Imagine investing $10,000 in the stock market right before a major crash. Painful, right? Now imagine if you had invested that same $10,000 gradually over time instead. You’d have bought shares at various prices. some high, some low, smoothing out the emotional rollercoaster and potentially saving yourself from a financial nightmare. This is the power of Dollar Cost Averaging (DCA), one of the most reliable investment strategies for building wealth without trying to time the market.

In simple terms, Dollar Cost Averaging is an investment strategy where you invest a fixed amount of money at regular intervals, regardless of market conditions. Instead of investing a lump sum all at once, you spread your investments over weeks, months, or years. This approach removes the guesswork from investing and helps you avoid the costly mistake of buying everything at the peak.

Whether you’re just starting your investment journey or looking for a more disciplined approach to growing your wealth, Dollar Cost Averaging offers a straightforward path to long-term success. It’s particularly valuable in today’s volatile markets, where understanding market emotions can mean the difference between panic selling and staying the course.

TL;DR

- Dollar Cost Averaging (DCA) means investing fixed amounts regularly, reducing the risk of poor market timing

- DCA lowers your average cost per share by buying more shares when prices are low and fewer when prices are high

- This strategy works best for long-term investors who want to build wealth steadily without emotional decision-making

- DCA is perfect for beginners because it requires no market expertise and can be automated through most investment platforms

- While DCA reduces timing risk, it may underperform lump-sum investing in consistently rising markets, but it provides better risk-adjusted returns for most investors

What is Dollar Cost Averaging?

Dollar Cost Averaging (DCA) is a systematic investment approach where you invest a predetermined amount of money at fixed intervals, regardless of the asset’s price. The formula is beautifully simple:

Investment Amount ÷ Share Price = Number of Shares Purchased

For example, if you invest $500 monthly:

- When shares cost $50, you buy 10 shares

- When shares cost $25, you buy 20 shares

- When shares cost $100, you buy 5 shares

Over time, this mathematical principle ensures you purchase more shares when prices are low and fewer shares when prices are high, resulting in a lower average cost per share than if you had invested randomly or tried to time the market.

This strategy is the opposite of market timing, where investors try to predict the best moments to buy and sell. According to research from the CFA Institute, even professional investors struggle to consistently time the market correctly. DCA acknowledges this reality and works with it rather than against it.

