Imagine you’re running a lemonade stand. At the end of summer, you count your cash and realize you made $500. Success, right? Well, not so fast. What if you could have earned $800 working at the local café instead? What about the time you spent making lemonade? Suddenly, that $500 doesn’t look quite as impressive (Economic Profit vs Accounting Profit).

This is the difference between accounting profit and economic profit, and understanding it could completely change how you think about money, business, and smart financial decisions. Whether you’re evaluating a side hustle, considering a career change, or trying to understand why you should invest your money wisely, knowing the distinction between these two profit measures is essential.

Key Takeaways

- Accounting profit is revenue minus explicit costs (the money you actually spend)

- Economic profit is revenue minus both explicit AND implicit costs (including opportunity costs)

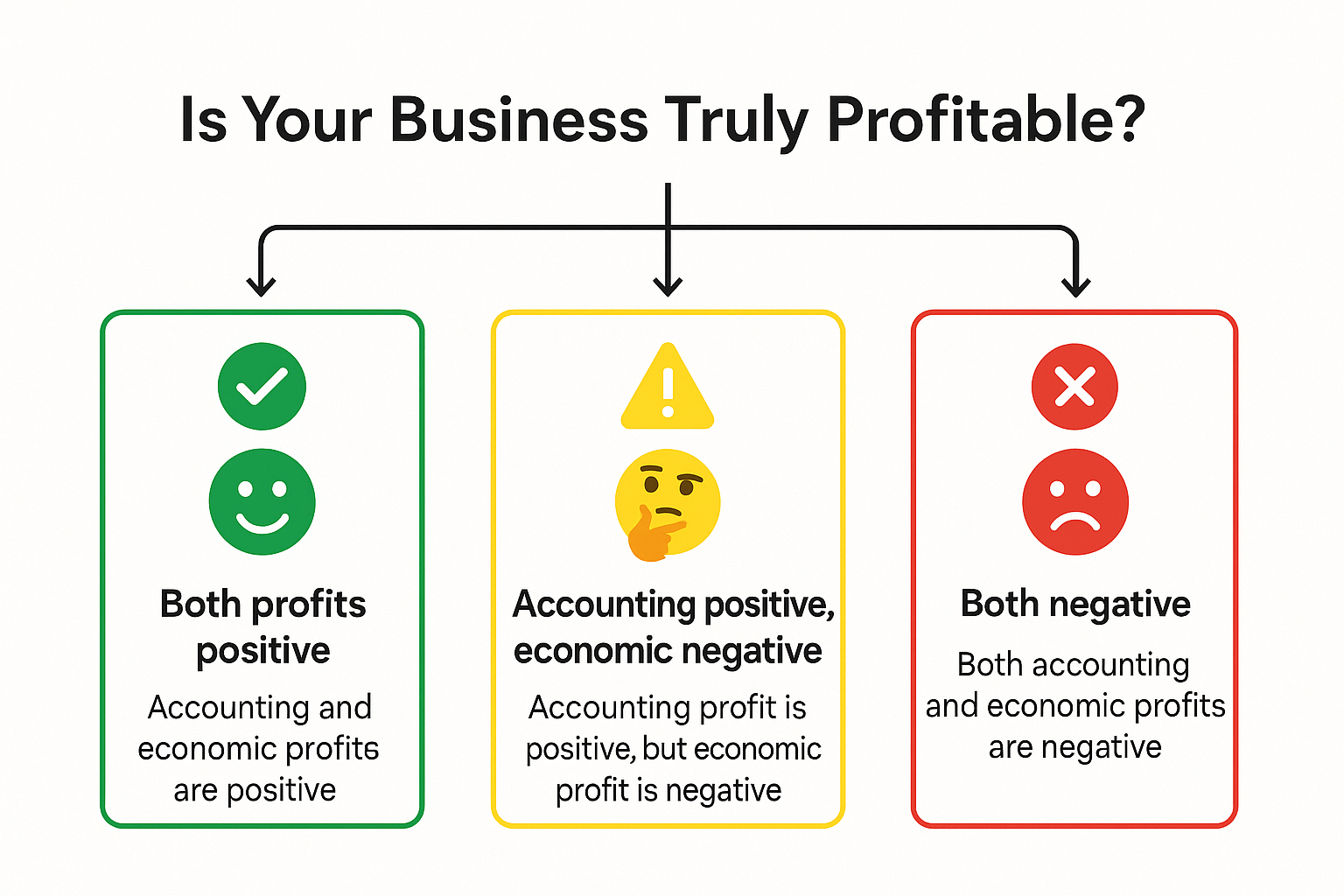

- A business can show positive accounting profit but negative economic profit simultaneously

- Economic profit helps you make better decisions by considering what you’re giving up

- Understanding both metrics is crucial for making smart investment choices and evaluating business opportunities

