← Back to Budgeting and Saving

Picture this: Your car breaks down on a Tuesday morning, and the repair bill is $1,200. Do you have the cash ready, or are you scrambling to figure out how to pay for it? This scenario perfectly illustrates why understanding the difference between an emergency fund vs savings can be a financial game-changer.

Many people use the terms “emergency fund” and “savings” interchangeably, but they serve completely different purposes in your financial life. One is your financial safety net designed to catch you when life throws curveballs, while the other helps you reach specific goals and dreams. Getting this distinction right is one of the smartest financial moves you can make in 2025.

In simple terms, Emergency Fund vs Savings refers to the strategic difference between money set aside exclusively for unexpected crises versus funds allocated for planned purchases, goals, or general wealth building. Understanding this difference is crucial for financial security and long-term success. Investopedia – “How to Build an Emergency Fund”

TL;DR

- Emergency funds are liquid cash reserves (3-6 months of expenses) kept in easily accessible accounts for unexpected financial emergencies only.

- Savings accounts are for planned goals like vacations, down payments, or purchases, money you know you’ll need in the future.

- The key difference: Emergency funds are for “what if” scenarios; savings are for “when I” goals

- Everyone needs both: An emergency fund protects your savings from being raided during crises.

- Start small: Even $500-$1,000 in emergency funds can prevent debt spirals while you build toward larger goals.

What Is an Emergency Fund?

An emergency fund is a dedicated pool of money set aside specifically for unexpected, urgent financial needs. Think of it as your financial fire extinguisher; you hope you never need it, but when disaster strikes, you’ll be incredibly grateful it’s there.

Key Characteristics of Emergency Funds:

- Purpose: Cover unexpected expenses like medical bills, job loss, urgent home repairs, or car breakdowns

- Accessibility: Must be immediately available (high liquidity)

- Amount: Typically 3-6 months of essential living expenses

- Stability: Kept in safe, low-risk accounts with minimal growth expectations

- Usage: Only touched during genuine emergencies

According to the Federal Reserve’s 2024 Report on the Economic Well-Being of U.S. Households, nearly 37% of Americans would struggle to cover a $400 emergency expense using cash or savings. This statistic highlights why building an emergency fund should be a top financial priority. TD Bank – “Savings vs. Emergency Fund: What’s the Difference?”

What Are Savings?

Savings represent money you set aside for future planned expenses, goals, or wealth accumulation. Unlike emergency funds, savings have specific purposes and timelines attached to them.

Key Characteristics of Savings:

- Purpose: Fund specific goals like vacations, home down payments, new cars, education, or retirement

- Flexibility: Can be in various account types depending on timeline and goals

- Amount: Varies based on individual goals and income

- Growth potential: May be invested for higher returns depending on the time horizon

- Usage: Withdrawn according to your plan and timeline

Savings can be categorized into short-term (less than 3 years), medium-term (3-10 years), and long-term (10+ years) based on when you’ll need the money. Each category may use different financial vehicles to optimize growth while managing risk. Consumer Financial Protection Bureau (CFPB)

