Picture this: It’s 2008, the stock market is crashing, companies are slashing dividends left and right, and investors are watching their retirement dreams evaporate. But there’s a group of companies, a special club, that not only kept paying dividends but actually increased them. Year after year. Decade after decade. Even during the worst financial crisis in generations.

These aren’t just any companies. They’re Dividend Aristocrats, and understanding them could transform how you think about building wealth through the stock market.

Whether you’re just starting your investing journey or looking to build a more stable portfolio, Dividend Aristocrats represent one of the most reliable wealth-building strategies available. They’re companies that have proven themselves through recessions, market crashes, and economic uncertainty, and they’ve rewarded their shareholders every single step of the way.

Key Takeaways

- Dividend Aristocrats are S&P 500 companies that have increased their dividends for at least 25 consecutive years

- These companies have historically outperformed the broader market while providing lower volatility

- Aristocrats offer a combination of income generation and long-term capital appreciation

- Only about 60-70 companies currently hold this prestigious status

- Regular dividend increases help protect against inflation and compound wealth over time

What Exactly Are Dividend Aristocrats?

Let’s cut through the jargon and get to the heart of what makes a Dividend Aristocrat.

A Dividend Aristocrat is a company in the S&P 500 Index that has increased its dividend payment to shareholders for at least 25 consecutive years. That’s not just paying dividends, that’s raising them, year after year, for over a quarter century. Investopedia

Think about that for a moment. Twenty-five years means surviving multiple recessions, market crashes, technological disruptions, and countless economic challenges. It means having such strong fundamentals and disciplined management that even when times get tough, the company can still reward shareholders with bigger checks.

