Available balance is the amount of money you can spend or withdraw from your bank account right now without overdrawing it. It reflects your current balance minus pending transactions, holds, and any restrictions, so it’s the most accurate number to check before making a purchase, transfer, or ATM withdrawal. This article is part of our complete Credit Guide, where we break down APRs, interest, rewards, fees, and how to use credit cards the smart way.

This $300 difference isn’t a banking error; it’s the math behind how financial institutions protect both themselves and their customers from overdrafts, returned payments, and processing delays. Understanding your Available Balance is fundamental to avoiding costly mistakes and maintaining control over your cash flow.

The available balance represents the actual funds you can access right now, accounting for pending transactions, holds, and processing delays that your current balance doesn’t reflect. This distinction matters because spending based on your current balance can trigger overdraft fees, declined transactions, and financial stress that proper financial literacy prevents.

Key Takeaways

- Available balance shows spendable funds: It reflects your current balance minus pending transactions, holds, and restrictions—the actual amount you can withdraw or spend without overdrawing your account.

- Current balance vs available balance: Current balance displays all posted transactions but ignores pending activity, while available balance accounts for everything affecting your account in real-time.

- Holds create temporary gaps: Gas stations, hotels, and restaurants place authorization holds that reduce available balance before the final transaction posts, sometimes for 1-7 business days.

- Credit cards work differently: A payment to your credit card updates your current balance immediately, but it may take 3-5 business days to increase your available credit.

- Weekend and holiday delays: Banks process transactions on business days only, meaning Friday deposits or payments may not affect the available balance until the following Monday or Tuesday.

What Is Available Balance?

Available balance is the amount of money in your bank account or credit line that you can immediately access for withdrawals, purchases, or payments without triggering overdraft fees or declined transactions.

This figure represents your current balance minus any pending transactions, holds, or restrictions that haven’t yet posted to your account. Banks calculate this number in real-time to prevent customers from spending money that’s already committed elsewhere.

The Math Behind Available Balance

The formula is straightforward:

Available Balance = Current Balance – Pending Debits – Holds + Pending Credits (if released)

For example:

- Current Balance: $2,000

- Pending debit card purchases: -$150

- Gas station hold: -$100

- Check deposit (on hold): $0 (not yet available)

- Available Balance: $1,750

This calculation protects both the bank and the account holder. As a result, you can’t accidentally spend funds that are already allocated to pending transactions or subject to verification holds.

Why Available Balance Matters for Financial Literacy

Understanding available balance is essential for effective budgeting and cash flow management. Many people check their current balance, see sufficient funds, and make purchases, only to face overdraft fees when pending transactions post simultaneously.

The data support this concern. According to the Consumer Financial Protection Bureau, Americans paid approximately $15.5 billion in overdraft and non-sufficient funds fees in 2019, with the average overdraft fee reaching $33.47 per incident. Most of these fees result from misunderstanding the difference between current and available balances.

Therefore, monitoring your available balance before every transaction becomes a fundamental risk management practice that prevents unnecessary fees and maintains financial stability.

Available Balance vs Current Balance: Understanding the Critical Difference

The distinction between these two numbers determines whether your next transaction succeeds or triggers costly fees.

Current balance shows all transactions that have fully posted to your account as of the last business day. This includes deposits that have cleared, purchases that have finalized, and any fees or interest charges applied to your account.

Available balance shows what you can actually spend right now, accounting for pending activity that hasn’t yet posted but will affect your account within days.

Side-by-Side Comparison

| Feature | Current Balance | Available Balance |

|---|---|---|

| Definition | All posted transactions | Spendable funds after pending items |

| Includes pending transactions | No | Yes |

| Reflects authorization holds | No | Yes |

| Shows deposit holds | Yes (as posted) | No (until released) |

| Updates in real-time | No (end of business day) | Yes (continuously) |

| Safe to spend | Maybe | Yes |

| Used for overdraft calculation | No | Yes |

Real-World Example: The Weekend Spending Trap

Consider this common scenario:

Friday afternoon:

- Current Balance: $800

- Available Balance: $800

- You make three debit card purchases: $50, $75, $120 (total: $245)

Friday evening:

- Current Balance: $800 (purchases haven’t posted yet)

- Available Balance: $555 ($800 – $245 pending)

Saturday morning:

- You see Current Balance: $800

- You make a $600 purchase for groceries and gas

- Available Balance would show -$45 if the bank allowed it

Monday morning:

- All transactions post

- Current Balance: $155 ($800 – $245 – $600)

- Overdraft fee: $35

- New Current Balance: $120

This scenario illustrates why relying on current balance creates financial risk. The available balance would have prevented the $600 purchase, saving $35 in fees.

