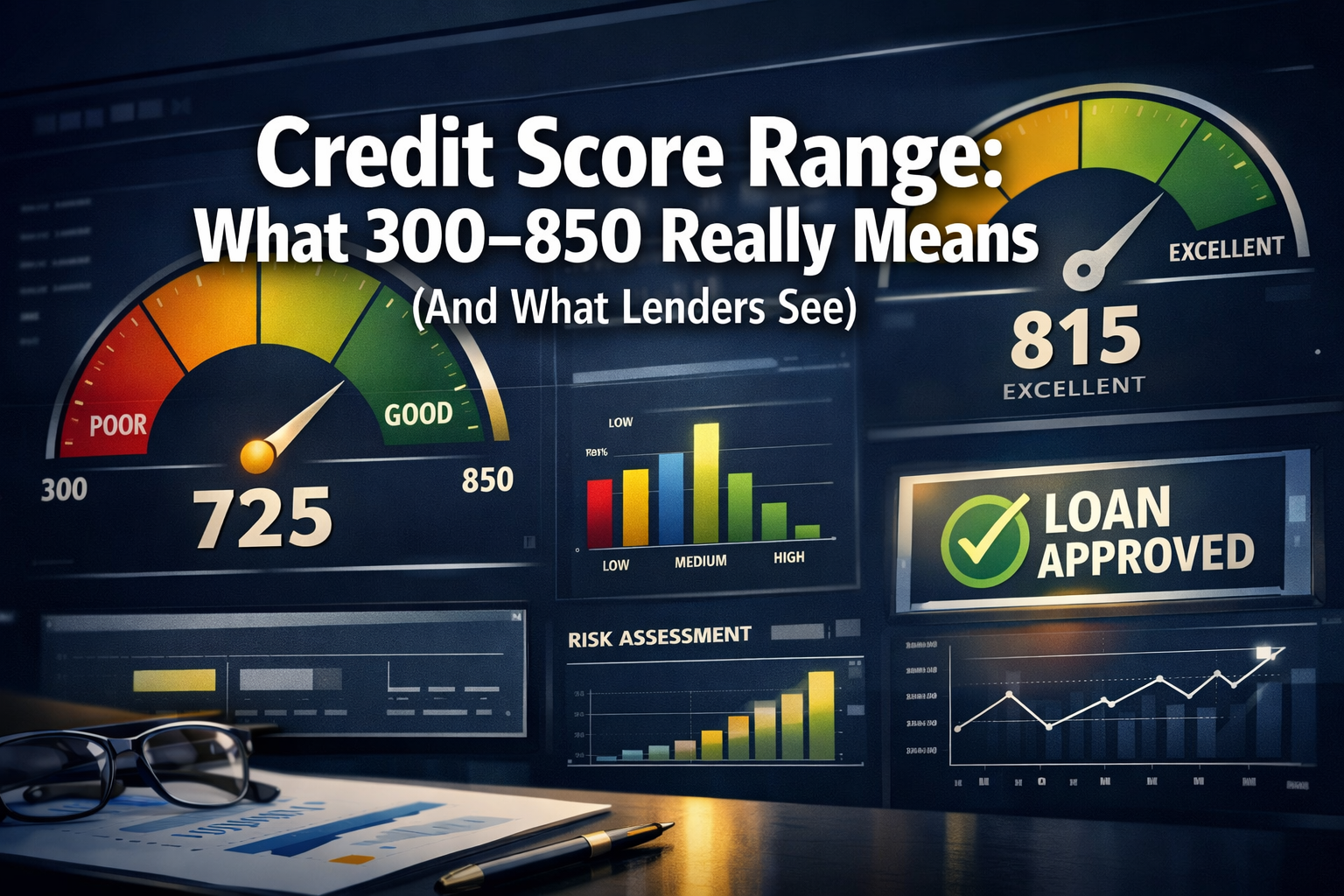

Picture this: You just checked your credit score and saw “687” staring back at you. But what does that number actually mean? Is it good? Bad? Will lenders approve your loan application?

A credit score is not a grade on your financial report card — it’s a risk prediction tool. Lenders use this three-digit number, ranging from 300 to 850, to estimate the likelihood you’ll repay borrowed money. The higher your score, the lower the risk you represent to lenders.

