Picture this: You quit your $100,000-per-year job to start a business. After a year of hard work, your company generates $120,000 in profit. Success, right? Not so fast. While your accounting profit looks impressive on paper, you’ve actually lost money when you consider what you gave up. Welcome to the world of economic profit – the hidden metric that reveals whether you’re truly creating wealth or just spinning your wheels.

Most investors and business owners focus exclusively on accounting profit, missing a crucial piece of the puzzle. Economic profit tells the complete story by factoring in opportunity costs – the returns you sacrifice by choosing one investment over another. This distinction isn’t just academic jargon; it’s the difference between making smart financial decisions and leaving money on the table.

Whether you’re evaluating stocks, real estate, or your own business venture, understanding economic profit will transform how you think about returns. Let’s dive into this game-changing concept that separates average investors from exceptional ones.

Key Takeaways

- Economic profit = Total Revenue – (Explicit Costs + Implicit Costs), revealing the true profitability of an investment

- Unlike accounting profit, economic profit includes opportunity costs – what you sacrifice by choosing one option over another

- Positive economic profit means you’re beating your next-best alternative; zero or negative means you should reconsider your investment

- Smart investors use economic profit to compare stocks, businesses, and investment opportunities on a level playing field

- Understanding this concept helps avoid the trap of celebrating accounting profits while actually losing money in real terms

What Is Economic Profit? The Complete Picture

Economic profit represents the true financial gain from an investment after accounting for all costs – both the obvious ones you can see on a balance sheet and the hidden opportunity costs you might be overlooking. Investopedia