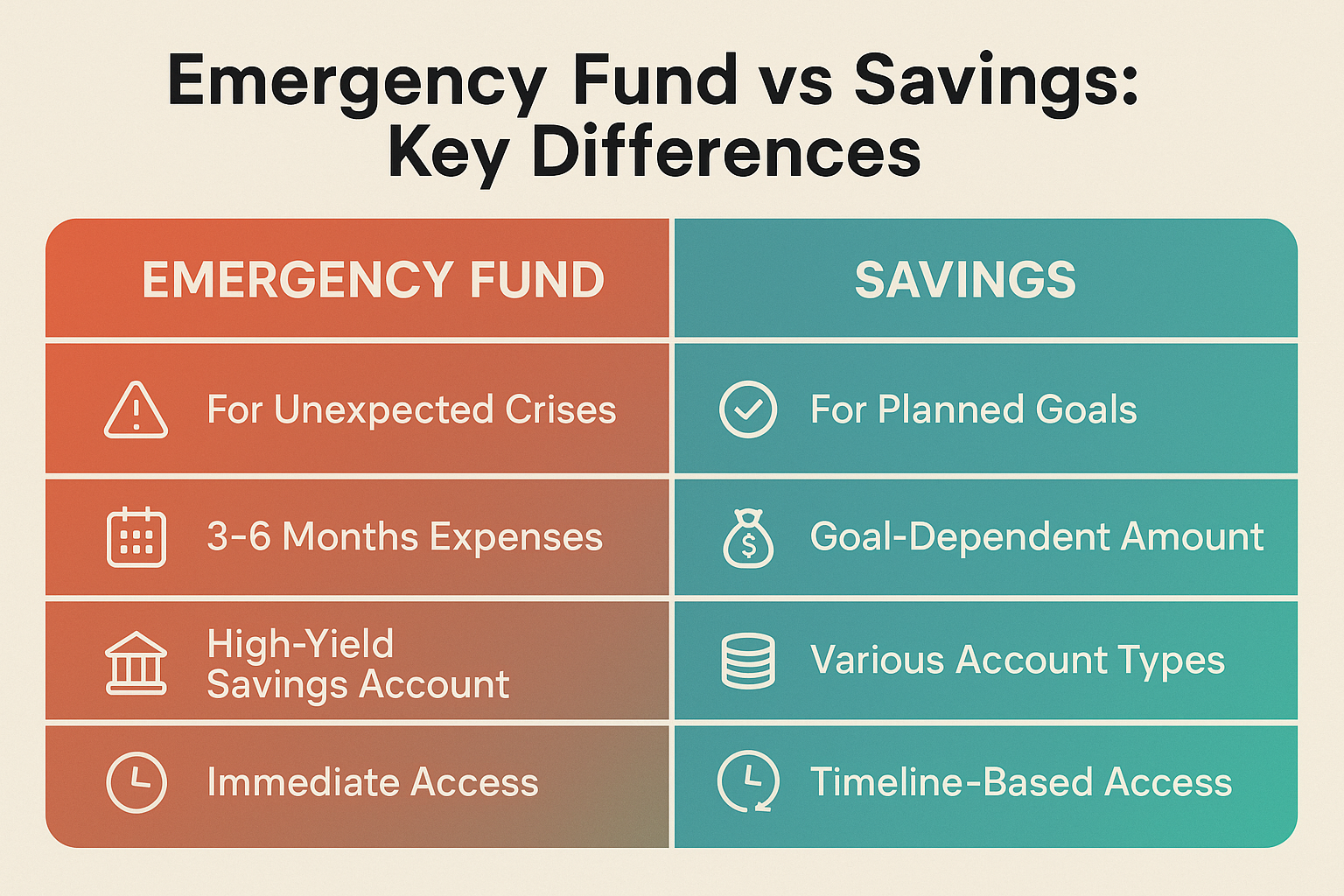

Emergency Fund vs Savings: The Core Differences

Understanding the distinction between these two financial tools is essential for building a solid financial foundation. Here’s a comprehensive comparison:

| Aspect | Emergency Fund | Savings |

|---|---|---|

| Primary Purpose | Unexpected crises and emergencies | Planned goals and purchases |

| Accessibility | Immediate (within 24-48 hours) | Varies by goal timeline |

| Ideal Amount | 3-6 months of expenses | Goal-dependent |

| Account Type | High-yield savings, money market | Savings accounts, CDs, investment accounts |

| Risk Tolerance | Zero to minimal risk | Can vary based on timeline |

| Withdrawal Triggers | Job loss, medical emergency, urgent repairs | Reaching savings goal, planned purchase |

| Growth Priority | Stability over growth | Balance of growth and accessibility |

| Replenishment | Immediately after use | According to savings plan |

The Mental Framework

Here’s the simplest way to distinguish them:

“Emergency funds answer the question: ‘What if something goes wrong?’ Savings answer the question: ‘What do I want to achieve?'”

Your emergency fund is defensive; it protects you from financial setbacks. Your savings are offensive; they help you move forward toward your goals and dreams.

Why You Need Both (Not Just One)

Many beginners make the mistake of thinking they only need one pot of money. However, having both an emergency fund and dedicated savings accounts is crucial for comprehensive financial health.

The Problem with Only Having Savings

If you only maintain savings accounts for your goals, you’ll be forced to raid them when emergencies strike. This creates several problems:

- Derailed goals: Your vacation fund becomes your car repair fund

- Opportunity costs: You might need to sell investments at a loss during market downturns

- Psychological stress: Watching your progress toward goals disappear is demoralizing

- Cycle of starting over: You constantly reset your financial progress

The Problem with Only Having an Emergency Fund

Conversely, if you only focus on emergency savings, you miss out on:

- Goal achievement: No dedicated funds for the things that improve your quality of life

- Investment growth: Emergency funds prioritize safety over returns, limiting wealth building

- Life enjoyment: Financial planning isn’t just about avoiding disaster—it’s about creating the life you want

- Long-term wealth: Without investing for retirement or other long-term goals, you’ll fall behind

According to Morningstar research, investors who maintain both emergency reserves and investment accounts demonstrate better long-term financial outcomes and experience less stress during market volatility.