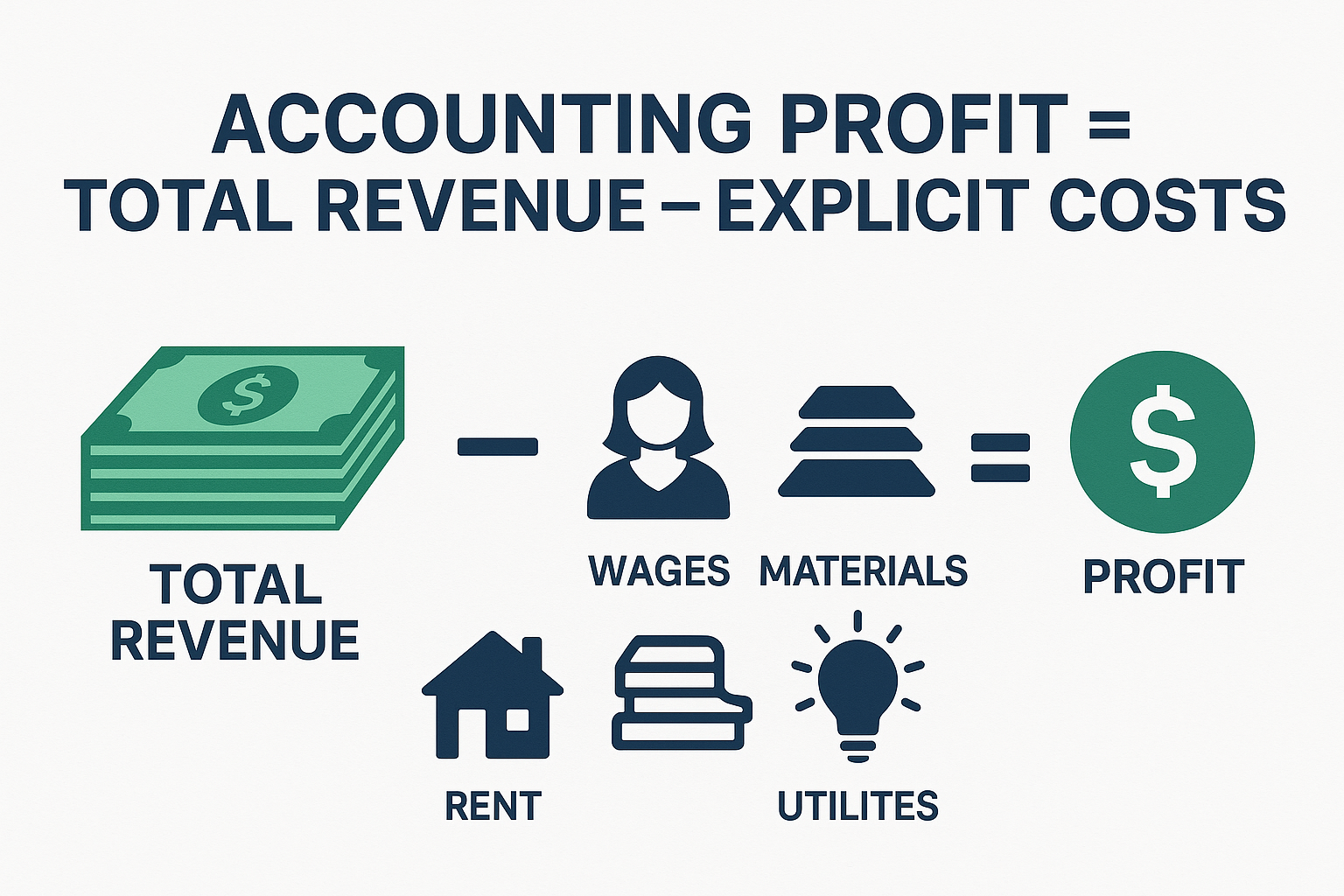

What Is Accounting Profit?

Accounting profit is the straightforward calculation most people think of when they hear the word “profit.” It’s simply your total revenue minus your explicit costs, the actual money flowing out of your pocket or bank account. Investopedia

The Formula for Accounting Profit

Accounting Profit = Total Revenue – Explicit Costs

Explicit costs include:

- Raw materials and supplies

- Employee wages and salaries

- Rent and utilities

- Equipment purchases

- Marketing and advertising expenses

- Taxes and fees

- Any other direct cash expenses

Real-World Example of Accounting Profit

Let’s say Sarah opens a small bakery. Here’s her first year:

Revenue: $150,000

Explicit Costs:

- Ingredients: $30,000

- Rent: $24,000

- Employee wages: $40,000

- Utilities: $6,000

- Equipment: $10,000

- Marketing: $5,000

Total Explicit Costs: $115,000

Accounting Profit: $150,000 – $115,000 = $35,000

On paper, Sarah’s bakery is profitable! Her accountant would report a $35,000 profit, and she’d pay taxes on this amount. But is she really better off than before she opened the bakery? That’s where economic profit comes in.

