Your credit score is a three-digit number that determines whether you qualify for a mortgage, the interest rate you pay on a car loan, and sometimes even whether you get hired for a job.

Yet most people don’t understand how it’s calculated, what affects it, or how to improve it strategically.

This guide breaks down the math behind credit scores, explains the exact factors that move your number up or down, and provides a data-driven roadmap to build excellent credit, whether you’re starting from scratch or rebuilding after financial setbacks.

You’ll learn what lenders see when they evaluate you, which behaviors hurt your score (even when they seem logical), and the precise steps that generate measurable improvement in 30, 60, and 90 days.

This guide is for:

- Beginners who need to understand credit fundamentals

- Anyone denied credit or offered unfavorable terms

- Students building credit for the first time

- People recovering from late payments or high utilization

- Anyone seeking better loan rates and financial opportunities

Key Takeaways

- Credit scores range from 300 to 850, with scores above 740 unlocking the best interest rates and loan terms

- Payment history (35%) and credit utilization (30%) account for nearly two-thirds of your score—making on-time payments and keeping balances low are the highest-impact actions

- Checking your own credit never hurts your score—only hard inquiries from lenders applying for new credit affect your number

- Strategic improvements show results in 30-90 days when you focus on utilization reduction, payment consistency, and error correction

- Income doesn’t directly affect credit scores—a high earner with maxed-out cards scores lower than a modest earner with low utilization and perfect payment history

What Is a Credit Score? (Plain English Definition)

A credit score is a numerical representation of your creditworthiness—your likelihood of repaying borrowed money on time.

Lenders, landlords, insurers, and employers use this three-digit number to assess financial risk. The higher your score, the lower the perceived risk, and the better the terms you receive.

Credit Score Definition (Beginner)

Think of your credit score as a financial report card that grades your borrowing behavior.

Instead of measuring academic performance, it measures:

- Whether you pay bills on time

- How much debt do you carry relative to your limits

- How long have you managed credit responsibly

- The variety of credit types you handle

- How often do you apply for new credit

The score translates complex financial behavior into a simple number that lenders can evaluate in seconds.

What a Credit Score Measures

Credit scores quantify default risk—the probability you’ll fail to repay a loan.

Scoring models analyze patterns in your credit history to predict future behavior. Research shows a strong correlation between past payment patterns and future defaults[1].

The core question lenders ask: If we extend $10,000 in credit, what’s the mathematical probability this person will repay it according to terms?

Your score answers that question using statistical modeling based on millions of consumer credit files.

Who Uses Your Credit Score

Credit scores influence more financial decisions than most people realize:

Lenders (banks, credit unions, online lenders)

- Determine approval for credit cards, mortgages, auto loans, and personal loans

- Set interest rates and credit limits

- Decide whether to require cosigners or collateral

Landlords

- Evaluate rental applications

- Determine security deposit amounts

- Assess the likelihood of on-time rent payments

Insurance companies

- Calculate premiums for auto and home insurance

- Use credit-based insurance scores (separate but related)

Employers (in some states)

- Screen candidates for positions involving financial responsibility

- Assess trustworthiness for security clearances

Utility providers

- Decide whether to require deposits for service activation

- Set deposit amounts for electricity, gas, water, and internet

Takeaway: Your credit score functions as a universal financial passport that opens or closes doors across multiple life domains.

How Credit Scores Work (Step-by-Step)

Understanding the mechanics behind credit scoring helps you make strategic decisions that improve your score.

Credit Reports vs Credit Scores

These terms are often confused but represent different things:

Credit report = Your complete financial history

- Lists all credit accounts (cards, loans, mortgages)

- Shows payment history for each account

- Records public information (bankruptcies, liens, judgments)

- Displays credit inquiries from lenders

- Contains personal information (name, addresses, employment)

Credit score = A calculated number derived from your report

- Uses algorithms to analyze report data

- Produces a three-digit number (300-850 range)

- Changes as report information updates

- Different scoring models produce different numbers

Analogy: Your credit report is the raw data; your credit score is the summary grade.

The Role of Credit Bureaus (Experian, Equifax, TransUnion)

Three major credit bureaus collect and maintain credit information:

Experian, Equifax, and TransUnion each:

- Gather data from lenders, creditors, and public records

- Compile individual credit reports

- Sell reports and scores to lenders

- Update files as new information arrives

Why do you have three different scores:

Not all lenders report to all three bureaus. Your Experian report might show different accounts than your TransUnion report, producing different scores.

A mortgage lender might pull all three reports and use the middle score for lending decisions. A credit card issuer might check only one bureau.

Data accuracy matters: Errors on one bureau’s report won’t appear on the others, which is why checking all three reports annually is critical for maintaining financial health.

