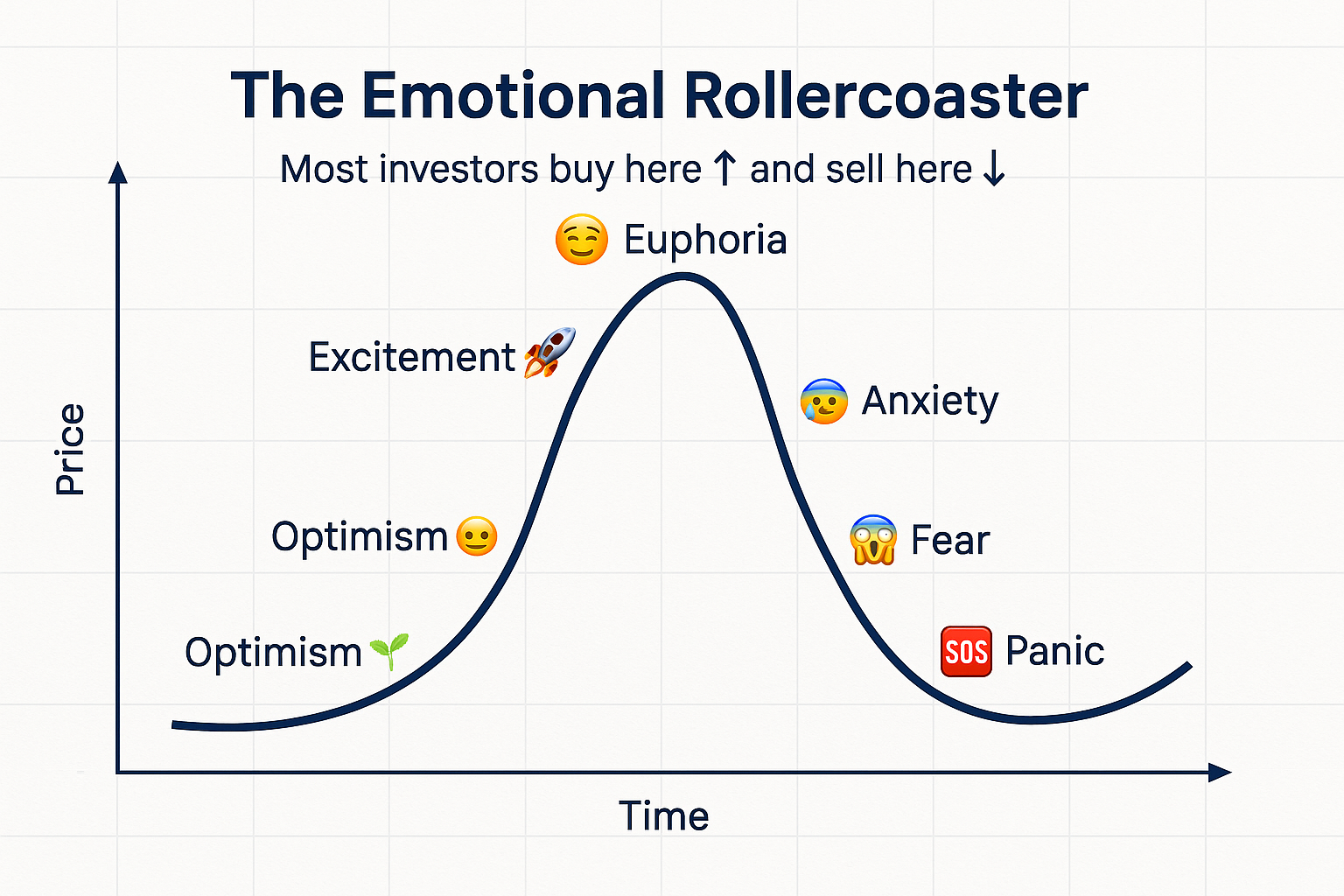

Picture this: You’re watching your portfolio soar to new heights, feeling invincible, ready to put every dollar you have into the market. Six months later, you’re staring at red numbers, paralyzed with fear, ready to sell everything at a loss. Sound familiar? You’ve just experienced the Cycle of Market Emotions—a psychological rollercoaster that has destroyed more wealth than any market crash ever could.

