Bookkeeping vs Accounting: Bookkeeping is the systematic recording of your daily transactions; accounting uses those records to prepare reports, file taxes, and give you strategic financial advice. If you’re a small business owner deciding which service to hire (or whether both are necessary), this guide walks you through what each role does, costs, software choices, and exactly when to call in an accountant. QuickBooks

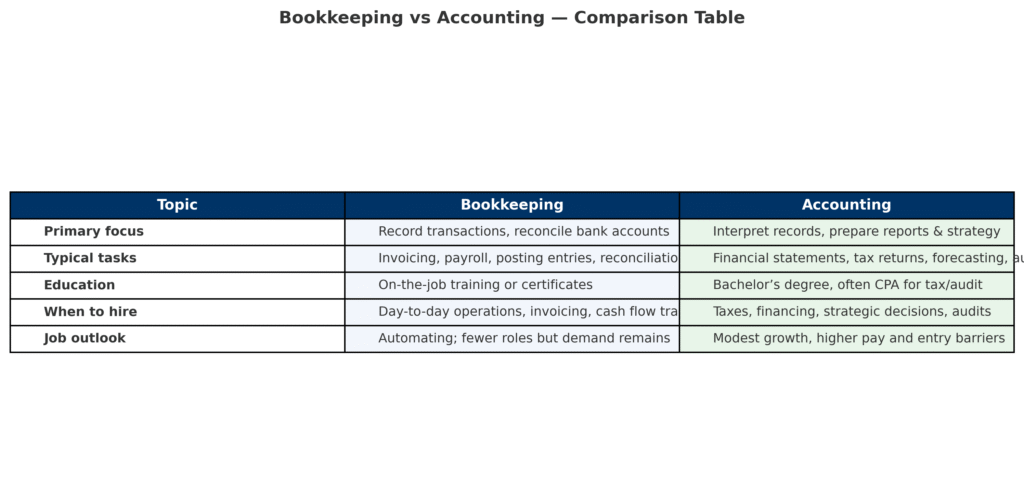

Bookkeeping vs Accounting: comparison at a glance

| Topic | Bookkeeping | Accounting |

|---|---|---|

| Primary focus | Record transactions, reconcile bank accounts | Interpret records, prepare financial statements, tax & strategy |

| Typical tasks | Invoicing, payroll, bank reconciliations, posting entries | P&L/Balance Sheet prep, tax returns, forecasts, audits |

| Education | On-the-job / certificates | Bachelor’s degree often + CPA for tax/audit |

| When to hire | Daily operations, cash flow, invoicing | Yearly taxes, financing, strategic decisions |

| Job outlook | Automating; fewer roles but steady demand for skilled operators. (BLS) | Modest growth; higher barriers & pay. (BLS) Bureau of Labor |

What Bookkeeping Actually Does

Bookkeepers keep the books accurate and current. Typical month-to-month tasks:

- Record sales, purchases, receipts, and payments.

- Reconcile bank and credit-card statements.

- Post journal entries and maintain the general ledger.

- Prepare basic reports (trial balance, preliminary P&L).

- Run payroll (sometimes) and manage invoicing.

Practical example: a coffee shop bookkeeper posts daily sales, reconciles the register to deposits weekly, and flags missing invoices at the month’s end. Bench

What Accountants Do And why They Cost More

Accountants take bookkeeping outputs and transform them into decisions:

- Close the books and prepare GAAP-style financial statements.

- Prepare tax returns and tax planning.

- Perform accrual adjustments, depreciation schedules, and account analyses.

- Audit support, investor reporting, and financial forecasting.

Accountants generally require more formal education; CPAs and experienced accountants command higher fees but provide compliance and strategy value. Investopedia

Who Needs Which (A Simple Decision Flow)

- You run a small solo biz with few monthly transactions → start with a bookkeeper (or DIY with software).