FICO vs VantageScore (Comparison)

Two primary scoring models dominate the industry:

| Feature | FICO Score | VantageScore |

|---|---|---|

| Score Range | 300-850 | 300-850 |

| Market Share | ~90% of lending decisions | Growing adoption |

| Versions | Multiple (FICO 8, 9, 10) | Currently VantageScore 4.0 |

| Credit History Required | 6 months | 1 month |

| Payment History Weight | 35% | Extremely influential |

| Utilization Weight | 30% | Highly influential |

| Scoring Differences | Industry-specific versions (auto, mortgage) | Consistent across industries |

FICO Score (Fair Isaac Corporation)

- Created in 1989, the industry standard

- Lenders use FICO for 90% of credit decisions[2]

- Different FICO versions for different loan types

- Auto lenders use FICO Auto Score

- Mortgage lenders use older FICO versions (2, 4, 5)

VantageScore (Created by the three bureaus)

- Launched in 2006 as an alternative to FICO

- More consistent scoring across bureaus

- Faster to generate scores for thin credit files

- Used by many credit monitoring services

Takeaway: When a lender checks your credit, they’re likely using a FICO score. When you check your own score through free monitoring tools, you might see VantageScore.

Both use similar factors and ranges, so improvement strategies work for both models.

Why Credit Scores Matter in Everyday Life

Credit scores directly impact your cost of borrowing and access to financial opportunities.

Interest rate example:

A borrower with a 760 credit score gets a 30-year mortgage at 6.5% interest.

A borrower with a 640 credit score gets the same mortgage at 8.0% interest.

On a $300,000 loan:

- 760 score: Monthly payment = $1,896 | Total interest = $382,633

- 640 score: Monthly payment = $2,201 | Total interest = $492,441

The 120-point score difference costs $109,808 in additional interest over 30 years.

That’s the math behind credit scores—better scores generate compound savings through lower borrowing costs.

The same principle applies to auto loans, credit cards, and personal loans. A strong credit score functions as a wealth-building tool by reducing the friction cost of leverage.

Credit Score Ranges Explained (Bad to Excellent)

Credit scores fall into five categories that lenders use to segment borrowers by risk level.

Credit Score Range Table

| Score Range | Rating | What It Means | Lender Perspective |

|---|---|---|---|

| 300-579 | Poor | High default risk | Likely denial or subprime terms |

| 580-669 | Fair | Elevated risk | Approval with higher rates, lower limits |

| 670-739 | Good | Average borrower | Standard approval, moderate rates |

| 740-799 | Very Good | Low risk | Preferred rates, higher limits |

| 800-850 | Excellent | Minimal risk | Best available terms, premium rewards |

What’s a Good Credit Score?

670 or above qualifies as “good” in most lending contexts.

At this threshold:

- Most lenders approve standard credit applications

- Interest rates approach competitive levels

- Credit card approvals become routine

- Rental applications face fewer obstacles

However, “good” doesn’t mean optimal.

The 740 threshold unlocks superior economics:

- Mortgage rates drop significantly

- Auto loan rates reach lowest tiers

- Premium credit cards become accessible

- Credit limits increase substantially

Data point: The average American credit score in 2025 is 716, placing most consumers in the “good” category but below the “very good” threshold, where the best terms are activated.

What Lenders Consider Excellent

Scores of 800+ represent the top 20% of consumers.

At this level:

- Lenders compete for your business

- You qualify for the lowest advertised rates

- Credit card companies offer premium products with high rewards

- Loan applications process faster with minimal documentation

- You have maximum negotiating leverage

Practical difference between 750 and 820:

Minimal. Both scores access the same top-tier pricing. The improvement from 680 to 740 generates far more economic value than 780 to 820.

Strategic insight: Focus on reaching 740 first. After that, score optimization delivers diminishing returns compared to other wealth-building strategies.