Understanding your current balance versus available balance is foundational to preventing overdrafts and managing daily cash flow effectively.

Why Your Available Balance May Be Lower Than Expected

Several banking mechanisms can create significant gaps between your current and available balances. Understanding these causes prevents confusion and financial mistakes.

1. Pending Debit Card Transactions

When you swipe your debit card, the merchant sends an authorization request to your bank. The bank immediately reduces your available balance by the purchase amount, even though the transaction won’t post to your current balance for 1-3 business days.

This delay exists because merchants batch their transactions at the end of each business day. Therefore, a purchase made on Monday morning might not post until Tuesday or Wednesday.

2. Authorization Holds

Certain industries place temporary holds on your account that exceed the final transaction amount:

Gas Stations: Pre-authorize $75-$125 even if you only pump $40 in fuel. The hold releases within 1-7 days, but your available balance reflects the full hold amount immediately.

Hotels: Place holds for the room rate plus 15-25% for incidental charges. A $200/night room might trigger a $250-$300 hold that lasts until checkout, plus 1-5 business days.

Restaurants: May pre-authorize 20% above your bill to account for potential tips. A $50 meal could create a $60 hold.

Car Rentals: Often hold $200-$500 above the rental cost for potential damages or additional charges.

These holds protect merchants from insufficient funds, but they temporarily reduce your spending power. The math works against account holders with tight cash flow: a $100 gas station hold on a $1,000 balance reduces available funds by 10% for up to a week.

3. Check Deposits and Hold Periods

When you deposit a check, your bank may credit your current balance immediately but place a hold on your available balance until the check clears. Federal regulations allow banks to hold checks for specific periods [3]:

- Local checks: Up to 2 business days

- Non-local checks: Up to 5 business days

- New accounts (less than 30 days): Up to 9 business days

- Large deposits (over $5,525): Extended holds on amounts exceeding the threshold

- Redeposited checks: Up to 7 business days

Therefore, a $2,000 check deposited on Friday might show in your current balance by Monday but remain unavailable until the following Friday.

4. ACH Transfers and Electronic Payments

Autopay arrangements, bill payments, and scheduled transfers reduce your available balance when scheduled, not when they post. This protects you from scheduling a $500 rent payment and then spending that $500 before the payment process.

5. Overdraft Protection Transfers

If your bank offers overdraft protection linked to a savings account or credit line, pending transfers reduce the available balance in your backup account before they post to your checking account.

Why Your Available Balance May Be Higher Than Your Current Balance

Less commonly, your available balance can exceed your current balance. Understanding these scenarios helps you recognize when additional funds become accessible.

1. Pending Refunds and Reversals

When a merchant processes a refund, many banks increase your available balance immediately, even though the transaction won’t post to your current balance for 3-5 business days.

Example:

- Current Balance: $500

- You return a $150 purchase

- Available Balance: $650 (immediate)

- Current Balance: $500 (until refund posts)

This policy benefits consumers by providing faster access to refunded money, improving cash flow during the processing delay.

2. Overdraft Protection Credit Lines

If your bank offers an overdraft line of credit, your available balance includes both your account balance and your available credit line. This creates scenarios where:

- Current Balance: -$50 (overdrawn)

- Overdraft Protection: $500 available

- Available Balance: $450

While this prevents declined transactions, it represents borrowed money that accrues interest charges. Therefore, using available balance from overdraft protection creates a cost that reduces long-term wealth building.

3. Released Authorization Holds

When authorization holds release before transactions post, your available balance increases while your current balance remains unchanged.

Example:

- You pump $40 in gas with a $100 hold

- The hold releases after 24 hours

- Available Balance increases by $60

- Current Balance remains unchanged until the $40 transaction posts

4. Deposit Availability Policies

Some banks offer immediate availability for certain deposits:

- Direct deposits from employers

- Wire transfers

- Government benefits (Social Security, tax refunds)

- Cashier’s checks or money orders (sometimes)

These deposits increase the available balance immediately, while the current balance updates at the end of the business day.