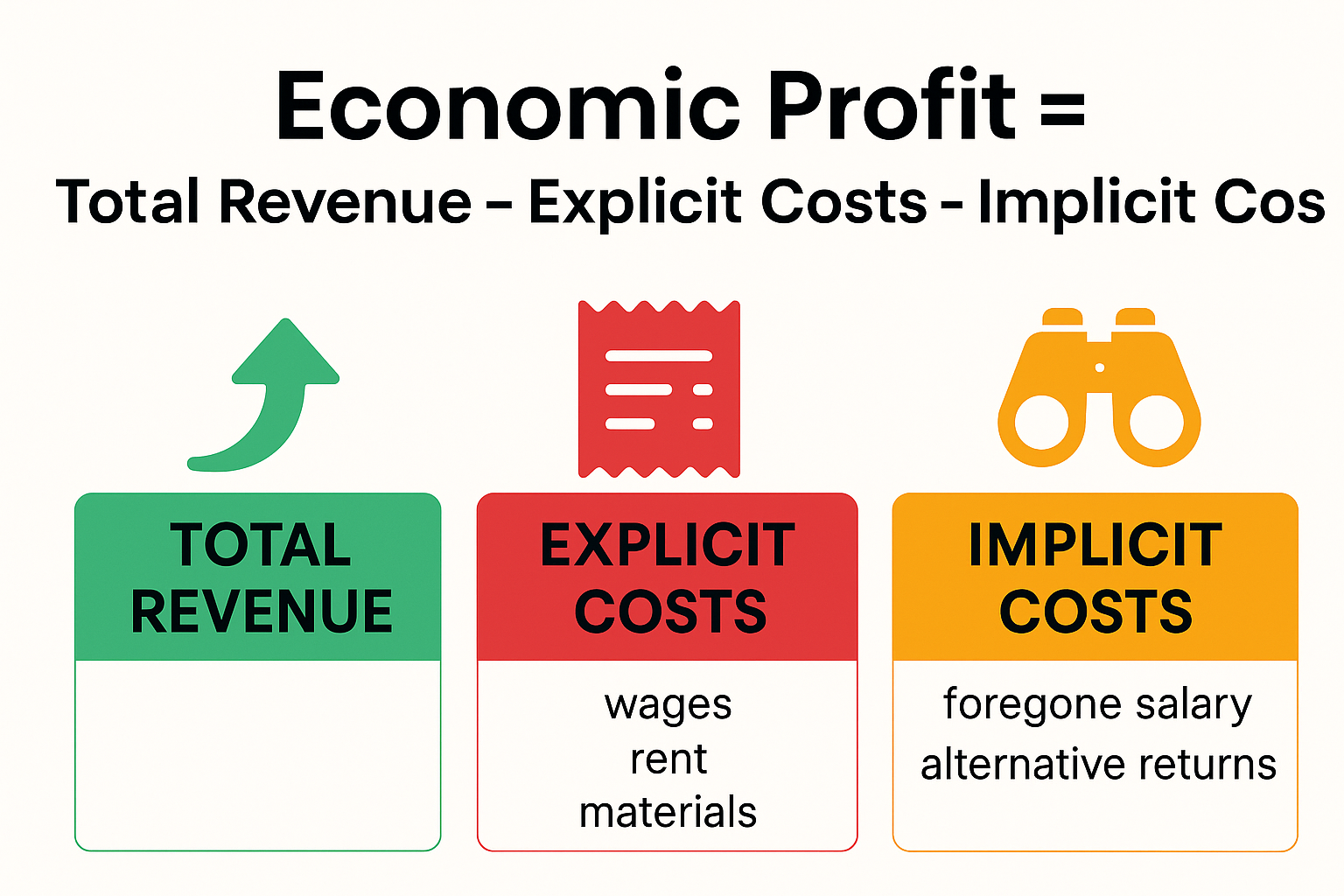

Economic Profit Formula

Here’s the fundamental formula:

Economic Profit = Total Revenue – Explicit Costs – Implicit Costs

Let’s break down each component:

Explicit Costs (The Obvious Ones)

These are your out-of-pocket expenses that show up on financial statements:

- Employee salaries and wages

- Rent and utilities

- Raw materials and inventory

- Marketing and advertising

- Equipment and technology

- Interest on loans

Implicit Costs (The Hidden Ones)

These are the opportunity costs – the benefits you give up by choosing one path over another:

- Salary you could earn working elsewhere

- Returns from alternative investments

- Value of your time and expertise

- Interest you could earn on capital invested in your business

- The rent you could collect if you owned the building

The magic happens when you subtract both types of costs from your revenue. That’s when you discover whether you’re genuinely creating value or just keeping busy.