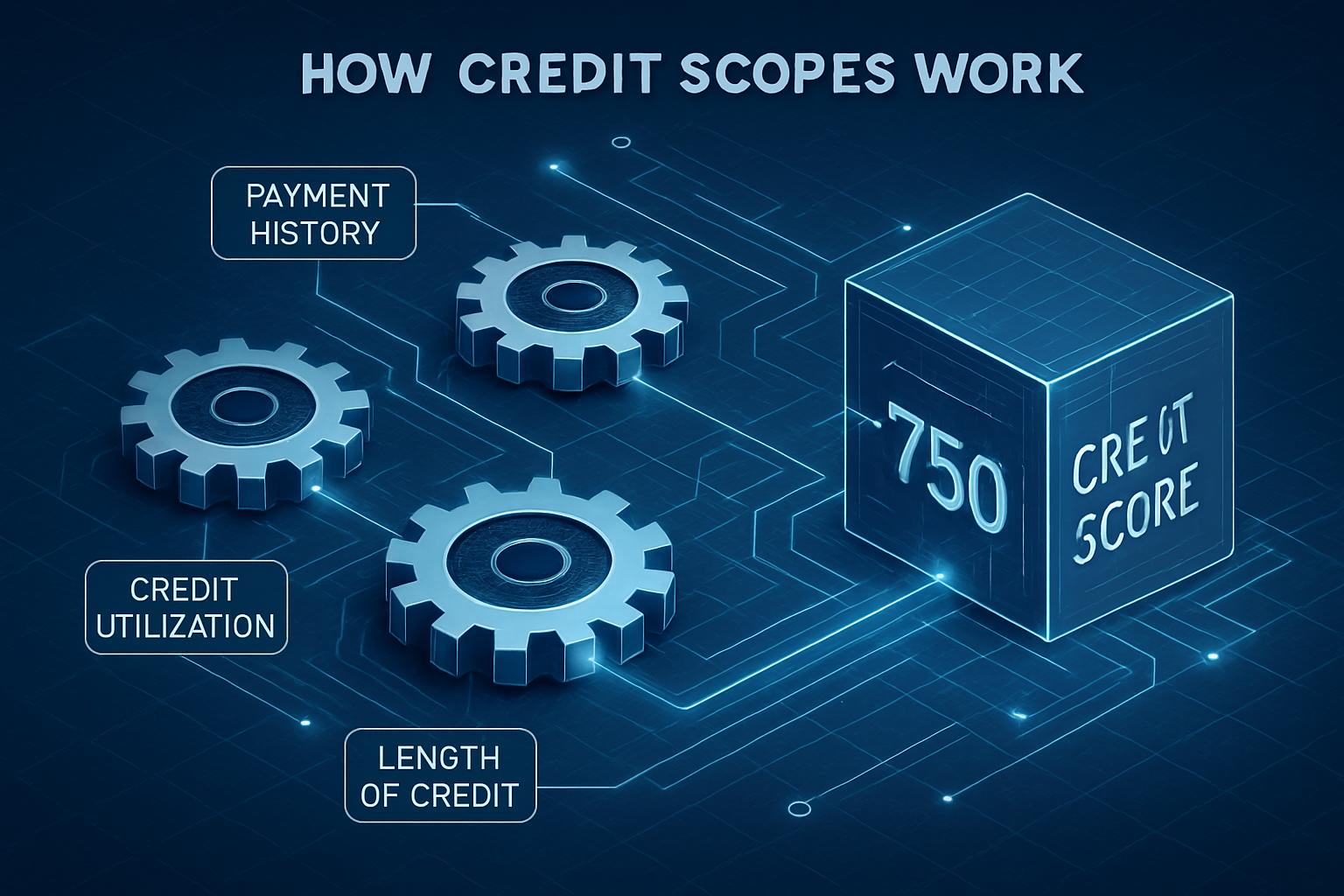

What Affects Your Credit Score? (The 5 Factors)

Credit scoring models evaluate five categories of information, each contributing a different percentage to your final score.

The Five Credit Score Factors (Percentage Breakdown)

1. Payment History: 35%

Whether you pay bills on time

2. Credit Utilization: 30%

How much credit you use relative to limits

3. Length of Credit History: 15%

How long have you managed credit accounts

4. Credit Mix: 10%

Variety of credit types (cards, loans, mortgages)

5. New Credit: 10%

Recent credit applications and new accounts

Total: 100%

Understanding these weights reveals where to focus improvement efforts.

Payment History (35%): The Dominant Factor

Payment history measures whether you pay minimum amounts by due dates.

This single factor carries more weight than any other because it directly predicts default risk. Consumers who miss payments historically default at higher rates.

What counts:

- Credit card payments

- Installment loan payments (auto, personal, student)

- Mortgage payments

- Retail account payments

What’s recorded:

- On-time payments (positive)

- Payments 30+ days late (negative)

- Payments 60, 90, 120+ days late (increasingly negative)

- Charge-offs, collections, bankruptcies (severely negative)

Impact timeline:

- One 30-day late payment can drop scores by 60-110 points

- The damage decreases over time

- Late payments remain on reports for 7 years

- Recent late payments hurt more than old ones

Recovery strategy:

Set up autopay for minimum payments on all accounts. Even if you pay the full balance manually, autopay prevents accidental late payments that devastate scores.

Takeaway: Perfect payment history is non-negotiable for excellent credit. One missed payment erases months of score-building progress.

Credit Utilization (30%): The Tactical Lever

Credit utilization measures how much of your available credit you’re using.

Formula: (Total Credit Card Balances ÷ Total Credit Limits) × 100 = Utilization %

Example:

- Card 1: $2,000 balance / $10,000 limit

- Card 2: $500 balance / $5,000 limit

- Card 3: $0 balance / $5,000 limit

Total balances: $2,500

Total limits: $20,000

Utilization: 12.5%

Optimal ranges:

- Below 10%: Excellent (maximizes scores)

- 10-30%: Good (minimal negative impact)

- 30-50%: Fair (begins lowering scores)

- 50-70%: Poor (significant score damage)

- Above 70%: Very poor (severe score suppression)

Why utilization matters more than people think:

Utilization is the only major factor you can change instantly. Payment history requires months of perfect behavior. Utilization can drop from 80% to 10% with a single large payment.

This makes utilization the fastest score improvement lever available.

Per-card vs overall utilization:

Scoring models examine both:

- Overall utilization across all cards

- Individual card utilization rates

Maxing out one card while keeping others at zero still damages scores. Distribute balances across cards or keep all cards below 30%.

Strategic timing:

Credit card companies report balances to bureaus on statement closing dates, not payment due dates.

To optimize reported utilization:

- Check when each card reports (usually the statement close date)

- Pay down balances before that date

- Let the low balance get reported

- Your score reflects the lower utilization

Detailed guide: Credit Utilization Explained

Length of Credit History (15%): The Time Factor

This factor measures how long you’ve managed credit accounts.

Scoring models evaluate:

- Age of the oldest account

- Age of the newest account

- Average age of all accounts

Why it matters:

Longer credit histories provide more data points for risk assessment. A 10-year track record of responsible use carries more predictive weight than 6 months.

Common mistake:

Closing old credit cards to “clean up” your credit profile.