- Your biz has growing complexity (inventory, payroll, multiple revenue streams) → keep a bookkeeper for daily ops + hire an accountant for month-end and taxes.

- You’re raising capital, selling the business, or need audited statements → accountants (and auditors) are essential.

Mini case study: Micro retail: Owner A outsourced bookkeeping (monthly reconciliation + invoices). In year 2, an accountant prepared a clean P&L that helped secure a $25k loan, proving ROI on the accountant’s fee.

Bookkeeping vs Accounting: Costs & Pricing

- Bookkeepers (US, outsourced): hourly $30–$90; fixed monthly packages $200–$1,500 depending on transaction volume.

- Accountants / CPA: hourly $100–$400+ for advisory and tax prep; engagements for audits or complex tax work are higher.

(Use these bands when creating pricing pages or estimating hire costs.) For job-market context and pay ranges, see Investopedia and BLS data. Investopedia

Software & automation: who wins what?

- Automation removes routine posting, bank rules, and transaction classification. That affects bookkeepers more than accountants.

- Accountants are still needed for judgment calls, tax strategy, accruals, and audit responses.

Bookkeeping vs Accounting: Common Software

| Software | Bookkeeping Features | Accounting Features |

|---|---|---|

| QuickBooks | Bank feed, Invoices, Payroll, Expense tracking | Accrual reporting, Closing entries, Tax prep, Forecasts |

| Xero | Bank feed, Invoices, Expense claims, Payroll | Accrual reporting, Financial statements, Tax prep |

| Bench | Bank feed, Invoices, Reconciliation, Receipt capture | Financial reports, Tax filings, Strategic insights |

Legal: records & retention (must-know)

Keep business records per IRS guidance generally 3 years, but up to 6–7 years in some situations (e.g., underreported income); employment tax records at least 4 years. Retain asset & property documentation while you own the asset + after its sale. See IRS recordkeeping guidance for details. IRS

For corporate/public filers, SEC guidance explains how financial statements and disclosure rules apply if you scale or pursue investor financing. SEC

How to run a monthly close (simple checklist)

- Import and categorize all bank/CC transactions.

- Reconcile bank & credit-card statements.

- Post recurring entries (rent, subscriptions).

- Review A/R and A/P; follow up on overdue invoices.

- Produce a draft P&L and balance sheet; flag anomalies.

- Send to your accountant if needed for adjustments & tax planning.

Yes, for small businesses, but watch for conflicts and skill limits. If tax filings or audits are complex, separate a certified accountant for year-end and advisory. Investopedia

Unusual one-offs: owner draws, adjusting entries, fraud investigations, and complex accruals; these need human review.

Digital copies are acceptable if legible and backed up; keep per IRS timelines (3–7 years depending on situation). IRS

Cash balance, net income, accounts receivable days, accounts payable days, gross margin, tracked in the P&L, and a 1-page dashboard.

Randomly sample 10 transactions, match to receipts and bank statements, and check reconciliation dates. If >1 error per 10, escalate.

No. Software reduces grunt work, but CPAs still provide compliance, interpretation, and strategic advice, especially for taxes and audits. QuickBooks

Download the free Monthly Close Checklist + Sample P&L

Use it in your first month to spot where a bookkeeper or accountant would save you time and money.

Final Thought on Bookkeeping vs Accounting

- Bookkeeping vs accounting isn’t just semantics; one handles daily transaction records, the other interprets them for taxes, audits, and strategy.

- Small businesses benefit from both: bookkeeping keeps your books accurate, and accounting ensures compliance and strategic decisions.

- Automation changes the game, but accountants are still critical for judgment calls, tax planning, accruals, and audit responses.

Disclaimer: This article provides general educational information and should not be taken as legal, tax, or accounting advice. For specific tax, audit, or legal questions, consult a licensed CPA or attorney.

Author bio

Max Fonji is the Founder & Editor at TheRichGuyMath.com. I write practical, beginner-friendly guides that help small business owners make smarter finance and hiring decisions.