How Dollar Cost Averaging Works: A Real-World Example

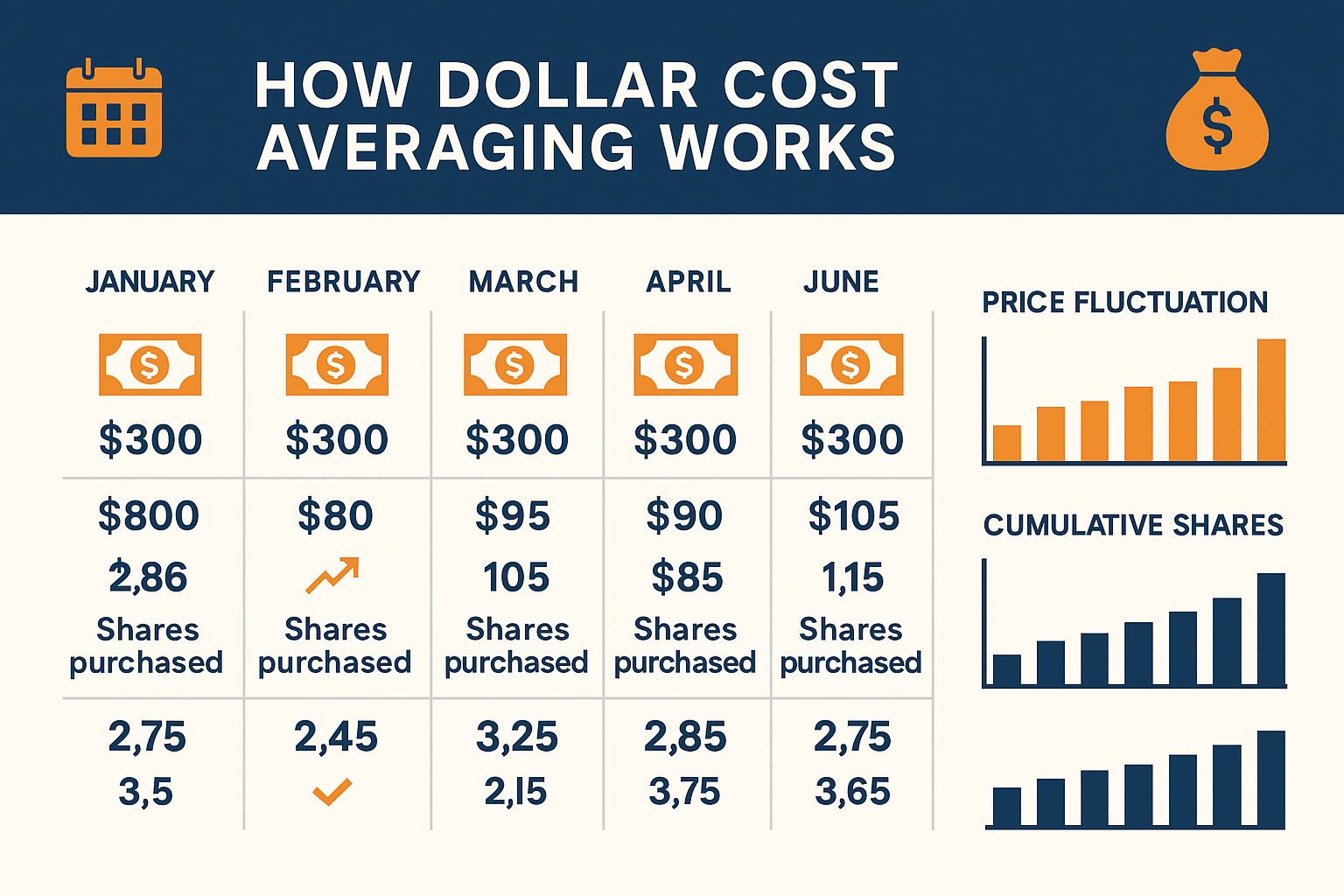

Let’s look at Sarah, a 28-year-old marketing professional who decides to invest $300 monthly in an S&P 500 index fund. Here’s what happens over six months during a volatile market period:

| Month | Investment Amount | Share Price | Shares Purchased | Total Shares | Total Invested |

|---|---|---|---|---|---|

| January | $300 | $100 | 3.00 | 3.00 | $300 |

| February | $300 | $90 | 3.33 | 6.33 | $600 |

| March | $300 | $80 | 3.75 | 10.08 | $900 |

| April | $300 | $85 | 3.53 | 13.61 | $1,200 |

| May | $300 | $95 | 3.16 | 16.77 | $1,500 |

| June | $300 | $105 | 2.86 | 19.63 | $1,800 |

Sarah’s average cost per share: $91.70 ($1,800 ÷ 19.63 shares)

If Sarah had invested the entire $1,800 in January at $100 per share, she would have only 18 shares. Through DCA, she accumulated 19.63 shares with an average cost of $91.70—a better position than lump-sum investing at the beginning.

Even more importantly, Sarah never had to stress about whether it was the “right time” to invest. She simply stuck to her plan, which is exactly why smart investors make better decisions by removing emotion from the equation.

The Psychology Behind Dollar Cost Averaging

One of the most powerful aspects of DCA isn’t mathematical—it’s psychological. Behavioral finance research from Morningstar shows that investors’ biggest enemy isn’t market volatility; it’s their own emotions.

Why Investors Make Poor Decisions

The typical investor experiences what behavioral economists call “loss aversion”—the pain of losing money feels roughly twice as strong as the pleasure of gaining it. This leads to:

- Panic selling during market downturns

- FOMO buying during market peaks

- Analysis paralysis when trying to find the “perfect” entry point

- Regret avoidance that keeps people out of the market entirely

Dollar Cost Averaging addresses all these psychological pitfalls by creating a disciplined framework that operates independently of emotions. When you commit to investing $500 every month, you invest that $500 whether the market is up, down, or sideways. This removes the emotional burden of decision-making.

“The investor’s chief problem, and even his worst enemy, is likely to be himself.” — Benjamin Graham

This is particularly important when you understand why people lose money in the stock market—it’s rarely because of bad markets, but because of bad decisions driven by emotion.