What actually happens:

- Closed accounts eventually fall off your report (after 10 years)

- Average account age decreases

- Available credit decreases

- Utilization percentage increases

- Score drops

Better strategy:

Keep old accounts open even with zero balances. Use them once per year for small purchases to prevent issuer closure due to inactivity.

For new credit builders:

You can’t accelerate time, but you can start now. Open a secured credit card or become an authorized user on a family member’s established account to begin building history.

Takeaway: Credit age rewards patience. Protect your oldest accounts and let time work in your favor.

Credit Mix (10%): Variety Signals Competence

Credit mix evaluates the diversity of credit types you manage.

Categories include:

- Revolving credit: Credit cards, lines of credit

- Installment loans: Auto loans, personal loans, student loans

- Mortgage loans: Home mortgages, home equity loans

Why variety matters:

Managing different credit types demonstrates broader financial competence. Someone who successfully handles a mortgage, auto loan, and credit card shows more diverse capability than someone with only credit cards.

Practical application:

Don’t open new accounts solely to improve credit mix. The 10% weight doesn’t justify the hard inquiry and new account impact.

Natural mix development:

As you progress through life stages, you’ll naturally acquire different credit types:

- First credit card (revolving)

- Auto loan for transportation (installment)

- Mortgage for home purchase (mortgage)

Let credit mix develop organically through genuine financial needs, not score optimization.

Takeaway: Credit mix contributes to excellent scores but shouldn’t drive borrowing decisions.

New Credit (10%): Application Frequency

New credit measures recent credit-seeking behavior.

Factors include:

- Number of recently opened accounts

- Number of recent credit inquiries

- Time since most recent account opening

- Time since most recent inquiry

Why it matters:

Research shows consumers who open multiple accounts in short periods default at higher rates[6]. Rapid credit-seeking signals financial stress.

Hard vs soft inquiries:

Hard inquiries (affect your score):

- Credit card applications

- Loan applications (auto, mortgage, personal)

- Apartment rental applications (sometimes)

Each hard inquiry typically drops scores by 5-10 points. The impact fades after 12 months and disappears after 24 months.

Soft inquiries (don’t affect your score):

- Checking your own credit

- Pre-approval offers

- Employer background checks

- Insurance quote requests

Rate shopping protection:

FICO models recognize legitimate rate shopping for auto loans and mortgages. Multiple inquiries for the same loan type within 14-45 days (depending on FICO version) count as a single inquiry.

This lets you compare lenders without score damage.

Strategic application timing:

Space credit applications at least 6 months apart when possible. If you need multiple cards, consider applying for 2-3 in one day (all inquiries before score updates) rather than spreading them over months.

Takeaway: Minimize unnecessary applications. When you need credit, apply strategically and use rate shopping windows for loans.

How to Improve Your Credit Score (Beginner Roadmap)

Credit score improvement follows predictable patterns when you address the highest-impact factors systematically.

30-Day Credit Score Boost

Focus: Quick wins that generate measurable improvement

Action 1: Pull all three credit reports

Visit AnnualCreditReport.com (the only authorized free source) and download reports from Experian, Equifax, and TransUnion.

Review each report for:

- Accounts you don’t recognize

- Incorrect late payment marks

- Wrong balance amounts

- Duplicate accounts

- Outdated information

Dispute errors immediately through each bureau’s online dispute process. Bureaus must investigate within 30 days.

Impact: Removing erroneous late payments or incorrect high balances can boost scores 20-100 points instantly.

Action 2: Pay down high-utilization cards below 30%

Calculate current utilization:

(Total Balances ÷ Total Limits) × 100

If above 30%, prioritize paying down cards with the highest utilization percentages first.

Example strategy:

- Card A: $4,500 / $5,000 (90% utilization) ← Pay this first

- Card B: $2,000 / $10,000 (20% utilization)

- Card C: $500 / $5,000 (10% utilization)

Pay Card A down to $1,500 (30%) before addressing others.

Impact: Dropping utilization from 60% to 30% typically increases scores 30-50 points within one billing cycle.

Action 3: Set up autopay for all accounts

Configure automatic minimum payments for:

- All credit cards

- Installment loans

- Any recurring bills reported to credit bureaus

This eliminates accidental late payments, the single biggest score killer.

Impact: Prevents future score damage and begins building positive payment history.

30-day expected improvement: 20-80 points depending on starting position and issues corrected.

60-90 Day Improvements

Focus: Building positive history and strategic optimization

Action 4: Continue perfect payment history

Every on-time payment strengthens your score incrementally. After 60-90 days of perfect payments, you’ll see:

- Recent positive marks outweigh older negative marks

- Gradual score increases as payment history percentage improves

- Reduced the impact of previous late payments

Action 5: Reduce utilization below 10%

If you achieved 30% utilization in month one, push toward 10% for maximum score benefit.

Tactics:

- Make mid-cycle payments before statement closing dates

- Request credit limit increases (soft inquiry) on existing cards

- Pay balances in full each month

Mathematical effect:

A utilization drop from 30% to 10% typically adds 15-30 points to scores already in a good range.

Action 6: Avoid new credit applications

Let recent inquiries age without adding new ones. Each month without new inquiries strengthens this factor.