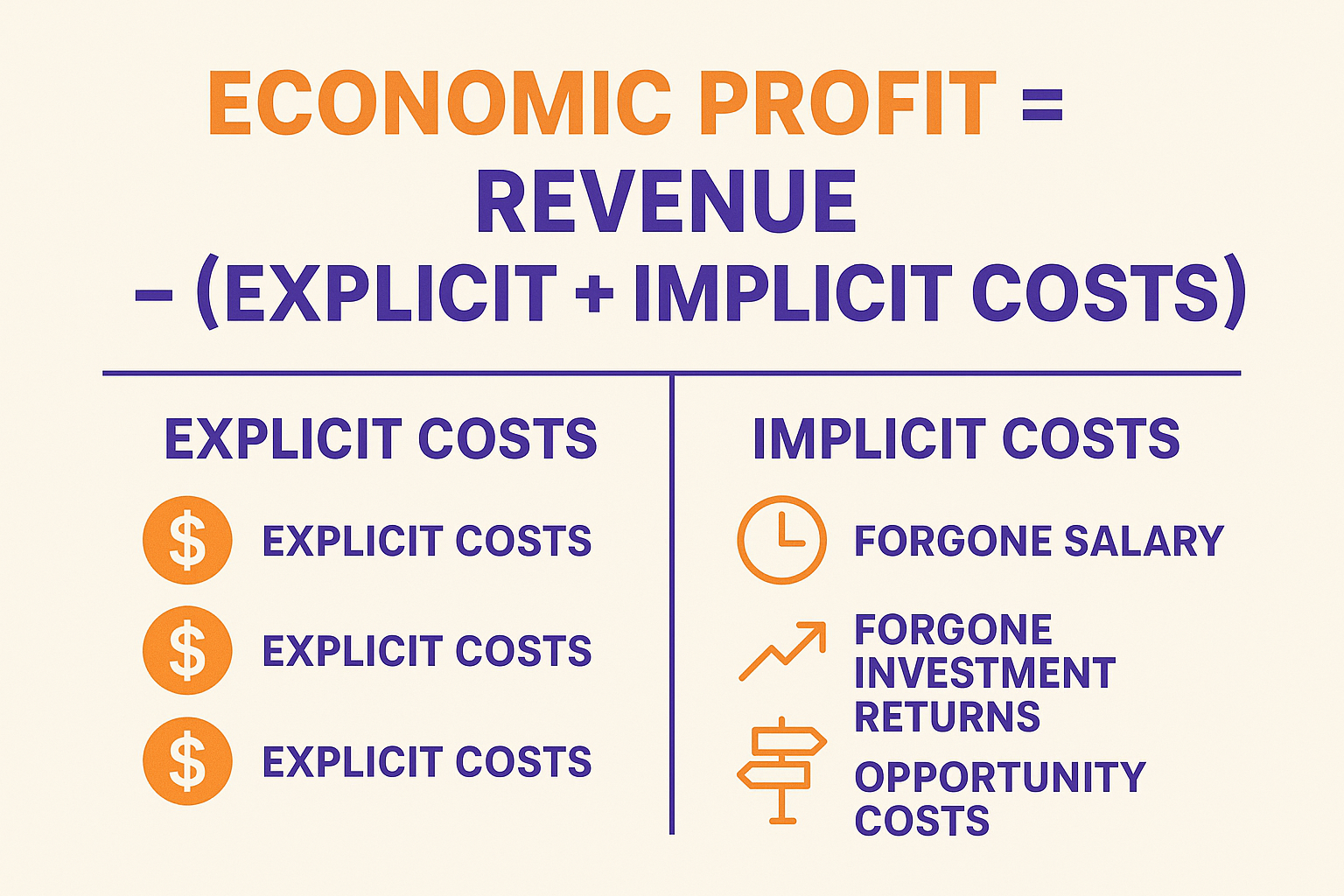

What Is Economic Profit?

Economic profit takes a deeper, more realistic look at profitability by including opportunity costs, the value of what you give up when you choose one option over another. Investopedia – Economic Profit

The Formula for Economic Profit

Economic Profit = Total Revenue – (Explicit Costs + Implicit Costs)

Or alternatively:

Economic Profit = Accounting Profit – Implicit Costs

Implicit costs (opportunity costs) include:

- Forgone salary from another job

- Return, you could have earned by investing your capital elsewhere

- Value of your time and labor

- Alternative uses of resources you own

- Potential income from renting out property you use for business

Real-World Example of Economic Profit

Let’s revisit Sarah’s bakery with a complete picture:

Accounting Profit: $35,000 (calculated above)

Implicit Costs:

- Sarah’s previous job salary: $55,000/year

- Return on $50,000 startup capital if invested in the stock market (assuming 8% annual return): $4,000

- Rent forgone on commercial space Sarah owns (could rent to someone else): $12,000

Total Implicit Costs: $71,000

Economic Profit: $35,000 – $71,000 = -$36,000

Suddenly, Sarah’s “profitable” bakery looks quite different! She’s actually $36,000 worse off economically than if she had kept her job and invested her capital elsewhere.

