← Back to Budgeting and Saving

Picture this: You’re cruising along in life, bills are paid, you’ve got a little money in the bank, and everything feels under control. Then BAM! Your car breaks down, your laptop dies, or worse, you lose your job. Suddenly, that comfortable feeling vanishes, replaced by panic and the dreaded question: “How am I going to pay for this?”

This scenario plays out thousands of times every day across America. According to a 2024 Federal Reserve report, nearly 40% of Americans are unable to cover a $400 emergency expense without borrowing money or selling something. That’s not because people are irresponsible; it’s because they haven’t built an emergency fund, the financial safety net that turns a crisis into a mere inconvenience.

An emergency fund isn’t just about having money sitting around. It’s about peace of mind, financial independence, and the freedom to handle life’s curveballs without derailing your entire financial future. Whether you’re just starting your financial journey or looking to strengthen your financial safety net, this guide will walk you through everything you need to know about building an effective emergency fund. FDIC Insurance

Key Takeaways

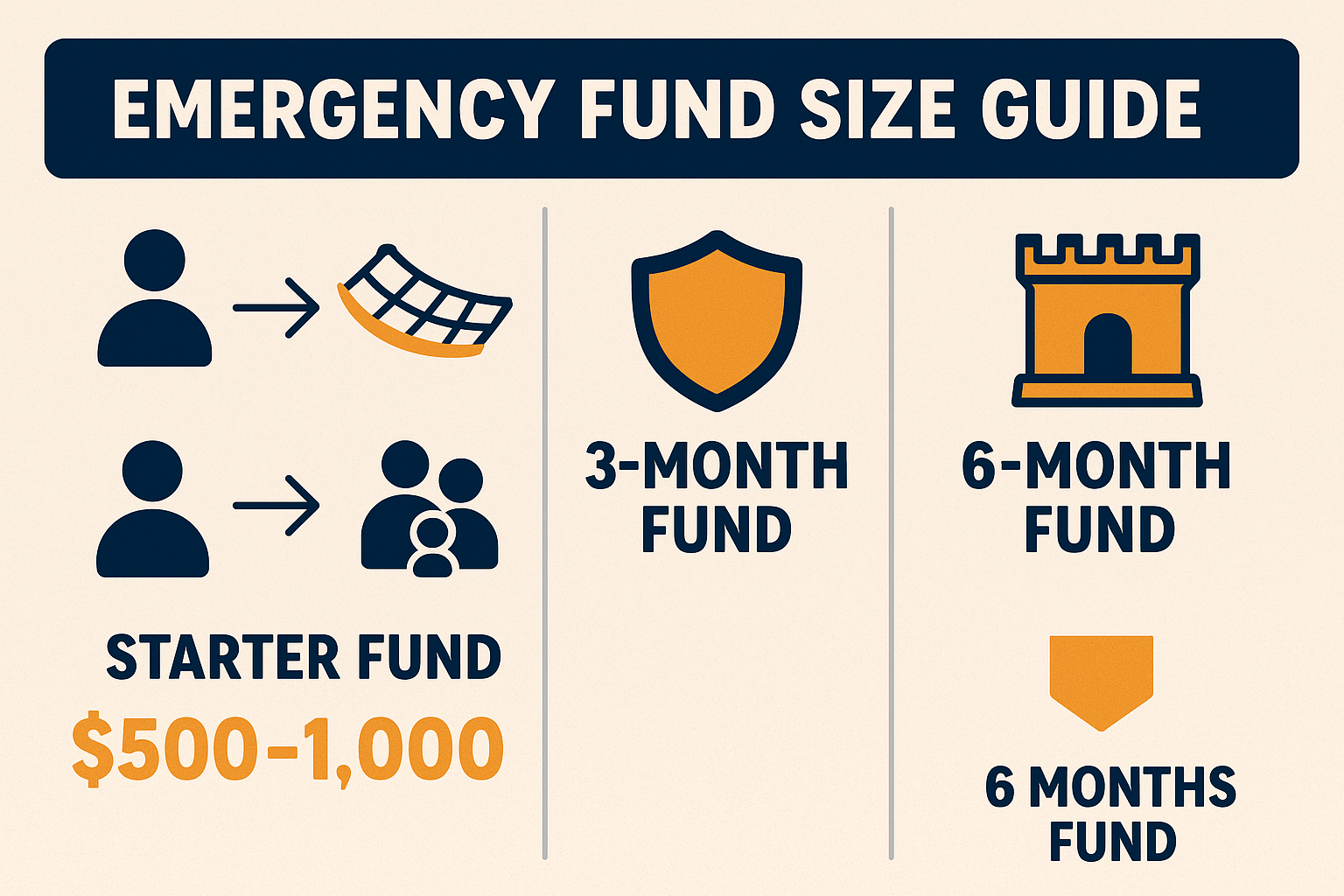

- An emergency fund is 3-6 months of essential expenses saved in an easily accessible account for unexpected costs.

- Start small with $500-$1,000 as your initial goal, then build up to full coverage.

- Keep your emergency fund in a high-yield savings account that’s separate from your regular checking account.

- Automate your savings by setting up automatic transfers each payday to make building your fund effortless

- Only use it for true emergencies, job loss, medical bills, urgent home repairs, or essential car fixes.

What Is an Emergency Fund (And Why You Need One)

An emergency fund is money you set aside specifically for unexpected expenses or financial emergencies. Think of it as your personal insurance policy against life’s unpredictability.

Unlike your regular savings for a vacation or new phone, an emergency fund has one job: to protect you when something goes wrong. It’s the difference between handling a $1,200 car repair with a quick transfer from savings versus putting it on a credit card at 24% interest and paying it off for the next two years. Investopedia – Emergency Fund Data

The Real Cost of Not Having an Emergency Fund

Let’s talk numbers. When Sarah, a 28-year-old teacher, didn’t have an emergency fund and her transmission failed, she had two choices:

- Put $2,500 on a credit card at 22% APR

- Take out a payday loan

