO) = (Accounts Payable / Cost of Goods Sold) × Number of Days

A higher DPO means you’re holding onto cash longer, but too high might indicate payment problems.

AP Turnover Ratio = Cost of Goods Sold / Average Accounts Payable

This shows how many times per year you pay off your average payables balance.

Common Mistakes to Avoid

Understanding accounts receivable vs accounts payable is one thing; avoiding costly mistakes is another. Here are the most common pitfalls and how to avoid them.

Accounts Receivable Mistakes

1. Extending Credit Without Proper Vetting

Don’t let excitement over a new customer cloud your judgment. Always:

- Check credit references

- Review credit reports

- Start with smaller credit limits

- Require deposits for large orders

2. Inconsistent Collection Efforts

Sporadic follow-up leads to:

- Customers thinking payment isn’t urgent

- Higher bad debt rates

- Unpredictable cash flow

Create and stick to a systematic collection schedule.

3. Not Writing Off Bad Debts

Holding onto uncollectible receivables:

- Distorts your financial statements

- Inflates your asset values

- Prevents you from focusing on collectible accounts

Establish clear criteria for when to write off bad debts (typically after 120-180 days of collection efforts).

4. Offering Too-Generous Payment Terms

Net 60 or Net 90 terms might win customers, but they:

- Tie up your cash for extended periods

- Increase non-payment risk

- Can create cash flow crunches

Balance competitive terms with your cash flow needs.

Accounts Payable Mistakes

1. Paying Too Early

Unless you’re taking an early payment discount, paying before the due date:

- Reduces your available cash unnecessarily

- Provides no benefit to your business

- Might indicate poor cash management

2. Paying Too Late

Consistently late payments:

- Damage supplier relationships

- Result in late fees and interest charges

- Can lead to loss of credit privileges

- Harm your business credit score

3. Not Taking Advantage of Early Payment Discounts

Missing a 2/10 Net 30 discount is like turning down a 36.5% annual return on investment. If you have the cash, take the discount!

4. Duplicate Payments

Without proper controls, businesses often pay the same invoice twice, especially when:

- Suppliers send multiple copies

- Different team members process invoices

- Systems aren’t integrated

Implement invoice numbering systems and verification processes to prevent this costly error.

5. Not Reconciling AP Regularly

Failing to reconcile accounts payable leads to:

- Missed payments

- Duplicate payments

- Inaccurate financial statements

- Poor cash flow forecasting

Monthly reconciliation should be standard practice.

The Impact on Financial Statements

Understanding how accounts receivable vs accounts payable appear on financial statements is crucial for interpreting your business’s financial health.

Balance Sheet Impact

Assets Section:

Current Assets:

Cash $50,000

Accounts Receivable $75,000

Inventory $40,000

Prepaid Expenses $5,000

Total Current Assets $170,000Liabilities Section:

Current Liabilities:

Accounts Payable $45,000

Accrued Expenses $12,000

Short-term Debt $20,000

Total Current Liabilities $77,000Working Capital Calculation:

Working Capital = $170,000 – $77,000 = $93,000

This shows your business has $93,000 in liquid resources to cover short-term obligations.

Cash Flow Statement Impact

On the cash flow statement, changes in AR and AP appear in the operating activities section:

Cash Flow from Operating Activities:

Net Income $45,000

Adjustments:

Increase in Accounts Receivable ($15,000) ← Cash tied up

Decrease in Accounts Payable ($8,000) ← Cash paid out

Depreciation $5,000

Net Cash from Operating Activities $27,000Key insight: Even with $45,000 in net income, your actual cash from operations is only $27,000 because:

- $15,000 is tied up in new receivables (sales made but not collected)

- $8,000 was used to pay down payables

This illustrates why profitable businesses can still face cash crunches!

Financial Ratios Affected by AR and AP

Several important financial ratios depend on AR and AP:

Current Ratio = Current Assets / Current Liabilities

- Measures short-term liquidity

- Higher AR increases the ratio

- Higher AP decreases the ratio

- Target: 1.5 to 3.0 for most businesses

Quick Ratio = (Current Assets – Inventory) / Current Liabilities

- More conservative liquidity measure

- AR is included, inventory is excluded

- Shows ability to pay obligations without selling inventory

- Target: 1.0 or higher

Working Capital Ratio = Current Assets / Current Liabilities

- Similar to the current ratio

- Indicates operational efficiency

- Both AR and AP significantly impact this metric

Understanding these relationships helps you interpret financial statements and make better business decisions. Just as understanding what moves the stock market helps investors make better decisions, understanding AR and AP helps business owners optimize their financial position.