Here’s what most people don’t realize: lenders don’t just see a number. They see a risk category that determines your approval odds, interest rates, and loan terms. Your score is only a summary of a larger system lenders use to judge reliability. If you’re new to the topic, start with our complete guide to how credit system works.

Understanding the credit score range empowers you to make informed financial decisions. Each range tells a different story about your creditworthiness, and knowing where you stand helps you plan your next moves strategically.

Key Takeaways

- Credit scores range from 300 to 850, with higher numbers indicating lower risk to lenders

- Five distinct ranges categorize borrowers from “Poor” to “Excellent” credit

- A score of 670+ is considered “good” and opens doors to better loan terms

- FICO scores dominate lending decisions, though VantageScore is gaining ground

- Your score directly impacts interest rates, with excellent credit saving thousands on loans

Credit Score Range

A credit score ranges from 300 to 850. Higher scores indicate lower risk to lenders and increase your approval odds while securing lower interest rates. The scoring system predicts the probability you’ll miss payments over the next 24 months, making it a powerful tool for lenders to assess risk quickly.

Most scores fall between 600 and 750, with the national average hovering around 714 as of 2026[8]. Understanding where your score fits within this range helps you set realistic expectations for loan applications and financial products.

The 5 Credit Score Ranges Explained

The credit score range is divided into five distinct categories that lenders use to make quick decisions about your creditworthiness[1]. Here’s exactly what each range means:

| Score Range | Category | What It Means | Approval Odds |

|---|---|---|---|

| 300-579 | Poor | High-risk borrower | Very limited |

| 580-669 | Fair | Subprime borrower | Limited options |

| 670-739 | Good | Average borrower | Good approval |

| 740-799 | Very Good | Strong borrower | Excellent approval |

| 800-850 | Excellent | Lowest risk | Best terms available |

Poor Credit (300-579): Lenders view you as a significant risk. Expect high interest rates, security deposits, and potential denials. About 16% of Americans fall into this range[8].

Fair Credit (580-669): You’re considered subprime, meaning higher rates and fees. Many mainstream lenders will work with you, but terms won’t be favorable. This represents roughly 18% of the population[8].

Good Credit (670-739): This is where opportunities open up. You’ll qualify for most loans and credit cards, though not at the best rates. Approximately 21% of consumers have good credit[8].

Very Good Credit (740-799): Lenders compete for your business. You’ll receive favorable terms and have access to premium financial products. About 25% of Americans achieve this level[8].

Excellent Credit (800-850): You represent minimal risk. Lenders offer their best rates, highest credit limits, and most attractive terms. Only 20% of consumers reach this elite tier[8].

What Is a “Good” Credit Score in 2026?

A “good” credit score begins at 670 according to most lenders and credit agencies[1]. This threshold represents the point where you transition from subprime to prime borrowing.

However, “good” depends on your goals:

For basic approvals: 670+ opens most doors

For competitive rates: 740+ gets you noticed

For premium terms: 800+ puts you in the top tier

The math behind these thresholds reflects statistical default rates. Borrowers with scores above 670 default at significantly lower rates than those below this mark. This creates a clear dividing line in lending decisions.

Real-world impact of good credit:

- Mortgage rates: Save 0.5-1.0% in interest compared to fair credit

- Auto loans: Qualify for manufacturer incentives and promotional rates

- Credit cards: Access rewards cards without annual fees

- Rentals: Avoid security deposits on apartments and utilities

Your score directly correlates with the wealth building potential through lower borrowing costs and better financial opportunities.

Why the Credit Score Range Ends at 850

The credit score range caps at 850 because that’s where the FICO model reaches maximum predictive accuracy[3]. Beyond this point, additional score increases provide no meaningful improvement in risk assessment.

The mathematics are straightforward: FICO designed its algorithm to predict default probability over 24 months. Statistical analysis showed that borrowers scoring 850 have virtually identical default rates to those scoring 820 or 830.

Key insight: An 850 score doesn’t mean you’re a “perfect” borrower — it means you’re statistically indistinguishable from other excellent borrowers in terms of default risk. The scoring model focuses on predictive value, not moral judgments about financial behavior.

This ceiling also prevents score inflation over time. Without a cap, scores could theoretically climb indefinitely, making the system less useful for lenders who need consistent risk categories.