She chose the credit card. By the time she paid it off 18 months later, she’d paid nearly $3,200 total, an extra $700 in interest alone. That’s money that could have gone toward her future instead of paying for yesterday’s emergency.

This is why understanding how banks work and using them strategically matters. Your emergency fund should work for you, not against you.

How Much Should Your Emergency Fund Be?

The classic advice is to save 3-6 months of essential expenses. But what does that actually mean for you?

Calculate Your Emergency Fund Target

Here’s the simple formula:

Monthly Essential Expenses × 3 to 6 = Your Emergency Fund Goal

Essential expenses include:

- Rent or mortgage

- Groceries and basic food

- Transportation (car payment, insurance, gas, or public transit)

- Utilities (electricity, water, heat, internet)

- Insurance premiums (health, car, home)

- Minimum debt payments

- Essential phone service

Notice what’s NOT included: Streaming services, dining out, gym memberships, shopping, or entertainment. Your emergency fund covers survival, not lifestyle.

Emergency Fund Guide: The 3–6 Month Rule

| Situation | Aim for 3 Months If… | Aim for 6+ Months If… |

|---|---|---|

| Job Stability | You have a stable job with low layoff risk | You work in a volatile industry |

| Income Source | You’re part of a dual-income household | You’re self-employed or the sole income earner |

| Support System | You have strong family or community support nearby | You have dependents or significant health concerns |

| Industry Outlook | Your industry is consistently hiring | Your job is highly specialized and harder to replace |

Let’s look at a real example:

| Expense Category | Monthly Cost |

|---|---|

| Rent | $1,200 |

| Groceries | $400 |

| Car payment & insurance | $450 |

| Utilities | $150 |

| Phone | $60 |

| Minimum debt payments | $200 |

| Total Monthly Essentials | $2,460 |

For this person:

- 3-month fund: $7,380

- 6-month fund: $14,760

Those numbers might feel overwhelming right now, and that’s okay. You don’t build this overnight. CFPB Emergency Fund Guide

Where to Keep Your Emergency Fund

Location matters just as much as the amount. Your emergency fund needs to be:

Easily accessible (you can get it within 1-2 days)

Safe (FDIC-insured, no risk of loss)

Separate from your everyday spending money

Earning interest (even a little helps)

Best Places for Your Emergency Fund

1. High-Yield Savings Account (HYSA) ⭐ BEST OPTION

In 2025, many online banks offer 4-5% APY on savings accounts—significantly better than traditional banks offering 0.01%. On a $10,000 emergency fund, that’s the difference between earning $1 versus $400-500 per year.