The truth is, markets don’t just move on fundamentals, earnings reports, or economic data. They move on emotions—fear, greed, hope, and panic. Understanding this cycle isn’t just interesting psychology; it’s the difference between building lasting wealth and becoming another statistic of investors who bought high and sold low.

For a broader perspective on managing investments and choosing the right assets, see our guide on complete investing basic.

In this comprehensive guide, we’ll break down the Cycle of Market Emotions, show you exactly where you are in the cycle right now, and give you the tools to make rational decisions when everyone else is losing their minds. Vanguard

Key Takeaways

- The Cycle of Market Emotions is a predictable pattern of psychological stages that investors experience during market fluctuations, from optimism to panic and back again

- Most investors lose money because they buy during euphoria (when prices are high) and sell during depression (when prices are low)—the exact opposite of successful investing

- Recognizing where you are in the emotional cycle helps you make rational decisions instead of emotional ones that destroy wealth

- The cycle repeats endlessly across all markets and time periods, making it one of the most reliable patterns in investing

- Successful investors use the cycle as a contrarian indicator—buying when others are fearful and selling when others are greedy

What Is the Cycle of Market Emotions?

In simple terms, the Cycle of Market Emotions is the predictable sequence of feelings that investors experience as markets rise and fall.

First documented by behavioral economists and popularized by traders and psychologists, this cycle shows how human psychology drives market movements. The cycle typically includes stages like optimism, excitement, thrill, euphoria, anxiety, denial, fear, desperation, panic, capitulation, despondency, depression, hope, relief, and back to optimism.

The Cycle of Market Emotions matters because it explains why intelligent people make terrible investment decisions. When you understand that your feelings are part of a predictable pattern—not unique insights about the market—you can step back and make better choices.

According to research from behavioral finance experts like Daniel Kahneman and Richard Thaler, emotional decision-making costs the average investor 3-5% annually compared to simply holding a diversified portfolio. Over a lifetime of investing, that’s the difference between a comfortable retirement and financial struggle. Nationwide

The Complete Cycle of Market Emotions: Stage by Stage

Let’s walk through each stage of the emotional cycle, what it feels like, and what’s actually happening in the market.

Stage 1: Optimism

What it feels like: The market has been stable or slightly positive. You’re feeling good about your investments and starting to believe things are looking up.

What’s happening: Prices are beginning to rise from a bottom. Smart money and institutional investors are quietly accumulating positions.

Typical investor behavior: Cautiously adding to positions, doing research, feeling confident but not overconfident.

The danger: None yet—this is actually one of the best times to invest, but most people are still too scared from the previous downturn.

Stage 2: Excitement

What it feels like: Your portfolio is up! The gains are becoming noticeable. You’re checking your account more frequently and feeling validated in your investment choices.

What’s happening: The uptrend is confirmed. More investors are noticing and jumping in. Media coverage becomes more positive.

Typical investor behavior: Increasing position sizes, telling friends about your gains, and spending more time researching new opportunities.

The danger: Overconfidence is beginning to build. Risk awareness starts to fade.

Stage 3: Thrill

What it feels like: This is amazing! Your portfolio is up significantly. You’re making more money from investments than from your job. You feel like a genius.

What’s happening: The market is in a strong uptrend. Valuations are getting stretched. Everyone has a story about making money.

Typical investor behavior: Taking bigger risks, using margin or leverage, ignoring warning signs, assuming the trend will continue forever.

The danger: This is where most people start making serious mistakes. Understanding what moves the stock market becomes less important than chasing gains.

Stage 4: Euphoria

What it feels like: You can’t lose! Everything you touch turns to gold. You’re considering quitting your job to trade full-time. Your friends and family are asking for investment advice.

What’s happening: This is the market top. Valuations are at extremes. Retail investors are pouring in. Professional investors are quietly exiting.

Typical investor behavior: Maximum risk-taking, buying overvalued assets, ignoring fundamentals, assuming “this time is different.”

The danger: This is the most dangerous point in the cycle. More wealth is destroyed at euphoria than at any other stage because this is when people invest the most money at the highest prices.