How Much Should You Save in Each?

Determining the right amounts for your emergency fund and savings requires an honest assessment of your situation and goals.

Emergency Fund Target Amounts

Minimum starter emergency fund: $500-$1,000

- Covers most minor emergencies

- Prevents reliance on credit cards

- Achievable goal for beginners

Standard emergency fund: 3-6 months of essential expenses

- Calculate your monthly rent/mortgage, utilities, food, insurance, minimum debt payments, and transportation

- Multiply by 3-6, depending on your situation

- Example: If monthly essentials = $3,000, target = $9,000-$18,000

Extended emergency fund: 6-12 months of expenses

- Recommended for self-employed individuals

- Ideal for single-income households

- Appropriate for those in volatile industries

Factors That Influence Your Emergency Fund Size:

Job stability: Unstable employment = larger fund needed

Income sources: Single income = more reserves; multiple incomes = can be slightly lower

Dependents: More people relying on you = larger cushion

Health status: Chronic conditions or high deductibles = more savings

Home ownership: Homeowners need more for repairs; renters need less

Insurance coverage: Better coverage = lower emergency fund needs

Savings Target Amounts

Savings targets are entirely goal-dependent. Here’s how to calculate them:

Short-term goals (0-3 years):

- Identify the total cost

- Determine your timeline

- Divide the total by the months available

- Example: $6,000 vacation in 12 months = $500/month

Medium-term goals (3-10 years):

- Consider potential investment growth

- Use conservative return estimates (4-6% annually)

- Account for inflation

- Example: $30,000 home down payment in 5 years = approximately $440/month at 5% return

Long-term goals (10+ years):