Pros:

- FDIC insured up to $250,000

- Easy online transfers

- Competitive interest rates

- No monthly fees (usually)

Cons:

- Takes 1-2 days to transfer to checking

- Requires opening a separate account

Top options: Marcus by Goldman Sachs, Ally Bank, American Express Personal Savings, Discover Online Savings

2. Money Market Account

Similar to high-yield savings but sometimes with check-writing privileges.

Pros:

- Competitive rates

- Sometimes offers a debit card or checks

- FDIC insured

Cons:

- May require a higher minimum balance

- Limited transactions per month

3. Traditional Savings Account

The convenience option is if you want everything at your current bank.

Pros:

- Easy to set up

- Instant transfers to checking

- Familiar bank relationship

Cons:

- Usually very low interest (0.01-0.05%)

- You’re losing money to inflation

Where NOT to Keep Your Emergency Fund

Checking Account: Too easy to accidentally spend

Under your mattress: No interest, not FDIC insured, fire risk

Stock market: Too volatile for money you might need tomorrow (though understanding why the stock market goes up is valuable for other savings)

Locked CDs: You’ll pay penalties for early withdrawal

Cryptocurrency: Far too volatile for emergency money

The stock market is for long-term investing and potentially earning passive income through dividends, not for your emergency fund. You don’t want to be forced to sell stocks during a market crash to pay for a roof repair.