Industry Benchmarks and Best Practices

Different industries have different norms for accounts receivable vs accounts payable management. Here’s what you need to know.

Industry-Specific AR Benchmarks

| Industry | Average DSO | Typical Payment Terms |

|---|---|---|

| Retail | 5-15 days | Immediate to Net 15 |

| Manufacturing | 45-60 days | Net 30 to Net 60 |

| Construction | 60-90 days | Net 60 to Net 90 |

| Professional Services | 30-45 days | Net 30 |

| Healthcare | 45-75 days | Net 30 to Net 60 (insurance delays) |

| Technology/SaaS | 30-45 days | Net 30 |

| Wholesale/Distribution | 35-50 days | Net 30 to Net 45 |

Your industry matters! A DSO of 60 days might be excellent for construction but terrible for retail.

Industry-Specific AP Benchmarks

| Industry | Average DPO | Common Strategies |

|---|---|---|

| Retail | 30-45 days | Negotiate seasonal terms |

| Manufacturing | 45-60 days | Match to production cycles |

| Construction | 30-60 days | Align with project milestones |

| Professional Services | 30-45 days | Standard terms, few exceptions |

| Technology | 30-60 days | Balance growth needs with supplier relationships |

Best Practices Across Industries

Regardless of your specific industry, these best practices apply universally:

For Accounts Receivable:

- Invoice immediately upon delivery of goods/services

- Offer multiple payment methods to remove friction

- Send payment reminders at regular intervals

- Review credit policies quarterly

- Monitor DSO monthly and investigate increases

- Maintain professional relationships even during collections

- Consider AR financing for large outstanding balances

For Accounts Payable:

- Centralize AP processing to prevent errors

- Negotiate payment terms with all vendors

- Take early payment discounts when cash flow allows

- Pay on time to maintain strong supplier relationships

- Automate where possible to reduce processing costs

- Monitor DPO monthly and optimize timing

- Maintain organized records for audits and tax purposes

Advanced Strategies: AR and AP Financing

When traditional management isn’t enough, businesses can use financial tools to optimize accounts receivable vs accounts payable.

Accounts Receivable Financing Options

1. Factoring

Sell your AR to a factoring company for immediate cash (typically 70-90% of invoice value). The factoring company then collects from your customers.

Pros:

- Immediate cash injection

- Transfers the collection responsibility

- No debt on the balance sheet

Cons:

- Costs 1-5% of invoice value

- May concern customers

- Reduces profit margins

Best for: Businesses with cash flow emergencies or rapid growth needs

2. AR Financing/Discounting

Similar to factoring, but you retain collection responsibility. The financing company provides a loan secured by your receivables.

Pros:

- Lower cost than factoring (typically 0.5-3%)

- You maintain customer relationships

- Faster than traditional loans

Cons:

- You’re still responsible for the collection

- Adds debt to the balance sheet

- Requires good quality receivables

Best for: Businesses needing working capital while maintaining customer relationships

3. Invoice Financing

Finance individual invoices rather than your entire AR portfolio.

Pros:

- Flexible—use only when needed

- No long-term commitments

- Maintains customer relationships

Cons:

- Higher per-invoice costs

- More administrative work

- Not all invoices may qualify

Best for: Businesses with occasional cash flow gaps

Accounts Payable Financing Options

1. Supply Chain Financing (Reverse Factoring)

Your supplier gets paid immediately by a financing company, while you pay the financing company on extended terms.

Pros:

- Extend payment terms without harming the supplier

- Supplier gets immediate cash

- Often lower cost than traditional financing

Cons:

- Requires setup and coordination

- May have minimum transaction sizes

- Additional administrative complexity

Best for: Large businesses with strong credit ratings

2. Dynamic Discounting

Pay suppliers early in exchange for discounts, using available cash strategically.

Pros:

- Earn returns on excess cash

- Strengthen supplier relationships

- Flexible—use when cash is available

Cons:

- Requires a technology platform

- Needs excess cash to be effective

- Must calculate ROI for each opportunity

Best for: Businesses with variable cash positions

3. Procurement Cards

Use corporate credit cards for purchases, extending payment by 30-60 days while suppliers get paid immediately.

