What Are Index Funds and Why Are They the Best Way to Invest?

Index funds are low-cost investment vehicles that track a specific market index—like the S&P 500, Dow Jones, or Total Stock Market. Instead of trying to pick winning stocks, investors buy index funds to get broad market exposure, diversification, and steady long-term returns.

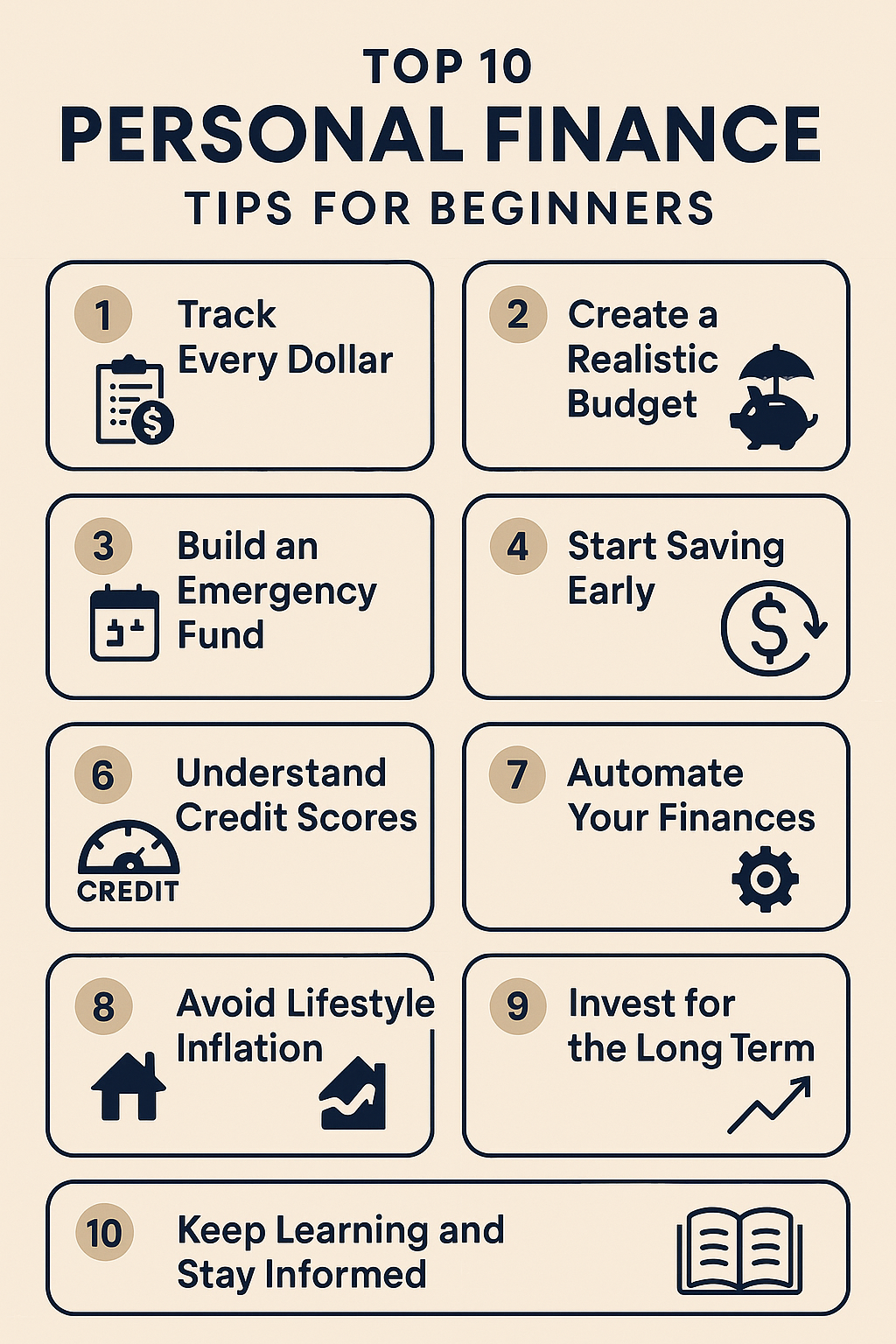

Why Index Funds Are Ideal for Beginners:

- ✅ Minimal fees (some as low as 0%)

- ✅ Instant diversification

- ✅ Passive investing (no need to manage actively)

- ✅ Consistent returns that match market performance

Legendary investor Warren Buffett has said that most people are better off investing in a low-cost S&P 500 index fund than trying to pick individual stocks.