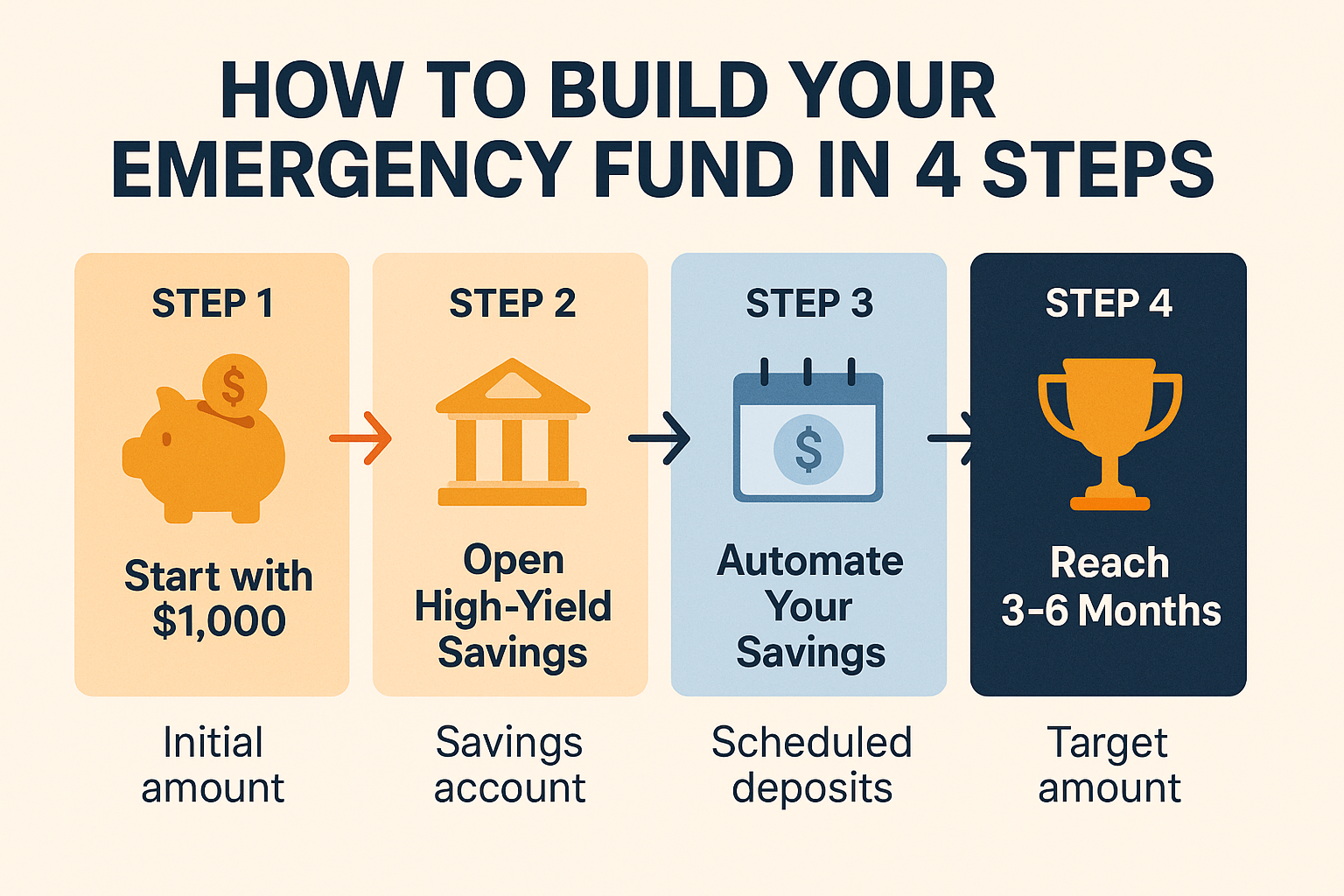

How to Build Your Emergency Fund (Step-by-Step)

Building an emergency fund from zero can feel like climbing a mountain. But every mountain is climbed one step at a time. Here’s your roadmap:

Step 1: Start with a Mini Emergency Fund ($500-$1,000)

Before you aim for 3-6 months of expenses, build a starter emergency fund of $500-$1,000. This smaller goal:

- Feels achievable quickly

- Covers most minor emergencies

- Builds momentum and confidence

- Protects you while you tackle high-interest debt

Quick ways to find your first $500-$1,000:

- Sell items you don’t use (Facebook Marketplace, eBay, Poshmark)

- Put your tax refund directly into savings

- Deposit cash gifts instead of spending them

- Cut dining out for one month

- Cancel unused subscriptions

- Take on a temporary side gig

Step 2: Set Up a Dedicated Savings Account

Open that high-yield savings account we talked about. Separate accounts = separate purposes. When your emergency fund is mixed with your regular savings, it’s too tempting to dip into it for non-emergencies. Rule One Investing – Insurance & Emergency Funds

Name your account something meaningful: “Emergency Fund – Do Not Touch” or “Financial Safety Net.” That mental reminder helps.

Step 3: Automate Your Savings

Here’s the secret sauce: automation. When you have to manually transfer money to savings each month, you’ll forget, make excuses, or “just skip this month.”

Set up an automatic transfer from checking to your emergency fund savings account:

- On payday (the day your paycheck hits)

- For a specific amount (even if it’s just $25)

- Non-negotiable (treat it like a bill you must pay)

This “pay yourself first” approach means you save before you have a chance to spend. It’s the same principle behind successful passive income strategies: consistency beats intensity.

Step 4: Find Extra Money to Accelerate Your Fund

While your automatic savings build your fund slowly and steadily, look for opportunities to boost it:

Windfalls:

- Tax refunds

- Work bonuses

- Birthday money

- Rebates or cashback rewards

- Stimulus payments

Budget optimization:

- Reduce one category by 10% and redirect it

- Try a “no-spend” challenge for a week or month

- Negotiate bills (insurance, phone, internet)

- Use coupons and cashback apps for groceries

Income boosts:

- Overtime at work

- Freelance side projects

- Selling crafts or services

- Temporary gig work

Step 5: Track Your Progress and Celebrate Milestones

Building an emergency fund takes time, sometimes years. Keep yourself motivated by:

Creating a visual tracker (thermometer chart, savings app, spreadsheet)

Celebrating milestones ($1,000, $2,500, $5,000, etc.)