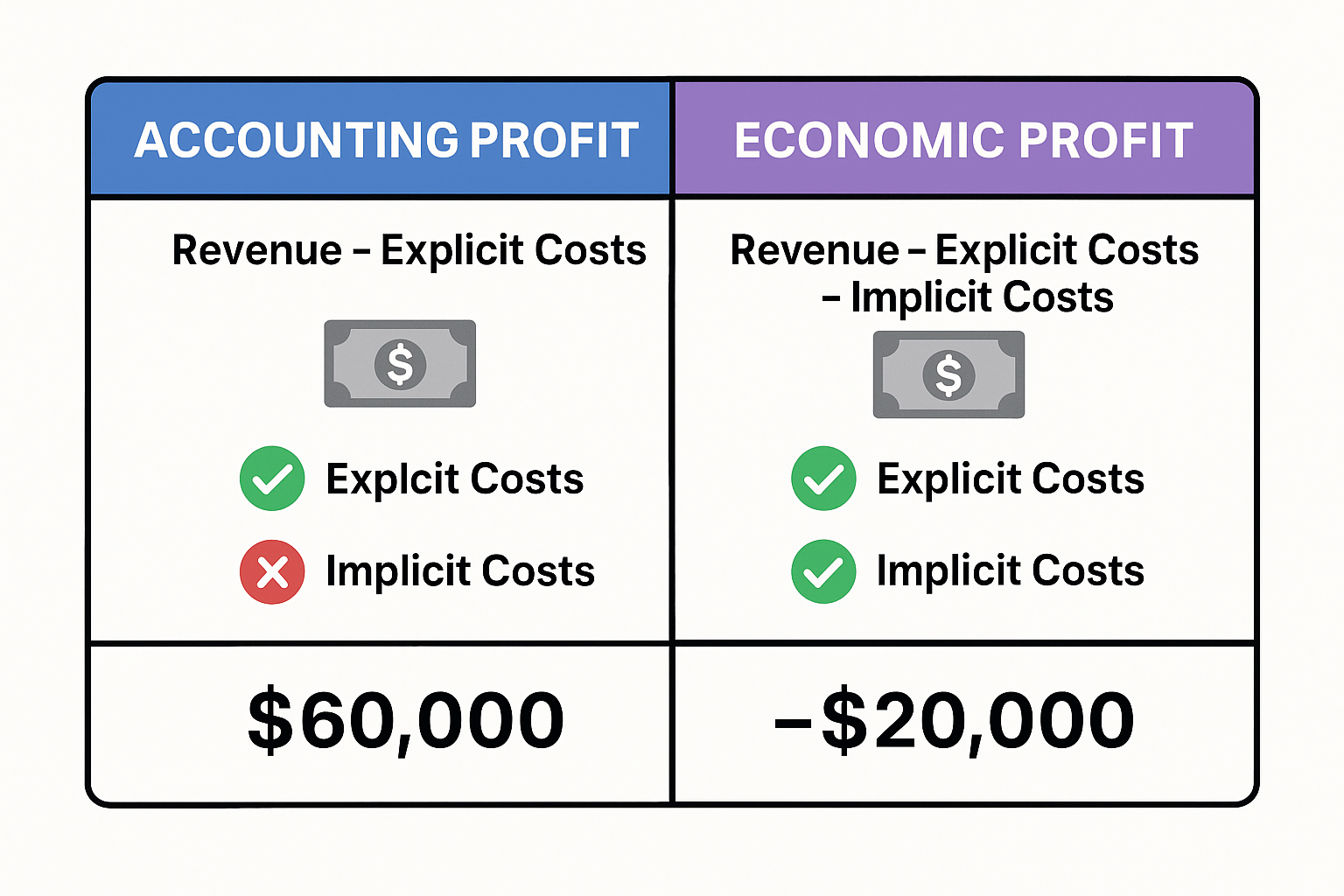

Economic Profit vs Accounting Profit: Why the Difference Matters

Most people celebrate when they see positive accounting profit. But savvy investors know that accounting profit only tells half the story. Corporate Finance

| Aspect | Accounting Profit | Economic Profit |

|---|---|---|

| Formula | Revenue – Explicit Costs | Revenue – Explicit Costs – Implicit Costs |

| Includes Opportunity Costs? | No | Yes |

| What It Shows | Whether you made money on paper | Whether you made the best use of your resources |

| Used For | Tax reporting, financial statements | Strategic decision-making, investment analysis |

| Typical Result | Usually positive | Often zero or negative |

Economic Profit vs Accounting Profit

A Real-World Example

Sarah owns a small bakery. Here’s how her numbers look after one year:

Revenue: $250,000

Explicit Costs:

- Ingredients: $80,000

- Rent: $30,000

- Employee wages: $60,000

- Utilities and other: $20,000

- Total Explicit Costs: $190,000

Accounting Profit: $250,000 – $190,000 = $60,000

Sarah feels great! She made $60,000 in profit. But wait…

Implicit Costs:

- Salary she gave up from her previous corporate job: $75,000

- Interest she could have earned investing her $100,000 startup capital at 5%: $5,000

- Total Implicit Costs: $80,000

Economic Profit: $250,000 – $190,000 – $80,000 = -$20,000

Sarah actually lost $20,000 compared to her next-best alternative. This doesn’t mean her bakery is failing – it means she needs to grow revenue or cut costs to make it worth her while.

Understanding this distinction helps you make better decisions about where to invest your money and whether to stay in a business or pursue other opportunities.

How Investors Use Economic Profit to Make Smarter Decisions

Economic profit isn’t just a theoretical concept – it’s a powerful tool for evaluating investment opportunities. Here’s how smart investors apply it:

1. Evaluating Stock Investments

When companies generate economic profit (also called economic value added or EVA), they’re creating wealth beyond their cost of capital. Companies with consistently positive economic profit tend to outperform the market.