Pros:

- Automatic payment extension

- Earn rewards/cashback

- Simplified expense tracking

Cons:

- Credit limits may be restrictive

- Not all suppliers accept cards

- Interest charges if not paid in full

Best for: Businesses with good credit and organized payment processes

Just as investors might explore ways to make passive income to diversify their earnings, businesses should explore various financing options to optimize cash flow.

Technology Solutions for AR and AP Management

Modern technology has revolutionized how businesses manage accounts receivable vs accounts payable. Here are the tools that can transform your financial operations.

Accounts Receivable Software Solutions

1. Invoicing and Payment Platforms

- QuickBooks Online: Comprehensive accounting with built-in AR management

- FreshBooks: User-friendly for service businesses and freelancers

- Xero: Cloud-based with excellent automation features

- Wave: Free option for small businesses

Key features to look for:

- Automated invoice generation and sending

- Payment reminders and follow-ups

- Multiple payment gateway integrations

- Mobile access

- Reporting and analytics

2. Specialized AR Automation Tools

- Tesorio: AI-powered cash flow prediction and collections

- Billtrust: Enterprise-level AR automation

- Chaser: Automated payment chasing and reminders

- YayPay: AI-driven collections management

3. Customer Relationship Management (CRM) Integration

- Salesforce with AR integration

- HubSpot with payment features

- Zoho CRM with invoicing

Benefits of integration:

- Complete customer view (sales + payments)

- Better credit decisions based on relationship history

- Coordinated communication

- Improved customer experience

Accounts Payable Software Solutions

1. AP Automation Platforms

- Bill.com: Popular cloud-based AP automation

- AvidXchange: Comprehensive AP and payment automation

- Tipalti: Global payments and AP automation

- MineralTree: Invoice processing and payment automation

Key features to look for:

- OCR (optical character recognition) for invoice scanning

- Automated matching to purchase orders

- Approval workflows

- Payment scheduling

- Vendor portal access

2. Expense Management Tools

- Expensify: Automated expense reporting

- Concur: Enterprise expense and AP management

- Divvy: Expense management with virtual cards

3. Enterprise Resource Planning (ERP) Systems

- SAP

- Oracle NetSuite

- Microsoft Dynamics

- Sage Intacct

Benefits for larger businesses:

- Complete financial integration

- Real-time visibility

- Advanced analytics

- Scalability

The ROI of AR/AP Technology

Investing in AR and AP technology typically delivers:

- 60-80% reduction in invoice processing time

- 50-70% decrease in processing costs

- 20-30% improvement in DSO (faster collections)

- 15-25% improvement in early payment discount capture

- 90%+ reduction in duplicate payments and errors

For a business processing 500 invoices monthly, AP automation alone can save $15,000-$25,000 annually in processing costs, not counting the value of improved cash flow!

Real-World Case Study: AR and AP Optimization in Action

Let’s examine how one business transformed its financial health by optimizing accounts receivable vs accounts payable.

The Business: TechSupply Co.

Industry: Technology equipment distributor

Annual Revenue: $5 million

Employees: 15

The Problem (Before Optimization)

Accounts Receivable Issues:

- Average DSO: 62 days

- 25% of receivables are over 60 days old

- Bad debt rate: 4% of sales

- Manual invoicing takes 2-3 days

- No systematic collection process

- Cash flow unpredictable

Accounts Payable Issues:

- Paying suppliers randomly between 20-50 days

- Missing 80% of early payment discounts

- Duplicate payments occur monthly

- No organized system for tracking due dates

- Supplier complaints about inconsistent payments

Financial Impact:

- Working capital: $180,000

- Monthly cash flow variance: ±$75,000

- Borrowing line of credit frequently

- Unable to take advantage of growth opportunities

The Solution: Comprehensive AR/AP Optimization

Phase 1: Accounts Receivable Improvements

- Implemented automated invoicing system (QuickBooks Online)

- Invoices are now sent the same day as delivery

- Automated payment reminders on days 15, 30, and 35

- Multiple payment options added

- Revised credit policies

- Required credit checks for orders over $5,000

- Reduced payment terms from Net 60 to Net 30

- Implemented 2/10 Net 30 for reliable customers

- Created a systematic collection process

- Assigned a dedicated AR manager

- Weekly AR aging review

- Established collection call schedule

- Set clear write-off policies (120 days)