Action 7: Become an authorized user (if building thin credit)

If you have limited credit history, ask a family member with excellent credit to add you as an authorized user on their oldest, lowest-utilization card.

Requirements for maximum benefit:

- Their card must have a perfect payment history

- Utilization should be below 10%

- Account should be at least 2+ years old

- The card issuer must report authorized users to the bureaus

Impact: Can add 20-60 points for thin-file borrowers by instantly adding an aged, positive account.

60-90 day expected improvement: Additional 30-70 points beyond 30-day gains, depending on consistency and starting position.

Long-Term Credit Building (6-24 Months)

Focus: Establishing excellent credit fundamentals

Strategy 1: Account aging

Protect your oldest accounts and let the average age increase naturally. Each month your accounts age, this factor strengthens.

Strategy 2: Strategic credit usage

Use credit cards regularly for small purchases, then pay in full. This demonstrates:

- Active credit management

- Responsible borrowing behavior

- Consistent payment capability

Optimal pattern:

- Charge 1-10% of the limit monthly

- Pay statement balance in full by the due date

- Maintain zero interest charges

- Build rewards/cash back

Strategy 3: Gradual credit limit increases

Every 6-12 months, request credit limit increases from existing card issuers. Many approve automatically without hard inquiries.

Effect:

- Higher limits = lower utilization with the same spending

- Lower utilization = higher scores

- More available credit = better financial flexibility

Strategy 4: Natural credit mix development

As life circumstances create genuine needs, add different credit types:

- Auto loan when purchasing a vehicle

- Mortgage when buying a home

- Personal loan for major expense (if rates are favorable)

Never borrow solely for credit mix improvement.

Long-term result: Scores consistently above 740, qualifying for the best available terms on all credit products.

Timeline expectation: Most borrowers can move from fair (650) to very good (760) in 12-18 months with consistent execution of these strategies.

Common Credit Score Myths (That Hurt You)

Misconceptions about credit scoring lead to counterproductive behaviors that damage scores.

Myth 1: Checking Your Credit Hurts Your Score

Reality: Checking your own credit is a soft inquiry that has zero score impact.

You should check your credit regularly:

- Annual free reports from AnnualCreditReport.com

- Monthly monitoring through credit card issuer tools

- Quarterly reviews for error detection

Why this myth persists: Confusion between soft inquiries (checking your own) and hard inquiries (lender applications).

Takeaway: Monitor your credit aggressively without fear of score damage.

Myth 2: Closing Cards Helps Your Score

Reality: Closing cards typically hurts your score through two mechanisms:

Mechanism 1: Utilization increase

- You have $10,000 total limit and $2,000 balance (20% utilization)

- You close a card with $5,000 limit

- Now you have $5,000 limits and $2,000 balances (40% utilization)

- Your score drops

Mechanism 2: Average age decrease

- Closed accounts eventually fall off your report (after 10 years)

- When your oldest account disappears, the average age decreases

- Scores drop from shortened history

When closing makes sense:

- Annual fee cards you don’t use (and the fee outweighs score impact)

- Cards are tempting overspending that threatens financial stability

Better alternative: Keep cards open, use occasionally, pay in full.

Myth 3: Carrying a Balance Boosts Your Score

Reality: Carrying a balance costs you interest without improving your score.

What actually matters: Utilization percentage reported on statement closing date, not whether you carry balances month-to-month.

Optimal strategy:

- Use cards for purchases

- Let statement generate showing 1-10% utilization

- Pay the statement balance in full before the due date

- Pay zero interest while maintaining a perfect payment history

Why this myth persists: Confusion about how utilization is calculated and reported.

Takeaway: Never pay credit card interest to “build credit.” It’s mathematically counterproductive.

Myth 4: Income Affects Your Credit Score

Reality: Credit scores don’t consider income, assets, or employment.

Scoring models analyze only credit report data:

- Payment history

- Utilization

- Account age

- Credit mix

- Recent inquiries

A person earning $40,000 with perfect payment history and 5% utilization scores higher than someone earning $400,000 with late payments and 80% utilization.

Where income matters:

- Loan approval decisions (separate from score)

- Credit limit determinations

- Debt-to-income ratio calculations

Takeaway: Credit scores measure borrowing behavior, not earning capacity.

Myth 5: Paying Off Collections Removes Them

Reality: Paid collections remain on your credit report for 7 years from the original delinquency date.

What changes:

- Status updates from “unpaid” to “paid”

- Newer scoring models (FICO 9, VantageScore 3.0+) ignore paid collections

- Older scoring models (still widely used by lenders) count them

Strategic approach:

- Negotiate “pay for delete” agreements in writing before paying

- If the collector won’t delete, the payment may not improve the score significantly

- Focus on building a positive history to outweigh old collections

Takeaway: Collections damage scores whether paid or unpaid in most scoring models currently used by lenders.

Real Credit Score Examples (Scenarios)

Understanding how different situations affect scores helps you predict your own trajectory.