FICO Score vs VantageScore: Understanding Both Models

Two primary models dominate the credit score range landscape, and understanding both helps explain why your scores might differ across platforms[2][5].

| Feature | FICO | VantageScore |

|---|---|---|

| Used by lenders | 90% of lending decisions | Growing adoption |

| Score range | 300-850 | 300-850 |

| Primary purpose | Lending decisions | Consumer education |

| Minimum credit history | 6 months | 1 month |

| Scoring factors | 5 categories | 6 categories |

FICO dominates actual lending. When you apply for a mortgage, auto loan, or credit card, lenders typically pull your FICO score. This model has decades of proven predictive accuracy, making it the industry standard.

VantageScore appears in consumer apps. Most free credit monitoring services show VantageScore because it’s less expensive to license. While useful for tracking trends, it may not match what lenders see.

The scoring differences matter. VantageScore weighs recent credit behavior more heavily, while FICO emphasizes long-term payment history. This can create score variations of 20-50 points between models.

Both models calculate scores using the information contained in your credit history. Learn more in our guide explaining what a credit report is.

What Determines Where You Fall in the Credit Score Range

Five key factors determine your position within the credit score range, each carrying a different weight in the calculation[1][5]:

1. Payment History (35% of FICO Score)

The most critical factor. Even one 30-day late payment can drop your score 60-110 points. The impact depends on your current score — higher scores face larger drops from missed payments.

What counts:

- Credit card payments

- Loan payments (auto, mortgage, personal)

- Public records (bankruptcies, foreclosures)

For a broader understanding, see the guide to payment history basics

2. Credit Utilization (30% of FICO Score)

How much credit are you using versus your limits? Keep total utilization below 30%, ideally under 10% for excellent scores. This factor updates monthly as card companies report balances.

Calculation example:

- Total credit limits: $10,000

- Total balances: $2,000

- Utilization rate: 20%

For detailed strategies, see our credit utilization guide.

3. Length of Credit History (15% of FICO Score)

How long have you had credit accounts? Longer histories provide more data for risk assessment. Keep old accounts open to maintain this factor.

4. Credit Mix (10% of FICO Score)

A variety of credit types you manage. Having both revolving credit (cards) and installment loans (auto, mortgage) demonstrates broader financial management skills.

5. New Credit Inquiries (10% of FICO Score)

Recent credit applications. Hard inquiries can temporarily lower your score by 5-10 points. Multiple inquiries for the same type of loan (like mortgage shopping) typically count as one inquiry if made within 14-45 days.

How Lenders Use Each Credit Score Range

Different lenders have varying risk tolerances, creating opportunities across the entire credit score range[1][4]. Understanding these differences helps you target the right products for your situation.

Mortgage Lenders

Conventional loans: Typically require 620+ FICO scores

FHA loans: Accept scores as low as 580 with higher down payments

VA loans: No minimum score requirement, but most lenders want 620+

Jumbo loans: Usually demand 700+ for competitive rates

Credit Card Companies

Premium rewards cards: Target 750+ scores

Standard cards: Approve 650+ scores regularly

Secured cards: Accept any score for rebuilding credit

Store cards: Often approve 600+ scores

Auto Lenders

Prime rates: Reserved for 720+ scores

Subprime lending: Serves the 500-650 range with higher rates

Buy-here-pay-here lots: Accept any score but charge premium rates

Interest rate examples (2026 rates):

- Excellent credit (800+): 3.5% auto loan, 15% credit card

- Good credit (670-739): 5.5% auto loan, 20% credit card

- Fair credit (580-669): 9.5% auto loan, 25% credit card

These rate differences compound significantly over time, making credit improvement a powerful wealth-building strategy.

How Fast Credit Scores Move Between Ranges

Credit scores respond to behavior changes, but the timeline varies dramatically based on the action taken[5][6]. Understanding these patterns helps set realistic expectations for improvement.

| Action | Timeline | Score Impact |

|---|---|---|

| Pay down balances | 1-2 months | +20-50 points |

| Consistent on-time payments | 3-6 months | +10-30 points |

| Missed payment | Immediate | -60-110 points |

| New account opening | 1-3 months | -5-15 points |

| Account closure | Immediate | Variable impact |

Fast improvements come from utilization changes. Paying down credit card balances creates the quickest score boosts because utilization updates monthly when statements close.

Payment history takes time to build. While missed payments hurt immediately, establishing a pattern of on-time payments requires consistent behavior over several months.