Stage 5: Anxiety

What it feels like: Wait… why did my portfolio just drop? This is probably just a temporary pullback. Right?

What’s happening: The market has peaked and is starting to decline. Initial drops are often sharp and catch people off guard.

Typical investor behavior: Checking accounts constantly, reading news obsessively, hoping for a recovery, holding positions that should be sold.

The danger: Denial is setting in. Instead of accepting the trend change, investors convince themselves it’s temporary.

Stage 6: Denial

What it feels like: This is just a correction. The market always comes back. I’m a long-term investor, so I’m not worried. (But you are worried.)

What’s happening: The decline continues. What looked like a dip becomes a clear downtrend. Losses are accumulating.

Typical investor behavior: Refusing to sell, averaging down on losing positions, avoiding looking at account balances, and making excuses.

The danger: Losses are growing. The longer the denial persists, the harder it becomes to make rational decisions. Many investors who understand why people lose money in the stock market are still trapped by this stage.

Stage 7: Fear

What it feels like: This is bad. Really bad. Your gains are gone. You’re now losing your original investment. Sleep is difficult.

What’s happening: The market is in a confirmed downtrend. Negative news dominates headlines. Selling pressure is intense.

Typical investor behavior: Seriously considering selling, paralyzed by indecision, emotionally exhausted, unable to think clearly.

The danger: Fear leads to poor timing. Many investors sell here, locking in losses just before a rebound.

Stage 8: Desperation

What it feels like: Make it stop! You’ll do anything to stop the bleeding. You can’t believe you were so stupid.

What’s happening: The market continues falling. Volatility is extreme. Every bounce is sold.

Typical investor behavior: Panic selling, abandoning investment plans, making impulsive decisions, seeking any way out.

The danger: Desperation leads to the worst possible decisions at the worst possible times.

Stage 9: Panic

What it feels like: SELL EVERYTHING! Get me out! I don’t care about the price!

What’s happening: This is often near the market bottom. Maximum fear and selling pressure. Volume spikes.

Typical investor behavior: Selling at any price, abandoning the market entirely, swearing never to invest again.

The danger: This is where massive wealth destruction occurs. Investors sell at the lowest prices to buyers who understand the cycle.

Stage 10: Capitulation

What it feels like: I give up. I’m out. I never want to see another stock chart again.

What’s happening: This is typically the market bottom. The last sellers are exiting. Smart money is accumulating aggressively.

Typical investor behavior: Complete exit from the market, moving everything to cash or “safe” assets, feeling defeated.

The danger: Missing the recovery. The best gains often come in the first months after capitulation.

Stage 11: Despondency

What it feels like: Numb. Empty. Regretful. You can’t believe you lost so much money.

What’s happening: The market has bottomed and is starting to stabilize. Selling pressure is exhausted.

Typical investor behavior: Sitting in cash, avoiding financial news, feeling like a failure, telling others to avoid investing.

The danger: Staying out of the market during the early recovery phase.

Stage 12: Depression

What it feels like: Markets are rigged. Investing doesn’t work. You’ll never recover your losses.

What’s happening: The market is actually beginning to recover, but most people don’t notice or don’t believe it.

Typical investor behavior: Complete avoidance of investing, spreading negativity, and missing opportunities.

The danger: This pessimism keeps people out during the best buying opportunities.

Stage 13: Hope

What it feels like: Hmm… maybe things aren’t so bad. The market has been going up for a while now. Maybe I should look at investing again?

What’s happening: The recovery is underway. Prices have risen significantly from the bottom. The trend is clearly positive.

Typical investor behavior: Cautiously researching, considering small positions, still skeptical.

The danger: Waiting too long. By the time most people feel hope, much of the recovery has already happened.

Stage 14: Relief

What it feels like: Okay, I’m back in. I’m being careful this time. I’ve learned my lesson.

What’s happening: The uptrend is established. The market is back in a healthy pattern.

Typical investor behavior: Re-entering the market, rebuilding positions, feeling cautiously optimistic.

The danger: None—this is actually a reasonable time to invest, though not as good as during depression or despondency.

Stage 15: Optimism

What it feels like: Things are looking good again. I’m feeling confident about my investments.