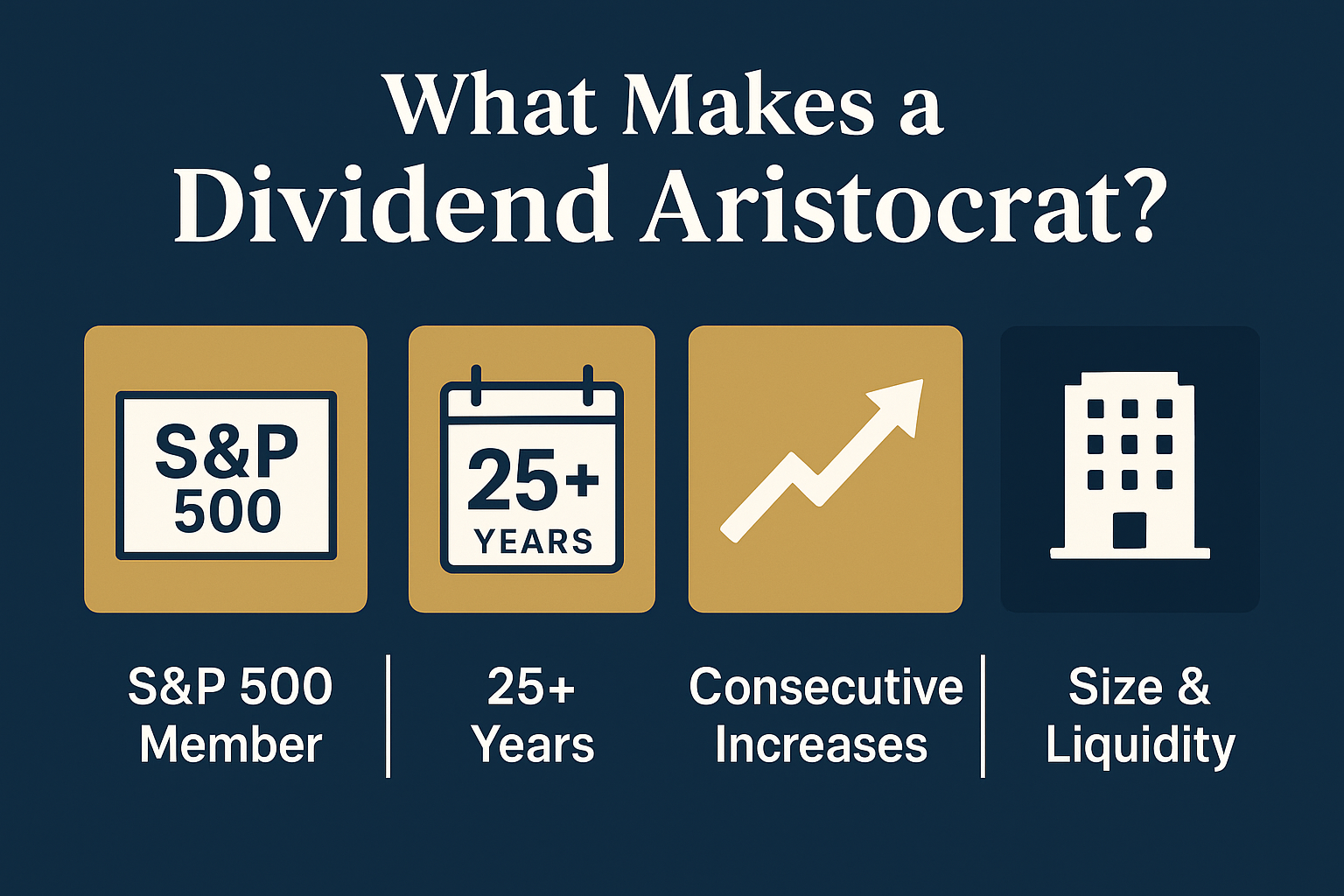

The Strict Requirements

To earn the Dividend Aristocrat badge, companies must meet several criteria:

- Be a member of the S&P 500 – This means they’re already among America’s largest, most established companies

- Increase dividends for 25+ consecutive years – Not just maintain, but actually raise the dividend every single year

- Meet minimum size and liquidity requirements – Ensuring they’re substantial enough for institutional investors

- Maintain sector diversification – The index is rebalanced to avoid over-concentration in any single sector

As of 2025, only about 60-70 companies hold this elite status, out of 500 in the S&P 500. That’s roughly 12-14% of the index. It’s an exclusive club for a reason.

Why Dividend Aristocrats Matter for Your Portfolio

You might be wondering: “Why should I care about companies that have raised dividends for decades?” Great question. Let’s break down why these companies deserve your attention.

1. Proven Business Quality

Companies don’t accidentally increase dividends for 25+ years. It requires:

- Strong cash flow generation – Consistent ability to produce more cash than they spend

- Disciplined management – Leadership focused on long-term shareholder value

- Competitive advantages – Moats that protect their business from competitors

- Financial stability – Balance sheets strong enough to weather economic storms

When you invest in Dividend Aristocrats, you’re buying companies that have already proven they can survive and thrive through multiple economic cycles. They’ve navigated the cycle of market emotions better than most.

2. Reliable Income Stream

For investors seeking passive income through dividend investing, Dividend Aristocrats offer something precious: predictability.

Unlike growth stocks that may or may not appreciate, or companies that might cut dividends when times get tough, Aristocrats have a track record of increasing payments. This makes them ideal for:

- Retirees needing steady income

- Investors building a dividend portfolio

- Anyone seeking to reduce portfolio volatility

- Long-term wealth builders using dividend reinvestment

3. Inflation Protection

Here’s something many investors overlook: inflation is a silent wealth killer.

If you buy a bond paying 4% annually, that payment stays fixed. But if inflation runs at 3%, your real return is only 1%. Over time, your purchasing power erodes.

Dividend Aristocrats combat this through regular dividend increases. As the cost of living rises, so do your dividend payments. It’s like having a built-in cost-of-living adjustment for your investment income.

4. Lower Volatility

Data shows that Dividend Aristocrats as a group tend to experience less dramatic price swings than the broader market. Why?