Advantages of Dollar Cost Averaging

1. Eliminates Market Timing Risk

Trying to time the market is notoriously difficult. A study by Fidelity Investments found that missing just the 10 best days in the market over 20 years can cut your returns in half. DCA ensures you’re always in the market, capturing both the good and bad days.

2. Reduces Average Cost Per Share

The mathematical beauty of DCA means you automatically buy more shares when prices are low and fewer when prices are high. This “buying the dip” happens naturally without any effort on your part.

3. Makes Investing Accessible

You don’t need a large lump sum to start investing. DCA allows you to begin with as little as $50 or $100 per month, making wealth-building accessible to nearly everyone. This is especially valuable for those looking to start earning passive income through dividend investing.

4. Reduces Emotional Stress

When you have a predetermined investment schedule, you don’t agonize over every market fluctuation. Your investment plan runs on autopilot, freeing your mental energy for other priorities.

5. Builds Discipline

DCA creates a savings habit. When your investments are automated, you’re “paying yourself first” before spending money on discretionary items. This discipline is foundational to building long-term wealth.

6. Works Well with Retirement Accounts

DCA naturally aligns with how most people earn money—through regular paychecks. Contributing a portion of each paycheck to your 401(k) or IRA is dollar cost averaging in action.

Limitations and Disadvantages of Dollar Cost Averaging

While DCA has many benefits, it’s important to understand its limitations to make informed decisions.

1. May Underperform Lump-Sum Investing in Rising Markets

Research from Vanguard analyzed historical data and found that lump-sum investing outperformed DCA approximately 66% of the time over 10-year periods in the U.S. market. This makes sense mathematically: if markets trend upward over time (which they historically do), delaying your full investment means missing potential gains.

However, the same research noted that DCA provides better risk-adjusted returns, meaning it offers a smoother ride with less volatility.

2. Transaction Costs Can Add Up

If you’re making frequent small investments, transaction fees can eat into your returns. Fortunately, many modern platforms offer commission-free trading, minimizing this concern.

3. Opportunity Cost of Cash

Money sitting in cash waiting to be invested earns minimal returns. If you have a lump sum available, keeping it in a low-interest savings account while slowly deploying it through DCA means potentially missing market gains.

4. Doesn’t Eliminate All Risk

DCA reduces timing risk, but it doesn’t eliminate market risk. If you invest in a declining asset over time, you’ll still lose money, just potentially less than if you’d invested everything upfront.

5. Requires Long-Term Commitment

DCA works best over extended periods. If you need your money in the short term, this strategy may not be appropriate.

Dollar Cost Averaging vs Lump-Sum Investing: Which is Better?

The dollar cost averaging vs lump sum debate is one of the most discussed topics in investment circles. Here’s how they compare:

| Factor | Dollar Cost Averaging | Lump-Sum Investing |

|---|---|---|

| Expected Returns | Slightly lower in rising markets | Higher in rising markets |

| Risk Level | Lower volatility, smoother ride | Higher volatility exposure |

| Emotional Difficulty | Easier to maintain | Harder psychologically |

| Best For | Regular income earners, risk-averse investors | Those with lump sums, higher risk tolerance |

| Market Timing Required | None | Potentially yes |

| Regret Risk | Lower | Higher (if market drops after investing) |

The Verdict: According to Morningstar research, if you have a lump sum and a high risk tolerance, lump-sum investing statistically offers better returns. However, if the psychological comfort of DCA helps you actually invest (rather than keeping money in cash out of fear), then DCA is the better choice.

For most people receiving regular paychecks, the question is moot—DCA is simply how you invest naturally. The real comparison is DCA versus trying to time the market, and DCA wins that battle decisively.

Understanding why the stock market goes up over time helps clarify why both strategies can work, but consistency matters most.

How to Implement Dollar Cost Averaging: Step-by-Step Guide

Ready to start using DCA? Here’s your action plan:

Step 1: Determine Your Investment Amount

Calculate how much you can comfortably invest each period without straining your budget. A good rule of thumb is to aim for 10-20% of your income, but start with whatever you can afford.

Example calculation:

- Monthly income: $4,000

- After essential expenses: $3,200

- Comfortable savings rate: 15%

- Monthly DCA investment: $600

Step 2: Choose Your Investment Frequency

Common DCA schedules include:

- Weekly: More frequent, better averaging

- Bi-weekly: Aligns with many paycheck schedules

- Monthly: Most popular, easy to manage

- Quarterly: Less frequent, higher per-investment amount

Monthly is the sweet spot for most investors—frequent enough to provide good averaging while being easy to maintain.