- Leverage compound growth through investing

- Consider tax-advantaged accounts

- Adjust for inflation and market volatility

- Example: Retirement planning through dividend investing strategies

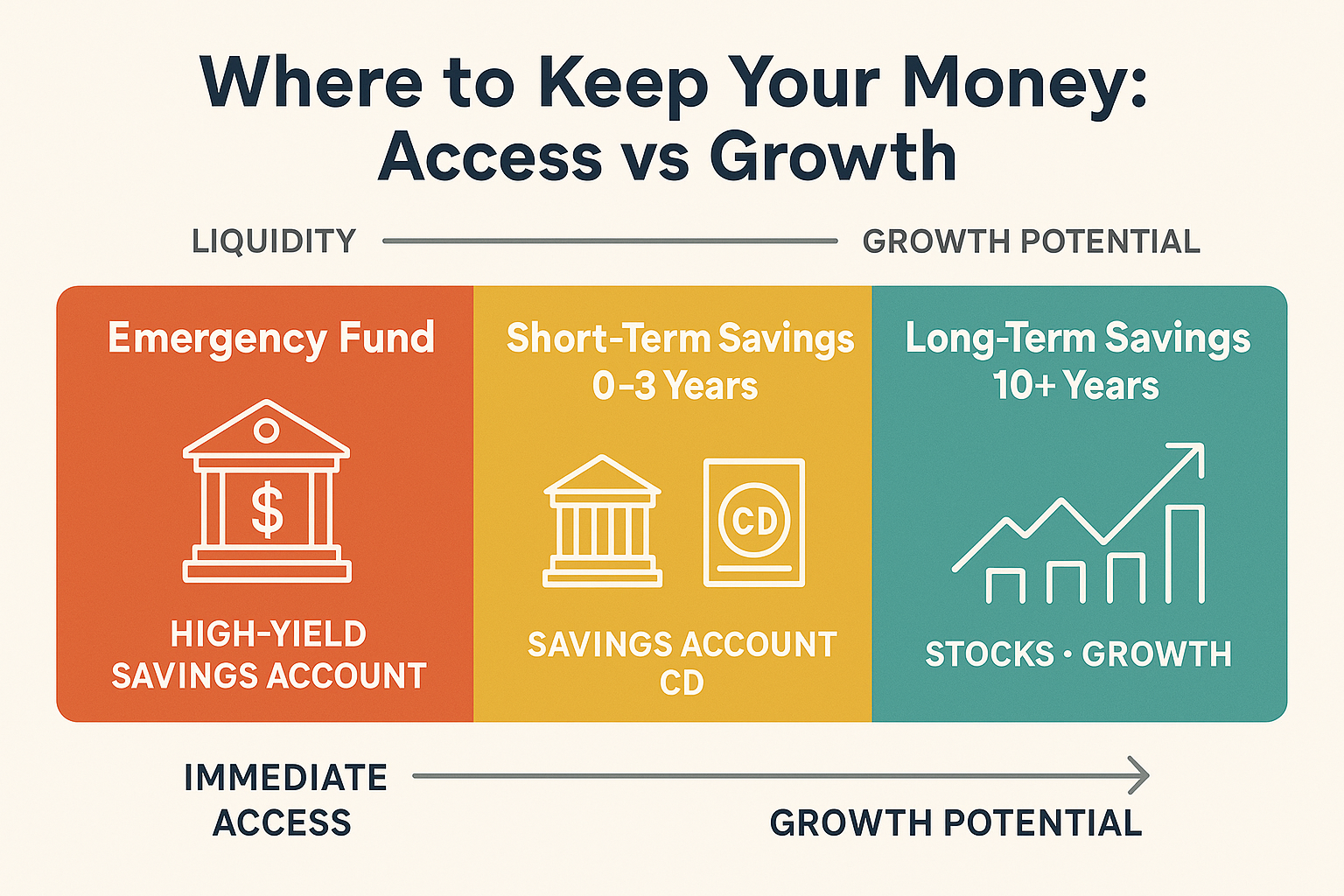

Where to Keep Your Emergency Fund

The location of your emergency fund is critical. It must balance three factors: accessibility, safety, and modest growth.

Best Options for Emergency Funds:

High-Yield Savings Accounts: Top Choice

- Pros: FDIC insured up to $250,000, instant access, competitive interest rates (4-5% in 2025)

- Cons: Interest rates fluctuate with Federal Reserve policy

- Best for: Most people’s primary emergency fund location

Money Market Accounts

- Pros: FDIC insured, check-writing ability, competitive rates

- Cons: May require higher minimum balances, limited transactions

- Best for: Those who want slightly more flexibility than savings accounts

Short-Term Treasury Bills (T-Bills)

- Pros: Government-backed (extremely safe), competitive returns

- Cons: Less liquid (must wait for maturity or sell), requires more financial knowledge

- Best for: Portion of emergency fund you’re less likely to need immediately

Where NOT to Keep Emergency Funds:

Checking accounts: Too easy to spend, minimal interest

Stocks or stock funds: Too volatile, could lose value when you need it

Long-term CDs: Penalties for early withdrawal defeat the purpose

Cryptocurrency: Extreme volatility makes it unsuitable for emergency needs

Under your mattress: No growth, no protection, vulnerable to theft/fire

The ideal setup is keeping your emergency fund in a high-yield savings account at a different bank than your checking account. This creates a psychological barrier against casual spending while maintaining easy access during true emergencies.

Where to Keep Your Savings

Your savings strategy should vary based on your timeline and goals. Unlike emergency funds, savings can take advantage of growth opportunities.

Short-Term Savings (0-3 years):

High-Yield Savings Accounts

- Safe and accessible

- Rates around 4-5% in 2025

- Perfect for near-term goals

Certificates of Deposit (CDs)

- Higher rates than savings for locking money away

- Choose maturity dates that align with your goal timeline

- FDIC insured

Money Market Funds

- Slightly higher returns than savings

- Very low risk

- Good liquidity

Medium-Term Savings (3-10 years):

Balanced Investment Accounts

- Mix of stocks and bonds (60/40 or 70/30)

- Moderate growth potential with managed risk

- Consider index funds for low fees

Target-Date Funds

- Automatically adjust risk as the goal date approaches

- Convenient for hands-off investors

- Available in many brokerage accounts

Bond Funds or Bond Ladders

- More stable than stocks

- Predictable income

- Lower growth but less volatility

Long-Term Savings (10+ years):

Stock Market Investments

- Highest growth potential over long periods

- Learn about why the stock market goes up over time

- Diversify through index funds or ETFs

Retirement Accounts (401k, IRA)

- Tax advantages accelerate growth

- Employer matching is free money

- Penalties discourage early withdrawal (good for discipline)

Dividend-Paying Stocks

- Generate passive income through dividends

- Reinvest for compound growth

- Research high dividend stocks carefully

Real Estate Investment Trusts (REITs)

- Diversification beyond traditional stocks

- Regular income distributions

- Accessible without buying property directly

The key principle: The longer your timeline, the more growth-oriented risk you can accept. Money needed in 6 months should never be in stocks, but money for retirement in 30 years should be heavily invested for maximum growth potential.

