Best ETFs to Buy in 2025 | Top Performing ETFs for Long-Term Wealth

Looking to grow your wealth the smart and simple way in 2025? ETFs (Exchange-Traded Funds) are one of the best tools available for beginner and long-term investors alike. They offer built-in diversification, low fees, and access to entire sectors or markets—all in a single trade.

ETFs, or Exchange-Traded Funds, are one of the easiest ways for beginners to start investing. They offer low fees, built-in diversification, and can be traded like stocks. This beginner’s guide explains what ETFs are, how they work, and why they’re a smart option for long-term investors.

If you’ve heard the term ETF thrown around and wondered what it means, you’re not alone. ETFs—or Exchange-Traded Funds—are one of the easiest, safest, and most effective ways for beginners to start investing.

What Are ETFs and Why Should You Invest in Them?

- ETFs (Exchange-Traded Funds) are baskets of stocks or other assets that trade on an exchange like a stock.

- They offer low fees and built-in diversification, reducing your risk.

- Ideal for beginners looking for simple, hands-off investing.

- Common ETFs include VOO (S&P 500), SCHD (Dividend Stocks), and VTI (Total Market).

- Great for long-term investing and dollar cost averaging strategies.

In this guide, we’ll cover the best ETFs to buy in 2025 based on performance, dividend potential, and long-term reliability.

What Is an ETF?

An ETF (Exchange-Traded Fund) is a type of investment that holds a basket of assets—like stocks, bonds, or commodities. When you buy one share of an ETF, you’re essentially buying tiny pieces of all the assets it holds. Think of it like a fruit basket: instead of buying a single apple (individual stock), you get apples, oranges, bananas, and grapes in one go.

How ETFs Work

- ETFs trade on the stock market, just like individual stocks (you can buy and sell them anytime the market is open).

- Each ETF tracks a specific index, sector, or strategy. For example:

- VOO tracks the S&P 500

- VTI tracks the total U.S. stock market

- SCHD focuses on dividend-paying stocks

- They offer instant diversification at a low cost.

Why ETFs Are Great for Beginners

- Diversification Without the Stress

- Buying one ETF like VTI spreads your money across thousands of companies.

- This reduces your risk compared to picking individual stocks.

- Low Fees

- ETFs are passively managed, which means they have very low expense ratios (often under 0.10%).

- You keep more of your profits over time.

- Easy to Buy and Sell

- You can buy ETFs through any brokerage app, like Robinhood, Fidelity, or Vanguard.

- They’re liquid, flexible, and beginner-friendly.

- Perfect for Long-Term Investing

- ETFs are ideal for building wealth slowly over time.

- Just set up automatic investments and let compound interest do the work.

How to Buy Your First ETF

- Open a brokerage account (Robinhood, Fidelity, Vanguard, etc.)

- Deposit money into your account.

- Search for an ETF (like VTI, SCHD, or QQQ)

- Buy as little as one share (or even fractional shares)

- Hold long-term and invest regularly

What Makes an ETF “The Best” to Buy?

Before diving into the list, here’s what we look for:

✅ Strong historical performance

✅ Low expense ratios

✅ Broad market exposure or strategic focus

✅ High assets under management (AUM)

✅ Consistent dividend payouts (if income-focused)

✅ Alignment with long-term trends (tech, healthcare, etc.)

Best ETFs to Buy in 2025

1. Vanguard Total Stock Market ETF (VTI)

Why It’s a Buy: VTI gives you exposure to thousands of U.S. companies—large, mid, and small-cap. It’s the ultimate “set-it-and-forget-it” ETF for long-term growth.

📌 Perfect for: Beginners and broad diversification

Focus: Entire U.S. stock market

Expense Ratio: 0.03%

Dividend Yield: ~1.5%

2. Schwab U.S. Dividend Equity ETF (SCHD)

- Focus: High-quality U.S. dividend-paying stocks

- Expense Ratio: 0.06%

- Dividend Yield: ~3.5%

- Why It’s a Buy: SCHD focuses on strong companies with consistent dividends. It’s great for passive income and capital appreciation.

📌 Perfect for: Dividend investors

3. Invesco QQQ Trust (QQQ)

- Focus: Nasdaq-100 tech-heavy index

- Expense Ratio: 0.20%

- Dividend Yield: ~0.7%

- Why It’s a Buy: QQQ gives you access to tech giants like Apple, Microsoft, and Nvidia. Despite volatility, it’s delivered strong long-term gains.

📌 Perfect for: Growth-focused investors

4. Vanguard S&P 500 ETF (VOO)

- Focus: S&P 500 Index (top 500 U.S. companies)

- Expense Ratio: 0.03%

- Dividend Yield: ~1.6%

- Why It’s a Buy: Tracks the most important index in the U.S. economy. Offers stable, long-term exposure to industry leaders.