For example, tech giants like Apple and Microsoft have historically generated substantial economic profit because their returns far exceed their cost of capital. Meanwhile, companies in capital-intensive industries like airlines often struggle to generate positive economic profit, even when they report accounting profits.

If you’re interested in dividend investing, look for companies that generate economic profit and return cash to shareholders. This combination suggests sustainable, high-quality earnings.

2. Comparing Business Opportunities

Imagine you’re deciding between two investment opportunities:

Option A: Open a franchise requiring $200,000 upfront, promising $40,000 annual accounting profit

Option B: Invest $200,000 in high-dividend stocks yielding 8% annually ($16,000)

At first glance, Option A looks better. But factor in your time:

- If managing the franchise requires 40 hours per week and your time is worth $50/hour, that’s an implicit cost of $104,000 per year (40 hours × 52 weeks × $50)

- Option B requires minimal time investment

Economic Profit Comparison:

Option A: $40,000 (accounting profit) – $104,000 (time value) = -$64,000

Option B: $16,000 (dividend income) – $0 (minimal time) = $16,000

Suddenly, Option B looks much more attractive! This is why understanding passive income strategies matters – they often generate superior economic profit.

3. Deciding When to Exit an Investment

Economic profit helps you know when to cut your losses. If your investment consistently generates negative economic profit, you’re destroying wealth – even if you’re making accounting profit.

Ask yourself: “Could I earn better returns elsewhere with the same capital and effort?” If the answer is yes, it might be time to exit.

This principle applies to stock market investing, too. Just because a stock is up doesn’t mean you should hold it. If another opportunity offers better risk-adjusted returns, switching might create more economic profit.

💰 Economic Profit Calculator

Explicit Costs

Implicit Costs (Opportunity Costs)

The Role of Opportunity Cost in Investment Analysis

Opportunity cost is the cornerstone of economic profit – and one of the most overlooked concepts in personal finance. It’s not about what you spend; it’s about what you don’t get because of your choice. Wall Street Prep

Understanding Opportunity Cost Through Real Examples

Example 1: The College Decision

Emma is deciding whether to attend a four-year university or start working immediately:

Option 1: College

- Explicit costs: $100,000 (tuition, books, housing)

- Implicit costs: $160,000 (4 years × $40,000 salary she could earn)

- Total opportunity cost: $260,000

Option 2: Work Immediately

- Explicit costs: $0

- Implicit costs: Future higher earnings she won’t get without a degree

This framework helps Emma make an informed decision based on expected lifetime earnings, not just tuition costs.

Example 2: The Real Estate Dilemma

Marcus owns a building worth $500,000 that he uses for his business. He pays no rent, so it seems “free.” But is it?

If Marcus could rent out the building for $30,000 per year, that’s his opportunity cost. His business needs to generate at least $30,000 more in profit than he could earn renting it out and operating elsewhere – otherwise, he’s losing money economically.

Why Most People Ignore Opportunity Costs (And Why You Shouldn’t)

Opportunity costs are invisible. They don’t show up on your bank statement or tax return. But ignoring them leads to poor decisions:

Staying in a low-paying job because it’s “comfortable” (opportunity cost: higher salary elsewhere)

Holding onto losing stocks because you “don’t want to realize the loss” (opportunity cost: better returns from other investments)

Running a business that barely breaks even (opportunity cost: salary + investment returns you’re sacrificing)

Smart investors constantly ask: “What else could I do with this money, time, and energy?” Understanding why the stock market goes up over time helps you appreciate the opportunity cost of keeping too much cash on the sidelines.