Step 3: Select Your Investments

For beginners, consider:

- Broad market index funds (S&P 500, Total Stock Market)

- Target-date retirement funds (automatically adjust risk over time)

- Diversified ETFs (provide instant diversification)

- Blue-chip dividend stocks (if you prefer individual stocks)

If you’re interested in generating income from your investments, explore high dividend stocks that can provide regular cash flow.

Step 4: Automate Your Investments

Set up automatic transfers from your checking account to your investment account. Most platforms allow you to:

- Schedule recurring purchases

- Automatically invest dividends

- Round up purchases to invest spare change

Automation is crucial; it removes the temptation to skip months or second-guess your strategy.

Step 5: Stay the Course

The hardest part of DCA is maintaining discipline during market extremes:

- During crashes: Keep investing (you’re buying at discount prices!)

- During rallies: Keep investing (you’re participating in gains!)

- During boring periods: Keep investing (consistency compounds!)

Review your strategy annually, but avoid making changes based on short-term market movements.

Dollar Cost Averaging for Different Life Stages

For Young Professionals (20s-30s)

Advantages: Long time horizon, ability to weather volatility

Strategy: Aggressive DCA into growth-focused index funds

- Invest 15-20% of income

- Focus on total stock market or S&P 500 funds

- Consider international exposure (20-30% of portfolio)

- Don’t worry about short-term volatility

For Mid-Career Investors (40s-50s)

Advantages: Higher income, established emergency fund

Strategy: Balanced DCA with diversification

- Invest 15-25% of income

- Begin adding bonds (age-appropriate allocation)

- Consider dividend-focused investments

- Increase contributions with raises and bonuses

For Pre-Retirees (50s-60s)

Advantages: Peak earning years, clear retirement timeline

Strategy: Conservative DCA with capital preservation

- Maximize retirement account contributions

- Gradually shift to more conservative allocations

- Consider DCA in bond funds and dividend aristocrats

- Focus on tax-advantaged accounts

For Parents Building Wealth for Children

If you’re thinking long-term, teaching your children about investing early can set them up for life. Learn how to make your kid a millionaire through the power of compound interest and early investing habits.

Common Mistakes to Avoid with Dollar Cost Averaging

Mistake #1: Stopping During Market Downturns

The Error: Pausing DCA when markets drop because it “feels” wrong to invest when losing money.

The Reality: Market downturns are when DCA provides the most value—you’re buying shares at discount prices.

The Fix: Remind yourself that lower prices mean more shares purchased. Some investors even increase contributions during significant downturns.

Mistake #2: Investing Too Conservatively

The Error: Choosing ultra-safe investments that barely beat inflation.

The Reality: DCA already reduces risk through timing diversification. Overly conservative investments may not generate sufficient returns to meet your goals.

The Fix: Match your investment choices to your time horizon and risk tolerance, not your fear level.

Mistake #3: Failing to Increase Contributions Over Time

The Error: Keeping the same investment amount for years despite income growth.

The Reality: Inflation and lifestyle creep can erode the real value of your fixed contributions.

The Fix: Increase your DCA amount by 3-5% annually or whenever you receive a raise.

Mistake #4: Checking Your Portfolio Too Frequently

The Error: Obsessively monitoring daily account values.

The Reality: Short-term fluctuations are normal and irrelevant to long-term success. Frequent checking increases anxiety and the temptation to make emotional decisions.

The Fix: Review your portfolio quarterly or semi-annually at most. Focus on contribution consistency, not daily values.

Mistake #5: Neglecting to Rebalance

The Error: Never adjusting your asset allocation as it drifts from your target.

The Reality: Over time, winning investments will comprise a larger portion of your portfolio, potentially increasing risk beyond your comfort level.