Building Your Emergency Fund: Step-by-Step Guide

Creating an emergency fund from scratch can feel overwhelming, but breaking it into manageable steps makes it achievable.

Step 1: Set Your Initial Target ($500-$1,000)

Start with a mini emergency fund before tackling the full 3-6 months. This smaller goal:

- Provides quick wins and momentum

- Covers most minor emergencies

- Prevents discouragement from massive initial targets

Step 2: Open a Dedicated Account

- Choose a high-yield savings account separate from your checking account

- Name it “Emergency Fund” for psychological clarity

- Set up automatic transfers from each paycheck

Step 3: Automate Your Contributions

Automation is the secret weapon for consistent saving:

- Set up automatic transfers on payday

- Start small if needed ($25-$50 per paycheck)

- Increase contributions as income grows or expenses decrease

Step 4: Find Extra Money

Accelerate your emergency fund building:

- Tax refunds: Direct the entire refund to emergency savings

- Work bonuses: Save at least 50% of unexpected income

- Side hustles: Dedicate all extra earnings to your fund initially

- Expense cuts: Identify one subscription or expense to eliminate and redirect that money

- Windfalls: Birthday money, rebates, or cash gifts go straight to savings

Step 5: Protect Your Fund

- Don’t touch it unless it’s a genuine emergency

- Define what qualifies as an emergency beforehand

- If you must use it, prioritize replenishing it immediately

Step 6: Celebrate Milestones

- $500 saved: You’re ahead of millions of Americans

- $1,000 saved: You’ve got a solid starter fund

- 1 month expenses: Major psychological milestone

- 3 months’ expenses: You’re financially resilient

- 6 months’ expenses: You’ve achieved financial security

“The emergency fund isn’t about earning returns—it’s about buying peace of mind and financial stability.”

Building Your Savings: Goal-Based Strategy

While emergency funds follow a relatively standard approach, savings require personalized strategies based on your unique goals.

Step 1: Identify and Prioritize Your Goals

List all your financial goals and categorize them:

Short-term (0-3 years):

- Vacation

- New laptop

- Holiday gifts

- Minor home improvements

Medium-term (3-10 years):

- Home down payment

- Car purchase

- Wedding

- Career transition fund

Long-term (10+ years):

- Retirement

- Children’s education

- Second home

- Financial independence

Step 2: Calculate Required Monthly Contributions

For each goal, determine:

- Total amount needed

- Timeline

- Expected return on investment (conservative estimates)

- Monthly contribution required

Example calculation:

- Goal: $20,000 car in 4 years

- Conservative investment return: 5% annually

- Required monthly savings: approximately $385

Step 3: Create Separate Savings “Buckets”

Use multiple accounts or sub-accounts to mentally separate goals:

- “Hawaii Vacation Fund”

- “House Down Payment”

- “New Car Savings”

Many banks allow you to create multiple savings goals within one account, or you can use different institutions.

Step 4: Automate Everything

Just like emergency funds, automation ensures consistency:

- Set up automatic transfers for each goal

- Align transfers with payday

- Review and adjust quarterly

Step 5: Optimize for Growth

- Short-term goals: High-yield savings

- Medium-term goals: Conservative investments

- Long-term goals: Growth-oriented investments

Understanding stock market fundamentals helps optimize long-term savings growth.

Step 6: Track and Adjust

- Review progress monthly

- Celebrate milestones (25%, 50%, 75% complete)

- Adjust contributions when income changes

- Rebalance investments as goals approach

Common Mistakes to Avoid

Even with good intentions, many people make critical errors in managing emergency funds and savings.

Emergency Fund Mistakes:

1. Keeping it too accessible

- Having your emergency fund in your regular checking account makes it too tempting to spend

- Solution: Separate bank, no debit card attached

2. Investing it aggressively

- Putting emergency money in stocks defeats the purpose

- During the 2020 market crash, some people lost 30-40% of their “emergency funds”

- Solution: Prioritize stability over returns

3. Using it for non-emergencies

- A sale on shoes is not an emergency

- Annual expenses you know are coming (insurance premiums, property taxes) aren’t emergencies