Reviewing monthly to see your progress

Reminding yourself why you’re doing this

When you hit that first $1,000, you’ve accomplished something huge. You’re now better prepared than 40% of Americans. That’s worth celebrating (inexpensively, of course!.

What Counts as a Real Emergency?

This is where many people struggle. An emergency fund isn’t a “whatever I want” fund. It’s for genuine financial emergencies that are:

Unexpected (you couldn’t plan for it)

Necessary (must be addressed now)

Urgent (can’t wait until next paycheck)

True Emergencies

- Medical emergencies or unexpected healthcare costs

- Essential car repairs (you need it to get to work)

- Critical home repairs (broken furnace in winter, roof leak, busted water heater)

- Job loss or sudden income reduction

- Emergency dental work

- Emergency vet bills for your pet

- Emergency travel (family crisis requiring immediate flight)

NOT Emergencies

- A great sale on something you’ve wanted

- Holiday shopping

- Upgrading to the newest phone

- Concert tickets

- Wedding guest outfit

- Vacation because you “need a break.”

- New gaming console release

The test: Ask yourself, “What happens if I don’t spend this money right now?”

If the answer is “nothing serious” or “I’ll be disappointed,” it’s not an emergency.

Rebuilding Your Emergency Fund After Using It

Here’s the thing about emergency funds: you will use them. That’s literally what they’re for. And that’s okay!

When you do tap into your emergency fund:

- Don’t feel guilty. This is exactly why you built it. You did the right thing by using it instead of going into debt.

- Pause other financial goals temporarily. Stop extra debt payments or investment contributions and redirect that money to rebuilding your emergency fund.

- Rebuild it as priority #1. Get it back to your target amount before resuming other goals.

- Use the same building strategies. Automate, find windfalls, optimize your budget.

Think of your emergency fund like an airbag in your car. When it deploys and saves you, you don’t feel bad; you’re grateful it was there. Then you get it replaced before driving again. Federal Reserve

Emergency Fund Myths (Busted!)

1: “I can just use my credit card for emergencies.”

Reality: Credit cards charge 15-25% interest. A $3,000 emergency becomes $3,750 if you take a year to pay it off. Plus, high credit utilization hurts your credit score. Understanding smart financial moves means knowing that credit cards are a last resort, not a plan.

2: “I’ll just invest this money instead; stocks earn more.”

Reality: Yes, the stock market historically returns 8-10% annually, but it’s volatile. When you need emergency money, you might be forced to sell during a downturn, locking in losses. Anyone who’s experienced the cycle of market emotions knows that selling during a panic is the worst time. Emergency funds need stability, not growth.

3: “I don’t need an emergency fund, I’m young and healthy.”

Reality: Emergencies don’t care about your age. Young people have car accidents, get laid off, and face unexpected expenses. In fact, younger workers often have less job security and fewer resources, making an emergency fund even more critical.

4: “I can’t save, I barely make enough to cover my bills.”

Reality: Even $5 or $10 per week adds up. That’s $260-520 per year. Start impossibly small if needed. The habit matters more than the amount initially. Many people discover they can save when they track spending and find leaks.

5: “Six months of expenses is impossible, I’ll never save that much.”

Reality: You don’t need to save it all at once. If you save $200/month, you’ll have $2,400 in a year, $7,200 in three years. Time and consistency are your allies. Start with $1,000, then build from there.

Emergency Fund vs Other Financial Goals

You’ve got multiple financial priorities competing for your limited dollars. Where does an emergency fund fit in the pecking order?

The Recommended Priority Order:

- Basic expenses (rent, food, utilities, the non-negotiables)

- Employer 401(k) match (that’s free money, always take it)

- Starter emergency fund ($500-$1,000)

- High-interest debt (credit cards, payday loans, anything above 10% interest)

- Full emergency fund (3-6 months of expenses)

- Other debt (student loans, car loans, mortgage)

- Retirement savings (beyond the match)

- Other investments (taxable brokerage, real estate, etc.)