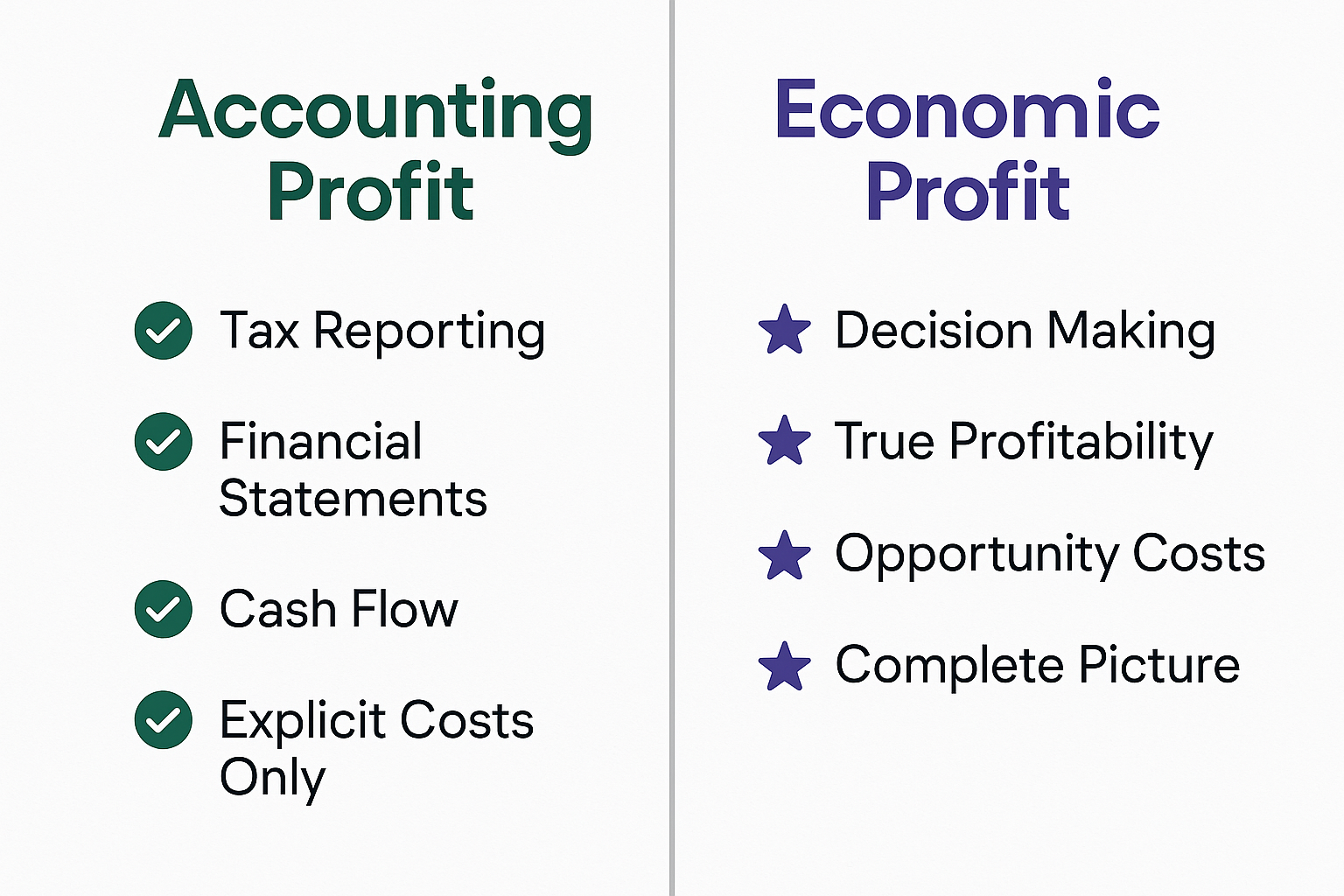

Economic Profit vs Accounting Profit: The Key Differences

Side-by-Side Comparison

| Feature | Accounting Profit | Economic Profit |

|---|---|---|

| Definition | Revenue minus explicit costs | Revenue minus explicit AND implicit costs |

| Costs Included | Only out-of-pocket expenses | Can be negative even when the accounting profit is positive |

| Purpose | Tax reporting, financial statements | Decision-making, true profitability |

| Perspective | Backward-looking (what happened) | Forward-looking (what could happen) |

| Result | Always higher or equal to economic profit | Always higher than or equal to economic profit |

| Used By | Accountants, tax authorities, investors | Economists, business strategists, entrepreneurs |

| Considers Alternatives | No | Yes |

Why Economic Profit Matters More for Decision-Making

While accounting profit is essential for taxes and financial reporting, economic profit is the superior metric for making smart business and investment decisions. Here’s why:

1. It Reveals True Opportunity Cost

Economic profit forces you to ask: “What am I giving up?” This is crucial whether you’re starting a business, changing careers, or deciding where to invest your money.

2. It Prevents the “Profitable Trap”

Many business owners stay in ventures that show accounting profit but destroy wealth economically. They’re working harder for less than they could earn elsewhere, but they just don’t realize it because the accounting looks good.

3. It Aligns with Rational Decision-Making

Economists use economic profit because it reflects how rational people actually make choices: by comparing alternatives and choosing the option with the highest value.