Scenario 1: College Student Building First Credit

Profile:

- Age: 20

- Credit history: 8 months

- Accounts: 1 student credit card ($500 limit)

- Payment history: Perfect (8/8 on-time payments)

- Utilization: 15% ($75 average balance)

- Inquiries: 1 (from card application)

Current score: 680

Limiting factors:

- Thin credit file (only one account)

- Short history (under 1 year)

- Limited credit mix (only revolving credit)

6-month improvement plan:

- Maintain perfect payments (builds history)

- Request a credit limit increase to $1,000 after 12 months (lowers utilization)

- Become an authorized user on the parent’s card (adds an aged account)

- Consider secured loan or credit-builder loan (adds installment mix)

Expected 6-month score: 710-730

Expected 18-month score: 740-760

Takeaway: Thin files improve rapidly with consistent positive behavior and strategic account additions.

Scenario 2: Rebuilder After Missed Payments

Profile:

- Age: 35

- Credit history: 7 years

- Accounts: 3 credit cards, 1 auto loan

- Payment history: 2 late payments (30 days) in the past 12 months, otherwise perfect

- Utilization: 45%

- Inquiries: 0 recent

Current score: 630

Damage sources:

- Recent late payments (major impact)

- High utilization (secondary impact)

90-day recovery plan:

Month 1:

- Pay down cards from 45% to 29% utilization (immediate 30-point boost)

- Set up autopay on all accounts (prevent future lates)

- Check reports for errors

Month 2-3:

- Continue perfect payments (begins building positive history)

- Reduce utilization to 15% (additional 20-point boost)

- Let late payments age (impact decreases monthly)

Expected 90-day score: 680-700

Expected 12-month score: 720-740 (as late payments age and positive history accumulates)

Takeaway: Recent late payments cause severe damage, but recovery accelerates with perfect subsequent behavior and utilization optimization.

Scenario 3: High Income, High Utilization User

Profile:

- Age: 42

- Income: $180,000

- Credit history: 15 years

- Accounts: 5 credit cards ($75,000 total limits), mortgage, paid-off auto loan

- Payment history: Perfect (never missed a payment)

- Utilization: 72% ($54,000 in revolving balances)

- Inquiries: 0 recent

Current score: 665

The paradox: Excellent payment history and high income, but poor score due to single factor, utilization.

Immediate fix:

Pay down credit cards from $54,000 to $22,500 (30% utilization).

Expected score after one billing cycle: 740-760

Further optimization:

Reduce balances to $7,500 (10% utilization).

Expected score: 780-800

Takeaway: Utilization dominates scoring even with a perfect payment history. High earners often carry high balances relative to limits, suppressing scores despite low default risk. The solution is mathematical: reduce the balance-to-limit ratio.

This scenario demonstrates why credit scores measure behavior, not capacity, and why understanding the math behind money matters more than income alone.

How to Check Your Credit Score (Safely)

Regular credit monitoring helps you track progress, detect errors, and prevent identity theft.

Free vs Paid Credit Monitoring

Free options:

AnnualCreditReport.com

- Official site authorized by federal law

- Provides free reports from all three bureaus

- Available once per 12 months per bureau

- Shows full credit report but not scores

- No credit card required

Credit card issuer tools

- Most major issuers provide free FICO or VantageScore access

- Updates monthly

- No impact on credit

- Examples: Discover Credit Scorecard, Chase Credit Journey, Capital One CreditWise

Credit Karma

- Free VantageScore 3.0 from TransUnion and Equifax

- Updates weekly

- Includes monitoring and alerts

- Ad-supported (shows credit card/loan offers)

Paid options:

myFICO.com

- Access to actual FICO scores lenders use

- Multiple FICO versions (8, 9, auto, mortgage)

- All three bureaus

- $19.95-$39.95/month

Experian Premium

- FICO scores and monitoring

- Identity theft insurance

- $24.99/month

Worth paying for?

Only if you’re actively applying for major loans (mortgage, auto) and need to see the exact scores lenders will use. For general monitoring, free tools suffice.

What to Avoid

Credit repair scams:

- Companies promising to “erase bad credit legally.”

- Charging upfront fees before services

- Guaranteeing specific score increases

- Advising you to dispute accurate information

Reality: You can dispute errors yourself for free. Accurate negative information can’t be legally removed until it ages off (7-10 years).

Sketchy monitoring services:

- Free trials requiring credit cards (often lead to unwanted subscriptions)

- Sites requesting Social Security numbers without clear privacy policies

- Non-secure websites (check for HTTPS)

Takeaway: Stick to established, reputable sources for credit monitoring.

How Often to Check

Recommended monitoring frequency:

Credit reports: Every 4 months (rotate bureaus)

- January: Pull Experian

- May: Pull Equifax

- September: Pull TransUnion

- Repeat cycle

This gives you free year-round monitoring by spacing the three annual reports.

Credit scores: Monthly

Use free credit card issuer tools for regular tracking.

Before major applications: 30-60 days prior

Check all three scores before applying for mortgages or auto loans to identify issues early.

After identity theft or data breaches: Immediately

Monitor closely for fraudulent accounts or inquiries.

Takeaway: Regular monitoring costs nothing and prevents costly surprises during loan applications.

Credit Score vs Credit Report (Clear Comparison)

Understanding the distinction prevents confusion and helps you use both tools effectively.