The Fix: Rebalance annually by selling overweight positions and buying underweight ones, or direct new DCA contributions to underweight assets. Federal Reserve

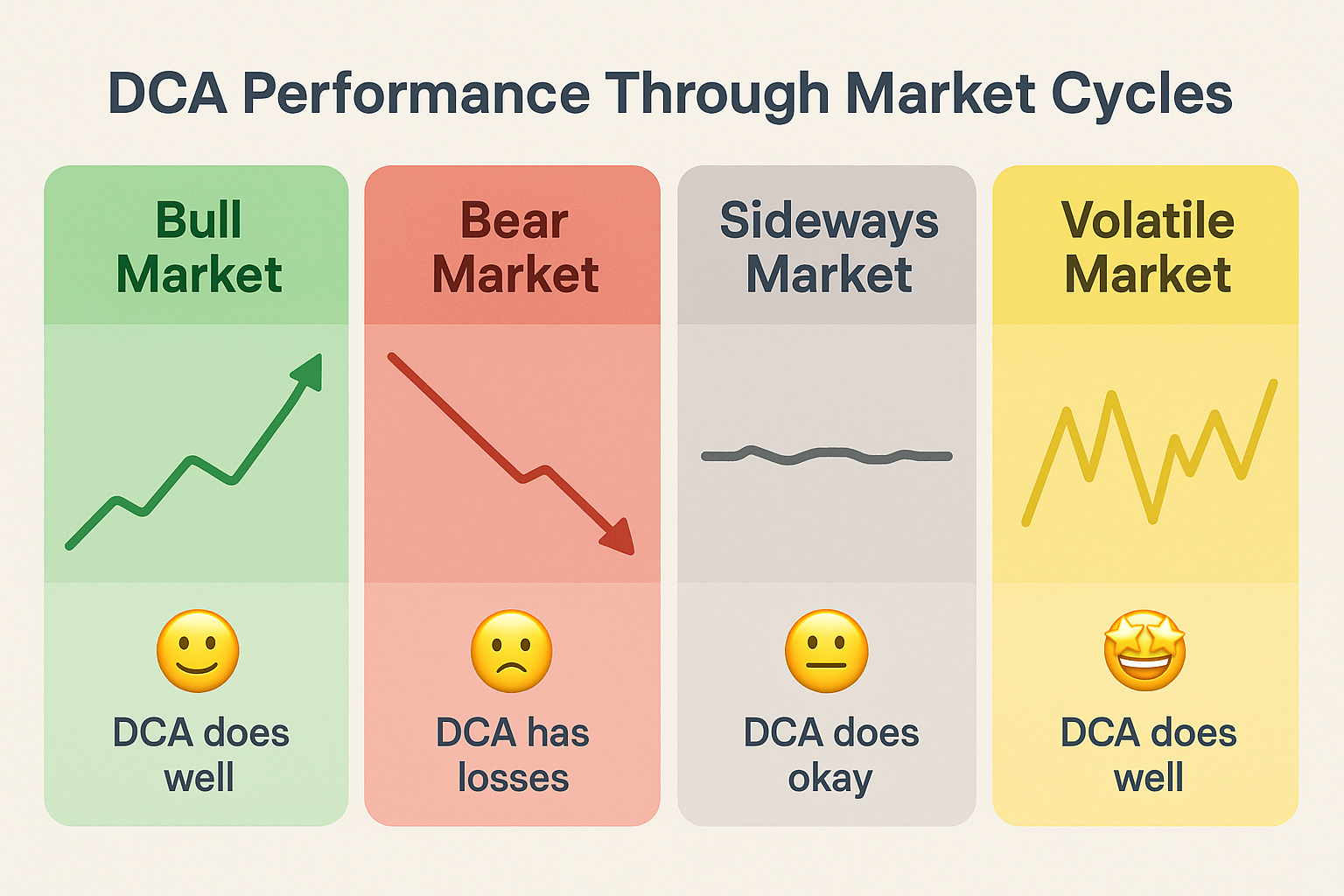

Dollar Cost Averaging in Different Market Conditions

Bull Markets (Rising Prices)

What happens: Your investment buys fewer shares each period as prices rise.

DCA Performance: Underperforms lump-sum investing but still generates positive returns.

Mindset: Stay disciplined. You’re participating in market gains, even if you’d have done better investing everything upfront.

Action: Continue your regular contributions. Consider this a good time to learn about the stock market fundamentals to understand what’s driving gains.

Bear Markets (Falling Prices)

What happens: Your investment buys more shares each period as prices fall.

DCA Performance: Significantly outperforms lump-sum investing. You’re accumulating shares at progressively lower prices.