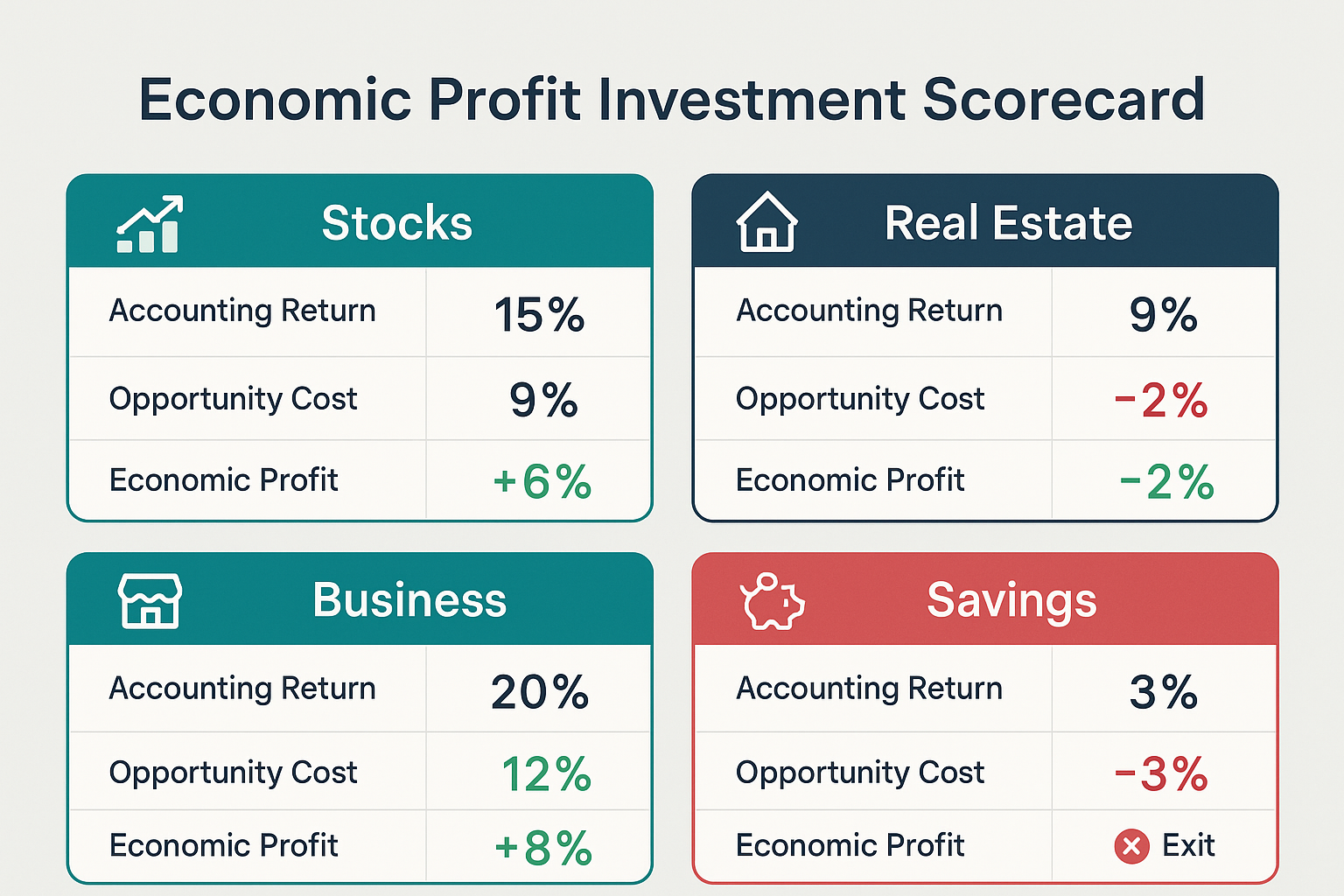

Economic Profit in Different Investment Scenarios

Let’s explore how economic profit applies across various investment types:

Stock Market Investing

When evaluating stocks, economic profit helps you understand whether a company is truly creating shareholder value.