Side-by-Side Comparison

| Feature | Credit Report | Credit Score |

|---|---|---|

| What it is | Detailed financial history document | Three-digit numerical summary |

| Contents | All accounts, payment history, inquiries, personal info | Single number (300-850) |

| Length | Multiple pages | One number |

| Updates | Continuous as lenders report | Recalculated when report changes |

| Free access | Once per year per bureau (federal law) | Sometimes free through lenders/cards |

| Used for | Detailed review, error checking, dispute filing | Quick risk assessment by lenders |

| Number of versions | One per bureau (3 total) | Multiple (different scoring models) |

| Legal rights | Free annual access guaranteed | No guaranteed free access |

When to Use Each

Use your credit report when:

- Checking for errors or fraudulent accounts

- Preparing to apply for major loans

- Disputing inaccurate information

- Understanding why your score changed

- Reviewing the complete payment history

Use your credit score when:

- Tracking improvement progress

- Deciding whether to apply for credit

- Comparing yourself to lending thresholds

- Monitoring month-to-month changes

Relationship: Your credit report is the source data. Your credit score is the calculated output derived from that data.

Analogy: The report is your financial transcript; the score is your GPA.

Takeaway: Monitor both regularly, reports for accuracy, scores for progress tracking.

How to Build a Strong Credit Score (Summary & Best Practices)

Building excellent credit requires consistent execution of evidence-based strategies.

The Core Principles

1. Perfect payment history is non-negotiable

Set up autopay for minimum payments on every account. Even if you pay manually, autopay prevents accidental late payments that devastate scores.

2. Keep utilization below 10% for optimal scores

Pay down balances before statement closing dates. Request limit increases periodically. Distribute spending across multiple cards.

3. Protect account age

Keep old accounts open and active. Use them occasionally to prevent issuer closure. Never close your oldest card unless necessary.

4. Build a credit mix naturally

Add different credit types as genuine financial needs arise. Don’t borrow solely for score optimization.

5. Minimize hard inquiries

Space applications 6+ months apart. Use rate shopping windows for loans. Avoid unnecessary credit applications.

The 30-60-90 Day Action Plan

Days 1-30:

- Pull all three credit reports from AnnualCreditReport.com

- Dispute any errors immediately

- Pay high-utilization cards below 30%

- Set up autopay on all accounts

- Expected improvement: 20-80 points

Days 31-60:

- Continue perfect payments

- Reduce utilization to 10%

- Avoid new credit applications

- Consider the authorized user strategy if building a thin file

- Expected improvement: Additional 15-40 points

Days 61-90:

- Maintain a perfect payment streak

- Optimize utilization timing (pay before statement dates)

- Request credit limit increases on existing cards

- Monitor score improvements

- Expected improvement: Additional 10-30 points

Total 90-day potential improvement: 45-150 points, depending on starting position and issues corrected.

Long-Term Maintenance

Once you achieve excellent credit (740+):

Monthly habits:

- Check credit score through free tools

- Review account activity for fraud

- Pay statement balances in full

- Maintain utilization below 10%

Quarterly habits:

- Pull one credit report (rotate bureaus)

- Verify all accounts are reporting correctly

- Check for unauthorized inquiries

Annual habits:

- Review all three credit reports thoroughly

- Request credit limit increases

- Assess whether to open new accounts for rewards optimization

Lifetime principles:

- Never miss payments

- Never max out credit cards

- Never close old accounts impulsively

- Never fall for credit repair scams

The Compound Effect

Credit building follows compound growth principles. Small, consistent actions generate exponential results over time.

Month 1: Perfect payments + utilization reduction = 40-point increase

Month 6: Continued perfect behavior = 80-point total increase

Month 12: Established positive history = 120-point total increase

Month 24: Aged accounts + perfect history = 150+ point total increase

Each positive action reinforces previous gains. Each month of perfect behavior makes the next month’s score higher.

The math behind credit scores rewards patience, consistency, and strategic optimization—the same principles that drive wealth building across all financial domains.

Interactive Credit Score Calculator

💳 Credit Score Improvement Calculator

Calculate your potential score improvement in 30, 60, and 90 days

🎯 Recommended Actions

Conclusion

Your credit score is a mathematical representation of your borrowing behavior that directly impacts your cost of capital and access to financial opportunities.

The scoring system rewards five key behaviors: perfect payment history, low credit utilization, aged accounts, diverse credit mix, and minimal new credit applications.

The highest-impact actions:

- Maintain 100% on-time payments through autopay

- Keep utilization below 10% by paying before statement dates

- Protect your oldest accounts from closure

- Monitor reports quarterly for errors and fraud

The fastest improvements come from:

- Disputing report errors (immediate to 30 days)

- Reducing utilization from high levels (30-60 days)

- Adding authorized user accounts (30-60 days)

The long-term strategy:

- Build a perfect payment history over 12-24 months

- Let accounts age naturally

- Use credit regularly but responsibly

- Never pay interest to “build credit.”

Credit scores above 740 unlock the best available terms on mortgages, auto loans, and credit cards—generating compound savings through reduced interest costs over decades.

The difference between a 640 score and a 760 score can cost over $100,000 in additional interest on a single mortgage.

Your next steps:

- Pull your free credit reports at AnnualCreditReport.com today

- Calculate your current utilization percentage

- Set up autopay on all credit accounts

- Create a 90-day improvement plan using the strategies in this guide

- Monitor progress monthly through free credit score tools

Understanding the math behind credit scores transforms them from mysterious numbers into controllable variables you can optimize through deliberate action.