What’s happening: The market is rising steadily. We’re back at the beginning of the cycle.

The cycle begins again.

Why the Cycle of Market Emotions Destroys Wealth

The Cycle of Market Emotions is devastating to investors for one simple reason: it causes people to do exactly the opposite of what works.

Successful investing requires buying low and selling high. But the emotional cycle makes people:

- Feel most confident (and invest the most) when prices are highest

- Feel most fearful (and sell everything) when prices are lowest

Let’s look at a real example:

Case Study: The 2020 COVID Market Crash

In February 2020, the S&P 500 was at an all-time high of around 3,380. Investor sentiment was at euphoria. Then COVID-19 hit.

By March 23, 2020, the market had crashed to 2,237—a 34% decline in just 33 days.

What most investors did:

- February 2020 (at the top): Fully invested, feeling great, buying more

- March 2020 (at the bottom): Panic selling, moving to cash, convinced the world was ending

What happened next:

The market recovered all losses by August 2020 and went on to gain another 50%+ over the next year.

The result:

- Investors who sold in panic locked in 30%+ losses

- Investors who bought during the panic made 50%+ gains

- Investors who simply held recovered and participated in the gains

According to data from Dalbar’s Quantitative Analysis of Investor Behavior, the average equity investor underperformed the S&P 500 by 4.39% annually over the 20 years ending in 2024, primarily due to emotional decision-making and poor timing.

This pattern repeats in every market cycle. The stock market goes up over time, but most investors miss those gains because of emotional mistakes.

The Psychology Behind the Cycle: Why We Can’t Help Ourselves

Understanding why we fall into these emotional traps is the first step to avoiding them.

Loss Aversion

Research by Daniel Kahneman and Amos Tversky shows that the pain of losing money is about twice as powerful as the pleasure of gaining money.

This means:

- A $10,000 loss hurts more than a $10,000 gain feels good

- We become risk-averse after losses (selling at bottoms)

- We become risk-seeking after gains (buying at tops)

Herd Mentality

Humans evolved to follow the crowd for survival. In investing, this manifests as:

- Buying because “everyone else is making money”

- Selling because “everyone else is getting out”

- Trusting the consensus even when it’s wrong

The problem? The crowd is always wrong at extremes. When everyone is bullish, there’s no one left to buy. When everyone is bearish, there’s no one left to sell.

Recency Bias

We give too much weight to recent events and assume they’ll continue:

- After a bull market: “Stocks always go up.”

- After a bear market: “Stocks always go down.”

- After a crash: “It’s different this time”

None of these is true, but they feel true in the moment.

Confirmation Bias

We seek information that confirms what we already believe:

- During euphoria, we only read bullish articles

- During panic, we only read bearish articles

- We ignore contradictory evidence

This creates echo chambers that reinforce emotional decisions.

How to Use the Cycle of Market Emotions to Your Advantage

Now that you understand the cycle, here’s how to profit from it instead of becoming a victim of it.

Strategy 1: Identify Where You Are in the Cycle

Ask yourself these questions:

- How do I feel about my investments right now?

- What is everyone around me saying about the market?

- Am I making decisions based on fear or greed?

- Is the media overwhelmingly positive or negative?

Use these indicators:

| Stage | Your Feelings | Media Coverage | Market Action |

|---|---|---|---|

| Optimism-Excitement | Cautiously positive | Balanced, slightly positive | Steady gains |

| Thrill-Euphoria | Invincible, genius | Extremely bullish, FOMO-inducing | Parabolic moves, new highs |

| Anxiety-Denial | Confused, worried | Starting to turn negative | First significant drops |

| Fear-Panic | Terrified, desperate | Extremely bearish, doom-focused | Sharp declines, high volatility |

| Capitulation-Depression | Defeated, hopeless | “End of markets” narratives | Bottoming process |

| Hope-Relief | Cautiously optimistic | Tentatively positive | Steady recovery |

Strategy 2: Be a Contrarian

The contrarian principle: Do the opposite of what feels comfortable.