- Dividend payments provide a “floor” that supports stock prices

- Quality companies attract long-term investors who don’t panic-sell

- Steady cash flows make earnings more predictable

- Mature businesses face fewer growth uncertainties

This doesn’t mean they never decline, every stock does. But the ride tends to be smoother, which helps investors avoid common mistakes that cause people to lose money in the stock market.

How Dividend Aristocrats Have Performed Historically

Numbers don’t lie, and the performance data for Dividend Aristocrats is compelling.

According to S&P Dow Jones Indices, the S&P 500 Dividend Aristocrats Index has historically outperformed the broader S&P 500 over long periods, particularly during market downturns. Here’s what the data shows:

| Period | S&P 500 Dividend Aristocrats | S&P 500 | Difference |

|---|---|---|---|

| 10-Year Annualized | ~11-12% | ~10-11% | +1% |

| 20-Year Annualized | ~10-11% | ~9-10% | +1% |

| During 2008 Crisis | -22% | -37% | +15% |

Note: Past performance doesn’t guarantee future results, but it does demonstrate resilience.

The Power of Dividend Reinvestment

The real magic happens when you reinvest those dividends. Let’s look at a simple example:

Scenario: You invest $10,000 in a Dividend Aristocrat yielding 3% annually, with dividend growth averaging 7% per year.

- Year 1: You receive $300 in dividends

- Year 5: You receive approximately $420 in dividends

- Year 10: You receive approximately $590 in dividends

- Year 20: You receive approximately $1,160 in dividends

If you reinvest those dividends, buying more shares each time, the compounding effect becomes extraordinary. Your $10,000 could grow to $40,000+ over 20 years, even without additional contributions.

This is one of the smart ways to make passive income that requires minimal ongoing effort.

Examples of Well-Known Dividend Aristocrats

Let’s make this concrete with some real companies you probably know:

Johnson & Johnson (JNJ)

The healthcare giant has increased dividends for over 60 consecutive years. From Band-Aids to prescription medications, J&J’s diversified business model has proven remarkably resilient.

Coca-Cola (KO)

The beverage behemoth has raised dividends for over 60 years. Despite changing consumer preferences, Coca-Cola’s global distribution and brand power keep the cash flowing.

Procter & Gamble (PG)

With over 65 years of consecutive dividend increases, P&G demonstrates how consumer staples can provide steady returns. People always need toothpaste, laundry detergent, and diapers—regardless of the economy.

Walmart (WMT)

The retail giant has increased dividends for nearly 50 years. Its low-cost business model actually thrives during economic uncertainty when consumers seek value.

McDonald’s (MCD)

With over 45 years of dividend growth, McDonald’s shows how a strong franchise model can generate consistent cash flows across economic cycles.

These aren’t exciting tech startups promising to disrupt industries. They’re steady, boring, profitable businesses that have mastered the art of generating cash and returning it to shareholders. Morningstar