Mindset: This is when DCA shines. Each contribution buys more shares that will appreciate when markets recover.

Action: Maintain or even increase contributions if possible. These periods create your best long-term returns.

Sideways Markets (Range-Bound)

What happens: Prices fluctuate within a range without a clear direction.

DCA Performance: Performs similarly to lump-sum investing with lower volatility.

Mindset: Boring markets test patience, but consistency still matters.

Action: Stay the course. Sideways markets eventually break out in one direction.

Volatile Markets (High Fluctuation)

What Happens: Prices swing dramatically up and down.

DCA Performance: Excels by averaging out the extremes.

Mindset: Volatility is DCA’s friend. Price swings create buying opportunities.

Action: Ignore the noise and maintain your schedule.

Tax Considerations for Dollar Cost Averaging

Understanding the tax implications of DCA can help you optimize your strategy:

Tax-Advantaged Accounts (Best for DCA)

401(k), 403(b), Traditional IRA:

- Contributions reduce current taxable income

- Investments grow tax-deferred

- Withdrawals are taxed as ordinary income in retirement

- Ideal for DCA because you won’t owe taxes on gains until withdrawal

Roth IRA, Roth 401(k):

- Contributions made with after-tax dollars

- Investments grow tax-free

- Qualified withdrawals are completely tax-free

- Perfect for DCA because you’ll never pay taxes on growth

Taxable Brokerage Accounts

Considerations:

- Capital gains taxes apply when you sell

- Dividend income is taxed annually

- Long-term capital gains (assets held >1 year) are taxed at lower rates

- DCA creates multiple tax lots with different purchase dates

Strategy: Use tax-loss harvesting to offset gains, and prioritize holding investments for at least one year to qualify for long-term capital gains rates. Investopedia

Tax-Efficient DCA Tips

- Prioritize tax-advantaged accounts first (max out 401(k) and IRA contributions)

- Place tax-inefficient investments (bonds, REITs) in tax-advantaged accounts

- Hold tax-efficient investments (index funds, growth stocks) in taxable accounts

- Track your cost basis for each purchase to optimize tax-loss harvesting

- Consider municipal bonds in taxable accounts if you’re in a high tax bracket

Dollar Cost Averaging and Dividend Investing

DCA pairs exceptionally well with dividend investing, creating a powerful wealth-building combination:

The Compounding Effect

When you DCA into dividend-paying investments:

- Your regular contributions buy shares

- Those shares pay dividends

- Dividends are reinvested to buy more shares (DRIP)

- More shares generate more dividends

- The cycle accelerates over time

This creates a “triple compounding” effect:

- Contribution compounding: Regular investments add up

- Price appreciation compounding: Share values grow

- Dividend compounding: Reinvested dividends buy more shares

Example: DCA with Dividend Reinvestment

Let’s say you invest $500 monthly in a dividend ETF yielding 3% annually:

Year 1: $6,000 invested + ~$90 in dividends = $6,090

Year 5: $30,000 invested + ~$2,300 in accumulated dividends = $32,300

Year 10: $60,000 invested + ~$10,500 in accumulated dividends = $70,500

The dividend reinvestment accelerates your wealth-building beyond just your contributions.

For more on this strategy, explore smart ways to make passive income through systematic investing.

Dollar Cost Averaging for Retirement Planning

DCA is the backbone of most successful retirement strategies:

401(k) Contributions

Every paycheck contribution to your 401(k) is DCA in action:

- Automatic deductions ensure consistency

- Employer matching amplifies your returns

- Pre-tax contributions reduce the current tax burden

- Decades of compounding create substantial wealth

Optimization tip: Contribute at least enough to capture the full employer match—it’s free money with an immediate 100% return.