When you’re at:

- Euphoria: Reduce positions, take profits, increase cash

- Panic: Increase positions, deploy cash, buy quality assets

- Optimism/Relief: Maintain balanced positions

Warren Buffett’s famous quote applies perfectly: “Be fearful when others are greedy, and greedy when others are fearful.”

This doesn’t mean being contrarian for its own sake. It means recognizing that extremes of emotion create extremes of pricing—and extremes of pricing create opportunities.

Strategy 3: Create Rules-Based Systems

Emotions are powerful. You can’t eliminate them, but you can prevent them from controlling your decisions.

Develop these rules before a crisis:

- Rebalancing rules: “I will rebalance to my target allocation every quarter, regardless of how I feel.”

- Buying rules: “I will invest X dollars every month, no matter what the market is doing.”

- Selling rules: “I will only sell when fundamentals change or I need the money, not because of price movements.”

- Position sizing rules: “I will never have more than X% in any single investment.”

Write these down. Make them specific. Follow them religiously.

Strategy 4: Dollar-Cost Averaging

One of the best ways to remove emotion from investing is to invest the same amount at regular intervals, regardless of market conditions.

Why this works:

- You buy more shares when prices are low

- You buy fewer shares when prices are high

- You remove the need to “time the market”

- You automate the process, eliminating emotional decisions

Many successful investors use dividend investing strategies combined with dollar-cost averaging to build wealth systematically while generating income.

Strategy 5: Focus on Time in the Market, Not Timing the Market

The data is clear: Missing the best days in the market is devastating to returns.

According to J.P. Morgan research:

- If you invested $10,000 in the S&P 500 in 2003 and stayed fully invested through 2023, you’d have about $65,453

- If you missed just the 10 best days (out of 5,000+ trading days), you’d have only $30,119

- If you missed the 30 best days, you’d have only $15,732

The problem: The best days often occur during the worst times—right after panic selling.

The solution? Stay invested. Ignore the noise. Trust the process.

Common Mistakes at Each Stage of the Cycle

Mistakes During Bull Markets (Optimism → Euphoria)

Overconcentration: Putting too much money into “hot” stocks or sectors

Using leverage: Borrowing money to invest when you feel invincible

Ignoring valuations: Paying any price because “it will keep going up”

Abandoning diversification: Selling stable investments for exciting ones

Lifestyle inflation: Spending unrealized gains

Mistakes During Bear Markets (Anxiety → Depression)

Panic selling: Locking in losses at the worst possible time

Abandoning plans: Giving up on long-term strategies due to short-term pain

Avoiding the market: Staying in cash during recovery

Averaging down blindly: Adding to losing positions without reassessing fundamentals

Making major life decisions: Changing careers or retirement plans based on temporary market conditions

Mistakes During Recovery (Hope → Relief)

Waiting for “confirmation”: Missing the early stages of recovery

Being too conservative: Staying in cash too long after the bottom

Chasing past performance: Buying what worked in the previous cycle

Overreacting to volatility: Selling during normal pullbacks

Real-World Examples: The Cycle in Action

The Dot-Com Bubble (1995-2002)

Optimism → Euphoria (1995-2000):

- The internet was going to change everything

- Companies with no profits had billion-dollar valuations

- Day trading became a national pastime

- The NASDAQ soared from 1,000 to over 5,000

Peak euphoria: March 2000, when even your barber was giving stock tips

Anxiety → Panic (2000-2002):

- The NASDAQ crashed 78% from peak to trough

- Trillions in wealth evaporated

- Investors who bought at the top lost everything

Depression → Hope (2002-2004):

- “The stock market is dead.”

- “I’ll never invest in stocks again.”

- Meanwhile, the recovery was beginning

The lesson: Those who sold during panic missed the subsequent 400%+ rally from 2002 to 2007.

The 2008 Financial Crisis

Euphoria (2006-2007):

- Real estate “never goes down”

- Banks were leveraged 30-to-1

- Everyone was flipping houses

Panic (2008-2009):

- The S&P 500 fell 57%

- Major banks collapsed

- “The end of capitalism”

Depression (2009):

- Newsweek cover: “The Death of Equities”

- Investors fled to cash

- Pessimism was universal

What happened next:

From the March 2009 bottom, the S&P 500 rallied over 400% in the next decade—the longest bull market in history.