4. It Includes the Cost of Capital

When you invest money in a business instead of earning passive income through dividend investing, you’re giving up potential returns. Economic profit accounts for this.

Real-Life Story: The Software Developer’s Dilemma

Meet James, a software developer earning $120,000 per year at a tech company. He had an idea for a mobile app and decided to quit his job to pursue it full-time. After one year:

Revenue from app: $180,000

Expenses:

- Server costs: $12,000

- Marketing: $20,000

- Contractor fees: $18,000

- Office space: $15,000

- Software licenses: $5,000

Total Explicit Costs: $70,000

Accounting Profit: $180,000 – $70,000 = $110,000

James was thrilled! He’d made $110,000 in profit. But when he calculated economic profit:

Implicit Costs:

- Forgone salary: $120,000

- Forgone employer 401(k) match (5%): $6,000

- Forgone health insurance value: $8,000

Total Implicit Costs: $134,000

Economic Profit: $110,000 – $134,000 = -$24,000

Despite showing a healthy accounting profit, James was actually $24,000 worse off economically than if he’d kept his job. This doesn’t necessarily mean he made the wrong choice; maybe he valued the freedom and learning experience. But understanding economic profit gave him the full picture. Morningstar

After this realization, James doubled down on marketing and product improvements. By year two, his revenue jumped to $320,000 with similar costs, finally achieving positive economic profit and validating his career change.

When Accounting Profit Still Matters

Don't throw away your accounting profit calculations just yet! They're still critically important for:

Tax Purposes

The IRS cares about accounting profit, not economic profit. You pay taxes based on explicit costs, not opportunity costs.

Financial Reporting

Investors, lenders, and stakeholders evaluate businesses using standardized accounting principles (GAAP). They need consistent, comparable accounting profit figures.

Legal Compliance

Publicly traded companies must report accounting profits in their financial statements according to regulatory requirements.

Tracking Cash Flow

Accounting profit helps you understand actual cash movements, money coming in and going out of your business.

Securing Financing

Banks and investors look at accounting profit when deciding whether to lend money or invest in your venture.

How to Calculate Both Types of Profit Step-by-Step

Calculating Accounting Profit

Step 1: Add up all revenue sources

- Sales revenue

- Service fees

- Interest income

- Any other income

Step 2: List all explicit costs

- Cost of goods sold

- Operating expenses

- Depreciation

- Interest on loans

- Taxes

Step 3: Subtract total explicit costs from total revenue

Example:

- Revenue: $200,000

- Explicit costs: $140,000

- Accounting Profit: $60,000

Calculating Economic Profit

Step 1: Calculate accounting profit (as above)

Step 2: Identify all implicit costs

- What salary could you earn elsewhere?

- What return could your invested capital earn in high dividend stocks?

- What could you earn renting out assets you use in the business?

- What is the value of your time?

Step 3: Add up all implicit costs

Step 4: Subtract implicit costs from accounting profit

Example:

- Accounting profit: $60,000

- Implicit costs: $75,000

- Economic Profit: -$15,000

Common Misconceptions About Economic Profit vs Accounting Profit

1: "Economic Profit Isn't Real"

Truth: Economic profit is actually MORE real because it reflects true wealth creation. Accounting profit can be misleading when it ignores opportunity costs.

2: "Only Economists Care About Economic Profit"

Truth: Smart entrepreneurs, investors, and business strategists use economic profit to make better decisions. Understanding why people lose money in the stock market often comes down to ignoring opportunity costs.

3: "You Can't Measure Implicit Costs Accurately"

Truth: While implicit costs require estimation, they're not arbitrary. Market salaries, investment returns, and rental rates provide objective benchmarks.

4: "If Accounting Profit Is Positive, You're Winning"

Truth: Positive accounting profit with negative economic profit means you're losing ground compared to your alternatives. You're working hard to earn less than you could elsewhere.

5: "Economic Profit Only Applies to Businesses"

Truth: Economic profit thinking applies to any decision with opportunity costs, career choices, education investments, and even how you spend your time.