IRA Contributions

While annual IRA contribution limits ($7,000 for 2025, or $8,000 if 50+) could be invested as a lump sum, many people prefer monthly DCA:

- $583/month for regular contributions

- $667/month if making catch-up contributions

Retirement DCA Timeline

Age 25-35: Aggressive growth DCA

- 100% stocks

- Maximum contribution rates

- Long time horizon absorbs volatility

Age 35-50: Growth-focused DCA

- 90% stocks, 10% bonds

- Increase contributions with raises

- Mid-length time horizon

Age 50-60: Balanced DCA

- 70% stocks, 30% bonds

- Maximize catch-up contributions

- Moderate time horizon

Age 60-65: Conservative DCA

- 50% stocks, 50% bonds

- Focus on capital preservation

- Short time horizon to retirement

Technology and Tools for Dollar Cost Averaging

Modern technology makes DCA easier than ever:

Automated Investment Platforms

Robo-Advisors (Betterment, Wealthfront, Schwab Intelligent Portfolios):

- Automatic rebalancing

- Tax-loss harvesting

- Low fees (0.25-0.50%)

- Perfect for hands-off DCA

Brokerage Platforms (Fidelity, Vanguard, Charles Schwab):

- Automatic investment plans

- Commission-free ETFs and mutual funds

- Dividend reinvestment programs (DRIPs)

- Comprehensive research tools

Micro-Investing Apps (Acorns, Stash):

- Round up spare change

- Ideal for beginners

- Small account minimums

- Educational resources

Features to Look For

Automatic transfers from checking to investment account

Recurring purchase schedules (weekly, monthly, etc.)

Fractional shares (invest exact dollar amounts)

Dividend reinvestment (automatic DRIP)

Low or no fees (commission-free trading)

Mobile app (monitor on the go)

Educational resources (learn as you invest)

Real Data: Historical DCA Performance

Let’s examine how DCA would have performed during major market events:

2008 Financial Crisis

Scenario: $500 monthly DCA into S&P 500 from January 2007 to December 2010

- Total invested: $24,000

- Market bottom: March 2009 (S&P 500 at ~677)

- Portfolio value at end of 2010: ~$26,800

- Result: Positive return despite investing through the worst financial crisis since the Great Depression

Key insight: Investors who maintained DCA through the crisis bought shares at generational lows and recovered quickly.

COVID-19 Pandemic (2020)

Scenario: $1,000 monthly DCA into S&P 500 from January 2020 to December 2021

- Total invested: $24,000

- Market bottom: March 2020 (S&P 500 at ~2,237)

- Portfolio value at end of 2021: ~$32,500

- Result: 35%+ return in just two years

Key insight: The March 2020 crash created a buying opportunity that significantly enhanced returns for DCA investors.

Long-Term Performance (20 Years)

Scenario: $500 monthly DCA into S&P 500 from January 2003 to January 2023

- Total invested: $120,000

- Portfolio value: ~$365,000

- Average annual return: ~8.5%

- Periods included: Two major crashes (2008, 2020) and multiple corrections

Key insight: Despite significant volatility, consistent DCA over two decades tripled the invested amount, demonstrating the power of staying the course.

According to Morningstar data, investors who maintained consistent DCA strategies through multiple market cycles significantly outperformed those who tried to time the market or who stopped investing during downturns.

FAQ

A good DCA strategy invests a fixed amount at regular intervals (typically monthly) into diversified, low-cost index funds or ETFs. The strategy should be automated, aligned with your financial goals, and maintained consistently regardless of market conditions. For most investors, contributing 10-20% of income monthly into a broad market index fund provides optimal results.

To calculate DCA returns, divide your total portfolio value by your total invested amount, then subtract 1 and multiply by 100 for the percentage return. Formula: ((Current Value ÷ Total Invested) – 1) × 100 = Return %. For example, if you invested $10,000 total and your portfolio is now worth $13,000: ((13,000 ÷ 10,000) – 1) × 100 = 30% return.

Statistically, lump-sum investing outperforms DCA about 66% of the time in rising markets, according to Vanguard research. However, DCA provides better risk-adjusted returns and reduces the psychological stress of investing a large amount at potentially the wrong time. For most people receiving regular income, DCA is the natural approach and removes the temptation to time the market.

Yes, DCA doesn’t eliminate investment risk—it only reduces timing risk. If you invest in declining assets or during a prolonged bear market, you can lose money. However, DCA typically results in smaller losses than lump-sum investing at market peaks, and when markets eventually recover, DCA positions you well because you’ve accumulated shares at lower prices.

DCA works best as a long-term strategy (5+ years minimum, ideally 10-30 years). The longer your time horizon, the more DCA can smooth out market volatility and benefit from compounding returns. For retirement investing, DCA should continue throughout your working career. If you have a lump sum to invest, research suggests limiting DCA to 6-12 months to avoid excessive opportunity cost.