The lesson: Maximum pessimism = maximum opportunity

The COVID-19 Crash (2020)

Euphoria (February 2020):

- Markets at all-time highs

- Record low volatility

- “Nothing can stop this market.”

Panic (March 2020):

- 34% crash in 33 days

- Circuit breakers triggered multiple times

- “The world is ending.”

Hope → Optimism (April 2020 onward):

- Fastest recovery in history

- New all-time highs within months

- 100%+ gain from the bottom

The lesson: The most terrifying moments often precede the best opportunities. Understanding what moves the stock market during crises helps maintain perspective.

Building Emotional Resilience: Practical Tools

Tool 1: The Investment Policy Statement (IPS)

Create a written document that outlines:

- Your investment goals

- Your risk tolerance

- Your asset allocation targets

- Your rebalancing rules

- Your buying and selling criteria

Why it works: When emotions run high, refer to this document. It’s your rational self talking to your emotional self.

Tool 2: The “Sleep Well” Test

Before making any investment decision, ask: “Will this decision let me sleep well at night?”

If the answer is no:

- Your position is too large

- You’re taking too much risk

- You need to adjust your strategy

Successful investing should reduce stress, not increase it.

Tool 3: The 72-Hour Rule

When you feel a strong urge to buy or sell based on emotion:

- Wait 72 hours

- Write down why you want to make the change

- Revisit the decision after the waiting period

The result: Most emotional impulses pass. The really good decisions still make sense after 72 hours.

Tool 4: The Accountability Partner

Find someone who:

- Understands investing

- Knows your goals

- Will challenge your emotional decisions

- Can provide an objective perspective

This could be a financial advisor, a trusted friend, or an investment club.

Tool 5: The Media Diet

During market extremes, limit your exposure to financial media.

Why? Media makes money from clicks and views, not from helping you make good decisions. They amplify emotions—both positive and negative.

Instead:

- Check your portfolio once per month (or quarter)

- Read long-form, educational content

- Focus on fundamentals, not price movements

- Avoid doom-scrolling financial Twitter

The Cycle of Market Emotions and Different Investment Strategies

For Long-Term Investors

Your advantage: Time heals all wounds. Every bear market in history has been followed by new highs.

Your strategy:

- Ignore the cycle’s short-term noise

- Rebalance during extremes

- Increase contributions during panic

- Never sell in fear

Consider building passive income through dividend investing, which provides cash flow regardless of market emotions.

For Active Traders

Your challenge: The cycle affects you more intensely because you’re more engaged.

Your strategy:

- Use technical indicators to identify cycle stages

- Reduce position sizes during euphoria

- Increase position sizes during panic

- Always use stop losses to protect against emotional holding

For Retirees

Your situation: You can’t afford major losses, but you also can’t afford to miss growth.

Your strategy:

- Maintain a balanced portfolio (stocks + bonds + cash)

- Keep 2-3 years of expenses in cash/bonds

- Rebalance annually to sell high and buy low

- Don’t panic-sell your stock allocation

Focus on high dividend stocks that provide income without requiring you to sell during downturns.

For Beginners

Your risk: You’re most vulnerable to emotional mistakes because you lack experience.

Your strategy:

- Start small while you learn

- Use dollar-cost averaging

- Invest in broad index funds

- Read educational content from trusted sources like TheRichGuyMath

- Expect to make mistakes—they’re part of the learning process

Advanced Concepts: Sentiment Indicators

Professional investors use quantitative measures to track where we are in the emotional cycle:

The VIX (Fear Index)

What it measures: Expected market volatility over the next 30 days

How to interpret:

- VIX below 15: Complacency (possible euphoria)

- VIX 15-25: Normal market conditions

- VIX above 30: Fear (possible opportunity)

- VIX above 40: Panic (major opportunity)

The contrarian play: When the VIX spikes above 40, it’s often a good time to buy.

Put/Call Ratio

What it measures: The ratio of put options (bearish bets) to call options (bullish bets)

How to interpret:

- High ratio: Excessive fear (possible bottom)

- Low ratio: Excessive optimism (possible top)

AAII Sentiment Survey

The American Association of Individual Investors tracks retail investor sentiment weekly.