Practical Applications in Your Financial Life

Career Decisions

When considering a job offer, don't just look at salary. Calculate the economic profit:

- New salary minus current salary (explicit)

- Minus moving costs, commute time value, lost benefits (implicit)

- Minus career growth opportunities, you're leaving behind

Investment Choices

When evaluating an investment opportunity, consider:

- Expected returns (revenue)

- Fees and taxes (explicit costs)

- Returns you could earn in alternative investments like smart passive income strategies (implicit costs)

Education Decisions

Thinking about going back to school? Calculate:

- Future salary increase (revenue)

- Tuition, books, fees (explicit costs)

- Forgone salary during school years (implicit costs)

Side Hustle Evaluation

Before starting a side business:

- Projected income (revenue)

- Startup and operating costs (explicit)

- Value of your time and energy (implicit)

Understanding these concepts helps you avoid the cycle of market emotions that comes from making decisions without considering all costs.

The Role of Normal Profit

There's actually a third concept worth understanding: normal profit.

Normal profit occurs when economic profit equals zero. This is the minimum profit necessary to keep a business operating in the long run.

When economic profit = 0:

- Accounting profit = Implicit costs

- The business owner earns exactly what they could earn in their next best alternative

- There's no incentive to leave the business, but also no incentive for new competitors to enter

Example:

- Revenue: $150,000

- Explicit costs: $80,000

- Accounting profit: $70,000

- Implicit costs: $70,000

- Economic profit: $0 (Normal profit)

In this scenario, the business owner is earning exactly what they would in their best alternative opportunity. They're not getting rich, but they're not losing ground either.

Industry Examples: Where Economic Profit Reveals Hidden Truths

Restaurant Industry

Restaurants often show modest accounting profits but negative economic profits when you factor in:

- Owner's 80-hour work weeks (implicit labor cost)

- Capital tied up in equipment and inventory

- Forgone returns from investing that capital elsewhere

This explains why understanding the stock market and alternative investments is crucial for business owners.

Real Estate

A rental property might show positive cash flow (accounting profit) but negative economic profit when considering:

- Property management time

- Opportunity cost of capital invested in the property

- Alternative returns from REITs or dividend stocks

Freelancing

Freelancers often celebrate their gross income without calculating:

- Self-employment taxes (explicit)

- No employer benefits like health insurance and retirement match (implicit)

- Unpaid time spent on marketing and administration (implicit)

- Income volatility and lack of job security (implicit risk cost)

How Companies Use Economic Profit for Strategic Decisions

Major corporations don't just track accounting profit; they use economic profit frameworks to:

1. Evaluate Division Performance

Companies assess whether each business unit creates value beyond its cost of capital. If a division shows accounting profit but negative economic profit, it might be a candidate for divestiture.

2. Make Investment Decisions

Before investing in new projects, companies calculate whether the expected returns exceed the opportunity cost of capital, essentially an economic profit calculation.

3. Determine Executive Compensation

Some companies tie bonuses and stock options to economic profit metrics (like EVA - Economic Value Added) rather than just accounting profit, better aligning incentives with value creation.

4. Assess Competitive Advantage

Sustained positive economic profit indicates a company has competitive advantages (moats) that allow it to earn above-market returns. This is why smart investors look beyond surface-level financial metrics.

The Limitations of Both Metrics

Accounting Profit Limitations

- Ignores opportunity costs: Doesn't show what you're giving up

- Can be manipulated: Through the timing of revenue recognition and expense categorization

- Backward-looking: Shows what happened, not what's optimal going forward

- Doesn't reflect true wealth creation: Can show profit while destroying economic value

Economic Profit Limitations

- Subjective implicit costs: Opportunity costs require estimation and assumptions

- Not standardized: Different people may calculate differently

- Difficult to verify: Can't be audited like accounting profit

- Ignores non-financial benefits: Doesn't capture job satisfaction, learning, flexibility, etc.

- Requires counterfactual thinking: You must imagine "what could have been"

The best approach? Use both metrics together for a complete picture.

Making Better Financial Decisions with Both Metrics

Here's a practical framework for decision-making:

Step 1: Calculate Accounting Profit

Understand the explicit financial impact and tax implications.

