Saving Money: Strategies, Accounts, and Long-Term Financial Stability

Building wealth begins with a simple but powerful habit: saving money consistently. Most people understand they should save, but few grasp…

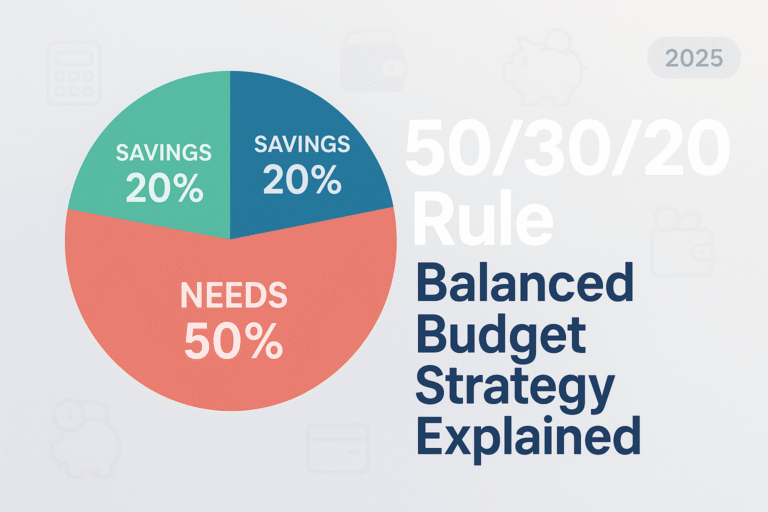

Personal finance is the day-to-day management of your money. It includes budgeting, saving, expenses, and planning for expected and unexpected costs. Most financial stress comes from a lack of structure rather than a lack of income.

This section focuses on building a stable financial foundation. You’ll learn how to create a budget, track spending, build an emergency fund, and plan for recurring expenses. The goal is to help you control cash flow so you know where your money goes each month.

Strong personal finance habits make every other financial decision easier. When your spending and saving are organized, credit becomes manageable, and investing becomes possible.

Building wealth begins with a simple but powerful habit: saving money consistently. Most people understand they should save, but few grasp…

← Back to Budgeting and Saving Picture this: you just got paid, and within days, your bank account looks like a…

← Back to Budgeting and Saving Picture this: it’s the middle of the month, your bank account is running on fumes,…

← Back to Budgeting and Saving Picture this: Your car breaks down on a Tuesday morning, and the repair bill is…

Imagine waking up tomorrow morning to find money in your bank account—money you didn’t have to clock in for, didn’t have…

Picture this: Two coffee shops sit side by side on the same street. Both generate $500,000 in annual sales. Yet one…

Rule of 70 is a quick mental shortcut: years to double ≈ 70 ÷ growth rate (%). Use it to estimate…

Every successful investor knows that most of a company’s value doesn’t come from the next quarter or even the next year….

The 2026 max 401k contribution limit is $23,500 for employee deferrals, with an additional $7,500 catch-up contribution allowed for individuals age…