Best Credit Cards For Beginners (2026 Guide)

A “beginner” in the credit card world typically means someone with limited or no credit history, or someone new to managing…

Personal finance is the day-to-day management of your money. It includes budgeting, saving, expenses, and planning for expected and unexpected costs. Most financial stress comes from a lack of structure rather than a lack of income.

This section focuses on building a stable financial foundation. You’ll learn how to create a budget, track spending, build an emergency fund, and plan for recurring expenses. The goal is to help you control cash flow so you know where your money goes each month.

Strong personal finance habits make every other financial decision easier. When your spending and saving are organized, credit becomes manageable, and investing becomes possible.

A “beginner” in the credit card world typically means someone with limited or no credit history, or someone new to managing…

Understanding the fundamental differences between secured vs unsecured credit cards can determine whether someone builds credit successfully or faces unnecessary financial…

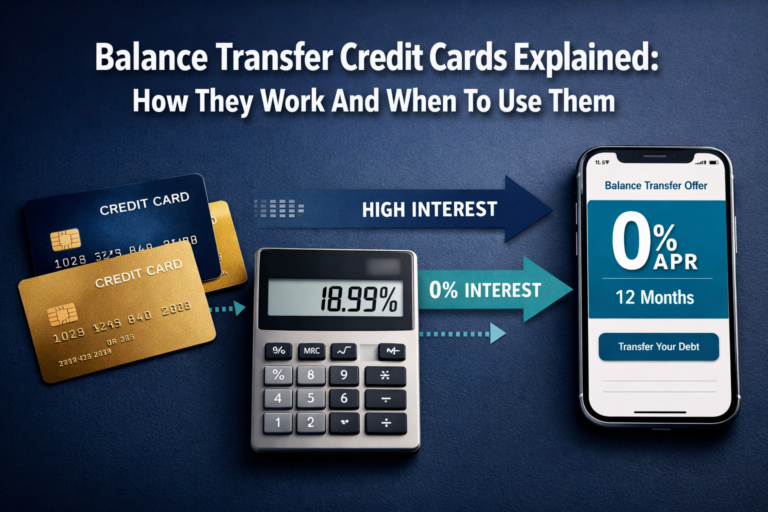

Balance transfer credit cards represent one of the most mathematically advantageous tools for eliminating high-interest debt, when used correctly. These specialized…

Credit card APR is one of the most important numbers on your statement, yet most cardholders don’t understand how it actually…

Credit cards are one of the most powerful financial tools available in 2026, but only when you understand the math behind…

Money doesn’t just sit still. When properly positioned, it grows sometimes slowly, sometimes exponentially. The difference between modest growth and life-changing…

Capital Gains Tax is the tax you pay on profits earned from selling investments or assets for more than you paid….

The 3x rent rule is a housing affordability guideline stating that your monthly gross income should be at least three times…

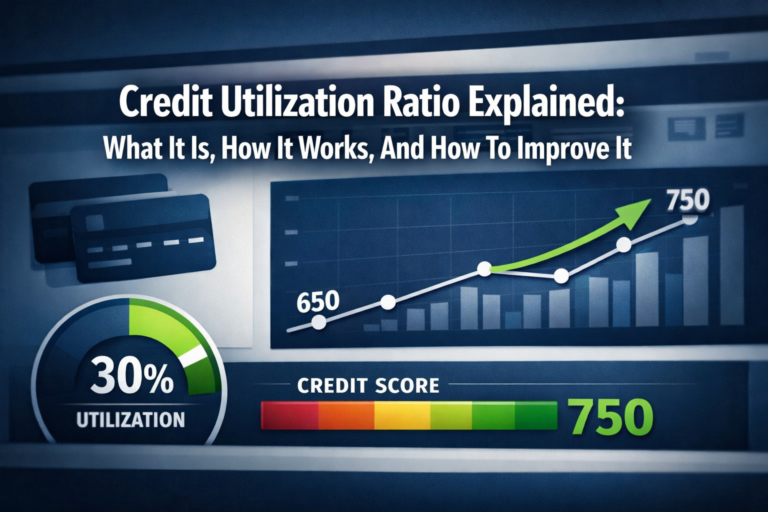

Credit utilization is the percentage of your available credit that you are currently using. It is calculated by dividing your credit…