Phase 2: Accounts Payable Improvements

- Centralized AP processing

- All invoices are routed through the AP manager

- Implemented approval workflows

- Created a vendor database with terms

- Optimized payment timing

- Scheduled payments for exact due dates

- Prioritized early payment discounts

- Negotiated extended terms with key suppliers (Net 60)

- Automated AP processes

- Implemented Bill.com for invoice processing

- Set up electronic payments

- Created automated payment scheduling

The Results (After 12 Months)

Accounts Receivable Improvements:

- Average DSO reduced from 62 to 38 days (39% improvement)

- Receivables over 60 days reduced from 25% to 8%

- Bad debt rate decreased from 4% to 1.5%

- Invoicing time reduced from 2-3 days to same-day

- 95% collection rate on invoices under 60 days

Accounts Payable Improvements:

- Capturing 75% of early payment discounts (up from 20%)

- Eliminated duplicate payments (saving $18,000 annually)

- Extended average DPO from 35 to 48 days

- Zero late payment fees (previously $6,000 annually)

- Improved supplier relationships and negotiating power

Overall Financial Impact:

- Working capital increased from $180,000 to $285,000 (58% improvement)

- Cash flow variance reduced from ±$75,000 to ±$25,000

- Eliminated the need for the line of credit borrowing

- Total annual savings: $127,000

- Early payment discounts captured: $45,000

- Reduced bad debts: $32,000

- Eliminated duplicate payments: $18,000

- Eliminated late fees: $6,000

- Reduced borrowing costs: $26,000

Strategic Benefits:

- Predictable cash flow enabled strategic planning

- Able to negotiate volume discounts with suppliers

- Invested in growth opportunities previously unavailable

- Improved credit rating with suppliers and lenders

This case study demonstrates the transformative power of optimizing both sides of the accounts receivable vs accounts payable equation. The improvements didn’t require massive capital investment—primarily process changes, technology adoption, and consistent execution.

Conclusion: Mastering the Balance for Business Success

Understanding accounts receivable vs accounts payable isn’t just an accounting exercise—it’s fundamental to your business’s financial health and long-term success. These two sides of the credit equation work together to determine your cash flow, working capital, and ability to seize opportunities or weather challenges.

Let’s recap the essential points:

Accounts Receivable (Money Owed TO You):

- Asset on your balance sheet

- Represents sales you’ve made but haven’t collected

- Goal: Collect as quickly as possible while maintaining customer relationships

- Optimize through clear credit policies, prompt invoicing, systematic follow-up, and technology

- Monitor DSO and AR aging reports monthly

Accounts Payable (Money You Owe TO Others):

- Liability on your balance sheet

- Represents purchases you’ve made but haven’t paid for

- Goal: Pay strategically—on time to maintain relationships, not early unless taking discounts

- Optimize through negotiated terms, centralized processing, automation, and strategic timing

- Monitor DPO and capture early payment discounts when financially sensible

The Cash Flow Connection:

The timing difference between collecting AR and paying AP creates your cash conversion cycle. Master this timing, and you’ll have the cash needed to invest in growth, handle emergencies, and build a financially resilient business.

Your Action Plan: Next Steps

Ready to optimize your accounts receivable vs accounts payable management? Here’s what to do right now:

Immediate Actions (This Week):

- Run AR and AP aging reports to understand your current position

- Calculate your DSO and DPO to establish baseline metrics

- Identify your oldest receivables and create a collection plan

- Review upcoming AP due dates and identify early payment discount opportunities

- Audit your invoicing process for delays and inefficiencies

Short-Term Actions (This Month):

- Review and update credit policies with clear terms and limits

- Implement or improve your invoicing system for faster, automated billing

- Establish systematic collection procedures with defined follow-up schedules

- Centralize AP processing to prevent errors and missed discounts

- Negotiate payment terms with your top 10 suppliers

Long-Term Actions (This Quarter):

- Implement AR/AP software to automate and streamline processes

- Develop cash flow forecasting based on AR collections and AP payments

- Train your team on AR and AP best practices

- Create monthly review processes to monitor metrics and adjust strategies

- Consider AR or AP financing if cash flow gaps persist

Remember: Small improvements in AR and AP management can generate significant cash flow improvements. A 10-day reduction in DSO combined with a 10-day increase in DPO can free up substantial working capital without any additional sales or investment.