Top 5 Best Index Funds to Buy in 2025

Below are the best index funds in 2025 based on performance, fees, and long-term growth potential. Whether you’re a new investor or looking to strengthen your portfolio, these are solid picks.

1. Vanguard S&P 500 ETF (VOO)

Keyphrase Focus: Best S&P 500 index fund

- Ticker: VOO

- Expense Ratio: 0.03%

- Assets Under Management: $1 trillion+

- Tracks: S&P 500 Index

Why It’s a Top Pick:

VOO is one of the most popular and best-performing index funds that tracks the 500 largest U.S. companies, including Apple, Microsoft, and Amazon. It’s ideal for investors who want to mirror the performance of the U.S. economy with low cost and high liquidity.

Perfect For:

Long-term investors who want stable, consistent growth.

2. Vanguard Total Stock Market ETF (VTI)

Keyphrase Focus: Best total stock market index fund

- Ticker: VTI

- Expense Ratio: 0.03%

- Tracks: CRSP U.S. Total Market Index

Why It’s a Top Pick:

VTI offers exposure to the entire U.S. stock market, including small-, mid-, and large-cap stocks. This makes it one of the most diversified index funds available, with over 4,000 holdings.

Perfect For:

Investors seeking maximum diversification in a single fund.

3. Schwab U.S. Dividend Equity ETF (SCHD)

Keyphrase Focus: Best dividend index fund

- Ticker: SCHD

- Expense Ratio: 0.06%

- Dividend Yield (2025): ~3.6%

- Tracks: Dow Jones U.S. Dividend 100 Index

Why It’s a Top Pick:

SCHD focuses on high-quality dividend-paying companies with a consistent track record of strong fundamentals and cash flow. It’s one of the best index funds for those who want growth plus income.

Perfect For:

Investors who want passive income through dividends while enjoying stock market growth.

4. Fidelity ZERO Total Market Index Fund (FZROX)

Keyphrase Focus: Best zero-fee index fund

- Type: Mutual Fund

- Expense Ratio: 0.00%

- Tracks: Fidelity U.S. Total Investable Market Index

Why It’s a Top Pick:

FZROX has no management fees, making it perfect for cost-conscious investors. It covers the entire U.S. stock market like VTI, but is only available through Fidelity.

Perfect For:

Long-term investors who want zero-cost exposure to U.S. equities.

5. iShares Core S&P 500 ETF (IVV)

Keyphrase Focus: Best low-cost index fund alternative to VOO

- Ticker: IVV

- Expense Ratio: 0.03%

- Tracks: S&P 500 Index

Why It’s a Top Pick:

IVV is nearly identical to VOO in holdings and performance but may offer better tax efficiency for some investors. It’s a great S&P 500 fund if you prefer iShares over Vanguard.

Perfect For:

Investors comparing alternatives to VOO or who use BlackRock platforms.

How to Choose the Best Index Funds for Your Portfolio

| Investment Goal | Recommended Fund |

|---|---|

| Long-term growth (S&P 500) | VOO or IVV |

| Maximum diversification | VTI or FZROX |

| Income from dividends | SCHD |

| Ultra-low fees | FZROX (Fidelity only) |

| Simple buy-and-hold strategy | VTI or VOO |

Tips:

- Start with one or two index funds and invest consistently each month.

- Reinvest dividends to maximize compounding.

- Use Dollar Cost Averaging to smooth out market volatility.

How to Start Investing in Index Funds as a Beginner

- Open a brokerage account (Fidelity, Vanguard, Schwab, or Robinhood)

- Deposit funds (you can start with $50–$100)

- Search for the ticker symbol (e.g., VTI or SCHD)

- Buy shares or fractional shares

- Set up automatic monthly investments

You don’t need thousands of dollars to start investing in the best index funds. Starting small and being consistent is what matters most.