How Banks Update Available Balances: The Processing Timeline

Understanding when and how banks process transactions explains why available balances change at seemingly random times.

Business Day Processing Rules

Banks operate on business day schedules, not calendar days. A business day is any day the Federal Reserve is open, excluding:

- Saturdays and Sundays

- Federal holidays (New Year’s Day, MLK Day, Presidents Day, Memorial Day, Juneteenth, Independence Day, Labor Day, Columbus Day, Veterans Day, Thanksgiving, Christmas)

Therefore, a transaction initiated on Friday afternoon won’t begin processing until Monday morning, or Tuesday if Monday is a federal holiday.

Daily Cutoff Times

Most banks establish daily cutoff times (typically 2:00 PM to 5:00 PM local time) that determine which business day a transaction belongs to:

- Deposit made at 1:00 PM: Processes same business day

- Deposit made at 6:00 PM: Processes next business day

This cutoff time affects when pending transactions reduce your available balance and when deposits become available.

The Overnight Processing Cycle

Banks batch and process transactions overnight in a specific order:

- Credits first: Deposits and incoming transfers post

- Debits by amount: Withdrawals and purchases post from largest to smallest (though some banks now process chronologically due to regulatory pressure)

This ordering can affect overdraft fees. Processing the largest transactions first increases the likelihood of multiple overdrafts rather than one, generating more fee revenue for banks, a practice that has faced significant regulatory scrutiny.

Real-Time vs. Batch Processing

Modern banking technology enables real-time available balance updates:

- Debit card authorizations: Reduce available balance instantly

- ATM withdrawals: Reduce available balance immediately

- Mobile check deposits: May increase available balance within minutes (for established customers)

- Peer-to-peer transfers (Zelle, Venmo): Often process within minutes

However, current balance updates still follow the overnight batch processing schedule. This creates the gap between the two numbers.

Available Balance on Credit Cards: Why Payments Don’t Increase Credit Immediately

Credit card available balance operates differently from bank account available balance, creating confusion for cardholders who pay their bills.

The Credit Card Payment Processing Cycle

When you submit a credit card payment:

Day 0 (Payment Submitted):

- Current Balance: Decreases by the payment amount immediately

- Available Credit: Remains unchanged

- Statement Balance: Remains unchanged

Days 1-3 (Payment Processing):

- Your bank sends funds to the credit card issuer

- Current Balance: Already reduced

- Available Credit: Still unchanged

Days 3-5 (Payment Posts and Clears):

- Credit card issuer receives and verifies funds

- Current Balance: Remains at reduced amount

- Available Credit: Increases by payment amount

Why This Delay Exists

Credit card issuers wait for payments to fully clear before increasing available credit to prevent fraud and returned payments. If they increased your available credit immediately and your payment bounced, you could spend money you don’t actually have access to.

The math creates a temporary restriction:

- Credit Limit: $5,000

- Current Balance: $3,000

- Available Credit: $2,000

- You make a $1,000 payment

- Current Balance: $2,000 (immediate)

- Available Credit: $2,000 (unchanged for 3-5 days)

- Available Credit after clearing: $3,000

This delay matters for cardholders practicing credit cycling, making multiple payments within a billing cycle to increase spending power. While legal, excessive cycling can trigger fraud alerts or account reviews.

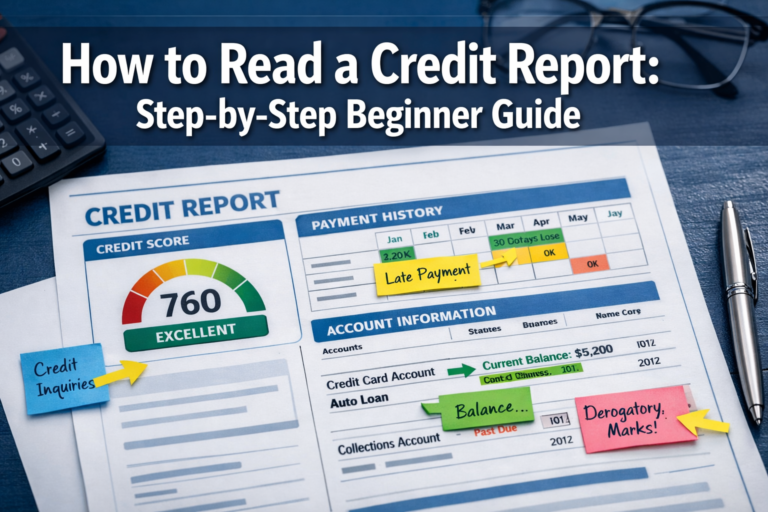

Statement Balance vs Current Balance vs Available Credit

Understanding these three numbers prevents confusion:

- Statement Balance: Amount owed from your last billing cycle (what you should pay to avoid interest)

- Current Balance: Statement balance plus new purchases minus payments

- Available Credit: Credit limit minus current balance minus pending transactions

For optimal credit utilization and credit score management, monitoring available credit helps you maintain utilization below 30% of your total credit limit.

Risks and Mistakes to Avoid with Available Balance

Even with available balance information, several common mistakes lead to financial problems.

1. Overdraft Fees from Pending Transaction Timing

The Mistake: Making a purchase based on available balance without accounting for pending transactions that will post simultaneously.

Example:

- Available Balance: $300

- Pending rent payment: $800 (scheduled for tomorrow)

- You spend $250 today

- Tomorrow: Rent posts, your purchase posts, overdraft fee: $35

The Solution: Maintain a mental buffer of at least $100-$200 below your available balance, or use budgeting tools that track pending transactions. Implementing the 50/30/20 rule helps ensure you maintain adequate reserves.

2. Spending Pending Deposits

The Mistake: Assuming a deposited check is available because it appears in your current balance.

Example:

- You deposit a $1,000 check

- Current Balance: Increases to $1,500

- Available Balance: Remains at $500 (check on hold)

- You write a $900 check

- Original check bounces

- Your $900 check bounces

- Fees from both your bank and the recipient: $70+

The Solution: Wait for deposits to clear completely before spending those funds, especially for large checks or checks from unfamiliar sources.

3. Ignoring Authorization Hold Amounts

The Mistake: Budgeting based on actual purchase amounts rather than authorization hold amounts.

Example:

- Available Balance: $200

- You pump $30 in gas

- Gas station places $100 hold

- Available Balance: $100

- You attempt a $150 grocery purchase

- Transaction declined despite having $170 in actual funds ($200 – $30)

The Solution: Add a 50-100% buffer when budgeting for gas, hotels, or car rentals to account for authorization holds.

4. Weekend and Holiday Timing Errors

The Mistake: Scheduling payments or making purchases late Friday without accounting for weekend processing delays.

Example:

- Friday 6:00 PM: You schedule a bill payment for “today.”

- Payment doesn’t process until Monday

- You make a weekend purchase, assuming the payment has already reduced your balance

- Monday: Payment and purchases all post simultaneously

- Result: Overdraft fees

The Solution: Schedule important payments at least one business day before the due date, and avoid making large purchases on weekends when you have pending transactions.

5. Confusing Available Credit with Available Cash

The Mistake: Treating available credit on a credit card as equivalent to available cash in a bank account.

Available credit represents borrowed money that accrues interest if not paid within the grace period. Using available credit for regular expenses without a repayment plan creates a debt cycle that undermines wealth building.

The Solution: Use credit cards strategically for rewards and fraud protection, but maintain sufficient available balance in your checking account to pay the full statement balance each month. This approach maximizes benefits while avoiding interest charges that erode financial progress.

Visual Examples: Understanding Available Balance in Real Banking Scenarios

Seeing actual account layouts helps solidify these concepts.

Bank Account Example

Checking Account – Monday Morning

Current Balance: $2,450.00

Available Balance: $1,825.00

─────────

Difference: $625.00Why the $625 difference?

Pending Transactions:

- Grocery store (Sunday): -$127.43

- Gas station hold: -$100.00

- Restaurant (Saturday): -$67.89

- Online purchase (Friday): -$89.99

- Rent (scheduled for Tuesday): -$1,200.00

Total Pending: -$1,585.31

Check Deposit (on hold):

- Deposited Saturday: +$960.00

- Available: +$0.00 (holds until Wednesday)

Calculation:

$2,450.00 (current) – $625.00 (net pending) = $1,825.00 (available)

Credit Card Example

Credit Card – After Making Payment

Credit Limit: $8,000.00

Current Balance: $2,100.00

Available Credit: $4,900.00

─────────

Payment Made Today: $1,500.00Why isn’t Available Credit $6,400?