Step 2: Calculate Economic Profit

Include all opportunity costs to see the true economic impact.

Step 3: Consider Non-Financial Factors

- Personal satisfaction and fulfillment

- Learning and skill development

- Work-life balance

- Risk tolerance

- Long-term goals and values

Step 4: Make an Informed Choice

If economic profit is positive, the decision makes financial sense.

If economic profit is negative but close to zero, Non-financial factors might justify the choice.

If economic profit is significantly negative, seriously reconsider unless non-financial benefits are extraordinary.

This framework applies whether you're deciding where to invest, choosing a career path, or starting a business.

They serve different purposes. Accounting profit is essential for reporting, taxes, and EPS; economic profit is more informative for value creation and capital allocation. Use both.

Yes. If the capital charge (Invested Capital × WACC) exceeds accounting profit, economic profit will be negative even when accounting profit is positive.

WACC requires estimating the cost of equity (commonly via CAPM), the cost of debt (market yields on company debt), and capital structure weights. Many finance platforms (e.g., Morningstar, company investor presentations) provide helpful inputs.

EVA is a branded implementation of economic profit popularized by Stern Stewart & Co.; conceptually, they are similar both subtract a capital charge from operating profit after tax.

Use company financial statements (10-K, 10-Q), and inputs from reliable data providers (Morningstar, Bloomberg, Yahoo Finance) to estimate invested capital and cost of capital.

Some short-term actions (reducing capital expenditure, selling assets) can temporarily inflate economic profit; true sustainable economic profit improvement requires raising ROIC or lowering WACC sustainably.

Traditional invested capital may understate the contribution of intangibles if they’re expensed. Better practice is to adjust invested capital to reflect economically productive investments; otherwise, ROI and economic profit calculations can be biased.

Conclusion: Thinking Like an Economist About Your Money

Understanding the difference between economic profit vs accounting profit fundamentally changes how you evaluate opportunities. While accounting profit tells you if you made money on paper, economic profit tells you if you made the best possible use of your resources.

The next time you're faced with a financial decision, whether it's a job offer, business opportunity, or investment choice, ask yourself:

✅ What's the accounting profit? (What will I earn after explicit costs?)

✅ What's the economic profit? (What am I giving up to pursue this?)

✅ Are there non-financial benefits that justify a lower economic profit?

Remember Sarah's bakery? After calculating her negative economic profit, she didn't necessarily make the wrong choice. Maybe she valued being her own boss, pursuing her passion, and building something of her own. But she made that choice with full awareness of the economic trade-off, and that's what matters.

The most successful people don't just make money; they maximize economic profit while aligning their choices with their values. They understand that every decision has an opportunity cost, and they choose wisely.

Your Next Steps

- Calculate your current situation: What's your economic profit in your current job or business?

- Evaluate alternatives: What opportunities are you not pursuing? What's their potential economic profit?

- Make informed changes: If you're experiencing negative economic profit with no offsetting benefits, it might be time for a change.

- Keep learning: Dive deeper into financial concepts that help you build wealth intelligently.

- Apply economic thinking: Use opportunity cost analysis for all major decisions, from investments to time allocation.

By mastering these concepts, you're not just learning accounting or economics; you're developing a superpower for making smarter financial decisions that build real, lasting wealth.

Disclaimer

This article is for educational and informational purposes only and should not be construed as financial, investment, or professional advice. The examples provided are hypothetical and for illustration purposes. Economic profit calculations require estimates and assumptions that may vary based on individual circumstances. Always consult with qualified financial advisors, accountants, and other professionals before making significant financial or business decisions. Past performance does not guarantee future results. The author and publisher are not responsible for any financial decisions made based on this content.

About the Author

Max Fonji is a financial educator and content strategist with over 30 years of experience helping individuals understand complex financial concepts. Through TheRichGuyMath.com, Max breaks down investing, economics, and wealth-building strategies into accessible, actionable insights for beginners and experienced investors alike. His mission is to democratize financial knowledge and empower readers to make smarter money decisions.