Benefits of Index Funds

✅ 1. Low Cost

Keyphrase Focus: low-cost investing

One of the biggest advantages of index funds is their low expense ratios—some as low as 0.03%, or even 0% (like Fidelity’s ZERO funds). That means more of your money stays invested and compounds over time.

💡 Example: Vanguard’s VOO has an expense ratio of just 0.03%.

✅ 2. Instant Diversification

Keyphrase Focus: diversified investment strategy

A single index fund can hold hundreds or thousands of stocks, reducing your exposure to any one company. This helps protect you from market volatility.

📈 For example, VTI holds over 4,000 companies across all sectors.

✅ 3. Strong Long-Term Returns

Index funds mirror market performance, which historically delivers 7–10% annual returns. You may not beat the market, but you won’t lag behind either.

📊 Long-term investors in S&P 500 index funds have built millions through compound growth.

✅ 4. Lower Risk Than Stock Picking

Picking individual stocks is risky—even pros underperform the market. Index funds eliminate guesswork and offer broad market exposure.

🔍 According to SPIVA, over 85% of active fund managers underperform the S&P 500 over 10 years.

✅ 5. No Need to Time the Market

With index funds, you don’t have to worry about buying at the perfect time. Use a dollar-cost averaging strategy to invest consistently.

💵 Learn more in our guide: Dollar Cost Averaging: A Smart Way to Start Investing

✅ 6. Automatic Rebalancing

Index funds automatically adjust their holdings to stay aligned with the index they track. That means less effort for you and more time for long-term compounding.

🔄 No need to manually buy or sell to rebalance.

✅ 7. Tax Efficiency

Keyphrase Focus: tax-efficient investing

ETFs like VTI and VOO are highly tax-efficient due to their structure. They often trigger fewer taxable events than actively managed funds.

💡 Tip: Hold index funds in a Roth IRA or traditional IRA for even greater tax advantages.

✅ 8. Simple and Transparent

Index funds are easy to understand. You know exactly what you’re buying and why. The holdings are published and updated regularly.

📝 No hidden strategies or risky trades behind the scenes.

✅ 9. Perfect for Passive Investing

If you don’t want to monitor the market every day, index funds are ideal. Just buy, hold, and chill.

🔐 “The best investment strategy is one you can stick with.” – John Bogle, founder of Vanguard

✅ 10. Backed by Financial Experts

Keyphrase Focus: Warren Buffett index fund advice

Warren Buffett recommends index funds for most investors. In fact, he’s said he wants 90% of his estate in a low-cost S&P 500 fund.

💬 “A low-cost S&P 500 index fund is the best investment most people can make.” — Warren Buffett

Final Thoughts: Are Index Funds Right for You?

If you want:

- ✅ Low fees

- ✅ Long-term growth

- ✅ Less risk

- ✅ Set-it-and-forget-it simplicity

… then index funds are perfect for your financial goals. Whether you’re saving for retirement, a house, or long-term wealth, they offer one of the smartest paths to success.

Related Articles on The Rich Guy Math

- ETFs vs. Individual Stocks: Which Is Better for Beginners?

- The $50/Month Investment Plan That Builds Wealth

- How to Start Investing with Just $100

- Why Index Funds Beat Stock Picking

About the Author

Max Fonji is the founder of The Rich Guy Math, a financial blog focused on helping beginners understand investing, passive income, and wealth building. With a background in financial education and a passion for simplifying complex ideas, Max makes it easy to take control of your financial future.

The S&P 500 (like VOO or IVV) are considered safe due to their historical performance and diversification among large-cap U.S. companies.

A common strategy is to invest 70–80% of your portfolio in index funds and the rest in bonds, cash, or dividend stocks depending on your age and goals.

Yes. Index funds often recover faster than individual stocks and offer long-term growth once the economy rebounds.

ETFs like VTI and VOO are more flexible, lower cost, and easy to trade. Mutual funds like FZROX are good for long-term, no-fee investing.