- Major purchases (house down payment, new car)

Notice that your starter emergency fund comes before aggressively paying off debt. Why? Because without that cushion, one emergency sends you right back into debt, creating a vicious cycle.

Once you have your starter fund, focus on high-interest debt while maintaining minimum payments on everything else. Then circle back to building your full emergency fund.

After that’s complete, you can explore dividend investing and other wealth-building strategies without the constant fear of financial disaster.

Advanced Emergency Fund Strategies

Once you’ve mastered the basics, consider these next-level approaches:

The Tiered Emergency Fund Approach

Instead of keeping everything in one place, split your emergency fund into tiers:

1. (Immediate Access): $1,000-2,000 in a regular savings account at your primary bank for same-day access.

2. (1-2 Day Access): The bulk of your emergency fund (remaining 2-5 months) in a high-yield savings account earning maximum interest.

3. (Extended Emergency): An additional 3-6 months in slightly less liquid but higher-earning vehicles like short-term CDs or Treasury bills.

This maximizes your interest earnings while maintaining accessibility.

The Sinking Funds Strategy

Separate predictable irregular expenses from true emergencies:

Instead of one giant emergency fund covering everything, create sinking funds for expected-but-irregular expenses:

- Car maintenance fund ($50/month)

- Home maintenance fund ($75/month)

- Medical copay fund ($30/month)

- Holiday gift fund ($40/month)

This keeps your true emergency fund for actual emergencies and prevents you from depleting it for things you should have anticipated.

The Income-Replacement Focus

Instead of calculating based on expenses, some people prefer to save based on income replacement:

- 3 months of gross income (conservative)

- 6 months of gross income (moderate)

- 12 months of gross income (very conservative)

This approach is simpler to calculate and provides extra cushion, but requires saving more.

Common Emergency Fund Mistakes (And How to Avoid Them)

1: Keeping it TOO accessible

Having your emergency fund in your regular checking account means you’ll accidentally spend it. Keep it separate but accessible within 1-2 days.

2: Investing it aggressively

Your emergency fund is not for growth; it’s for protection. Volatility is the enemy. Keep it safe and boring.

3: Not adjusting as life changes

Got married? Had a baby? Bought a house? Changed jobs? Your emergency fund needs should change, too. Review it annually.

4: Using it for non-emergencies

That “amazing deal” isn’t an emergency. Protect your fund’s purpose ruthlessly.

5: Never starting because the goal feels too big

Perfect is the enemy of good. $25 saved is infinitely better than $0 saved. Start small, start now.

Mistake #6: Stopping once you hit your goal

Inflation happens. Expenses increase. Review your target amount every year and adjust upward if needed.

Real-Life Emergency Fund Success Stories

Marcus’s Story:

Marcus, a 32-year-old graphic designer, thought emergency funds were for “paranoid people.” Then his company downsized, and he lost his job. With no savings, he maxed out three credit cards, borrowed from family, and nearly lost his apartment.

After finally landing a new job, Marcus committed to building an emergency fund. He started with just $50 per paycheck. Eighteen months later, he had $4,200 saved, about four months of bare-bones expenses.

Two years after that, his car needed a $1,800 repair. Instead of panic, Marcus transferred the money from his emergency fund, got the repair done, and methodically rebuilt the fund over the next six months. “Having that money changed everything,” he said. “I actually slept that night instead of lying awake worrying.”

Priya’s Approach:

Priya, a 26-year-old nurse, automated her emergency fund from day one. She set up a $75 automatic transfer every payday to a high-yield savings account she nicknamed “Fortress of Solitude.”

She never thought about it, never missed the money, and fourteen months later was shocked to discover she had $2,100 saved. “I honestly forgot it was happening,” she laughed. “It was the easiest financial goal I ever achieved.”

These stories illustrate an important truth: consistency beats intensity. You don’t need to make dramatic sacrifices. You just need to start and keep going.