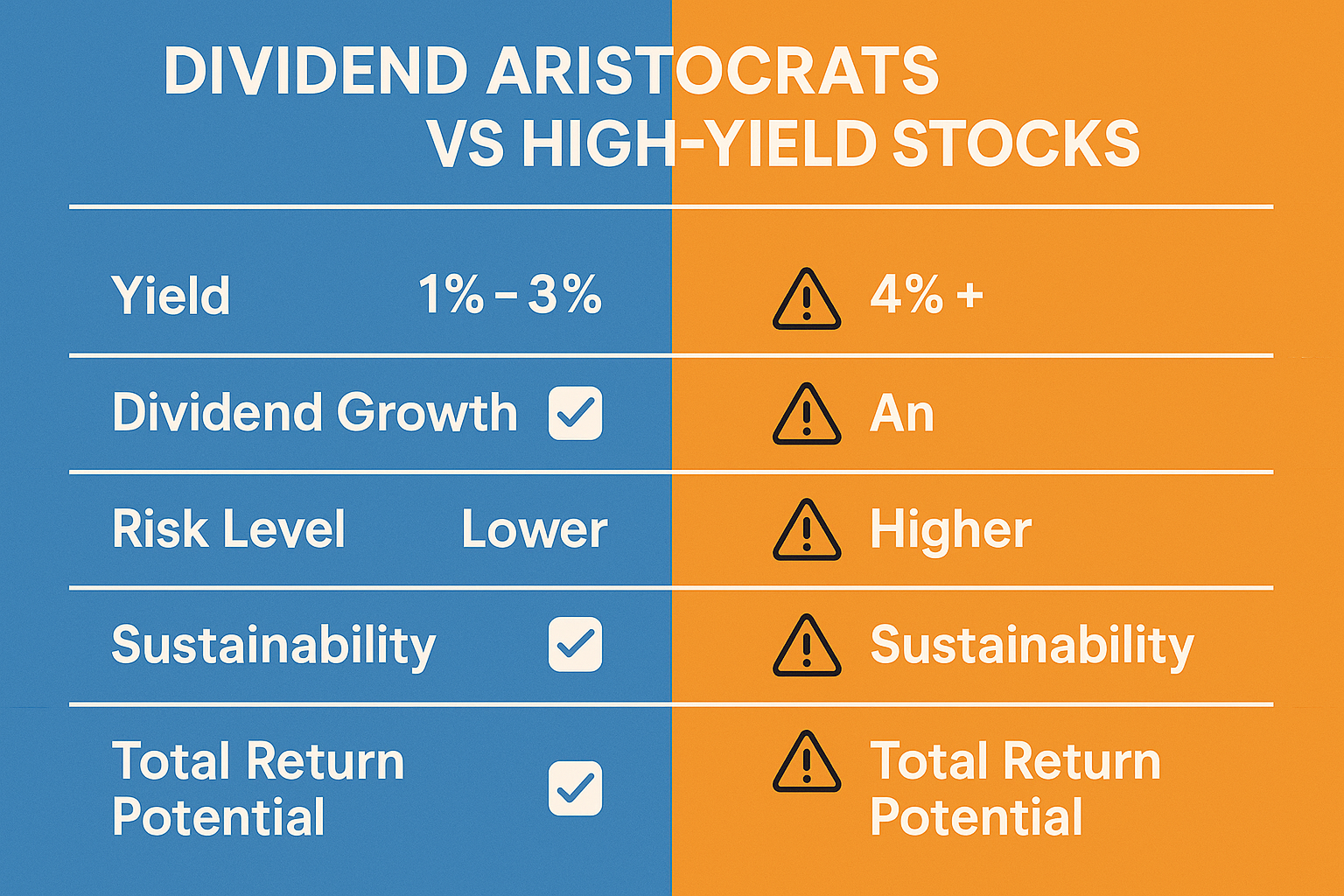

Dividend Aristocrats vs High-Yield Dividend Stocks

Here’s a critical distinction many beginner investors miss: Dividend Aristocrats are not the same as high-dividend stocks.

Let’s compare:

Dividend Aristocrats:

- ✅ Moderate yields (typically 2-4%)

- ✅ Consistent dividend growth

- ✅ Lower risk of dividend cuts

- ✅ Focus on total return (dividends + growth)

- ✅ Proven track record of stability

High-Dividend Stocks:

- ⚠️ High yields (often 6%+)

- ⚠️ Inconsistent dividend growth

- ⚠️ Higher risk of dividend cuts

- ⚠️ May sacrifice growth for yield

- ⚠️ Often in struggling industries

The yield trap: A stock yielding 8% might seem attractive, but if the company cuts its dividend by 50% next year, you’ve actually lost money. Meanwhile, a Dividend Aristocrat yielding 3% but growing 7% annually will surpass that high-yielder within a few years, and with far less risk.

Think of it this way: Would you rather have a friend who gives you $8 today but might disappear tomorrow, or a friend who gives you $3 today but increases it to $4, then $5, then $6 over the coming years? The Dividend Aristocrats are the reliable friend.