📌 Perfect for: Core portfolio holdings

5. iShares MSCI ACWI ETF (ACWI)

- Focus: Global stocks (U.S. + international)

- Expense Ratio: 0.32%

- Dividend Yield: ~1.9%

- Why It’s a Buy: ACWI includes more than 2,000 stocks across developed and emerging markets—giving you full global exposure.

📌 Perfect for: Diversified international investing

6. Vanguard Real Estate ETF (VNQ)

- Focus: U.S. Real Estate Investment Trusts (REITs)

- Expense Ratio: 0.12%

- Dividend Yield: ~4%

- Why It’s a Buy: VNQ gives you access to top REITs and income-producing real estate. A solid hedge and income source in any portfolio.

📌 Perfect for: Passive income through real estate

7. iShares U.S. Healthcare ETF (IYH)

- Focus: U.S. healthcare sector

- Expense Ratio: 0.39%

- Dividend Yield: ~1.2%

- Why It’s a Buy: Healthcare is a resilient, growing sector fueled by aging populations and medical innovation.

📌 Perfect for: Defensive growth investing

How to Choose the Right ETF

When picking the best ETFs for your portfolio, ask:

- Do I want income, growth, or both?

- Am I focused on the U.S. market or globally?

- Do I want to minimize fees?

- Am I investing passively for the long term?

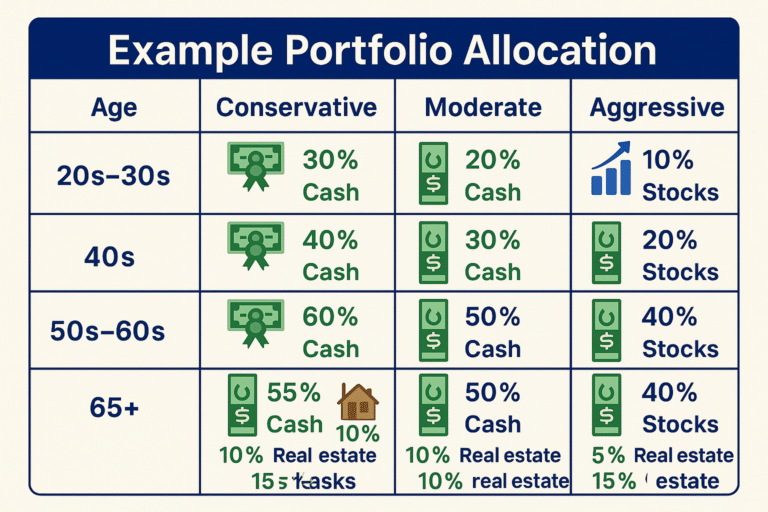

Use ETFs to match your risk tolerance, time horizon, and financial goals.

Sample Beginner Portfolio (2025)

| Investment Type | ETF | Allocation |

|---|---|---|

| U.S. Broad Market | VTI | 40% |

| S&P 500 | VOO | 20% |

| Dividend Income | SCHD | 20% |

| Tech Growth | QQQ | 10% |

| Real Estate | VNQ | 10% |

You can adjust this based on your goals and risk tolerance.

Benefits of Investing in ETFs

- Diversification: Own dozens or even hundreds of stocks with one investment.

- Low Cost: Most ETFs have very low expense ratios, often less than 0.10%.

- Liquidity: Buy and sell them easily during market hours.

- Transparency: You can see exactly what assets the ETF holds.

- Tax Efficiency: ETFs tend to be more tax-efficient than mutual funds.

Pro Tip: Dollar-Cost Averaging

Instead of trying to time the market, invest a fixed amount into your ETF every month. This strategy is called dollar-cost averaging, and it helps smooth out the ups and downs of the market.

Final Thoughts: ETFs Are Your Best First Investment

ETFs are simple, diversified, and designed to grow with the market. You don’t need to be a stock-picking genius to succeed—just choose a solid ETF, stay consistent, and think long-term. Want to build a strong portfolio from scratch? Start with ETFs. It’s the smartest first step toward financial freedom.

The best ETFs to buy in 2025 offer simple, cost-effective access to powerful sectors of the market. Whether you’re looking for growth, dividends, or global exposure, ETFs like VTI, SCHD, and QQQ are solid picks to build wealth passively.

Start small, invest consistently, and let compounding work in your favor.

Related Blog Posts

- 🔗 ETFs vs. Individual Stocks: Which Is Better for Beginners?

- 🔗 How to Start Investing with Just $100 in 2025

- 🔗 The $50/Month Investment Plan That Builds Wealth

- 🔗 What Are Dividend Stocks and Why They Matter

🔗 External Links:

An ETF is a collection of assets that you can trade like a stock. It provides exposure to various sectors or markets in one investment.

Yes, ETFs are perfect for beginners due to their low costs and built-in diversification.

ETFs trade like stocks and usually have lower fees. Mutual funds are traded once per day and may charge more.

Popular options include VOO (S&P 500), SCHD (dividends), and VTI (total market).