Tools and Resources for Building Your Emergency Fund

Budgeting Apps (Free Options)

- Mint – Tracks spending and savings goals

- YNAB (You Need A Budget) – Envelope budgeting system (paid, but offers a free trial)

- EveryDollar – Simple zero-based budgeting

- PocketGuard – Shows how much you can safely spend

High-Yield Savings Account Comparison Sites

- Bankrate.com – Compares savings account rates

- NerdWallet – Reviews and comparisons

- DepositAccounts.com – Comprehensive rate tracking

Savings Calculators

- Savings Goal Calculator – Figure out how long it’ll take

- Emergency Fund Calculator – Determine your target amount

- Compound Interest Calculator – See how your fund grows with interest

Additional Reading

For more financial strategies and insights, explore our comprehensive blog covering everything from basic money management to advanced investing concepts.

💰 Emergency Fund Calculator

Calculate how much you need to save for financial security

Enter Your Monthly Expenses

Your Emergency Fund Goals

How Long to Reach Your 6-Month Goal?

Taking Action: Your Emergency Fund Roadmap

You’ve made it through the complete guide. Now it’s time to act. Here’s your step-by-step action plan to start building your emergency fund today, not tomorrow, not next month, but right now:

This Week:

- Calculate your monthly essential expenses using the calculator above

- Determine your emergency fund target (start with $1,000, then 3 months, then 6 months)

- Open a high-yield savings account (if you don’t have one)

- Name your account something meaningful (“Emergency Fund – Do Not Touch”)

This Month:

- Set up automatic transfers to your emergency fund (start with any amount, even $25)

- Find one expense to cut and redirect that money to your emergency fund

- Sell unused items and deposit the proceeds

- Save any windfalls (tax refund, bonus, gift money)

This Year:

- Hit your $1,000 starter emergency fund milestone

- Celebrate when you reach it (inexpensively!)

- Continue building toward your 3-month goal

- Review and adjust your target amount based on life changes

Long-Term:

- Reach your full 6-month emergency fund

- Maintain it and rebuild immediately after any use

- Review annually and adjust for inflation

- Move on to other financial goals with confidence

Remember: Every dollar you save is a dollar of freedom. Freedom from panic when the car breaks down. Freedom from taking on high-interest debt. Freedom to handle life’s curveballs without derailing your entire financial future.

Conclusion

Building an emergency fund isn’t glamorous. It won’t make you rich. You can’t post photos of it on Instagram or brag about it at parties. But it’s the foundation of every successful financial life.

Think of your emergency fund as the financial equivalent of wearing a seatbelt. You don’t put it on expecting to crash; you put it on because if something happens, you’ll be protected. And that protection changes everything.

The truth is simple: Life will throw emergencies at you. The only question is whether you’ll face them from a position of strength (with a fully-funded emergency fund) or weakness (with empty pockets and mounting debt).

You now have everything you need to build your financial safety net:

- You know how much to save

- You know where to keep it

- You know how to build it

- You know when to use it

- You have a calculator to plan it

- You have a roadmap to achieve it

The only thing left is to start.

Don’t wait for the perfect time. Don’t wait until you’re making more money. Don’t wait until after the holidays or your vacation or when things “settle down.” Start today with whatever you can, $5, $10, $25. Start impossibly small if you have to, but start.

Your future self, the one who faces an emergency with calm confidence instead of panic, will thank you.

Take action now. Open that savings account. Set up that automatic transfer. Save that first dollar. Your financial safety net awaits.

About the Author

Max Fonji is a financial educator and content strategist with over a decade of experience helping people build stronger financial foundations. Through TheRichGuyMath.com, Max breaks down complex financial concepts into actionable strategies that real people can use to improve their financial lives. When not writing about personal finance, Max enjoys analyzing market trends, studying behavioral economics, and finding new ways to make money work smarter, not harder.

Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. The strategies and suggestions presented are general in nature and may not be suitable for your specific financial situation. Emergency fund targets, savings strategies, and account recommendations should be evaluated based on your individual circumstances, risk tolerance, and financial goals. Interest rates, account features, and financial products mentioned are subject to change. Always verify current rates and terms before opening any financial account. For personalized financial advice, please consult with a qualified financial advisor, certified financial planner, or other appropriate financial professional. TheRichGuyMath.com and the author are not responsible for any financial decisions made based on the information in this article.