The newer scoring models like FICO 10T examine trends over 24 months, making sustained good behavior more important than quick fixes[5]. This shift rewards borrowers who demonstrate consistent financial management rather than those who game the system temporarily.

Why Your Score Differs Between Apps and Lenders

Score variations are completely normal and result from three key factors that create the credit score range differences you see across platforms[2][3].

Different Credit Bureaus

Each bureau (Experian, Equifax, TransUnion) maintains separate databases. Not all creditors report to every bureau, creating information gaps that affect scores.

Multiple Scoring Models

FICO alone has dozens of versions:

- FICO 8 (most common)

- FICO 9 (newer standard)

- FICO 10/10T (latest versions)

- Industry-specific models (auto, mortgage, bankcard)

Update Timing Differences

Credit card companies report balances on different dates. Your score might reflect last month’s high balance on one platform while showing this month’s paid-off balance on another.

Typical variation ranges:

- Same model, different bureaus: 10-30 points

- Different models, same bureau: 20-50 points

- Different models, different bureaus: 30-80 points

Focus on trends, not specific numbers. If scores are moving in the same direction across platforms, you’re on the right track regardless of the exact figures.

What Score Do You Need for Major Financial Goals

Different financial products require different positions within the credit score range[1][4]. Here’s what you need for common goals in 2026:

| Financial Goal | Minimum Score | Competitive Score | Best Terms Score |

|---|---|---|---|

| Credit card approval | 580 | 650 | 750+ |

| Auto loan | 500 | 660 | 720+ |

| Mortgage (conventional) | 620 | 680 | 740+ |

| Personal loan | 600 | 670 | 720+ |

| Business credit | 650 | 700 | 750+ |

| Premium rewards cards | 700 | 750 | 800+ |

Mortgage lending specifics:

- FHA loans: 580 minimum (500 with 10% down)

- VA loans: No official minimum, but 620+ preferred

- USDA loans: 640 minimum for automated approval

- Jumbo loans: 700+ typically required

The math behind these thresholds reflects default statistics. Lenders set minimums based on historical data showing where default rates spike significantly.

Rate shopping strategy: Once you hit the minimum threshold, focus on improving your score to the next tier before applying. A 20-point improvement can save thousands in interest over a loan’s lifetime.

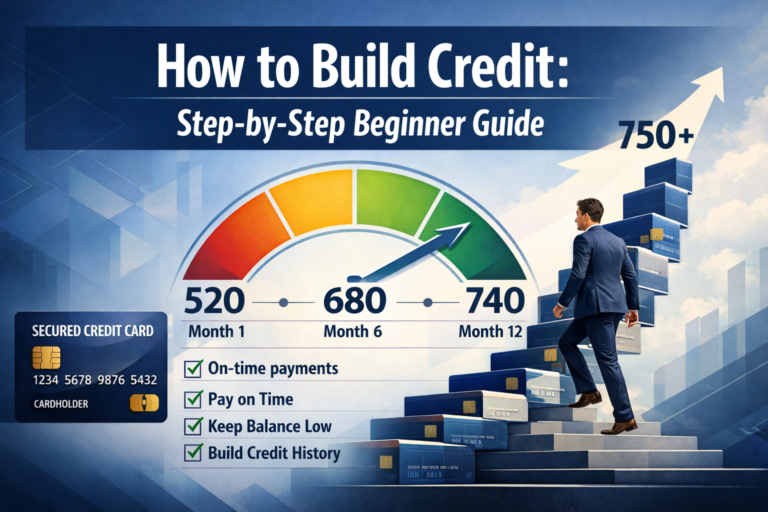

How to Move Into the Next Credit Score Range

Strategic credit improvement follows predictable patterns that can move you up within the credit score range systematically[4][6].

Immediate Actions (1-2 months)

Pay down credit card balances to below 10% of limits. This creates the fastest score improvements because utilization updates monthly.

Request credit limit increases on existing cards without using the extra credit. This automatically improves your utilization ratio.

Pay balances before statement dates to show lower utilization when cards report to bureaus.

Medium-term strategies (3-6 months)

Never miss payment due dates. Set up automatic payments for at least the minimums to ensure a perfect payment history going forward.

Dispute inaccurate information on credit reports. Errors can artificially depress scores, and corrections provide immediate improvements.