- Solution: Create a separate “irregular expenses” fund

4. Never replenish after use

- Using your emergency fund is fine—that’s what it’s for

- Not rebuilding it leaves you vulnerable

- Solution: Make replenishment the top financial priority after an emergency

5. Stopping at the starter fund

- $1,000 is better than nothing, but insufficient for major emergencies

- Solution: Continue building to a full 3-6 months after establishing the starter fund

Savings Mistakes:

1. No clear goals

- Saving “just to save” lacks motivation and direction

- Solution: Define specific, measurable goals with timelines

2. Being too conservative with long-term money

- Keeping 30-year retirement savings in a savings account loses to inflation

- Historical stock market returns significantly outpace savings rates over decades

- Solution: Match investment approach to timeline

3. Raiding savings for emergencies

- This is why you need both emergency funds AND savings

- Solution: Build an emergency fund first, then focus on savings goals

4. Ignoring inflation

- A $30,000 car today might cost $35,000 in 5 years

- Solution: Adjust savings targets for inflation (typically 2-3% annually)

5. Trying to time the market

- Waiting for the “perfect” time to invest often means missing years of growth

- Solution: Use dollar-cost averaging—invest consistently regardless of market conditions

Many investors fall victim to the cycle of market emotions, which can derail long-term savings plans. Understanding these patterns helps maintain discipline.

Real-World Example: Sarah’s Financial Journey

Let’s see how understanding Emergency Fund vs Savings transformed one person’s financial life.

The Starting Point (January 2023)

Sarah’s situation:

- Age 28, marketing coordinator

- Income: $55,000/year ($3,500/month after taxes)

- Debt: $8,000 student loans, $2,500 credit card

- Savings: $1,200 in checking account

- Emergency fund: $0

- Goals: Pay off debt, save for a house, build retirement

The Problem

In March 2023, Sarah’s car needed $900 in repairs. With no emergency fund, she put it on her credit card, increasing her balance to $3,400. She felt stuck in a cycle of one step forward, two steps back.

The Transformation

Phase 1: Emergency Fund (March-August 2023)

- Opened a high-yield savings account at 4.5% APY

- Automated $250/month to emergency fund

- Used tax refund ($850) for emergency fund

- Reached $2,000 emergency fund by August

Phase 2: Debt + Emergency Fund (September 2023-June 2024)

- Continued $100/month to emergency fund

- Allocated $400/month to debt payoff

- Paid off credit card by February 2024

- Eliminated student loans by June 2024

- Emergency fund grew to $3,000

Phase 3: Full Emergency Fund + Savings (July 2024-Present)

- Calculated essential monthly expenses: $2,400

- Target emergency fund: $14,400 (6 months)

- Allocated $500/month to emergency fund

- Started $200/month to house down payment fund

- Began contributing 6% to 401(k) for employer match

Results by January 2025:

- Emergency fund: $8,000 (continuing toward $14,400 goal)

- House down payment savings: $1,400 (invested in a conservative fund)

- Retirement account: $2,800

- Debt: $0

- Peace of mind: Priceless

The Lesson

When Sarah’s car needed another repair in December 2024 ($650), she paid from her emergency fund without stress, debt, or derailing her other goals. She simply paused her house savings for two months to replenish the emergency fund, then resumed her regular plan.

This is the power of understanding Emergency Fund vs Savings—having the right money in the right place for the right purpose.

Advanced Strategies for Optimization

Once you’ve mastered the basics, consider these advanced approaches to maximize your financial strategy.

The Tiered Emergency Fund Approach

Instead of keeping all emergency funds in one savings account, create tiers:

Tier 1: Immediate Access (1 month expenses)

- High-yield savings account

- Instant access for urgent needs

Tier 2: Quick Access (2 months’ expenses)

- Money market account or short-term treasury bills

- Accessible within 2-3 days

- Slightly higher returns

Tier 3: Delayed Access (3 months’ expenses)

- Short-term bond funds or 3-month CDs

- Accessible within a week

- Best returns while maintaining safety

This approach maximizes returns while ensuring you always have immediate access to some emergency funds.

The Savings Waterfall Method

Prioritize your savings contributions in this order:

- Employer 401(k) match (free money—always max this first)

- Starter emergency fund ($1,000)

- High-interest debt (credit cards over 15% APR)

- Full emergency fund (3-6 months)

- Max out Roth IRA (tax-free growth)

- Additional 401(k) contributions (up to IRS limits)

- Taxable investment accounts (for non-retirement goals)

- Extra mortgage payments or other goals

This sequence optimizes for both security and growth, ensuring you build a foundation before pursuing maximum returns.

