Capital Allocation is the process by which a company strategically distributes its financial resources to maximize long-term value. It balances growth opportunities, shareholder returns, and risk management. How a company allocates its cash flow, whether reinvesting in operations, paying down debt, or returning money to investors, can determine its success or failure. Investopedia – Capital Allocation

TL;DR (Too Long; Didn’t Read)

- Capital allocation determines how companies use cash to grow and reward shareholders.

- Key strategies: reinvesting in core business, M&A, dividends, stock buybacks, and balance sheet strengthening.

- Decision factors include company stage, market conditions, and shareholder expectations.

- Diversifying approaches and monitoring ROI ensures long-term sustainable growth.

- Always align allocation with strategic goals and maintain financial health.

What is Capital Allocation?

Capital allocation is the process of distributing a company’s financial resources to generate sustainable growth and shareholder value. Companies that allocate capital wisely avoid wasteful spending while investing in initiatives that provide strong returns. Effective capital allocation also maintains financial stability and balances risk.

Example: Apple has historically allocated capital through a mix of reinvestment, dividends, and stock buybacks, which has supported consistent growth and shareholder value.

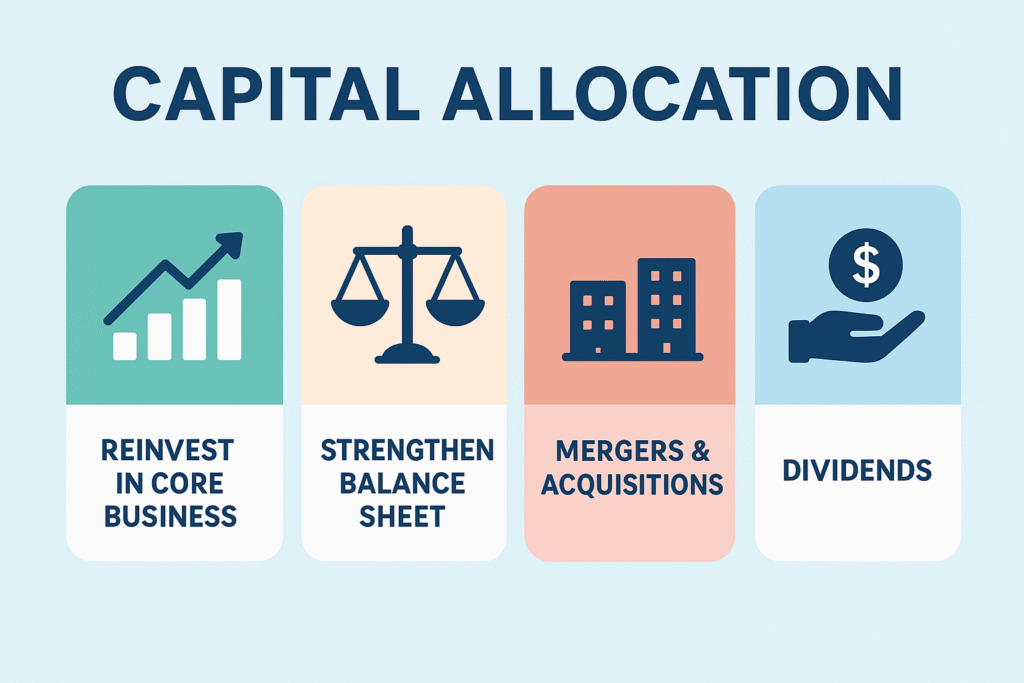

Key Capital Allocation Strategies

1. Reinvest in Core Business

- Pros: Spurs growth, fuels innovation, strengthens competitive positioning.

- Cons: Risk of low ROI if investments are poorly executed.

- Example: Amazon reinvests heavily in logistics and technology to expand market share.

2. Strengthen the Balance Sheet

- Pros: Reduces debt, lowers interest expenses, improves credit ratings.

- Cons: Overly conservative allocation may miss high-return opportunities.

- Example: Microsoft used cash reserves to pay down debt, improving financial flexibility.

3. Mergers & Acquisitions (M&A)

- Pros: Enables rapid expansion, operational synergies, and market entry.

- Cons: High costs, integration challenges, and cultural risks.

- Example: Facebook’s acquisition of Instagram accelerated user growth and revenue.

4. Dividends

- Pros: Provides direct returns to shareholders and signals financial health.

- Cons: Reduces funds available for reinvestment.

- Example: Coca-Cola pays steady dividends to maintain investor confidence.

5. Stock Buybacks

- Pros: Boosts share price, increases earnings per share, demonstrates confidence in growth.

- Cons: Reduces cash for other uses; poor timing can destroy value.

- Example: Apple’s buybacks increased shareholder wealth while maintaining strategic investments.

Morningstar – Investment Strategies

How Companies Decide on Capital Allocation

Decisions depend on:

- Growth Stage: Startups prioritize reinvestment; mature firms may favor dividends or buybacks.

- Market Conditions: Economic downturns may prompt balance sheet strengthening.

- Shareholder Expectations: Some investors prefer steady dividends, others prefer long-term growth.

Pro Tip: Companies should monitor ROI for each allocation method and adjust strategies over time. SEC – Financial Reporting Guidelines

Best Practices for Effective Capital Allocation

- Diversify Approaches: Avoid relying on a single strategy.

- Align with Company Vision: Ensure spending supports strategic goals.

- Monitor ROI: Continuously evaluate outcomes and adapt.

- Communicate Clearly: Share allocation rationale with investors to maintain trust.

Dividend Strategies for Long-Term Growth

It ensures a company’s cash is used effectively to maximize growth and shareholder value.

Reinvestment, balance sheet strengthening, M&A, dividends, and stock buybacks.

They consider growth opportunities, financial health, market conditions, and shareholder expectations.

There’s no one-size-fits-all; startups may allocate 70% to reinvestment, while mature firms may split evenly between dividends and buybacks.

Yes, excessive buybacks can deplete cash reserves and hinder long-term growth.

Final Thoughts on Capital Allocation

Smart capital allocation isn’t about choosing one strategy over another; it’s about balance. Companies that reinvest in growth while maintaining financial health and rewarding shareholders tend to build sustainable value over time.

Want actionable finance insights? Subscribe to TheRichGuyMath.com/newsletter for weekly tips on capital allocation, investing, and wealth-building strategies.