Become an authorized user on someone else’s account with excellent payment history and low utilization.

Long-term building (6+ months)

Keep old accounts open to maintain a credit history length, even if you don’t use them regularly.

Diversify credit types by adding an installment loan if you only have credit cards, or vice versa.

Limit new applications to avoid multiple hard inquiries that temporarily lower scores.

If your score is low, follow our step-by-step guide on how to build credit.

Major Credit Score Myths That Keep You Stuck

Misconceptions about the credit score range prevent many people from taking effective action. Here are the biggest myths debunked with facts:

Myth 1: Checking Your Score Hurts It

Truth: Checking your own score is a “soft inquiry” that never affects your credit. Hard inquiries from lenders when you apply for credit can temporarily lower scores by 5-10 points.

Myth 2: Carrying a Balance Helps Your Score

Truth: Credit cards report your statement balance, not whether you pay in full. Carrying a balance only costs you interest without improving your score.

Myth 3: Income Affects Your Credit Score

Truth: Scoring models don’t consider income, employment, or assets. They only analyze credit account behavior and payment history.

Myth 4: Closing Cards Improves Your Score

Truth: Closing cards reduces available credit, potentially increasing utilization ratios. Keep old accounts open unless they charge annual fees you can’t justify.

Myth 5: You Need to Use All Your Cards

Truth: Inactive cards don’t hurt your score as long as they remain open. Use cards occasionally to prevent closure from inactivity.

Myth 6: Paying Off Loans Immediately Boosts Scores

Truth: Installment loans help your credit mix. Paying them off early might slightly lower scores by reducing account variety.

The bottom line: Focus on payment history and utilization management rather than trying to game the system with complex strategies.

Latest Changes in Credit Scoring for 2026

The credit score range landscape is evolving with new models and data sources that affect how lenders evaluate borrowers[4][6][7].

FICO 10T Adoption

Trend-based scoring now examines 24 months of credit behavior instead of snapshots. This rewards consistent good behavior while penalizing recent negative patterns more heavily.

Impact: Borrowers with improving credit trends may see higher scores, while those with recent problems face larger penalties.

Expanded Data Sources

Rent and utility payments now contribute to credit scores through newer models, helping 30-35 million previously “unscorable” consumers build credit records[4].

Buy-now-pay-later (BNPL) reporting is beginning to appear on credit reports, potentially helping borrowers build credit through on-time payments but risking score damage from missed payments.

Medical Debt Changes

Paid medical collections and debts under $500 are disappearing from credit reports, reducing unexpected credit score penalties for many borrowers[4].

Timeline: These changes rolled out throughout 2023-2024 and continue improving scores for affected consumers in 2026.

VantageScore Growth

More lenders are adopting VantageScore models alongside FICO, particularly for credit cards and personal loans. This creates more opportunities for borrowers with shorter credit histories.

Key difference: VantageScore can generate scores with just one month of credit history versus FICO’s six-month requirement[2].

Understanding Score Ranges by Age and Demographics

Credit score distribution varies significantly across age groups, reflecting different life stages and financial experience levels[8].

Ages 18-29 (Gen Z/Young Millennials)

Average score: 680

Common challenges: Limited credit history, student loans, first-time credit building

Opportunities: Time advantage for long-term credit building

Ages 30-39 (Millennials)

Average score: 701

Common factors: Mortgage applications, family expenses, career establishment

Focus areas: Balancing utilization with major purchases

Ages 40-49 (Gen X)

Average score: 725

Key insight: 34% have subprime scores below 620, while 39% qualify for superprime loans with scores above 720[1]

Considerations: Peak earning years, multiple credit products

Ages 50-59 (Late Gen X/Early Boomers)

Average score: 746

Notable trend: Only 25% have very poor credit scores, and 49% have superprime scores above 800[1]

Advantages: Established credit history, lower debt-to-income ratios

Ages 60+ (Baby Boomers)

Average score: 760+

Characteristics: Highest scores due to long credit histories and paid-off mortgages

Focus: Maintaining excellent credit into retirement

The pattern is clear: Scores generally improve with age as people gain experience managing credit and pay down major debts like mortgages.