The Sinking Fund Strategy

Create dedicated “sinking funds” for predictable irregular expenses that aren’t emergencies:

- Annual insurance premiums

- Property taxes

- Car maintenance and registration

- Holiday gifts

- Annual subscriptions

Calculate the annual cost, divide by 12, and save that amount monthly. This prevents these predictable expenses from becoming “emergencies.”

Combining Savings with Strategic Investing

For medium and long-term goals, consider:

Dollar-Cost Averaging: Invest the same amount regularly regardless of market conditions, reducing the impact of market timing.

Tax-Loss Harvesting: Offset investment gains with strategic losses to minimize taxes (for taxable accounts).

Asset Allocation Shifting: Gradually move from stocks to bonds as your goal date approaches, protecting gains while maintaining growth.

For those interested in building wealth through the market, exploring smart moves in investing can complement your savings strategy.

Emergency Fund vs Savings for Different Life Stages

Your approach should evolve as your life circumstances change.

College Students and Recent Graduates

Emergency Fund:

- Target: $1,000-$2,000 starter fund

- Priority: Lower since many have a parental safety net

- Location: High-yield savings

Savings:

- Focus on career development and skills

- Small retirement contributions if an employer match is available

- Short-term goals (travel, moving expenses)

Young Professionals (20s-30s)

Emergency Fund:

- Target: 3-6 months’ expenses

- Priority: High—establishing financial independence

- Build aggressively in the first 2-3 years of your career

Savings:

- Max employer retirement match

- Save for a home down payment

- Begin building wealth through investing

- Consider strategies for making your future financially secure

Families with Children

Emergency Fund:

- Target: 6-9 months expenses (higher due to dependents)

- Priority: Critical—more people relying on income

- Consider a larger fund due to increased unexpected costs

Savings:

- College savings (529 plans)

- Retirement (don’t neglect this for kids’ college)

- Family goals (larger home, vacations)

- Emergency fund for home repairs

Pre-Retirees (50s-60s)

Emergency Fund:

- Target: 12-24 months expenses

- Priority: Maximum—job loss harder to recover from

- A larger cushion provides a bridge to retirement if needed

Savings:

- Aggressive retirement contributions (catch-up allowed)

- Conservative investment approach as retirement nears

- Healthcare savings (HSA if eligible)

- Transition planning funds

Retirees

Emergency Fund:

- Target: 12-24 months’ expenses in cash

- Priority: Essential—no employment income to fall back on

- Prevents forced sale of investments during market downturns

Savings:

- Shift to income-generating investments

- Maintain some growth investments for longevity

- Healthcare and long-term care reserves

- Legacy planning

FAQ

An emergency fund is money set aside specifically for unexpected financial crises like job loss, medical emergencies, or urgent repairs, kept in highly liquid, safe accounts. Savings are funds allocated for planned goals and purchases like vacations, down payments, or retirement, which may be invested based on the timeline. The key distinction is that emergency funds are for unpredictable “what if” scenarios, while savings are for intentional “when I” goals.

A standard emergency fund should contain 3-6 months of essential living expenses kept in a high-yield savings account for immediate access. Savings amounts vary entirely based on your specific goals—calculate what you need for each goal and when you need it, then work backward to determine monthly contributions. Most financial experts recommend building your emergency fund to at least $1,000 before aggressively pursuing other savings goals.

The optimal strategy is to build a starter emergency fund of $500-$1,000 first, then focus on high-interest debt (credit cards above 15% APR), and then complete your full emergency fund. This approach prevents you from going deeper into debt when emergencies occur while you’re paying down existing debt. However, always contribute enough to your employer retirement plan to capture the full company match—that’s an immediate 100% return you shouldn’t miss.

No—an emergency fund should only be used for genuine emergencies: unexpected job loss, medical crises, urgent home or car repairs, or other unforeseen necessities. “Good deals,” sales, or investment opportunities should be funded through your regular savings or discretionary income. Maintaining this discipline ensures your safety net remains intact when you truly need it. If you frequently feel tempted to raid your emergency fund, you may need to create separate savings accounts for opportunities and irregular expenses.

High-yield savings accounts offering 4-5% APY are the best location for emergency funds in 2025, providing FDIC insurance, immediate access, and competitive returns without market risk. Money market accounts are another excellent option with similar benefits and sometimes check-writing privileges. Avoid investing emergency funds in stocks, long-term CDs, or cryptocurrency—the volatility and access restrictions defeat the purpose of emergency savings.