Key metric: Return on Invested Capital (ROIC) vs. Weighted Average Cost of Capital (WACC)

- If ROIC > WACC → Positive economic profit

- If ROIC < WACC → Negative economic profit

Companies with sustained positive economic profit tend to be excellent long-term investments. This is why quality matters as much as price when selecting stocks.

Real Estate Investing

Real estate investors often celebrate positive cash flow without considering economic profit:

Accounting view: Rental income – mortgage – expenses = positive cash flow

Economic profit view: Must also subtract:

- Opportunity cost of the down payment invested elsewhere

- Value of time spent managing property

- Alternative returns from REITs or other investments

A property with positive cash flow might have negative economic profit if you could earn better returns with less hassle elsewhere.

Starting a Business

Entrepreneurs are especially prone to ignoring economic profit. The excitement of “being your own boss” can cloud judgment.

Critical questions:

- What salary are you giving up?

- What returns could your startup capital earn in index funds?

- What’s your time worth?

- How long until you match your opportunity costs?

Many successful businesses generate positive accounting profit but negative economic profit for years. Understanding this helps you set realistic expectations and timelines.

Side Hustles and Gig Work

The gig economy makes economic profit analysis essential:

Driving for a rideshare company:

- Accounting profit: Fares – gas – car maintenance

- Economic profit: Also subtract vehicle depreciation, insurance increases, and the hourly wage you could earn elsewhere

That $20/hour gross income might become $8/hour after all economic costs – less than minimum wage in many states!

Common Mistakes When Calculating Economic Profit

Even experienced investors make these errors:

1: Forgetting to Include Your Time

Your time has value, even if you’re not directly paid for it. If you spend 10 hours per week managing investments, that’s 520 hours per year. At $50/hour, that’s $26,000 in opportunity cost.

Fix: Always assign a realistic value to your time based on what you could earn doing something else.

2: Using the Wrong Comparison Benchmark

Some people compare their investment returns to savings account rates (nearly 0%). That’s too low.

Fix: Use appropriate benchmarks:

- Stock investments → S&P 500 index returns (~10% historically)

- Real estate → REIT index returns

- Business ventures → Your current salary + safe investment returns

3: Ignoring Risk Differences

A risky startup shouldn’t just beat your current salary – it should beat your salary plus a risk premium.

Fix: Adjust your opportunity cost upward for riskier ventures. If you’re taking on significant risk, you should expect significantly higher returns.

4: Emotional Attachment to Sunk Costs

Many investors hold losing positions because they’ve already invested so much time and money. But sunk costs are irrelevant to economic profit.

Fix: Ask, “If I were starting fresh today, would I make this same investment?” If not, it’s time to exit. Learn more about why people lose money in the stock market to avoid this trap.

How to Apply Economic Profit to Your Investment Strategy

Ready to put economic profit to work? Here’s your action plan:

Step 1: Calculate Your Personal Opportunity Cost

Determine your baseline opportunity cost:

For employed individuals:

- Annual salary + benefits

- Plus: Returns from investing in low-cost index funds (~10% annually)

For business owners:

- Best alternative salary you could earn

- Plus: Investment returns on capital tied up in your business

For retirees:

- Safe withdrawal rate from portfolio (typically 4%)

- Plus: Value of your time and expertise

Step 2: Evaluate Current Investments

Review each major investment through an economic profit lens:

Questions to ask:

- What’s my total return (including time invested)?

- What could I earn with similar risk elsewhere?

- Am I generating positive economic profit?

- If not, what needs to change?

Step 3: Set Economic Profit Targets

Before making any new investment, establish your hurdle rate – the minimum return needed to justify the investment:

Example hurdle rates:

- Low-risk investments: Current salary equivalent + 5%

- Medium-risk investments: Current salary equivalent + 10%

- High-risk ventures: Current salary equivalent + 20%+

Step 4: Review Regularly

Economic profit isn’t a one-time calculation. Review quarterly:

✅ Are your investments still beating their opportunity costs?

✅ Have better alternatives emerged?

✅ Should you reallocate capital?

Understanding the cycle of market emotions helps you stay rational during these reviews, avoiding emotional decisions that destroy economic profit.