How to Invest in Dividend Aristocrats

Ready to add Dividend Aristocrats to your portfolio? You have several options:

Option 1: Buy Individual Aristocrat Stocks

Pros:

- Complete control over which companies you own

- Ability to overweight your favorites

- Direct ownership and voting rights

- Potentially lower fees than funds

Cons:

- Requires research and monitoring

- Need significant capital for proper diversification

- Must manage rebalancing yourself

- Time-intensive

Best for: Investors who enjoy researching the stock market and have time to manage their portfolio actively.

Option 2: Dividend Aristocrat ETFs

Several exchange-traded funds focus specifically on Dividend Aristocrats:

ProShares S&P 500 Dividend Aristocrats ETF (NOBL)

- Tracks the S&P 500 Dividend Aristocrats Index

- Equal-weighted approach

- Low expense ratio (~0.35%)

- Automatic rebalancing

SPDR S&P Dividend ETF (SDY)

- Focuses on high-yield dividend growers

- Includes some Aristocrats

- Slightly different methodology

Pros:

- Instant diversification across all Aristocrats

- Professional management and rebalancing

- Low minimum investment

- Simple and hands-off

Cons:

- Annual fees (though modest)

- Less control over individual holdings

- May include companies you’d prefer to avoid

Best for: Beginners or busy investors who want Aristocrat exposure without the work.

Option 3: Dividend-Focused Mutual Funds

Some actively managed mutual funds focus on dividend growth stocks, including many Aristocrats.

Pros:

- Professional stock selection

- May identify future Aristocrats early

- Active risk management

Cons:

- Higher fees than ETFs

- Active management doesn’t always outperform

- Less tax-efficient than ETFs

Building a Dividend Aristocrat Strategy

Simply buying Dividend Aristocrats isn’t enough, you need a strategy. Here’s how to approach it:

Step 1: Determine Your Allocation

How much of your portfolio should be in Dividend Aristocrats? Consider:

- Your age: Younger investors might allocate 20-30%, older investors 40-60%

- Income needs: Retirees might want higher allocations for income

- Risk tolerance: Aristocrats reduce volatility but may underperform in bull markets

- Other holdings: Balance with growth stocks and bonds

Step 2: Diversify Across Sectors

Don’t put all your eggs in one industry basket. Aim for representation across:

- Consumer Staples

- Healthcare

- Industrials

- Financials

- Consumer Discretionary

- Materials

- Utilities

- Technology (fewer Aristocrats here, but growing)

Step 3: Reinvest Those Dividends

Set up automatic dividend reinvestment (DRIP) through your brokerage. This ensures:

- You buy more shares automatically

- No transaction fees (usually)

- Compounding happens without effort

- You benefit from dollar-cost averaging

Step 4: Monitor and Rebalance Annually

Once or twice a year, review your holdings:

- Has any company been removed from the Aristocrats list?

- Are any sectors overweighted?

- Should you add new Aristocrats that were recently added?

- Are valuations reasonable, or should you wait?

Step 5: Stay Patient

Dividend Aristocrat investing is a long-term strategy. You won’t get rich overnight, but you’ll build wealth steadily and sleep better during market crashes.

As Warren Buffett famously said: “The stock market is a device for transferring money from the impatient to the patient.”

Common Mistakes to Avoid

Even with quality companies like Dividend Aristocrats, investors can stumble. Here are pitfalls to avoid:

Chasing Yield

Just because a company is a Dividend Aristocrat doesn’t mean it’s always a good buy. If a stock has fallen dramatically, its yield might look attractive, but there could be underlying problems.

Example: A stock trading at $100 with a $3 dividend yields 3%. If it falls to $50, the yield is now 6%, but the company might be in trouble.

Ignoring Valuation

Dividend Aristocrats can become overvalued, especially when interest rates are low and investors flock to dividend-paying stocks. Use metrics like:

- Price-to-Earnings (P/E) ratio

- Dividend payout ratio

- Price-to-Book ratio

- Compare current valuation to historical averages

Forgetting About Growth

While dividends are important, don’t ignore total return. A company that grows its dividend 3% annually but whose stock price stagnates will underperform one that grows dividends 5% with modest price appreciation.