How to interpret:

- Bullish % above 50%: Excessive optimism

- Bearish % above 50%: Excessive pessimism

- Extreme readings often precede reversals

CNN Fear & Greed Index

This composite indicator combines seven metrics to gauge market emotion on a 0-100 scale.

How to interpret:

- 0-25: Extreme Fear (buying opportunity)

- 25-45: Fear

- 45-55: Neutral

- 55-75: Greed

- 75-100: Extreme Greed (consider reducing risk)

Creating Your Personal Emotion-Proof Investment Plan

Here’s a step-by-step framework to build resilience against the Cycle of Market Emotions:

Step 1: Define Your Goals

Be specific:

- “I want to be rich.”

- “I want $2 million by age 65 for retirement.”

Write down:

- Target amount

- Target date

- Purpose (retirement, house, education, etc.)

Step 2: Determine Your True Risk Tolerance

Ask yourself:

- How would I feel if my portfolio dropped 30% tomorrow?

- Would I sell, hold, or buy more?

- How much money can I afford to lose without affecting my life?

Be honest: Most people overestimate their risk tolerance during bull markets and underestimate it during bear markets.

Step 3: Create Your Asset Allocation

Based on your goals and risk tolerance, determine your mix:

Example allocations:

| Profile | Stocks | Bonds | Cash | Real Estate/Other |

|---|---|---|---|---|

| Aggressive (20s-30s) | 90% | 5% | 5% | 0% |

| Moderate (40s-50s) | 70% | 20% | 5% | 5% |

| Conservative (60s+) | 50% | 35% | 10% | 5% |

Step 4: Establish Rebalancing Rules

Example rule: “I will rebalance when any asset class deviates more than 5% from its target allocation, or once per year, whichever comes first.”

This forces you to:

- Sell what’s gone up (during euphoria)

- Buy what’s gone down (during panic)

- Remove emotion from the process

Step 5: Automate Everything Possible

- Set up automatic monthly investments

- Enable automatic dividend reinvestment

- Use target-date funds or robo-advisors if you don’t trust yourself

- Schedule annual reviews in your calendar

Step 6: Educate Yourself Continuously

The more you understand about markets, the less emotional you’ll be:

- Read books on behavioral finance

- Study market history

- Learn from others’ mistakes

- Follow educational resources like TheRichGuyMath’s smart money moves

Step 7: Track Your Behavior, Not Just Your Returns

Keep a journal:

- How did you feel during market swings?

- What decisions did you make?

- Were they based on logic or emotion?

- What would you do differently?

Over time, you’ll notice patterns and become more aware of your emotional triggers.

The Cycle of Market Emotions: A Lifetime Perspective

Here’s the ultimate truth about the Cycle of Market Emotions: You will experience it dozens of times in your investing lifetime. Russell Investments

The stock market has had:

- 26 bear markets (20%+ declines) since 1928

- Dozens of corrections (10-20% declines)

- Multiple crashes (30%+ declines)

- Countless smaller pullbacks

This means:

- If you invest for 40 years, you’ll likely experience 10+ bear markets

- You’ll feel euphoria many times

- You’ll feel panic many times

- The cycle will repeat endlessly

The investors who succeed are those who:

- Recognize the cycle

- Prepare for it

- Don’t let it control their decisions

- Stay invested through all stages

Think of the Cycle of Market Emotions like the weather. You can’t control it, but you can:

- Understand the patterns

- Prepare appropriately

- Dress for the conditions

- Know that storms always pass

FAQ: Cycle of Market Emotions

What is the Cycle of Market Emotions?

The Cycle of Market Emotions is a behavioral finance concept that describes the predictable sequence of psychological stages investors experience during market fluctuations, ranging from optimism and euphoria during bull markets to fear and depression during bear markets. Understanding this cycle helps investors recognize when emotions are driving their decisions rather than logic.

How long does a complete Cycle of Market Emotions last?

A complete cycle can last anywhere from several months to several years, depending on the market environment. The 2020 COVID crash cycle completed in about 6 months, while the 2008 financial crisis cycle took nearly 4 years from peak euphoria to recovery. The key is that cycles are measured by emotional stages, not fixed time periods.