Real-Life Success Story: How Economic Profit Changed Everything

Meet David, a 38-year-old software engineer who discovered economic profit the hard way.

For five years, David ran a consulting business on the side, generating about $30,000 annually in accounting profit. He felt successful – until he calculated his economic profit:

Revenue: $80,000

Explicit costs: $50,000 (software, marketing, contractors)

Accounting profit: $30,000

But then he added implicit costs:

Time investment: 15 hours/week × 52 weeks = 780 hours

Hourly rate at day job: $75/hour

Opportunity cost of time: 780 × $75 = $58,500

Economic profit: $30,000 – $58,500 = -$28,500

David was actually losing $28,500 per year! He was working evenings and weekends for less than his day job paid.

His decision: David shut down the consulting business and redirected those 780 hours to:

- Spending time with family

- Investing in dividend-paying stocks that generate passive income

- Learning skills that led to a promotion and $20,000 raise

Result: David increased his economic profit by nearly $50,000 annually while working fewer hours and improving his quality of life.

This story illustrates why economic profit matters: it reveals the true cost of your choices, helping you make decisions that genuinely improve your financial position.

Advanced Economic Profit Concepts for Serious Investors

Once you’ve mastered the basics, these advanced concepts will sharpen your analysis:

Economic Value Added (EVA)

EVA is a corporate finance metric that measures economic profit:

EVA = NOPAT – (Capital × WACC)

Where:

- NOPAT = Net Operating Profit After Tax

- Capital = Total invested capital

- WACC = Weighted Average Cost of Capital

Companies with positive EVA are creating shareholder value. Many successful investors screen for companies with growing EVA trends.

Residual Income

Similar to economic profit, residual income measures profit exceeding a minimum required return:

Residual Income = Net Income – (Equity Capital × Required Rate of Return)

This helps you evaluate whether management is earning adequate returns on shareholder equity.

Risk-Adjusted Returns

Economic profit should account for risk. Two investments might have similar returns, but vastly different risk profiles:

Investment A: 12% return, low volatility

Investment B: 12% return, high volatility

Investment A has a higher economic profit because it achieves the same return with less risk (lower opportunity cost of stress and potential losses).

Sharpe Ratio helps quantify this:

Sharpe Ratio = (Return – Risk-Free Rate) / Standard Deviation

Higher Sharpe ratios indicate better risk-adjusted returns – essentially, better economic profit per unit of risk.

Economic Profit and Tax Considerations

Economic profit analysis becomes more complex when you factor in taxes, but it’s crucial for accurate decision-making:

Tax-Advantaged Accounts

Investing through IRAs, 401(k)s, or other tax-advantaged accounts reduces your effective opportunity cost:

Example:

- $10,000 invested in taxable account earning 10% = $1,000 gain, taxed at 20% = $800 after-tax

- $10,000 in Roth IRA earning 10% = $1,000 gain, tax-free = $1,000 after-tax

The Roth IRA generates 25% more economic profit due to tax savings. This is why teaching your children about smart investing early and using tax-advantaged accounts can dramatically improve long-term wealth creation.

Business Deductions

Business owners can reduce explicit costs through deductions, improving both accounting and economic profit:

- Home office deduction

- Vehicle expenses

- Equipment depreciation

- Health insurance premiums

Important: These deductions only improve economic profit if they reduce real costs, not just tax liability. Spending $1 to save $0.30 in taxes still costs you $0.70.

Building Wealth Through Economic Profit Thinking

The ultimate goal of understanding economic profit isn’t just to calculate numbers – it’s to build lasting wealth by consistently making choices that maximize your true returns.

The Compound Effect

Small improvements in economic profit compound dramatically over time:

Scenario 1: Investment generating 8% accounting profit but 0% economic profit (just matching opportunity cost)

30-year result: You keep pace with alternatives but create no additional wealth

Scenario 2: Investment generating 8% accounting profit and 3% economic profit (beating alternatives by 3%)

30-year result: You create substantial additional wealth beyond what you would have earned anyway

That 3% economic profit edge, compounded over 30 years on a $100,000 investment, equals an extra $142,726!