Lack of Diversification

Owning five Dividend Aristocrats might seem diversified, but if they’re all in the same sector, you’re exposed to sector-specific risks. Spread your investments across industries.

Panic Selling During Downturns

Dividend Aristocrats are designed to be held through market cycles. Selling during a downturn locks in losses and interrupts your compounding. Remember, these companies have survived worse. SSGA

Dividend Aristocrats vs Dividend Kings and Champions

You might encounter other dividend-focused categories. Here’s how they compare:

| Category | Requirement | Number of Companies | Index |

|---|---|---|---|

| Dividend Aristocrats | S&P 500 + 25 years | ~60-70 | Yes (NOBL) |

| Dividend Kings | Any company + 50 years | ~45 | No official index |

| Dividend Champions | Any company + 25 years | ~150+ | No official index |

| Dividend Achievers | Any company + 10 years | ~300+ | Yes (multiple) |

Dividend Kings are the ultimate elite, companies that have increased dividends for 50+ consecutive years. They’re even rarer than Aristocrats but aren’t limited to S&P 500 companies.

Dividend Champions use the same 25-year criteria as Aristocrats but include companies outside the S&P 500, offering more opportunities but less liquidity.

Dividend Achievers have a lower bar (10 years), making them more numerous but potentially less proven.

For most investors, Dividend Aristocrats offer the best balance of quality, liquidity, and accessibility.

Real-World Success Story: The Power of Patient Dividend Investing

Let me share a story that illustrates the power of Dividend Aristocrats.

Meet Sarah, a teacher who started investing in 1995 at age 35. She didn’t have much, just $5,000 to start and $200 per month to invest. But she made smart moves by focusing on Dividend Aristocrats.

She bought shares in companies like Coca-Cola, Johnson & Johnson, and Procter & Gamble. Nothing fancy. She set up automatic dividend reinvestment and added $200 monthly, rain or shine.

What happened?

- 2000 Dot-com crash: Her portfolio dropped, but the dividends kept coming. She kept investing.

- 2008 Financial crisis: Another painful decline, but again, those dividend checks arrived. She kept investing.

- 2020 Pandemic: Market chaos, but by now, her dividend income was substantial. She kept investing.

By 2025, at age 65, Sarah’s portfolio was worth over $450,000. Her annual dividend income? Over $15,000, and growing at about 7% per year.

She didn’t time the market. She didn’t pick the hottest stocks. She simply invested consistently in quality companies that rewarded shareholders. That’s the Dividend Aristocrat advantage.

Tax Considerations for Dividend Investors

Before diving in, understand how dividends are taxed:

Qualified vs Ordinary Dividends

Qualified Dividends:

- Taxed at lower capital gains rates (0%, 15%, or 20% depending on income)

- Most Dividend Aristocrat dividends qualify

- Must hold the stock for 60+ days during the 121-day period around the ex-dividend date

Ordinary Dividends:

- Taxed at your regular income tax rate

- Less common with Aristocrats

- Can significantly reduce after-tax returns

Tax-Advantaged Accounts

Consider holding Dividend Aristocrats in:

Roth IRA:

- Dividends grow tax-free

- No taxes on qualified withdrawals in retirement

- Ideal for younger investors

Traditional IRA/401(k):

- Tax-deferred growth

- Deduct contributions now, pay taxes later

- Good for high earners

Taxable Brokerage:

- Flexibility to access funds anytime

- Qualified dividend tax treatment

- No contribution limits

Strategy tip: Hold your highest-yielding Aristocrats in tax-advantaged accounts and lower-yielding ones in taxable accounts to minimize tax drag.

The Future of Dividend Aristocrats

Looking ahead to 2025 and beyond, several trends are shaping the Dividend Aristocrat landscape:

Technology Companies Joining the Ranks

Historically, tech companies reinvested profits for growth rather than paying dividends. But as the sector matures, more tech giants are establishing dividend programs. Companies like Microsoft and Apple, while not yet Aristocrats, are on track to join in the coming decades.