At what stage of the Cycle of Market Emotions should I buy?

The best buying opportunities typically occur during the fear, panic, capitulation, and depression stages when prices are lowest and sentiment is most negative. However, this is also when buying feels most uncomfortable. The second-best time is during optimism and relief when the recovery is confirmed but not yet overextended.

How can I avoid making emotional investment decisions?

Create a written investment plan before a crisis occurs, use dollar-cost averaging to automate investments, set clear rules for buying and selling, limit exposure to financial media during extremes, and implement a 72-hour waiting period before making major changes. Having an accountability partner or financial advisor can also provide objective perspective.

Is the Cycle of Market Emotions the same for all investors?

While the overall market cycle follows a predictable pattern, individual investors experience stages at different intensities based on their experience level, risk tolerance, and portfolio composition. New investors and those with concentrated portfolios tend to experience more extreme emotional swings than experienced investors with diversified holdings.

Can professional investors avoid the Cycle of Market Emotions?

Even professional investors experience these emotions, but they typically have better systems, discipline, and experience to manage them. Many institutional investors use quantitative models and strict rules to override emotional impulses. However, research shows that even professionals can fall victim to herd mentality and emotional decision-making during extremes.

What’s the biggest mistake investors make in the Cycle of Market Emotions?

The biggest mistake is buying during euphoria (when prices are highest and risk is greatest) and selling during panic or capitulation (when prices are lowest and opportunity is greatest). This “buy high, sell low” pattern is the opposite of successful investing and destroys more wealth than any other behavioral error.

Conclusion: Mastering Your Emotions, Mastering the Market

The Cycle of Market Emotions isn’t just an interesting psychological curiosity—it’s the single most important concept for investment success that most people ignore.

Here’s what we’ve learned:

The cycle is predictable. It repeats in every market, in every era, across all asset classes. Human psychology hasn’t changed in thousands of years, and it won’t change in your lifetime.

The cycle is powerful. It causes intelligent people to make terrible decisions, destroying wealth at a scale that no market crash ever could.

The cycle is beatable. Not by ignoring your emotions—that’s impossible—but by recognizing them, preparing for them, and building systems that prevent them from controlling your decisions.

The greatest investors in history—Warren Buffett, Peter Lynch, John Templeton—succeeded not because they were smarter or had better information, but because they mastered their emotions when others couldn’t.

Your Action Plan: Starting Today

- Identify where you are in the current cycle by honestly assessing your feelings and the market environment

- Create your Investment Policy Statement outlining your goals, allocation, and rules

- Set up automatic investments to remove emotion from the equation

- Educate yourself on market history and behavioral finance

- Find an accountability partner who can provide an objective perspective

- Commit to the process, knowing that you’ll be tested repeatedly

Remember: The goal isn’t to time the market perfectly or avoid all losses. The goal is to stay in the game long enough for compound growth to work its magic.

Every time you feel the urge to panic sell or euphoric buy, ask yourself: “Where am I in the Cycle of Market Emotions? Is this feeling a signal or noise?”

More often than not, intense emotions are the best contrarian indicators you’ll ever find.

The market will continue its cycles. Prices will rise and fall. Euphoria and panic will come and go. The question is: Will you be a victim of the cycle, or will you use it to your advantage?

The choice is yours. The cycle is waiting.

For more insights on building wealth through intelligent investing, explore our guides on smart ways to make passive income and understanding the stock market fundamentals.

Interactive Tool: Cycle of Market Emotions Tracker

🎯 Where Are You in the Cycle of Market Emotions?

Answer these questions honestly to identify your current emotional stage

The Complete Cycle

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Investing involves risk, including the potential loss of principal. Past performance does not guarantee future results. Always conduct your own research and consider consulting with a qualified financial advisor before making investment decisions. The Cycle of Market Emotions is a behavioral concept and should not be used as the sole basis for investment decisions.

Written by Max Fonji — With over a decade of experience in financial education and investing, Max is your go-to source for clear, data-backed investing education. Through TheRichGuyMath.com, Max helps everyday investors understand complex financial concepts and build lasting wealth through smart, emotion-proof strategies.