Start with the highest-impact factors: payment history and utilization, and build from there.

The compound effect of consistent positive behavior will generate measurable results within 30 days and excellent credit within 12-24 months.

Educational Disclaimer

This article provides educational information about credit scores and credit management strategies. It is not financial advice, credit repair services, or a guarantee of specific credit score improvements.

Credit score changes depend on individual circumstances, credit history, and the specific scoring models used by lenders. Results vary based on starting position, consistency of implementation, and factors beyond the scope of this guide.

Before making financial decisions:

- Review your complete credit reports from all three bureaus

- Consult with qualified financial advisors for personalized guidance

- Understand that credit scoring models differ across lenders and industries

- Recognize that legitimate credit improvement takes time and consistent positive behavior

The Rich Guy Math provides data-driven financial education to help readers understand how financial systems work. We do not offer credit repair services, loan products, or personalized credit counseling.

Always verify information with official sources such as the Consumer Financial Protection Bureau (CFPB), Federal Trade Commission (FTC), and your specific lenders.

Author Bio

Max Fonji is the founder of The Rich Guy Math, a data-driven financial education platform that explains the mathematical principles behind wealth building, investing, and credit management. With expertise in financial analysis and evidence-based money strategies, Max translates complex financial concepts into actionable frameworks that help readers make informed decisions.

The Rich Guy Math focuses on teaching the cause-and-effect relationships in personal finance—showing not just what to do, but why it works mathematically. From compound interest fundamentals to credit utilization optimization, every article prioritizes clarity, data, and practical application.

Max’s approach combines analytical rigor with educational warmth, making sophisticated financial concepts accessible to beginners while providing depth for intermediate learners. The goal: equip readers with the knowledge to build wealth through understanding, not guesswork.

References

[1] Consumer Financial Protection Bureau. (2023). “Key Dimensions and Processes in the U.S. Credit Reporting System.” CFPB Research Report.

[2] Fair Isaac Corporation. (2024). “Understanding Your FICO Score.” myFICO.com.

[3] Experian. (2025). “Consumer Credit Review: Annual Credit Score Trends.” Experian Data Analytics.

[4] FICO. (2024). “What’s in Your FICO Scores?” Fair Isaac Corporation Consumer Education. myFICO.com

[5] Federal Reserve. (2023). “Report on the Economic Well-Being of U.S. Households.” Federal Reserve Board.

[6] Consumer Financial Protection Bureau. (2022). “Credit Inquiries and Credit Scores.” CFPB Consumer Resources.

Frequently Asked Questions

Is 650 a good credit score?

A 650 credit score falls in the fair category, placing you in the middle range of creditworthiness. While you’ll likely qualify for credit cards and loans, you won’t receive the best interest rates.

Most lenders consider scores of 670+ as good and 740+ as very good. At 650, expect higher interest rates and potentially lower credit limits compared to borrowers with stronger credit profiles.

To improve a 650 score, focus on reducing credit card utilization below 30% and maintaining perfect payment history. Many borrowers move into the good range within 3–6 months by addressing these two factors.

How fast can I raise my credit score?

Credit score improvement speed depends on your starting point and which factors you target.

- 30 days: Paying down high utilization (for example, from 60% to 30%) can boost scores by 30–50 points within one billing cycle.

- 60–90 days: Perfect payment history combined with utilization optimization can produce 50–100 point gains.

- 12–24 months: Rebuilding after late payments or collections typically results in 100–150+ point improvements with consistent positive behavior.

Can paying rent improve credit?

Rent payments typically don’t appear on credit reports because most landlords don’t report them. However, rent-reporting services can change that.

Options include Experian Boost (free, Experian only), RentTrack, and LevelCredit (paid services reporting to multiple bureaus).

Rent reporting is most effective for borrowers with thin credit files or limited payment history. Some people see 20–40 point increases, while others see minimal impact. It works best as a supplement—not a replacement—for traditional credit building.

Does income affect credit score?

No. Income does not directly affect your credit score. Credit scoring models only evaluate information found in your credit report, such as payment history, utilization, account age, credit mix, and inquiries.

Income matters during loan approval, not scoring. Lenders use income to calculate your debt-to-income ratio. Someone earning $40,000 with perfect payment history can have a higher score than someone earning $200,000 with late payments and high utilization.

Why did my score drop after paying off debt?

Credit scores can temporarily drop after paying off debt for several reasons:

- Credit mix change: Closing an installment loan reduces account diversity.

- Utilization shift: Closing a credit card lowers available credit, raising utilization on remaining cards.

- Account age impact: Closed accounts eventually fall off your report, reducing average age.

These drops are usually small (5–20 points) and temporary. Scores typically recover within one to two months with continued on-time payments.

How many points is one late payment?

A single 30-day late payment can reduce a credit score by 60–110 points, depending on your starting score and overall credit profile.

Higher scores experience larger drops. A borrower with a 780 score may fall to the low 700s or high 600s, while someone at 680 may drop into the low 600s.

The impact fades over time:

- 0–6 months: Maximum damage

- 6–12 months: Impact reduced by ~30–40%

- 12–24 months: Impact reduced by ~60–70%

- 24+ months: Minimal ongoing impact

Late payments remain on your credit report for seven years, but recovery typically occurs within 9–18 months with perfect payment history.