The $1,500 payment reduced your current balance immediately, but won’t increase available credit until the payment clears in 3-5 business days.

Timeline:

- Today (Monday): Current Balance drops to $2,100, Available Credit stays at $4,900

- Thursday: Payment clears, Available Credit increases to $6,400

Pending Transactions:

- Online purchase: -$250.00

- Restaurant: -$85.00

- Subscription service: -$15.00

Actual Available Credit: $4,550.00

This demonstrates why monitoring both current balance and available credit prevents overspending and maintains healthy credit utilization ratios.

💰 Available Balance Calculator

Conclusion: Mastering Available Balance for Financial Control

Understanding your available balance transforms from a minor banking detail into a fundamental tool for financial stability and wealth building.

The math is straightforward: Available Balance = Current Balance - Pending Debits - Holds + Available Pending Credits. However, the application requires consistent attention to transaction timing, authorization holds, and processing delays that create gaps between what your account shows and what you can actually spend.

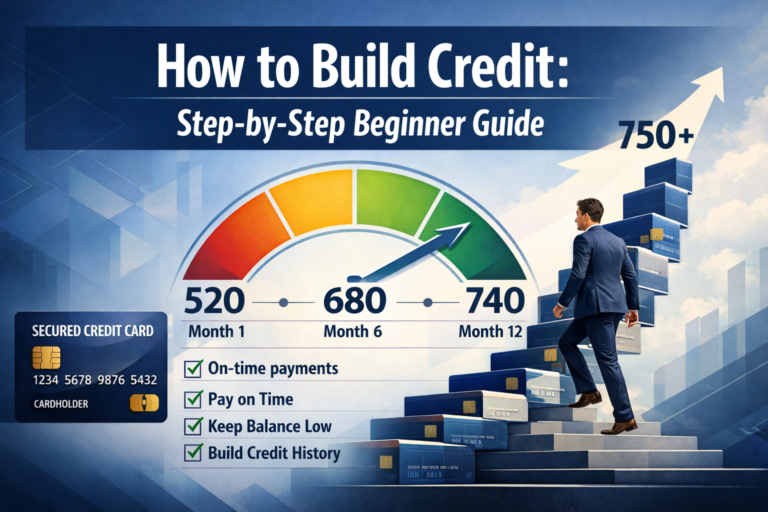

Actionable Next Steps

1. Check Available Balance Before Every Transaction

Make this your default habit. Current balance creates false confidence; available balance shows reality.

2. Maintain a Buffer

Keep at least $100-$200 below your available balance as a safety margin for processing delays and unexpected holds. This buffer prevents overdraft fees that average $33.47 per incident and can cascade into multiple fees.

3. Track Pending Transactions Manually

Use a budgeting app or spreadsheet to monitor pending transactions, especially those scheduled for future dates. This practice reinforces the discipline required for effective cash flow management.

4. Understand Your Bank's Processing Schedule

Learn your bank's cutoff times, business day definitions, and hold policies. This knowledge prevents timing errors that trigger fees.

5. Separate Current and Available for Credit Cards

Remember that credit card payments reduce the current balance immediately, but don't increase available credit for 3-5 business days. Plan large purchases accordingly.

6. Build an Emergency Fund

The ultimate solution to available balance stress is maintaining adequate reserves. Following evidence-based budgeting principles like the 50/30/20 rule creates the financial cushion that makes daily balance monitoring less critical.

The Bigger Picture: Financial Literacy and Wealth Building

Mastering available balance represents one component of comprehensive financial literacy. Understanding how money moves through accounts, when transactions post, and how institutions calculate available funds builds the foundation for more advanced concepts:

- Managing assets and liabilities effectively

- Optimizing credit utilization for credit score improvement

- Implementing systematic budgeting that accounts for cash flow timing

- Building reserves that enable compound growth through investing

The data-driven approach to available balance, treating it as a mathematical certainty rather than an estimate, prevents costly mistakes and creates the mental discipline required for long-term wealth building.

Therefore, available balance monitoring isn't about obsessing over every dollar. It's about developing the systematic thinking and risk management practices that distinguish those who build wealth from those who struggle with basic cash flow management.