The businesses that thrive aren’t necessarily those with the highest revenues—they’re the ones that manage cash flow effectively. By mastering accounts receivable vs accounts payable, you’re taking control of your business’s financial destiny.

Just as successful investors learn to understand market cycles and make informed decisions, successful business owners master the fundamentals of AR and AP to build sustainable, profitable enterprises.

Your journey to better financial management starts with a single step. Which action will you take today?

📊 AR vs AP Cash Flow Calculator

Calculate how your receivables and payables impact working capital and cash flow

💰 Accounts Receivable (Money Owed TO You)

💳 Accounts Payable (Money You Owe TO Others)

📈 Your Cash Flow Analysis

💡 Insights & Recommendations

FAQ: Accounts Receivable vs Accounts Payable

Accounts receivable represent money owed TO your business by customers, while accounts payable represent money your business owes TO suppliers. AR is an asset on your balance sheet (money coming in), while AP is a liability (money going out). Managing both effectively is crucial for healthy cash flow and business sustainability.

Yes, absolutely! It’s common for businesses to both buy from and sell to the same company. For example, you might sell products to a distributor (creating AR) while also purchasing supplies from that same distributor (creating AP). These are tracked separately in your accounting system, though some businesses choose to “net” them for payment purposes.

Accounts receivable become cash when customers pay, improving cash flow. Accounts payable becomes a cash outflow when you pay suppliers, reducing cash flow. The timing difference between when you collect AR and when you pay AP creates your cash conversion cycle. Collecting AR faster and paying AP strategically (on time, but not early) optimizes cash flow.

A good AR turnover ratio varies by industry, but generally, 6-12 times per year is healthy for most businesses, meaning you collect your average receivables 6-12 times annually. The formula is: Net Credit Sales ÷ Average Accounts Receivable. Higher ratios indicate faster collection, but extremely high ratios might suggest overly restrictive credit policies that limit sales growth.

In most cases, yes—if you have available cash. A typical 2/10 Net 30 discount (2% off for paying 20 days early) translates to an annualized return of approximately 36.5%, which beats most investment alternatives. However, only take the discount if it won’t create cash flow problems elsewhere in your business. Never borrow money at high interest rates just to take an early payment discount.

To reduce DSO and collect receivables faster: (1) Invoice immediately upon delivery, (2) Offer multiple convenient payment methods, (3) Send automated payment reminders, (4) Implement early payment incentives like 2/10 Net 30, (5) Tighten credit policies for high-risk customers, (6) Follow up consistently on overdue accounts, and (7) Consider AR financing for large outstanding balances. Even a 10-day reduction in DSO can significantly improve cash flow.

Consistently late AP payments can result in: late fees and interest charges, damaged supplier relationships, loss of credit privileges (requiring prepayment for future orders), reduced credit limits, difficulty securing credit from new suppliers, and harm to your business credit score. In severe cases, suppliers may refuse to work with you or take legal action. However, occasional late payments due to genuine cash flow issues can usually be resolved through honest communication with suppliers.

Working capital = Current Assets – Current Liabilities. Since AR is a current asset and AP is a current liability, increasing AR increases working capital, while increasing AP decreases working capital. However, what matters more for day-to-day operations is the timing of AR collection and AP payment, which determines your actual cash position. You can have strong working capital on paper, but still face cash crunches if receivables aren’t collected promptly.

Disclaimer

This article is for educational purposes only and does not constitute financial, accounting, or business advice. While the information presented is based on established accounting principles and industry best practices, every business situation is unique. Before making significant changes to your accounts receivable or accounts payable processes, consult with a qualified accountant, financial advisor, or business consultant who understands your specific circumstances. Tax laws, accounting standards, and industry regulations vary by location and change over time, so always verify current requirements with appropriate professionals.

About the Author

Written by Max Fonji — With over a decade of experience in financial education and business consulting, Max is your go-to source for clear, data-backed insights on personal finance, investing, and business management. At TheRichGuyMath.com, Max breaks down complex financial concepts into actionable strategies that real people can use to build wealth and financial security. Whether you’re learning about dividend investing, exploring high-dividend stocks, or mastering business fundamentals like accounts receivable and accounts payable, Max provides the knowledge you need to make informed financial decisions.