True emergencies include unexpected job loss or income reduction, urgent medical or dental expenses not covered by insurance, essential home repairs (roof leak, broken furnace, plumbing disaster), necessary car repairs that prevent you from getting to work, emergency travel for family crises, and other unforeseen necessities that impact your ability to meet basic needs. Annual expenses you know are coming, wants versus needs, sales or deals, and planned expenses are NOT emergencies and should be funded differently.

Taking Action: Your Next Steps

Understanding Emergency Fund vs Savings is just the beginning—now it’s time to take action. Here’s your personalized action plan:

This Week:

Calculate your monthly essential expenses (housing, food, utilities, insurance, minimum debt payments, transportation)

Open a high-yield savings account specifically for your emergency fund at a bank separate from your checking

Set up automatic transfer of at least $50-$100 to your emergency fund starting with your next paycheck

List your top 3-5 financial goals with approximate costs and timelines

This Month:

Reach your first $500 in emergency savings—this is a critical milestone

Open dedicated savings accounts for your top 2-3 goals (many banks allow multiple savings goals)

Create a budget that allocates money to both the emergency fund and savings goals

Research investment options for any long-term savings goals (10+ years out)

This Quarter:

Build an emergency fund of at $1,000 minimum

Establish consistent monthly contributions to both emergency and savings accounts

Review and optimize your account locations (are you getting competitive interest rates?)

Begin investing for long-term goals if you haven’t already

This Year:

Complete a full emergency fund (3-6 months of expenses)

Make substantial progress on your primary savings goal

Develop advanced strategies, like sinking funds for irregular expenses

Review and rebalance your overall financial plan quarterly

Remember, personal finance is exactly that—personal. Your specific targets, timelines, and strategies should reflect your unique situation, goals, and risk tolerance. The fundamental principle remains constant: protect yourself with emergency funds while building your future with strategic savings.

The Bottom Line

The difference between an emergency fund and savings isn’t just semantic—it’s the foundation of financial security and success. Your emergency fund is your financial shield, protecting you from life’s unpredictability without derailing your progress. Your savings are your financial ladder, helping you climb toward the life you want to create.

You don’t have to choose between them—you need both. Start where you are, with what you have. Even $25 per paycheck directed to each bucket begins building the financial foundation that will serve you for decades.

The journey from financial anxiety to financial confidence begins with understanding this crucial distinction and taking consistent action. Whether you’re just starting or optimizing an existing strategy, the principles of Emergency Fund vs Savings will guide you toward a more secure and prosperous future.

Your future self will thank you for the financial discipline and clarity you develop today. Start building both your emergency fund and your savings this week—not next month, not when you get a raise, but right now. The best time to plant a tree was 20 years ago. The second-best time is today.

For more insights on building wealth and making smart financial decisions, explore additional resources on personal finance strategies and continue your journey toward financial mastery.

Interactive Emergency Fund & Savings Calculator

💰 Emergency Fund & Savings Calculator

Calculate how much you need in emergency funds and monthly savings to reach your goals

📋 Your Personalized Recommendations

🎯 Your Financial Roadmap

Disclaimer

This article is for educational purposes only and does not constitute financial advice. The information provided is based on general financial principles and should not be considered personalized financial guidance. Individual financial situations vary significantly, and what works for one person may not be appropriate for another.

Before making any financial decisions, consult with a qualified financial advisor, certified financial planner, or other licensed professional who can assess your specific circumstances, goals, and risk tolerance. The author and publisher are not responsible for any financial decisions made based on the information in this article.

Past performance of investments does not guarantee future results. All investments carry risk, including the potential loss of principal. Interest rates, market conditions, and economic factors change over time and may differ from the examples provided.

Always verify current rates, terms, and conditions with financial institutions before opening accounts or making investment decisions. FDIC insurance limits and regulations are subject to change.

About the Author

Written by Max Fonji — With over a decade of experience in personal finance education and investment strategy, Max is your go-to source for clear, data-backed investing education. Max specializes in breaking down complex financial concepts into actionable strategies that beginners can implement immediately.

Through TheRichGuyMath.com, Max has helped thousands of readers build emergency funds, develop savings strategies, and create wealth through intelligent investing. His approach combines academic rigor with real-world practicality, ensuring readers receive both the “why” and the “how” of personal finance.

Max’s mission is simple: Make financial literacy accessible to everyone, regardless of their starting point or background. When not writing about finance, Max enjoys analyzing market trends, reading behavioral economics research, and helping individuals achieve their financial goals through education and empowerment.