Start today: Check your available balance, identify any gaps from your current balance, and understand exactly why those differences exist. This simple practice builds the financial awareness that compounds into lasting financial security.

Educational Disclaimer

This article provides educational information about available balance concepts and banking practices. It does not constitute financial, legal, or professional advice. Banking policies, hold periods, and processing times vary by institution and account type. Always consult your specific bank's terms and conditions, and contact their customer service for account-specific questions. The author and publisher assume no liability for financial decisions made based on this information. Overdraft policies, fee structures, and processing schedules are subject to change. For personalized financial guidance, consult a qualified financial advisor or certified financial planner.

About the Author: Max Fonji

Max Fonji is a data-driven financial educator and the founder of The Rich Guy Math, where he explains the mathematical principles behind wealth building, investing, and financial decision-making. With a background in financial analysis and a passion for evidence-based investing, Max translates complex financial concepts into clear, actionable insights.

His approach combines rigorous quantitative analysis with practical application, helping readers understand not just what financial strategies work, but why they work through mathematical proof and logical reasoning. Max's work focuses on compound growth principles, valuation fundamentals, and risk management strategies that build long-term wealth.

Through The Rich Guy Math, Max has helped thousands of readers develop financial literacy by teaching the cause-and-effect relationships that govern money management. His educational content emphasizes data over emotion, evidence over anecdote, and mathematical certainty over financial marketing hype.

When not analyzing financial data or writing educational content, Max researches market efficiency, studies behavioral finance patterns, and develops frameworks that make sophisticated financial concepts accessible to beginner and intermediate investors.

References

[1] Consumer Financial Protection Bureau. (2021). "Data Point: Overdraft/NSF Revenue in Q4 2019 versus Q4 2020." CFPB Research Report.

[2] Federal Trade Commission. (2022). "Debit Card Holds at Gas Stations and Hotels." Consumer Information, FTC.gov.

[3] Federal Reserve Board. (2023). "Regulation CC: Availability of Funds and Collection of Checks." Federal Reserve Regulatory Guidelines.

[4] Consumer Financial Protection Bureau. (2022). "CFPB Acts to Protect the Public from Unnecessary Overdraft Fees." CFPB Press Release, December 2022.

Frequently Asked Questions About Available Balance

Does available balance mean I can spend it?

No, not always. Available balance shows what the bank believes you can use right now, but pending charges or holds may still settle later. Spending all of it can trigger overdraft fees if additional transactions post afterward.

Why is my available balance lower than my current balance?

Available balance is reduced by:

- pending debit card transactions

- merchant holds

- ATM withdrawals

- unposted fees

Current balance doesn’t subtract these yet, so it’s often higher.

Why is my available balance zero after a payment?

Payments can show as posted, but banks often don’t update available balance until the full transaction clears. This delay is common on weekends and holidays, especially with credit cards.

Do pending transactions affect available balance?

Yes. Pending charges immediately reduce available balance even though they haven’t fully posted yet. When the merchant finalizes the payment, the amount posts to the current balance.

How long does it take for available balance to update?

Most banks update available balance:

- immediately for card swipes

- within minutes to hours for mobile deposits

- next business day for larger deposits

Weekends and holidays can delay updates.

Can available balance increase before current balance?

Yes. When a pending charge is released or reversed, available balance can increase first, while the current balance updates later.

What causes available balance to go negative?

Negative available balance happens when:

- fees or charges exceed what’s available

- overdraft protection covers transactions

- pending transactions settle higher than expected

Do refunds increase available balance?

Yes. Refunds usually increase available balance as soon as the bank receives the authorization. The current balance may update later.

Why did my available balance drop without spending?

Common reasons:

- merchant holds from gas, hotels, or restaurant tips

- monthly fees

- automatic payments

- pending withdrawals

Does available balance include pending deposits?

Some banks include part of a deposit in available balance immediately, but large or risky deposits may be held. The full deposit is released after the hold period.

Does available balance include overdraft?

If you have overdraft protection, your available balance may include a portion of your overdraft limit. You can spend it, but fees may apply.

What is available credit vs available balance?

Available balance applies to bank accounts. Available credit applies to credit cards or lines of credit:

- Balance: cash you can spend

- Credit: borrowing limit you can use