The best DCA investments are diversified, low-cost index funds and ETFs that track broad market indices (S&P 500, Total Stock Market, Total International). These provide instant diversification, low fees, and historical long-term growth. Avoid individual stocks for DCA unless you’re experienced, and steer clear of highly volatile or speculative investments that might not recover from downturns.

Absolutely. Bear markets are when DCA provides the most value because you’re purchasing shares at discounted prices. Every contribution during a downturn buys more shares that will appreciate when the market recovers. According to CFA Institute research, maintaining or increasing DCA contributions during bear markets significantly enhances long-term returns.

Conclusion: Taking Action with Dollar Cost Averaging

Dollar Cost Averaging isn’t just an investment strategy; it’s a financial philosophy that prioritizes consistency over perfection, discipline over emotion, and long-term thinking over short-term speculation.

The beauty of DCA lies in its simplicity. You don’t need to:

- Predict market movements

- Analyze complex financial statements

- Monitor economic indicators

- Stress about daily market fluctuations

You simply need to invest a fixed amount regularly and let time and mathematics work in your favor.

Your DCA Action Plan

This Week:

- Calculate how much you can invest monthly (aim for 10-20% of income)

- Choose a low-cost brokerage or robo-advisor platform

- Select a diversified index fund or ETF

- Set up automatic transfers from your checking account

This Month:

- Make your first DCA investment

- Set up automatic recurring purchases

- Enable dividend reinvestment (DRIP)

- Create a simple tracking spreadsheet (or use your platform’s tools)

This Year:

- Maintain your investment schedule without interruption

- Ignore market noise and short-term volatility

- Review your strategy once quarterly (not daily!)

- Increase your contribution amount with any raises or bonuses

Long-Term:

- Continue DCA for decades

- Rebalance annually

- Adjust asset allocation as you age

- Watch your wealth compound into financial freedom

Final Thoughts

The hardest part of investing isn’t finding the perfect strategy—it’s actually implementing one and sticking with it. Dollar Cost Averaging removes the barriers that prevent most people from building wealth: fear, complexity, and the need for perfect timing.

Whether you’re just starting your financial journey or looking to optimize your existing investment approach, DCA provides a proven path to long-term wealth accumulation. The rich guy math behind it is simple: consistent contributions + time + compound returns = financial success.

The best time to start was yesterday. The second-best time is today. Set up your first automatic DCA investment right now, and you’ll be on your way to building the financial future you deserve.

References and Further Reading

This article incorporates research and data from the following authoritative sources:

- Vanguard Research: “Dollar-cost averaging just means taking risk later” – Analysis of lump-sum vs. DCA performance across global markets

- Morningstar: Behavioral finance research on investor decision-making and market timing

- CFA Institute: Professional investment analysis and market timing studies

- Fidelity Investments: Research on the impact of missing the best market days

- U.S. Securities and Exchange Commission (SEC.gov): Investor education resources on systematic investing strategies

For additional investment education and strategies, explore these related resources:

Disclaimer

This article is for educational purposes only and does not constitute financial advice. Dollar Cost Averaging is an investment strategy that carries risk, including the potential loss of principal. Past performance does not guarantee future results. The examples and scenarios presented are hypothetical and for illustration purposes only.

Before implementing any investment strategy, consider your individual financial situation, risk tolerance, time horizon, and investment objectives. Consult with a qualified financial advisor or tax professional to discuss your specific circumstances. The author and TheRichGuyMath.com are not responsible for any investment decisions made based on this content.

Investment returns and principal value will fluctuate, and shares or units may be worth more or less than the original cost when redeemed. All investments involve risk, and there is no guarantee that any investment strategy will be successful.

About the Author

Written by Max Fonji — With over a decade of experience in financial education and investment strategy, Max is your go-to source for clear, data-backed investing education. Max specializes in breaking down complex financial concepts into actionable strategies that everyday investors can implement to build long-term wealth. Through TheRichGuyMath.com, Max has helped thousands of readers develop disciplined investment approaches and achieve their financial goals.

💰 Dollar Cost Averaging Calculator

See how consistent investing builds wealth over time

Growth Over Time

Year-by-Year Breakdown

| Year | Contributions | Balance | Interest Earned | Total Gain |

|---|