Creating a Personal Economic Profit Dashboard

Track these metrics monthly or quarterly:

| Investment | Accounting Return | Opportunity Cost | Economic Profit | Action |

|---|---|---|---|---|

| Stock Portfolio | 12% | 10% | +2% | Hold |

| Rental Property | 8% | 10% | -2% | Review |

| Side Business | 15% | 12% | +3% | Expand |

| Savings Account | 1% | 10% | -9% | Reallocate |

This dashboard instantly shows where you’re creating value and where you’re destroying it.

The Mindset Shift

Economic profit thinking transforms how you view every financial decision:

Before: “I made $5,000 profit this year!”

After: “I made $5,000, but I could have made $8,000 doing something else. I lost $3,000 in economic profit.”

This isn’t pessimism – it’s clarity. It helps you:

- Exit mediocre investments faster

- Double down on winners

- Avoid opportunity traps

- Make decisions based on reality, not wishful thinking

No. Economic profit always equals or is less than accounting profit because it includes all the costs of accounting profit plus additional implicit costs. However, understanding this relationship helps you identify truly exceptional investments.

Ideally, yes – but with nuance. New businesses might have negative economic profit initially while building value for the future. The key is having a clear timeline for when economic profit should turn positive. If it consistently remains negative with no path to improvement, reconsider the investment.

Use your next-best alternative – the highest-returning option you’re giving up. If you could earn 10% in index funds or 7% in bonds, use 10% as your opportunity cost.

Absolutely! Any choice involving resource allocation (time, money, energy) involves opportunity costs. Career decisions, education choices, and even how you spend your free time – all benefit from economic profit thinking.

Yes, but you can adjust for non-monetary benefits. If you’d pay $10,000 per year for the lifestyle and enjoyment your business provides, subtract that from your opportunity cost. Just be honest about these valuations.

Conclusion: Your Next Steps to Economic Profit Mastery

Understanding economic profit is like putting on financial X-ray glasses – suddenly, you see the hidden reality behind every investment decision. While accounting profit tells you whether you made money, economic profit tells you whether you made the right choice.

Here’s your action plan to start applying economic profit today:

- Calculate your baseline opportunity cost – What could you earn in your next-best alternative? This becomes your benchmark for all investment decisions.

- Audit your current investments – Use the economic profit calculator above to evaluate each major investment. Are you creating real wealth or just staying busy?

- Set economic profit targets – Before making new investments, establish minimum hurdle rates that account for opportunity costs and risk.

- Review quarterly – Economic profit isn’t static. Market conditions change, better opportunities emerge, and your personal situation evolves. Regular reviews keep you on track.

- Teach others – Share this framework with family, friends, and business partners. Better collective decision-making benefits everyone.

Remember: positive accounting profit feels good, but positive economic profit builds wealth. The difference between the two often determines whether you achieve financial independence or just tread water for decades.

Start small. Pick one investment or business venture and calculate its true economic profit this week. You might be surprised by what you discover – and that surprise could be worth thousands or even millions of dollars over your lifetime.

The path to wealth isn’t about working harder or taking bigger risks. It’s about making smarter choices that maximize economic profit. Armed with this knowledge, you’re now equipped to do exactly that.

About the Author

Max Fonji is a financial educator and investment strategist with over 15 years of experience helping everyday investors build lasting wealth. As the founder of TheRichGuyMath.com, Max specializes in breaking down complex financial concepts into actionable strategies that anyone can understand and implement. His evidence-based approach to investing has helped thousands of readers make smarter financial decisions and achieve their long-term goals.

Disclaimer: This article is for educational and informational purposes only and should not be construed as financial advice. Economic profit calculations involve assumptions and estimates that may not apply to your specific situation. Always consult with a qualified financial advisor before making investment decisions. Past performance does not guarantee future results, and all investments carry risk, including the potential loss of principal.