Economic Uncertainty and Defensive Positioning

With inflation concerns, interest rate volatility, and geopolitical tensions, investors are increasingly seeking the stability that Dividend Aristocrats provide. This trend may continue, potentially driving valuations higher.

ESG Integration

Environmental, Social, and Governance (ESG) factors are becoming more important. Many Dividend Aristocrats are adapting their businesses to meet ESG standards, which could enhance their long-term sustainability.

Potential Challenges

Not everything is rosy:

- Some traditional Aristocrats face disruption (think retail in the Amazon age)

- Rising interest rates can make bonds more competitive with dividend stocks

- Economic recessions could pressure even the strongest companies

The key is staying informed and understanding that why the stock market goes up over the long term, even if individual companies face challenges.

Should You Invest in Dividend Aristocrats?

This isn’t a one-size-fits-all answer. Dividend Aristocrats are excellent for:

✅ Investors seeking steady income

✅ Those wanting lower volatility than the overall market

✅ Long-term wealth builders who value consistency

✅ Retirees or near-retirees needing reliable cash flow

✅ Conservative investors prioritizing capital preservation

They may be less suitable for:

❌ Aggressive growth seekers willing to accept high volatility

❌ Short-term traders looking for quick gains

❌ Investors in very low tax brackets where growth stocks might be more efficient

❌ Those who need maximum growth potential and don’t need income

For most investors, a balanced approach works best: some Dividend Aristocrats for stability and income, combined with growth stocks for capital appreciation.

Conclusion: The Aristocrat Advantage

Dividend Aristocrats aren’t the flashiest investments. They won’t double overnight or make headlines with revolutionary products. But that’s exactly their appeal.

In a world of market volatility, meme stocks, and get-rich-quick schemes, Dividend Aristocrats offer something increasingly rare: reliability.

They’re companies that have proven themselves through decades of economic cycles. They’ve survived recessions, market crashes, technological disruptions, and countless challenges, and they’ve rewarded shareholders every step of the way.

Whether you’re just starting your investment journey or looking to add stability to your portfolio, Dividend Aristocrats deserve serious consideration. They won’t make you rich overnight, but they’ll help you build wealth steadily, sleep better during market downturns, and enjoy growing income for years to come.

Your Next Steps:

- Educate yourself further – Research individual Aristocrats that interest you

- Check your current holdings – Do you already own any Aristocrats?

- Decide on an allocation – How much of your portfolio should be in dividend-growth stocks?

- Choose your approach – Individual stocks, ETFs, or a combination?

- Start small – You don’t need thousands to begin; even one share gets you started

- Set up dividend reinvestment – Automate the compounding process

- Stay patient – Remember, this is a long-term wealth-building strategy

The journey to financial independence isn’t about finding the perfect stock or timing the market perfectly. It’s about making smart, consistent decisions and letting time work its magic.

Dividend Aristocrats give you a proven path to follow, one that thousands of successful investors have walked before you.

Disclaimer

This article is for educational and informational purposes only and should not be construed as financial advice. Investing in stocks involves risk, including the potential loss of principal. Past performance does not guarantee future results. The companies mentioned are examples only and not recommendations to buy or sell. Always conduct your own research or consult with a qualified financial advisor before making investment decisions. The author may or may not hold positions in the securities discussed.

About the Author

Max Fonji is a financial educator and content strategist at TheRichGuyMath.com, dedicated to making investing accessible and understandable for everyday people. With a focus on long-term wealth building through dividend investing and smart financial planning, Max breaks down complex financial concepts into actionable strategies that anyone can implement. When not writing about finance, Max enjoys analyzing market trends and helping readers achieve their financial goals through education and empowerment

💎 Dividend Aristocrat Growth Calculator

See how dividend reinvestment and annual increases compound your wealth