Interactive Credit Score Range Calculator

- Keep credit utilization below 30% of your limits

- Make all payments on time, every time

- Don’t close old credit cards

- Consider becoming an authorized user on someone else’s account

Conclusion

Understanding the credit score range from 300 to 850 empowers you to make informed financial decisions and take strategic action to improve your creditworthiness. Your score isn't just a number — it's a powerful tool that determines your access to financial opportunities and the cost of borrowing money.

The key insight: A high credit score results from consistent financial habits, not tricks or shortcuts. Focus on making payments on time, keeping utilization low, and maintaining accounts responsibly over time.

Your next steps:

- Check your current score using a free monitoring service

- Identify your target range based on your financial goals

- Implement improvement strategies systematically

- Monitor progress monthly to stay on track

Remember that moving between credit score ranges takes time and patience. The math behind money rewards consistent behavior over quick fixes. Start with the fundamentals — payment history and utilization management — and build from there.

Your credit score directly impacts your wealth-building potential through lower borrowing costs and better financial opportunities. Every point improvement brings you closer to financial freedom and better terms on major purchases.

Disclaimer

This article provides educational information about credit scores and should not be considered personalized financial advice. Credit scoring models and lending criteria vary by institution and change over time. Always consult with qualified financial professionals before making major financial decisions. The author is not responsible for any financial decisions made based on this information.

Author Bio

Max Fonji is a data-driven financial educator and the founder of The Rich Guy Math. With expertise in financial analysis and wealth-building strategies, Max translates complex financial concepts into actionable insights for everyday investors. His evidence-based approach helps readers understand the math behind money and make informed financial decisions. Max holds advanced certifications in financial planning and regularly contributes to major financial publications.

References

[1] Credit Score Ranges And What They Mean - https://www.chase.com/personal/credit-cards/education/credit-score/credit-score-ranges-and-what-they-mean

[2] Vantagescore 3 - https://vantagescore.com/insights/vantagescore-3

[3] Credit Score - https://www.visionsfcu.org/credit-score

[4] Your 2026 Credit Score Playbook: The Biggest Changes And What They Mean For You - https://mcfcu.org/financialwellness/your-2026-credit-score-playbook-the-biggest-changes-and-what-they-mean-for-you/

[5] Fico 10 Score Changes What It Means To Your Credit - https://www.experian.com/blogs/ask-experian/fico-10-score-changes-what-it-means-to-your-credit/

[6] Your 2026 Credit Score Playbook: The Biggest Changes And What They Mean For You - https://www.elgacu.com/your-2026-credit-score-playbook-the-biggest-changes-and-what-they-mean-for-you/

[7] Your 2026 Credit Score Playbook: The Biggest Changes (and What They Mean For You) - https://www.soarion.org/learn/resources/articles-news/articles/2026/01/21/your-2026-credit-score-playbook--the-biggest-changes-(and-what-they-mean-for-you)

[8] Average Credit Score - https://www.empower.com/the-currency/life/money/average-credit-score

Frequently Asked Questions

Is 700 a good credit score?

Yes, 700 is considered a good credit score and falls within the "Good" range (670–739). You will qualify for most loans and credit cards, although you may not receive the absolute lowest interest rates. Most lenders view scores of 700 or higher favorably when making approval decisions.

What is the average credit score in the U.S.?

The average credit score in the United States is approximately 714 as of 2026. This places the typical consumer in the "Good" credit range and reflects gradual improvement in consumer credit behavior and debt management over recent years.

Can you have a 900 credit score?

No. Standard FICO and VantageScore credit scoring models both have a maximum score of 850. Some specialized industry FICO models (such as auto and credit card lending scores) may range from 250–900, but these are not commonly used for general lending decisions.

How often do credit scores update?

Credit scores typically update once per month when creditors report new account information to the credit bureaus. Reporting timing varies by creditor—some report mid-month while others report at the end of the billing cycle. Changes in credit behavior may take about 30–60 days to fully appear in your score.

Does income affect your credit score?

No, income does not directly affect your credit score. Credit scoring models only evaluate credit account activity, payment history, and debt usage. However, higher income can indirectly help by making it easier to pay bills on time and keep credit utilization low.

Why did my credit score drop 20 points?

A 20-point drop is usually caused by increased credit card utilization, a missed payment, or a recent hard inquiry from applying for credit. Review your credit report for balance changes, payment status updates, or newly opened accounts. In many cases, higher credit utilization is the most common reason for moderate score decreases.